- Home

- »

- Biotechnology

- »

-

Protein Labeling Market Size, Share & Growth Report, 2030GVR Report cover

![Protein Labeling Market Size, Share & Trends Report]()

Protein Labeling Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Reagents, Kits), By Application (Mass Spectrometry, Cell-based Assays), By Method, By Region, And Segment Forecasts

- Report ID: 978-1-68038-969-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Labeling Market Size & Trends

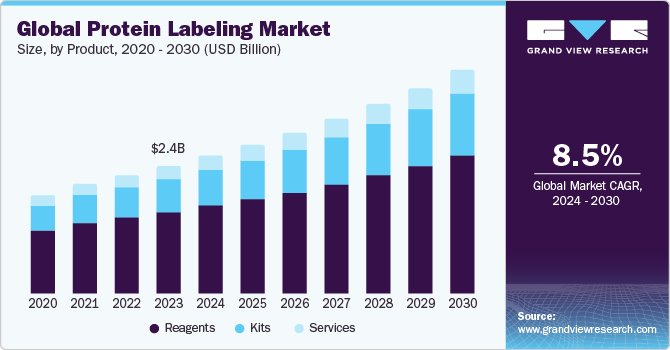

The global protein labeling market size was estimated at USD 2.43 billion in 2023 and is projected to grow at a CAGR of 8.46% from 2024 to 2030. Market growth can be attributed to the increase in spending on proteomics research, rapid technological advancements in the market, and the rise in the adoption of bioengineering techniques. The area of proteomics research has witnessed a notable surge in funding and attention, catalyzed by several key drivers.

Advancements in analytical technologies, especially in mass spectrometry and chromatography, have enabled researchers to explore deeper into the elaborate structure of proteins to understand their roles in health, disease, and drug development. The pharmaceutical industry's enhanced focus on R&D has increased interest in proteomics, as it plays an important role in identifying drug targets and interpreting mechanisms of action. In September 2023, approximately USD 50.3 million was awarded by NIH for multi-omics research on diseases and human health. This investment would help develop a novel research consortium focusing on advanced generation and analysis of multi-omics data to study human health. Moreover, with the growth in personalized medicine, the need for understanding individual variations in protein expression is expected to increase, driving the demand for advanced proteomics techniques and protein labeling methods.

Furthermore, rapid technological advancements expedite market growth. The continuous evolution of labeling techniques, bolstered by innovations in fluorescence, isotopic labeling, and analytical technologies such as advanced mass spectrometry, has enhanced the precision and capabilities of protein labeling methods. The introduction of multiplexing techniques and customizable protocols further amplifies the adaptability of protein labeling, allowing simultaneous detection of multiple proteins and accommodating diverse experimental designs. Moreover, the introduction of novel labeling agents, characterized by improved specificity and stability, is expanding the technology for researchers.

The adoption of bioengineering techniques has witnessed a significant increase, substantially contributing to the growth of the market. As bioengineering continues to advance, researchers are increasingly accepting innovative methodologies to engineer proteins with enhanced functionalities, creating opportunities for applications in areas such as drug delivery, diagnostics, and biotechnology.

The COVID-19 pandemic had a significant positive impact on various industries, including the life sciences sector. Various factors such as increased focus on life sciences research, accelerated drug discovery, vaccine development, growing investment in R&D activities, and increasing adoption of technologically advanced solutions for better accuracy have propelled the demand for protein labeling. Moreover, the protein labeling industry is fundamental to drug discovery, and during the pandemic, there was a high focus on the development of antiviral drugs and vaccines. In addition, protein labeling is necessary for the development of diagnostic tools, and the pandemic created a demand for rapid and accurate diagnostic tests.

Market Concentration & Characteristics

The companies operating in the protein labeling industry have been significantly influenced by a high degree of innovation aimed at enhancing patient outcomes and maintaining their competitive position within the industry. In addition, the provision of grants for innovative research and development activities serves to further bolster production efforts and demand within the industry.

The market is also characterized by the moderate level of merger and acquisition activities undertaken by several industry players. This is due to several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. For instance, in January 2022, Thermo Fisher Scientific, Inc. acquired PeproTech, Inc., a major recombinant protein manufacturer. PeproTech, Inc. also offers recombinant cytokines for research. Thus, this acquisition strengthened the protein labeling portfolio of Thermo Fisher Scientific, Inc.

Regulations related to products used in proteomic research overlap with broader regulations in genomics, biotechnology, and medical research. For instance, ethical considerations are paramount in proteomics research, especially involving human subjects. Researchers should adhere to ethical guidelines and obtain informed consent when collecting and analyzing biological samples. Moreover, adherence to medical device regulations and guidelines is crucial in a clinical setting, such as for biomarker discovery or diagnostics.

Numerous industry players are focusing on expanding their product and services portfolio. They are launching novel protein labeling services and products. For instance, in June 2023, Thermo Fisher Scientific Inc. launched the Orbitrap Astral mass spectrometer that offers rapid throughput, high sensitivity, and extensive proteome coverage. Such product and service launches are anticipated to support the expansion of the industry’s products & services.

The industry is currently witnessing a low level of regional expansion, with growth prospects driven by an expanding customer base for protein labeling products & services. Larger corporations frequently acquire smaller entities to enhance their market presence, broaden their product offerings, and strengthen their competitive position in diverse regions.

Product Insights

The reagents segment dominated the industry in 2023, accounting for a 63.59% share of the global revenue. An increase in the number of labeling agents and genetically engineered protein labels being discovered can be attributed to the estimated share of the reagents segment. Protein labeling reagents offer a versatile toolbox for researchers and practitioners, facilitating a wide range of applications that contribute to advancing the understanding of cellular processes, disease mechanisms, and the development of new therapeutics. Moreover, the presence of market participants engaged in providing customized solutions based on different protocols is expected to drive this segment in the coming years.

The kits segment is expected to witness the fastest CAGR of 9.63% over the forecast period. Protein labeling kits provide researchers with standardized and user-friendly tools to achieve specific labeling goals, reducing the complexity of experimental setup and optimizing reproducibility. The choice of a specific kit depends on the labeling method and the desired application. These kits typically include reagents, buffers, and protocols for specific labeling methods. Kits provide a convenient way for labeling proteins and antibodies with fluorescent labels or biotin for applications such as cell-based assays, western blotting, ELISA, and immunofluorescence.

Method Insights

The in-vitro segment dominated the market with the largest share of 70.50% in 2023. In vitro, protein labeling methods are those in which the sample to be studied or analyzed is collected and then processed in a laboratory. Enzymes, dyes, and nanoparticles are used as probes or tags in in-vitro labeling using co-translational and site-specific labeling methods. Due to the extremely specific impact of the enzymes, enzymatic labeling dominated the segment. The nanoparticle-based in vitro procedures segment is predicted to grow at the fastest pace over the forecast period. This approach employs gold nanoparticles, which can be precisely attached to an antibody or hinge thiol on IgG or Fab. Because of their small size, nanoparticles can reach complicated areas and form covalent connections with the target protein or peptide, resulting in improved labeling and stability. Thus, the in-vitro segment is also expected to grow at the fastest CAGR.

The in-vivo segment is projected to witness significant growth from 2024 to 2030. Life sciences research funding has increased, enhancing molecular studies that unravel illness causes while discovering biomarkers. Furthermore, the adoption of photoreactive labeling method is anticipated to increase with growth in research pertaining to live-cell monitoring and disease diagnosis. Owing to the intrinsic specificity associated with using this method, Photo-Affinity Labeling (PAL) in chemical proteomics serves as a convenient tool for investigating Protein-Protein Interactions (PPIs).

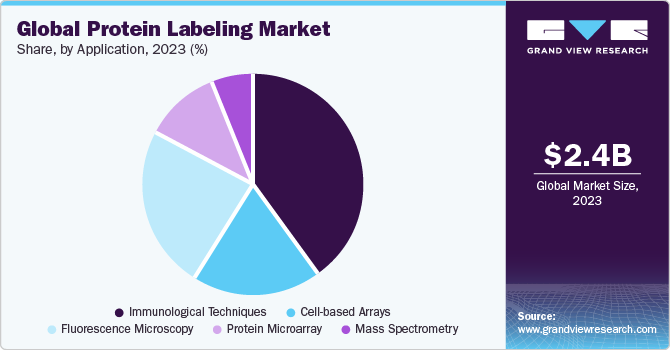

Application Insights

The immunological techniques segment dominated the market in 2023 with a share of 39.85%, primarily due to the growing prevalence of chronic disorders. Another factor propelling the sector is increased R&D expenditure by biotechnology & biopharmaceutical businesses to develop complicated biologics, such as monoclonal antibodies & vaccines. The growth of research activities in genomics and proteomics is contributing to the demand for protein labeling techniques & reagents. Moreover, this technique includes flow cytometry, immunoassays, western blotting, and immunofluorescence, involving the usage of labels. These are majorly used in cancer research, autoimmune disease research, and the development of therapeutics.

The fluorescence microscopy segment is projected to witness the fastest CAGR of 9.77% from 2024 to 2030. Fluorescence microscopy is widely used to study the subcellular localization of proteins. By labeling target proteins with fluorescent tags, researchers visualize their distribution within cells and organelles. The increasing focus on biomedical research, including cancer biology, neuroscience, and immunology, fuels the demand for protein labeling techniques in fluorescence microscopy to understand cellular and molecular mechanisms. In January 2021, CytoSMART Technologies announced the launch of a fluorescence live-cell imager, which enabled researchers to understand the cellular processes in real time while the cells were kept under controlled conditions inside an incubator.

Regional Insights

North America protein labeling market dominated globally with a revenue share of 41.75% in 2023. The region experiences market growth due to the substantial investment in research and development, rise in healthcare expenditure, and technological innovations enhancing the accuracy and efficiency of protein analysis. Furthermore, the presence of key market players in the region, such as Thermo Fisher Scientific, Inc.; Revvity Inc. (PerkinElmer, Inc.); Promega Corporation; New England Biolabs; LI-COR, Inc.; and Danaher Corporation, propels the market growth.

U.S. Protein Labeling Market Trends

The protein labeling market in the U.S. is expected to grow over the forecast period due to development of high-throughput proteomics platforms, advancements in mass spectrometry, and the integration of proteomics with other omics technologies like genomics and metabolomics. Furthermore, in August 2023, Talus Bioscience, a biotech startup, received an investment of USD 4.3 million to boost its drug discovery & development platform. Hence, the rising investments are anticipated to propel market growth in the region.

Europe Protein Labeling Market Trends

The protein labeling market in Europe was identified as a lucrative region in this industry. This is attributed to strong government support, advancements in research infrastructure, and the technological growth in molecular biology.

The UK protein labeling market is expected to grow over the forecast period due to increased government support & private investment to enhance the manufacturing & innovation capabilities of the country’s life sciences sector. For instance, in March 2023, the UK government announced plans to allocate USD 295.35 million (£277 million) to support manufacturing projects in medical diagnostics & human medicines of four life sciences companies in the UK.

The protein labeling market in Germany is expected to grow over the forecast period due to the growing collaboration among organizations to enhance research studies. For instance, in April 2023, a German-based Clinical Research Organization (CRO), Taros Chemical, collaborated with Welab Barcelano, a Spain-based drug discovery & development center, to enhance and support the R&D process.

The France protein labeling market is expected to grow over the forecast period due to collaborative efforts contributed to the dynamic landscape of genetic and molecular advancements. In addition, France has world-class public & private scientific research institutions, such as the French National Centre for Scientific Research, Institut Curie, Institut G. Roussy, and Pasteur Institute. The increasing number of research initiatives by these research organizations and companies is expected to significantly boost the demand, creating a favorable environment for market growth.

Asia Pacific Protein Labeling Market Trends

Asia Pacific protein labeling market is anticipated to witness the fastest CAGR of 10.45% from 2024 to 2030 globally. The Asia Pacific regional market is expected to be driven by the increasing research and development activities, rising biotechnology and pharmaceutical industries, advancements in proteomic research, and increasing prevalence of chronic diseases.

The protein labeling market in China is anticipated to witness lucrative growth over the forecast period. This growth can be attributed to the rising investments in cancer research from government & private organizations. These investments help develop infrastructure for academic and research institutes using the latest technologies. For instance, in May 2023, GE HealthCare, a medical equipment company, officially initiated the Precision Medicine Industrial Base project in Chengdu Tianfu International Bio-town.

The Japan protein labeling market is expected to witness a rapid growth over the forecast period. In Japan, companies are collaborating to develop novel tests and instruments. The government is encouraging advancements to enable efficient capture and quantitative analysis of genomic data. The ongoing clinical research studies and collaborative strategic initiatives are anticipated to propel market growth in Japan.

The protein labeling market in India is anticipated to grow at a rapid rate over the forecast period. Companies & organizations are undertaking several initiatives to increase awareness of proteomics across India. Moreover, the government is undertaking initiatives to accelerate drug approvals, which is expected to boost the market in the coming decade.

Middle East And Africa Protein Labeling Market Trends

The protein labeling market in the Middle East and Africa is projected to grow in near future due to the increasing adoption of protein labeling technologies by smaller companies offering protein labeling kits as well as larger companies launching new products with a wide range of applications, along with the increased investment in R&D that supports advancements in protein analysis technologies such as mass spectrometry and protein microarray biochips, driving the demand for protein labeling products and services.

The Saudi Arabia protein labeling market growth can be attributed to various initiatives undertaken by the government to expand the biotechnology sector in the country. For instance, in June 2022, the Saudi Arabian Minister of Industry & Mineral Resources, as chairman of the biopharmaceutical industry committee, announced several investment opportunities, with an overall worth of USD 3.4 billion in vital medicine and vaccines to accomplish the Kingdom’s pharmaceutical & health security objectives.

The protein labeling market in the UAE is witnessing rising investments by academic & research institutes to perform biopharmaceutical research, which is expected to boost the market in the coming decade. Moreover, the increasing adoption of the advanced techniques, tools & technologies of chromatography and sequencing techniques by the life sciences companies boosts the market growth. In addition, the increasing number of clinical trials & diagnostics for treating chronic diseases, such as cancer and diabetes, is expected to drive the market growth.

Key Protein Labeling Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Protein Labeling Companies:

The following are the leading companies in the protein labeling market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Revvity Inc.

- Promega Corporation.

- F. Hoffmann-La Roche Ltd

- LGC Ltd

- New England Biolabs.

- LI-COR, Inc.

- Danaher (Cytiva)

- Jena Bioscience GmbH

Recent Developments

-

In March 2024, ImmunoPrecise Antibodies Ltd. announced the acquisition of Carterra's LSA instrument platform. This strategic move aims to enhance ImmunoPrecise Antibodies' capacity for high-throughput surface plasmon resonance-based antibody characterizations, significantly boosting its capabilities in various label-free protein interaction analyses.

-

In December 2023, PerkinElmer, a global provider of analytical services and solutions, completed the acquisition of Covaris, a prominent developer of solutions driving advancements in life sciences. This merger is poised to boost Covaris' growth opportunities while extending PerkinElmer's life sciences portfolio into the rapidly expanding diagnostics end market.

-

In October 2023, Thermo Fisher Scientific announced the acquisition of Olink, a frontrunner in next-generation proteomics. This is anticipated to strengthen its presence in the rapidly growing proteomics market by incorporating uniquely differentiated solutions.

-

In September 2023, NanoString introduced its spatial proteomics panel, GeoMx Digital Spatial Profiler (DSP), enabling researchers to profile over 500 proteins simultaneously in Formalin-Fixed, Paraffin-Embedded (FFPE) tissue.

-

In August 2023, The New York Structural Biology Center collaborated with Syncell, a life sciences company, to develop Optoproteomics Center of Excellence as a part of the new NYSBC Proteomics Core, which would include Syncell’s Microscoop platform. This innovative spatial proteomic system anticipates capturing proteins from a detailed subcellular structure in various tissues & cell biospecimens.

Protein Labeling Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.62 billion

Revenue forecast in 2030

USD 4.27 billion

Growth Rate

CAGR of 8.46% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, method, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Revvity Inc.; Promega Corporation; F. Hoffmann-La Roche Ltd; LGC Ltd; New England Biolabs; LI-COR, Inc.; Danaher (Cytiva); and Jena Bioscience GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Labeling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein labeling market report based on product, method, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents

-

Proteins

-

Enzymes

-

Probes/Tags

-

Monoclonal Antibodies

-

Other Reagents

-

-

Kits

-

Services

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

In-vitro Labeling Methods

-

Enzymatic Labeling

-

Dye-based Labeling

-

Co-translational Labeling

-

Site-specific Labeling

-

Nanoparticle Labeling

-

Others

-

-

In-vivo Labeling Methods

-

Photoreactive Labeling

-

Radioactive Labeling

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunological Techniques

-

Cell-based Arrays

-

Fluorescence Microscopy

-

Protein Microarray

-

Mass Spectrometry

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global protein labeling market size was estimated at USD 2.43 billion in 2023 and is expected to reach USD 2.62 billion in 2024.

b. The global protein labeling market is expected to grow at a compound annual growth rate of 8.46% from 2024 to 2030 to reach USD 4.27 billion by 2030.

b. North America dominated the protein labeling market with a share of 43.09% in 2023. The presence of sophisticated healthcare infrastructure, favorable government initiatives & the presence of key market players in this region is some drivers of this market.

b. Some key players operating in the protein labeling market include Thermo Fisher Scientific, Inc.; Merck KGaA; Revvity Inc.; Promega Corporation; F. Hoffmann-La Roche Ltd; LGC Ltd; New England Biolabs; LI-COR, Inc.; Danaher (Cytiva); and Jena Bioscience GmbH

b. Increase in spending on proteomics research, increase in adoption of bioengineering techniques, and rapid technological advancements in the market is expected to drive the protein labeling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.