- Home

- »

- Medical Devices

- »

-

Prosthetic Heart Valve Market Size, Industry Report, 2033GVR Report cover

![Prosthetic Heart Valve Market Size, Share & Trends Report]()

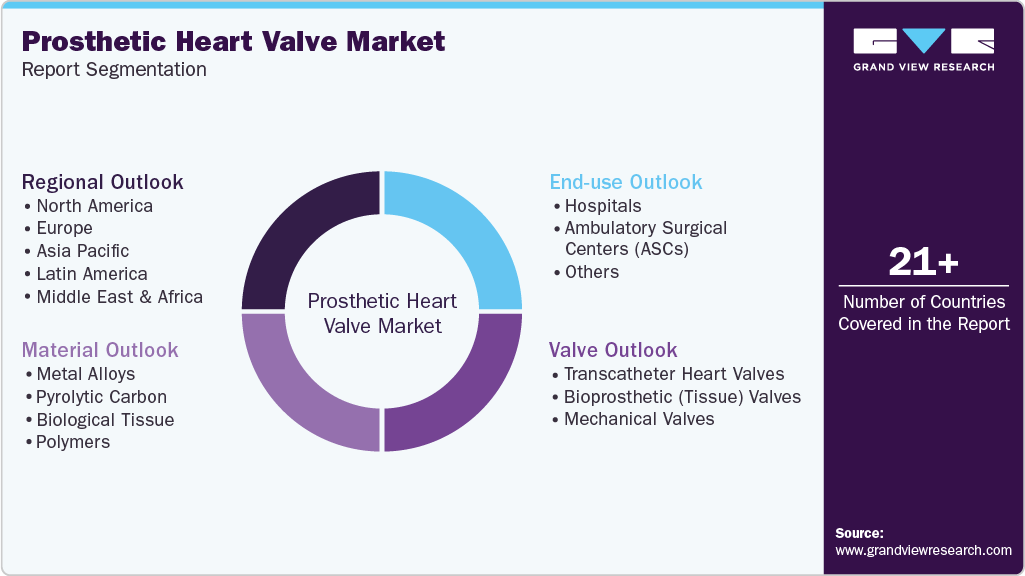

Prosthetic Heart Valve Market (2025 - 2033) Size, Share & Trends Analysis Report By Valve (Transcatheter Heart Valves, Bioprosthetic (Tissue) Valves, Mechanical Valves), By Material (Biological Tissue, Pyrolytic Carbon), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-701-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Prosthetic Heart Valve Market Summary

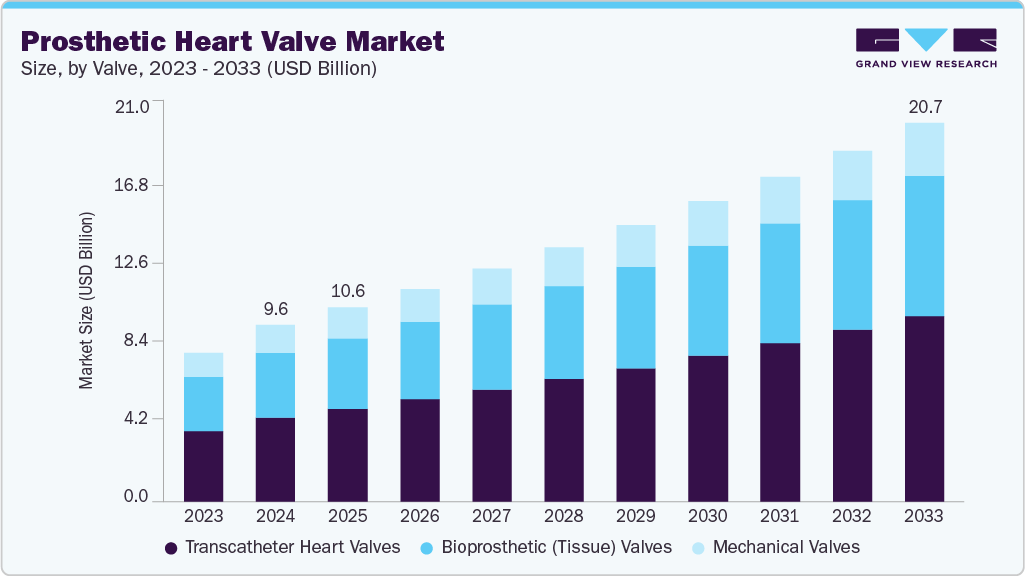

The global prosthetic heart valve market size was estimated at USD 9.64 billion in 2024 and is projected to reach USD 20.69 billion by 2033, growing at a CAGR of 8.7% from 2025 to 2033. Rising valvular heart diseases drive the growth of the market.

Key Market Trends & Insights

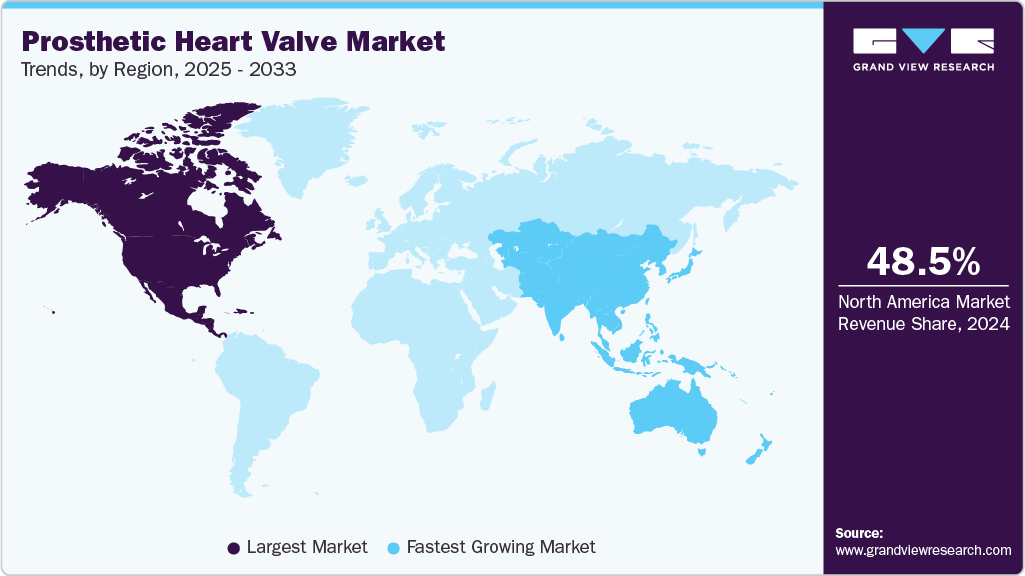

- The North America prosthetic heart valve industry dominated the global market in 2024, accounting for the largest revenue share of 48.5%.

- The U.S. prosthetic heart valve industry is anticipated to register the fastest CAGR during the forecast period.

- By valve, the transcatheter heart valves segment held the largest revenue share in 2024.

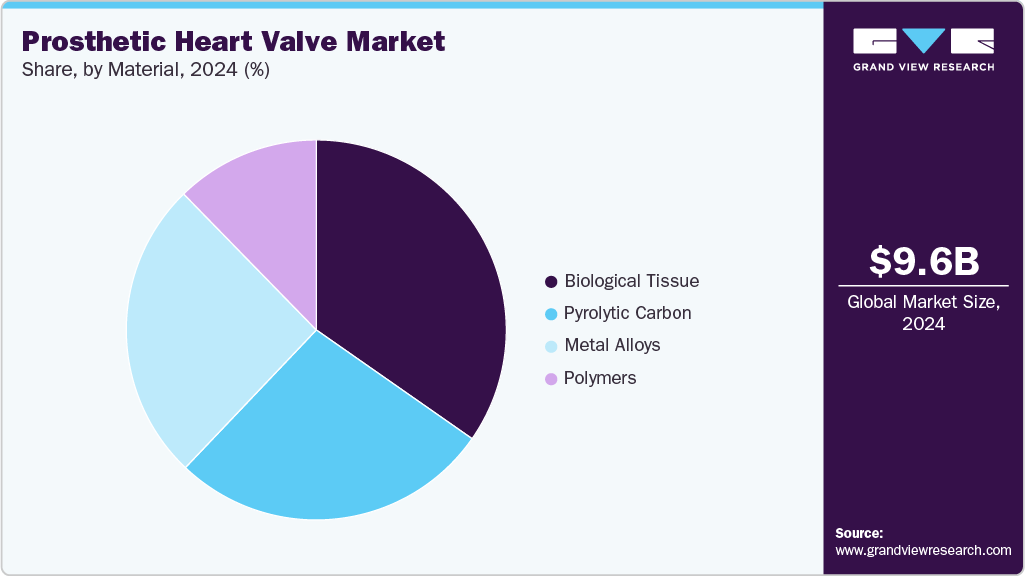

- By material, the biological tissue segment held the largest revenue share in 2024.

- By end use, the hospitals segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.64 Billion

- 2033 Projected Market Size: USD 20.69 Billion

- CAGR (2025-2033): 8.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to an NCBI article published in December 2024, recent estimates indicate that approximately 54.8 million people are affected by rheumatic heart disease (RHD), with a confidence range between 43.3 and 67.6 million. In addition, non-rheumatic calcific aortic valve disease (CAVD) impacts around 13.3 million individuals, while non-rheumatic degenerative mitral valve disease (DMVD) accounts for approximately 15.5 million cases globally. These conditions are among the leading causes of structural valve deterioration, often necessitating surgical or transcatheter valve replacement. Moreover, the high and growing prevalence of both rheumatic and degenerative valve disorders across diverse age groups and regions is a key factor propelling the expansion of the market.

The rising incidence of heart valve disorders, particularly among the elderly, is a key driver for the growing adoption of prosthetic heart valve procedures, including both surgical and transcatheter approaches. Degenerative conditions such as aortic stenosis and mitral regurgitation are becoming increasingly prevalent, prompting the need for effective interventions like prosthetic valve implants. According to the CDC article published in 2024, three in four adults in the U.S. have limited awareness of heart valve disease, with particularly low recognition among those aged 65 and older, ironically, the group most at risk. Annually, more than 5 million Americans are diagnosed with heart valve disease, and the condition is responsible for over 25,000 deaths each year. These figures underscore a pressing need for improved education, early diagnosis, and expanded access to prosthetic heart valve therapies.

Heart Valve Replacement Procedures in the U.S. (2023)

Procedure Type

Total Procedures

Average Procedures Per Site

TAVR (Transcatheter Aortic Valve Replacement)

100,501

120

SAVR (Surgical Aortic Valve Replacement)

18,792

~18

Source: Cleveland Clinic & GVR

Government funding and awareness campaigns fuel growth in the prosthetic heart valve industry. According to the American Heart Association, Inc., an article published in October 2024, the CDC awarded USD 8.4 million in grants to the American Heart Association to launch national campaigns focused on heart valve disease education. These initiatives will include educational outreach targeting patients, healthcare providers, and women, an underserved high-risk group. The program stems from the bipartisan CAROL Act, signed into law in December 2022, to prioritize HVD research and awareness.

There is an increasing demand for minimally invasive surgeries, including transcatheter valve replacement (TAVR), due to their shorter recovery times, reduced complication risks, and lower overall healthcare costs than traditional open-heart surgery. This shift towards non-invasive procedures is a critical factor propelling the market. In April 2024, Abbott announced FDA approval for its TriClip system, a transcatheter edge-to-edge repair technology for treating tricuspid regurgitation (TR). This first-of-its-kind device allows for less invasive treatment, improving patient outcomes without needing high-risk open-heart surgery. Clinical trials showed significant improvements in TR severity and quality of life for patients treated with TriClip.

Technological advancements in Transcatheter Heart Valves (THV) design, such as enhanced valve durability, ease of implantation, and better patient outcomes, are key drivers driving market growth. Advancements in imaging techniques and valve delivery systems also significantly improve procedural success and expand the patient pool eligible for THV procedures. In August 2024, Boston Scientific announced that its ACURATE Prime Aortic Valve System received CE mark approval. This state-of-the-art transcatheter aortic valve replacement system features a new valve size to serve patients with larger anatomies. It is indicated for individuals at low, intermediate, and high risk experiencing severe aortic stenosis. The system incorporates a self-expanding design and a refined deployment mechanism, enhancing valve positioning accuracy to improve overall patient outcomes.

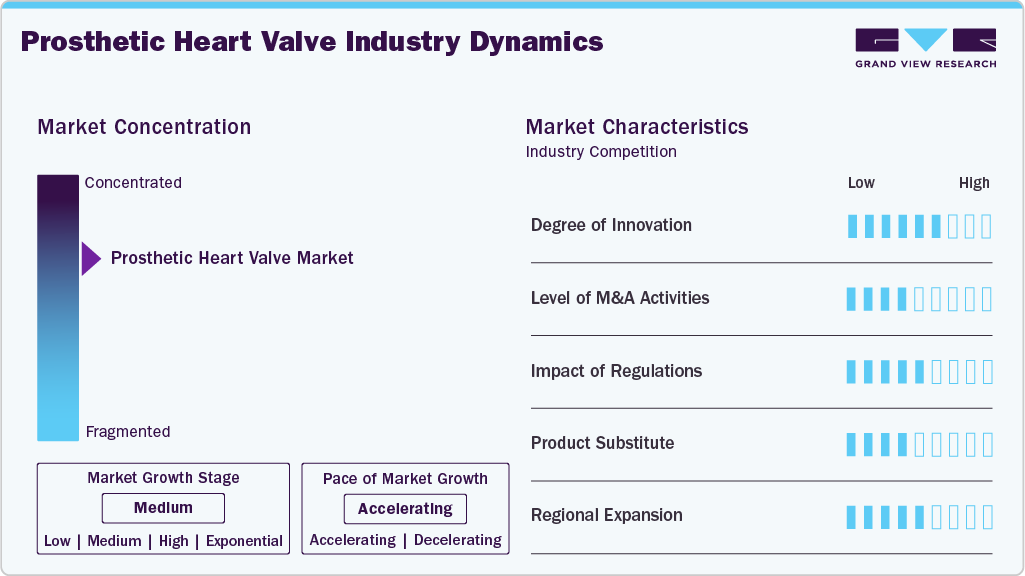

Market Concentration & Characteristics

The global prosthetic heart valve industry demonstrates a strong focus on innovation, particularly with integrating digital and AI-driven technologies. For instance, in November 2024, Abbott initiated first-in-patient procedures using its investigational transcatheter aortic valve implantation (TAVI) balloon-expandable system for treating symptomatic severe aortic stenosis. This next-generation system is designed to lay the groundwork for AI-assisted, software-guided procedures. Once clinical validation and regulatory approvals are achieved, it will complement Abbott’s existing Navitor TAVI system, further expanding the company’s portfolio and enhancing procedural precision and personalization.

Key players in the prosthetic heart valve industry, including Edwards Lifesciences, Medtronic, and Abbott, actively engage in mergers and acquisitions to enrich their structural heart portfolios, support innovation, and gain geographical access. For instance, In September 2024, Edwards Lifesciences announced acquisitions of JenaValve Technology and Endotronix a combined investment of approximately USD 1.2 billion to significantly enhance its transcatheter valve and monitoring capabilities as part of its structural heart expansion strategy.

Regulatory frameworks play a key role in the prosthetic heart valve industry, ensuring patient safety and clinical efficacy. Agencies such as the U.S. FDA, European Medicines Agency (EMA), and Japan’s PMDA enforce stringent clinical trial requirements and post-market surveillance. While these rigorous standards increase time-to-market and development costs, they also maintain high quality benchmarks across devices. Recent shifts toward expedited pathways, such as the FDA’s Breakthrough Devices Program, allow faster approval for innovative heart valves, especially transcatheter options without compromising safety.

Currently, no true direct substitutes for prosthetic heart valves exist. While pharmacological therapies (e.g., anticoagulants or beta-blockers) can temporarily manage symptoms associated with valvular heart disease, they do not address the underlying mechanical dysfunction of the valve. Minimally, invasive surgical techniques and valve repair methods may be used in early stages, but they are not viable for severe stenosis or regurgitation.

Key manufacturers in the prosthetic heart valve industry, such as Edwards Lifesciences, Medtronic, and Abbott, are actively expanding their geographic footprint by targeting emerging economies with rising cardiovascular disease burdens. These companies are leveraging partnerships with regional distributors, setting up local manufacturing and training centers, and tailoring product offerings to suit regulatory and clinical preferences in Asia-Pacific, Latin America, and the Middle East.

Valve Insights

By valve, the transcatheter heart valves segment dominated the market with the largest revenue share of 47.5% in 2024. Increasing valvular heart diseases, government initiatives, and advancements in tricuspid valve interventions and neochord systems will likely increase usage rates during the forecast period. In May 2024, MicroPort CardioFlow’s VitaFlow Liberty Transcatheter Aortic Valve received CE certification, making it the first TAVI device developed in China to gain approval for use in the European Union. This second-generation valve offers improved safety and functional enhancements, addressing the needs of over 47 million individuals globally affected by aortic valve disorders. The device has already been adopted by nearly 700 medical institutions across multiple countries, helping to meet the increasing global demand for transcatheter aortic valve implantation procedures.

The bioprosthetic (Tissue) valves segment is anticipated to grow at a significant CAGR over the forecast period. Rising valvular heart diseases, increasing geriatric population, and technological advancements drive the market growth. These valves, which are often constructed from bovine or porcine tissue, are increasingly preferred in older and intermediate-risk populations because they eliminate the need for lifelong anticoagulation and are associated with a lower risk of thrombotic complications than mechanical valves. For instance, in May 2024, Edwards Lifesciences introduced the SAPIEN 3 Ultra RESILIA valve in Europe. This next-gen transcatheter tissue valve incorporates RESILIA tissue, a proprietary anti-calcification platform designed to extend durability and reduce structural valve deterioration (SVD). Clinical results from the COMMENCE trial demonstrated 99.3% freedom from SVD over a mean follow-up of 7.7 years, alongside stable hemodynamics and a 97.2% rate of freedom from reoperation.

End-use Insights

The hospital segment dominated the market with the largest revenue share of 42.1% in 2024. Hospitals are the predominant setting for heart valve replacement procedures, including surgical and transcatheter approaches. They offer access to advanced infrastructure, multi-disciplinary cardiac teams, and post-operative care capabilities. In January 2025, GE HealthCare signed a USD 249 million AI imaging agreement with a 31-hospital system in the U.S., underscoring hospitals’ increasing investment in advanced technologies that support cardiovascular diagnostics and surgical planning. Hospitals remain the primary setting for prosthetic heart valve procedures due to their comprehensive infrastructure, including catheterization labs, hybrid operating rooms, and access to 24/7 emergency care. These facilities are equipped to manage both transcatheter and open-heart valve replacement surgeries, particularly for high-risk or elderly patients requiring multidisciplinary evaluation and follow-up care.

The Ambulatory Surgical Centers (ASCs) segment is anticipated to grow significantly over the forecast period. Ambulatory Surgical Centers (ASCs) are emerging as essential contributors to delivering minimally invasive cardiac interventions, including select prosthetic heart valve procedures such as transcatheter aortic valve replacements (TAVR) for low-risk patients. According to a 2024 MedPAC report, approximately 6,100 ASCs provided care to nearly 3.3 million Medicare fee-for-service beneficiaries in 2022, with total ASC service spending reaching around USD 6.1 billion. This was accompanied by a 2.8% increase in procedures per beneficiary, signaling a broader industry shift toward outpatient care models that offer greater efficiency and lower costs. ASCs are increasingly equipped with advanced imaging and catheterization technologies, enabling safe and effective heart valve procedures in eligible patients outside traditional hospital settings. Their ability to streamline care pathways, reduce hospital readmission rates, and minimize overall healthcare expenditure positions them as a key end-use segment in the evolving prosthetic heart valve industry.

Material Insights

The biological tissue segment dominated the market with a revenue share of 34.7% in 2024. Biological tissue materials, commonly used in bioprosthetic heart valves, are derived from animal sources such as bovine (cow), porcine (pig) pericardium, or heart valves. Technological advancements drive the growth of the market. For instance, in January 2024, Medtronic received FDA approval for its Avalus Ultra surgical aortic valve in the United States. This next-generation bioprosthetic valve is built on the proven foundation of the original Avalus valve platform and introduces several key enhancements. It features a polyetheretherketone (PEEK) base frame and a low-profile design. It offers improved hemodynamic performance, ease of implantation, and consistent valve circularity to facilitate better blood flow and long-term outcomes. Moreover, Avalus Ultra includes radiopaque markers for enhanced visibility during imaging and future valve-in-valve procedures and simplified sizing systems to assist surgical teams during implantation.

The pyrolytic carbon centers segment is expected to grow significantly over the forecast period. Pyrolytic carbon is a synthetic form known for its exceptional biocompatibility, durability, and thromboresistance, making it a widely used material in mechanical heart valves. Technologically advanced products offered by key players drive the growth of the market. For instance, Abbott's Regent Mechanical Heart Valve. This valve incorporates pyrolytic carbon leaflets and a carbon-coated orifice ring, allowing for smooth, reliable function and extended durability. The valve is designed for long-term performance, with many clinical studies showing a lifespan exceeding 20 years. Its bileaflet design ensures efficient hemodynamics and low pressure gradients, making it suitable for younger patients who require a lasting solution. Moreover, the On-X mechanical valve by Artivion, Inc. (formerly CryoLife) features pure pyrolytic carbon leaflets and sewing rings. The On-X valve is designed to reduce the risk of thromboembolism and has demonstrated favorable outcomes in reducing anticoagulation needs.

Regional Insights

North America prosthetic heart valve market dominated globally with a revenue share of 48.5% in 2024, driven by a well-established healthcare infrastructure, rising patient awareness, and substantial healthcare expenditure. The region consistently squeezes technological innovations, particularly in minimally invasive cardiac procedures. The U.S. remains at the forefront, driven by the presence of leading manufacturers, supportive reimbursement frameworks, and efficient healthcare delivery systems. For instance, in October 2024, the announcement of findings from Edwards Lifesciences' EARLY TAVR Trial assessed outcomes in patients with asymptomatic severe aortic stenosis. The study revealed that early transcatheter aortic valve replacement (TAVR) significantly reduced adverse events reported in 26.8% of treated patients compared to 45.3% under clinical monitoring, over a median follow-up period of 3.8 years. These results, presented at the TCT symposium and published in The New England Journal of Medicine, underscore the growing preference for early intervention and the continued clinical validation of TAVR technologies across the region.

U.S. Prosthetic Heart Valve Market Trends

The U.S. prosthetic heart valve industry dominated the North America region in 2024. Technologically advanced products launched by key manufacturers drive the market's growth. For instance, in May 2024, 4C Medical Technologies, Inc., was granted Breakthrough Device designation by the U.S. Food and Drug Administration (FDA) for its AltaValve System, a transcatheter mitral valve replacement (TMVR) device. This designation expedites the development and review process, giving patients earlier access to innovative technologies that address life-threatening or irreversibly debilitating conditions.

Europe Prosthetic Heart Valve Market Trends

Europe's prosthetic heart valve industry is expected to grow significantly over the forecast period. Rising heart valve cases and technological advancement drives the growth of the market. For instance, in October 2024, Medtronic obtained CE certification for its Evolut FX+ TAVR system. The design features wider coronary access windows-four times larger than previous versions facilitating future catheter-based interventions and enhancing long-term patient management.

The prosthetic heart valve industry in the UK is expected to grow significantly during the forecast period. Rising heart valve cases and technological advancements drive the market's growth. For instance, in December 2024, Abbott introduced the Navitor Vision valve in the UK and Ireland to support transcatheter aortic valve implantation (TAVI) procedures. This minimally invasive device is specifically intended for patients with severe aortic stenosis who are considered high risk for traditional surgical approaches. The valve offers improved visualization capabilities during placement, enabling greater precision throughout implantation.

France's prosthetic heart valve industry is expected to grow significantly during the forecast period, due to a high burden of heart valve diseases and active governmental efforts to support cardiovascular innovation. The country has embraced transcatheter heart valves (THVs), especially transcatheter aortic valve replacement (TAVR), owing to its favorable clinical outcomes and cost efficiency. France's robust healthcare infrastructure and universal health coverage ensure broad access to advanced medical technologies, enabling the widespread adoption of minimally invasive procedures like TAVR. This environment continues to support integrating next-generation prosthetic heart valve solutions nationwide.

Asia Pacific Prosthetic Heart Valve Market Trends

The Asia Pacific prosthetic heart valve industry is expected to register the fastest growth rate over the forecast period. Rising heart valve cases, increasing geriatric population, and technological advancement. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, the Asia Pacific region had around 697 million individuals aged 60 and above, accounting for nearly 60% of the global elderly population. This rapidly aging demographic is a key driver of demand in the market, as age-related heart valve diseases become more prevalent. The growing geriatric base, combined with increasing healthcare investments and expanding access to minimally invasive cardiac procedures, is accelerating the adoption of transcatheter and surgical heart valve replacements across the region.

China's prosthetic heart valve industry is expected to grow significantly over the forecast period. Increasing heart valve cases, rising healthcare expenditure, and technological advancement. For instance, in December 2024, MicroPort CardioFlow’s second-generation VitaFlow Liberty Transcatheter Aortic Valve and Retrievable Delivery System has secured marketing approval from South Korea’s Ministry of Food and Drug Safety (MFDS). This electric, retrievable TAVI platform stands out with its hybrid-density self-expanding frame, bovine pericardial leaflets, and dual-layer PET sealing skirt, engineered to deliver strong radial force, precise coaxial deployment, and reduced risk of paravalvular leakage.

Japan prosthetic heart valve industry is expected to register a significant growth rate over the forecast period. Increasing CVD cases, rising healthcare expenditure, and Strategic initiatives by the key player. For instance, in October 2023, Meril Life Sciences entered into an exclusive 10-year distribution agreement with Japan Lifeline to promote its Myval Octacor transcatheter heart valve in Japan, contingent upon regulatory approval from the Pharmaceuticals and Medical Devices Agency (PMDA). This advanced balloon-expandable TAVR valve offers a vast size matrix to accommodate a broader patient base and utilizes a distinct octagonal cell frame to enhance placement accuracy during implantation.

India prosthetic heart valve industry is expected to register a significant growth rate over the forecast period. Increasing CVD cases, rising healthcare expenditure, and technological advancement. For instance, in October 2024, the Sree Chitra Tirunal Institute recently launched a Centre of Excellence focused on minimally invasive cardiovascular devices, including transcatheter aortic valve technologies. This initiative enhances treatment options and outcomes for high-risk cardiac patients. Additionally, the center supports India's ‘Make in India’ mission by fostering collaboration between researchers and the domestic medical device industry, aiming to drive innovation and self-reliance in advanced cardiovascular care.

Latin America Prosthetic Heart Valve Market Trends

The Latin America prosthetic heart valve industry is anticipated to witness considerable growth over the forecast period, fueled by rising heart valve cases and strategic initiatives by the key players. For instance, in November 2022, Venus Medtech successfully conducted the first-in-man implantations of its Venus PowerX transcatheter aortic valve in Argentina, marking the device's earliest clinical use outside China. During these procedures, physicians utilized Venus’s next-generation self-expanding dry‑tissue valve system, notable for its retrievable capability and polymer skirt, which was designed to minimize paravalvular leakage. These initial overseas cases underscore the growing appetite for advanced TAVR technologies in emerging healthcare markets, driven by rising cardiovascular disease rates and improving medical infrastructure.

The Brazilian prosthetic heart valve industry is witnessing steady growth, driven by the country’s high prevalence of cardiovascular diseases, especially among its aging population. With a growing shift toward minimally invasive procedures such as transcatheter aortic valve replacement (TAVR), Brazil’s healthcare system is gradually embracing advanced heart valve technologies. Although challenges persist-such as regional disparities in healthcare access and the high costs associated with prosthetic valve treatments-adoption is accelerating, particularly in major urban areas. Support from both government initiatives and the expanding private healthcare sector is further contributing to the increased uptake of prosthetic heart valves across the country.

Middle East and Africa Prosthetic Heart Valve Market Trends

The Middle East and Africa prosthetic heart valve industry is anticipated to witness considerable growth over the forecast period, fueled by rising heart valve cases, technological advancements, and government funding and initiatives. For instance, In October 2024, Cleveland Clinic Abu Dhabi's Heart, Vascular & Thoracic Institute achieved a significant milestone in October 2024 by completing 500 Transcatheter Aortic Valve Implantation (TAVI) procedures-an accomplishment that began with the UAE's first TAVI in 2015 a designated Center of Excellence for Adult Cardiac Surgery, the institute has played a pivotal role in transforming the treatment landscape of aortic stenosis in the UAE, offering a minimally invasive alternative to open-heart surgery that is especially beneficial for high-risk patients. This achievement underlines the growing importance of high-volume centers in advancing prosthetic valve adoption in emerging regions. It highlights the global expansion of TAVR as a leading therapeutic option in structural heart disease care.

The prosthetic heart valve industry in Saudi Arabia is anticipated to grow considerably during the forecast period. Strategic initiatives by the key player, for instance, in January 2024, MicroPort CardioFlow Medtech Corporation advanced its global presence by securing marketing authorization for the VitaFlow Liberty TAVI system from the Saudi Food and Drug Authority (SFDA). This milestone supports the company's broader expansion into the Middle East and underscores growing regional demand for minimally invasive structural heart solutions.

Key Prosthetic Heart Valve Company Insights

Key prosthetic heart valve industry participants focus on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and business footprints.

Key Prosthetic Heart Valve Companies:

The following are the leading companies in the prosthetic heart valve market. These companies collectively hold the largest market share and dictate industry trends.

- Edwards Lifesciences

- Medtronic plc

- Abbott Laboratories

- Boston Scientific Corp.

- CryoLife, Inc. (now Artivion)

- MicroPort Scientific Corp.

- Lepu Medical Technology(Beijing) Co., Ltd.

- Venus Medtech (Hangzhou) Inc.

- Foldax, Inc.

- Meril Life Sciences

- TTK Healthcare Limited

Recent Developments

-

In May 2025, Abbott’s Tendyne transcatheter mitral valve replacement system received FDA approval to treat patients with severe mitral annular calcification (MAC) who are high-risk surgical candidates.

-

In March 2025, Corcym obtained FDA clearance for its Lancelot valve, a collapsible bovine pericardium device combined with a nitinol frame, enabling simplified minimally invasive implant procedures.

-

In March 2024, Medtronic announced that its Evolut FX+ transcatheter aortic valve replacement (TAVR) system had received approval from the U.S. Food and Drug Administration (FDA) to treat symptomatic severe aortic stenosis. The next-generation system includes a refined, diamond-shaped frame design, aimed at improving coronary access while continuing to deliver the reliable valve performance associated with the Evolut series.

Prosthetic Heart Valve Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.60 billion

Revenue forecast in 2033

USD 20.69 billion

Growth rate

CAGR of 8.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Valve, material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Edwards Lifesciences; Medtronic plc; Abbott Laboratories; Boston Scientific Corp.; CryoLife, Inc. (now Artivion); MicroPort Scientific Corp.; Lepu Medical Technology (Beijing) Co., Ltd.; Venus Medtech (Hangzhou) Inc.; Foldax, Inc.; Meril Life Sciences; TTK Healthcare Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Prosthetic Heart Valve Market Report Segmentation

This report forecasts revenue growth and analyzes the latest trends in each sub-segments from 2021 to 2033 at the global, regional, and country levels. For this report, Grand View Research has segmented the global prosthetic heart valve market report based on valve, material, end-use, and region:

-

Valve Outlook (Revenue, USD Million, 2021 - 2033)

-

Transcatheter Heart Valves

-

Bioprosthetic (Tissue) Valves

-

Homograft’s

-

Heterografts

-

Stented

-

Stentless

-

-

Mechanical Valves

-

Tilting Disc Valves

-

Ball Cage Valves

-

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Metal Alloys

-

Pyrolytic Carbon

-

Biological Tissue

-

Polymers

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global prosthetic heart valve market size was estimated at USD 9.64 billion in 2024 and is expected to reach USD 10.60 billion in 2025.

b. The global prosthetic heart valve market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2033 to reach USD 20.69 billion by 2033.

b. North America dominated the prosthetic heart valve market with a revenue share of 48.5% in 2024, driven by a well-established healthcare infrastructure, rising patient awareness, and substantial healthcare expenditure.

b. Some of the keyplayer operating in the market include Edwards Lifesciences, Medtronic plc, Abbott Laboratories, Boston Scientific Corp., CryoLife, Inc. (now Artivion), MicroPort Scientific Corp., Lepu Medical Technology (Beijing) Co.,Ltd., Venus Medtech (Hangzhou) Inc. , Foldax, Inc. , Meril Life Sciences and TTK Healthcare Limited.

b. Key factors driving the prosthetic heart valve market growth include rising valvular heart diseases, government funding and awareness campaigns and technological advancements in heart valve.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.