- Home

- »

- Biotechnology

- »

-

Primary Cell Culture Market Size, Industry Report, 2030GVR Report cover

![Primary Cell Culture Market Size, Share & Trends Report]()

Primary Cell Culture Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Primary Cells, Media), By Cell Type (Human Cells, Animal Cells) By Application (Cell & Gene Therapy Development), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-590-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Primary Cell Culture Market Summary

The global primary cell culture market size was estimated at USD 4.79 billion in 2024 and is projected to reach USD 8.67 billion by 2030, growing at a CAGR of 10.5% from 2025 to 2030. The market growth can be primarily attributed to the increasing prevalence of chronic disorders, government investments in cell-based research, and the expanding pharmaceutical and biotechnology industry.

Key Market Trends & Insights

- North America primary cell culture market dominated the global market with a revenue share of 41.58% in 2024.

- The primary cell culture market in the Asia Pacific region is expected to grow at the fastest CAGR of 11.73% during the forecast period.

- Based on cell, the human cells segment dominated the market with a revenue share of 81.09% in 2024.

- In terms of application, the cell & gene therapy development segment dominated the market with a revenue share of 40.19% in 2024.

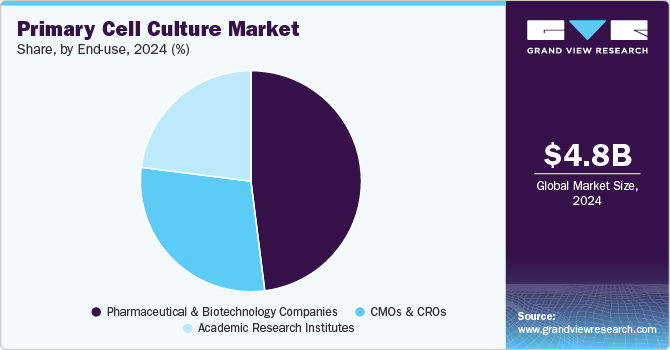

- Based on end-use, the pharmaceutical and biopharmaceutical companies segment accounted for the largest revenue share of 48.11% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.79 Billion

- 2030 Projected Market Size: USD 8.67 Billion

- CAGR (2025-2030): 10.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These factors have led to increased research, facilitating the high adoption of primary cell cultures. The growing need for primary cell culture is being driven by increased research to find novel treatments. Cancer is becoming increasingly prevalent worldwide. According to the American Cancer Society (ACS), the number of cancer cases is predicted to reach 35 million by 2050. Cancer research heavily relies on primary cell cultures derived from tumor tissues to study disease progression, metastasis, and drug resistance. Governments and organizations invest more in cancer research, creating a higher demand for primary cell culture systems.

The increasing use of primary cell cultures for in-vitro testing and drug screening has increased the market’s rise. These are derived from tissues, allowing researchers to analyze cellular structure in vivo while demonstrating normal functioning. As a result, they are employed as model systems to investigate cell biochemistry and physiology, aging processes, signaling investigations, metabolic processes, and the effects of harmful substances and medications.

For instance, in November 2022, QIAGEN Digital Insights (QDI) launched a new cell line database in collaboration with ATCC, a biological materials organization and supplier of authenticated cell lines. The database provides manually curated sequencing data for standardized, authenticated, reproducible cell lines15. This allows biopharma researchers to access genomic information from popular ATCC cell lines, primary cell lines, and tissues for preclinical experiments, eliminating the need for lengthy and expensive gene sequencing

The COVID-19 pandemic has positively influenced the primary cell culture market, as researchers increasingly use primary cell culture to understand the infection26. Standardized and characterized epithelium cell culture models help understand how the coronavirus affects physical barriers2. These models are important for mimicking the functions of the respiratory tract, potentially leading to breakthroughs that translate research findings into medical applications

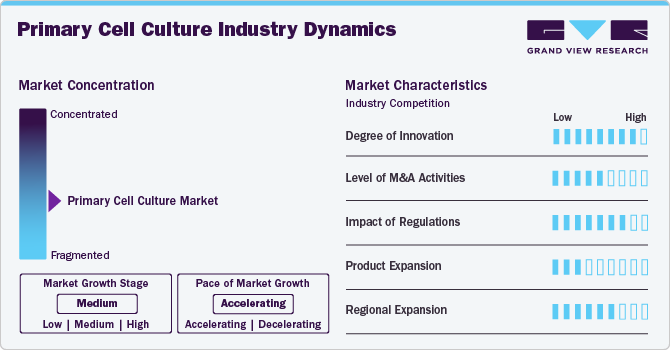

Market Concentration & Characteristics

The primary cell culture industry is experiencing significant innovation due to technological advancements, materials, and applications in biotechnology, pharmaceuticals, and regenerative medicine. Traditional 2D culture methods are being replaced by 3D systems, including scaffold-based systems, hydrogels, and spheroid/organoid cultures, to better mimic in vivo conditions

The primary cell culture industry has experienced significant growth, driven by strategic collaborations and partnerships among key industry players. These alliances aim to enhance product offerings, streamline research and development, and accelerate the commercialization of innovative cell culture technologies.

Regulatory guidelines are crucial for ensuring the safety, efficacy, and quality of products used in cell culture, especially in research, drug discovery, and clinical applications. Regulatory bodies like the U.S. FDA and the European Union mandate compliance with Good Manufacturing Practices (GMP) for primary cell culture products used in therapeutics and research.

Product expansion is a key strategy for companies in the Primary Cell Culture industry, allowing them to address evolving customer needs, increase market share, and capitalize on emerging applications like regenerative medicine, biologics production, and advanced cell-based research. For instance, in November 2023, ACROBiosystems announced the release of GMP-grade DLL4. This recombinant, soluble form of Delta-like Ligand 4 (DLL4), used for manufacturing stem cells, is among the limited products in the market produced under GMP conditions.

The primary cell culture industry is experiencing significant regional expansion, indicating rapid growth and increasing market presence across different geographic regions. For instance, in 2023, Fujifilm Corporation allocated USD 200 million between two production units in its cell therapy expansion strategy. The funds are divided between Fujifilm Cellular Dynamics, focused on human induced pluripotent stem cells, and Fujifilm Diosynth Biotechnologies, a CDMO for biologics & advanced therapies.

Product Insights

The primary cells segment held the largest revenue share of 37.10% in 2024. The growth of the primary cells segment can be attributed to their inherent physiological relevance and functional characteristics. Primary cells are isolated directly from tissues or organs, preserving their original biological properties and maintaining complex interactions within their native microenvironment. Furthermore, companies are investing a lot in improving the development of primary cells to manufacture novel therapies. Further, companies are collaborating with global companies to strengthen their product portfolios. For instance, in April 2023, AnaBios acquired Cell Systems to expand its human cell portfolio for drug development.

The media segment is expected to grow significantly at a CAGR of 11.16% during the forecast period. Since primary cells are fragile, supplementary products such as cell culture media, sera, and buffers create an environment that mimics the physiological conditions required for primary cells to survive and proliferate. The availability of various high-quality media tailored for specific cell types and research applications has contributed to their growth in the primary cell culture market, as researchers rely on these products to ensure successful and reproducible experiments and outcomes.

Cell Type Insights

The human cells segment dominated the market with a revenue share of 81.09% in 2024. Human cells offer a unique opportunity to study and understand human-specific physiological and pathological processes. They allow researchers to investigate disease mechanisms, evaluate drug efficacy and toxicity, and develop personalized treatment approaches. In 2021, human cells played a crucial role in COVID-19 research, enabling scientists to study the virus's interaction with human cells and develop targeted therapies and vaccines.

The animal cells segment is expected to grow lucratively over the forecast period. The growing applications of animal-origin primary cells for vaccine development are major factors fueling the segment’s growth. Animal cells, such as mice, rats, and porcine cells, have been extensively studied and characterized, making them valuable tools for various research applications. They serve as important models for studying human biology, disease mechanisms, drug development, and toxicity testing. Moreover, the segment growth can be attributed to comprehensive product offerings of animal-origin primary cells by companies such as Lonza, Merck KGaA, and Thermo Fisher Scientific, Inc.

Application Insights

The cell & gene therapy development segment dominated the market with a revenue share of 40.19% in 2024. Cell and gene therapy development is dominating the application segment in the primary cell culture market due to the rapidly growing field of regenerative medicine and the increasing demand for personalized therapies. Cell and gene therapies hold great potential for treating various diseases, including cancer, genetic disorders, and autoimmune conditions. They involve the manipulation and modification of cells or genes to restore or enhance their function, and primary cell culture plays a critical role in their development. In 2024, the FDA approved seven cell and gene therapy products, many representing significant firsts in the field14. These approvals include Aucatzyl, Kebilidi, Ryoncil, and Symvess, among others. This demonstrates the market's massive need for gene treatments.

The model system segment has been anticipated to show the fastest growth over the forecast period. Model systems dominate the application segment in the primary cell culture market due to their essential role in understanding biological processes, disease mechanisms, and drug development. Model systems, such as organoids, 3D cell cultures, and tissue engineering constructs, offer a more representative and physiologically relevant environment than traditional 2D cell cultures. Furthermore, companies are investing in adopting more 3D cell culture techniques to enhance their biological research. For instance, in May 2021, CELLINK acquired Visikol, a contract research company that offers high-quality products in 3D tissue imaging, multiplex imaging, and 3D cell culture technique.

End-use Insights

The pharmaceutical and biopharmaceutical companies segment accounted for the largest revenue share of 48.11% in 2024. Of the primary cell culture industry. This is due to the increasing reliance on cell-based models for drug discovery, development, and production. These companies are leveraging human primary cells to better simulate in vivo conditions, enhancing the accuracy and relevance of preclinical studies. The growing demand for personalized medicine targeted therapies, and biologics has further accelerated the adoption of primary cell cultures, as they provide more physiologically relevant systems for testing and validating new drug candidates.

The CROs and CMOs segment is expected to experience notable growth owing to the increasing demand for outsourced research and manufacturing services. As pharmaceutical and biopharmaceutical companies seek to reduce costs and enhance operational efficiency, CROs and CMOs provide specialized expertise in cell culture-based assays, testing, and production. These organizations rely on primary cell cultures to offer more accurate, reliable models for drug development, toxicology studies, and vaccine testing, meeting the industry's growing need for high-quality, reproducible results.

Regional Insights

North America primary cell culture market dominated the global market with a revenue share of 41.58% in 2024. This is due to several factors, including robust research infrastructure, significant investments in biomedical research, and the presence of key industry players. The region has a robust scientific community and well-established research institutions that actively contribute to advancements in cell culture technologies. Additionally, North America is home to numerous biotechnology and pharmaceutical companies investing heavily in primary cell culture research and development.

U.S. Primary Cell Culture Market Trends

The primary cell culture market in the U.S. accounted for the largest market share in the North American region in 2024. The U.S. is the hub for the operations of major players in the supply and logistics market, such as Thermo Fisher Scientific, Inc., Merck, and Danaher. Moreover, its strong infrastructure, availability of necessary funds, and ability to adapt to advanced technology drive overall market growth.

Europe Primary Cell Culture Market Trends

Europe accounts for a significant share of global stem cell transplantation and cancer treatment R&D and holds a significant share in stem cell research studies. These factors, along with rising government funding in stem cell research and the presence of organizations that help accelerate research studies, are expected to drive the market's growth over the forecast period.

The primary cell culture market in Germany is expected to grow significantly over the forecast period. Innovations in the country aim to enhance the efficiency and scalability of gene therapy vector production, underscoring the industry's commitment to advancing cell culture technologies and further propelling the market's growth.

The UK's primary cell culture market held a significant share in 2024. Increasing investments in developing innovative cell culture solutions, alongside emerging regional players offering advanced technologies, are poised to boost the UK’s market growth significantly.

Asia Pacific Primary Cell Culture Market Trends

The primary cell culture market in the Asia Pacific region is expected to grow at the fastest CAGR of 11.73% during the forecast period. The growth is primarily due to the region’s lower costs associated with stem cell transplantation, thereby contributing to the high demands. In addition, researchers are conducting extensive R&D activities, which can be further attributed to the region’s growth.

Additionally, there has been a surge in the development and manufacturing of cell and gene therapies in Asia Pacific, with notable advancements in regenerative medicine, stem cell research, and tissue engineering applications. The growing investment, research capabilities, and cost advantages have propelled the primary cell culture market in the Asia Pacific.

China’s primary cell culture market accounted for the largest market share in the Asia Pacific region in 2024. The country has witnessed substantial growth in its biopharmaceutical and life sciences sectors, driven by significant investments in research and development. China's large population provides a vast pool of diverse cell sources, facilitating extensive primary cell culture research and thereby contributing to the overall market growth in China.

The primary cell culture market in Japan is witnessing rapid growth over the forecast period. Rising cancer cases, an aging population, and an increasing disease burden are expected further to stimulate the demand for human primary cell cultures.

MEA Primary Cell Culture Market Trends

The MEA primary cell culture market is expected to grow exponentially over the forecast period due to several key factors. This growth is attributed to increased disposable income, infrastructural development, and rising awareness in Middle Eastern and African countries, leading to new business, investments, and partnerships in the cell culture industry

The primary cell culture market in Saudi Arabia is expected to grow over the forecast period. The South African government and private sector are collaborating to promote biopharmaceutical research, which is further fueling the demand for advanced cell culture technologies in both academic and clinical research settings.

Kuwait's primary cell culture market is anticipated to grow moderately over the forecast period due to the ongoing investments in medical research and collaborations with international biotech firms.

Key Primary Cell Culture Company Insights

The market players operating in the primary cell culture market are adopting product approval to increase the reach of their products in the market, improve their availability in diverse geographical areas, and enhance production/research activities. These strategies enable companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Primary Cell Culture Companies:

The following are the leading companies in the primary cell culture market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Lonza

- STEMCELL Technologies

- Cell Biologics, Inc.

- PromoCell

- ZenBio

- AllCells

- American Type Culture Collection

- Axol Biosciences Ltd.

Recent Development

-

In December 2024, BioCentriq signed a long-term lease for a new manufacturing facility in Princeton, NJ, which will be its headquarters. The USD 12M investment will enhance its capabilities in cell therapy development and production.

-

In February 2024, Gemini Bioproducts, LLC introduced a new human AB serum product designed for use in the primary cell culture market, supporting cell therapy and regenerative medicine applications.

-

In February 2023, Thermo Fisher Scientific, Inc. announced a collaboration with Celltrio, a manufacturing company, to enable a fully automated cell culture system for their customers.

-

In February 2022, CellulaREvolution secured USD 2.2 million in funding to accelerate the launch of its Continuous Cell Culture Technology.

Primary Cell Culture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.25 billion

Revenue Forecast in 2030

USD 8.67 billion

Growth rate

CAGR of 10.55% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, cell type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Merck KGaA; Lonza STEMCELL Technologies Inc.; Cell Biologics, Inc.; PromoCell; ZenBio; AllCells; American Type Culture Collection; Axol Biosciences Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Primary Cell Culture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels, and analyzes the latest trends in each of the sub-segments from 2018 to 2030. Grand View Research has segmented the global primary cell culture market report based on product, end-use, cell type, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary Cells

-

Hematopoietic Cells

-

Skin Cells

-

Hepatocytes

-

Gastrointestinal Cells

-

Lung Cells

-

Renal Cells

-

Heart Cells

-

Skeletal and Muscle Cells

-

Other Primary Cells

-

-

Media

-

Serum-free Media

-

Serum-containing Media

-

Others

-

-

Reagents and Supplements

-

Attachment Solutions

-

Buffers and Salts

-

Freezing Media

-

Sera

-

Growth Factors and Cytokines

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell & Gene Therapy Development

-

Vaccine Production

-

Model System

-

Virology

-

Prenatal Diagnosis

-

Others

-

-

Cell Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Human Cells

-

Animal Cells

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CMOs & CROs

-

Academic Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America (LATAM)

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global primary cell culture market size was estimated at USD 4.79 billion in 2024 and is expected to reach USD 5.25 billion in 2025.

b. The global primary cell culture market is expected to grow at a compound annual growth rate of 10.55% from 2025 to 2030 to reach USD 8.67 billion by 2030.

b. The primary cells segment held the largest share of 37.10% in 2024. The growth of the primary cells segment can be attributed to their inherent physiological relevance and functional characteristics.

b. Based on cell type, the human cells segment dominated the market with a share of 81.09% in 2024. Human cells offer a unique opportunity to study and understand human-specific physiological and pathological processes.

b. Some of the key players operating in the market include, Thermo Fisher Scientific Inc., Merck KGaA, Lonza STEMCELL Technologies Inc., Cell Biologics, Inc., PromoCell, ZenBio, AllCells, American Type Culture Collection, Axol Biosciences Ltd.

b. The market growth can be primarily attributed to the increasing prevalence of chronic disorders, government investments in cell-based research, and the expanding pharmaceutical and biotechnology industry. These factors have led to increased research, facilitating the high adoption of primary cell cultures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.