- Home

- »

- Next Generation Technologies

- »

-

Quantum Key Distribution Market Size, Industry Report 2030GVR Report cover

![Quantum Key Distribution Market Size, Share & Trends Report]()

Quantum Key Distribution Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By End-use (BSFI, Healthcare), By Type, By Application (Network Security, Database Encryption), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-568-0

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Quantum Key Distribution Market Summary

The global quantum key distribution market size was estimated at USD 446.0 million in 2024 and is projected to reach USD 2.49 billion by 2030, growing at a CAGR of 33.5% from 2025 to 2030. As quantum computing advances, traditional encryption methods will become increasingly vulnerable.

Key Market Trends & Insights

- The North America leads the global quantum key distribution market, accounting for a leading share of 36.8% in 2024.

- The quantum key distribution market in the U.S. is expanding rapidly, driven by the increasing demand.

- Based on type, the extended range communication systems segment accounted for the highest revenue market share.

- Based on application, the network security segment is expected to account for the largest market revenue share in 2024.

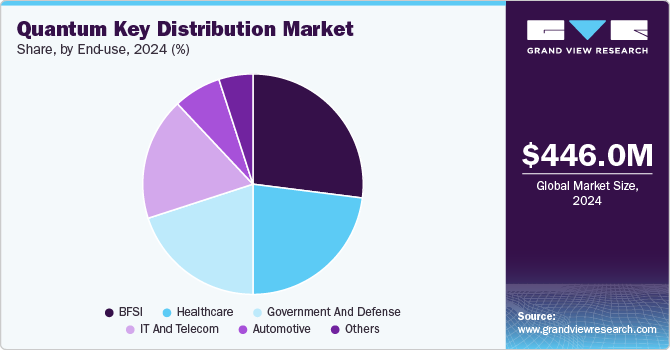

- Based on end-use, the BFSI segment held the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 446.0 Million

- 2030 Projected Market Size: USD 2.49 Billion

- CAGR (2025-2030): 33.5%

- North America: Largest market in 2024

This shift highlights the growing need for quantum-safe encryption techniques. Quantum key distribution (QKD) offers a solution to secure communications against future quantum computing threats. It is particularly critical for protecting sensitive data in infrastructure, government, and defense sectors.

The project emphasizes developing and implementing QKD to safeguard against emerging cybersecurity risks. For instance, in January 2025, Thales Alenia Space, an aerospace company in France, and Hispasat initiated the development of the quantum key distribution system from geostationary orbit. This project aims to produce unbreakable encryption keys using satellite-based quantum communication, positioning Spain at the forefront of the European Quantum Communication Infrastructure (EuroQCI) initiative.

Integrating QKD into an established fiber optic network highlights the trend of incorporating advanced quantum technologies into current infrastructure. This approach facilitates the adoption of quantum security solutions across various industries. As quantum technologies become more accessible, sectors will increasingly implement them to secure communications. The move sets a precedent for industries to enhance their networks against emerging cyber threats. For instance, in October 2024, Eurofiber, a telecommunications equipment supplier in the Netherlands, collaborated with Q*Bird to integrate QKD technology into Eurofiber’s extensive fiber optic network. This collaboration enhances data security across sectors such as logistics, finance, and government, providing robust protection against emerging cyber threats, including those posed by future quantum computing capabilities.

The deployment of 5G networks is accelerating the demand for enhanced security solutions, creating an opportunity for quantum key distribution (QKD) to address these needs. As 5G networks expand, they introduce new vulnerabilities, making traditional encryption methods less effective against advanced cyber threats. QKD offers a level of security theoretically immune to quantum computing attacks, positioning it as a critical tool for safeguarding 5G communications.

Integrating QKD with 5G networks can provide secure key exchange, ensuring data remains encrypted during transmission. This is particularly vital for sectors such as telecommunications, finance, and healthcare, which rely on the integrity of sensitive information. Companies are exploring ways to combine QKD with 5G to future-proof their infrastructure against evolving cybersecurity risks. As the global rollout of 5G continues, the partnership between QKD and 5G networks is expected to become a cornerstone of secure communication..

The growing adoption of satellite-based quantum key distribution (QKD) is transforming global communication security. Satellite-based QKD allows secure key exchange over long distances, overcoming the limitations of terrestrial networks. Traditional QKD systems face constraints due to the range of optical fibers, making satellites a viable alternative for global reach. Successful demonstrations of satellite-based QKD highlight its potential for secure communication. This technology protects sensitive data for the military, government, and commercial sectors. Satellites provide a solution to the risks associated with land-based network interception. As satellite technology evolves, satellite-based QKD is expected to enhance cybersecurity. The future of QKD looks promising, with satellite-based solutions poised to revolutionize international communication security.

Components Insights

In terms of components, the solution segment dominates the market and is anticipated to hold 69.0% in 2024. The increasing need for secure communication systems across various industries drives this dominance. Solutions in the QKD market include hardware and software components that enable secure key exchange and encryption. As cybersecurity threats continue growing, organizations invest in QKD solutions to safeguard sensitive data. The widespread adoption of QKD solutions, particularly in sectors such as telecommunications and government, is a key factor contributing to this market dominance.

The services segment in the QKD market is experiencing significant growth. This includes installation, maintenance, and consulting services for QKD systems, essential for ensuring optimal performance. As more organizations adopt QKD technologies, the demand for these services has risen, particularly in sectors with stringent security requirements. Service providers are expanding their offerings to support the complex integration of QKD systems with existing infrastructure. This trend is expected to continue, as the need for expert support and customization grows alongside QKD adoption.

Type Insights

The extended range communication systems segment accounted for the highest revenue market share. These systems ensure secure communications across long distances, where traditional encryption methods may fail. As the demand for secure global communications increases, the extended range segment is positioned to expand further. Long-range communication is vital for defense, telecommunications, and finance sectors, where data security is paramount. The integration of satellite-based QKD and advanced optical fibers is accelerating the growth of this segment. With the rise in global communication needs, extended range systems will continue to drive significant revenue growth in the QKD market.

The multiplexing transmission systems segment is experiencing significant market growth. These systems facilitate the simultaneous transmission of multiple communication channels over the same infrastructure, improving efficiency. Multiplexing systems are becoming increasingly crucial in sectors with high data transmission demands, such as telecommunications and finance. The ability to maximize resource usage while ensuring secure communication is driving their adoption. As QKD technologies advance, the need for multiplexing systems continues to rise, contributing to the market expansion.

Application Insights

The network security segment is expected to account for the largest market revenue share in 2024. This segment accounts for the largest share due to the critical need for secure data transmission across networks. Organizations are investing heavily in QKD solutions to protect network infrastructures from advanced threats. Generating and distributing quantum keys in real time strengthens network resilience. Telecommunication and government sectors are key adopters, driving high revenue contributions. Ongoing enhancements in quantum communication protocols ensure this dominance will continue.

Database encryption applications are experiencing rapid market growth. Demand for quantum-secure keys to protect stored data is pushing adoption rates upward. Financial institutions and healthcare providers are leading the shift to quantum-safe database encryption. This trend reflects concerns over future quantum computing attacks on stored information. Service providers are expanding encryption offerings to include seamless integration with database systems. Continued innovation in QKD will support the expansion of this growing segment.

End-use Insights

The BFSI segment held the largest market revenue share in 2024. BFSI applications have dominated the market. This dominance is driven by the critical need to protect high-value financial transactions and sensitive client data. QKD provides an unmatched level of security that appeals to banks and investment firms facing advanced cyber threats. Adoption of quantum-secure key exchange protocols has accelerated across trading platforms and payment networks. Major financial institutions are investing in QKD solutions to future-proof their infrastructures against quantum computing attacks. Continued enhancements in quantum communication technologies will ensure BFSI remains the leading adopter of QKD.

Healthcare is experiencing rapid growth in the QKD market. Securing patient records and medical research data is fueling this expansion. Hospitals and pharmaceutical companies are piloting QKD solutions to safeguard sensitive information. Regulatory requirements for data privacy and security are further incentivizing healthcare providers. Integrating existing health IT systems is becoming smoother as service providers broaden their offerings. As quantum technologies mature, healthcare is set to become a significant adopter of quantum-secure communications.

Regional Insights

North America leads the global quantum key distribution market, accounting for a leading share of 36.8% in 2024. This is due to its advanced technological infrastructure and substantial investment in cybersecurity. Many tech giants and startups focus on advancing QKD technologies, further pushing market growth. The region is also home to key industries, including finance, defense, and telecommunications, which require high levels of secure communication.

U.S. Quantum Key Distribution Market Trends

The quantum key distribution market in the U.S. is expanding rapidly, driven by the increasing demand for secure communication solutions across sectors such as banking, defense, and healthcare. Government initiatives to advance quantum technologies and secure critical infrastructure are boosting adoption. The presence of leading technology companies investing heavily in QKD solutions also contributes to the market's growth. With continued advancements, the U.S. market is expected to maintain its leading position in the global QKD sector.

Europe Quantum Key Distribution Market Trends

The quantum key distribution market in Europe is growing steadily, driven by research initiatives and governmental funding across several countries. The region has proactively invested in quantum technologies, particularly cybersecurity, to protect data and communication infrastructure. Key European industries, including finance and telecommunications, are adopting QKD solutions to future-proof their operations. As European countries collaborate on quantum research, the region is expected to see continued QKD market expansion.

Asia Pacific Quantum Key Distribution Market Trends

The quantum key distribution market in Asia Pacific is witnessing significant growth fueled by rapid technological advancements and increasing cybersecurity needs. Countries such as China and Japan are leading the way with major quantum research and development investments. The growing demand for secure communication networks, particularly in sectors such as telecommunications and defense, is driving market expansion. As the region embraces digital transformation, the need for quantum-safe solutions continues to rise, further boosting the market’s growth.

Key Quantum Key Distribution Company Insights

Some of the key companies in the market include InfiniQuant, KETS Quantum Security Ltd, Kloch Inc., LuxQuanta Technologies S.L., and others. Organizations focus on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

MagiQ Technologies Inc. has been active in quantum key distribution (QKD) development. The company provides QKD systems designed for secure fiber-optic communication networks. It focuses on government, defense, and enterprise markets where secure key exchange is critical. MagiQ continues improving its QKD solutions' reliability and scalability to meet growing cybersecurity demands.

-

NEC Corporation is advancing QKD by integrating quantum communication technologies into real-world networks. The company is involved in domestic and international pilot projects to demonstrate secure QKD-based infrastructure. NEC combines QKD with classical network technologies to ensure practical deployment. Its efforts support the development of quantum-secure communication systems for critical industries.

Key Quantum Key Distribution Companies:

The following are the leading companies in the quantum key distribution (QKD) market. These companies collectively hold the largest market share and dictate industry trends.

- ID Quantique

- InfiniQuant

- KETS Quantum Security Ltd

- Kloch Inc.

- LuxQuanta Technologies S.L.

- MagiQ Technologies Inc.

- NEC Corporation

- QuantumCTek Co., Ltd.

- QuintessenceLabs Pty Ltd

- Telsy S.p.A.

- Toshiba Corporation

Recent Developments

-

In March 2025, LuxQuanta Technologies S.L. launched the second generation of its QKD system, NOVA LQ®, at MWC 2025. The system extends CV-QKD reach to 100km, supports multi-receiver topologies, and operates over lit optical fibre, reducing deployment costs while ensuring compatibility with existing networks.

-

In March 2025, Toshiba Europe Limited launched a commercial QKD system that integrates post-quantum cryptography (PQC), using NIST’s ML-KEM standard. This combined QKD and PQC solution offers enhanced quantum-safe security and is available as a software upgrade for existing systems.

-

In November 2024, Telsy S.p.A., in collaboration with QTI(Quantum Telecommunications Italy) and MEO, a Portuguese telecommunications operator, successfully demonstrated Quantum Key Distribution (QKD) over terrestrial and submarine fiber optics in Lisbon. The trial showed secure QKD-enabled communications across three network nodes using existing infrastructure.

Quantum Key Distribution Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 586.1 million

Revenue forecast in 2030

USD 2.49 billion

Growth rate

CAGR of 33.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Component, type, application, end-use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

ID Quantique; InfiniQuant; KETS Quantum Security Ltd; Kloch Inc.; LuxQuanta Technologies S.L.; MagiQ Technologies Inc.; NEC Corporation; QuantumCTek Co., Ltd.; QuintessenceLabs Pty Ltd; Telsy S.p.A.; Toshiba Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Quantum Key Distribution Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global quantum key distribution market report based on component, type, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Extended Range Communication Systems

-

Multiplexing Transmission Systems

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Secure Communication

-

Network Security

-

Database Encryption

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government and Defense

-

BFSI

-

Healthcare

-

IT and Telecom

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global quantum key distribution market size was estimated at USD 446.0 million in 2024 and is expected to reach USD 586.1 million in 2025.

b. The global quantum key distribution market is expected to grow at a compound annual growth rate of 33.5% from 2025 to 2030 to reach USD 2,488.1 million by 2030.

b. North America dominated the quantum key distribution market with a share of 36.8% in 2024. This is attributed to strong government support, early adoption of quantum technologies, and significant cybersecurity investments.

b. Some key players operating in the quantum key distribution market include ID Quantique, InfiniQuant, KETS Quantum Security Ltd, Kloch Inc., LuxQuanta Technologies S.L., MagiQ Technologies Inc., NEC Corporation, QuantumCTek Co., Ltd., QuintessenceLabs Pty Ltd, Telsy S.p.A., and Toshiba Corporation

b. Key factors driving the market growth include rising concerns over data security, advancements in quantum communication, and increasing investments in secure network infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.