- Home

- »

- Next Generation Technologies

- »

-

Proactive Services Market Size, Share & Trends Report 2030GVR Report cover

![Proactive Services Market Size, Share & Trends Report]()

Proactive Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Service (Technical Support, Design & Consulting), By Technology (Analytics, AI), By End-use, By Enterprise Size, By Application, And Segment Forecasts

- Report ID: GVR-4-68038-792-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Proactive Services Market Size & Trends

The global proactive services market size was valued at USD 4.15 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 20.8% from 2023 to 2030. The growing trend of understanding customer expectations & buying patterns, adoption of smartphones & tablets, and high usage of the internet, e-commerce websites & shopping applications are a few factors contributing to the growth of this market. Although the COVID-19 pandemic has overturned the way organizations have embraced their work, allowing employees to manage significant disturbances in worldwide supply chains. The pandemic caused stronger digitalization initiatives across the globe, it led organizations to acknowledge the disruption and adapt to proactive services to ensure business intelligence and process enhancement.

COVID-19 has raised worries among consumers like uneasiness about visiting the stores, purchasing products virtually, and trust issues with digital shopping. All such issues can expand the volume of inbound calls and strain the organization’s staff leading to more expenses; thus, it is vital to adopt proactive practices across the organization. For instance, due to the pandemic, Nike was compelled to close more than 5,000 of its 7,000 stores across China majorly impacting the offline business. However, the online business did exceptionally well, Nike decided to engage its employees with customers digitally. Nike decided to proactively reach out to customers and offer various services, such as sending automated emails to customers after they place an order with details of tracking information and shipping time.

These initiatives helped Nike attain 35% growth in its online sales. There is a rise in the number of people opting for online shopping, permitting retailers and other business organizations to seize the valuable opportunity of adopting more sustainable practices by integrating the existing workflow with their digital presence. High usage of cell phones, tablets, and other electronic devices to access bank accounts for transactions is anticipated to increase and thus drive the market. Customers expect support and guidance, hence acquiring new customers is not the only priority for organizations but retaining existing customers and ensuring they have all that they need is also important.

Proactive services allow marketers to identify the pain points of customers, not only understanding their current needs but also supporting their latent needs. The expanding interest and adoption rate of Machine Learning (ML), Artificial Intelligence (AI), and the Internet of Things (IoT) across various industries supports data-rich solutions and are expected to fuel market growth. With the help of such technologies, organizations may well predict the future patterns of their customers and offer them services even before they realize their needs. Moreover, the expanding utilization of bots is affecting the market as it would help examine the success rate of ads or content posted across various platforms.

To avoid challenges like cost management and implementation while executing changes in the organization, it is important to improve performance across the entire IT infrastructure, which means the implementation of proactive services across all levels of the organization. While firms adopt new technologies, cost management is one of the most significant problems for the end-users of proactive services. To defeat these difficulties, organizations should concentrate on acquiring self-analytic devices, proactive & preventive support systems, omnichannel presence, and other upgraded management tools. In addition, organizations should acquire a strong IT security framework to prevent the loss of any data as it could affect an organization’s brand reputation.

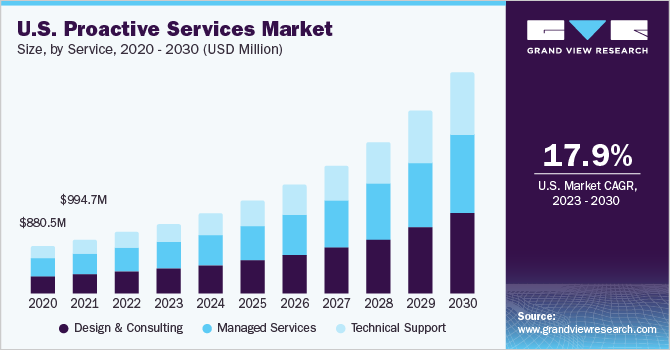

Service Insights

The managed services segment accounted for the largest market share of over 38.5% in 2022. Managed services allow the outsourcing of IT tasks for better work efficiency. Advantages offered by the implementation of managed services are low operational cost, enhanced functional effectiveness, and reduced workload on the in-house IT team. The need for ideal resource allocation, remote monitoring, and management of hardware, security services, and communication support will further boost this segment's growth. In addition, cloud computing and big data analytics are also expected to drive the growth. A few of the benefits offered by managed services include minimized downtime, scalability, data compliance, and faster response time.

The technical support segment is expected to grow the fastest CAGR of 21.8% over the forecast period. The need for organizations to comply with the latest regulations and the increase in security threats compel organizations to disburden their daily IT operations and turn to service providers. In addition, technology is evolving at a considerable pace, it demands continuous upgrades and maintenance, which is expected to support the growth of this segment. Technical support service includes reactive problem-solving, troubleshooting, customer support, predictive analysis, and self-service among others.

Technology Insights

The analytics segment accounted for a market share of 51.9% in 2022. The analytics solution can handle tremendous amounts of data and it helps organizations achieve proactive customer care. Organizations can leverage advanced analytics to measure various variables, understand consumers’ purchasing patterns, analyze probabilities, and measure anomalies to find out the root causes. A higher amount of data collection results in better analytical capabilities; moreover, predictive analytics technology allows synchronous and real-time intervention, which is why organizations adopt analytics tools. Organizations that make heavy use of IoT devices contain heterogeneous streams of data that can be utilized by analytical tools to achieve consistency across the business.

The AI segment is expected to grow at the highest CAGR of 21.8%. An increasing number of organizations are adopting AI due to its ability to accurately comprehend data and based on that send customized product and service recommendations. In addition, it would help in cross-selling and upselling. Artificial intelligence saves customers’ time by assisting them in navigation through various web portals and applications. For instance, chatbots can help clients by addressing FAQs and other queries so that customers do not have to wait on long calls for assistance. Customers expect to stay updated about their order status, delivery time, or any changes in schedule, all these can be proactively conveyed to the customer with the help of AI, which will support the segment growth.

Enterprise Size Insights

The large enterprise segment accounted for the largest share of more than 58.1% in 2022. Large enterprises are focusing on executing the seamless implementation of digital strategies including preventive techniques across different levels of the organization, and they have sound financial backup to support the required on-premise infrastructure. Many banks and insurance companies are also seen to implement proactive services as it minimizes the risk associated with transactions. In addition, customers are often seen reaching out to contact centers to enquire about product delivery details or clarifications about prices, terms & conditions. To avoid such inbound calls, large enterprises actively focus on implementing proactive services as it results in reduced operational cost.

The Small & Medium Enterprise (SME) segment is expected to witness the fastest growth at a CAGR of 22.6%. Due to budget constraints, SMEs face multiple challenges, such as a lack of skilled workforce, lack of domain-specific experts, scalability, and management control. However, with the help of cloud deployment, SMEs can bring more stability and control in their business process, and it would also help in the reduction of the device cost. The rise in vendors offering the solution to SMEs is further pushing SMEs to rapidly adopt proactive services for enhanced network performance across all channels and better customer retention.

Application Insights

The customer experience management segment accounted for the largest share of 25.9% in 2022. Customer experience management helps organizations in many ways, such as spreading good word of mouth, retaining existing customers, acquiring new customers, improving customer satisfaction, higher customer lifetime value, and brand loyalty among others. Organizations can strengthen their brand preference by serving differentiated experiences and lowering costs by reducing churn rates. In addition, factors, such as lower marketing and acquisition costs, operational innovation, technological advancements, and heightened customer expectations will help in boosting the segment's growth.

The cloud management segment is expected to grow at the fastest CAGR of 23.3% over the forecast period. Cloud management proactive service providers offer system monitoring, proactive patches for better security, capacity management, backup services, preventive maintenance, and service management. Cloud management provides a single platform to monitor the status of the entire IT infrastructure, it utilizes proactive threshold management across multiple elements to remediate the problem even before it occurs thus maximizing the organization’s uptime and availability. Lower operational cost, ease of deployment, and customization as per the organization’s need are a few other key factors driving the growth of this segment.

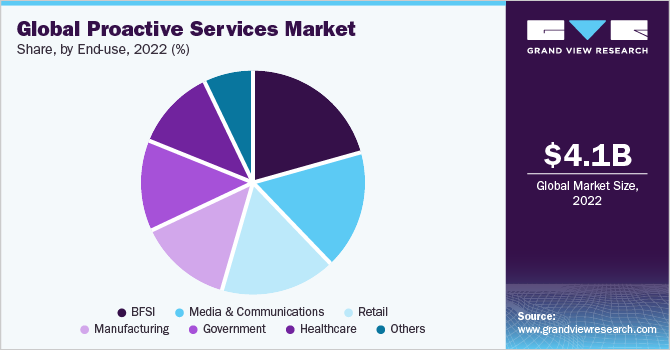

End-Use Insights

The BFSI segment captured over 20.9% of the overall revenue share in 2022 and is expected to continue to dominate the market throughout the forecast period. The developing interest of banks and other financial institutions to enhance customer engagement and interaction processes aimed at creating a lasting impact on customers is expected to support the growth of this segment. Due to the COVID-19 pandemic, an increase in mobile banking services is observed, which further pushes banks to implement proactive services in the fast-growing marketplace. Banks and financial institutes contain sensitive financial data, due to which, customers often reach out to banks even for the smallest query.

This leads to large volumes of inbound calls, which can be expensive for organizations. With the help of proactive services, banks can proactively inform customers about any updates or changes relating to their accounts, which will not only enhance customer experience but also make them trust the bank more. The healthcare segment is expected to grow at the fastest CAGR of 23.1% over the forecast period. The healthcare segment is highly reactive, but a shift towards value-based care with better population health and lower cost is expected to support the segment's growth.

With the use of sophisticated technology and algorithms to analyze various data streams, healthcare departments can predict future risks by utilizing pattern recognition with known outcomes. Proactive services help healthcare workers to address the issue before it advances, plus it helps patients to avoid the expense associated with high-risk conditions, such as the need for emergency surgery or the number of days spent in the ICU.

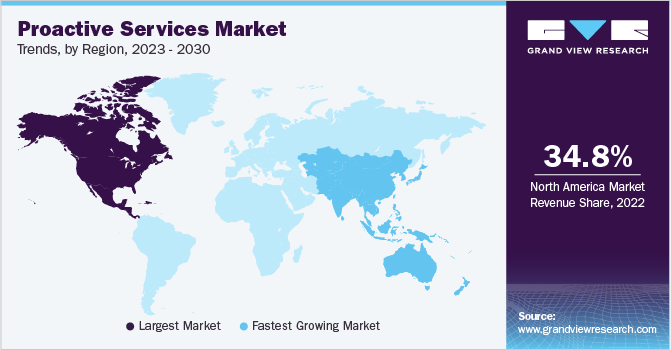

Regional Insights

North America dominated the global market in 2022 and accounted for 34.8% revenue share. Proactive services demand active and flexible IT support, which can be found in most service vendors present in this region. In addition, stabilized economy and heavy investments by government bodies into various technologies, such as AI, advanced data analytics, and ML make North America one of the most advanced software and information technology service industries Moreover, North America has a large retail industry that focuses on delivering proactive services, which is one of the key factors supporting the regional market growth.

Asia Pacific is anticipated to register the fastest growth rate of 22.9% over the forecast period. This can be attributed to the rapidly expanding service sector and the rising number of startups in the region. Proactive services offer startups the support they need to enhance their visibility in the marketplace, it allows accurate customer segmentation and based on that provides precise product suggestions. In addition, an increased number of mobile users and growing use of social media analytics & e-commerce will fuel the regional market growth.

Key Companies & Market Share Insights

Industry players utilize a variety of inorganic growth tactics, such as partnerships, mergers, and acquisitions, to broaden their product offerings. For instance, AT&T helps their subscribers to avoid the phenomenon called ‘Bill Shock’, which occurs when the customer receives the bill for the first time, and it is difficult for them to understand. In such a scenario, customers are observed to make multiple inbound calls, hence, to avoid this, AT&T added a personalized video link with the first bill, which will walk them through the bill. Prominent players operating in the global proactive services market include:

-

Amazon Web Services, Inc.

-

Avaya Inc.

-

Cisco Systems, Inc

-

DXC Technology

-

Fortinet, Inc.

-

Genesys

-

Hewlett Packard Enterprise Company

-

Huawei Technologies Co., Ltd

-

International Business Machines Corporation

-

Juniper Network, Inc.

-

LivePerson, Inc

-

Microsoft Corporation

-

NICE

-

Symantec Corporation

Proactive Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.85 billion

Revenue forecast in 2030

USD 18.19 billion

Growth Rate

CAGR of 20.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service, technology, enterprise size, application, end-use, region

Regional scope

North America: Europe: Asia Pacific: Latin America: and Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services, Inc.; Avaya Inc.; Cisco Systems, Inc.; DXC Technology; Fortinet, Inc.; Genesys; Hewlett Packard Enterprise Company; Huawei Technologies Co., Ltd.; International Business Machines Corp.; Juniper Network, Inc.; LivePerson, Inc.; Microsoft Corp.; NICE, Symantec Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Proactive Services Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the proactive services market based on service, technology, enterprise size, application, end-use, and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Design & Consulting

-

Managed Services

-

Technical Support

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Analytics

-

Artificial Intelligence

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud Management

-

Customer Experience Management

-

Data Center Management

-

End-point Management

-

Network Management

-

Others

-

-

End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

Manufacturing

-

Media & Communications

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global proactive services market size was estimated at USD 4.15 billion in 2022 and is expected to reach USD 4.85 billion in 2023.

b. The key players operating in the Enterprise Mobility Management market include Amazon Web Services, Inc., Avaya Inc., Cisco Systems, Inc., DXC Technology, Fortinet, Inc., Genesys, Hewlett Packard Enterprise Company, Huawei Technologies Co., Ltd. International Business Machines Corporation, Juniper Network, Inc., LivePerson, Inc., Microsoft Corporation, NICE , and Symantec Corporation

b. The growing trend of understanding customer expectations and buying patterns, adoption of smartphones and tablets, and high usage of the internet, e-commerce websites, and shopping applications are a few factors contributing to the growth of this market

b. The global proactive services market is expected to grow at a compound annual growth rate of 20.8% from 2023 to 2030 to reach USD 18.19 billion by 2030.

b. The North American regional market dominated the proactive services market in 2022 and accounted for 34.8% market share. Proactive services demand active and flexible IT support, which can be found in most service vendors present in this region. Additionally, stabilized economy and heavy investment by government bodies into various technologies such as Artificial Intelligence (AI), advanced data analytics, Machine Learning (ML) make North America one of the most advanced software and information technology service industries. Besides, North America has a fairly large retail industry that focuses on delivering proactive services, it is one of the key factors supporting the growth of proactive services in the region

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.