- Home

- »

- Clinical Diagnostics

- »

-

Predictive Genetic Testing And Consumer Genomics Market Report, 2030GVR Report cover

![Predictive Genetic Testing And Consumer Genomics Market Size, Share & Trends Report]()

Predictive Genetic Testing And Consumer Genomics Market (2025 - 2030) Size, Share & Trends Analysis Report By Test, By Application, By Setting (DTC, Professional), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-374-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

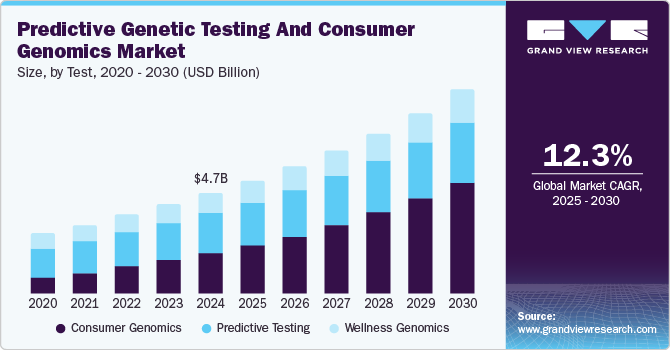

The global predictive genetic testing and consumer genomics market size was valued at USD 4.74 billion in 2024 and is projected to grow at a CAGR of 12.3% from 2025 to 2030. The increasing incidence rates of various genetic disorders globally and improving efforts by governments to launch programs and initiatives that can boost research and development in the genetic testing segment are factors expected to drive industry expansion in the coming years. Additionally, there has been a noticeable increase in the number of partnership models between major vendors operating in the genomics industry, which has widened the scope of this market. Such innovative collaborations have enabled companies to offer comprehensive and feasible solutions to consumers, driving their adoption rate.

The rising awareness regarding genetic disorders such as cardiovascular diseases (CVDs), diabetes, Alzheimer’s disease, and different forms of cancer has created substantial demand for predictive genetic testing. This is an advanced technique that predicts the risk of such conditions in asymptomatic patients by examining their DNA for modifications/mutations in living organism genes. The use of predictive genetic testing offers highly accurate next-generation platform sequencing outcomes, thus improving the scope of developing a cure for genetic disorders. The rapidly expanding personalized medicine sector is anticipated to act as another major driver for market growth during the forecast period. The development of personalized medicine involves utilizing a person’s genetic structure to guide them in the prevention, diagnosis, and treatment of diseases. Predictive genetic testing has become a vital aspect of this industry due to various advancements in microarray and genetic technologies in recent years.

Companies involved in the development of predictive testing and genomics products are frequently investing in research & development activities to understand the occurrence of various diseases and how the genetic structure factors in their development. For instance, 23andMe, in partnership with the Johns Hopkins University School of Medicine and the National Institutes of Health, has published findings regarding the link between sickle cell trait and higher chances of certain blood clots. The study, released in September 2024, found that there is an association between having sickle cell trait and pulmonary emboli development. Another association has been confirmed between Factor V Leiden and pulmonary emboli and deep vein thrombosis. Such results can prove to be important in cases of hospitalizations or surgeries for people with sickle cell trait. Organizations are also collaborating with educational and research institutions to introduce or strengthen genetics education. This is expected to boost awareness regarding predictive genetic testing and the correlation of genetics to different disorders.

Test Insights

The predictive testing segment accounted for a significant market revenue share in 2024. This testing is expected to witness a steady demand in the coming years on account of rising incidences of genetic disorders among the global population and increasing focus on genetic counseling services. Predictive genetic testing and molecular genetic diagnosis have assumed a vital role in clinical practices and translational research for neurodegenerative diseases in recent years. There is an expectation that the accurate and early identification of diseases or genetic risks in individuals will reduce chances of morbidity and mortality through screening, observation, and early treatment or prevention. Presymptomatic as well as predispositional tests are anticipated to witness significant growth over the forecast period. Tests to understand genetic susceptibility in individuals have witnessed substantial demand as they can identify people facing a higher risk of disorders such as cancer and cardiovascular diseases.

The consumer genomics segment dominated the market in 2024 and is anticipated to advance at the fastest CAGR of 17.9% from 2025 to 2030. There has been a steady growth in the demand for direct-to-consumer (DTC) genetic testing as individuals have become more eager to understand their ancestry, genetic traits, and health risks through a comprehensive DNA analysis. Through various government and non-government initiatives, the general population has become more aware of genetics and the advantages of genetic testing. These benefits include making informed and timely decisions regarding healthcare and the need for prevention and monitoring options, along with understanding and managing the risk of cancer by identifying appropriate treatments. The use of DTC genomic testing has been very popular in revealing family ancestry, with companies such as Ancestry.com now offering convenient genomic tests for people wanting to understand their genomic ancestry. Organizations such as the American College of Medical Genetics and Genomics and the American Society of Human Genetics have published recommendations regarding DTC genomics testing, which can aid individuals in understanding how to approach these tests.

Application Insights

The breast & ovarian cancer segment accounted for the largest revenue share in 2024 and is expected to maintain its leading position during the forecast period. The increasing incidences of breast & ovarian cancer globally have driven demand for predictive genetic testing to determine the risk of these conditions due to the presence of an inherited gene mutation. As per the World Health Organization (WHO), around 2.3 million women were diagnosed with breast cancer globally in 2022, leading to 670,000 deaths. Meanwhile, the World Cancer Research Fund International stated that there were more than 320,000 new cases of ovarian cancer detected worldwide in 2022, with it being considered the eighth most common cancer form in women. The Centers for Disease Control and Prevention (CDC) states that around 5-10% of breast cancers and 10-15% of ovarian cancers are hereditary. Mutations in BRCA1 and BRCA2 genes increase the risk of these types of cancer, with the presence of a BRCA gene mutation in a parent resulting in a 50% chance of the offspring having the same gene mutation.

The demand for predictive genetic testing and consumer genomics in screening for other forms of cancer is expected to witness substantial growth from 2025 to 2030. Cancer is caused by a faulty gene that might be inherited or caused by the alteration of genetic material in the somatic cells. Unlike inherited genes, these can spread to any organ and lead to the development of different forms of cancer. Detection of cancer-causing mutations has become increasingly possible through the use of predictive genetic testing in the clinical stages. The high adoption rate of therapeutic techniques to cure cancer is expected to drive segment expansion in the coming years. Some common types of genetic tests include hereditary cancer gene panel tests, multigene tests, and gene-specific tests. The use of these tools can enable healthcare professionals to identify family members who may potentially carry the same genetic mutations, leading to the development of a better cancer risk management pathway.

Setting Insights

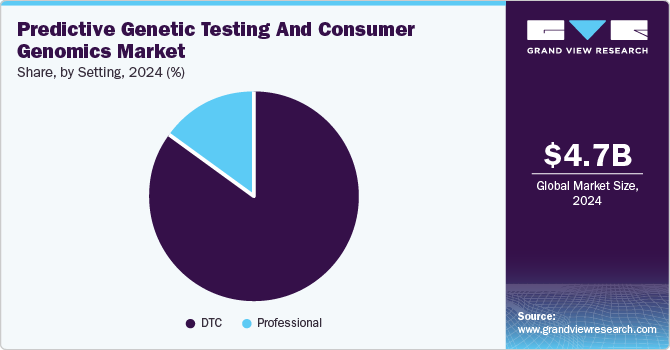

The DTC segment accounted for a dominant revenue share in the market in 2024, as these tests are available at economical costs to consumers. Furthermore, there is significant awareness among consumers regarding the test process and its features & limitations, leading to increased competition among companies aiming to launch accurate testing kits. These kits can be purchased from retail stores or through online platforms, enabling consumers to compare products from different companies. The testing process involves collection of the consumers’ DNA samples at their homes via techniques such as cheek swabs or saliva collection and then sending these samples back to the company for analysis. The results of these tests are generally sent to the consumer through the involved company’s website, mobile application, or any messaging service, ensuring privacy. The high convenience and accessibility provided by DTC tests have allowed consumers to understand their ancestry and genetic makeup without the involvement of a healthcare provider, driving segment growth.

The professional segment is anticipated to advance at a moderate growth rate during the forecast period. The increasing availability of advanced testing kits in hospitals and other medical institutions, coupled with expert advice that healthcare professionals can provide, has encouraged consumers to avail of predictive genetic testing services in these settings. The growth of the genetic counseling industry is expected to contribute substantially to segment expansion on account of rising demand for personalized medicines, technological advancements, and increased awareness among consumers regarding these services. Companies such as Myriad Genetics, Ambry Genetics, and GeneDx, among others, offer premium genetic counseling services to individuals.

Regional Insights

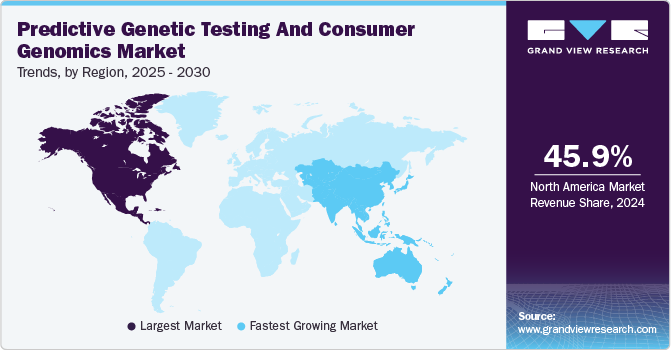

North America led the market in 2024, accounting for a 45.9% global revenue share. The extensive presence of key players undertaking initiatives to enhance their consumer genomics & predictive genetic testing offerings is anticipated to propel regional market growth. Additionally, the high prevalence of diseases such as cancer, diabetes, and cardiovascular disorders in regional economies has created better awareness regarding the role of genetics in their occurrence, leading to increased demand for these testing services. Moreover, the rising pace of initiatives organizations undertake to expand the scope and monitor the functioning of available predictive genetic testing tools is expected to drive market growth in the coming years.

U.S. Predictive Genetic Testing and Consumer Genomics Market Trends

The U.S. accounts for a dominant revenue share in the regional market and is anticipated to maintain its position during the forecast period. The presence of organizations such as the American Board of Genetic Counseling, the National Society of Genetic Counselors, and the American Society of Human Genetics has led to a constant monitoring of medical genetic practices in the economy, driving market growth. Additionally, the widespread availability of services offered by notable companies such as 23andMe and Myriad Genetics has propelled the development of advanced testing kits to provide more accurate consumer results. Moreover, there is a constant growth in the number of people suffering from chronic conditions, prompting biologists and healthcare institutions to invest in developing predictive genetic tests as a preventive care method.

Europe Predictive Genetic Testing and Consumer Genomics Market Trends

Europe is projected to contribute substantially to the global market in the coming years on account of the rising prevalence of disorders such as CVDs and various forms of cancer among the regional population. Regulations regarding genetic testing differ by country and are generally considered to be directly related to healthcare services. The launch of various government initiatives to encourage the use of advanced testing techniques and the emergence of several companies offering predictive genetic testing and consumer genomics services are expected to aid regional growth.

The UK is anticipated to account for a substantial share of the regional market during the forecast period. Growing awareness regarding the role of genetics in causing disorders such as breast cancer, ovarian cancer, and CVDs is anticipated to boost the demand for predictive testing services in the economy. The National Health Service (NHS) has introduced the ‘Genomics Education Programme’ to enable medical professionals to leverage advancements and innovations in genomics to offer optimal patient care. In January 2024, the program developed a strategic framework to integrate genomic medicine into pharmacy education and training in three years, which is expected to drive market expansion in the economy.

Asia Pacific Predictive Genetic Testing and Consumer Genomics Market Trends

Asia Pacific is expected to register the fastest CAGR in the market from 2025 to 2030 on account of the increasing popularity and growing awareness amongst the regional population regarding the availability of genetic tests to identify the elevated risk of chronic diseases. Additionally, strengthening healthcare infrastructure in regional economies such as China, Japan, India, and Singapore is expected to provide further avenues for growth for service providers. MedGenome Labs is a leading provider of genetic diagnostic testing services in India and South Asian economies, offering AI-based solutions to ensure better management of rare inherited diseases, cancer, diabetes, and CVDs, among other conditions.

The rapid development of healthcare infrastructure in India, coupled with the growing presence of multinational companies that offer genetic testing kits, has resulted in a significant contribution of the economy to the regional market. Research carried out to assess the effectiveness of these tests is anticipated to accelerate the growth of this market. Diagnostic companies in India are increasingly investing in expanding their service offerings by developing advanced predictive tests. Constant developments in predictive testing as a useful technique for preventive care are expected to drive market growth. For instance, Nucleome Informatics, a genomics service provider based in Telangana, has launched an advanced genetic test to diagnose inherited retinal disorders called the ‘DrSeq IRD panel.’ The test has been designed to boost early detection and disease management, particularly in individuals with a family history of blindness.

Key Predictive Genetic Testing And Consumer Genomics Company Insights

Some notable companies in the predictive genetic testing and consumer genomics market include 23andMe, Myriad Genetics, and Abbott, among others.

-

23andMe is a consumer genetics testing organization that operates in the U.S., the UK, and Canada, among other countries. The company mainly functions through the Therapeutics and the Consumer & Research Services segments. The latter division offers personal genome service (PGS), which includes a suite of genetic reports containing information regarding customers' genetic ancestral origins, their risk of acquiring genetic conditions, and the probability of passing on rare carrier conditions to their children. Meanwhile, the Therapeutics segment is involved in developing novel therapies and conducting R&D of programs in a range of therapeutic areas, such as oncology, immunological and inflammatory diseases, and other diseases.

-

Myriad Genetics is a precision medicine and genetic testing organization involved in developing genetic tests across the U.S. and other countries globally. The company provides tests for prenatal care, mental health, cancer risk assessment, and cancer management for different forms such as breast, ovarian, and pancreatic. Myriad Genetics has developed several advanced tests, including the BRACAnalysis CDx Germline Companion Diagnostic Test, which helps determine the ideal therapy for individuals suffering from metastatic breast, metastatic pancreatic, ovarian, and metastatic prostate cancer with deleterious or suspected deleterious germline BRCA variants. Another test is the Foresight Carrier Screen, which is a prenatal testing service that helps future parents assess the risk of passing on a recessive genetic disorder to their offspring.

Key Predictive Genetic Testing And Consumer Genomics Companies:

The following are the leading companies in the predictive genetic testing and consumer genomics market. These companies collectively hold the largest market share and dictate industry trends.

- 23andMe, Inc.

- Myriad Genetics, Inc.

- F. Hoffmann-La Roche Ltd

- Abbott

- Agilent Technologies, Inc.

- Thermo Fisher Scientific Inc.

- BGI

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- ARUP Laboratories

Recent Developments

-

In August 2024, Myriad Genetics announced the completion of the sale of the company’s EndoPredict business unit to Eurobio Scientific, a France-based developer of in-vitro medical diagnostics and life sciences solutions. EndoPredict is a prognostic testing service that predicts the risk of recurrence of breast cancer in patients, thus identifying individuals who can safely forgo chemotherapy. The development also involves Myriad Genetics awarding Eurobio Scientific the sales rights of Prolaris in-vitro diagnostic (IVD) kits in markets outside of the U.S.

-

In July 2024, 23andMe announced its partnership with 20 notable lung cancer advocacy institutes to launch a comprehensive study to advance lung cancer research efforts. The main objective of the Lung Cancer Genetics Study is to better understand the genetics of lung cancer-afflicted people to help improve its detection, ensure a reduction in risk, and provide optimal care to patients.

Predictive Genetic Testing and Consumer Genomics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.32 billion

Revenue forecast in 2030

USD 9.51 billion

Growth rate

CAGR of 12.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test, application, setting, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, China, Japan, India, Singapore, Australia, Brazil, South Africa

Key companies profiled

23andMe, Inc.; Myriad Genetics, Inc.; F. Hoffmann-La Roche Ltd; Abbott; Agilent Technologies, Inc.; Thermo Fisher Scientific Inc.; BGI; Bio-Rad Laboratories, Inc.; Illumina, Inc.; ARUP Laboratories

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Predictive Genetic Testing And Consumer Genomics Market Report Segmentation

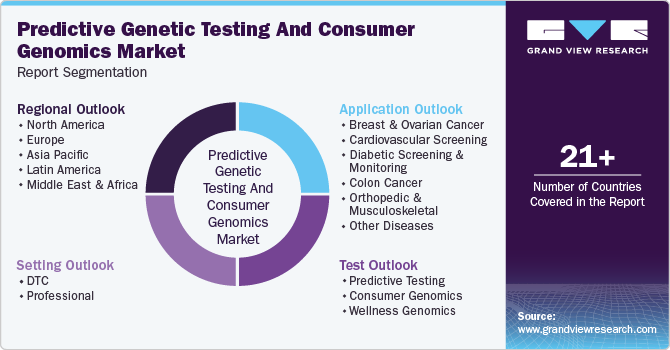

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the predictive genetic testing and consumer genomics market report based on test, application, setting, and region:

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Predictive Testing

-

Genetic Susceptibility Test

-

Predictive Diagnostics

-

Population Screening

-

-

Consumer Genomics

-

Wellness Genomics

-

Nutria Genetics

-

Skin & Metabolism Genetics

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast & Ovarian Cancer

-

Cardiovascular Screening

-

Diabetic Screening & Monitoring

-

Colon Cancer

-

Parkinsonism/Alzheimer’s Disease

-

Urologic Screening/Prostate Cancer Screening

-

Orthopedic & Musculoskeletal

-

Other Cancer Screening

-

Other Diseases

-

-

Setting Outlook (Revenue, USD Million, 2018 - 2030)

-

DTC

-

Professional

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.