- Home

- »

- Next Generation Technologies

- »

-

Programmatic Advertising Platform Market Size Report, 2030GVR Report cover

![Programmatic Advertising Platform Market Size, Share & Trends Report]()

Programmatic Advertising Platform Market (2024 - 2030) Size, Share & Trends Analysis Report By Platform Type, By Ad Format, By Deployment Model, By Pricing Model, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-329-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Programmatic Advertising Platform Market Summary

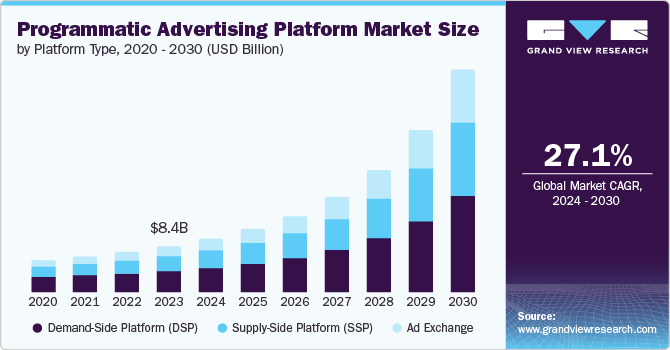

The global programmatic advertising platform market size was estimated at USD 8.43 billion in 2023 and is projected to reach USD 41.44 billion by 2030, growing at a CAGR of 27.1% from 2024 to 2030. The adoption of big data, advanced analytics, and ad tech innovations has enabled the programmatic ecosystem to grow. By using data and algorithms, programmatic platforms can optimize and automate digital ad buying at an unprecedented scale.

Key Market Trends & Insights

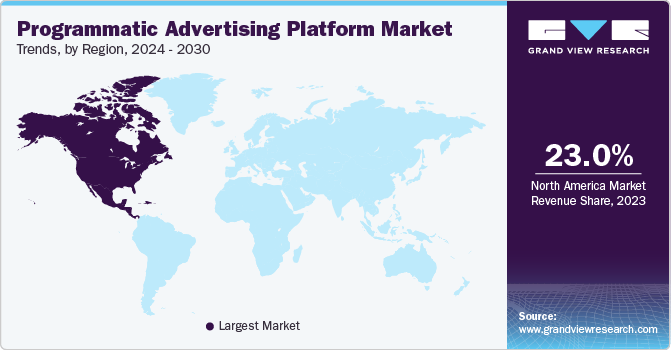

- North America held a significant revenue share of over 23% in 2023 and is expected to witness considerable growth over the coming years.

- The programmatic advertising platform market in the U.S. is expected to grow at a CAGR of nearly 26% from 2024 to 2030.

- The programmatic advertising platform market in Asia Pacific accounted for the highest revenue share of 34% in 2023.

- Based on platform type, demand-side platform (DSP) accounted for the largest revenue share in 2023.

- In terms of Ad format, display advertising accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.43 Billion

- 2030 Projected Market Size: USD 41.44 Billion

- CAGR (2024-2030): 27.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Advertisers can micro-target consumers based on demographics, interests, browsing behavior, and other data points. As consumers spend more and more time on digital devices and platforms, brands are allocating larger shares of ad budgets to digital media. This steady flow of ad dollars into digital channels has directly fueled the expansion of programmatic ad platforms.Major industry players like Google LLC, Amazon.com, Inc., and Adobe have invested heavily in developing sophisticated platforms and tools. Ad tech startups have also increased due to abundant venture capital funding. These investments in the programmatic supply chain have paved the way for long-term mainstream adoption. Manual media buying and selling is inefficient, non-transparent, and does not leverage data. Programmatic trading eliminates human friction in transactions and provides superior targeting capabilities. Over 80% of digital display ads are now traded programmatically. As brands realize the performance benefits, programmatic platforms are the new normal.

Internet-connected televisions and the growth of over-the-top (OTT) video services are opening new programmatic opportunities. Advertisers can apply data-driven targeting strategies across desktop, mobile, and connected TV inventory using demand-side platforms (DSPs). Streaming media usage has exploded due to the popularity of platforms like Hulu, Amazon Prime Video, Disney+, Apple TV+, and countless others. This rapid shift to over-the-top consumption provides billions of additional impressions for programmatic targeting.

Innovative new ad units like 360-degree ads, AR/VR ads, voice ads, and more are gaining traction across devices as consumer engagement with digital media deepens. Programmatic platforms enable these immersive formats to be bought and sold at scale using the same automated processes as standard display and video inventory. Testing also becomes simpler, fueling further innovation cycles into premium ad experiences. Programmatic advertising remains concentrated in North America, China, Western Europe, and several additional major markets. As internet connectivity and speeds improve in developing countries, their digital ad markets will rapidly mature to catch up with programmatic capabilities.

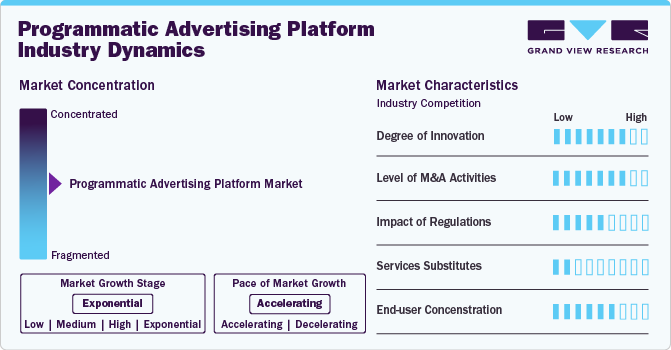

Market Concentration & Characteristics

The market growth stage is exponential, and the pace is accelerating. Programmatic advertising has become increasingly popular due to its efficiency and effectiveness in reaching targeted audiences. With the use of artificial intelligence and machine learning, programmatic advertising platforms can optimize ad campaigns and make data-driven decisions in real time. This has led to a shift away from traditional advertising methods towards programmatic advertising, which is expected to continue to grow in the coming years as more and more businesses see the benefits of this approach.

The market is seeing an increasing number of merger and acquisition (M&A) activities by the leading players underlying a dynamic industry landscape. This trend has been driven by several factors, including the need to expand market share, diversify offerings, and stay competitive in a rapidly evolving market. Many of the key players in the market have been acquiring smaller companies to gain access to new technologies, expertise, and customer bases. This has led to the concentration of industry, with a few large players dominating the market.

The market is also subject to moderate regulatory scrutiny. This is due to concerns around data privacy, transparency, and accountability in the use of consumer data for advertising purposes. In many countries, there are regulations in place that govern the use of personal data for advertising purposes. For example, the European Union's General Data Protection Regulation (GDPR) requires companies to obtain explicit consent from users before collecting and using their data for advertising purposes.

The programmatic advertising platform faces minimal competition from product substitutes in the market. This unique position stems from its specialized capabilities in automating ad buying processes across digital channels, offering precise targeting and real-time optimizations. Unlike traditional advertising methods, programmatic platforms leverage data-driven insights and algorithms to maximize campaign effectiveness and ROI.

End user concentration is a significant factor in the programmatic advertising platform market. The market is dominated by a few large players who serve a significant portion of the market's end-users. Large advertisers and agencies that spend significant amounts on digital advertising are the primary end-users of the market. These end-users have significant bargaining power due to their size and the amount of money they spend on advertising. As a result, they can negotiate favorable terms with platform providers and are able to exert significant influence on the market.

Platform Type Insights

Demand-side platform (DSP) accounted for the largest revenue share in 2023. Programmatic advertising enables advertisers to purchase ad inventory automatically and in real-time through an auction-based system. A critical component of programmatic advertising is demand-side platform (DSP) technology, which allows advertisers to manage their programmatic ad buying across various ad exchanges and supply-side platforms (SSPs). Another factor contributing to the growth of DSPs is the increased use of data-driven advertising.

Supply-side platforms segment is expected to register the fastest CAGR from 2024 to 2030. Programmatic advertising has revolutionized the way marketers buy and sell ad inventory. One of the essential components of programmatic advertising is the supply-side platform (SSP), which enables publishers to sell their ad inventory programmatically. SSPs provide publishers with a platform to manage and optimize their ad inventory across multiple ad exchanges and demand-side platforms (DSPs).

Ad Format Insights

Display advertising accounted for the largest revenue share in 2023. The growth of display advertising in programmatic platforms is the ability to target specific audiences with greater precision than traditional advertising methods. Programmatic advertising allows advertisers to use data to target specific demographics, interests, and behaviors, resulting in more effective ad campaigns. Another key factor driving growth in display advertising is the rise of mobile devices.

Video advertising is expected to register the fastest CAGR from 2024 to 2030. The growth of video advertising in programmatic platforms is the high engagement rates of video content. Video ads are more likely to capture viewers' attention and increase brand awareness than other forms of advertising. Programmatic advertising allows advertisers to target specific audiences with video content, resulting in more effective ad campaigns.

Distribution Model Insights

Cloud-based distribution model accounted for the largest revenue share in 2023. Cloud-based deployment models are more scalable and flexible. They allow platforms to quickly and easily add or remove capacity as demand fluctuates. This is important in an industry where ad inventory and traffic can vary rapidly. It also means that programmatic advertising platforms can easily expand into new markets or regions without having to invest in expensive hardware and infrastructure. Cloud-based deployment models are more cost-effective. They eliminate the need for users to purchase and maintain expensive hardware and software licenses.

The on-premises deployment model is expected to have a moderate CAGR from 2024 to 2030. The key driver of the growth is the desire for greater control and security over sensitive data. By managing the platform in-house, clients have more visibility and control over their data, as well as the ability to customize the platform to meet their specific needs.

Pricing Model Insights

The CPM pricing model accounted for the largest revenue share of 30% in 2023. Advertisers can easily calculate the cost of their ad campaigns based on the number of impressions they want to generate. The popularity of the CPM pricing model is due to the flexibility it offers. It can be used for various ad formats, including display, video, and mobile, making it a versatile pricing model. This flexibility is crucial, as advertisers need to reach their target audience across multiple channels.

CPV pricing model segment is expected to register the fastest CAGR of around 27% from 2024 to 2030. The reason for the growth of the CPV pricing model is due to the increasing popularity of video advertising. Video ads have become a popular way for advertisers to engage with their target audience and deliver their message effectively. The CPV pricing model provides an efficient way for advertisers to pay for video ads, ensuring that they only pay for completed views.

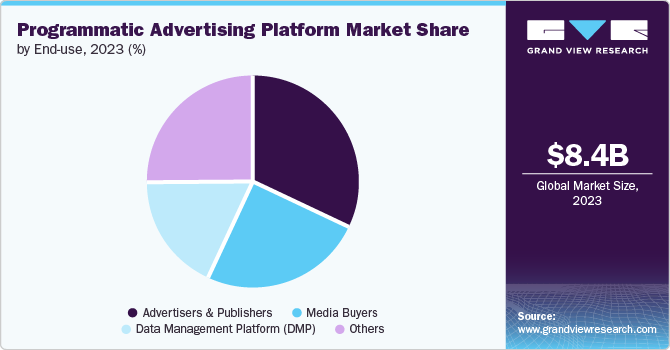

End-use Insights

Advertisers and publishers accounted for the largest market revenue share in 2023. Advertisers and publishers are the key players in this market, and both are expected to contribute significantly to market growth. Programmatic advertising enables advertisers to target their audience more effectively and efficiently. It allows advertisers to buy ad space through automated platforms that use algorithms to determine the best ad placement based on data such as user behavior, demographics, and location.

Data management platforms (DMP) are expected to register the fastest CAGR from 2024 to 2030. The increasing demand for personalized and targeted advertising drives the growth of the DMP within the market. DMPs allow advertisers to access a wealth of data, including user behavior, demographics, and location, which can then be used to inform ad targeting and optimization. By using DMPs, advertisers can deliver more relevant and personalized ads to their target audience, resulting in higher engagement rates and better ROI. Advertisers and publishers need to stay updated with the latest DMP technologies and best practices to remain competitive.

Regional Insights

North America held a significant revenue share of over 23% in 2023 and is expected to witness considerable growth over the coming years. Various major industrial verticals in the region are predominantly embracing digitalization, which is creating novel business opportunities and revenue potential, driving the demand for programmatic advertising. The increasing investment by advertisers in advertising technologies with enhanced capabilities and performance is stimulating the demand for programmatic advertising which enables precise targeting, real-time optimization, and efficient ad delivery.

U.S. Programmatic Advertising Platform Market Trends

The programmatic advertising platform market in the U.S. is expected to grow at a CAGR of nearly 26% from 2024 to 2030, owing to higher demand for enhanced advertising technologies that enable efficient ad delivery and enable precise targeting across various industries. The early adoption of digital technologies that offer lucrative prospects and new revenue streams for businesses is expected to drive market growth in the upcoming years.

Asia Pacific Programmatic Advertising Platform Market Trends

The programmatic advertising platform market in Asia Pacific accounted for the highest revenue share of 34% in 2023 owing to the rapidly growing region’s digital ecosystem of the region. Moreover, the increased internet penetration, smartphone adoption, and online connectivity provides positive growth prospects for the regional programmatic advertising platform market. The market expansion is being further driven by the innovations in ad tech, data analytics, and machine learning which enhances the efficiency and effectiveness of programmatic advertising.

The Japan programmatic advertising platform market is estimated to expand at the CAGR of nearly 22% from 2024 to 2030 with increasing advertising budgets of businesses toward digital platforms. Moreover, rising demand for programmatic advertising as it offers better return-on-investment, real-time optimization, and cost-effectiveness, is also favoring the market growth.

The programmatic advertising platform market in India is estimated to record a notable CAGR of 30% from 2024 to 2030 with rapid digital transformation in the country coupled with increased internet penetration and smartphone usage. Advertisers are leveraging this digital shift to reach their target audiences effectively, which offers significant growth opportunities for the market.

The China programmatic advertising platform market is accounted for the largest revenue share of more than 21% in 2023. This is attributed to the proliferation of e-commerce platforms, social media, and digital content in the country, which has created more opportunities for programmatic advertising.

Europe Programmatic Advertising Platform Market Trends

The programmatic advertising platform market in Europe is anticipated to grow at the considerable CAGR of 28% from 2024 to 2030 with growing emphasis of regional businesses on integrating programmatic advertising into digital marketing strategies. They are increasingly adopting programmatic advertising as it facilitates efficient ad spending and targeted campaigns. Moreover, factors like evolving media landscape and exposure to a plethora of content across various platforms are urging businesses to implement efficient and effective media planning, which offers significant opportunities for the regional programmatic advertising platform market.

The France programmatic advertising platform market accounted for a significant revenue share of 9% in 2023. This can be credited to the increasing allocation of budget by various brands and agencies for programmatic advertising due to its proven effectiveness. The availability of programmatic buying platforms and advanced advertising technologies enhances the market outlook further.

The programmatic advertising platform market in the UK. is estimated to grow at a CAGR of over 29% from 2024 to 2030, owing to increasing demand for these solutions due to various advantages. Programmatic advertising uses data to segment audiences with precision allowing advertisers to target users based on demographics, interests, online behavior, etc.

The Germany programmatic advertising platform market is estimated to grow at a CAGR of over 28% from 2024 to 2030. The growth is attributed to the ongoing digital transformation in the country, wherein advertisers are increasingly recognizing the effectiveness and efficiency of programmatic advertising.

Middle East & Africa (MEA) Programmatic Advertising Platform Market Trends

The programmatic advertising platform market in the Middle East & Africa (MEA) region is estimated to grow at a significant growth rate of over 28% from 2024 to 2030. The market growth is being driven by the increasing adoption of digital technology in the region. As more businesses shift their operations online, the demand for efficient and targeted advertising solutions rises. In addition, the surge in e-commerce platforms and online shopping is creating new growth avenues for the market.

Programmatic advertising market in Saudi Arabia accounted for a considerable revenue share of 31% in 2023 owing to shifting focus of advertisers from conventional media to digital platforms. Programmatic advertising aligns well with this transformation, offering efficiency and scalability. Moreover, advancements in data analytics and machine learning that empower advertisers to make data-driven decisions, are driving the demand for programmatic advertising, thereby expediting the regional market expansion further.

Key Programmatic Advertising Platform Company Insights

Some key players operating in the market include Google Inc., Adobe Systems Inc., and Xandr (Microsoft Advertising), among others.

-

Google Inc. has implemented several operating strategies to maintain its position in the market. Its key strategy is to constantly innovate and improve its technology to offer advertisers and publishers more effective and efficient solutions. Google also focuses on building strong partnerships with key players in the industry, such as agencies and publishers, to expand its reach and influence.

-

Xandr's key strategy is to provide a transparent and efficient platform where advertisers can easily access premium inventory and optimize their campaigns. The company specializes in offering a unified and integrated platform that enables advertisers to manage their campaigns across different channels, including mobile, video, and display.

The Trade Desk, Smart Ads, Rubicon Project Inc., and MediaMath Inc. are some emerging market participants in the market.

-

The Trade Desk has implemented several operating strategies to establish its position. The company's key strategy is to provide a self-service platform that enables advertisers to access premium inventory and manage their campaigns efficiently. The Trade Desk has a strong focus on offering a user-friendly platform with customizable reporting and analytics to help advertisers optimize their campaigns.

-

Rubicon Project Inc. has implemented several operating strategies to establish its position. The company's key strategy is to provide a flexible and transparent platform that enables buyers and sellers to transact seamlessly. Rubicon Project specializes in offering a header-bidding solution that allows publishers to maximize their ad revenues by offering their inventory to multiple demand sources simultaneously.

Key Programmatic Advertising Platform Companies:

The following are the leading companies in the programmatic advertising platform market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Inc.

- NextRoll, Inc.

- Amazon.com, Inc.

- Criteo S.A.

- DataXu Inc. (Roku)

- Google LLC

- MediaMath Inc.

- PubMatic

- Rocket Fuel Inc.

- Magnite Inc.

- Flutter Media Private Limited

- The Trade Desk, Inc.

- Xandr (Microsoft Advertising)

- Yahoo Inc.

Recent Developments

-

In November 2023, Roku announced a partnership with Unity to help mobile app businesses easily expand their app installation campaigns to TV streaming inventory. His partnership offers mobile app marketers the only seamless experience in executing TV streaming campaigns, combining Roku's premium inventory with Unity's user acquisition technology and expertise.

-

In November 2023, RocketFuel Inc. partnered with Ripple, which includes adopting Ripple Payments into its suite of payment products to meet the increasing demand for faster, more reliable, and less expensive FIAT payments to merchants and partners globally.

-

In July 2023, Criteo and Brandcrush combined announced a partnership with Phuzion Media to give retailers deeper levels of access to commerce data gathered from traditional offline media.

Programmatic Advertising Platform Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.81 billion

Revenue forecast in 2030

USD 41.44 billion

Growth rate

CAGR of 27.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform type, ad format, deployment model, pricing model, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East; Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Adobe Systems Inc.; Adroll.com; Amazon; Crieto; DataXu Inc. (Roku); Google Inc.; MediaMath Inc.; PubMatic; Rocket Fuel Inc.; Rubicon Project Inc.; SmartAds; The Trade Desk; Xandr (Microsoft Advertising); Yahoo Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Programmatic Advertising Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global programmatic advertising platform market report based on platform type, ad format, deployment model, pricing model, end-use, and region:

-

Platform Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Demand-Side Platform (DSP)

-

Supply-Side Platform (SSP)

-

Ad Exchange

-

-

Ad Format Outlook (Revenue, USD Million, 2018 - 2030)

-

Display Advertising

-

Video Advertising

-

Mobile Advertising

-

Native Advertising

-

-

Deployment Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

Pricing Model Outlook (Revenue, USD Million, 2018 - 2030)

-

CPM (Cost Per Mile)

-

CPC (Cost Per Click)

-

CPV (Cost Per View)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Advertisers & Publishers

-

Media Buyers

-

Data Management Platform (DMP)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global programmatic advertising platform market size was estimated at USD 8.43 billion in 2023 and is expected to reach USD 9.81 billion in 2024.

b. The global programmatic advertising platform market is expected to grow at a compound annual growth rate of 27.1% from 2024 to 2030 to reach USD 41.44 billion by 2030.

b. North America held a significant revenue share of around 23% in 2023 and is expected to witness considerable growth over the coming years. Various major industrial verticals in the region are predominantly embracing digitalization, which is creating novel business opportunities and revenue potential, driving the demand for programmatic advertising.

b. Some key players operating in the programmatic advertising platform market include Google Inc., Adobe Systems Inc., and Xandr (Microsoft Advertising), The Trade Desk, Smart Ads, Rubicon Project Inc., MediaMath Inc, and among others

b. The adoption of big data, advanced analytics, and ad tech innovations has enabled the programmatic ecosystem to grow. By using data and algorithms, programmatic platforms can optimize and automate digital ad buying at an unprecedented scale.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.