- Home

- »

- Automotive & Transportation

- »

-

Project Logistics Market Size & Share, Industry Report, 2033GVR Report cover

![Project Logistics Market Size, Share & Trends Report]()

Project Logistics Market (2025 - 2033) Size, Share & Trends Analysis Report By Service, By Transportation Mode (Road, Rail, Air, Sea, Multimodal), By End-use Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-711-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Project Logistics Market Summary

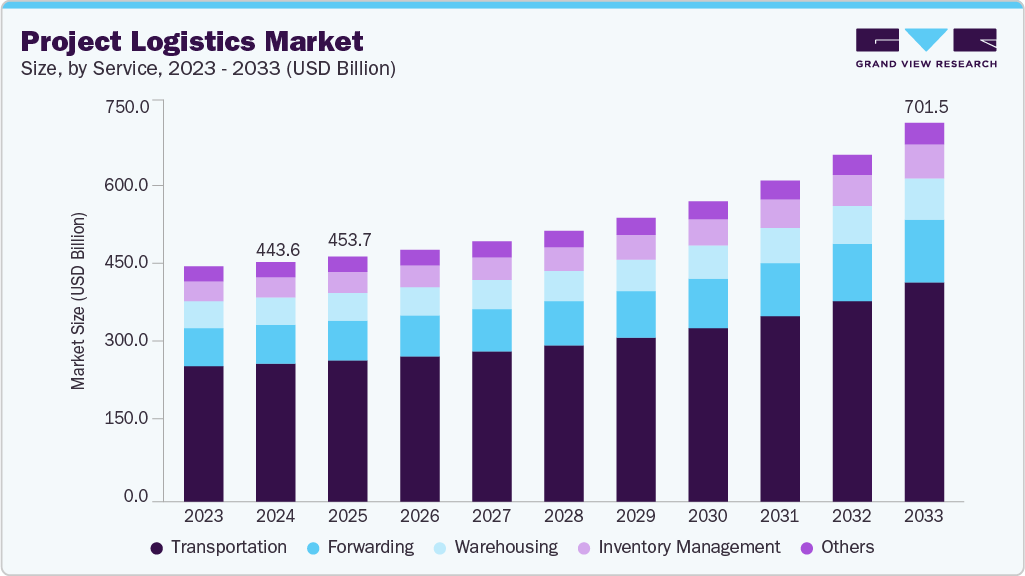

The global project logistics market size was estimated at USD 443.60 billion in 2024, and is projected to reach USD 701.51 billion by 2033, growing at a CAGR of 5.6% from 2025 to 2033.The project logistics industry is driven by the rapid expansion of large-scale infrastructure, energy, mining, and industrial development projects across the globe.

Key Market Trends & Insights

- Asia Pacific dominated the project logistics market with the largest revenue share of 38.6% in 2024.

- The project logistics industry in the China held a dominant position in 2024.

- By service, the transportation segment led the market with the largest revenue share of 57.6% in 2024.

- By transportation mode, the road segment accounted for the largest market revenue share in 2024.

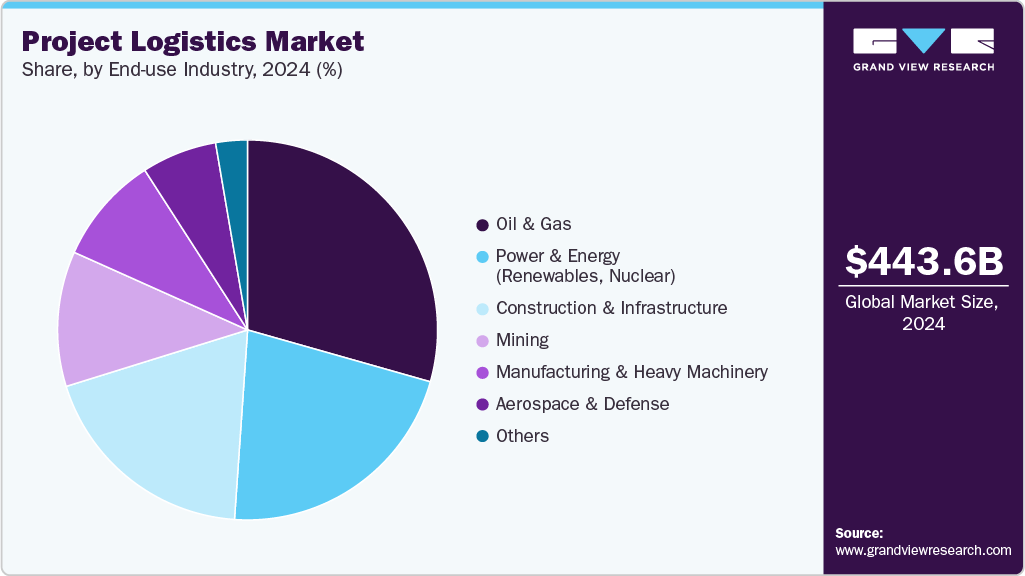

- By end use industry, the oil & gas segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 443.60 Billion

- 2033 Projected Market Size: USD 701.51 Billion

- CAGR (2025-2033): 5.6%

- Asia Pacific: Largest market in 2024

As governments and private entities continue to invest in complex undertakings such as renewable energy farms, oil and gas pipelines, and transportation networks, the demand for specialized logistics solutions that can handle heavy, oversized, or time-sensitive cargo has increased significantly.Technological trends are reshaping the project logistics landscape, with digitalization and automation playing a central role. Advanced tracking systems using GPS and IoT sensors now allow real-time visibility of shipments, enhancing security and coordination across various transportation legs. Artificial intelligence and predictive analytics are being increasingly used to optimize route planning and minimize disruptions, while blockchain technology is beginning to be adopted for secure and transparent documentation, especially in customs and cross-border transactions. In addition, the use of drones and digital twins is improving project planning, risk assessment, and monitoring of cargo movements in difficult terrains or remote locations.

Investments in the project logistics industry are growing, with logistics firms expanding their capabilities through mergers, acquisitions, and infrastructure development. Key players are investing in specialized equipment such as heavy-lift cranes, modular transporters, and customized storage solutions to serve large-scale projects better. In parallel, governments and port authorities are funding improvements in transportation infrastructure, like ports, railways, and roadways, to support the seamless movement of oversized project cargo. Emerging markets, particularly in Asia-Pacific and the Middle East, are witnessing a surge in investments due to ongoing mega infrastructure and energy projects.

The regulatory landscape in the project logistics industry is complex and varies significantly across regions. Compliance with international safety standards, environmental regulations, and customs procedures is essential for smooth operations. Regulatory frameworks often require specialized permits and coordination with multiple government agencies for the transport of abnormal loads or hazardous materials. Furthermore, sustainability-related regulations are influencing logistics providers to reduce emissions and adopt greener practices, especially within the European Union and North America. The push for harmonized trade procedures under initiatives like the WTO Trade Facilitation Agreement is also gradually streamlining project logistics in developing countries.

Despite its growth, the project logistics industry faces several restraints. High capital expenditure and operational costs, especially in handling and transporting heavy or oversized cargo, pose financial challenges for smaller firms. Infrastructure bottlenecks in emerging markets, such as poor road conditions, underdeveloped ports, and limited warehousing facilities, can lead to delays and cost overruns. In addition, geopolitical instability, trade tensions, and fluctuating fuel prices can disrupt supply chains and impact project timelines. The shortage of skilled personnel and the complexity involved in managing multimodal transport further add to the operational difficulties in this sector.

Service Insights

The transportation segment led the market with the largest revenue share of 57.6% in 2024. The transition to renewable energy and clean technologies is contributing to the growth of transportation services in project logistics. Projects such as offshore wind farms, solar power plants, and hydroelectric installations require the movement of massive turbines, solar panels, and construction modules to often remote or offshore locations. These projects typically operate under tight construction timelines and depend on the precision and reliability of logistics providers to keep everything on schedule. As more countries commit to carbon reduction goals and green energy initiatives, the demand for specialized transportation services within project logistics is expected to grow significantly.

The inventory management segment is expected to grow at the fastest CAGR during the forecast period. The increasing complexity and scale of modern infrastructure and industrial projects fuel the growth of the segment. Large-scale ventures, such as oil and gas installations, renewable energy farms, and mining operations, involve thousands of components sourced from multiple countries and delivered over extended timelines. Coordinating the arrival and storage of these materials at different project phases is critical to avoiding costly delays. Inventory management services ensure that each part, component, and piece of equipment is properly tracked, stored, and delivered in sync with the project schedule, thus improving overall project efficiency.

Transportation Mode Insights

The road segment led the market with the largest revenue share of 36.5% in 2024. Last-mile connectivity and route flexibility drive the growth of the segment. While sea, air, or rail can handle long-distance bulk movements, road transport is essential for reaching project sites, especially in remote, underdeveloped, or geographically challenging regions. Roadways enable direct delivery of cargo to project locations without requiring transshipment, reducing handling risks and delays. In complex projects such as wind farms, mining operations, or power plants, road transport provides the versatility needed to navigate variable terrains and deliver oversized components directly to the construction zone.

The multimodal segment is expected to grow at the fastest CAGR during the forecast period. Cost and time efficiency are driving the adoption of multimodal transportation in project logistics. By using a combination of transport modes, logistics providers can reduce overall freight costs and optimize routes. For instance, rail may offer significant cost savings over long distances compared to road, while sea freight can reduce expenses for intercontinental shipping. Meanwhile, road transport can handle last-mile delivery with greater flexibility. Multimodal strategies also help avoid congestion at specific transport hubs and mitigate delays caused by weather, infrastructure issues, or geopolitical risks.

End-use Industry Insights

The oil & gas segment accounted for the largest market revenue share in 2024. The remote and challenging location of oil & gas operations, especially offshore platforms, desert oilfields, or deepwater rigs, drives the adoption of project logistics in the oil & gas industry. These projects often take place in areas with limited or underdeveloped infrastructure, requiring customized logistics solutions including multimodal transportation, route surveys, permitting, and last-mile delivery using specialized vehicles or even helicopters and barges. Project logistics providers bring expertise in navigating such terrain and environmental conditions, ensuring cargo reaches its final destination despite geographic and infrastructure hurdles.

The power & energy segment is projected to grow at the fastest CAGR of 6.4% over the forecast period. The global transition toward renewable energy sources is accelerating the demand for project logistics. Wind, solar, and hydroelectric projects involve large volumes of specialized components, such as wind turbine blades, photovoltaic panels, and hydro turbines, that are often sourced from multiple countries and must be delivered to remote or offshore sites. Project logistics services ensure that these components arrive on time and in optimal condition, aligning with the tight construction timelines typical of renewable energy installations. As governments continue to invest in clean energy to meet climate goals, the need for reliable logistics support becomes even more important.

Regional Insights

The project logistics market in North America held a significant share in 2024. The North American market is characterized by mature infrastructure, a high level of industrial activity, and a robust energy sector. Investments in renewable energy, oil and gas, large-scale construction, and public infrastructure projects primarily drive demand. The presence of established multimodal transport networks and advanced logistics technologies enables the efficient movement of oversized and high-value project cargo.

U.S. Project Logistics Market Trends

The project logistics market in the U.S. held a dominant position in North America in 2024, due to the resurgence in infrastructure spending under federal initiatives such as the Infrastructure Investment and Jobs Act. Key sectors contributing to demand include offshore wind, LNG terminals, power transmission, and transportation infrastructure. The need to move heavy and specialized equipment across vast distances, from ports to inland project sites, is driving the adoption of integrated multimodal logistics solutions.

Asia Pacific Project Logistics Market Trends

Asia Pacific dominated the project logistics market with the largest revenue share of 38.6% in 2024. The Asia Pacific market is experiencing rapid growth due to extensive infrastructure development and industrialization across emerging economies. Large-scale investments in transport corridors, energy projects, and urban development are creating strong demand for integrated logistics services.

The project logistics market in India is expected to grow at a rapid CAGR during the forecast period, fueled by government-backed infrastructure programs such as Gati Shakti, Bharatmala, and renewable energy targets. Large-scale solar parks, wind farms, industrial corridors, and smart city projects are contributing to increased logistics activity.

The China project logistics market held a substantial market share in 2024. The market is driven by massive state-led infrastructure projects, energy installations, and the Belt and Road Initiative (BRI). The country’s dominance in renewable energy manufacturing and large-scale power transmission projects supports continuous logistics demand.

Europe Project Logistics Market Trends

The project logistics market in Europe was identified as a lucrative region in 2024. Europe's market is being shaped by the continent's aggressive push toward decarbonization and energy transition. Investments in offshore wind farms, nuclear decommissioning, cross-border rail and transport infrastructure, and green hydrogen projects are generating steady demand for complex logistics operations.

The UK project logistics market is expected to grow at a substantial CAGR during the forecast period, amid large-scale infrastructure projects such as HS2, offshore wind development, and port upgrades. The country's ambitious renewable energy targets and investments in grid reinforcement fuel the growth of the market.

The project logistics market in Germany held a substantial market share in 2024. Germany's market is underpinned by its strong industrial base, particularly in manufacturing, energy, and engineering. The ongoing energy transition (Energiewende) is fueling demand for logistics services supporting wind, solar, and hydrogen infrastructure development.

Key Project Logistics Company Insights

Some of the key companies in the project logistics industry include A.P. Moller - Maersk, CEVA Logistics, Express Global Logistics, Deutsche Post AG, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

A.P. Moller - Maersk is an integrated container logistics company based in Copenhagen, Denmark, operating in over 130 countries. Maersk offers a comprehensive range of services, including maritime freight transport, port operations, supply chain management, warehousing, ocean and inland haulage, freight forwarding, and digital logistics solutions. In the context of project logistics, Maersk provides specialized and tailored services to handle complex, large-scale, and heavy cargo movements critical for industries such as energy, infrastructure, and manufacturing.

-

CEVA Logistics is a logistics and supply chain management company with a presence in over 170 countries. CEVA specializes in delivering comprehensive, end-to-end logistics solutions across industries, including consumer & retail, automotive, industrial, energy, aerospace, and more. In the realm of project logistics, CEVA excels at managing large-scale, complex, and high-value projects requiring tailored transport, engineering, and supply chain solutions.

Key Project Logistics Companies:

The following are the leading companies in the project logistics market. These companies collectively hold the largest market share and dictate industry trends.

- A.P. Moller - Maersk

- CEVA Logistics

- Express Global Logistics

- Deutsche Post AG

- GEODIS

- Kuehne+Nagel

- C.H. Robinson Worldwide, Inc.

- Röhlig Logistics GmbH & Co. KG.

- Transworld Group

- EMO Trans

Recent Developments

-

In August 2025, HPL One expanded its operations in Dubai, UAE, offering integrated, end-to-end solutions tailored to complex and critical cargo movements. The company operates with a lean organizational structure, enabling agile decision-making and execution across strategic markets in Europe, the Middle East, the CIS region, and Asia. HPL One’s services cover project forwarding, marine chartering, transport engineering, route surveys, multimodal transport, risk analysis, and onsite coordination.

Project Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 453.76 billion

Revenue forecast in 2033

USD 701.51 billion

Growth rate

CAGR of 5.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report mode

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

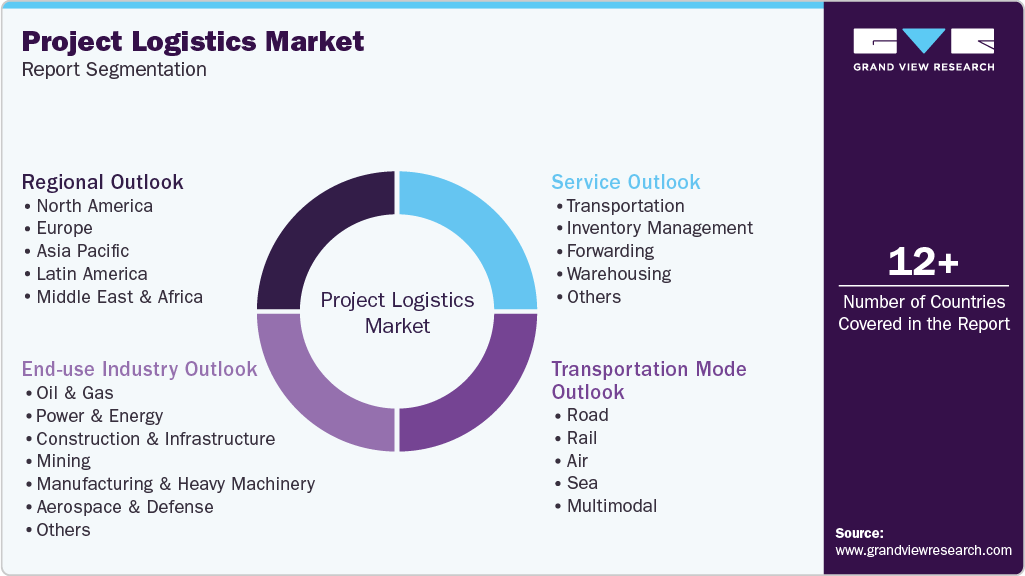

Service, transportation mode, end-use industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

A.P. Moller - Maersk; CEVA Logistics; Express Global Logistics; Deutsche Post AG; GEODIS; Kuehne+Nagel; C.H. Robinson Worldwide, Inc.; Röhlig Logistics GmbH & Co. KG.; Transworld Group; EMO Trans

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Project Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global project logistics market report based on service, transportation mode, end-use industry, and region:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Transportation

-

Inventory Management

-

Forwarding

-

Warehousing

-

Others

-

-

Transportation Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Road

-

Rail

-

Air

-

Sea

-

Multimodal

-

-

End-use Industry Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil & Gas

-

Power & Energy

-

Construction & Infrastructure

-

Mining

-

Manufacturing & Heavy Machinery

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global project logistics market size was estimated at USD 443.60 billion in 2024 and is expected to reach USD 453.76 billion in 2025.

b. The global project logistics market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2033 to reach USD 701.51 billion by 2033.

b. Asia Pacific dominated the project logistics market with a share of 38.6% in 2024. The Asia Pacific project logistics market is experiencing rapid growth due to extensive infrastructure development and industrialization across emerging economies.

b. Some key players operating in the project logistics market include A.P. Moller – Maersk; CEVA Logistics; Express Global Logistics; Deutsche Post AG; GEODIS; Kuehne+Nagel; C.H. Robinson Worldwide, Inc.; Röhlig Logistics GmbH & Co. KG.; Transworld Group; EMO Trans.

b. The project logistics market is driven by the rapid expansion of large-scale infrastructure, energy, mining, and industrial development projects across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.