- Home

- »

- Biotechnology

- »

-

Cell Culture Media Market Size, Share, Trends Report, 2030GVR Report cover

![Cell Culture Media Market Size, Share & Trends Report]()

Cell Culture Media Market Size, Share & Trends Analysis Report By Product (Serum-free Media, Stem Cell Culture Media), By Type (Liquid Media, Semi-solid And Solid Media), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-957-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cell Culture Media Market Size & Trends

The global cell culture media market size was estimated at USD 4.73 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.54% from 2024 to 2030. Cell culture media is generally a gel or liquid including compounds required to regulate and support the growth of cells or microorganisms used in the manufacturing of biopharmaceuticals. Culture media is a critical ingredient in biopharmaceutical manufacturing, aiding the growth of cells, and is the fastest-growing segment within this market. This growth is mainly driven by growing demand for biopharmaceuticals, favorable governmental policies, and increasing investment in R&D.

The outbreak of COVID-19 has improved demand for well-established cell-based vaccine production technologies. Moreover, it has given rise to a few scientific innovations, particularly in the production and testing of vaccine technology. For instance, Vero cell line originated from the African green monkey kidney and has been extensively used for viral vaccine manufacturing. It has also been used for the development of various SARS-CoV variants. ProVeroTM1 Serum-free Medium manufactured by Lonza Bioscience is a protein-free medium, of non-animal origin designed to support the growth of Vero cells and MDCK.

Furthermore, cell culture-produced AAV vectors have also gained thrust as one of the most effective protein and gene delivery tools in vaccine manufacturing as well as gene therapy. Key market players are expanding their production capabilities. In 2021, Sartorius increased its production in all regions due to elevated demand in its core business and to additional customer needs related to COVID-19 therapeutics and COVID-19 vaccines. The biosimilars market is on the cusp of momentous growth. This growth is due to several mAb biosimilars that are anticipated to be launched in a few years as patents on significant drugs, such as trastuzumab (Herceptin from Roche), infliximab (Remicade from J&J), and Adalimumab (Humira from Abbott) are going to expire.

Additionally, the FDA’s approval of cell-based candidate vaccine viruses (CVVs) for use in cell-based influenza vaccines could advance the efficiency of cell-based flu vaccines. Cell culture technology has been used to develop other U.S.-licensed vaccines, comprising vaccines for smallpox, rotavirus, rubella, hepatitis chickenpox, and polio. Furthermore, for 2021-2022 influenza season, all 4 flu viruses used in the cell-based vaccine are cell-derived. For instance, in October 2021, Seqirus received U.S. FDA approval for FLUCELVAX QUADRIVALENT, the first and the only cell-based influenza vaccine in the U.S.

Market Dynamics

The expansion of clear, regulatory approval paths for biosimilars in emerging markets is generating opportunities for biosimilar monoclonal antibodies. The availability of an approval pathway in the U.S. has led to new opportunities for biosimilar manufacturers to enter major markets around the globe. Biosimilar versions of monoclonal antibodies have a probability to offer cost reductions of 25% to 30%, and many emerging countries are vigorously developing pathways for biosimilar approvals & are swiftly catching up.

Emerging countries such as Venezuela, Brazil, Colombia, India, and Mexico have established regulations for biosimilar approval. Russia is also developing a pathway for approval, as are other countries across Africa and Asia. The China FDA has also begun discussions on the development of a biosimilar approval procedure. In recent years, China’s biosimilar drug industry has established rapidly. By the end of 2019, the country had maximum number of biosimilar drugs in research, with 391 biosimilar drugs in the R&D pipeline.

In recent years, stem cell therapy has become an advanced and promising scientific research topic. The development of treatment methods has induced great opportunities. Stem cells have considerable potential to become one of the most significant aspects of medicine. In addition to the fact that they play a huge role in development of restorative medicine, their study also divulges additional information about complex events that happen during human development.

Moreover, there is growing interest in improving stem cell culture not only because cell culture is extensively used in basic research for studying stem cell biology but also due to the potential therapeutic applications of cultured stem cells. Funding related to stem cell research has augmented in recent years, which has further accelerated the growth of research. In March 2022, the City of Hope received a USD 4.9 million grant from the California Institute for Regenerative Medicine. This funding will help the Research Centre to guide next generation of scientific leaders in stem cell research and its translation into innovative lifesaving treatments. The grants will fund laboratory research and help scientists to learn how to implement cell-based therapies, engineer, and manufacture cells, obtain regulatory approval, and commercialize biomedical products.

Product Insights

Based on product, the serum-free media (SFM) segment held the highest market share of 36.0% in 2023. The use of serum-free media signifies a significant tool, which allows the researchers to perform specific applications or grow a specific cell type without using serum. Advantages of using serum-free media include increased growth and/or productivity, more consistent performance, better control over physiological sensitivity, and diminishing the risk of infection by serum-borne adventitious agents in the culture.

In addition, serum-free alternatives better serve animal welfare which is the major factor driving the adoption of SFM. The field of gene and cell therapy is rapidly growing, and the Food and Drug Administration (FDA) regulatory guidelines are demanding more control of raw materials to sustain the reliable and safe manufacturing of drug products. The use of SFM offers an opportunity to produce additional reproducible formulations and fewer batch-to-batch variability.

Application Insights

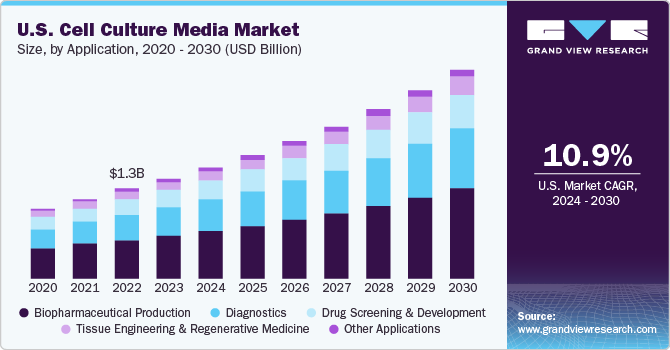

Based on application, the biopharmaceutical production segment dominated the market with a revenue share of 42.71% in 2023. The biopharmaceutical industry’s demand for more reproducible and better-defined media to meet the expanding production levels while reducing the risk of contamination in the downstream processes is significantly increasing the demand for this market.

Moreover, strategic activities by key biopharmaceutical companies also drive the segment growth. For instance, in July 2021 Cytiva and Pall Corporation invested USD 1.5 billion over two years to meet the rising demand for biotechnology solutions. The two companies plan to invest USD 400+ million for culture media in powder or liquid along with expanding their operations in the U.S., Austria, and UK.

Type Insights

Based on type, the liquid media segment captured the highest revenue share of 62.9% in 2023. An increasing number of biologics and biosimilars manufacturers, both downstream and upstream, are switching from premixed powders to liquid media owing to factors such as rapid mycobacterial growth and high rate of isolation. Moreover, it eradicates a few process steps, and also reduces the probability of hazardous exposure, and makes manufacturing and development more flexible and simpler than powdered media. In addition, ready-to-use liquid media also eliminates the need for mixing containers, balances, and installation of water for injection (WFI) loop which is needed for mixing powder media.

The segment is also being driven by the strategic activities of the manufacturers. For instance, in June 2021, Sartorius opened its new site in Israel, which focuses on customized and specialty cell culture mainly for the advanced therapies market. This site will serve as a significant production site for buffers and liquid cell culture.

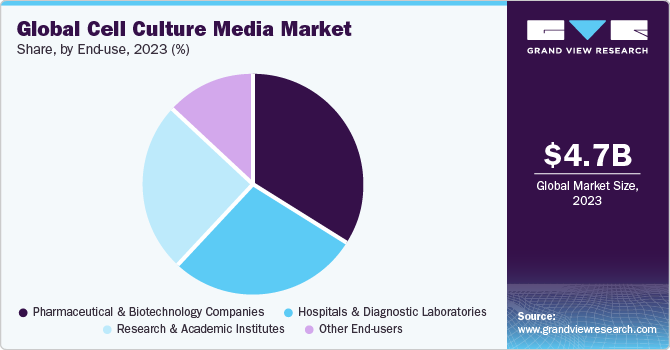

End-use Insights

The pharmaceutical and biotechnology companies segment captured the highest revenue share of 34.25% in 2023. The expansion of the current manufacturing capacities for biopharmaceuticals drives the demand for cell culture products. For instance, in September 2020, Cytiva announced the expansion of its manufacturing capacity and hiring personnel in significant areas to support the growth of the biotechnology industry. The company has planned investment of around USD 500 million for five years to increase the manufacturing capacity.

In addition, the increasing clinical trials will further offer lucrative opportunities in the review period. For instance, in 2021, the number of industry-sponsored trials in progress for regenerative medicine augmented by 100 as compared to 2020, bringing the total to 1,320. There were 1,328 regenerative medicine trials in progress worldwide supported by non-industry groups such as government entities and academic centers.

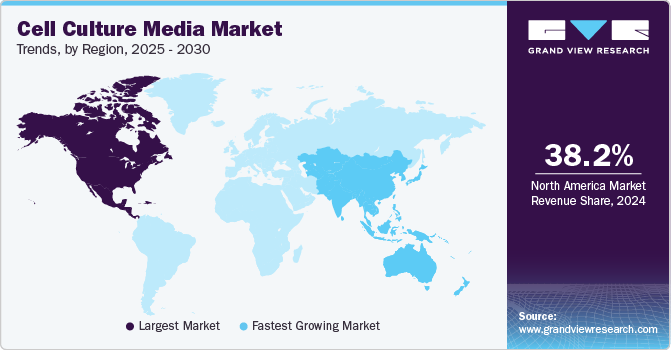

Regional Insights

North America dominated the regional market with a revenue share of 37.58% in 2023. This major share can be attributed to the growth in the pharmaceutical and biotechnology industries, mounting approvals for cell culture-based vaccines, and rising incidence of diseases such as cancer coupled with investments and funding in cell-based research.

Asia Pacific is estimated to grow at the fastest CAGR of 14.92% during the forecast period owing to the increase in awareness associated with the use of the cell culture technique. Furthermore, strategic activities by key market players to expand their presence in the Asia Pacific countries to capture high market share are expected to offer lucrative opportunities. For instance, In December 2021, Fujifilm Irvine Scientific, Inc. started the construction of its new bioprocessing center in China, with the aim to ensure cell culture media optimization support for biotherapeutic drug development, vaccines, and advanced therapies.

Key Cell Culture Media Company Insights

Key players in cell culture media market are implementing various strategies including partnership, merger and acquisition, geographical expansion, and strategic collaboration to expand their market presence. In July 2023, Merck KGaA invested USD 24.38 million to boost cell culture media production in the U.S. This development expanded the production capacity of the Lenexa facility to manufacture cell culture media.

In September 2023, Celltrion invested USD 94.5 million to construct a facility with an annual production capacity of 8 million vials in Songdo, Incheon. The new development is expected to increase the bioreactor capacity to 600,000 L and will be operational in 2027. In March 2023, Samsung Biologics announced that it would commence the construction of a fifth plant holding a capacity of 180,000 liters. Post completion, Samsung Biologics will maintain its global biomanufacturing capacity leadership with a total of 784,000 liters.

Key Cell Culture Media Companies:

The following are the leading companies in the cell culture media market. These companies collectively hold the largest market share and dictate industry trends.

- Sartorius AG

- Danaher

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- FUJIFILM Corporation

- Lonza

- BD

- STEMCELL Technologies

- Cell Biologics, Inc.

- PromoCell GmbH

Cell Culture Media Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.27 billion

Revenue forecast in 2030

USD 10.70 billion

Growth rate

CAGR of 12.54% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France, Italy, Spain, Denmark, Sweden, Norway, China; Japan; India, South Korea, Australia, Thailand, Brazil; Mexico, Argentina, South Africa; Saudi Arabia, UAE, Kuwait

Key companies profiled

Sartorius AG; Danaher Corporation; Merck KGaA; Thermo Fisher Scientific, Inc.; FUJIFILM Corporation; Lonza; BD; STEMCELL Technologies; Cell Biologics, Inc.; PromoCell GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Culture Media Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell culture media market report based on product, application, type, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Serum-free Media

-

CHO Media

-

BHK Medium

-

Vero Medium

-

HEK 293 Media

-

Other Serum-free media

-

Classical Media

-

Stem Cell Culture Media

-

Specialty Media

-

Chemically Defined Media

-

Other Cell Culture Media

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Production

-

Monoclonal Antibodies

-

Vaccines Production

-

Other Therapeutic Proteins

-

Diagnostics

-

Drug Screening And Development

-

Tissue Engineering And Regenerative Medicine

-

Cell And Gene Therapy

-

Other Tissue Engineering And Regenerative Medicine Applications

-

Other Applications

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Media

-

Semi-solid And Solid Media

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical And Biotechnology Companies

-

Hospitals And Diagnostic Laboratories

-

Research And Academic Institutes

-

Other End-users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell culture media market size was estimated at USD 4.76 billion in 2023 and is expected to reach USD 5.27 billion in 2024.

b. The global cell culture media market is expected to witness a compound annual growth rate of 12.54% from 2024 to 2030 to reach USD 10.70 billion in 2030.

b. The serum-free media segment held the largest share of the cell culture media market. This is attributed to the increasing gene and cell therapy research along with advantages offered by SFM, which in turn is likely to increase the adoption and anticipate the market growth.

b. The key players competing in the cell culture media market include Danaher Corporation (CYTIVA), Sartorius Stedim Biotech, Thermo Fisher Scientific, Inc, and Merck KGaA.

b. Expansion of biosimilars and biologics, growth in stem cell research, and emerging bio manufacturing technologies for cell-based vaccines are the major factors which are likely to drive the cell culture media market.

Table of Contents

Chapter 1. Cell Culture Media Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Information Procurement

1.3.1. Market Formulation & Data Visualization

1.3.2. Data Validation & Publishing

1.4. Research Assumptions

1.5. Research Methodology

1.5.1. Purchased Database

1.5.2. Gvr’s Internal Database

1.5.3. 1secondary Sources

1.5.4. Primary Research

1.5.5. Details Of Primary Research

1.6. Information Or Data Analysis

1.6.1. Data Analysis Models

1.7. Market Formulation & Validation

1.8. Model Details

1.8.1. Commodity Flow Analysis (Model 1)

1.8.1.1. Approach 1: Commodity Flow Approach

1.8.2. Volume Price Analysis (Model 2)

1.8.2.1. Approach 2: Volume Price Analysis

1.9. List Of Secondary Sources

1.10. Objectives

1.10.1. Objective 1:

1.10.2. Objective 2:

1.10.3. Market Estimation For Cell Culture Media Market

Chapter 2. Cell Culture Media Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Cell Culture Media Market: Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Ancillary Market Outlook

3.2. Market Trends and Outlook

3.3. Market Dynamics

3.3.1. Market Driver Impact Analysis

3.3.1.1. Expansion Of Biosimilars And Biologics

3.3.1.2. Growth In Stem Cell Research

3.3.1.3. Emerging Cell Culture Technologies For Cell-Based Vaccines

3.3.2. Market Restraint Impact Analysis

3.3.2.1. Ethical Issues Concerning The Use Of Animal-Derived Products

3.3.2.2. Stringent Regulatory Guidelines

3.4. Business Environment Analysis

3.4.1. Swot Analysis; By Factor (Political & Legal, Economic And Technological)

3.4.2. Porter’s Five Forces Analysis

3.5. Recent Developments and Impact Analysis, by Key Market Participants

3.5.1. Mergers and acquisitions

3.5.2. Technological collaborations

3.5.3. Licensing and partnerships

3.6. COVID-19 Impact Analysis

Chapter 4. Product Business Analysis

4.1. Product Movement Analysis & Market Share, 2023 & 2030

4.2. Serum-free Media

4.2.1. Global serum-free media market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.2. CHO Media

4.2.2.1. Global CHO market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.3. HEK 293 Media

4.2.3.1. Global HEK 293 market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.4. BHK Media

4.2.4.1. Global BHK market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.5. Vero Medium

4.2.5.1. Global Vero Medium market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.6. Other serum-free media

4.2.6.1. Global other serum-free media market estimates and forecasts, 2018 - 2030 (USD Million)

4.3. Classical Media

4.3.1. Global Classical Media market estimates and forecasts, 2018 - 2030 (USD Million)

4.4. Stem Cell Culture Media

4.4.1. Global Stem Cell Culture Media Market Estimates And Forecasts, 2018 - 2030 (USD Million)

4.5. Chemically Defined Media

4.5.1. Global Chemically Defined Media Market Estimates And Forecasts, 2018 - 2030 (USD Million)

4.6. Specialty Media

4.6.1. Global Speciality Media Market Estimates And Forecasts, 2018 - 2030 (USD Million)

4.7. Other Cell Culture Media

4.7.1. Global Other Cell Culture Media Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Type Business Analysis

5.1. Type Movement Analysis & Market Share, 2023 & 2030

5.2. Liquid Media

5.2.1. Global Liquid Media Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.3. Semisolid & Solid Media

5.3.1. Global Semi-Solid & Solid Media Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Application Business Analysis

6.1. Application Movement Analysis & Market Share, 2023 & 2030

6.2. Biopharmaceutical Production

6.2.1. Global Biopharmaceutical Production Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.2.2. Monoclonal Antibodies

6.2.2.1. Global Monoclonal Antibodies Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.2.3. Vaccines Production

6.2.3.1. Global Vaccines Production Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.2.4. Other Therapeutic Proteins

6.2.4.1. Global Other Therapeutic Proteins Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.3. Diagnostics

6.3.1. Global Diagnostics Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.4. Drug Screening & Development

6.4.1. Global Drug Screening & Development Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.5. Tissue Engineering & Regenerative Medicine

6.5.1. Global Tissue Engineering & Regenerative Medicine Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.5.2. Cell & Gene Therapy

6.5.2.1. Global Cell & Gene Therapy Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.5.3. Other Tissue Engineering & Regenerative Medicine

6.5.3.1. Global Other Tissue Engineering & Regenerative Medicine Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.6. Other Applications

6.6.1. Global Other Applications Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 7. End-User Business Analysis

7.1. Application Movement Analysis & Market Share, 2023 & 2030

7.2. Pharmaceutical & Biotechnology Companies

7.2.1. Global Pharmaceutical & Biotechnology Companies Market Estimates And Forecasts, 2018 - 2030 (USD Million)

7.3. Hospitals & Diagnostic Laboratories

7.3.1. Global Hospitals & Diagnostic Laboratories Market Estimates And Forecasts, 2018 - 2030 (USD Million)

7.4. Research & Academic Institutes

7.4.1. Global Research & Academic Institutes Market Estimates And Forecasts, 2018 - 2030 (USD Million)

7.5. Other End-User

7.5.1. Global Other End-User Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Cell Culture Media Market: Regional Estimates and Trend Analysis, by Product, Type, Application, & End-User

8.1. Cell Culture Media Market: Regional Outlook

8.2. North America

8.2.1. North America cell culture media market, 2018 - 2030 (USD Million)

8.2.2. U.S.

8.2.2.1. Key Country Dynamics

8.2.2.2. Competitive Scenario

8.2.2.3. Regulatory Framework

8.2.2.4. U.S. cell culture media market, 2018 - 2030 (USD Million)

8.2.3. Canada

8.2.3.1. Key Country Dynamics

8.2.3.2. Competitive Scenario

8.2.3.3. Regulatory Framework

8.2.3.4. Canada cell culture media market, 2018 - 2030 (USD Million)

8.3. Europe

8.3.1. Europe cell culture media market, 2018 - 2030 (USD Million)

8.3.2. UK

8.3.2.1. Key Country Dynamics

8.3.2.2. Competitive Scenario

8.3.2.3. Regulatory Framework

8.3.2.4. UK cell culture media market, 2018 - 2030 (USD Million)

8.3.3. Germany

8.3.3.1. Key Country Dynamics

8.3.3.2. Competitive Scenario

8.3.3.3. Regulatory Framework

8.3.3.4. Germany cell culture media market, 2018 - 2030 (USD Million)

8.3.4. France

8.3.4.1. Key Country Dynamics

8.3.4.2. Competitive Scenario

8.3.4.3. Regulatory Framework

8.3.4.4. France cell culture media market, 2018 - 2030 (USD Million)

8.3.5. Italy

8.3.5.1. Key Country Dynamics

8.3.5.2. Competitive Scenario

8.3.5.3. Regulatory Framework

8.3.5.4. Italy cell culture media market, 2018 - 2030 (USD Million)

8.3.6. Spain

8.3.6.1. Key Country Dynamics

8.3.6.2. Competitive Scenario

8.3.6.3. Regulatory Framework

8.3.6.4. Spain cell culture media market, 2018 - 2030 (USD Million)

8.3.7. Denmark

8.3.7.1. Key Country Dynamics

8.3.7.2. Competitive Scenario

8.3.7.3. Regulatory Framework

8.3.7.4. Denmark cell culture media market, 2018 - 2030 (USD Million)

8.3.8. Sweden

8.3.8.1. Key Country Dynamics

8.3.8.2. Competitive Scenario

8.3.8.3. Regulatory Framework

8.3.8.4. Sweden cell culture media market, 2018 - 2030 (USD Million)

8.3.9. Norway

8.3.9.1. Key Country Dynamics

8.3.9.2. Competitive Scenario

8.3.9.3. Regulatory Framework

8.3.9.4. Norway cell culture media market, 2018 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Asia Pacific cell culture media market, 2018 - 2030 (USD Million)

8.4.2. Japan

8.4.2.1. Key Country Dynamics

8.4.2.2. Competitive Scenario

8.4.2.3. Regulatory Framework

8.4.2.4. Japan cell culture media market, 2018 - 2030 (USD Million)

8.4.3. China

8.4.3.1. Key Country Dynamics

8.4.3.2. Competitive Scenario

8.4.3.3. Regulatory Framework

8.4.3.4. China cell culture media market, 2018 - 2030 (USD Million)

8.4.4. India

8.4.4.1. Key Country Dynamics

8.4.4.2. Competitive Scenario

8.4.4.3. Regulatory Framework

8.4.4.4. India cell culture media market, 2018 - 2030 (USD Million)

8.4.5. Singapore

8.4.5.1. Key Country Dynamics

8.4.5.2. Competitive Scenario

8.4.5.3. Regulatory Framework

8.4.5.4. Singapore cell culture media market, 2018 - 2030 (USD Million)

8.4.6. Australia

8.4.6.1. Key Country Dynamics

8.4.6.2. Competitive Scenario

8.4.6.3. Regulatory Framework

8.4.6.4. Australia cell culture media market, 2018 - 2030 (USD Million)

8.4.7. Thailand

8.4.7.1. Key Country Dynamics

8.4.7.2. Competitive Scenario

8.4.7.3. Regulatory Framework

8.4.7.4. Thailand cell culture media market, 2018 - 2030 (USD Million)

8.4.8. South Korea

8.4.8.1. Key Country Dynamics

8.4.8.2. Competitive Scenario

8.4.8.3. Regulatory Framework

8.4.8.4. South Korea cell culture media market, 2018 - 2030 (USD Million)

8.5. Latin America

8.5.1. Latin America cell culture media market, 2018 - 2030 (USD Million)

8.5.2. Brazil

8.5.2.1. Key Country Dynamics

8.5.2.2. Competitive Scenario

8.5.2.3. Regulatory Framework

8.5.2.4. Brazil cell culture media market, 2018 - 2030 (USD Million)

8.5.3. Mexico

8.5.3.1. Key Country Dynamics

8.5.3.2. Competitive Scenario

8.5.3.3. Regulatory Framework

8.5.3.4. Mexico cell culture media market, 2018 - 2030 (USD Million)

8.5.4. Argentina

8.5.4.1. Key Country Dynamics

8.5.4.2. Competitive Scenario

8.5.4.3. Regulatory Framework

8.5.4.4. Argentina cell culture media market, 2018 - 2030 (USD Million)

8.6. MEA

8.6.1. MEA cell culture media market, 2018 - 2030 (USD Million)

8.6.2. South Africa

8.6.2.1. Key Country Dynamics

8.6.2.2. Competitive Scenario

8.6.2.3. Regulatory Framework

8.6.2.4. South Africa cell culture media market, 2018 - 2030 (USD Million)

8.6.3. Saudi Arabia

8.6.3.1. Key Country Dynamics

8.6.3.2. Competitive Scenario

8.6.3.3. Regulatory Framework

8.6.3.4. Saudi Arabia cell culture media market, 2018 - 2030 (USD Million)

8.6.4. UAE

8.6.4.1. Key Country Dynamics

8.6.4.2. Competitive Scenario

8.6.4.3. Regulatory Framework

8.6.4.4. UAE cell culture media market, 2018 - 2030 (USD Million)

8.6.5. Kuwait

8.6.5.1. Key Country Dynamics

8.6.5.2. Competitive Scenario

8.6.5.3. Regulatory Framework

8.6.5.4. Kuwait cell culture media market, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Company Categorization

9.2. Strategy Mapping

9.3. Company Market Position Analysis, 2023

9.4. Company Profiles/Listing

9.4.1. Sartorius AG

9.4.1.1. Overview

9.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.1.3. Product Benchmarking

9.4.1.4. Strategic Initiatives

9.4.2. Danaher

9.4.2.1. Overview

9.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.2.3. Product Benchmarking

9.4.2.4. Strategic Initiatives

9.4.3. Merck KGaA

9.4.3.1. Overview

9.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.3.3. Product Benchmarking

9.4.3.4. Strategic Initiatives

9.4.4. Thermo Fisher Scientific, Inc.

9.4.4.1. Overview

9.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.4.3. Product Benchmarking

9.4.4.4. Strategic Initiatives

9.4.5. FUJIFILM Corporation

9.4.5.1. Overview

9.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.5.3. Product Benchmarking

9.4.5.4. Strategic Initiatives

9.4.6. Lonza

9.4.6.1. Overview

9.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.6.3. Product Benchmarking

9.4.6.4. Strategic Initiatives

9.4.7. BD

9.4.7.1. Overview

9.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.7.3. Product Benchmarking

9.4.7.4. Strategic Initiatives

9.4.8. STEMCELL Technologies

9.4.8.1. Overview

9.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.8.3. Product Benchmarking

9.4.8.4. Strategic Initiatives

9.4.9. Cell Biologics, Inc.

9.4.9.1. Overview

9.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.9.3. Product Benchmarking

9.4.9.4. Strategic Initiatives

9.4.10. PromoCell GmbH

9.4.10.1. Overview

9.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.10.3. Product Benchmarking

9.4.10.4. Strategic Initiatives

List of Tables

Table 1. List of Secondary Sources

Table 2. List of Abbreviations

Table 3. Global Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 4. Global Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 5. Global Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 6. Global Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 7. Global Cell Culture Media Market, by Region, 2018 - 2030 (USD Million)

Table 8. North America Cell Culture Media Market, by Country, 2018 - 2030 (USD Million)

Table 9. North America Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 10. North America Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 11. North America Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 12. North America Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 13. U.S. Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 14. U.S. Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 15. U.S. Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 16. U.S. Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 17. Canada Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 18. Canada Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 19. Canada Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 20. Canada Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 21. Europe Cell Culture Media Market, by Country, 2018 - 2030 (USD Million)

Table 22. Europe Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 23. Europe Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 24. Europe Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 25. Europe Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 26. Germany Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 27. Germany Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 28. Germany Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 29. Germany Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 30. UK Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 31. UK Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 32. UK Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 33. UK Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 34. France Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 35. France Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 36. France Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 37. France Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 38. Italy Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 39. Italy Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 40. Italy Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 41. Italy Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 42. Spain Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 43. Spain Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 44. Spain Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 45. Spain Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 46. Denmark Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 47. Denmark Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 48. Denmark Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 49. Denmark Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 50. Norway Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 51. Norway Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 52. Norway Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 53. Norway Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 54. Sweden Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 55. Sweden Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 56. Sweden Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 57. Sweden Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 58. Asia Pacific Cell Culture Media Market, by Country, 2018 - 2030 (USD Million)

Table 59. Asia Pacific Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 60. Asia Pacific Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 61. Asia Pacific Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 62. Asia Pacific Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 63. China Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 64. China Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 65. China Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 66. China Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 67. Japan Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 68. Japan Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 69. Japan Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 70. Japan Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 71. India Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 72. India Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 73. India Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 74. India Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 75. South Korea Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 76. South Korea Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 77. South Korea Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 78. South Korea Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 79. Australia Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 80. Australia Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 81. Australia Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 82. Australia Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 83. Thailand Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 84. Thailand Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 85. Thailand Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 86. Thailand Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 87. Latin America Cell Culture Media Market, by Country, 2018 - 2030 (USD Million)

Table 88. Latin America Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 89. Latin America Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 90. Latin America Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 91. Latin America Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 92. Brazil Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 93. Brazil Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 94. Brazil Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 95. Brazil Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 96. Mexico Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 97. Mexico Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 98. Mexico Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 99. Mexico Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 100. Argentina Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 101. Argentina Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 102. Argentina Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 103. Argentina Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 104. Middle East and Africa Cell Culture Media Market, by Country, 2018 - 2030 (USD Million)

Table 105. Middle East and Africa Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 106. Middle East and Africa Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 107. Middle East and Africa Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 108. Middle East and Africa Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 109. South Africa Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 110. South Africa Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 111. South Africa Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 112. South Africa Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 113. Saudi Arabia Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 114. Saudi Arabia Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 115. Saudi Arabia Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 116. Saudi Arabia Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 117. UAE Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 118. UAE Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 119. UAE Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 120. UAE Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

Table 121. Kuwait Cell Culture Media Market, by Product, 2018 - 2030 (USD Million)

Table 122. Kuwait Cell Culture Media Market, by Type, 2018 - 2030 (USD Million)

Table 123. Kuwait Cell Culture Media Market, by Application, 2018 - 2030 (USD Million)

Table 124. Kuwait Cell Culture Media Market, by End-use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Information Procurement

Fig. 3 Primary Research Pattern

Fig. 4 Market Research Approaches

Fig. 5 Value Chain-Based Sizing & Forecasting

Fig. 6 Market Formulation & Validation

Fig. 7 Cell Culture Media, Market Segmentation

Fig. 8 Market Snapshot, 2023

Fig. 9 Market Trends & Outlook

Fig. 10 Market Driver Relevance Analysis (Current & Future Impact)

Fig. 11 Market Restraint Relevance Analysis (Current & Future Impact)

Fig. 12 Market Challenge Relevance Analysis (Current & Future Impact)

Fig. 13 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 14 Porter’s Five Forces Analysis

Fig. 15 Market Penetration Vs Growth Prospect Mapping, 2023

Fig. 16 Global Cell Culture Media Market: Product Movement Analysis

Fig. 17 Global Cell Culture Media Market for Serum-free Media, 2018 - 2030 (USD Million)

Fig. 18 Global Cell Culture Media Market for Classical Media, 2018 - 2030 (USD Million)

Fig. 19 Global Cell Culture Media Market for Srem Cell Culture Media, 2018 - 2030 (USD Million)

Fig. 20 Global Cell Culture Media Market for Specialty Media, 2018 - 2030 (USD Million)

Fig. 21 Global Cell Culture Media Market for Chemically Defined Media, 2018 - 2030 (USD Million)

Fig. 22 Global Cell Culture Media Market for Other Cell Culture Media, 2018 - 2030 (USD Million)

Fig. 23 Global Cell Culture Media Market: Type Movement Analysis

Fig. 24 Global Cell Culture Media Market for Liquid Media, 2018 - 2030 (USD Million)

Fig. 25 Global Cell Culture Media Market for Semi-solid and Solid Media, 2018 - 2030 (USD Million)

Fig. 26 Global Cell Culture Media Market: Application, Movement Analysis

Fig. 27 Global Cell Culture Media Market for Biopharmaceutical Production, 2018 - 2030 (USD Million)

Fig. 28 Global Cell Culture Media Market for Diagnostics, 2018 - 2030 (USD Million)

Fig. 29 Global Cell Culture Media Market for Drug Screening and Development

Fig. 30 Global Cell Culture Media Market for Tissue Engineering and Regenerative Medicine

Fig. 31 Global Cell Culture Media Market for Other Applications

Fig. 32 Global Cell Culture Media Market: End-Use Movement Analysis

Fig. 33 Global Cell Culture Media Market for Pharmaceutical and Biotechnology Companies, 2018 - 2030 (USD Million)

Fig. 34 Global Cell Culture Media Market for Hospitals and Diagnostic Laboratories, 2018 - 2030 (USD Million)

Fig. 35 Global Cell Culture Media Market for Research and Academic Institutes, 2018 - 2030 (USD Million)

Fig. 36 Other End-users

Fig. 37 Regional Marketplace: Key Takeaways

Fig. 38 Regional Outlook, 2023 & 2030

Fig. 39 Global Cell Culture Media Market: Region Movement Analysis

Fig. 40 North America Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 41 U.S. Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 42 Canada Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 43 Europe Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 44 Germany Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 45 UK Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 46 France Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 47 Italy Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 48 Spain Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 49 Denmark Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 50 Sweden Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 51 Norway Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 52 Asia Pacific Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 53 Japan Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 54 China Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 55 India Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 56 South Korea Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 57 Australia Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 58 Thailand Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 59 Latin America Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 60 Brazil Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 61 Mexico Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 62 Argentina Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 63 Middle East and Africa Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 64 South Africa Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 65 Saudi Arabia Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 66 UAE Cell Culture Media Market 2018 - 2030 (USD Million)

Fig. 67 Kuwait Cell Culture Media Market 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Cell Culture Media Product Outlook (Revenue, USD Million, 2018 - 2030)

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Cell Culture Media Application Outlook (Revenue, USD Million, 2018 - 2030)

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Cell Culture Media Type Outlook (Revenue, USD Million, 2018 - 2030)

- Liquid Media

- Semi-solid and Solid Media

- Cell Culture Media End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Cell Culture Media Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- U.S. Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- U.S. Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- U.S. Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- U.S. Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- U.S. Cell Culture Media Market, By Product

- Canada

- Canada Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Canada Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Canada Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Canada Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Canada Cell Culture Media Market, By Product

- U.S.

- Europe

- Germany

- Germany Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Germany Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Germany Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Germany Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Germany Cell Culture Media Market, By Product

- U.K.

- U.K. Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- U.K. Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- U.K. Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- U.K. Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- U.K. Cell Culture Media Market, By Product

- France

- France Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- France Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- France Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- France Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- France Cell Culture Media Market, By Product

- Italy

- Italy Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Italy Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Italy Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Italy Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Italy Cell Culture Media Market, By Product

- Spain

- Spain Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Spain Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Spain Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Spain Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Spain Cell Culture Media Market, By Product

- Denmark

- Denmark Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Denmark Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Denmark Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Denmark Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Denmark Cell Culture Media Market, By Product

- Sweden

- Sweden Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Sweden Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Sweden Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Sweden Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Sweden Cell Culture Media Market, By Product

- Norway

- Norway Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Norway Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Norway Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Norway Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Norway Cell Culture Media Market, By Product

- Germany

- Asia Pacific

- China

- China Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- China Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- China Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- China Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- China Cell Culture Media Market, By Product

- Japan

- Japan Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Japan Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Japan Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Japan Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Japan Cell Culture Media Market, By Product

- India

- India Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- India Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- India Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- India Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- India Cell Culture Media Market, By Product

- South Korea

- South Korea Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- South Korea Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- South Korea Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- South Korea Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- South Korea Cell Culture Media Market, By Product

- Australia

- Australia Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Australia Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Australia Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Australia Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Australia Cell Culture Media Market, By Product

- Thailand

- Thailand Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Thailand Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Thailand Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Thailand Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Thailand Cell Culture Media Market, By Product

- China

- Latin America

- Brazil

- Brazil Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Brazil Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Brazil Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Brazil Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Brazil Cell Culture Media Market, By Product

- Mexico

- Mexico Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Mexico Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Mexico Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Mexico Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Mexico Cell Culture Media Market, By Product

- Argentina

- Argentina Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Argentina Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Argentina Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Argentina Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Argentina Cell Culture Media Market, By Product

- Brazil

- Middle East & Africa

- South Africa

- South Africa Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- South Africa Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- South Africa Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- South Africa Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- South Africa Cell Culture Media Market, By Product

- Saudi Arabia

- Saudi Arabia Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Saudi Arabia Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Saudi Arabia Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Saudi Arabia Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Saudi Arabia Cell Culture Media Market, By Product

- UAE

- UAE Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- UAE Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- UAE Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- UAE Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- UAE Cell Culture Media Market, By Product

- Kuwait

- Kuwait Cell Culture Media Market, By Product

- Serum-free Media

- CHO Media

- BHK Medium

- Vero Medium

- HEK 293 Media

- Other Serum-free media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

- Kuwait Cell Culture Media Market, By Application

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Other Applications

- Biopharmaceutical Production

- Kuwait Cell Culture Media Market, By Type

- Liquid Media

- Semi-solid and Solid Media

- Kuwait Cell Culture Media Market, by End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Other End-users

- Kuwait Cell Culture Media Market, By Product

- South Africa

- North America

Cell Culture Media Market Dynamics

Driver: Expansion Of Biosimilars And Biologics

The biosimilar market is poised for significant expansion. This surge is primarily due to the expected introduction of numerous mAb biosimilars shortly as patents on key drugs, such as trastuzumab (Herceptin from Roche), infliximab (Remicade from J&J), and Adalimumab (Humira from Abbott), are set to lapse. Moreover, the development of transparent, regulatory approval routes for biosimilars in emerging markets is creating opportunities for biosimilar monoclonal antibodies. The presence of an approval pathway in the U.S. has opened new avenues for biosimilar manufacturers to penetrate major markets worldwide. Biosimilar versions of monoclonal antibodies have the potential to deliver cost savings of 25% to 30%, and numerous emerging nations are actively formulating pathways for biosimilar approvals & are rapidly gaining ground. Emerging nations such as Venezuela, Brazil, Colombia, India, and Mexico have instituted regulations for biosimilar approval. Russia is also formulating an approval pathway, as are other countries across Africa and Asia. The China FDA has also initiated discussions on the formulation of a biosimilar approval process. In recent years, China's biosimilar drug industry has grown swiftly.

Emerging Cell Culture Technologies For Cell-Based Vaccines

Viral vaccines based on cell culture are globally utilized to protect humans from infections. The cell culture is an ongoing process that develops substrates for the secure production of viral vaccines. The rising global demand and stringent safety regulations for new vaccines to manage and eliminate viral diseases have driven manufacturers & researchers towards cell culture-based vaccines. According to the CDC, for the 2020 to 2021 period, the viruses given to the manufacturer for growth in cell culture are derived from cells, not eggs. Furthermore, cultivating flu viruses in eggs can suggest changes, leading to differences between the vaccine’s viruses and those circulating. Additionally, the FDA’s endorsement of cell-based CVVs for use in cell-based flu vaccines could enhance the effectiveness of cell-based flu vaccines. Cell culture technology has been employed to create other vaccines licensed in the U.S., including vaccines for smallpox, rotavirus, rubella, hepatitis chickenpox, and polio. Moreover, for the influenza season of 2021 to 2022, all four flu viruses used in the cell-based vaccine are derived from cells.

Restraint: Ethical Issues Concerning The Use Of Animal-Derived Products