- Home

- »

- Clinical Diagnostics

- »

-

Ovarian Cancer Diagnostics Market, Industry Report, 2033GVR Report cover

![Ovarian Cancer Diagnostics Market Size, Share & Trends Report]()

Ovarian Cancer Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Cancer (Epithelial Tumor, Germ Cell Tumor, Stromal Cell Tumor), By Diagnosis (Imaging, Blood Test, Biopsy), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-421-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ovarian Cancer Diagnostics Market Summary

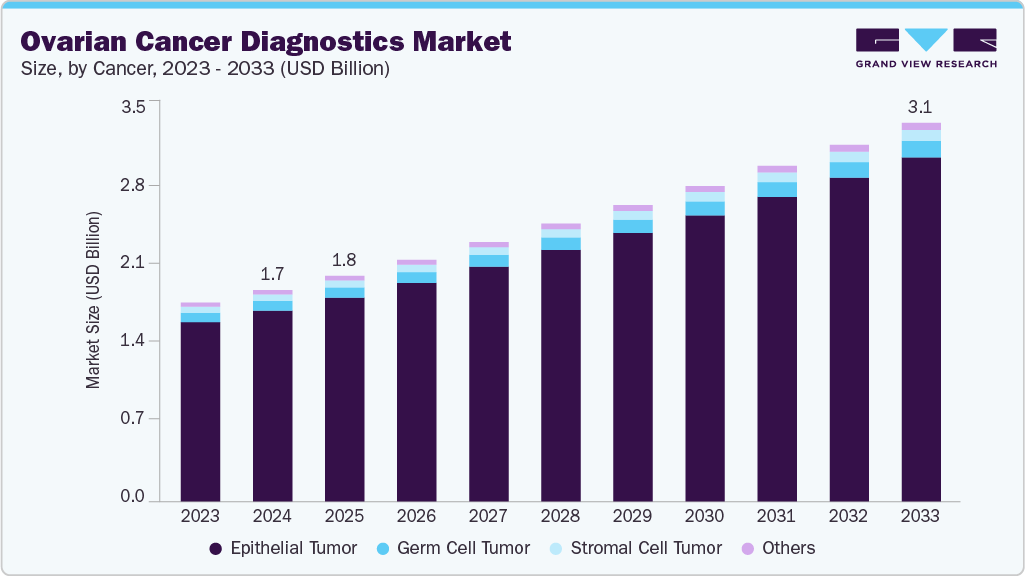

The global ovarian cancer diagnostics market size was estimated at USD 1.74 billion in 2024 and is projected to reach USD 3.11 billion by 2033, growing at a CAGR of 6.73% from 2025 to 2033. The ovarian cancer diagnostics market is advancing rapidly, driven by biomarker discovery, federal funding, and new technologies.

Key Market Trends & Insights

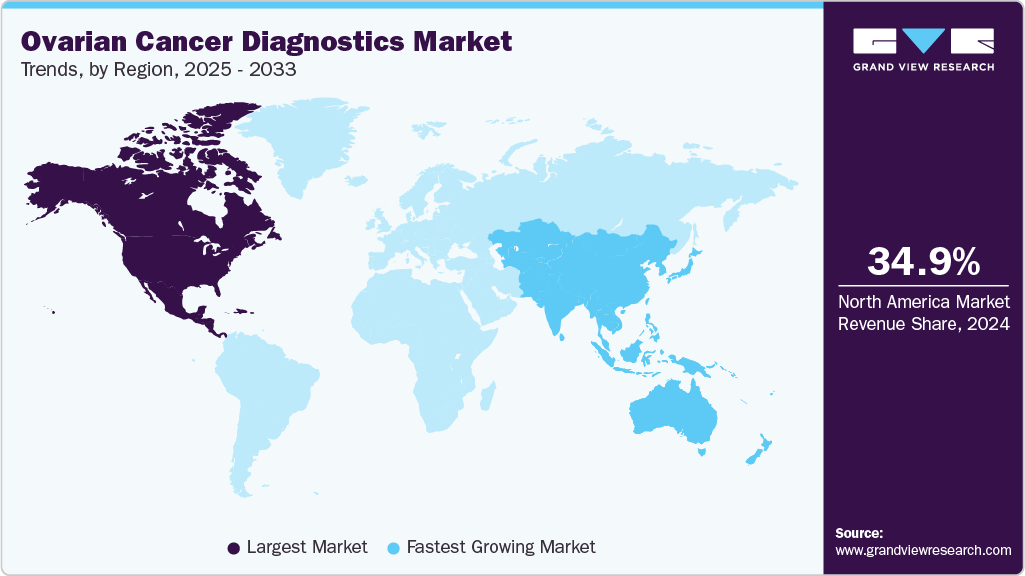

- North America held the largest share of 34.96% in 2024.

- Advancements in diagnostic technologies are transforming methods for diagnosis of ovarian cancer in the U.S. Techniques such as MRI and CT scans provide detailed images that help detect ovarian tumors, assess their size and spread more accurately.

- By cancer, the epithelial tumor segment held the highest market share of 90.33% in 2024.

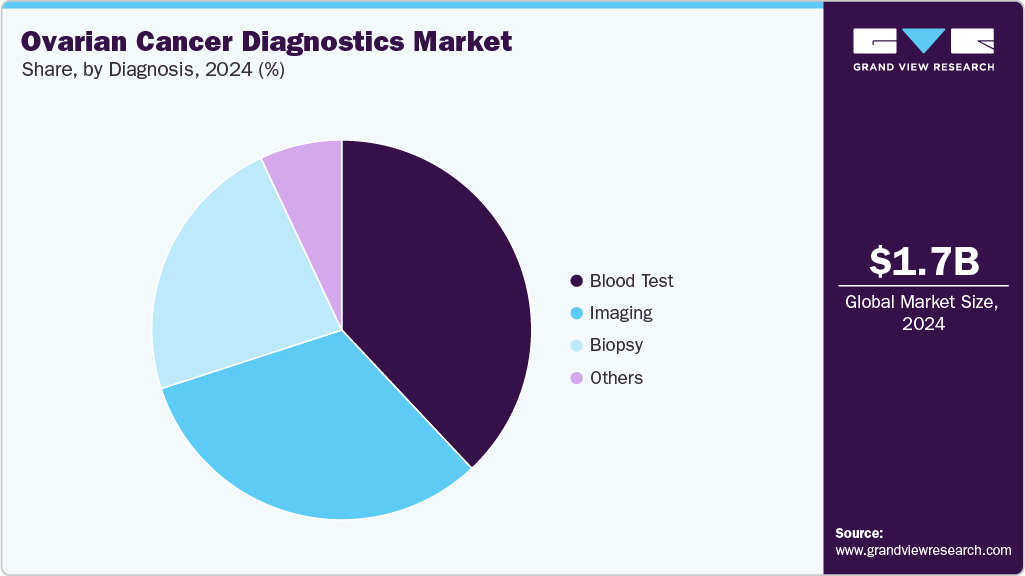

- By diagnosis, the imaging segment held the highest market share of 31.95% in 2024.

- By end-use, the hospital laboratories segment held the highest market share of 40.49% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.74 Billion

- 2033 Projected Market Size: USD 3.11 Billion

- CAGR (2025-2033): 6.73%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In 2025, the U.S. will see nearly 21,000 new cases and over 12,000 deaths, underscoring the need for earlier detection. Breakthroughs include PPP2R1A mutations as predictive biomarkers in ovarian clear cell carcinoma and AOA Dx’s multi-omic, AI-powered blood test, which achieved >90% accuracy in symptomatic women, outperforming traditional biomarkers. Federal support is strong, with the DoD allocating $650M in FY25 to the Ovarian Cancer Research Program, funding precision medicine, prevention, and survivorship studies. Despite progress, testing disparities persist, particularly in older and underserved women. Overall, the market is shifting toward precision, multi-omic, and patient-centric diagnostics with significant growth potential.The ovarian cancer diagnostics market is significantly transforming, shaped by epidemiological need, biomarker discovery, technological innovation, and shifting clinical strategies. In 2025, an estimated 20,890 new cases of ovarian cancer will be diagnosed in the U.S., with 12,730 deaths (American Cancer Society). Despite being the 11th most common cancer among women, ovarian cancer remains the fifth leading cause of cancer-related death and the deadliest gynecologic malignancy. As of 2022, approximately 243,572 women in the U.S. were living with a prior ovarian cancer diagnosis (SEER), reflecting the growing patient base that depends on early and accurate diagnostics. Significantly, mortality rates are modestly declining but lag behind improvements seen in other cancers, highlighting the urgency for better detection and stratification tools.

The market is increasingly shaped by biomarker-driven innovation. A landmark discovery in July 2025 at MD Anderson Cancer Center identified PPP2R1A mutations as a predictive biomarker for improved survival in ovarian clear cell carcinoma (OCCC) treated with immunotherapy, with median overall survival extending to 66.9 months versus 9.2 months in non-mutant patients. This breakthrough validates immunogenomic diagnostics and highlights the role of genetic testing in patient stratification, fueling demand for next-generation molecular diagnostics. Parallel efforts focus on the PP2A pathway, with early-phase trials exploring therapeutic targeting in OCCC and other tumor types, demonstrating how diagnostics and therapeutics converge in a precision oncology framework.

In parallel, large-scale funding initiatives are reinforcing this momentum. In April 2025, the U.S. Department of Defense (DoD) announced $650 million in appropriations for its Congressionally Directed Medical Research Programs (CDMRP), with a dedicated portion for the Ovarian Cancer Research Program (OCRP). The FY25 OCRP will support high-impact research on early detection, prevention, survivorship, and precision medicine, offering major grants such as the Investigator-Initiated Research Award (up to $1.05M), the Clinical Trial Academy - Early Career Investigator Award (up to $1.4M), and Pilot Awards (up to $350K). These investments signal strong federal backing to accelerate diagnostic innovation and improve clinical outcomes.

Despite advances, testing gaps remain a significant market driver. In March 2025, the Ovarian Cancer Research Alliance (OCRA) and Komodo Health reported that nearly half of women with ovarian cancer are not receiving genetic testing, despite universal guidelines. Disparities are most evident among women over 65 and those on public insurance, where testing rates fall below 40%. Since genetic testing underpins therapy selection particularly for BRCA mutation-positive patients eligible for PARP inhibitors addressing these gaps is central to improving outcomes. As a result, organizations like OCRA are expanding patient-support tools, such as the “Find a Doctor” platform (launched April 2024), which connects patients to more than 2,000 gynecologic oncology specialists and integrates trial-finder functionality, increasing awareness and adoption of diagnostics.

The market also benefits from strategic realignment in preventive strategies. Following evidence from large-scale UK trials showing the limited impact of symptom-based detection on mortality, OCRA and the Society of Gynecologic Oncology (SGO) began advocating for universal genetic testing and opportunistic salpingectomy (fallopian tube removal during pelvic surgery) in 2023. This shift reflects a growing reliance on risk-based and genetic diagnostics rather than conventional screening, driving greater uptake of molecular and genomic tests.

Technological breakthroughs are also redefining early detection. In August 2025, AOA Dx published peer-reviewed results in Cancer Research Communications showing that its multi-omic, AI-powered blood test achieved strong accuracy in symptomatic women, with an AUC of 93% for all stages and 91% for early-stage ovarian cancer in training cohorts, and 92% and 88% respectively, in independent real-world cohorts. The platform outperformed traditional biomarkers by combining lipid, ganglioside, and protein biomarkers with machine learning, offering a scalable, non-invasive solution that could transform early-stage detection, where survival benefits are most significant.

Furthermore, initiatives such as OCRA’s international data commons and the first ovarian ad endometrial cancer registry (2023) create the infrastructure for large-scale real-world evidence generation. By consolidating patient-level genomic and clinical data, these efforts aim to accelerate biomarker discovery, improve predictive diagnostics, and inform payor adoption an increasingly important growth lever for the diagnostics industry.

Overall, the ovarian cancer diagnostics market moves rapidly from traditional pathology and symptom awareness toward a genomics-led, precision-driven, patient-centered model. Growth is fueled by a convergence of factors: rising disease prevalence, breakthrough biomarkers such as PPP2R1A, demand for equitable access to genetic testing, integration of digital patient navigation tools, robust federal research funding, and international collaboration in data-driven research. While challenges around testing disparities, cost barriers, and lack of validated early screening tools persist, the sector is evolving into a high-value segment of the broader next-generation cancer diagnostics market. Its trajectory is increasingly defined by companion diagnostics, liquid biopsy innovations, and immunogenomic testing, which are expected to unlock significant commercial and clinical opportunities over the next decade.

Market Concentration & Characteristics

Innovation in ovarian cancer diagnostics has accelerated in recent years, largely because traditional tools such as CA-125 testing and imaging offer limited reliability for early detection. New multi-omic assays, such as AOA Dx’s blood-based platform, are setting a benchmark for integrating proteomics, lipidomics, and machine learning into one test. Advances in genetic biomarkers, including BRCA, HRD, and the recently identified PPP2R1A mutation, are reshaping treatment stratification. Research funding from federal agencies and advocacy groups is also encouraging high-risk, high-reward projects aimed at transforming screening, prevention, and precision diagnostics.

While ovarian cancer diagnostics has not seen the same level of blockbuster M&A activity as broader oncology diagnostics, the trend is slowly shifting. Larger diagnostics and life science firms are eyeing startups with strong biomarker pipelines, AI-powered analytics, and liquid biopsy platforms. Collaborations with pharma remain a key growth lever, especially for companion diagnostics tied to PARP inhibitors and immunotherapy. Several mid-sized acquisitions in recent years have highlighted a push to build more comprehensive women’s health portfolios, signaling that consolidation, although measured, is becoming a strategic pathway for market entry and scale.

The regulatory environment is particularly important in ovarian cancer diagnostics, where early detection tools face scrutiny because of the high risk of false positives and negatives. The FDA’s approval of genetic and HRD companion diagnostics has already transformed therapeutic eligibility, while ongoing changes under Europe’s IVDR are increasing compliance demands for diagnostic manufacturers. In the U.S., CMS reimbursement remains a decisive factor influencing adoption, particularly among older patients on Medicare. Government-backed funding, such as the Department of Defense’s $650 million allocation for ovarian cancer research in FY25, illustrates strong policy support for innovation.

Despite the progress in molecular and multi-omic testing, ovarian cancer diagnosis still relies heavily on older substitutes such as ultrasound, CT imaging, pelvic exams, and the CA-125 blood test. These remain entrenched in clinical practice because they are inexpensive and widely accessible, but they lack the sensitivity needed for early detection. Symptom-based diagnosis also continues to play a role, though it has limited impact on mortality. As precision tools gain traction, these conventional substitutes are increasingly viewed as insufficient, yet they remain part of the diagnostic pathway, especially in resource-limited settings.

End User adoption of ovarian cancer diagnostics is uneven. Academic medical centers, NCI-designated cancer institutes, and specialized women’s health hospitals account for the majority of advanced testing. They have the infrastructure to run NGS, liquid biopsy, and companion diagnostics while integrating genetic counseling. By contrast, community hospitals and smaller clinics face barriers around cost, expertise, and reimbursement, which restrict adoption. Patient advocacy groups and digital health platforms are helping bridge the gap by improving awareness and navigation. Pharma companies also represent an important end user segment as they increasingly depend on diagnostics to guide trial design and therapy eligibility.

Cancer Insights

Epithelial tumor held the largest market revenue share of 90.33% in 2024. According to National Library of Medicine, epithelial ovarian tumors, the most common type of ovarian cancer, account for about 95% of all ovarian cancer cases. This high incidence rate significantly drives the demand for effective diagnostic tools tailored specifically to this Cancer. Given the substantial proportion of ovarian cancer patients affected by epithelial tumors, there is a critical need for accurate and efficient diagnostic methods to identify and characterize these tumors at an early stage.

Technological innovations in imaging techniques, molecular diagnostics, and genetic profiling are significantly enhancing the accuracy and early detection of stromal cell tumors within the global ovarian cancer diagnostics market. Advanced emerging technologies, such as MRI (Magnetic Resonance Imaging) and ultrasound, provide detailed images that helps in identifying and characterizing stromal cell tumors with greater precision than traditional methods is driving the growth of stromal cell tumor segment.

Diagnosis Insights

The imaging segment held the largest market revenue share of 31.95% in 2024. Imaging remains a cornerstone of ovarian cancer diagnostics and is undergoing rapid transformation, directly influencing the market landscape. Ultrasound, particularly transvaginal sonography, continues to be the first-line modality due to its accessibility and cost-effectiveness. The adoption of structured reporting systems such as O-RADS for ultrasound and MRI is improving consistency, accuracy, and clinical confidence, while also driving demand for AI-powered analytics and decision-support tools that enhance interpretation.

CT scans remain central for staging and surgical planning, but their role is increasingly complemented by PET/CT and MRI, which improve the detection of metastases and recurrence. This multimodality approach reflects the broader shift toward comprehensive diagnostic ecosystems, integrating imaging with molecular diagnostics such as genomics and liquid biopsy. Functional imaging, including diffusion-weighted MRI and PET/MRI, is expanding in advanced centers, offering both structural and metabolic insights that are vital for personalized treatment planning and clinical trial endpoints. A notable milestone came in November 2021, when the FDA approved Cytalux (pafolacianine), a targeted imaging agent designed to illuminate ovarian cancer lesions intraoperatively. By binding to folate receptors and fluorescing under near-infrared light, Cytalux enabled surgeons to identify additional cancerous lesions in 26.9% of patients that were missed through conventional methods. This breakthrough highlights the emergence of molecular imaging agents as a powerful adjunct to traditional modalities, improving surgical precision and patient outcomes while opening new commercial avenues in intraoperative imaging.

Innovations in biopsy technologies, such as ultrasound-guided biopsies, fine-needle aspiration (FNA), and core needle biopsy (CNB), are improving accuracy and reducing invasiveness, thereby increasing their adoption in ovarian cancer diagnostics. Moreover, Artificial intelligence (AI) is accelerating the transition of ovarian cancer diagnostics toward minimally invasive and highly accurate platforms. A landmark September 2024 study from Johns Hopkins Kimmel Cancer Center, published in Cancer Discovery, demonstrated that combining cell-free DNA fragmentome analysis (DELFI-Pro) with protein biomarkers CA-125 and HE4 significantly improves early detection accuracy. The AI-enabled liquid biopsy detected 72% of Stage I, 69% of Stage II, 87% of Stage III, and 100% of Stage IV ovarian cancers, while sharply reducing false positives. Critically, it also distinguished benign adnexal masses from malignant tumors, potentially sparing many women from unnecessary exploratory surgery.

Building on this trend, AOA Dx presented data in April 2025 showing its AI-driven multi-omic liquid biopsy outperformed traditional biomarkers in a 1,000-patient symptomatic cohort, achieving AUCs of 92-93% across all stages and ~89% in early-stage disease. By integrating lipids, gangliosides, and proteins with machine learning, AOA’s test addresses ovarian cancer’s molecular heterogeneity more effectively than single-biomarker approaches. In May 2025, AOA Dx partnered with Sonrai Analytics to leverage its AI-powered bioinformatics platform for biomarker validation and regulatory readiness. This collaboration aims to accelerate the clinical translation of AOA’s test by combining multi-omic datasets with clinical and demographic data in a secure, cloud-native environment. Together, these advances position AI-powered liquid biopsies as a pivotal growth driver in ovarian cancer diagnostics. They promise earlier detection, better risk stratification, fewer unnecessary surgeries, and alignment with the broader precision oncology paradigm, creating opportunities for commercial adoption in screening, diagnosis, and therapeutic decision support.

End-use Insights

The hospital laboratories segment held the highest market revenue share of 40.49% in 2024. Hospitals often collaborate with diagnostic companies, research institutions, and pharmaceutical companies to enhance diagnostic capabilities and develop innovative diagnostic tools for ovarian cancer. These partnerships contribute to the adoption of new diagnostic technologies in hospital settings. In May 2024, the Maharashtra government announced plans to outsource critical healthcare services in state hospitals through collaborations with private entities. This initiative aims to extend advanced healthcare services to remote and underserved areas, thereby improving patients’ access to quality medical care.

The increasing integration of artificial intelligence (AI) and machine learning (ML) algorithms in ovarian cancer diagnostics is driving advancement in healthcare sector. AI and ML technologies enable cancer diagnostic centers to analyze vast amounts of patient data quickly and accurately, aiding in early detection and precise prognosis. These algorithms detect subtle patterns and anomalies in imaging results, biomarker data, and genetic profiles that may indicate ovarian cancer at its earliest stages, when treatment is most effective.

Regional Insights

North America held the largest share of 34.96% in 2024. High healthcare expenditure in North America is driving investments towards advanced diagnostic technologies and infrastructure within cancer diagnostic centers. The substantial financial resources available enable healthcare providers and institutions to adopt and integrate cutting-edge diagnostic modalities, such as genetic testing, molecular imaging, and AI-driven analytics, into clinical practice. This timely adoption of new technologies enhances the accuracy, efficiency, and scope of diagnostic capabilities for diseases such as ovarian cancer. The financial capability supports the development of state-of-the-art facilities equipped with specialized equipment and skilled healthcare professionals, thereby improving patient access to comprehensive diagnostic services.

U.S. Ovarian Cancer Diagnostics Market Trends

Advancements in diagnostic technologies are transforming methods for diagnosis of ovarian cancer in the U.S. Techniques such as MRI and CT scans provide detailed images that help detect ovarian tumors, assess their size and spread more accurately. These imaging methods have improved significantly, offering better resolution and contrast, which enhances their effectiveness in diagnosis and treatment planning. Biomarker tests, such as CA-125 and HE4 measurements in blood samples, are crucial for monitoring cancer progression and treatment response. When combined with advanced imaging, these biomarkers provide a comprehensive approach to diagnosing ovarian cancer across its stages. Genetic testing plays a key role in identifying mutations such as BRCA1 and BRCA2, linked to higher ovarian cancer risks. This genetic information not only aids in early detection among high-risk individuals but also guides personalized treatment strategies. Continued advancements in these technologies promise earlier detection, improved outcomes, and potentially reduced mortality rates from ovarian cancer.The U.S. market is driven by high disease burden, strong uptake of genetic testing, and rapid integration of AI-powered liquid biopsy platforms. Federal initiatives, such as DoD and NIH-backed research programs, continue to stimulate biomarker discovery. However, disparities in access-particularly among older women and those on public insurance-remain a structural barrier to equitable adoption.

Europe Ovarian Cancer Diagnostics Market Trends

Europe shows steady demand growth, supported by widespread BRCA and HRD testing adoption, as well as structured clinical networks that integrate molecular and imaging diagnostics. EU-funded projects are accelerating early detection research. Cost-containment policies and differences in reimbursement frameworks across member states, however, limit uniform adoption of novel diagnostics, keeping the market fragmented.

The UK market is increasingly shaped by national screening debates and outcomes of long-term trials questioning symptom-based detection. NHS is focusing on opportunistic salpingectomy and universal germline testing, while partnering with academic groups to validate liquid biopsies. Broader integration of genomic testing into standard care, supported by the Genomic Medicine Service, underpins sustainable demand growth.

Germany leads continental Europe in adoption of companion diagnostics and integration of imaging with molecular tests. Strong research collaborations with universities and biotech firms are driving biomarker-led innovation. Favorable reimbursement pathways for BRCA testing support growth, though high cost pressures on hospitals slow the uptake of advanced AI-enabled platforms and non-invasive liquid biopsy tests.

Asia Pacific Ovarian Cancer Diagnostics Market Trends

Asia Pacific is the fastest-growing region, driven by rising incidence, government-backed cancer screening initiatives, and increasing investments in diagnostic infrastructure. Japan and China dominate in technology adoption, with local biotech firms actively developing liquid biopsy platforms. However, uneven access between urban and rural populations creates disparities, and price sensitivity remains a limiting factor for advanced diagnostics.

China’s market is accelerating with strong government emphasis on precision medicine and expansion of molecular testing capacity. Partnerships between local hospitals and global diagnostic firms are expanding access to genetic and liquid biopsy tests. Despite rapid growth, challenges include uneven quality across laboratories and a need for greater clinician awareness of guideline-recommended diagnostic protocols.

Japan’s ovarian cancer diagnostics market is defined by high adoption of imaging innovations and integration of biomarker-led diagnostics into routine care. National health insurance coverage for BRCA testing and companion diagnostics drives uptake. The country’s strong clinical trial ecosystem also positions Japan as a key hub for validating AI-enabled and multi-omic early detection platforms.

Latin America Ovarian Cancer Diagnostics Market Trends

In Latin America, ovarian cancer diagnostics adoption is hindered by limited infrastructure and reimbursement constraints, though demand is growing with improved awareness and private sector investment. Brazil leads the region in implementing molecular tests, but access to advanced imaging and liquid biopsy remains uneven. Partnerships with NGOs and regional cancer alliances are expanding testing reach.

Brazil is emerging as the focal point of Latin America’s ovarian cancer diagnostics market, with rising adoption of BRCA testing and growing investments in diagnostic labs. Academic collaborations are enabling pilot programs in liquid biopsy and AI-based imaging analytics. However, significant disparities persist between private and public healthcare sectors, limiting nationwide access to advanced diagnostics.

Middle East And Africa Ovarian Cancer Diagnostics Market Trends

The region is at an early stage of adoption, with diagnostic infrastructure concentrated in urban centers. UAE and Saudi Arabia are investing in genomic testing and cancer centers, while African countries rely heavily on imaging as the primary diagnostic modality. Limited reimbursement frameworks and shortage of trained specialists constrain advanced diagnostics adoption, but awareness is rising.

Saudi Arabia is investing heavily in healthcare transformation under Vision 2030, which includes precision oncology and advanced diagnostics. New cancer centers and partnerships with global diagnostic firms are accelerating the adoption of BRCA and molecular testing. However, the market faces challenges in scaling nationwide access and addressing shortages in specialized gynecologic oncology expertise.

Key Ovarian Cancer Diagnostics Company Insights

Major players are increasingly focusing on strategic initiatives, such as product launches & development, mergers & acquisitions, licensing partnerships, and co-development deals, making this market highly competitive.

-

F. Hoffmann-La Roche AG offers biomarker assays, crucial for monitoring ovarian cancer progression and treatment response.Its offerings include innovative molecular imaging technologies and digital pathology solutions, enabling precise tumor characterization and personalized treatment planning.

Key Ovarian Cancer Diagnostics Companies:

The following are the leading companies in the ovarian cancer diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche AG

- Johnson & Johnson Services, Inc.

- GlaxoSmithKline Plc

- AstraZeneca Plc

- Siemens Healthcare GmbH

- Abbott

- Thermo Fisher Scientific

- Bio-Rad Laboratories, Inc

- Quest Diagnostics Incorporated

- Illumina, Inc

Recent Developments

-

In January 2025, the Ovarian Cancer Research Alliance (OCRA) launched a nationwide awareness campaign in the U.S. to increase uptake of genetic testing among women, focusing particularly on underserved populations over 65 and those on public insurance.

-

In March 2025, Komodo Health partnered with OCRA to publish data showing diagnostic testing disparities in ovarian cancer, prompting insurers and hospitals to revisit guidelines and expand coverage for BRCA and HRD testing.

-

In April 2025, AOA Dx presented clinical data at the AACR Annual Meeting demonstrating high accuracy of its AI-powered multi-omic liquid biopsy platform, showing strong performance in early-stage ovarian cancer detection across 1,000 patient samples.

-

In May 2025, Sonrai Analytics and AOA Dx entered a strategic collaboration to integrate multi-omic biomarker validation and AI-powered data infrastructure, accelerating the regulatory pathway for AOA’s first-in-class liquid biopsy test for symptomatic women.

-

In July 2025, MD Anderson Cancer Center reported a breakthrough discovery of PPP2R1A mutations as predictive biomarkers for ovarian clear cell carcinoma response to immunotherapy, reshaping companion diagnostic development in ovarian cancer.

-

In 2023, the Society of Gynecologic Oncology (SGO) and OCRA began advocating universal germline testing and opportunistic salpingectomy, signaling a major shift in prevention and diagnostic strategies in the ovarian cancer space.

-

In 2024, OCRA launched the first Ovarian and Endometrial Cancer Registry and International Data Commons, creating a global data-sharing ecosystem to accelerate biomarker discovery, diagnostics validation, and payer adoption.

Ovarian Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.85 billion

Revenue forecast in 2033

USD 3.11 billion

Growth rate

CAGR of 6.73% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Diagnosis, cancer, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway Japan; China ; India; Australia; South Korea; Thailand ; Brazil; Argentina; South Africa; South Arabia; UAE & Kuwait

Key companies profiled

F. Hoffmann-La Roche AG; Johnson & Johnson Services Inc.; GlaxoSmithKline Plc; AstraZeneca Plc; Siemens Healthcare GmbH; Abbott; Thermo Fisher Scientific; Bio-Rad Laboratories, Inc; Quest Diagnostics Incorporated; Illumina, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ovarian Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ovarian cancer diagnostics market report based on cancer, diagnosis, end-use, and region:

-

Cancer Outlook (Revenue, USD Million, 2021 - 2033)

-

Epithelial Tumor

-

Germ Cell Tumor

-

Stromal Cell Tumor

-

Others

-

-

Diagnosis Outlook (Revenue, USD Million, 2021 - 2033)

-

Imaging

-

Ultrasound

-

CT Scan

-

MRI Scan

-

PET Scan

-

Others

-

-

Blood Test

-

CA125

-

HER2

-

BRCA

-

CEA

-

ER & PR

-

KRAS Mutation

-

Others

-

-

Biopsy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Laboratories

-

Cancer Diagnostic Centers

-

Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

South Arabia

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ovarian cancer diagnostics market size was estimated at USD 1.74 billion in 2024 and is expected to reach USD 1.85 billion in 2025.

b. The global ovarian cancer diagnostics market is expected to grow at a compound annual growth rate of 6.73% from 2025 to 2033 to reach USD 3.11 billion by 2033.

b. North America dominated the ovarian cancer diagnostics market with a share of 34.96% in 2024. High healthcare expenditure in North America is driving investments towards advanced diagnostic technologies and infrastructure within cancer diagnostic centers.

b. Some key players operating in the ovarian cancer diagnostics market include F. Hoffmann-La Roche AG, Johnson & Johnson Services Inc., GlaxoSmithKline Plc, AstraZeneca Plc, Siemens Healthcare GmbH, Abbott, Thermo Fisher Scientific, Bio-Rad Laboratories, Inc, Quest Diagnostics Incorporated, Illumina, Inc

b. Key factors that are driving the market growth include rising prevalence of ovarian cancer, increasing emphasis on early diagnosis & treatment, and Innovations in diagnostic technologies, such as next-generation sequencing (NGS), liquid biopsy, and biomarker discovery, are significantly enhancing the accuracy and efficiency of ovarian cancer diagnostics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.