- Home

- »

- Digital Media

- »

-

Professional Services Automation Software Market, 2033GVR Report cover

![Professional Services Automation Software Market Size, Share & Trends Report]()

Professional Services Automation Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution (Project Management, Billing & Invoice Management), By Deployment (On-Premise, Cloud), By Enterprise Size, By Application (Consulting Firm, Technology Companies), By Region, And Segment Forecasts

- Report ID: 978-1-68038-790-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Professional Services Automation Software Market Summary

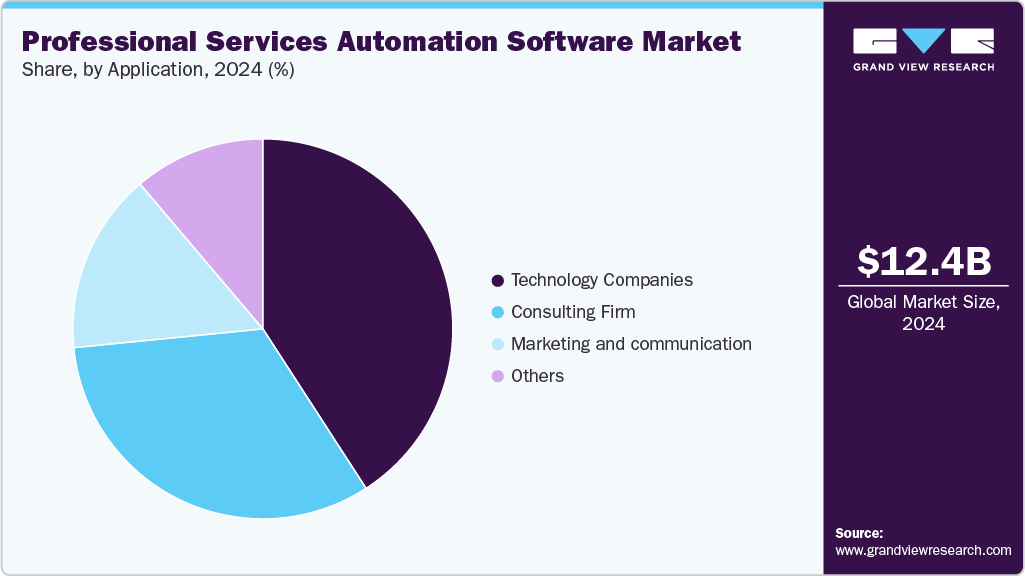

The global professional services automation software market size was estimated at USD 12.40 billion in 2024 and is projected to reach USD 40.25 billion by 2033, growing at a CAGR of 14.7% from 2025 to 2033. The rising adoption of cloud-based professional services automation (PSA) software solutions is driving the market growth.

Key Market Trends & Insights

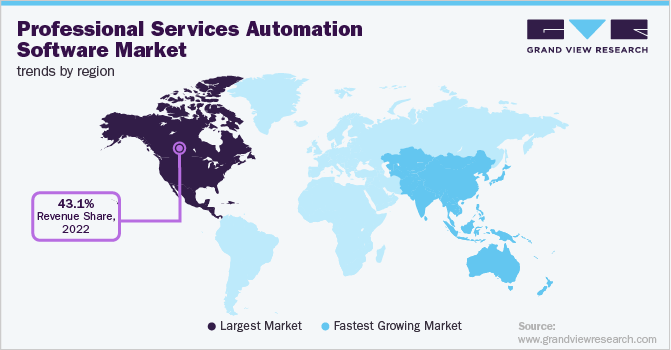

- North America held a 42.1% revenue share of the global professional services automation software market in 2024.

- The U.S. professional services automation software industry is projected to grow during the forecast period.

- By solution, the project management segment held the largest revenue share of 30.0% in 2024.

- By deployment, the on-premise segment held the largest revenue share in 2024.

- By enterprise size, the large enterprise segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.40 Billion

- 2033 Projected Market Size: USD 40.25 Billion

- CAGR (2025-2033): 14.7%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

The growing emphasis on client-centric service delivery models is driving the expansion of the professional services automation software industry. Clients expect personalized solutions, transparent communication, and measurable results. PSA solutions empower service providers to meet these expectations by offering real-time project tracking, client reporting, and feedback integration mechanisms. These systems enable firms to share live dashboards with clients, showcasing progress updates, milestones achieved, and resource utilization. This transparency fosters trust and strengthens client relationships, ultimately leading to higher retention rates and recurring business. Furthermore, by leveraging PSA data, companies can gain deep insights into client behavior, project profitability, and satisfaction levels, allowing them to tailor future services more effectively.

The market growth is further driven by the rapid integration of emerging technologies such as generative AI, machine learning, and robotic process automation (RPA) into service operations. These technologies are transforming how professional service firms plan, execute, and deliver projects. Generative AI, for instance, can assist in creating project documentation, proposals, and client communications automatically, while RPA streamlines repetitive administrative tasks, such as invoicing and data entry. This technological synergy reduces manual errors, increases speed, and enhances overall efficiency in project management workflows.

The growth of the market for professional services automation software is also accelerated by the increasing prevalence of subscription-based and outcome-driven business models in the professional services sector. Traditional project-based engagements are being gradually replaced by recurring revenue models that focus on delivering continuous value. PSA systems are designed to support such frameworks by enabling accurate tracking of recurring tasks, subscription billing, and service-level agreement (SLA) compliance. These capabilities enable organizations to maintain financial predictability while ensuring that services are consistently delivered in accordance with client expectations. Moreover, as professional services become increasingly digital, the integration of PSA with customer success management tools enables companies to monitor client outcomes and adjust their strategies proactively. This alignment between service delivery and long-term business value creation is fostering stronger adoption of PSA platforms among firms transitioning toward subscription-oriented operating models.

The rising adoption of hybrid delivery models combining on-site, remote, and outsourced teams is another major driver shaping the professional services automation market landscape. Professional service firms today operate in a highly distributed environment where projects often involve collaboration between in-house teams, freelancers, and third-party vendors across time zones. Managing such dynamic ecosystems manually is both complex and inefficient. PSA platforms simplify this challenge by providing centralized coordination tools that integrate communication, task management, and workflow automation. These systems enable managers to oversee cross-functional collaboration seamlessly while maintaining a unified view of project progress and resource utilization. As global workforce models become more fluid and talent increasingly distributed, the ability of professional services automation systems to manage diverse teams effectively is becoming a key factor driving their adoption across industries.

Solution Insights

The project management segment dominated the professional services automation software market, accounting for a 30.0% revenue share in 2024. The growing need for streamlined coordination and visibility across complex, multi-phase projects drives market growth. As organizations undertake larger and more intricate service engagements, often involving cross-functional teams and global clients, the limitations of traditional project tracking tools have become increasingly evident. PSA solutions with integrated project management capabilities enable centralized oversight of project timelines, budgets, deliverables, and performance metrics in real time. This unified approach allows managers to align resource allocation, task dependencies, and client milestones more effectively, reducing inefficiencies and communication gaps. The ability to visualize project progress through dynamic dashboards and analytics empowers decision-makers to respond promptly to delays or risks, ultimately enhancing delivery quality and profitability. The demand for transparency and agility in project execution, particularly among IT, consulting, and engineering firms, continues to drive the adoption of PSA systems tailored to robust project management functionalities.

Business analytics is projected to be the fastest-growing segment from 2025 to 2033. The rising demand for real-time performance monitoring and agile reporting is fueling the growth of the business analytics segment. In today’s fast-paced service environment, decision-makers need instant access to key business metrics without waiting for periodic reports. PSA platforms equipped with real-time analytics dashboards provide immediate visibility into project health, resource performance, and financial indicators. This instant insight empowers leaders to act swiftly in response to emerging issues such as delays, overspending, or utilization gaps before they escalate into major problems. Additionally, real-time analytics facilitate agile business planning, enabling teams to adapt quickly to client requirements or market shifts. As organizations increasingly adopt agile methodologies, the need for continuous, real-time visibility through PSA analytics tools is becoming a vital driver of market expansion.

Deployment Insights

The on-premise segment dominated the professional services automation software industry in 2024. The increasing importance of intellectual property (IP) protection and proprietary data confidentiality among professional service firms drives segment growth. In consulting, design, engineering, and IT services, proprietary methodologies, algorithms, and client-specific solutions represent valuable intellectual assets. On-premise PSA systems enable organizations to safeguard this proprietary knowledge within their own data environments, reducing exposure to external vendors or shared cloud infrastructures. By ensuring that project documentation, performance analytics, and internal strategies remain securely hosted, companies mitigate the risks of data leakage or unauthorized access. This control over intellectual property is particularly critical for firms that work on competitive bids or sensitive projects, where confidentiality directly impacts client trust and brand reputation. The assurance of keeping IP-secure under organizational control continues to drive strong adoption of on-premise PSA systems across high-value professional service sectors.

The cloud segment is projected to grow the fastest from 2025 to 2033. The increasing pace of digital transformation and software-as-a-service (SaaS) adoption across professional service industries is a significant factor fueling growth in the cloud PSA market. Organizations are increasingly transitioning from traditional, static software deployments to cloud-native solutions that provide continuous updates, integrations, and process automation. PSA vendors have responded by offering advanced cloud-based platforms equipped with AI-driven analytics, workflow automation, and predictive forecasting capabilities that help organizations manage projects more intelligently. The cloud environment supports easy integration with enterprise applications such as customer relationship management (CRM), enterprise resource planning (ERP), and collaboration tools, creating a connected ecosystem for seamless data flow. This interoperability enables professional service firms to eliminate silos, enhance transparency, and make data-driven decisions in real time.

Enterprise Size Insights

The large enterprise segment dominated the market in 2024. The increasing importance of cross-functional collaboration and integrated service delivery propels segment growth. Large enterprises often operate through multiple departments, such as IT, finance, operations, and customer success, that must work cohesively to deliver complex client solutions. PSA systems enable this integration by connecting disparate functions through a unified platform that ensures smooth information flow and collaborative project execution. For example, the integration of PSA with customer relationship management (CRM) and enterprise resource planning (ERP) systems allows enterprises to synchronize client engagement, project planning, and financial management. This holistic visibility fosters greater coordination between departments and ensures alignment between client expectations and internal capabilities.

The small & medium enterprise segment is projected to grow at a significant CAGR from 2025 to 2033. The shift toward remote and hybrid work models drives the adoption of PSA among SMEs. With smaller teams often dispersed across multiple locations or working from home, maintaining coordination and productivity can be challenging. PSA solutions provide centralized, cloud-based platforms that allow teams to collaborate, share updates, and track project milestones in real time. Mobile accessibility and intuitive user interfaces enable employees to manage tasks and submit reports on the go, increasing engagement and accountability. This digital connectivity enhances overall project performance, even in decentralized work environments. For SMEs that rely heavily on flexible staffing and freelance consultants, PSA tools also simplify contract management and performance tracking, ensuring that all team members remain aligned with organizational goals despite geographical dispersion.

Application Insights

The technologies companies segment dominated the professional services automation software market in 2024. The increasing reliance on distributed and remote workforces in the technology sector is fueling the PSA market’s growth. Technology companies often employ global teams that work across multiple time zones, utilizing remote collaboration tools and agile methodologies. PSA platforms provide a centralized digital environment that allows teams to coordinate effectively, track progress in real time, and maintain consistent project documentation. Cloud-based PSA solutions, in particular, support seamless access to project data from any location, ensuring that teams remain aligned and productive even in decentralized setups. This centralized visibility is crucial for maintaining accountability, particularly in industries where project deadlines and deliverable quality significantly impact client satisfaction.

The marketing and communication segment is projected to grow the fastest from 2025 to 2033. The rapid digitalization of marketing channels and tools is also driving growth in the PSA market within the marketing and communication sector. Agencies today manage diverse digital assets across social media, search engines, content platforms, and advertising networks, all of which demand continuous monitoring and coordination. PSA platforms help centralize campaign schedules, creative approvals, and deliverable tracking within one environment, ensuring that cross-channel campaigns remain synchronized. Additionally, the integration of PSA solutions with marketing automation, CRM, and content management systems allows firms to unify client data and campaign insights, creating a cohesive workflow from planning to reporting. This interconnectivity eliminates data silos, enhances collaboration, and enables faster turnaround times for campaign execution.

Regional Insights

North America dominated the professional services automation software market, accounting for a 42.1% revenue share in 2024. The high penetration of small and medium-sized enterprises (SMEs) across North America has played a crucial role in driving PSA market expansion. SMEs are increasingly investing in automation tools to enhance operational efficiency, control project costs, and compete with larger firms. The availability of affordable cloud-based PSA solutions tailored for smaller organizations has lowered adoption barriers and encouraged widespread use. These systems enable SMEs to manage multiple client projects, optimize team productivity, and enhance billing accuracy with minimal upfront investment. As SMEs continue to embrace digitalization to remain agile in competitive markets, PSA vendors are expanding their offerings with modular, scalable, and easy-to-integrate platforms.

U.S. Professional Services Automation Software Market Trends

The U.S. professional services automation software industry is projected to grow during the forecast period. The increasing adoption of cloud-native and mobile-enabled PSA platforms drives U.S. market growth. With professionals working across diverse environments, including client sites, offices, and remotely, there is an increasing need for mobile access to project data, approvals, and performance dashboards. PSA vendors in the U.S. are responding by offering mobile-first applications that provide real-time project tracking, task management, and communication capabilities accessible from smartphones and tablets. This mobility enables service professionals to stay connected and responsive, even while on the move, thereby enhancing operational agility and reducing turnaround times.

Asia Pacific Professional Services Automation Software Market Trends

The Asia Pacific professional services automation software industry is expected to grow at the fastest CAGR of 16.8% over the forecast period. The integration of advanced analytics and performance measurement capabilities within PSA systems is another crucial growth driver. Enterprises across the Asia Pacific are adopting PSA platforms not just for process automation but for their ability to generate actionable insights into project profitability, employee productivity, and client engagement. With built-in analytics, these platforms enable decision-makers to monitor key performance indicators (KPIs) in real time and identify bottlenecks that affect delivery or cost efficiency. Predictive analytics functions also help forecast future project outcomes, enabling proactive decision-making and resource optimization. This analytical depth is driving PSA adoption among data-driven organizations that value transparency and continuous improvement in operational performance.

The professional services automation software market in China is projected to grow during the forecast period. The rise of cloud computing and the adoption of Software-as-a-Service (SaaS) in China are driving the growth of professional services automation solutions. Chinese enterprises are increasingly favoring cloud-based PSA platforms for their scalability, flexibility, and cost efficiency. Cloud deployment enables real-time data access, collaborative workflows, and integration with other enterprise systems such as customer relationship management (CRM) and enterprise resource planning (ERP). This aligns with China’s broader move toward cloud infrastructure, supported by both public and private investments in digital transformation. The growing trust in cloud security and local data governance frameworks further accelerates the adoption of PSA across industries.

Europe Professional Services Automation Software Market Trends

The professional services automation software industry in Europe is expected to grow during the forecast period. The rise of the gig economy and flexible workforce structures in Europe contributes to PSA market expansion. With the growing prevalence of freelancers, independent consultants, and contract-based professionals, organizations are seeking automation tools that can effectively manage dynamic workforce models. PSA platforms enable the seamless integration of freelance resources into ongoing projects, allowing for precise tracking of time, deliverables, and costs. This flexibility enables firms to maintain project continuity and optimize staffing levels in response to workload fluctuations. Moreover, PSA systems streamline administrative processes, such as invoicing and expense management, for both permanent and contract workers. As Europe continues to embrace flexible employment and digital freelancing, PSA tools are becoming central to efficiently coordinating distributed and hybrid workforces.

The professional services automation software market in Germany is expected to grow during the forecast period. The increasing integration of artificial intelligence (AI) and predictive analytics into PSA systems is also fueling market growth in Germany. Businesses are leveraging AI-driven automation to enhance project forecasting, financial planning, and performance monitoring. Predictive analytics capabilities within PSA solutions enable organizations to identify potential project risks, budget overruns, or resource bottlenecks before they occur, allowing for proactive decision-making. German enterprises, known for their data-driven and engineering-oriented management approaches, are particularly receptive to these intelligent automation capabilities. The integration of AI aligns with Germany’s broader technological innovation initiatives, fostering a culture of continuous improvement and process optimization.

Key Professional Services Automation Software Company Insights

Microsoft Corporation and Oracle Corporation are some of the leading participants in the professional services automation software market.

-

Microsoft Corporation is a global technology company. At the core of Microsoft’s presence in the market is its Dynamics 365 platform, a comprehensive suite of enterprise applications that integrates customer relationship management (CRM) and enterprise resource planning (ERP) functionalities. Dynamics 365 Project Operations, a specialized PSA solution within this ecosystem, enables professional service organizations to manage projects end-to-end from opportunity and contract management to resource scheduling, time tracking, and financial analytics.

-

Oracle Corporation is a global technology company. Oracle’s PSA capabilities are primarily delivered through Oracle Fusion Cloud Applications, specifically within the Oracle Cloud ERP and Oracle Cloud Project Management solutions. These platforms are designed to provide end-to-end visibility and control over service projects, from planning and budgeting to execution and billing. By integrating these functions into a unified cloud environment, Oracle enables professional service firms to maintain transparency and agility throughout the project lifecycle.

ConnectWise, Inc. and Workday, Inc. are some of the emerging participants in the professional services automation software market.

-

ConnectWise, Inc. is a U.S.-based software company. ConnectWise’s PSA offerings include ConnectWise PSA, a robust cloud-based solution designed to centralize and automate service operations. The platform provides end-to-end functionality that supports project planning, time tracking, billing, ticketing, and contract management. It enables service providers to monitor project progress in real time, optimize resource utilization, and maintain full visibility over costs and revenue streams.

-

Workday, Inc. is an enterprise software company. Workday’s PSA offering is its Workday Professional Services Automation Software solution, which combines resource management, project tracking, time and expense management, and billing into one unified system. This platform enables professional service organizations to optimize workforce deployment, monitor project performance, and maintain financial accuracy. By integrating human capital management (HCM) and financial management functionalities, Workday ensures that businesses have a complete view of both their talent and operational outcomes.

Key Professional Services Automation Software Companies:

The following are the leading companies in the professional services automation software market. These companies collectively hold the largest market share and dictate industry trends.

- Autotask Corporation

- Atlassian

- BMC Software, Inc.

- ConnectWise, Inc.

- Deltek, Inc.

- FinancialForce.com

- Kimble Apps

- Klient, Inc.

- Microsoft Corporation

- NetSuite OpenAir, Inc.

- Oracle Corporation

- Planview

- SAP SE

- Upland Software, Inc.

- Workday, Inc.

Recent Developments

-

In Septemeber 2025, DarcyIQ launched a native Kaseya Autotask integration via a new MCP (Model Context Protocol) server. This integration lets Managed Service Providers and IT service firms connect Autotask PSA with DarcyIQ’s AI consulting tools, enabling natural language management of tickets, projects, and client workflows directly within DarcyIQ for greater operational efficiency and seamless service delivery.

-

In June 2025, ConnectWise, Inc. launched ConnectWise PSA, a transformative initiative that delivers a modernized professional services automation software (PSA) experience within the Asio Platform. This integration offers a unified user interface (UI) and user experience (UX), minimizing the need to switch between multiple solutions and enabling faster, more efficient issue resolution. By utilizing shared platform services, ConnectWise PSA enhances operational efficiency and helps managed service providers (MSPs) lower overall costs.

Professional Services Automation Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.47 billion

Revenue forecast in 2033

USD 40.25 billion

Growth rate

CAGR of 14.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, enterprise size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Autotask Corporation; Atlassian; BMC Software, Inc.; ConnectWise, Inc.; Deltek, Inc.; FinancialForce.com; Kimble Apps; Klient, Inc.; Microsoft Corporation; NetSuite OpenAir, Inc.; Oracle Corporation; Planview; SAP SE; Upland Software, Inc.; Workday, Inc.;

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Professional Services Automation Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global professional services automation software market report based on solution, deployment, enterprise size, application, and region:

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Project Management

-

Billing & Invoice Management

-

Resource Management

-

Timesheet & Expense Management

-

Business Analytics

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Consulting Firm

-

Technology Companies

-

Marketing and Communication

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global professional services automation software market size was estimated at USD 12.40 billion in 2024 and is expected to reach USD 13.47 billion in 2025.

b. The global professional services automation software market is expected to witness a compound annual growth rate of 14.7% from 2025 to 2033 to reach USD 40.25 billion by 2033.

b. The project management segment dominated the professional services automation software market with a market share of 30.0% in 2024. The growing need for streamlined coordination and visibility across complex, multi-phase projects drives market growth.

b. Autotask Corporation, BMC Software, Inc., ConnectWise, Inc., Deltek, Inc., FinancialForce.com, Kimble Apps, Microsoft Corporation, NetSuite OpenAir, Inc., Oracle Corporation and Planview are some of the major industry players in this domain.

b. An increasing need for operational efficiency in professional services firms is expected to propel the PSA software market over the forecast period. In addition, the increasing sprawl of cloud deployment is also aiding market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.