- Home

- »

- Organic Chemicals

- »

-

Potassium Sorbate Market Size, Share, Industry Report, 2033GVR Report cover

![Potassium Sorbate Market Size, Share & Trends Report]()

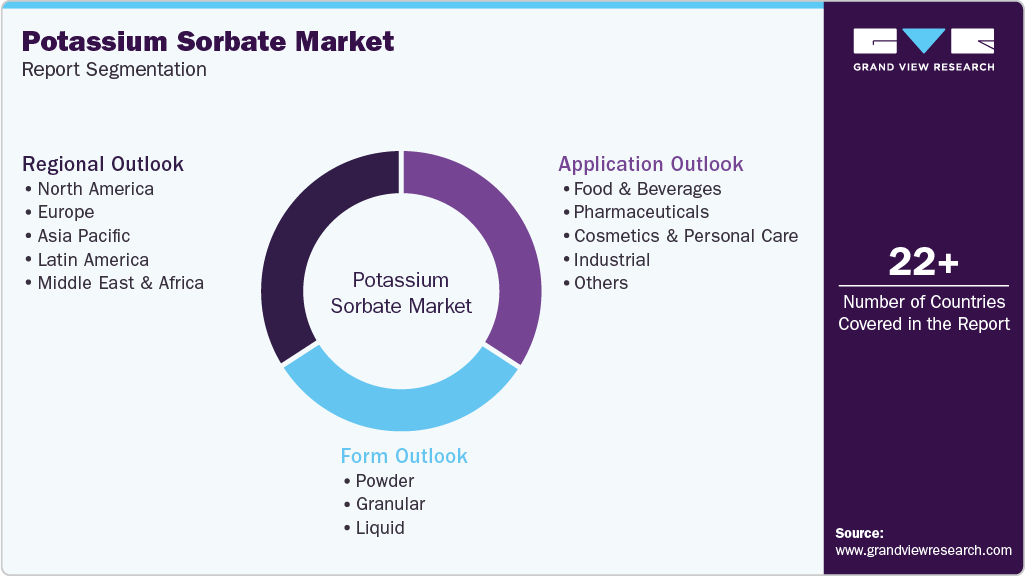

Potassium Sorbate Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Powder, Granular, Liquid), By Application (Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-639-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Potassium Sorbate Market Summary

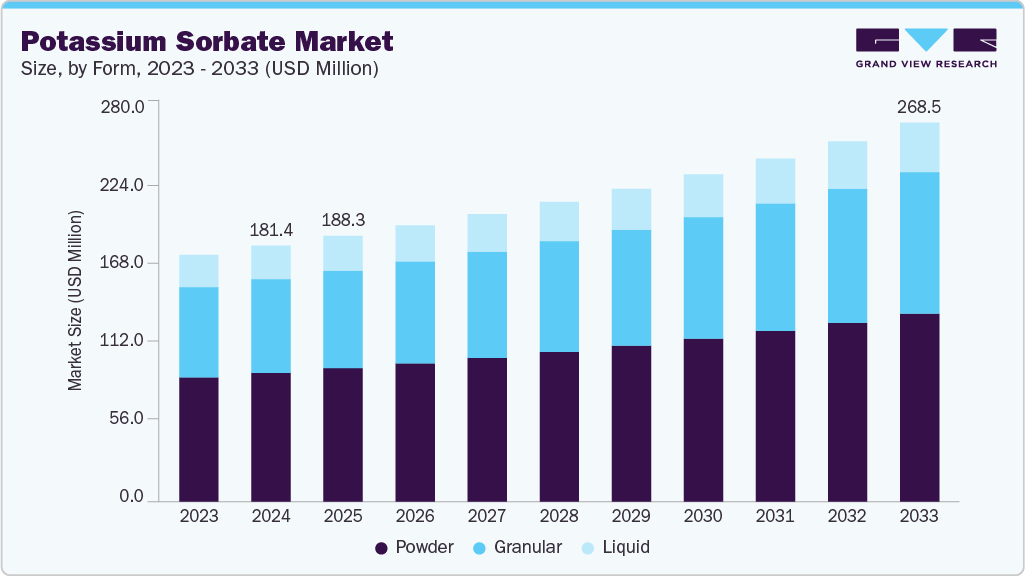

The global potassium sorbate market size was estimated at USD 181.4 million in 2024 and is projected to reach USD 268.5 million by 2033, growing at a CAGR of 4.5% from 2025 to 2033. The market is primarily driven by the rising demand for effective and safe food preservatives amid growing consumption of processed and packaged foods.

Key Market Trends & Insights

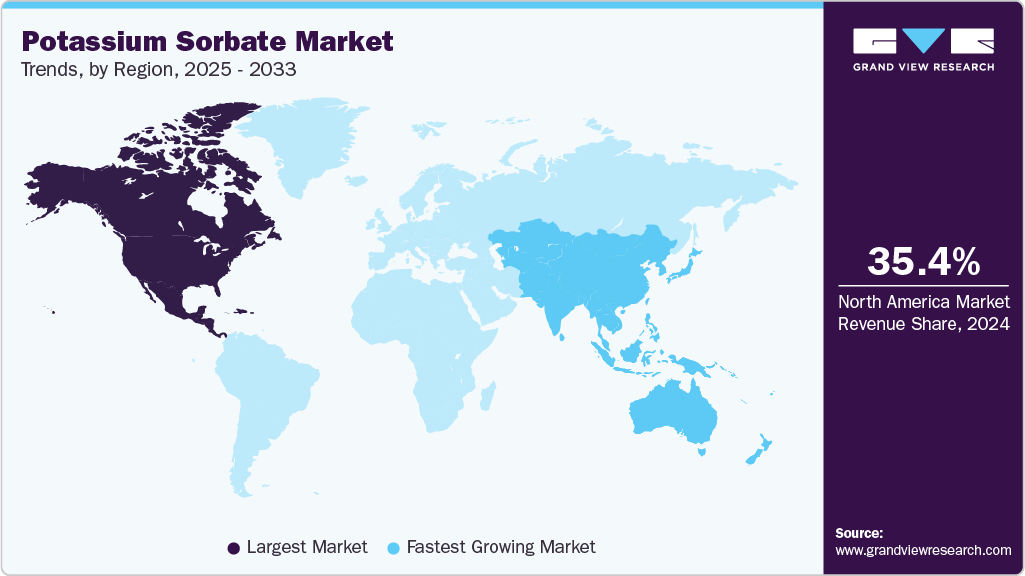

- North America dominated the market with the largest revenue share of 35.4% in 2024.

- The market in China is expected to grow at a significant CAGR of 4.7% from 2025 to 2033.

- By form, the granular segment is expected to grow at a CAGR of 4.7% from 2025 to 2033 in terms of revenue.

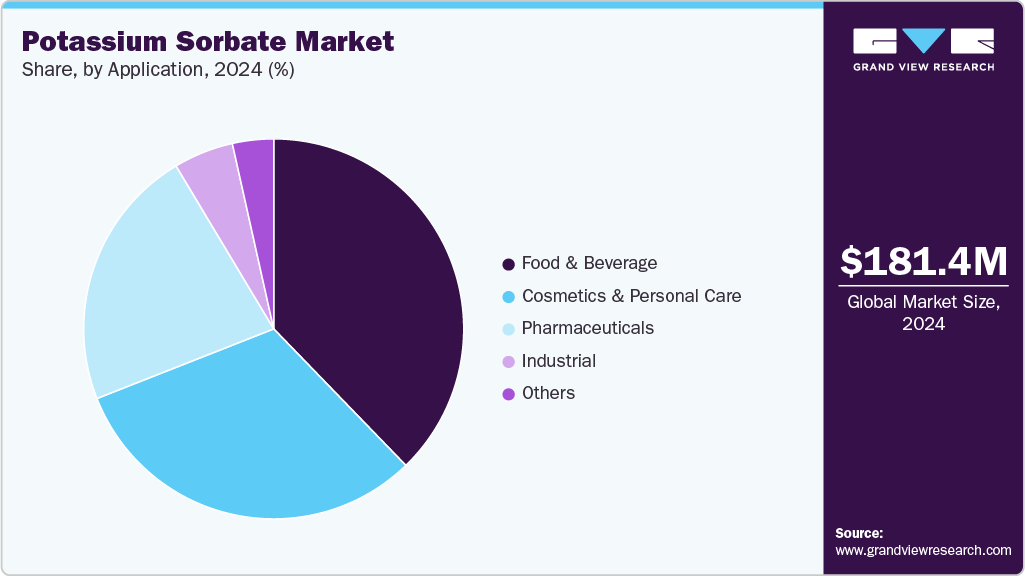

- By application, the food & beverage segment held the largest revenue share of 37.8% in 2024 in terms of value.

- By form, the powder segment held the largest revenue share of 50.2% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 181.4 Million

- 2033 Projected Market Size: USD 268.5 Million

- CAGR (2025-2033): 4.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region from 2025 to 2033

In addition, increasing utilization in cosmetics and pharmaceuticals, owing to its antifungal properties and regulatory approvals such as GRAS status by the FDA, is further propelling market growth. The shift toward clean-label and paraben-free formulations is also creating new growth avenues across end use industries.The market is poised to benefit from the expanding processed food industry in emerging economies, particularly in Asia Pacific and Latin America, where urbanization and lifestyle changes are driving packaged food consumption. In addition, the growing preference for paraben-free and natural preservative alternatives in cosmetics and personal care products presents a lucrative opportunity for potassium sorbate, given its mild toxicity and effective antimicrobial properties.

Despite its wide acceptance, the market faces challenges from increasing consumer skepticism toward chemical preservatives, particularly in the context of clean-label and organic product trends. The availability of natural preservative substitutes, such as vinegar, rosemary extract, and essential oils, poses a threat to market growth. Moreover, regulatory variations across regions and potential allergic reactions in sensitive individuals may limit adoption in certain formulations and markets.

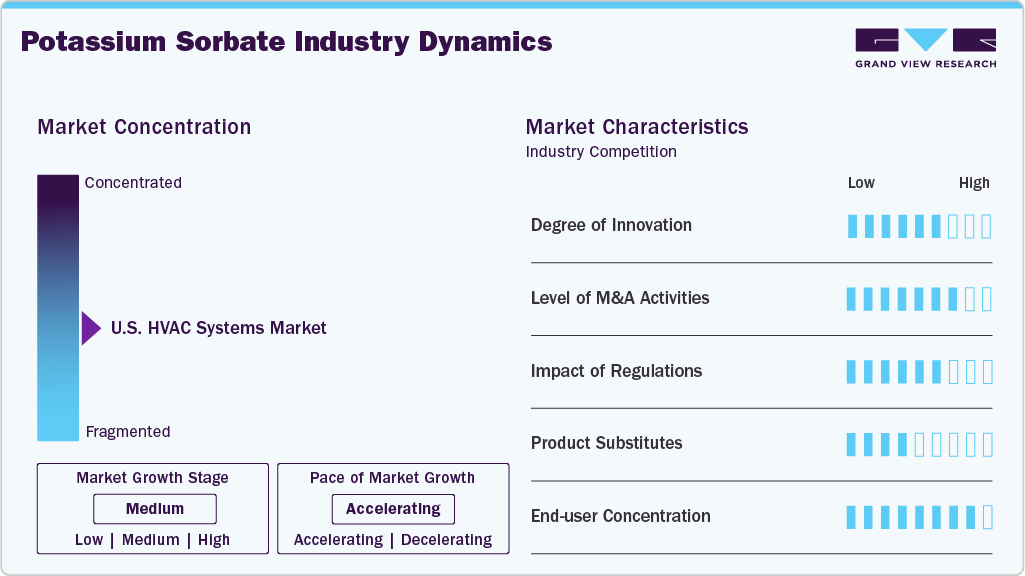

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Titan Biotech, TCI, Merck, Shandong Kunda Biological Technology Co., Ltd., and Hunan Huari Pharmaceutical Co., Ltd. dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the market are adopting strategies such as strategic partnerships, capacity expansions, and product portfolio diversification to strengthen their market position. Companies are also focusing on developing high-purity, food-grade potassium sorbate variants to cater to stringent regulatory and quality standards across food, pharmaceutical, and cosmetic applications.

Form Insights

In 2024, the powder segment held the largest revenue share of 50.2% in the global market, primarily due to its widespread adoption in the food and beverage industry. Powdered potassium sorbate offers several advantages, including longer shelf life, ease of handling, and cost-efficiency in bulk applications. Its high solubility in water makes it ideal for processed food items, baked goods, dairy products, and beverages. Moreover, food manufacturers prefer the powdered form for its ease of incorporation during production and better dispersion in dry mixes, further strengthening its market dominance.

The granular and liquid segments are also gaining traction, driven by specific end use preferences. Granular potassium sorbate is favored in applications requiring uniform particle distribution, such as dairy products and industrial processing, where precise dosing and reduced dust formation are critical. Meanwhile, the liquid form is witnessing significant growth, particularly in pharmaceuticals and cosmetics, owing to its ease of mixing, quick dissolution, and suitability for formulations such as syrups, lotions, and emulsions. As formulation trends evolve toward more efficient and consumer-friendly products, both granular and liquid forms are expected to gain a larger share over the forecast period.

Application Insights

In 2024, the food & beverages segment accounted for the largest revenue share of 37.8% due to the increasing global demand for processed, packaged, and shelf-stable food products. Potassium sorbate is widely used as a preservative in baked goods, dairy, canned fruits, and beverages due to its strong antifungal properties and approval for use by major regulatory bodies such as the FDA and EFSA. The rise in consumer preference for ready-to-eat meals, coupled with the growing need for extending product shelf life without compromising safety and taste, has significantly contributed to the segment's dominance.

Beyond food and beverages, pharmaceuticals represent a growing application area, where potassium sorbate is used to stabilize liquid medications, syrups, and supplements. In the cosmetics and personal care segment, it serves as a mild preservative in creams, shampoos, and lotions, aligning with the rising demand for paraben-free and skin-friendly formulations. The industrial segment, while smaller, utilizes potassium sorbate in adhesives, coatings, and other applications where microbial resistance is essential. The others category includes niche applications such as animal feed and textile processing, showing gradual adoption. Together, these diverse applications reflect the compound’s broad functional utility and contribute to sustained market growth.

Regional Insights

North America potassium sorbate industry held the largest revenue share of 35.4% in 2024, supported by the region’s well-established food processing industry, stringent food safety regulations, and high demand for long-shelf-life products. The growing preference for clean-label and preservative-free formulations has led manufacturers to adopt potassium sorbate as a safer alternative to traditional synthetic preservatives.

US Potassium Sorbate Market Trends

The potassium sorbate industry in the US is driven by strong regulatory backing, including GRAS status by the FDA, and the growing consumer demand for packaged and convenience food products. The presence of leading food and cosmetics manufacturers, along with a highly health-conscious consumer base, has spurred the adoption of safe and effective preservatives like potassium sorbate.

Asia Pacific Potassium Sorbate Market Trends

Asia Pacific potassium sorbate industry is expected to grow at the fastest CAGR of 4.9% from 2025 to 2033, driven by rapid urbanization, expanding middle-class population, and rising consumption of packaged foods and personal care products. Countries such as India, Japan, South Korea, and Southeast Asian nations are witnessing increased demand for food preservation solutions amid the growing retail and convenience food sectors.

China potassium sorbate industry represents a key market within Asia Pacific, fueled by its large-scale food processing industry, booming cosmetics sector, and cost-sensitive pharmaceutical manufacturing. The government’s focus on improving food safety standards and expanding domestic consumption of packaged and convenience foods has significantly boosted potassium sorbate usage.

Europe Potassium Sorbate Market Trends

Europe potassium sorbate industry held the third-largest revenue share of 28.1% in 2024, fueled by stringent food safety regulations, rising demand for natural preservatives, and a mature packaged food industry. The region’s strong emphasis on sustainability and clean-label products has led manufacturers to favor potassium sorbate due to its low toxicity and broad-spectrum antimicrobial efficacy.

Germany potassium sorbate industry is one of the leading markets for potassium sorbate in Europe, backed by its advanced food processing infrastructure and strong presence of cosmetic and pharmaceutical manufacturers. The country’s focus on high-quality, shelf-stable food products and consumer preference for safe, preservative-containing personal care goods are key growth drivers.

Latin America Potassium Sorbate Market Trends

The potassium sorbate market in Latin America is experiencing steady growth, driven by the rising demand for packaged and processed foods, particularly in countries such as Brazil, Mexico, and Argentina. Expanding urban populations, increasing disposable incomes, and a shift toward Western dietary habits are encouraging food manufacturers to adopt effective preservative solutions such as potassium sorbate.

Middle East & Africa Potassium Sorbate Market Trends

The Middle East & Africa potassium sorbate industry is gradually expanding, supported by increasing investments in food processing and personal care manufacturing. Rising demand for shelf-stable food products due to high ambient temperatures, coupled with growing awareness of product hygiene and preservation, is driving uptake across the region.

Key Potassium Sorbate Company Insights

Key players, such as Titan Biotech, TCI, Merck, Shandong Kunda Biological Technology Co., Ltd., and Hunan Huari Pharmaceutical Co., Ltd., are dominating the market.

Merck

-

Merck KGaA is a leading global science and technology company offering potassium sorbate under its high‑quality EMPROVE ESSENTIAL / SAFC portfolio. These formulations, available in both powder and granular Ph.Eur., BP, NF, FCC, and E 202 grades, are manufactured under cGMP conditions and backed by extensive documentation and certificates (e.g., COA, GMP, halal, kosher), ensuring compliance across pharmaceutical, food, and cosmetic industries. Merck emphasizes supply chain transparency, regulatory compliance, and technical support, positioning its potassium sorbate products as trusted excipients in liquid, semi‑solid, and solid formulations where antimicrobial stabilization is required.

Key Potassium Sorbate Companies:

The following are the leading companies in the potassium sorbate market. These companies collectively hold the largest market share and dictate industry trends.

- Titan Biotech

- TCI

- Merck

- Shandong Kunda Biological Technology Co., Ltd.

- Hunan Huari Pharmaceutical Co., Ltd.

- Jiangsu Mupro Ift Corp.

- Celanese Corporation

- BIMAL PHARMA PVT. LTD.

- FBC Industries

- Conflate Chemtech

- ASTRRA CHEMICALS

Global Potassium Sorbate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 188.3 million

Revenue forecast in 2033

USD 268.5 million

Growth rate

CAGR of 4.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

US; Canada; Mexico; Germany; UK; France; China; India; Japan; South Africa; Brazil

Key companies profiled

Titan Biotech; TCI; Merck; Shandong Kunda Biological Technology Co., Ltd.; Hunan Huari Pharmaceutical Co., Ltd.; Jiangsu Mupro Ift Corp.; Celanese Corporation; BIMAL PHARMA PVT. LTD.; FBC Industries; Conflate Chemtech; ASTRRA CHEMICALS

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Potassium Sorbate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global potassium sorbate market report based on form, application, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Pharmaceuticals

-

Cosmetics & Personal Care

-

Industrial

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Powder

-

Granular

-

Liquid

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Middle East & Africa

-

South Africa

-

Saidi Arabia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global potassium sorbate market size was estimated at USD 181.4 million in 2024 and is expected to reach USD 188.3 million in 2025.

b. The global potassium sorbate market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033 to reach USD 268.5 million by 2030.

b. The food & beverages segment held the largest revenue share in 2024 due to the widespread use of potassium sorbate as a preservative in processed, packaged, and ready-to-eat food products to extend shelf life and prevent microbial growth. Growing consumer demand for convenience foods and stringent food safety regulations further supported its dominant position in this segment.

b. Some of the key players operating in the potassium sorbate market include Merck, Shandong Kunda Biological Technology Co.,Ltd., Titan Biotech, TCI, Hunan Huari Pharmaceutical Co.,Ltd., Jiangsu Mupro Ift Corp., Celanese Corporation, BIMAL PHARMA PVT. LTD., FBC Industries, Conflate Chemtech, ASTRRA CHEMICALS.

b. Key factors driving the potassium sorbate market include the rising demand for effective food preservatives amid growing processed food consumption and increasing use in pharmaceuticals and personal care products due to its antimicrobial properties and regulatory approvals. The shift toward clean-label and paraben-free formulations further accelerates market growth across end-use industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.