- Home

- »

- Plastics, Polymers & Resins

- »

-

Polysilicon Market Size, Share, Growth, Industry Report 2033GVR Report cover

![Polysilicon Market Size, Share & Trends Report]()

Polysilicon Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Solar PV, Monocrystalline Solar Panel, Multicrystalline Solar Panel, Electronics (Semiconductors)), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-340-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polysilicon Market Summary

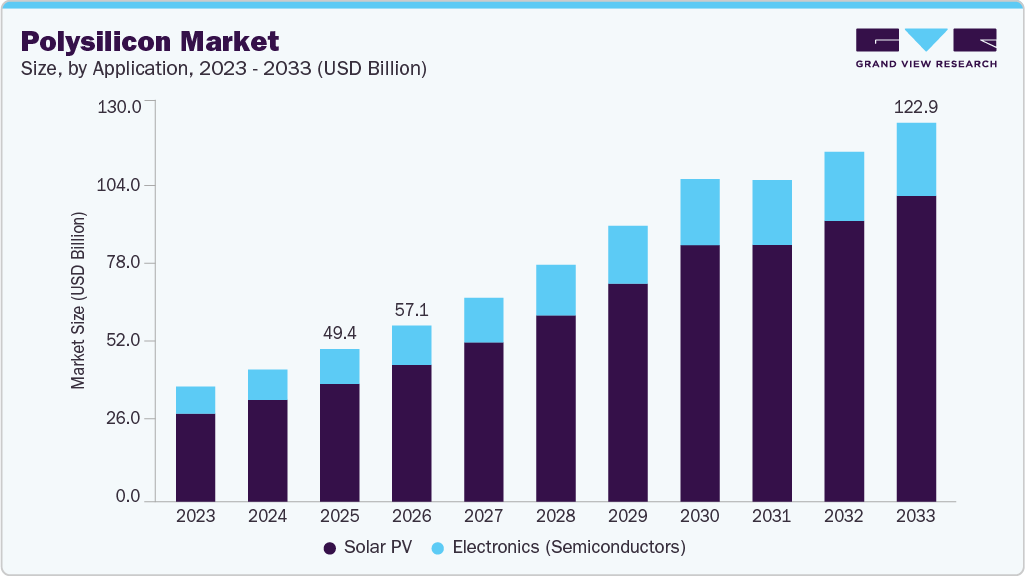

The global polysilicon market size was estimated at USD 49.44 billion in 2025 and is projected to reach USD 122.92 billion by 2033, growing at a CAGR of 11.6% from 2026 to 2033. The growing demand for high-efficiency solar modules is driving the market growth, as manufacturers require more ultra-pure material to achieve improved cell performance.

Key Market Trends & Insights

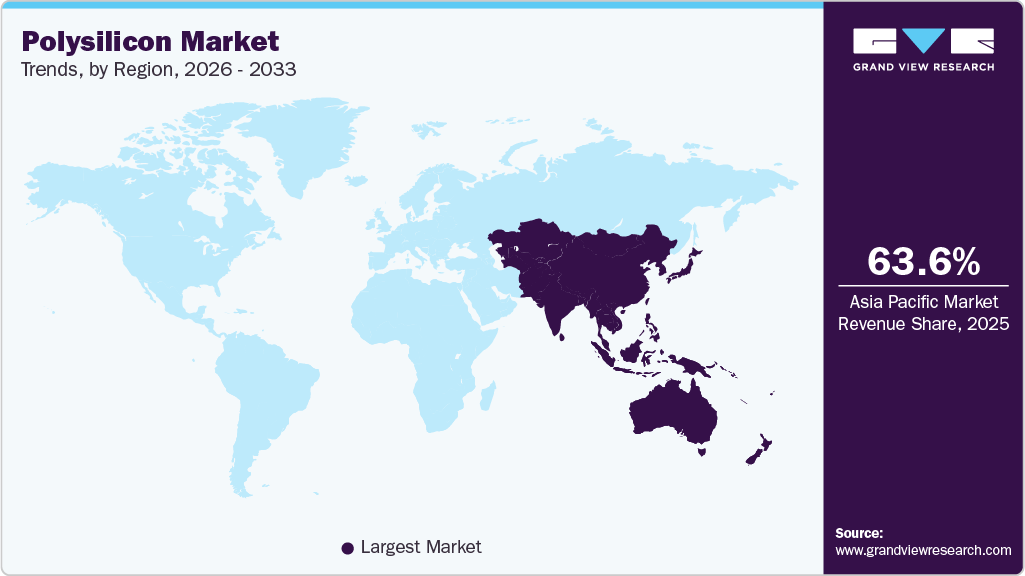

- Asia Pacific dominated the global polysilicon industry with the largest revenue share of 63.57% in 2025.

- The polysilicon industry in China is expected to grow at a substantial CAGR of 12.3% from 2026 to 2033.

- By application, the solar PV segment is expected to grow at a considerable CAGR of 12.2% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 49.44 billion

- 2033 Projected Market Size: USD 122.92 billion

- CAGR (2026 - 2033): 11.6%

- Asia Pacific: Largest market in 2025

New investments in renewable energy projects across the Asia Pacific, Europe, and North America are also increasing the procurement of stable polysilicon supplies for long-term solar capacity targets.

The market is shifting from a state of tight supply and price spikes to one of structural overcapacity and increased price volatility. Large-scale Chinese expansions and faster module production have increased available volumes more quickly than end-demand growth. This fuels short-term price swings and compresses margins across the value chain. Market segmentation is sharper. Solar-grade volumes dominate, while the semiconductor polysilicon market remains smaller but more price-resilient due to its strict purity requirements.

Drivers, Opportunities & Restraints

Demand for higher-purity silicon from wafer fabs is a clear growth driver for the semiconductor polysilicon market. Investment in logic, memory, and foundry capacity for AI, 5G, and automotive chips raises long-term wafer consumption. Semiconductor-grade polysilicon requires additional processing steps and tighter control over impurities. That increases value per kilogram and attracts specialized suppliers. Policymakers and industry groups also promote local wafer chains, which support upstream polysilicon demand.

Advances in purification and alternative manufacturing create a gateway to the polysilicon purification market. Fluidized bed reactors and incremental process improvements reduce energy per ton and cut unit costs. Firms that scale lower-carbon, modular purification can win share from legacy Siemens-process players. The recycling of silicon and integrated supply projects in non-China regions present further upside for firms that can certify the purity and traceability of both PV and semiconductor buyers.

Energy intensity and environmental compliance constraints limit new capacity and increase operating costs. Polysilicon production consumes large amounts of electricity and chemicals. Stricter emissions rules, carbon pricing, and permitting delays increase project time and capital requirements. Investors face higher upfront costs and uncertain returns when ESG standards necessitate retrofits or relocation. This dampens rapid greenfield expansion and makes lifecycle emissions management a commercial necessity.

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The market exhibits slight consolidation, with key players dominating the industry landscape. Major companies such as High-Purity Silicon America Corporation, OCI COMPANY Ltd., Qatar Solar Technologies, REC Silicon ASA, Tongwei Co., Ltd, Tokuyama Corporation, Wacker Chemie AG, Xinte Energy Co., Ltd, DAQO NEW ENERGY CO, LTD., GCL-TECH, Hemlock Semiconductor Operations LLC, Hemlock Semiconductor, L.L.C., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

The adoption of n-type cell technologies, such as TOPCon and HJT, is a key driver for the solar PV polysilicon market. Manufacturers shifting capacity to higher efficiency cells require silicon with tighter specifications and a consistent supply. This raises demand for mono-grade polysilicon and forces upstream investment in scale and traceability. At the same time, oversupply and inventory cycles impact timing, so suppliers that match quality with flexible delivery gain a commercial advantage.

The expansion of wafer fab capacity for AI, automotive, and edge computing is strengthening the semiconductor polysilicon industry. New foundry builds, and CHIPS-style support increase wafer starts and create steady demand for ultra-high purity feedstock. That demand tightens technical specifications and benefits the polysilicon purification market, because semiconductor-grade material requires additional refining and certification. Companies that combine purification capability with supply security capture premium margins.

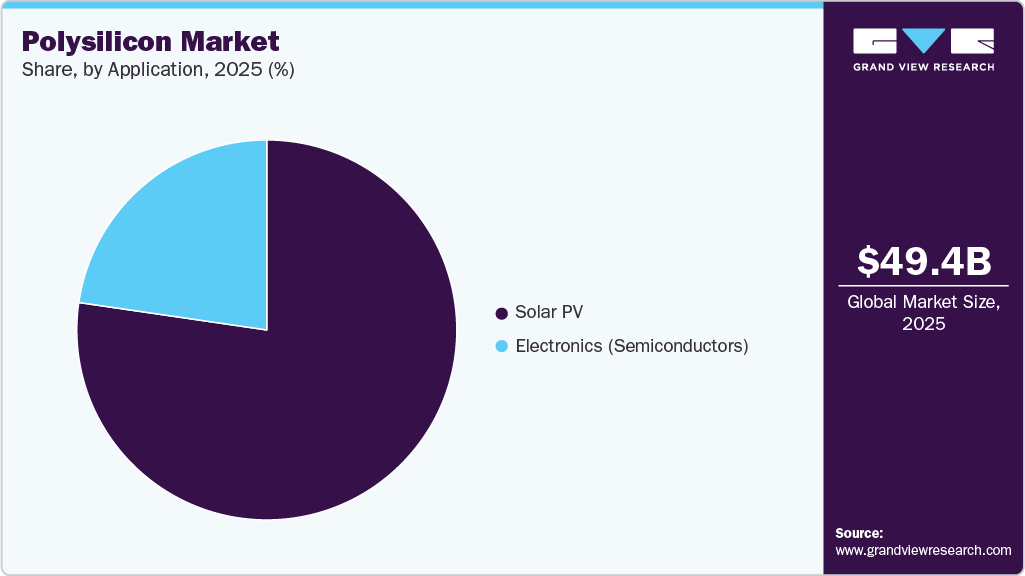

Application Insights

Solar PV dominated the market across the application segmentation in terms of revenue, accounting for a market share of 77.31% in 2025, and is forecasted to grow at a 12.2% CAGR from 2026 to 2033. The adoption of n-type cell technologies, such as TOPCon and HJT, is a key driver for the solar PV polysilicon market. Manufacturers shifting capacity to higher efficiency cells require silicon with tighter specifications and a consistent supply. This raises demand for mono-grade polysilicon and forces upstream investment in scale and traceability. At the same time, oversupply and inventory cycles impact timing, so suppliers that match quality with flexible delivery gain a commercial advantage.

The electronics (semiconductors) segment is expected to expand at a substantial CAGR of 9.3% through the forecast period. The expansion of wafer fab capacity for AI, automotive, and edge computing is strengthening the semiconductor polysilicon market. New foundry builds, and CHIPS-style support increase wafer starts and create steady demand for ultra-high purity feedstock. That demand tightens technical specifications and benefits the polysilicon purification market, because semiconductor-grade material requires additional refining and certification. Companies that combine purification capability with supply security capture premium margins.

Regional Insights

The Asia Pacific polysilicon industry held the largest share, accounting for 63.57% of the revenue in 2025, and is expected to grow at the fastest CAGR of 11.8% over the forecast period. Rapid PV deployment and aggressive manufacturing expansion drive regional market growth. Strong installation pipelines across South and Southeast Asia, as well as large-scale cell and module projects in India, compel upstream capacity growth. Governments support integrated value chains through incentives and concessional finance, encouraging local ingot and wafer projects. That creates both scale opportunities and short-term oversupply risk, so suppliers with flexible commercial terms gain an advantage.

The China polysilicon market is driven by domestic capacity growth and consolidation. Rapid expansions created surplus volumes and margin pressure. The industry is moving toward consolidation and capacity rationalization to stabilize prices and reduce low-grade output. Export friction and tighter scrutiny in major markets increase the incentive to rebalance production toward higher-value, purified grades. Policy steering and coordinated industry actions are central to near-term market realignment.

North America Polysilicon Market Trends

Policy stimulus and reshoring of manufacturing are the primary drivers reshaping the regional market. Federal incentives and state-level factory investments have accelerated domestic cell and module capacity. Buyers now prefer suppliers that can demonstrate secure logistics and a low carbon footprint. That raises demand for nearby polysilicon supply and for partners capable of certifying traceability across the entire value chain. Domestic ramp-ups also compress import dependence and support investment in higher-purity production.

The CHIPS and related semiconductor incentives are driving targeted demand for electronic-grade polysilicon. Direct funding and awards to domestic producers strengthen the business case for ultra-high-purity capacity. Foundry and memory investments increase wafer starts and create predictable, long-term feedstock requirements. Policymakers and prime contractors now prioritize suppliers who can meet traceability and specification certification requirements. This dynamic is lifting margins for producers able to deliver semiconductor-grade material at scale.

Europe Polysilicon Market Trends

Industrial policy and climate targets are the key drivers for European polysilicon demand. The Green Deal and reindustrialization programs push the bloc to build local PV and upstream supply chains. Member states favor projects that lower import exposure while meeting strict environmental standards. European module and equipment investments are creating pull for qualified polysilicon and for suppliers offering low-carbon footprints and regulatory compliance. Policy certainty is now a decisive factor in investment decisions.

Key Polysilicon Company Insights

The polysilicon industry is highly competitive, with several key players dominating the landscape. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Polysilicon Companies:

The following are the leading companies in the polysilicon market. These companies collectively hold the largest Market share and dictate industry trends.

- High-Purity Silicon America Corporation

- OCI COMPANY Ltd.

- Qatar Solar Technologies

- REC Silicon ASA

- Tongwei Group Co., Ltd

- Tokuyama Corporation

- Wacker Chemie AG

- Xinte Energy Co., Ltd

- DAQO NEW ENERGY CO., LTD.

- GCL-TECH

- Hemlock Semiconductor Operations LLC and Hemlock Semiconductor, L.L.C.

Recent Developments

-

In December 2025, Chinese polysilicon makers set up an acquisition vehicle to tackle industry oversupply. The newly registered firm has CNY 3.0 billion (approximately USD 420 million) in capital and is backed by multiple leading silicon producers, enabling it to pursue asset consolidation and capacity rationalization.

-

In May 2025, United Solar Polysilicon announced a strategic partnership with OQ Alternative Energy to develop a 700 MW photovoltaic project. The collaboration links polysilicon feedstock capability with large-scale PV deployment, signaling stronger vertical integration between producers and project developers.

Polysilicon Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 57.12 billion

Revenue forecast in 2033

USD 122.92 billion

Growth rate

CAGR of 11.6% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Global Transparent Plastic Market Report Segmentation

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

High-Purity Silicon America Corporation; OCI COMPANY Ltd.; Qatar Solar Technologies; REC Silicon ASA; Tongwei Co., Ltd; Tokuyama Corporation; Wacker Chemie AG; Xinte Energy Co., Ltd; DAQO NEW ENERGY CO, Ltd.; GCL-TECH; Hemlock Semiconductor Operations LLC and Hemlock Semiconductor, L.L.C.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polysilicon Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polysilicon market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Solar PV

-

Monocrystalline Solar Panel

-

Multicrystalline Solar Panel

-

Electronics (Semiconductors)

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polysilicon market size was estimated at USD 49.44 billion in 2025 and is expected to reach USD 57.12 billion in 2026.

b. The global polysilicon market is expected to grow at a compound annual growth rate of 15.9% from 2026 to 2033 to reach USD 122.92 billion by 2033.

b. Solar PV dominated the market across the application segmentation in terms of revenue, accounting for a market share of 77.31% in 2025, and is forecasted to grow at a 16.5% CAGR from 2026 to 2033.

b. Some key players operating in the polysilicon market include High-Purity Silicon America Corporation; OCI COMPANY Ltd.; Qatar Solar Technologies; REC Silicon ASA; Tongwei Co., Ltd; Tokuyama Corporation; Wacker Chemie AG; Xinte Energy Co., Ltd; DAQO NEW ENERGY CO,. LTD.; GCL-TECH; Hemlock Semiconductor Operations LLC and Hemlock Semiconductor, L.L.C.

b. Growing demand for high-efficiency solar modules is driving the polysilicon market, as manufacturers need more ultra-pure material to achieve better cell performance. New investments in renewable energy projects across Asia Pacific, Europe and North America are also increasing procurement of stable polysilicon supply for long term solar capacity targets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.