- Home

- »

- Advanced Interior Materials

- »

-

PTFE Membrane Market Size, Share & Growth Report, 2030GVR Report cover

![PTFE Membrane Market Size, Share & Trends Report]()

PTFE Membrane Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Hydrophobic, Hydrophilic), By End Use (Industrial Filtration, Textile), By Region, And By Segment Forecasts

- Report ID: GVR-4-68040-355-9

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

PTFE Membrane Market Summary

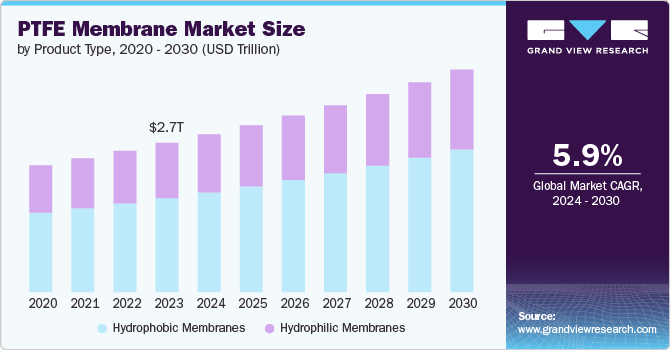

The global PTFE membrane market size was estimated at USD 2,753.7 billion in 2023 and is projected to reach USD 4,107.8 billion by 2030, growing at a CAGR of 5.9% from 2024 to 2030. This growth is attributed to their superior chemical resistance, high thermal stability, and excellent filtration efficiency, making them the preferable choice for various end-use industries which include pharmaceuticals, food and beverage, chemical processing, and water treatment, where stringent filtration standards are required.

Key Market Trends & Insights

- North America PTFE membrane market dominated the global market with a revenue share of 23.5% in 2023.

- The PTFE membrane market in the Asia Pacific is expected to grow at the highest CAGR from 2024 to 2030.

- Based on product type, the hydrophobic membrane dominated the market with a revenue share of 63.1% in 2023.

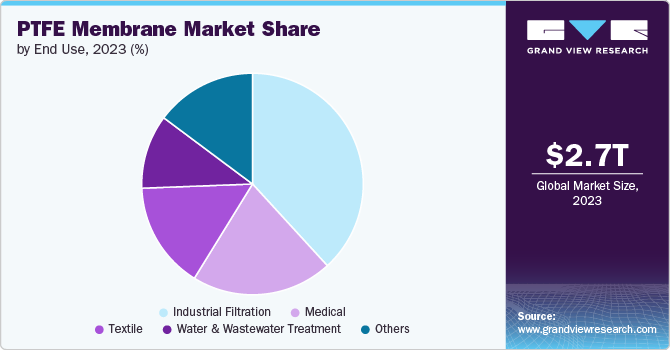

- Based on end use, the Industrial filtration accounted for the largest revenue share of 38.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2,753.7 Billion

- 2030 Projected Market USD 4,107.8 Billion

- CAGR (2024-2030): 5.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Moreover, the increasing emphasis on environmental protection and stringent regulations by the government regarding water and air quality expected to drive the adoption of PTFE membrane in pollution control and wastewater management. As industries continue to prioritize sustainability and regulatory compliance, the versatile and robust properties of PTFE Membrane position them as an ideal choice, thereby boosting their demand for the market.

Technological advancements are encouraging the development of enhanced manufacturing processes that produce Membrane with higher porosity and uniform pore distribution, improving filtration efficiency and durability. Innovations in surface modification techniques, including plasma treatment and grafting, have resulted in an expanded range of applications by enhancing the membrane’s hydrophilic or hydrophobic properties, thus making them more versatile for different industrial uses.

Moreover, advancements in nanotechnology have led to the creation of PTFE Membrane with nanoscale features, providing superior performance in critical applications such as microfiltration and gas separation. These technological improvements have not only improved the performance and lifespan of PTFE Membrane but also reduced production costs, making them more accessible and attractive to a broader range of industries.

Product Type Insights

The hydrophobic membrane dominated the market with a revenue share of 63.1% in 2023 and further expected to grow at a significant CAGR from 2024 to 2030. The growth is attributed to the unique properties which make them important in numerous applications. These membranes offer exceptional water repellency, chemical resistance, and thermal stability, making them a preferable choice for use in aggressive environments where traditional materials fail. Major industries such as pharmaceuticals, biotechnology, electronics, and wastewater treatment depend on hydrophobic PTFE Membrane for critical processes like sterile venting, gas filtration, and liquid separation.

Demand for hydrophilic PTFE membrane manufacturing is expected to grow at a significant CAGR from 2024 to 2030. This is due to their unique combination of properties that cater to specific industrial needs. These membranes are characterized by their ability to attract and absorb water, making them ideal for applications requiring controlled fluid flow, such as medical devices, laboratory filtration, and diagnostic assays. Hydrophilic PTFE Membrane offers excellent chemical compatibility, high throughput, and low protein binding, which are critical factors in sectors like biopharmaceuticals and life sciences where maintaining product purity and integrity is paramount.

End Use Insights

Industrial filtration end use accounted for the largest revenue share of 38.2% in 2023 owing to their exceptional properties that enhance filtration efficiency and durability. PTFE membranes offer high chemical resistance, thermal stability, and superior mechanical strength, making them suitable for challenging industrial environments where robust filtration solutions are essential. These membranes are widely used in applications such as chemical processing, pharmaceutical manufacturing, food and beverage production, and wastewater treatment, where they effectively remove contaminants while maintaining product purity and quality.

Medical end-use is anticipated to grow at a significant CAGR from 2024 to 2030. The demand for PTFE Membrane in medical applications is driven by their exceptional biocompatibility, chemical inertness, and precise filtration capabilities. These membranes are widely used in medical devices such as venting filters, infusion filters, and diagnostic assays where maintaining sterility, controlling fluid flow, and ensuring reliable filtration are critical. PTFE Membrane offers advantages including high purity, low extractable, and resistance to a wide range of chemicals and solvents, making them a preferable choice for applications in pharmaceutical manufacturing, diagnostic testing, and implantable medical devices.

Regional Insights

North America PTFE membrane market dominated the global market with a revenue share of 23.5% in 2023. The demand is expected to rise owing to a growing emphasis on environmental sustainability and stringent regulations by the government regarding air and water quality, prompting industries to adopt advanced filtration solutions like PTFE Membrane. In addition, the U.S. and Canada have a robust healthcare sector that continues to expand, which is expected to drive the demand for PTFE membranes in medical applications including pharmaceutical manufacturing and medical device filtration.

U.S. PTFE Membrane Market Trends

The PTFE membrane market in the U.S. is growing at a CAGR of 6.1% over the forecast period. The country’s strong presence in sectors including electronics, aerospace, and chemical processing is expected to boost the demand for PTFE Membrane due to its reliability in harsh operating conditions and critical applications. Moreover, technological advancements in manufacturing processes have improved the performance and cost-effectiveness of PTFE Membrane, making them more attractive to industries across the country.

Europe PTFE Membrane Market Trends

Europe PTFE membrane market is growing at a CAGR of 5.7% from 2024 to 2030. Environmental and industrial sectors in the region emphasize sustainability and stringent emission regulations which are predicted to drive the adoption of PTFE Membrane for air and water filtration applications. The continuous innovation in membrane technology, coupled with increasing investments in research and development across Europe, further supports the expanding applications and demand for PTFE membranes in the region.

Asia Pacific PTFE Membrane Market Trends

The PTFE membrane market in the Asia Pacific is expected to grow at the highest CAGR from 2024 to 2030. Rapid industrialization and urbanization in countries like China, India, Japan, and Southeast Asian nations are driving the requirement for advanced filtration technologies in industrial processes, wastewater treatment, and air pollution control. PTFE membranes, known for their high chemical resistance, durability, and efficiency in filtration, are crucial in meeting these environmental and regulatory challenges.

Key PTFE Membrane Company Insights

Some key players operating in the market include Pall Corporation and Saint Gobain.

-

Pall Corporation is a global leader in filtration, separation, and purification technologies for wide range of industries including biopharmaceuticals, healthcare, aerospace, food and beverage, and industrial manufacturing. The company's product portfolio includes advanced filtration systems, Membrane, purification technologies, and laboratory instruments designed to enhance process efficiencies, ensure product quality, and meet stringent regulatory standards.

-

Saint Gobain is engaged in designing, manufacturing, and distributing a wide range of materials and solutions for the construction industry. It operates through various brands across the globe, including ADFORS, British Gypsum, CertainTeed, LLC, CHRYSO, ISOVER, Panofrance, and WEBER.

Fiberflon and Hawach Scientific Co., Ltd. are some emerging participants in the market.

-

Fiberflon is a leading manufacturer and supplier of high-performance PTFE-coated fabrics, tapes, belts, and Membrane for a wide range of industries including food processing, packaging, textiles, chemical processing, and aerospace.

-

Hawach Scientific Co., Ltd. is engaged in the production and distribution of laboratory filtration products and equipment. The company has a vast product line which includes syringe filters, filter Membrane, filter papers, chromatography products, and other laboratory consumables. The company focuses on providing high-quality solutions for scientific research, pharmaceuticals, biotechnology, environmental monitoring, and industrial applications.

Key PTFE Membrane Companies:

The following are the leading companies in the PTFE membrane market. These companies collectively hold the largest market share and dictate industry trends.

- Pall Corporation

- Saint Gobain

- Fiberflon

- Hawach Scientific Co., Ltd.

- Corning Incorporated

- Donaldson Company, Inc

- HYUNDAI MICRO Co., Ltd.

- Cytiva

- Merck KGaA

- W. L. Gore & Associates, Inc.

Recent Developments

-

In May 2022, Merck KGaA, a leading science and technology company, is expanding its filtration and membrane production facilities in Ireland with an approximate investment of 440 million euros. This initiative made the company the most significant single site for Merck’s Life Science business sector and is expected to create more than 370 jobs by 2027.

PTFE Membrane Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,910.7 billion

Revenue forecast in 2030

USD 4,107.8 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Corning Incorporated; Donaldson Company, Inc.; HYUNDAI MICRO Co., Ltd.; Cytiva; Merck KGaA; W. L. Gore & Associates, Inc.; Pall Corporation; Saint Gobain; Fiberflon; Hawach Scientific Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts orking days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global PTFE Membrane Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global PTFE membrane market based on the product type, end use, and region:

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hydrophobic Membrane

-

Hydrophilic Membrane

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Industrial Filtration

-

Medical

-

Textile

-

Water & Wastewater Treatment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global PTFE membrane market size was estimated at USD 2,753.7 million in 2023 and is expected to reach USD 2,910.7 million in 2024.

b. The global PTFE membrane market is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2030 to reach USD 4,107.8 million by 2030.

b. Hydrophobic membranes accounted for the largest revenue share of over 63.1% in 2023. The growth is attributed to the unique properties which make them important in numerous applications. These membranes offer exceptional water repellency, chemical resistance, and thermal stability, making them a preferable choice for use in aggressive environments.

b. Some key players operating in the PTFE membrane market include Corning Incorporated, Donaldson Company, Inc., HYUNDAI MICRO Co., Ltd., Cytiva, Merck KGaA, W. L. Gore & Associates, Inc., Pall Corporation, Saint Gobain, Fiberflon, Hawach Scientific Co., Ltd.

b. The key factors that are driving the market growth are the properties of PTFE membrane such as superior chemical resistance, high thermal stability, and excellent filtration efficiency, making them preferable choice for various end-use industries which includes pharmaceuticals, food and beverage, chemical processing, and water treatment, where stringent filtration standards are required.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.