- Home

- »

- Biotechnology

- »

-

Protein Engineering Market Size And Share Report, 2030GVR Report cover

![Protein Engineering Market Size, Share & Trends Report]()

Protein Engineering Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Reagents, Instruments), By Protein Type (Insulin, Vaccines), By End-use (CROs, Pharma & Biotech Companies), By Technology, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-456-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Engineering Market Summary

The global protein engineering market size was estimated at USD 2.60 billion in 2023 and is expected to grow at a CAGR of 16.24% from 2024 to 2030. The market growth can be attributed to a number of factors, including the increased focus of biotechnology and pharmaceutical businesses on research & development of protein-based therapies due to their advantages over non-protein drugs, including higher cost-effectiveness and better patient outcomes.

Key Market Trends & Insights

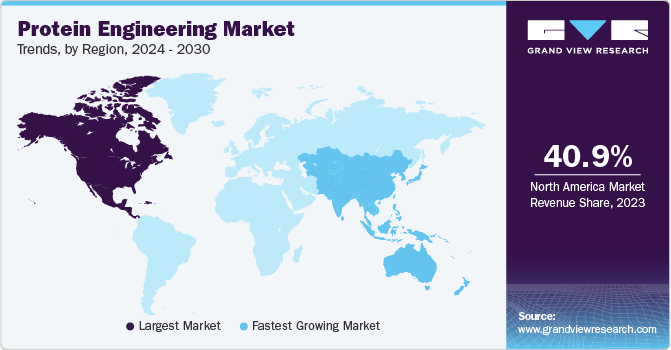

- North America dominated the global protein engineering market with the largest revenue share of 40.89% in 2023.

- The protein engineering market in the U.S. led the North America market and held the largest revenue share in 2023.

- By product, the instruments segment led the market, holding the largest revenue share of 51.76% in 2023.

- By technology, the hybrid approach segment is expected to grow at the fastest CAGR from 2024 to 2030.

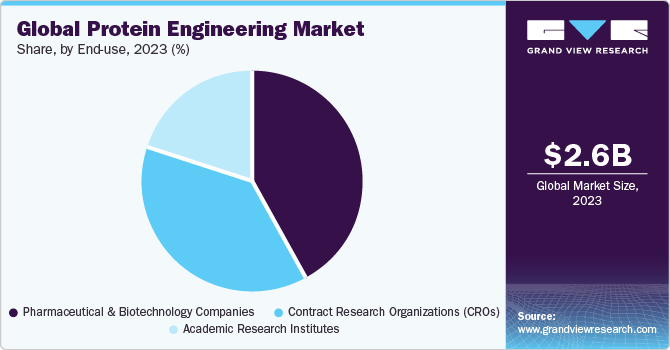

- By end use, the pharmaceutical & biotechnology companies segment held the dominant position in the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.60 Billion

- 2030 Projected Market Size: USD 7.62 Billion

- CAGR (2024-2030): 16.24%

- North America: Largest market in 2023

Similarly, an increase in demand for targeted therapies for the treatment of cancer and autoimmune diseases is driving the adoption of protein engineering. The COVID-19 pandemic has boosted the industry due to applications of protein engineering in the production of COVID-19 vaccines and diagnostics.

A bioluminescent diagnostic kit, for instance, was developed in July 2021 by scientists at the Eindhoven University of Technology in Germany. It can be utilized to determine whether an individual’s immune system is producing antibodies in reaction to the coronavirus. Similarly, it is anticipated that the industry will witness substantial growth during the forecast period due to the growth in the number of clinical trials involving protein-based treatments for COVID-19. Furthermore, protein engineering is frequently utilized to overcome drug-related defects and can enhance the affinities and effectiveness of molecules for a variety of purposes, such as cardiovascular repair.

The features mentioned above have resulted in a growing demand for the use of protein engineering instruments for the invention of cutting-edge treatments and have sped up market development. In addition, the growing number of government efforts aiming to improve protein engineering capabilities are predicted to offer significant growth potential for the market. As a result, there is an increase in research activities and programs, the number of funds allocated, and R&D spending in this domain. For instance, Nabla Bio announced the closure of a USD 11 million seed fundraising round in December 2021. With the help of this financing, a platform for AI-first design will be developed to enable the development of next-generation antibody therapeutics.

In addition, in January 2022, Generate Biomedicines & Amgen confirmed a research partnership contract to develop protein therapies for five clinical targets. The demand for protein engineering is further increased by the rising incidence of chronic & lifestyle disorders, including diabetes, cardiovascular conditions, and others. Other significant factors anticipated to contribute to the market's revenue growth include the increasing incidence of protein deficiency disorders, such as Protein-Energy Malnutrition (PEM), primarily in low-income countries globally. With the growth in private and public investments in synthetic biology and ongoing developments in engineering personalized therapies, the industry is expected to witness substantial growth in the near future.

Market Concentration & Characteristics

The degree of innovation in the protein engineering industry is significant, with new technologies and processes constantly being developed to improve efficiency and effectiveness. This has resulted in the production of high-quality products that meet consumers' diverse needs. Advances in research and development have led to the discovery of new applications for protein engineering, making it a valuable product for a wide range of industries.

Mergers and acquisition activities can have a significant impact on the growth of the protein engineering industry. Partnerships help companies to reduce costs and increase efficiency. In January 2024, Bruker Corporation announced an agreement for the acquisition of Chemspeed Technologies AG. Chemspeed Technologies AG specializes in providing automated laboratory R&D solutions. The company is focused on robotics solutions and modular automation that cater to the needs of pharma drug formulation & materials research for consumer applications. The acquisition is expected to aid Bruker's expansion into digitalization, lab automation, and scientific software solutions.

Regulations related to products used in proteomic research overlap with broader regulations in genomics, biotechnology, and medical research. Researchers are required to adhere to ethical guidelines and obtain informed consent when collecting & analyzing biological samples. Moreover, with the increasing use of high-throughput technologies and big data analysis in proteomics, there is a need to comply with data privacy & security regulations, particularly when dealing with human or sensitive data.

The protein engineering industry is experiencing growth due to the increasing demand for engineered enzymes in various industrial applications, including biofuel production, food processing, and bioremediation. Protein engineering allows for the optimization of enzyme properties such as catalytic activity, stability, and substrate specificity, enabling more efficient and sustainable industrial processes.

The protein engineering industry has witnessed significant regional expansion in recent years. This expansion can be attributed to several factors, including economic development, advancements in research infrastructure, regulatory frameworks, and evolving healthcare needs. For instance, in December 2023, Waters Corporation opened a new global capability center in Bengaluru, India. This center enables Waters to accelerate technology & software development, productivity digitization, and operational excellence in the life sciences field.

Product Insights

The instruments segment dominated the market in 2023 with the largest revenue share of 51.76% of the overall product revenue and is expected to grow at the fastest CAGR over the forecast period. Researchers are increasingly preferring automated technologies for promoting rapid molecular development processes, which is one of the important factors driving segment growth. Furthermore, rising demand for high-efficiency protein engineering tools, such as real-time PCR apparatus and chromatographic systems, is likely to boost the segment growth over the forecast period.

The reagents segment is anticipated to register a significant CAGR from 2024 to 2030 due to the rising utilization of reagents for a variety of applications, including the production of growth factors, vaccines, monoclonal antibodies, and other therapeutics. Furthermore, the use of reagents for research and development purposes in the production of novel vaccines for COVID-19 has fueled the opportunities for the launch of new products in this domain and is likely to drive market growth in the coming years.

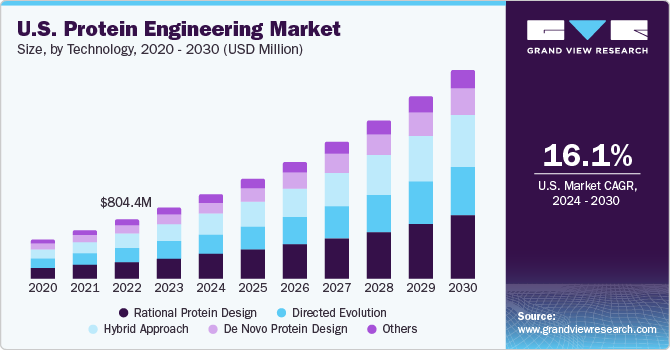

Technology Insights

The rational protein design segment led the industry with the largest revenue share of 30.03% in 2023. The dominant share is a result of the widespread usage of this technology in enzyme engineering and antibody development. The rapid expansion in commercial applications of enzyme engineering has resulted in the development of enhanced and modified enzymes that possess the desired catalytic properties. Techniques, such as site-directed mutagenesis, are frequently used in rational design engineering approaches, and the high market penetration of such techniques aids in driving segment growth.

The hybrid approach segment is anticipated to witness the fastest CAGR over the forecast period. This can be attributed to the frequent adoption of hybrid approaches, which use a combination of directed evolution and rational design for various applications, such as the enhancement of redox proteins and enzymes. These enzymes hold high importance in the engineering of nanodevices for bio-sensing and other major nanotechnology engineering applications, thus strengthening future growth prospects.

Protein Type Insights

The monoclonal antibodies segment held the largest revenue share of 23.86% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. One of the major factors contributing to the increased use of these technologies is the rising R&D spending in the development of therapeutically enhanced monoclonal antibodies. In addition, the increasing adoption of targeted monoclonal antibodies for the treatment of cancer and other chronic diseases is expected to boost the segment in the near future. Similarly, the growth potential is expected to further improve with the introduction of genetic platforms that use cutting-edge technology, such as next-generation sequencing for enabling efficient protein engineering for the development of monoclonal antibodies.

The insulin segment is expected to grow at a significant CAGR from 2024 to 2030 due to the increase in demand for insulin as a result of the growing diabetic population worldwide. In the U.S. alone, around 8.3 million people require insulin for the regulation of blood sugar levels. Moreover, established players in the segment, such as Eli Lilly, Novo Nordisk, and Sanofi, offer multiple types of insulin, which increases the scope of applications for the segment. These factors are expected to drive the growth of insulin protein engineering in the near future.

End-use Insights

The pharmaceutical & biotechnology companies segment captured the largest share of more than 42.16% in 2023. The large share is due to the growing use of in silico drug development models for the treatment of diabetes, cancer, and neurological problems. By developing drug variations of patent-expiring drugs using a computer modeling approach, these organizations continuously work to maintain their market presence. Furthermore, the growing funding and investment support from public and private healthcare organizations for the development of sophisticated protein engineering technologies to provide better patient outcomes is fueling the segment.

The Contract Research Organizations (CROs) segment is anticipated to register the fastest CAGR from 2024 to 2030. This can be attributed to the rising propensity of outsourcing and contract research and manufacturing in the biopharmaceutical industry. Advantages offered by CROs, such as improved productivity, improved service efficiency, and a greater emphasis on key development areas in protein engineering, including de novo protein engineering, are anticipated to drive segment growth.

Regional Insights

North America protein engineering market dominated in 2023 with the largest share of 40.89% of the overall global revenue. Throughout the projected period, the region is expected to retain its leadership. A rising number of collaborations encouraged by key market players to increase their R&D capabilities are likely to be responsible for the greater share captured by this region. For instance, in September 2021, the protein engineering partnership between Selecta Biosciences, Inc. & Cyrus Biotechnology, Inc. combined Selecta’s ImmTOR platform with Cyrus’ capacity to fundamentally redesign protein treatments. The collaboration’s main initiative was the development of an exclusive interleukin-2 (IL-2) agonist made to selectively enhance regulatory T cell (Treg) growth for the treatment of individuals with autoimmune disorders.

U.S. Protein Engineering Market Trends

The protein engineering market in the U.S. is expected to grow over the forecast period. The rising research funding, presence of key players, and availability of healthcare infrastructure are expected to contribute to the high revenue share.

Europe Protein Engineering Market Trends

The protein engineering market in Europe is identified as a lucrative region in this industry. Europe has a substantial increase in biopharmaceutical R&D activities due to rising scientific awareness and growing investments in the healthcare sector. The R&D investments in the pharmaceutical industry in the country reached USD 1382 million (EUR 1,267 million) in 2021, recording an increase of 9.2% over 2020. These factors are expected to support the market in the region.

The UK protein engineering market held a significant share in 2023. The UK-based biotech firms are outperforming their European counterparts in securing early-stage funding. Between 2018 and 2020, biotech start-ups in the country raised USD 3.6 billion, marking a 20% increase compared to the funds raised from 2015 to 2017. Consequently, the country’s R&D services sector is poised for significant growth in the upcoming decade.

The protein engineering market in France is expected to grow remarkably over the forecast period. In June 2020, Sanofi invested around USD 679.4 million in two French sites to increase vaccine research in the country. Hence, the growing investments by the leading organizations are anticipated to boost the market over the forecast period.

Germany protein engineering market is anticipated to grow significantly over the forecast period. The increasing collaborative initiatives among organizations to enhance research studies in Germany are expected to propel the protein labeling market growth. For instance, in April 2023, a German-based Clinical Research Organization (CRO), Taros Chemical, collaborated with Welab Barcelano, a Spain-based drug discovery & development center, to enhance and support the R&D process.

Asia Pacific Protein Engineering Market Trends

Asia Pacific protein engineering market is anticipated to witness the fastest CAGR of 17.50% over the forecast period. This is attributed to the high incidence of cancer, cardiovascular, and autoimmune disorders in developing Asian countries. In addition, untapped opportunities in this region are expected to contribute to the growth of the sector due to the high economic development in emerging markets, such as India and China. Moreover, the presence of a large population base for the development and clinical testing of protein engineering applications is anticipated to boost the region’s growth.

The protein engineering market in China is expected to grow over the forecast period. Growth can be attributed to the rising investments in cancer research from government & private organizations. These investments help develop infrastructure for academic and research institutes using the latest technologies.

Japan protein engineering market is witnessing significant growth over the forecast period. In April 2023, the Barcelona Supercomputing Center - Centro Nacional de Supercomputación (BSC-CNS) and Fujitsu Limited signed a dual collaboration agreement. This collaboration will drive personalized medicine research by leveraging clinical data and promoting advancements in quantum simulation technologies utilizing tensor networks.

MEA Protein Engineering Market Trends

The protein engineering market in MEA is expected to grow exponentially over the forecast period. The MEA region is witnessing significant growth due to improved infrastructure and policies laid down by regulatory bodies. The rising disposable income and increasing geriatric population are some of the major factors driving the market growth. Furthermore, increasing conferences, events, workshops, congresses, summits, and others on protein engineering are anticipated to boost market growth.

Saudi Arabia protein engineering market is expected to grow over the forecast period. The growing healthcare awareness and increasing demand for enhanced ultrasound technologies for effective management of chronic diseases, such as cancer and cardiovascular diseases, in Saudi Arabia are expected to boost the market during the forecast period.

The protein engineering market in Kuwait is anticipated to grow over the forecast period. Kuwait is expected to have the lowest revenue share in the global protein engineering industry due to the limited investment in R&D, healthcare infrastructure challenges, lack of robust industry collaboration, strong competition from countries with developed biotech sectors, and limited awareness & education about exosome applications.

Key Protein Engineering Company Insights

The market players operating in the protein engineering industry are seeking product approvals to increase the reach of their products in the market and improve their availability in diverse geographical areas. They are also expanding as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Protein Engineering Companies:

The following are the leading companies in the protein engineering market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies

- Bruker Cor.

- Thermo Fisher Scientific, Inc.

- PerkinElmer, Inc.

- Waters Corp.

- Bio-Rad Laboratories

- Merck KGaA

- Danaher Corp.

- Genscript Biotech Corp.

- Amgen, Inc.n

Recent Development

-

In January 2024, Agilent Technologies Inc. launched a new automated parallel capillary electrophoresis system for protein analysis.

-

In January 2024, Biognosys expanded its U.S. presence with the establishment of its new proteomics CRO facility in Massachusetts. This expansion would enable Biognosys to provide proteomics services to its U.S. biopharma customers. Biognosys was acquired by Bruker Corporation in January 2023.

-

In December 2023, Thermo Fisher Scientific, Inc. announced a distribution agreement with AESKU.GROUP GmbH to support, market, and sell its portfolio of FDA-cleared automated instruments, IFA products, & software in the U.S.

Protein Engineering Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.09 billion

Revenue forecast in 2030

USD 7.62 billion

Growth rate

CAGR of 16.24% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, protein type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand;South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Agilent Technologies; Bruker Corp.; Thermo Fisher Scientific, Inc.; PerkinElmer, Inc.; Waters Corp.; Bio-Rad Laboratories; Merck KGaA; Danaher Corp.; Genscript Biotech Corp; Amgen Inc.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Engineering Market Report Segmentation

This report forecasts revenue growth and analyzes the latest trends in each of the sub-segments from 2018 to 2030. Grand View Research has segmented the global protein engineering market report based on product, technology, protein type, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Software & Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Rational Protein Design

-

Directed Evolution

-

Hybrid Approach

-

De Novo Protein Design

-

Others

-

-

Protein Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulin

-

Monoclonal Antibodies

-

Vaccines

-

Growth Factors

-

Colony Stimulating Factors

-

Coagulation Factors

-

Interferon

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research Institutes

-

Contract Research Organizations (CROs)

-

Pharmaceutical & Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global protein engineering market size was estimated at USD 2.60 billion in 2023 and is expected to reach USD 3.09 billion in 2024.

b. The global protein engineering market is expected to grow at a compound annual growth rate of 16.24% from 2023 to 2030 to reach USD 7.62 billion by 2030.

b. Rational protein design dominated the protein engineering market with a share of 30.03% in 2023. This is attributable to the extensive usage of this technology for engineering antibodies and other therapeutics. Similarly, growth in its commercial applications for engineering enhanced and modified enzymes possessing desired catalytic properties has boosted the segment.

b. Some key players operating in the protein engineering market include Agilent Technologies, Bruker Corporation, Thermo Fisher Scientific, Inc., PerkinElmer, Inc., Waters Corporation, Bio-Rad Laboratories, Merck KGaA, Danaher Corporation, Genscript Biotech Corp., and Amgen Inc.

b. Key factors that are driving the market growth include a preference for protein-based therapeutics over non-protein drugs due to the positive clinical outcomes associated with these drugs and the rising urgency to curb high R&D costs in clinical trials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.