- Home

- »

- Next Generation Technologies

- »

-

Quantum Communication Market Size, Industry Report, 2030GVR Report cover

![Quantum Communication Market Size, Share & Trends Report]()

Quantum Communication Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Solutions, Services), By Transmission Medium, By Enterprise Size, By Vertical (BFSI, Government & Defense, Healthcare, Aerospace), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-516-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Quantum Communication Market Summary

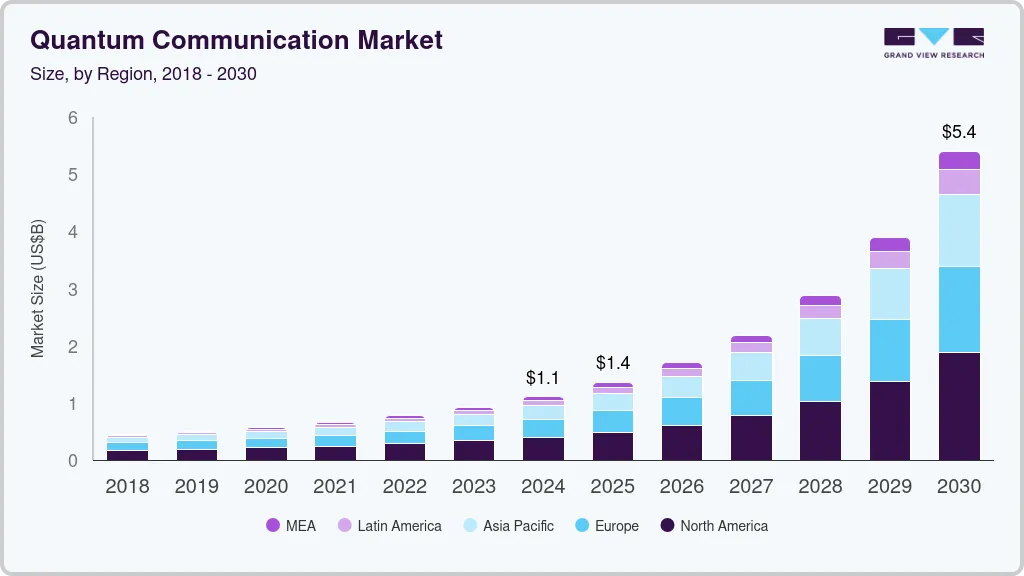

The global quantum communication market size was estimated at USD 1,103.0 million in 2024 and is projected to reach USD 5,399.2 million by 2030, growing at a CAGR of 31.8% from 2025 to 2030. The industry is gaining momentum, primarily driven by the escalating demand for secure communication systems in the digital-first world.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of offering, solutions accounted for a revenue share of 69.5% in 2024.

- Services are the most lucrative offering segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,103.0 Million

- 2030 Projected Market Size: USD 5,399.2 Million

- CAGR (2025-2030): 31.8%

- North America: Largest market in 2024

With cyberattacks becoming more sophisticated, traditional encryption techniques are increasingly vulnerable to breaches. Quantum Key Distribution (QKD), a cornerstone of quantum communication, offers a revolutionary solution by leveraging the principles of quantum mechanics. Unlike classical methods, QKD generates encryption keys that cannot be intercepted or duplicated without altering the transmitted data, ensuring unparalleled security. This breakthrough has positioned quantum communication as a vital technology in safeguarding sensitive data across finance, healthcare, and defense industries.

The growing adoption of quantum technologies in national defense strategies significantly contributes to market growth. Governments worldwide invest heavily in quantum communication infrastructure to protect classified information and maintain a competitive edge. For instance, China and the U.S. are actively developing quantum communication networks, with projects like China's Quantum Experiments at Space Scale (QUESS) satellite demonstrating real-world capabilities. These advancements enhance secure communication and pave the way for global quantum internet frameworks, fostering international collaboration in research and development.

The rising integration of quantum communication with existing telecommunication networks further propels the market. Telecom providers are exploring hybrid systems that combine classical and quantum networks to achieve greater scalability and flexibility. Innovations such as fiber-optic quantum communication and satellite-based quantum networks are bridging the gap between research and commercialization. This synergy is driving technological advancements, enabling broader deployment and access to quantum communication solutions for enterprises and consumers alike.

The emergence of smart cities and the Internet of Things (IoT) also catalyzes the demand for robust and secure communication systems. Quantum communication offers a future-proof framework to address the security challenges posed by interconnected devices. The ability to ensure data integrity and confidentiality in real time is critical for applications ranging from autonomous vehicles to critical infrastructure management. As urbanization accelerates and smart ecosystems expand, quantum communication technologies are poised to play a pivotal role in securing the digital backbone of modern societies.

The ongoing surge in research funding and private investments significantly accelerates market development. Startups and established companies are partnering with academic institutions to push the boundaries of quantum technologies. Public-private collaborations foster innovation, with breakthroughs such as room-temperature quantum devices and integrated photonic chips bringing quantum communication closer to mainstream adoption. These efforts underline market potential and highlight the urgency to address emerging cybersecurity threats, solidifying quantum communication’s position as a transformative technology for the future.

Offering Insights

Solutions accounted for the largest share of 69.5% in 2024. With the rising threats from cyberattacks and the growing sophistication of quantum computing, organizations are turning to advanced solutions like QKD and quantum cryptography systems to protect sensitive data. These solutions offer unparalleled security, as they use the principles of quantum mechanics to ensure that intercepted data cannot be replicated without altering the communication, thus preventing breaches. Defense, finance, and healthcare industries focus on implementing these solutions to safeguard critical information and maintain secure communication channels in an increasingly digital world.

The services segment is expected to grow significantly during the forecast period. The services segment in the quantum communication industry is emerging rapidly, driven by the growing demand for expertise in the deployment and maintenance of quantum communication systems. As businesses and governments implement quantum solutions, there is a rising need for consulting services to navigate the complexities of quantum technology integration. In addition, training services are becoming essential to equip personnel with the necessary skills to operate and manage quantum communication systems effectively. Managed services are also gaining traction as organizations seek continuous support to ensure the smooth operation and ongoing optimization of their quantum infrastructure.

Transmission Medium Insights

The fiber-based QKD segment held the largest market share in 2024. The fiber-based QKD segment is gaining significant traction, primarily driven by the widespread availability and infrastructure of optical fiber networks. As optical fibers already serve as the backbone for many communication systems, integrating quantum key distribution into existing fiber networks is a logical and cost-effective approach. This segment benefits from the inherent advantages of fiber optic cables, including their high data transmission capacity and established global reach. Fiber-based QKD is particularly favored in urban areas and regions with well-established fiber infrastructures, where secure communication solutions are in high demand.

The free-space/satellite-based QKD segment is expected to grow significantly during the forecast period. The free-space and satellite-based QKD segment is emerging as a groundbreaking solution driven by the need for secure global communication beyond the constraints of traditional fiber networks. Unlike fiber-based systems, satellite-based QKD can facilitate communication across vast distances, including remote and underserved areas, by utilizing the atmosphere and space as the medium for data transmission. This segment is particularly relevant for international and intercontinental communication, where laying fiber-optic cables is impractical or expensive. Satellite-based QKD enables governments and corporations to establish secure communication channels that are resistant to interception or disruption, a critical requirement for national security and global enterprises.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024. Large enterprises are increasingly leading the adoption of quantum communication technologies, driven by their critical need to protect vast amounts of sensitive data across global networks. With a significant presence in sectors like finance, telecommunications, and defense, these organizations are at the forefront of exploring quantum solutions to safeguard intellectual property, communications, and business operations against evolving cyber threats. The scale of their operations demands highly secure, scalable, and robust communication systems, which is where QKD and quantum cryptography shine.

The small & medium enterprises (SMEs) segment is projected to grow at the fastest CAGR over the forecast period. SMEs are beginning to embrace quantum communication technologies, though at a more gradual pace compared to large enterprises. These businesses are driven by the need for cost-effective yet secure communication solutions to protect their data without compromising performance. While SMEs may not have the same scale of operations as large enterprises, they increasingly recognize the importance of securing customer data and intellectual property. As quantum technologies become more accessible and affordable, SMEs find that solutions like cloud-based QKD and hybrid communication systems offer a viable path to enhancing their cybersecurity capabilities.

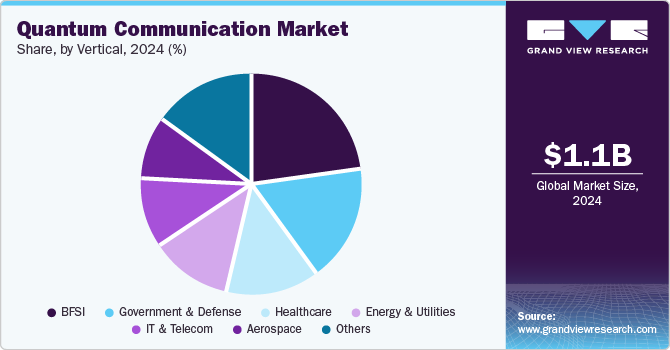

Vertical Insights

The BFSI segment dominated the market in 2024. The BFSI sector is rapidly adopting quantum communication technologies to address the growing need for enhanced security in financial transactions and customer data protection. With the increasing frequency and sophistication of cyberattacks targeting sensitive financial data, banks, insurers, and investment firms are turning to quantum key distribution (QKD) and quantum cryptography to ensure data integrity and confidentiality. These organizations handle vast amounts of critical and personal information daily, making them prime candidates for quantum communication solutions, which offer robust protection against potential future threats from quantum computing.

Healthcare is projected to grow at a significant CAGR over the forecast period. In the healthcare sector, quantum communication technologies are emerging as a critical tool for protecting patient data and ensuring secure telemedicine communications. With healthcare organizations handling an ever-growing volume of sensitive patient information, including personal health records, medical research data, and clinical trial results, the need for enhanced encryption and secure communication is paramount. QKD is becoming particularly important as healthcare providers seek to future-proof their systems against evolving cybersecurity threats, especially with the rise of digital health solutions and cloud-based platforms.

Regional Insights

The North America quantum communication market accounted for a 36.3% share of the overall market in 2024. The North American market is experiencing significant growth, driven by the region's leading role in technological innovation and its increasing emphasis on cybersecurity. With the United States and Canada heavily invested in advanced research and development, North America is becoming a hub for quantum communication technologies, particularly in sectors like defense, telecommunications, and finance. As cyber threats continue to escalate, there is an urgent need for quantum-safe solutions that can protect critical infrastructure and sensitive data. The U.S. government has made substantial investments in quantum research, with initiatives like the National Quantum Initiative Act supporting the development of quantum technologies.

U.S. Quantum Communication Market Trends

The quantum communication industry in the U.S. held a dominant position in 2024, driven by the nation's ongoing technological advancements and significant investments in quantum research. With an emphasis on enhancing cybersecurity, U.S. companies and government agencies are increasingly adopting quantum key distribution (QKD) and quantum cryptography solutions to safeguard critical infrastructure and sensitive data.

Europe Quantum Communication Market Trends

The quantum communication industry in Europe was identified as a lucrative region in 2024. The increasing regulatory emphasis on data protection and privacy and a rise in the demand for cybersecurity solutions are driving the adoption of quantum technologies. As European organizations in sectors like finance, defense, and telecommunications recognize the importance of quantum-secure communication, the region is experiencing steady market growth.

Germany quantum communication market is expected to experience significant growth in the coming years, driven by the country's robust investment in quantum research and technology. As one of Europe’s leaders in innovation, Germany is at the forefront of developing secure communication systems to address growing concerns about data privacy and cybersecurity.

Asia Pacific Quantum Communication Market Trends

The quantum communication industry in Asia Pacific held a significant share in 2024, with countries like China, Japan, and South Korea playing a prominent role in advancing quantum research and technology adoption. China has substantially invested in quantum communication infrastructure, including pioneering satellite-based quantum key distribution (QKD) systems. While regulatory barriers and limited infrastructure in certain markets slow the widespread adoption of quantum communication, the region is experiencing increasing interest in secure communication solutions, particularly from government agencies and large enterprises.

China quantum communication market held a substantial market share in 2024. China has made substantial investments in quantum research, including developing the world’s first quantum satellite, Micius, which has advanced satellite-based quantum key distribution (QKD) systems. The government’s focus on national security and secure communication networks has led to large-scale deployments of quantum communication infrastructure, such as quantum communication lines connecting major cities.

The quantum communication industry in India held a significant share in 2024. India’s market is gaining momentum in 2024, driven by increasing government initiatives and growing awareness of quantum technologies' potential. The Indian government has launched several programs, such as the National Mission on Quantum Technologies and Applications (NM-QTA), to support research and development in quantum communication and computing.

Key Quantum Communication Company Insights

Major players in the market include Toshiba, ID Quantique, Thales, QuantumCTek, and Arqit. These companies are driving advancements in quantum technologies, aiming to secure their competitive position through strategic initiatives such as partnerships, investments in research and development, and collaborations with academic and governmental institutions. By focusing on innovation and expanding their product portfolios, these firms seek to address the growing demand for secure communication solutions in a rapidly evolving digital landscape.

-

Toshiba has pioneered quantum key distribution (QKD) technology, offering advanced solutions for secure data transmission. The company is focused on enhancing the scalability and robustness of its quantum communication systems to meet the needs of sectors like finance, healthcare, and defense. Toshiba’s strategic partnerships with telecommunication providers and enterprises highlight its commitment to expanding quantum-safe networks worldwide.

-

ID Quantique specializes in QKD and quantum random number generators (QRNGs). The company’s products cater to industries prioritizing data security, such as banking and government. With a strong emphasis on R&D, ID Quantique continuously innovates to address emerging cybersecurity challenges while maintaining compliance with international security standards.

Key Quantum Communication Companies:

The following are the leading companies in the quantum communication market. These companies collectively hold the largest market share and dictate industry trends.

- Toshiba

- ID Quantique

- Thales

- IDEMIA

- QuintessenceLabs

- QuantumCTek

- Qubitekk

- Quantum Xchange

- Arqit

- Aliro Quantum

Recent Developments

-

In April 2024, Toshiba Digital Solutions, in collaboration with KT Corporation, demonstrated hybrid quantum secure communication technologies to safeguard financial networks at South Korea's Shinhan Bank. The solution combines Quantum Key Distribution (QKD) and Post-Quantum Cryptography (PQC) to protect sensitive data from future quantum computer-based cyber threats. The demonstration involved a secure 22-kilometer network between Shinhan Bank's Seoul headquarters and its Gangnam Annex, implementing end-to-end encryption compliant with South Korea's Quantum Cryptography Communication Secure System.

-

In May 2024, ID Quantique launched a quantum-safe communication ecosystem to accelerate the adoption of quantum networks. As part of this initiative, its new Clarion KX software platform now supports multi-vendor Quantum Key Distribution (QKD) interoperability, addressing the increasing demand for telecom-grade solutions that enable seamless and cost-effective migration to quantum-safe communications. The addition of key technology partners, including HEQA Security, LuxQuanta, Quantum Optics Jena, and ThinkQuantum, has strengthened the ecosystem.

Quantum Communication Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.36 billion

Revenue forecast in 2030

USD 5.40 billion

Growth rate

CAGR of 31.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, transmission medium, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Toshiba; ID Quantique; Thales; IDEMIA; QuintessenceLabs; QuantumCTek; Qubitekk; Quantum Xchange; Arqit; Aliro Quantum

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Quantum Communication Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global quantum communication market report based on offering, transmission medium, enterprise size, vertical, and region:

-

Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Quantum Communication Components

-

Photon Sources

-

Quantum Memory

-

Quantum Detectors

-

Quantum Modulators and Transceivers

-

Quantum Repeaters

-

-

Quantum Key Distribution (QKD) Solutions

-

Quantum Random Number Generator (QRNG)

-

Quantum-Safe Cryptographic Solutions

-

-

Services

-

-

Transmission Medium Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fiber-Based QKD

-

Free-Space/Satellite-Based QKD

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government & Defense

-

Healthcare

-

Aerospace

-

IT & Telecom

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The escalating demand for secure communication systems in a digital-first world drives growth of the quantum communication market.

b. The global quantum communication market size was estimated at USD 1.10 billion in 2024 and is expected to reach USD 1.36 billion in 2025.

b. The global quantum communication market is expected to grow at a compound annual growth rate of 31.8% from 2025 to 2030 to reach USD 5.40 billion by 2030.

b. North America dominated the quantum communication market with a share of 36.26% in 2024. The growth is attributed to the region's leading role in technological innovation and its increasing emphasis on cybersecurity.

b. Some key players operating in the quantum communication market include Toshiba; ID Quantique ; Thales; IDEMIA; QuintessenceLabs; QuantumCTek ; Qubitekk ; Quantum Xchange; Arqit; Aliro Quantum.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.