- Home

- »

- Renewable Chemicals

- »

-

Precision Fermentation Market Size, Industry Report, 2033GVR Report cover

![Precision Fermentation Market Size, Share & Trends Report]()

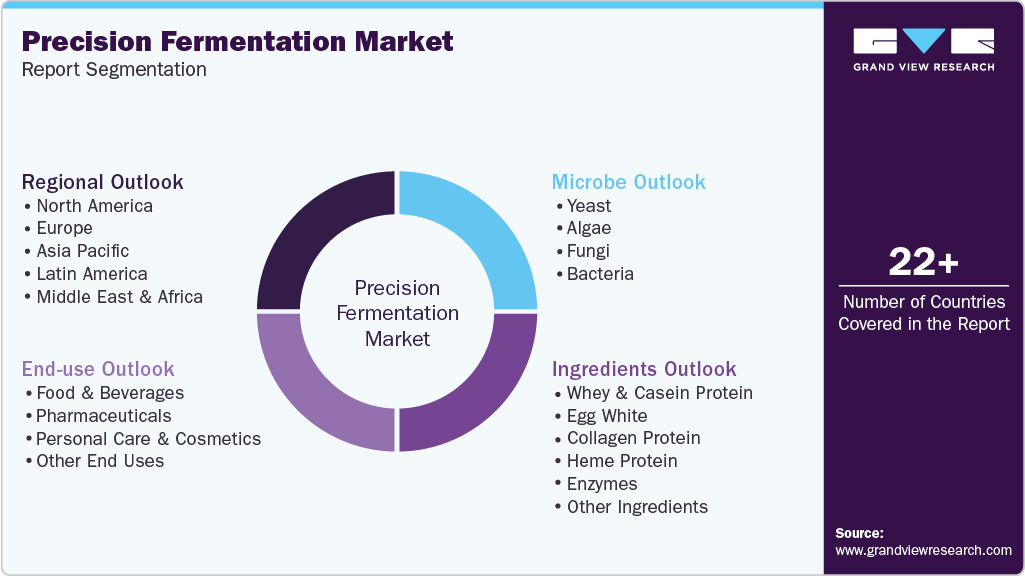

Precision Fermentation Market (2026 - 2033) Size, Share & Trends Analysis Report By Microbe (Yeast, Algae, Fungi, Bacteria), By Ingredients (Whey & Casein Protein, Egg White), By End Use (Food & Beverages, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-371-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Precision Fermentation Market Summary

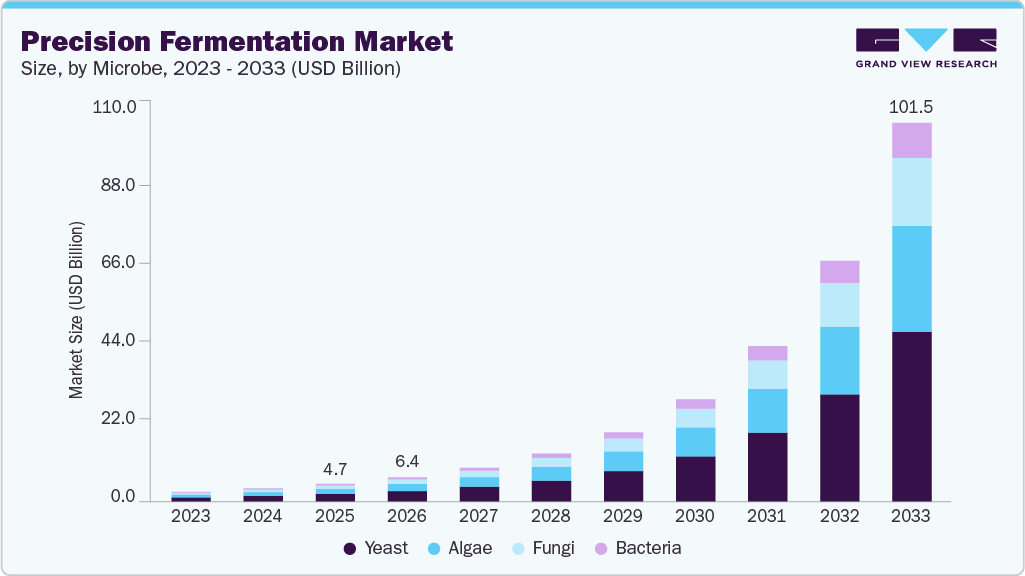

The global precision fermentation market size was estimated at USD 4.68 billion in 2025 and is projected to reach USD 101.53 billion by 2033, growing at a CAGR of 48.3% from 2026 to 2033 due to consumers’ increasing demand for sustainable and eco-friendly products. This demand is a result of the rising awareness about the negative impact of traditional production methods on the environment, including deforestation, greenhouse gas emissions, and water pollution.

Key Market Trends & Insights

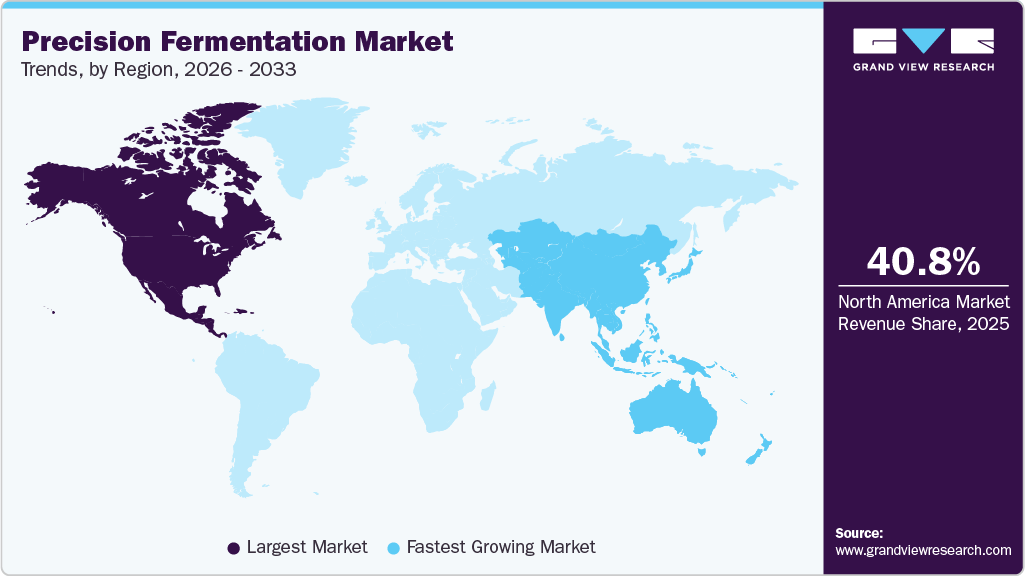

- North America dominated the precision fermentation market with the largest revenue share of 40.8% in 2025.

- The market in India is expected to grow at the fastest CAGR of 49.9% from 2026 to 2033 in terms of revenue.

- By Ingredients, the whey & casein protein segment held the largest revenue share of 20.8% in 2025.

- By microbe, the yeast segment held the largest revenue share of 43.1% in 2025 in terms of value.

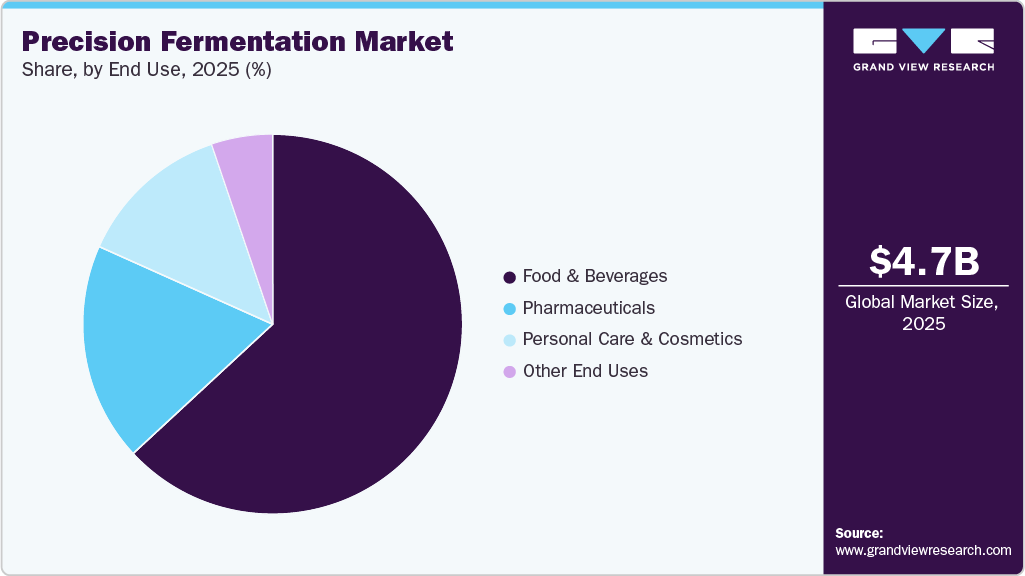

- By end use, the food & beverages segment held the largest revenue share of 63.1% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: USD 4.68 Billion

- 2033 Projected Market Size: USD 101.53 Billion

- CAGR (2026-2033): 48.3%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The market is seeing a surge in demand for alternative protein sources due to the environmental concerns associated with traditional protein production methods.Consumer preferences are shifting toward plant-based animal protein, leading to changes in eating patterns. This shift has been further accelerated by the shortage of beef and pork during the pandemic, leading to an increased demand for precision fermented-based products. The market has witnessed a significant increase in the sales of plant-based products, indicating a growing consumer preference for alternative protein sources.

Technological advancements and regulatory support have contributed to the growth of the market. Advancements in biotechnology, along with the growing environmental concern and rising government support, have further fueled the demand for precision fermentation. This method offers an opportunity to produce a wide range of sustainable, nutritious, and cost-effective alternative protein sources, further driving its demand. These factors collectively contribute to the growth and expansion of the market, positioning it as a key player in the production of sustainable and eco-friendly products, alternative protein sources, and specialized ingredients for various industries such as food, pharmaceuticals, and cosmetics.

Advancements in the food industry have emerged as a key trend in the product market. Major companies operating in the food and nutrition sector are focused on developing new advancements in their products to strengthen their position in the market. For instance, the introduction of animal-free ingredients in food products is a significant trend driving the market.

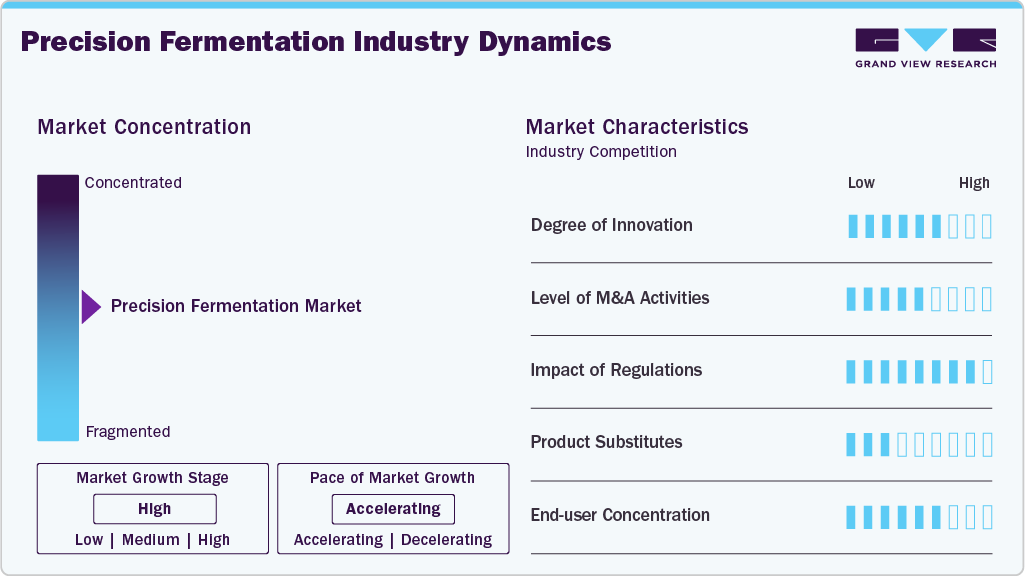

Market Concentration & Characteristics

The competitive landscape of the industry is marked by a mix of pioneering startups and emerging challengers, with several companies capturing significant market share and shaping industry direction through technology differentiation and strategic partnerships. Geltor, Perfect Day, The Every Co., Impossible Foods, and Motif FoodWorks are frequently cited as leading players with strong revenue positioning and broad market influence, collectively controlling a substantial portion of the precision fermentation ingredients market through offerings in animal-free collagen, dairy proteins, egg proteins, and heme compounds for alternative meats. These firms have leveraged advances in synthetic biology and fermentation scale-up to secure early commercial traction and investor confidence, fostering integrations into mainstream food and personal care products.

Beyond the established leaders, a cohort of innovative entrants such as Formo, Eden Brew, Mycorena, Change Foods, and MycoTechnology are differentiating through focused ingredient specialization and unique market niches. Formo, for example, is advancing animal-free cheese technologies in Europe, while Eden Brew targets dairy protein micelles, and Change Foods emphasizes sustainable dairy replacements; Mycorena and MycoTechnology bring complementary capabilities in fungal-derived ingredients and flavor modulation. These companies, alongside broader ecosystem participants, are intensifying competition through strategic collaborations, targeted funding rounds, and product launches that broaden application footprints in food, cosmetics, and specialty ingredients, reinforcing the dynamic and rapidly evolving nature of the precision fermentation landscape.

Microbe Insights

The yeast segment dominated the market, accounting for the largest revenue share of 43.1% in 2025, primarily due to its well-established industrial scalability, regulatory acceptance, and superior protein expression efficiency. Yeast strains, particularly Saccharomyces cerevisiae and Pichia pastoris, offer faster fermentation cycles, high yield consistency, and compatibility with large-scale bioreactors, making them the preferred production hosts for commercially viable ingredients such as whey and casein proteins, enzymes, and egg white proteins. Additionally, yeast benefits from GRAS status in major markets, reducing regulatory complexity and accelerating time-to-market for food, pharmaceutical, and personal care applications. Strong investment inflows, extensive strain-engineering advancements, and proven downstream processing economics further reinforced yeast’s leadership position in 2025.

In contrast, bacteria, fungi, and algae represent high-growth but comparatively smaller revenue segments, each addressing distinct application niches. Bacteria are gaining traction due to rapid cell division rates and suitability for producing heme proteins, enzymes, and specialty bioactives, particularly in alternative protein and pharmaceutical applications. Fungi are increasingly adopted for complex protein expression and industrial enzymes, benefiting from robust secretion capabilities and tolerance to diverse fermentation conditions. Meanwhile, algae remain a niche yet strategic segment, driven by demand for high-value specialty ingredients such as nutraceutical proteins, pigments, and functional bioactives. Collectively, these microbe categories are expected to complement yeast-based systems, supporting diversification of production platforms and enabling broader commercialization of precision fermentation-derived ingredients over the forecast period.

Ingredients Insights

The whey & casein protein segment held the largest revenue share of 20.8% in 2025, driven by strong commercial adoption across dairy alternatives and functional nutrition applications. Precision-fermented whey and casein proteins offer identical amino acid profiles, functional performance, and sensory attributes compared to conventional dairy proteins, while eliminating animal dependency and significantly reducing environmental impact. Their compatibility with existing food formulations, coupled with rising consumer demand for sustainable, lactose-free, and allergen-controlled dairy products, has accelerated uptake among food manufacturers.

Other ingredient segments are witnessing robust but comparatively differentiated growth trajectories. Egg white proteins are gaining momentum in bakery, confectionery, and processed foods due to their foaming, binding, and emulsification properties, while collagen proteins are emerging as a high-margin segment supported by rising demand from nutraceuticals, personal care, and biomedical applications. Heme proteins, although niche in revenue contribution, play a strategically critical role in enhancing flavor and sensory authenticity in plant-based meat alternatives. Enzymes represent a volume-driven segment with stable demand across food processing, pharmaceuticals, and industrial biotechnology, benefiting from well-established fermentation economics. Meanwhile, other ingredients, including specialty fats, growth factors, flavor compounds, and bioactives, are expanding the application scope of precision fermentation, supporting long-term market diversification and value creation.

End Use Insights

The food & beverages segment dominated the market, accounting for the largest revenue share of 63.1% in 2025, driven by the rapid commercialization of animal-free proteins and enzymes across mainstream food applications. Precision fermentation enables the production of dairy-identical proteins, egg proteins, enzymes, and flavor-enhancing ingredients that seamlessly integrate into existing food formulations without compromising taste, texture, or nutritional value. Strong consumer demand for sustainable, clean-label, and allergen-free food products, combined with increasing penetration of plant-based and hybrid foods, has accelerated adoption by global food manufacturers. Additionally, relatively clearer regulatory pathways for food applications, shorter product development cycles, and higher production volumes have positioned food & beverages as the primary revenue-generating end-use segment.

In comparison, pharmaceuticals, personal care & cosmetics, and other end users represent smaller but high-value and fast-evolving segments. The pharmaceutical segment benefits from precision fermentation’s ability to produce high-purity proteins, enzymes, and bioactive compounds with consistent quality, supporting applications in therapeutics, vaccines, and diagnostics. Personal care & cosmetics emerging as a high-growth segment, fueled by rising demand for animal-free collagen, peptides, and active ingredients aligned with sustainability and ethical sourcing trends. Other end users, including agriculture, industrial biotechnology, and research institutions, continue to leverage precision fermentation for specialty bioactives and functional molecules, contributing to market diversification and long-term expansion beyond food-centric applications.

Regional Insight

North America precision fermentation market has remained the largest, primarily due to the increasing consumer awareness and the growing demand for sustainable and eco-friendly products. This trend is fueled by the rising adoption of healthy food ingredients and the increasing embrace of veganism. Notably, according to The Hartman Group, around 40% of U.S. adults, over 90 million individuals, are projected to embrace products, with an estimated reach of 132 million consumers by 2027.

U.S. Precision Fermentation Market Trends

The precision fermentation market in the U.S. is growing due to the increasing consumer awareness and consumption of healthy food ingredients, along with the growing trend of veganism, which is contributing to the growth of the market in this region. Approximately 40% of U.S. adults, totaling over 90 million individuals, are expressing readiness to adopt products.

Asia Pacific Precision Fermentation Market Trends

The precision fermentation market in Asia-Pacific is driven by the need to address food security, population growth, and sustainability. Countries like Japan, China, and Singapore have been particularly active in research and development efforts related to precision fermentation.

Europe Precision Fermentation Market Trends

The precision fermentation market in Europe is growing as regulatory agencies in Europe have been actively engaged in reviewing and updating guidelines related to precision fermentation products. This regulatory involvement reflects the significance of Europe in the market, with countries like Germany, the Netherlands, and the UK leading in research and development.

Latin America Precision Fermentation Market Trends

The precision fermentation market in Latin America is gradually expanding, driven by rising interest in alternative proteins, sustainable food production, and biotech-driven ingredients. Countries like Brazil and Argentina are witnessing growing investments in food tech and bio-innovation, supporting applications in dairy alternatives, enzymes, and functional ingredients. However, the market remains at a nascent stage, with scalability and regulatory support being key challenges for broader adoption.

Middle East & Africa Precision Fermentation Market Trends

The precision fermentation market in the Middle East & Africa is in the early stages of development, with growing interest in food security, alternative protein sources, and biotechnology innovation. Countries like the UAE and Israel are investing in food tech startups and research focused on sustainable production methods. However, limited infrastructure, regulatory clarity, and high production costs currently constrain large-scale adoption across the broader region.

Key Precision Fermentation Company Insight

Key players operating in the precision fermentation market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Precision Fermentation Companies:

The following are the leading companies in the precision fermentation market. These companies collectively hold the largest market share and dictate industry trends.

- Geltor

- Perday Day Inc

- The Every Co.

- Impossible Foods Inc.

- Motif FoodWorks Inc.

- Formo

- Eden Brew

- Mycorena

- Change Foods

- MycoTechnology

Recent Developments

-

In March 2025, the government of the UK announced an investment of USD 1.87 million in an R&D and innovation hub to help the Food Standards Agency (FSA) enhance its expertise in new technologies. This investment focuses on precision fermentation, which uses microorganisms to produce specific components such as fats, proteins, and sugar. The hub aims to provide innovators and investors with more precise guidance on regulatory requirements and to strengthen the FSA's scientific capacity for assessing the risks of innovative products.

-

In May 2023, EVERY Company and Alpha Foods entered into a Joint Development Agreement with the shared objective of bringing next-generation alt-meat products to the market. This collaboration aims to assertively leverage EVERY's trailblazing expertise in animal-free protein production and Alpha Foods' renowned chef-crafted plant-based foods to accelerate advancements in taste and texture for non-animal products.

-

In March 2023, The partnership between The Hartman Group, Perfect Day, and Cargill provided invaluable insights into consumer attitudes and preferences related to precision fermentation ingredients, thus strengthening Perfect Day's market position and establishing its leadership in the Precision Fermentation Alliance.

Precision Fermentation Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6.44 billion

Revenue forecast in 2033

USD 101.53 billion

Growth rate

CAGR of 48.3% from 2026 to 2033

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Microbe, ingredients, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Geltor; Perday Day Inc.; The Every Co.; Impossible Foods Inc.; Motif FoodWorks Inc; Formo; Eden Brew; Mycorena; Change Foods; MycoTechnology.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precision Fermentation Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global precision fermentation market report based on microbe, ingredient, end use, and region:

-

Microbe Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Yeast

-

Algae

-

Fungi

-

Bacteria

-

-

Ingredients Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Whey & Casein Protein

-

Egg White

-

Collagen Protein

-

Heme Protein

-

Enzymes

-

Other Ingredients

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Food & Beverages

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global precision fermentation market size was estimated at USD 4.68 billion in 2025 and is expected to reach USD 6.44 billion in 2026.

b. The global precision fermentation market is expected to grow at a compound annual growth rate of 48.3% from 2026 to 2033 to reach USD 101.53 billion by 2033.

b. The yeast segment dominated the precision fermentation microbe market, accounting for the largest revenue share of 43.1% in 2025, due to its proven industrial scalability, high protein expression efficiency, and broad regulatory acceptance across major end-use industries. Its compatibility with large-scale bioreactors and cost-efficient downstream processing has enabled faster commercialization of high-volume ingredients, reinforcing its market leadership.

b. Some of the key players operating in the precision fermentation market include Geltor, Perday Day Inc, The Every Co., Impossible Foods Inc., Motif FoodWorks Inc., Formo, Eden Brew, Mycorena, Change Foods, and MycoTechnology.

b. The precision fermentation market is primarily driven by rising demand for sustainable, animal-free proteins and bio-identical ingredients, coupled with growing investment in alternative protein technologies. The advances in strain engineering, improving fermentation yields, and increasing regulatory approvals are accelerating commercialization across food, pharmaceutical, and personal care applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.