- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Probiotics Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Probiotics Market Size, Share & Trends Report]()

Probiotics Market Size, Share & Trends Analysis Report By Product (Food & Beverages, Dietary Supplements), By Ingredient (Bacteria, Yeast), By Distribution Channel, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-093-4

- Number of Pages: 200

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

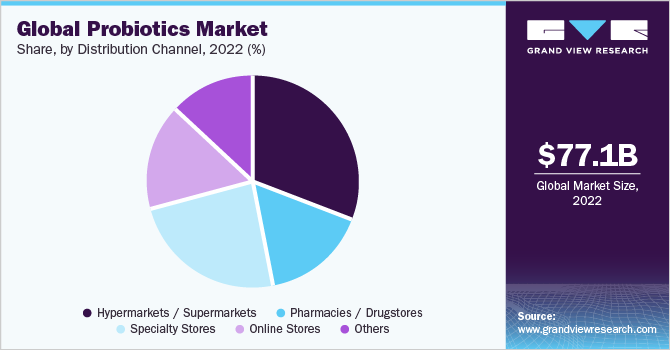

The global probiotics market size was estimated at USD 77.12 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.0% from 2023 to 2030. The growing awareness about the health benefits of probiotics, such as improved gut health and overall digestive function, is anticipated to boost the growth of the market across the globe. As more people become interested in taking a proactive approach to their health, they are looking for natural, non-pharmaceutical solutions that can help support their gut microbiome. The market penetration of dairy products is projected to be high on account of the increased consumption of functional dairy products for digestive wellness.

Consumers across the world are largely focused on improving gut and microbiome health. According to a survey conducted by the International Food Information Council (IFIC), in 2021, 70% of the respondents consumed yogurt for general health and wellness. However, 60% of the respondents believed it was good for enhancing digestive health. It is anticipated that probiotics in dairy products, such as yogurt, will witness high penetration as they are known to control intestinal flora. Fast-paced lifestyles have led to increased health issues and gut problems, compelling consumers to increasingly focus on preventive healthcare.

Consumers are also shifting towards diets that aid in disease prevention, which is one of the primary factors driving the inclusion of probiotics in functional foods and nutraceuticals. Other factors contributing to the uptake of probiotics as a preventive healthcare measure include increased disposable income, improved living standards, and the growth of the elderly population. Moreover, consumers have become more aware of the benefits of probiotics for digestive health. Currently, several well-characterized strains of lactobacilli and bifidobacteria can reduce the risk of gastrointestinal infections or treat similar conditions.

By consuming probiotics, the digestive tract can be replenished with beneficial bacteria, thereby improving digestive health. In addition, the field of probiotics has seen significant research advancements, leading to a better understanding of the mechanisms of action and potential health benefits of different strains. This scientific progress has fueled the interest of probiotic companies in leveraging this knowledge to develop strains with specific attributes and functionalities. For instance, in March 2023, England-based pharmaceutical company, FERRYX Ltd., announced the launch of the FX-856 strain that helps reduce the symptoms of diarrhea, constipation, bloating, and ulcerative colitis.

Market Dynamics

Consumers have been seeking alternatives to conventional pharmaceutical interventions, which has driven the demand for natural and holistic health solutions. This trend has compelled probiotic companies to develop probiotic strains that can address specific health concerns and provide natural solutions to consumers.

Manufacturers are increasingly fortifying food and beverage products with enzymes, probiotics, and prebiotics. This is attributed to consumer demand for food items with higher nutritional and fiber content. Digestive ingredients such as probiotics are widely used in fish oil and yogurt to reduce the risk of gut health issues. This is expected to fuel market growth over the forecast period.

Increasing innovations in the field are expected to result in high product demand. General Mills, Inc. partnered with Goodbelly to launch probiotic cereals and yogurt, which are available in five flavors, namely vanilla bean, peach, coconut, strawberry, and black cheery. General Mills will be responsible for the production, sales, and marketing of the products. Plant-based products are also being introduced in the market. For instance, in February 2022, Optibac Probiotics announced the launch of all-in-one probiotic adult gummies sourced from plant fibers. The supplement contains Vitamin D, calcium, zinc, and bacillus coagulans.

Product Insights

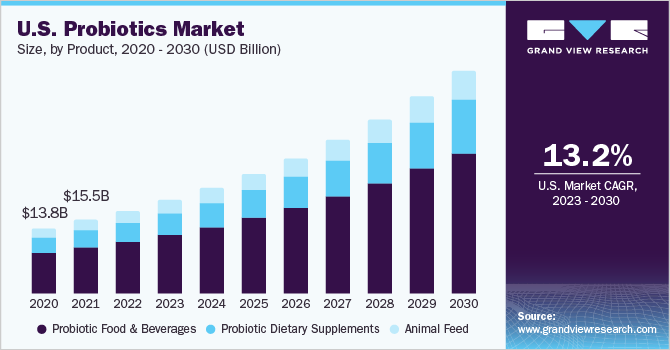

The probiotic food & beverage segment dominated the market with a revenue share of over 60% in 2022. Manufacturers are increasingly fortifying food and beverage products with enzymes and probiotics. This is attributed to consumer demand for food items with higher nutritional and fiber content. Digestive ingredients such as probiotics are widely used in fish oil and yogurt to reduce the risk of gut health issues. The increasing awareness of improving quality of life and the rise in disposable incomes have prompted consumers to adopt probiotics as a solution to their health issues. Manufacturers are expanding their businesses in response to the growing demand for probiotics in foods and beverages. For instance, in August 2022, Korea's Hy Co, formerly known as Korea Yakult, announced its expansion into probiotic business categories to include a wider range of products.

While the company previously focused primarily on functional fermented milk products, it is now diversifying into probiotic food, drinks, and supplements. The probiotic dietary supplements segment is expected to grow at a CAGR of 14.13% during the forecast period. The growing inclination toward wellness programs on account of increasing health-related issues, such as blood pressure, unhealthy lifestyles, obesity, and improper diet, is expected to drive the growth of the probiotics dietary supplement industry. These supplements help build a strong immune system to treat several gastrointestinal diseases, dental caries, and breast cancer. Furthermore, many adults and children in the U.S. take one or more dietary supplements like probiotics to get adequate amounts of essential nutrients to enhance their health.

Manufacturers are investing in clinical research to develop new strains of probiotics that would help boost immunity, support women’s health concerns, and balancing of nutrition. The key players in the market are focusing on introducing products with new ingredient formulations. Rising awareness regarding weight management is a key factor fueling the market growth owing to increasing obesity rates and chronic diseases.In May 2023, Roquette introduced PEARLITOL ProTec, an innovative excipient specifically designed to enhance the stability of probiotic supplements. This new offering addresses the challenge of maintaining the viability and efficacy of probiotics throughout their shelf life.

Ingredient Insights

The bacteria-based ingredient segment accounted for a revenue share of 83.6% in 2022. These products offer numerous health benefits for both humans and animals. They serve as aflatoxin adsorbents, contribute to the prevention of colon cancer, and aid in the prevention of oral diseases, urinary tract infections, respiratory infections, bowel ailments, and other bacterial infections within the body. The market is experiencing growth due to the increasing popularity of functional foods, the adoption of probiotic ingredients in developing economies, and rising disposable incomes. In April 2023, Lesaffre's Gnosis introduced an enhanced quality specification for its well-established probiotic bacteria, LifeinU L. Rhamnosus GG.

This development is a response to the growing consumer interest in superior probiotics, driven by an increased understanding of the significance of the microbiome in maintaining overall health and well-being. The demand for yeast-based probiotics is expected to grow at a CAGR of 13.4% during the forecast period. These products offer several advantages over bacterial probiotics, particularly in the treatment of intestinal manifestations, gastric acidity, and various types of diarrheas. Yeast-based dietary supplements are popular as they contain significant amounts of proteins, amino acids, vitamin B, and peptides. Furthermore, probiotic yeast is considered safe for consumption across all age groups.In September 2021, Angel Yeast launched a strain of yeast probiotic, Saccharomyces boulardii Bld-3. It is effective in combating diarrhea while simultaneously enhancing the digestive and immune systems in both children and adults.

End-use Insights

The human probiotic segment dominated the market with a revenue share of nearly 85% in 2022. The aging population is increasing globally, and this rapid rise is likely to lead to an increase in the number of chronic diseases, which, in turn, is expected to boost the need for microbes such as probiotics to control the threat of the leading chronic diseases such as colon cancer, inflammatory bowel disease (IBD) and diarrheal diseases. In October 2021, Qingdao Vland Biotech Group Co. and ADM announced that they established a joint venture to meet the increasing demand for human probiotics in China. This 50-50 joint venture specializes in the production and distribution of human probiotics, leveraging the experience and expertise of ADM and Vland. By integrating a comprehensive range of technological, commercial, and production capabilities, the joint venture aimed at catering to the market's diverse needs.

The demand for animal probiotics is projected to grow at a CAGR of 13.7% during the forecast period. There has been a rise in the adoption of probiotics in animal feed for farm animals in the past few years. The use of probiotics in animal feed has shown significant results in terms of improved immune systems, animal performance, and digestion. The increasing focus on animal welfare and the desire to reduce the use of antibiotics in animal husbandry have further fueled the demand for animal probiotics. In August 2021, Chr. Hansen, a leading bioscience company, introduced an innovative range of live probiotics specifically formulated for pet foods and supplements. These probiotics help promote optimal digestion, enhance immunity, and improve the overall well-being of pets.

Distribution Channel Insights

Sales of probiotics through hypermarkets/supermarkets accounted for a revenue share of 31.1% in 2022. The presence of a huge variety of probiotics in one place and the ease of purchasing have contributed to the dominance of supermarkets & hypermarkets as a distribution channel in the market in recent years. The regulatory framework surrounding probiotics plays a major role in their distribution through pharmacies and drugstores. Probiotic supplements are often categorized as over-the-counter (OTC) products, which can be conveniently purchased without a prescription. This classification allows probiotics to be readily available in pharmacies and drugstores, further increasing their accessibility to consumers. Sales through online stores are projected to grow at a CAGR of 16.6% during the forecast period.

Online distribution channels have been experiencing significant growth in the probiotics industry due to several key factors. The convenience and accessibility offered by online shopping have contributed to the rising popularity of online purchases of probiotics. Furthermore, with online shopping, consumers can browse and compare a wide range of probiotic products from the comfort of their own homes without the need to visit physical stores. In January 2021, HempFusion Wellness expanded its distribution on Amazon by establishing a distinctive e-commerce store within the platform. This strategic move enabled HempFusion's renowned probiotic supplement brand, Probulin, to effectively enhance brand awareness while simultaneously boosting sales and providing comprehensive product information for its extensive range of scientifically formulated offerings.

Regional Insights

The Asia Pacific region accounted for a revenue share of 38.2% in 2022. Consumers in this region are increasingly seeking healthy products on account of rising awareness regarding fitness and maintaining good digestive health. Rising disposable incomes, improving the standard of living, and increasing acceptance of functional foods are the major factors driving the growth of the industry. In addition, the growing importance of gut health in overall well-being has increased demand for products that maintain a healthy gut microbiome. Probiotic supplements are seen as a convenient and effective way to introduce beneficial bacteria into the gut and thus have become increasingly popular among health-conscious consumers in the region. The demand in India is projected to grow at a CAGR of 15.8% during the forecast period.

This market is currently in its emerging phase and manufacturers continue to focus on digestive and immune health. Liquid probiotics remain dominant in the market with the increasing demand for probiotic-filled beverages, milk, yogurt-based drinks, and juices. The demand in the North America market is expected to grow at a CAGR of 13.2% during the forecast period. North America is one of the prominent regional markets for probiotics owing to higher market penetration in the developed economies of the region. The U.S. market was valued at USD 17.47 billion in 2022. Rising awareness regarding healthy lifestyles and increasing disposable incomes are the major factors contributing to the growth of the market in the region and its member countries.

The Europe market is expected to grow at a CAGR of 13.2% during the forecast period.The initiatives undertaken by the European Probiotic Association (EPA), such as providing guidelines and organizing educational webinars, serve as driving factors for the growth of the probiotics industry in Europe. The guidelines established by the EPA ensure that probiotic products in Europe meet stringent quality and safety standards. This fosters consumer confidence in probiotics and encourages their usage, leading to an increased demand for probiotic products in the market. The availability of clear guidelines helps manufacturers develop high-quality probiotic formulations, which further contributes to market growth. The UK probiotics industry accounted for a revenue share of over 15% in 2022 and is projected to grow at a CAGR of nearly 14% during the forecast period.

Key Companies & Market Share Insights

The global market is characterized by intense competition, mainly attributed to several players operating in the market. Various companies operating in the market are offering innovative products to cater to consumer demand. For instance, in November 2022, Arla Foods Group announced the launch of fermented protein drinks, which contain whey-based hydrolysates Lacprodan HYDRO.365 and Nutrilac FO-8571. The company is looking to develop trendy beverages that are high in probiotics and protein, enabling it to stand out amidst the competition. Some of the prominent players in the global probiotics market include:

-

Arla Foods

-

BioGaia

-

Chr. Hansen Holding A/S

-

Danone

-

DuPont De Nemours, Inc.

-

General Mills, Inc.

-

i-Health, Inc.

-

Lallemand Inc.

-

Lifeway Foods Inc.

-

Mother Dairy Fruit & Vegetable Pvt. Ltd.

-

Kerry Group plc

-

Nestle S.A.

-

Probi AB

-

Yakult Honsha Co., Ltd.

Recent Development

-

In June 2023, ADM announced the opening of a USD 30 million state-of-the-art manufacturing facility in Spain to cater to the unmet demand for probiotics and postbiotics.

-

In April 2023, the FDA approved Seres Therapeutics’ live oral microbiome capsule Vowst and will be commercialized by Nestle using its gastroenterology sales force.

-

In November 2022, Nestlé made a breakthrough discovery and product in infant microbiome, launched under the brand name WYETH S-26® ULTIMA®, in collaboration with Pennington Biomedical Research Center and Rhode Island Hospital, USA.

-

In April 2022, Symrise and Probi collaboratively introduced SymFerment®, a sustainable probiotic skincare ingredient.

-

In August 2021, Chr. Hansen Holding A/S introduced its new science-based stable live probiotics product portfolio for the pet segment. The line-up included CHR. HANSEN PET-PROSTART™ for kittens and puppies, CHR. HANSEN PET-PROESSENTIALS™ for adult pets, and CHR. HANSEN PET-PROVITAL™ for senior cats and dogs.

-

In July 2021, Symrise launched its first processed probiotic dedicated to oral care called SymReboot™ OC which promotes a healthy oral microbiome and strengthens gums.

-

In May 2021, Chr. Hansen Holding A/S launched Bovacillus™, an innovative product to support beef cattle health and dairy farming.

Probiotics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 87.72 billion

Revenue forecast in 2030

USD 220.14 billion

Growth rate

CAGR of 14.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, ingredient, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Arla Foods; BioGaia; Chr. Hansen Holding A/S; Danone; DuPont De Nemours, Inc.; General Mills, Inc.; i-Health, Inc.; Lallemand Inc.; Lifeway Foods Inc; Mother Dairy Fruit & Vegetable Pvt. Ltd; Kerry Group plc; Nestle S.A.; Probi AB; Yakult Honsha Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Probiotics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the probiotics market report based on product, ingredient, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Probiotic Food & Beverages

-

Dairy Products

-

Non-Dairy

-

Cereals

-

Baked Food

-

Fermented Meat

-

Dry Foods

-

-

Probiotic Dietary Supplements

-

Food Supplements

-

Nutritional Supplements

-

Specialty Supplements

-

Infant Formula

-

-

Animal Feed

-

-

Ingredient Outlook (Revenue, USD Million, 2017 - 2030)

-

Bacteria

-

Yeast

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Human Probiotics

-

Animal Probiotics

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Hypermarkets / Supermarkets

-

Pharmacies / Drugstores

-

Specialty Stores

-

Online Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global probiotics market size was estimated at USD 77.12 billion in 2022 and is expected to reach USD 87.72 billion in 2023.

b. The probiotics market is expected to grow at a compound annual growth rate of 14.0% from 2023 to 2030 to reach USD 220.14 billion by 2030.

b. Probiotic food & beverage was the dominant product segment in terms of revenue, occupying over 60% in 2022 and is expected to experience significant growth over the forecast period. Growing awareness regarding the health benefits of fermented food products has been driving the demand for probiotic food & beverages.

b. Some of the key players in the probiotics market include Arla Foods, BioGaia, Chr. Hansen Holding A/S, Danone, DuPont De Nemours, Inc., General Mills, Inc., i-Health, Inc., Lallemand Inc., Lifeway Foods Inc, Mother Dairy Fruit & Vegetable Pvt. Ltd, Kerry Group plc, Nestle S.A., Probi AB, and Yakult Honsha Co., Ltd.

b. The growing awareness about the health benefits of probiotics, such as improved gut health and overall digestive function, is anticipated to boost the growth of the probiotics market across the globe.

Table of Contents

Chapter 1. Probiotics Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.4. Information analysis

1.4.1. Market formulation & data visualization

1.4.2. Data validation & publishing

1.5. Research Scope and Assumptions

1.6. List of Data Sources

Chapter 2. Probiotics Market: Executive Summary

Chapter 3. Probiotics Market: Industry Outlook

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related Market Outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Raw Material Trends

3.3.2. Manufacturing Trends

3.3.3. Cost Structure & Profit Margin Analysis

3.3.4. Sales Channel Analysis

3.4. Technology Overview

3.5. Regulatory Framework

3.6. Market Dynamics

3.6.1. Market Drivers

3.6.2. Market Restraints

3.6.3. Industry Challenges

3.7. Industry Analysis Tools

3.7.1. Industry Analysis - Porter’s Five Forces Analysis

3.7.1.1. Threat of New Entrants

3.7.1.2. Bargaining Power of Suppliers

3.7.1.3. Bargaining Power of Buyers

3.7.1.4. Threat of Substitutes

3.7.1.5. Competitive Rivalry

3.7.2. PESTEL Analysis

3.7.2.1. Political Landscape

3.7.2.2. Economic Landscape

3.7.2.3. Social Landscape

3.7.2.4. Technology Landscape

3.7.2.5. Environmental Landscape

3.7.2.6. Legal Landscape

3.7.3. Major Deals & Strategic Alliances

Chapter 4. Global Probiotics Market: Product Estimates & Trend Analysis

4.1. Definitions & Scope

4.2. Product Movement Analysis & Market Share, 2022 & 2030 (USD Million)

4.3. Probiotics Market Estimates & Forecast, by Product (USD Million)

4.3.1. Probiotic Food & Beverages

4.3.1.1. Dairy Products

4.3.1.2. Non - dairy

4.3.1.3. Cereals

4.3.1.4. Baked Food

4.3.1.5. Fermented Meat

4.3.1.6. Dry Foods

4.3.2. Probiotic Dietary Supplements

4.3.2.1. Food Supplements

4.3.2.2. Nutritional Supplements

4.3.2.3. Specialty Supplements

4.3.2.4. Infant Formula

4.3.3. Animal Feed

Chapter 5. Global Probiotics Market: Ingredient Estimates & Trend Analysis

5.1. Definitions & Scope

5.2. Ingredient Movement Analysis & Market Share, 2022 & 2030 (USD Million)

5.3. Probiotics Market Estimates & Forecast, by Application (USD Million)

5.3.1. Bacteria

5.3.2. Yeast

Chapter 6. Global Probiotics Market: End - Use Estimates & Trend Analysis

6.1. Definitions & Scope

6.2. End - Use Movement Analysis & Market Share, 2022 & 2030 (USD Million)

6.3. Global Probiotics Market Estimates & Forecast, by End - Use (USD Million)

6.3.1. Human Probiotics

6.3.2. Animal Probiotics

Chapter 7. Global Probiotics Market: Distribution Channel Estimates & Trend Analysis

7.1. Definitions & Scope

7.2. Distribution Channel Movement Analysis & Market Share, 2022 & 2030 (USD Million)

7.3. Global Probiotics Market Estimates & Forecast, by Distribution Channel (USD Million)

7.3.1. Hypermarkets/Supermarkets

7.3.2. Pharmacies/Drugstores

7.3.3. Specialty Stores

7.3.4. Online Stores

7.3.5. Others

Chapter 8. Probiotics Market: Regional Estimates & Trend Analysis

8.1. Key Takeaways

8.2. Regional Movement Analysis & Market Share, 2022 & 2030 (USD Million)

8.3. North America

8.3.1. North America Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.2. U.S.

8.3.2.1. U.S. Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.3. Canada

8.3.3.1. Canada Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.4. Mexico

8.3.4.1. Mexico Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4. Europe

8.4.1. Europe Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.2. Germany

8.4.2.1. Germany Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.3. UK

8.4.3.1. UK Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.4. France

8.4.4.1. France Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.5. Italy

8.4.5.1. Italy Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.6. Spain

8.4.6.1. Spain Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5. Asia Pacific

8.5.1. Asia Pacific Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5.2. China

8.5.2.1. China Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5.3. India

8.5.3.1. India Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5.4. Japan

8.5.4.1. Japan Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5.5. Australia & New Zealand

8.5.5.1. Australia & New Zealand Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6. Central & South America

8.6.1. Central & South America Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6.2. Brazil

8.6.2.1. Brazil Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6.3. Argentina

8.6.3.1. Argentina Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.7. Middle East & Africa

8.7.1. Middle East & Africa Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.7.2. Saudi Arabia

8.7.2.1. Saudi Arabia Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.7.3. South Africa

8.7.3.1. South Africa Probiotics Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Their Impacts on the Industry

9.2. Company Categorization

9.3. Participant’s Overview

9.3.1. Arla Foods Group

9.3.2. BioGaia AB

9.3.3. Chr. Hansen Holding A/S

9.3.4. Danone

9.3.5. DuPont De Nemours, Inc.

9.3.6. General Mills, Inc.

9.3.7. i - Health, Inc.

9.3.8. Lallemand Inc.

9.3.9. Lifeway Foods Inc

9.3.10. Mother Dairy Fruit & Vegetable Pvt. Ltd

9.3.11. Kerry

9.3.12. Nestle S.A.

9.3.13. Probi AB

9.3.14. Yakult Honsha Co., Ltd.

9.4. Financial Performance

9.5. Product Benchmarking

9.6. Company Market Share Analysis, 2022

9.7. Company Heat Map Analysis

9.8. Strategy Mapping

List of Tables

1. Probiotics market - Driving factor market analysis

2. Probiotics market - Restraint factor market analysis

3. Probiotics market estimates and forecast, by product, 2017 - 2030 (USD Million)

4. Probiotic food & beverages market estimates and forecast, by product, 2017 - 2030 (USD Million)

5. Probiotic dietary supplements market estimates and forecast, by product, 2017 - 2030 (USD Million)

6. Probiotics market estimates and forecast, by ingredient, 2017 - 2030 (USD Million)

7. Probiotics market estimates and forecast, by end-use, 2017 - 2030 (USD Million)

8. Probiotics market estimates and forecast, by distribution channel, 2017 - 2030 (USD Million)

9. Company market share analysis, 2022

List of Figures

1. Information procurement

2. Primary research pattern

3. Primary research process

4. Primary research approaches

5. Probiotics market: Market snapshot

6. Probiotics market: Segment outlook

7. Probiotics market: Competitive outlook

8. Probiotics market: Value chain analysis

9. Probiotics market: Porter’s analysis

10. Probiotics market: PESTEL analysis

11. Probiotics market, by product: Key takeaways

12. Probiotics market, by product: Market share, 2022 & 2030

13. Probiotic food & beverages market estimates & forecasts, 2017 - 2030 (USD Million)

14. Probiotic dairy products market estimates & forecasts, 2017 - 2030 (USD Million)

15. Probiotic non-dairy products market estimates & forecasts, 2017 - 2030 (USD Million)

16. Probiotic cereals market estimates & forecasts, 2017 - 2030 (USD Million)

17. Probiotic baked food market estimates & forecasts, 2017 - 2030 (USD Million)

18. Probiotic fermented meat market estimates & forecasts, 2017 - 2030 (USD Million)

19. Probiotic dry foods market estimates & forecasts, 2017 - 2030 (USD Million)

20. Probiotic dietary supplements market estimates & forecasts, 2017 - 2030 (USD Million)

21. Probiotic food supplements market estimates & forecasts, 2017 - 2030 (USD Million)

22. Probiotic nutritional supplements market estimates & forecasts, 2017 - 2030 (USD Million)

23. Probiotic specialty supplements market estimates & forecasts, 2017 - 2030 (USD Million)

24. Probiotic infant formula market estimates & forecasts, 2017 - 2030 (USD Million)

25. Probiotic animal feed market estimates & forecasts, 2017 - 2030 (USD Million)

26. Bacteria-based probiotics market estimates & forecasts, 2017 - 2030 (USD Million)

27. Yeast-based probiotics market estimates & forecasts, 2017 - 2030 (USD Million)

28. Human probiotics market estimates & forecasts, 2017 - 2030 (USD Million)

29. Animal probiotics market estimates & forecasts, 2017 - 2030 (USD Million)

30. Probiotics market estimates & forecasts through supermarkets/hypermarkets, 2017 - 2030 (USD Million)

31. Probiotics market estimates & forecasts through supermarkets/hypermarkets, 2017 - 2030 (USD Million)

32. Probiotics market estimates & forecasts through pharmacies & drugstores, 2017 - 2030 (USD Million)

33. Probiotics market estimates & forecasts through specialty stores, 2017 - 2030 (USD Million)

34. Probiotics market estimates & forecasts through online stores, 2017 - 2030 (USD Million)

35. Probiotics market estimates & forecasts through other channels, 2017 - 2030 (USD Million)

36. North America market estimates & forecasts, 2017 - 2030 (USD Million)

37. U.S. market estimates & forecasts, 2017 - 2030 (USD Million)

38. Canada market estimates & forecasts, 2017 - 2030 (USD Million)

39. Mexico market estimates & forecasts, 2017 - 2030 (USD Million)

40. Europe market estimates & forecasts, 2017 - 2030 (USD Million)

41. Germany market estimates & forecasts, 2017 - 2030 (USD Million)

42. UK market estimates & forecasts, 2017 - 2030 (USD Million)

43. France market estimates & forecasts, 2017 - 2030 (USD Million)

44. Italy market estimates & forecasts, 2017 - 2030 (USD Million)

45. Spain market estimates & forecasts, 2017 - 2030 (USD Million)

46. Asia Pacific market estimates & forecasts, 2017 - 2030 (USD Million)

47. China market estimates & forecasts, 2017 - 2030 (USD Million)

48. Japan market estimates & forecasts, 2017 - 2030 (USD Million)

49. India market estimates & forecasts, 2017 - 2030 (USD Million)

50. Australia & New Zealand market estimates & forecasts, 2017 - 2030 (USD Million)

51. Central & South America market estimates & forecasts, 2017 - 2030 (USD Million)

52. Brazil market estimates & forecasts, 2017 - 2030 (USD Million)

53. Argentina market estimates & forecasts, 2017 - 2030 (USD Million)

54. Middle East & Africa market estimates & forecasts, 2017 - 2030 (USD Million)

55. Saudi Arabia market estimates & forecasts, 2017 - 2030 (USD Million)

56. South Africa market estimates & forecasts, 2017 - 2030 (USD Million)

57. Probiotics market: Key Company/Competition categorization

58. Company market share analysis, 2022 (%)

59. Company heat map analysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Probiotic Product Outlook (Revenue, USD Million, 2017 - 2030)

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Probiotic Ingredient Outlook (Revenue, USD Million, 2017 - 2030)

- Bacteria

- Yeast

- Probiotic End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Human Probiotics

- Animal Probiotics

- Probiotic Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

- Hypermarkets/Supermarkets

- Pharmacies/ Drugstore

- Specialty Stores

- Online Stores

- Others

- Probiotic Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- North America Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- North America Probiotics Market, by Ingredient

- Bacteria

- Yeast

- North America Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- North America Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- U.S.

- U.S. Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- U.S. Probiotics Market, by Ingredient

- Bacteria

- Yeast

- U.S. Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- U.S. Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- U.S. Probiotics Market, by Product

- Canada

- Canada Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Canada Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Canada Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Canada Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Canada Probiotics Market, by Product

- Mexico

- Mexico Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Mexico Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Mexico Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Mexico Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Mexico Probiotics Market, by Product

- North America Probiotics Market, by Product

- Europe

- Europe Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Europe Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Europe Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Europe Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Germany

- Germany Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Germany Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Germany Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Germany Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Germany Probiotics Market, by Product

- UK

- UK Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- UK Probiotics Market, by Ingredient

- Bacteria

- Yeast

- UK Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- UK Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- UK Probiotics Market, by Product

- France

- France Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- France Probiotics Market, by Ingredient

- Bacteria

- Yeast

- France Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- France Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- France Probiotics Market, by Product

- Italy

- Italy Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Italy Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Italy Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Italy Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Italy Probiotics Market, by Product

- Spain

- Spain Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Spain Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Spain Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Spain Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Spain Probiotics Market, by Product

- Europe Probiotics Market, by Product

- Asia Pacific

- Asia Pacific Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Asia Pacific Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Asia Pacific Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Asia Pacific Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- China

- China Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- China Probiotics Market, by Ingredient

- Bacteria

- Yeast

- China Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- China Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- China Probiotics Market, by Product

- Japan

- Japan Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Japan Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Japan Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Japan Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Japan Probiotics Market, by Product

- India

- India Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- India Probiotics Market, by Ingredient

- Bacteria

- Yeast

- India Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- India Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- India Probiotics Market, by Product

- Australia & New Zealand

- Australia & New Zealand Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Australia & New Zealand Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Australia & New Zealand Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Australia & New Zealand Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Australia & New Zealand Probiotics Market, by Product

- Asia Pacific Probiotics Market, by Product

- Central & South America

- Central & South America Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Central & South America Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Central & South America Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Central & South America Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Brazil

- Brazil Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Brazil Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Brazil Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Brazil Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Brazil Probiotics Market, by Product

- Argentina

- Argentina Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Argentina Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Argentina Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Argentina Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Argentina Probiotics Market, by Product

- Central & South America Probiotics Market, by Product

- Middle East & Africa

- Middle East & Africa Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Middle East & Africa Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Middle East & Africa Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Middle East & Africa Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Saudi Arabia

- Saudi Arabia Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- Saudi Arabia Probiotics Market, by Ingredient

- Bacteria

- Yeast

- Saudi Arabia Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- Saudi Arabia Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- Saudi Arabia Probiotics Market, by Product

- South Africa

- South Africa Probiotics Market, by Product

- Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

- Probiotic Food & Beverages

- South Africa Probiotics Market, by Ingredient

- Bacteria

- Yeast

- South Africa Probiotics Market, by End-use

- Human Probiotics

- Animal Probiotics

- South Africa Probiotics Market, by Distribution Channel

- Hypermarket/Supermarket

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

- Others

- South Africa Probiotics Market, by Product

- Middle East & Africa Probiotics Market, by Product

- North America

Probiotics Market Dynamics

Driver: Growing Inclination For Preventive Healthcare

The focus on preventive healthcare has increased, owing to the rising health issues and gut problems caused by consumers’ fast-paced lifestyles. Moreover, consumers’ inclusion of probiotics in healthy diets, increased disposable income, improved living standards, and growth in the elderly population are other factors that are driving the probitotics market. The increasing awareness of their benefits in digestive health have aided the probiotics market growth. Currently, several well-characterized strains of lactobacilli and bifidobacteria are available for human consumption to reduce the risk of gastrointestinal infections or treat similar conditions. Their consumption can aid the digestive tract by repopulating it with beneficial bacteria. Consequently, the inclusion of probiotics in regular meals can help consumers in developing lymphocytes, which strengthen immune responses.

Driver: Development Of Efficient Probiotic Strains

The rising consumer preference for natural health solutions over traditional pharmaceuticals has spurred the growth of the probiotics industry. Companies are now focusing on creating probiotic strains that cater to specific health needs. This shift is a direct response to the increasing demand for holistic health alternatives. Concurrently, the probiotics sector has witnessed substantial advancements in research, leading to a deeper understanding of the potential health benefits and mechanisms of various strains. This scientific progress has piqued the interest of companies, encouraging them to leverage this knowledge to engineer strains with unique attributes. A notable example is the England-based pharmaceutical company, FERRYX LTD. In March 2023, they launched the FX-856 strain, designed to alleviate symptoms of gastrointestinal disorders such as diarrhea, constipation, bloating, and ulcerative colitis. This development exemplifies the industry’s commitment to providing natural solutions to health concerns.

Restraint: High Product Development Costs And Stringent Government Regulations

The probiotics market’s growth is hindered by the high costs of research and development (R&D). These costs encompass setting up efficient labs, acquiring research equipment, and employing skilled researchers. The lack of incentives from regulatory bodies adds to the financial strain of developing new products. Consequently, companies struggle to allocate adequate resources to R&D, which could be used for innovation and product expansion. The regulatory environment for probiotic products is intricate and strict. The approval process for new probiotic ingredients or health claims is slow, with regulatory bodies often demanding substantial scientific evidence to support health claims. This requirement prolongs product development and launch, as companies must conduct thorough studies and provide extensive documentation for review.

What Does This Report Include?

This section will provide insights into the contents included in this probiotics market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Probiotics market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Probiotics market quantitative analysis

-

Market size, estimates, and forecast from 2017 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the probiotics market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for probiotics market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of probiotics market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Probiotics Market Categorization:

The probiotics market was categorized into five segments, namely product (Probiotic Food & Beverages, Probiotic Dietary Supplements, Animal Feed), ingredient (Bacteria, Yeast), end-use (Human Probiotics, Animal Probiotics), distribution channel (Hypermarkets / Supermarkets, Pharmacies / Drugstores, Specialty Stores, Online Stores), and region (North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa)

Segment Market Methodology:

The probiotics market was segmented into product, ingredient, end-use, distribution channel, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The probiotics market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into sixteen countries, namely, the U.S.; Canada; Mexico; the UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; Brazil; Argentina; Saudi Arabia; South Africa.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Probiotics market companies & financials:

The probiotics market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Arla Foods Group - Arla Foods Group, a public company established in 2000, is based in Viby, Denmark. It produces a variety of products including dairy items, enzymes, probiotics, dietary supplements, wine ingredients, cheese, and phytonutrients. The company processes milk at six locations owned by 9,406 dairy farmers across seven countries. Arla Foods Group markets its products in 150 countries, with key markets in Sweden, Denmark, the UK, Belgium, Luxembourg, and the Netherlands. Its portfolio includes brands like Apetina, Lurpak, Castello, Arla Cream Cheese, Arla Lactofree, and Arla Natura. The company also supplies ingredients for various industries such as early life nutrition, sports nutrition, health foods, dairy, bakery, and affordable nutrition. It manufactures key ingredients like hydrolysates, alpha-lactalbumin, and whey protein concentrates, used in products like protein bars and powders.

-

BioGaia AB - BioGaia AB, a public company founded in 1990 and based in Stockholm, Sweden, specializes in the sale, marketing, and development of probiotic products. It operates through five subsidiaries: BioGaia Biologics Inc., BioGaia Pharma AB, MetaboGen AB, BioGaia Japan Inc., and BioGaia Production AB. The company’s products are distributed through approximately 80 local centers in 100 countries worldwide. BioGaia AB offers a range of probiotic products targeting adult gut health, baby and child health, immune health, pregnancy health, oral health, and bone health. These products, which are milk-free, gluten-free, and lactose-free, come in various forms such as tablets, capsules, drops, and lozenges. They are manufactured and packaged in six facilities located in Spain, Denmark, the U.S., Sweden, and Belgium. The company maintains a robust research unit and collaborates with various hospitals and universities, including the Karolinska Institute in Stockholm, the Swedish University of Agricultural Sciences in Uppsala, the Sahlgrenska University Hospital in Gothenburg, the University Hospitals of Bari and Turin in Italy, and Texas Children’s.

-

Chr. Hansen Holding A/S - Chr. Hansen Holding A/S, a Danish bioscience company established in 1874, specializes in the production and development of cultures, enzymes, and probiotics. These are used in a wide range of products, including food, beverages, dietary supplements, animal feed, and plant protection. The company operates two main business segments: food cultures & enzymes, and health nutrition. Chr. Hansen’s natural ingredient solutions cater to the nutritional, agricultural, and pharmaceutical industries. Their products find application in cheese production, beverages, confectionery, dietary supplements, cereals, bakery products, pharmaceuticals, and agricultural products. With a presence in over 140 countries, offices in more than 30 countries, and production facilities and development centers in Denmark, the U.S., France, and Germany, Chr. Hansen has a global footprint. The company also maintains research and development and product development units. A strategic alliance with FMC Corporation enables the development and commercialization of biological plant protection products. Chr. Hansen boasts the largest collection of bacteria, with nearly 40,000 strains. In 2020, the company achieved 75 production registrations globally in animal health & nutrition. This makes Chr. Hansen a significant player in the bioscience industry.

-

Danone - Danone, a multinational food corporation, was established in 1919 and is based in Paris, France. The company manufactures a variety of products including yogurt, packaged water, dairy products, and baby nutrition products. These products are offered to various industries such as food & beverages, life nutrition, and pharmaceuticals. Danone operates under various brands, catering to essential dairy and plant-based products, waters, and specialized nutrition. Some of the well-known brands under Danone include Activia, Alpro, Actimel, Danette, Aptamil, Danio, Nutricia, Nutrilon, Volvic, Bonafont, AQUA, Cow & Gate, Horizon Organic, Mizone, Oikos, and more. The company has a significant global presence with operations in countries like the U.S., Mexico, Brazil, India, Russia, China, Indonesia, and Spain. It also maintains a research unit, Nutricia Research, located in Utrecht, the Netherlands. This extensive network and diverse product portfolio make Danone a key player in the food industry.

-

DuPont de Nemours, Inc - DuPont de Nemours, Inc., a multinational conglomerate, was established in 2019 following its separation from DowDuPont, Inc. The split resulted in three distinct companies focusing on specialty products, material sciences, and agricultural businesses. DuPont de Nemours, Inc., the specialty products division, is now headquartered in Delaware, U.S. The company offers a wide range of products and services to various industries and operates through five business segments: Nutrition & Biosciences, Electronics & Imaging, Transportation & Industrial, Safety & Construction, and Non-Core. These segments cater to diverse sectors including food & beverage, agriculture, electronics & communications, home & construction, safety & protection, packaging & printing, chemical, marine, mining, energy, apparel, and automotive. With subsidiaries in over 70 countries and manufacturing units in around 40 countries, DuPont de Nemours, Inc. has a significant global presence. This extensive network and diverse product portfolio make DuPont de Nemours, Inc. a key player in the industry.

-

General Mills, Inc. - General Mills Inc., a public company, is a leading manufacturer of consumer foods. The company operates through various segments including U.S. retail, international, convenience stores & food service, and joint ventures. It specializes in producing a range of products such as frozen foods, nutrition bars, yogurt, shelf-stable vegetables, frozen pastries, and baking products. The company manufactures its products in 13 countries and markets them in over 130 countries, with a regional presence in countries like the UK, Ireland, Argentina, France, India, Singapore, Australia, and Switzerland. General Mills Inc. also has a dedicated research and development unit that focuses on product improvement, new product development, and process design. The company owns several well-known brands including Pillsbury, Progresso, Oatmeal Crisp, Lärabar, Latina, Fiber One, Cocoa Puffs, Cheerios, Bugles, Blue Wilderness, Blue Freedom, Blue Buffalo, Crunch, Yoplait, and more. This diverse portfolio makes General Mills Inc. a significant player in the consumer foods industry.

-

i-Health, Inc. - i-Health Inc., a private entity established in 1995, is nestled in Cromwell, Connecticut, U.S. It operates as a subsidiary of DSM Nutritional Products and has made its mark globally in the consumer packaged goods industry. The company’s expertise lies in the production of various health supplements including probiotics, UTI pain relievers, menopause relief supplements, omega-3 supplements, and natural remedies for yeast infections. i-Health Inc. is not just a manufacturer but also takes on the roles of marketer, distributor, and developer of its branded products. Its portfolio boasts of several brands such as Culturelle, AZO, Estroven, UP4, Ovega-3, BrainStrong, and Life’s DHA. Each brand caters to different health needs of consumers. One of its notable products is the probiotic supplement offered under the brand name Culturelle. These probiotics are available in forms that are easy to consume, like chewable and capsules, and are used in various end-use applications including supplements and food products. Through its diverse range of products, i-Health Inc. continues to contribute to the health and wellness of consumers worldwide.

-

Lallemand Inc. - Lallemand Inc., a private firm, is a global leader in the development, production, and distribution of yeasts, bacteria, and probiotics, primarily for human nutrition. The company provides microbiological solutions for a wide range of applications including nutrition, baking, brewing, food ingredients, human and animal health, oenology, probiotics, and biofuels. The company operates through two main business units: the Yeast Group, based in Canada, and the Specialties Group, based in France. These units oversee 11 business divisions that focus on various applications of bacteria and yeast, such as cosmetics, plant care, pharmaceuticals, manufacturing and specialty cultures, bio-ingredients, brewing, biofuels and distilled spirits, oenology, health solutions, animal nutrition, and organic yeast. Lallemand Inc. operates 47 plants worldwide, including 27 yeast and 9 bacteria plants. The company has a global footprint with operations in 50 countries and commercial offices in China, Australia, India, Belgium, Japan, among others. It also maintains research units in the UK, Canada, the U.S., Finland, and other countries, reinforcing its commitment to innovation and quality.

-

Lifeway Foods Inc. - Lifeway Foods, Inc., a public company founded in 1986, is a leading supplier of the probiotic fermented beverage, Kefir, in the U.S. The company, headquartered in Morton Grove, Illinois, specializes in the production of cultured dairy products, with drinkable kefir being its primary product. In addition to kefir, Lifeway Foods also manufactures cheese, cream, frozen kefir, and a line of products for kids called ProBugs. The company offers kefir in various flavors and varieties, including whole milk, low fat, and organic versions. It also supplies other probiotic organic and natural dairy products. All products from Lifeway Foods are made from all-natural, GMO-free, lactose-free, and gluten-free ingredients. The company markets its products in several countries including the U.S., Mexico, the UK, Norway, Sweden, the Middle East, Ireland, and the Caribbean. It sells its products through distributors, direct sales, and brokers, with United Natural Foods (UNFI), C&S Wholesale Grocers, and KeHE Distributors being some of its distributors. As of 2020, Lifeway Foods employed 316 individuals. Through its diverse product range, Lifeway Foods continues to contribute to the health and wellness of consumers worldwide.

-

Mother Dairy Fruit & Vegetable Pvt. Ltd. - Mother Dairy Fruit & Vegetable Pvt. Ltd., a private company, is a wholly-owned subsidiary of the National Dairy Development Board (NDDB). Established under a government initiative, the company operates three brands: Mother Dairy, Safal, and Dhara. Mother Dairy manufactures, sells, and markets a variety of products including milk, ice creams, paneer, ghee, and more. Its product portfolio also includes fruits and vegetables, frozen vegetables, edible oils, and processed foods like jams and fruit juices. The company distributes its products across all regions of India and markets fresh and frozen fruit & vegetable products under the Safal brand. With 423 retail outlets in cities like Noida, Ghaziabad, Delhi, Faridabad, Gurgaon, and Bangalore, it has a strong presence in the Indian market. Safal operates a state-of-the-art plant in Bangalore that produces around 23,000 MT of aseptic fruit pulp, which it sells to major companies like Pepsi, Nestle, and Coco-Cola. Mother Dairy has a global presence, operating in 40 countries including Russia, the U.S., the Middle East & Africa, among others. The company is ISO 9001:2008 (QMS), ISO 22000:2005 (FSMS), and ISO 14001:2004 (EMS) certified. Safal holds FSSC 22000, Star K Kosher, Halal, the U.S. FDA, HACCP, and SGF certifications.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Probiotics Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2017 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Probiotics Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.