- Home

- »

- Automotive & Transportation

- »

-

Rail Logistics Market Size And Trends, Industry Report, 2030GVR Report cover

![Rail Logistics Market Size, Share & Trends Report]()

Rail Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Service, By Cargo Type (Bulk, Containerized), By End-use Industry (Mining & Metals, Energy, Agriculture & Food, Chemical, Automotive, Retail & E-commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-577-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rail Logistics Market Size & Trends

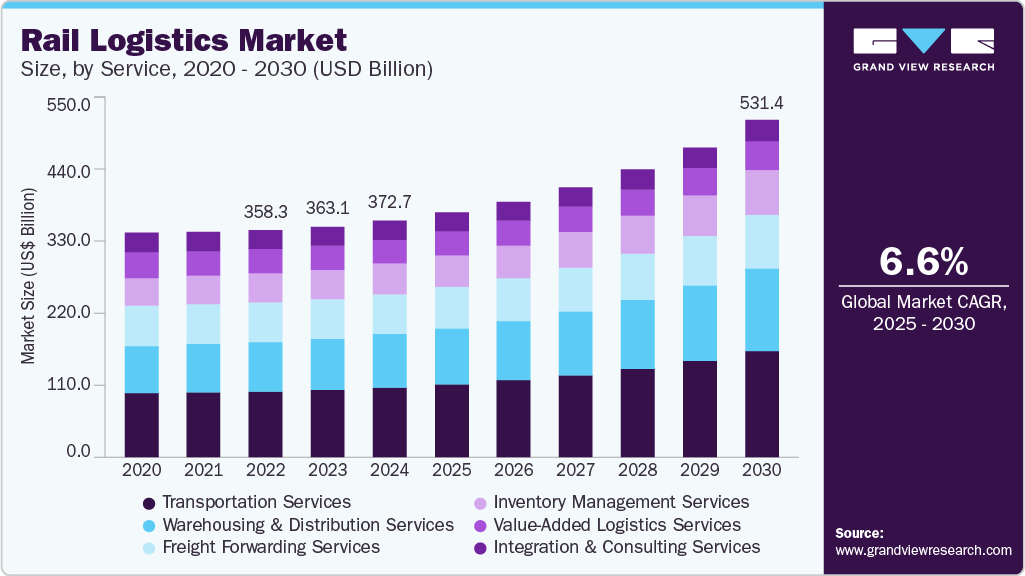

The global rail logistics market size was estimated at USD 372.77 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. The rail logistics industry's growth is driven by several underlying drivers, most notably the growing demand for cost-efficient, bulk transportation solutions amid rising global trade volumes.

Key Highlights:

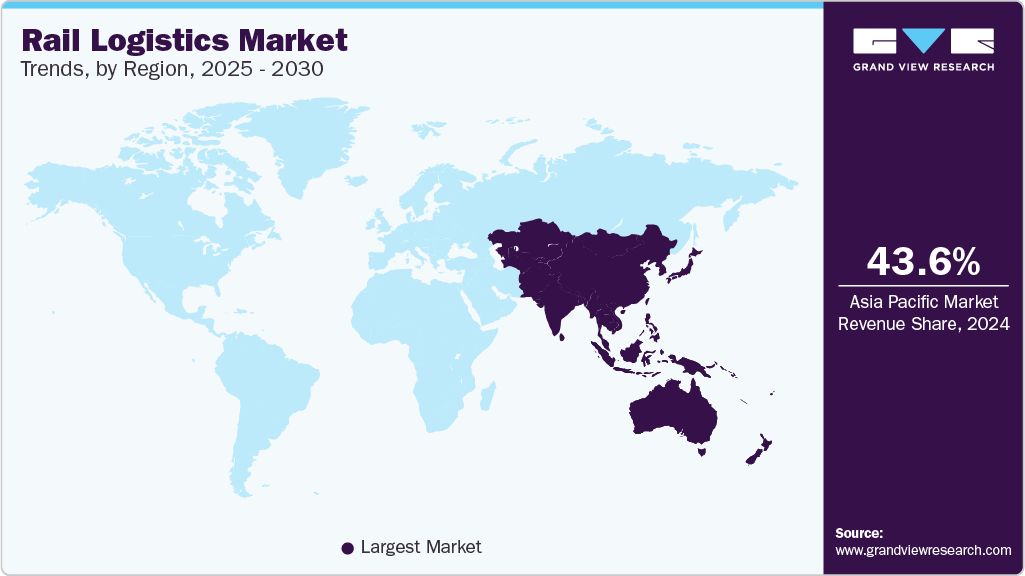

- The Asia Pacific led the global rail logistics market with a revenue share of 43.56% in 2024.

- The rail logistics market in India is expected to grow at a fastest CAGR over the forecast period.

- By service, the transportation services segment accounted for the largest share of 29.6% in 2024.

- Based on cargo type, the bulk segment held the largest market share in 2024.

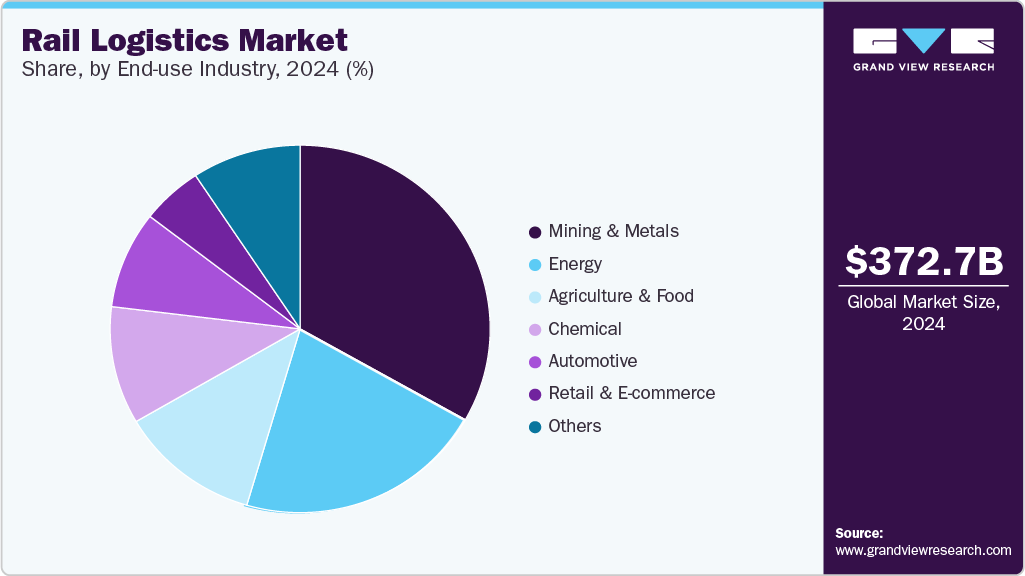

- By end-use industry, the mining and metals segment dominated the market in 2024.

Increasing urbanization and industrialization have necessitated more reliable freight corridors, while concerns around reducing carbon emissions have further positioned rail as a preferred mode over road transport. In addition, government initiatives supporting infrastructure development and intermodal connectivity have played a significant role in enhancing the market potential.

Environmental regulations and corporate sustainability goals are encouraging shippers and logistics providers to shift more freight from road to rail. Rail transport offers significant reductions in greenhouse gas emissions per ton-kilometer compared to trucking, making it an attractive option in the global push to decarbonize supply chains. In Europe, green freight initiatives and emissions trading schemes are actively encouraging modal shifts, while in North America and Asia Pacific, rail is being positioned as a cleaner alternative to highway transport for both bulk and intermodal cargo. This sustainability trend is expected to increase as more governments set net-zero targets and impose stricter carbon pricing mechanisms.

Substantial public and private sector investments in upgrading rail infrastructure are opening new capacity and improving service reliability. Projects such as India’s Dedicated Freight Corridors, China's Belt and Road rail links, and North America’s network upgrades are expanding the operational footprint of rail logistics. In addition, digital technologies such as real-time tracking, predictive maintenance, and automated train operations are enhancing efficiency and reducing costs. Smart rail freight solutions powered by IoT and AI are enabling better asset utilization and cargo visibility, which is critical to attracting high-value and time-sensitive freight segments. Thus, investment in rail infrastructure and increasing digitalization in the rail industry is propelling the growth of the rail logistics industry.

The automotive industry’s reliance on rail for transporting vehicles and parts is growing rapidly across the globe, where rail offers cost-effective long-distance delivery. The rise in electric vehicle (EV) production has added further momentum, with new assembly plants creating fresh demand for inbound and outbound rail logistics. In addition, the rapid growth in e-commerce is boosting intermodal freight volumes, as online retailers and 3PL providers seek scalable and sustainable alternatives to trucking. Rail’s capacity to handle large volumes over long distances makes it an increasingly important pillar in retail and distribution networks, thereby driving the growth of the rail logistics industry.

However, factors such as high capital requirements for infrastructure development and maintenance could hamper the growth of the rail logistics industry. Operational bottlenecks caused by legacy systems, limited last-mile connectivity, and capacity constraints at key nodes have also been reported. Furthermore, competition from more flexible road and air freight services, along with geopolitical disruptions affecting cross-border routes, has exerted pressure on market participants. As a result, strategic efforts have been necessitated to overcome these challenges and sustain momentum in the rail logistics sector.

Service Insights

The transportation services segment accounted for the largest share of 29.6% in 2024. The segment growth is supported by expanding rail networks and increasing demand for cost-efficient, long-haul freight solutions. Growth is further being fueled by ongoing shifts from road to rail, particularly in bulk and intermodal segments, as shippers seek more sustainable and scalable transport options. Major infrastructure investments, such as new freight corridors and electrified rail lines, are unlocking additional capacity and improving service reliability. Moreover, cross-border rail routes are gaining traction, providing faster alternatives to ocean shipping and more affordable options compared to air freight. Thus, stringent environmental regulations and increasing fuel costs are expected to contribute to the growth of the segment.

The warehousing and distribution services segment is expected to grow at a notable CAGR during the forecast period. The segment is experiencing rapid growth as supply chains become more complex and demand for integrated solutions rises. Rail operators and third-party logistics providers are expanding value-added services, including transloading, cross-docking, and inventory management, at strategic rail hubs and inland terminals. In addition, the rise of e-commerce, regionalization of supply chains, and the need for faster last-mile delivery are driving investments in rail-linked logistics parks and distribution centers.

Cargo Type Insights

The bulk segment held the largest market share in 2024. Bulk freight continues to form the backbone of rail logistics, driven by the transport of commodities such as coal, iron ore, agricultural products, and chemicals. While traditional bulk segments face maturity in developed markets, selective growth opportunities are emerging in response to rising demand for minerals critical to clean energy transitions, such as lithium, copper, and nickel. In addition, the agricultural sector is sustaining steady volumes, supported by export growth from regions such as North America, Latin America, and Eastern Europe. However, structural headwinds persist due to the global shift away from coal and the volatility of commodity markets. To sustain relevance, bulk rail operators are investing in network efficiency, digitization, and enhanced capacity at key export corridors, thereby driving the segment’s growth.

The containerized segment is expected to register a moderate CAGR during the forecast period. The segment’s growth is fueled by increasing globalization, the rise of e-commerce, and shippers’ growing preference for multimodal solutions that balance cost, speed, and sustainability. Rail-based intermodal services offer a competitive alternative to long-haul trucking, particularly in North America, Europe, and along emerging Asia-Europe corridors. Investments in inland dry ports, container terminals, and cross-border harmonization are further accelerating the adoption of rail for containerized cargo.

End-use Industry Insights

The mining and metals segment dominated the market in 2024. The mining and metals sector remains a cornerstone of rail logistics, accounting for a significant share of bulk freight volumes globally. Rail continues to offer the most cost-effective and scalable solution for transporting heavy minerals and ores from remote mining sites to ports and processing hubs. While traditional commodities such as coal and iron ore face demand pressure in mature markets, new growth opportunities are emerging from the rising global appetite for energy transition minerals such as lithium, copper, and nickel, essential for battery production and renewable energy infrastructure. To maintain competitiveness, mining companies and rail operators are collaborating to modernize infrastructure, enhance network reliability, and adopt digital tools for supply chain optimization, thereby driving the segment’s growth.

The retail & e-commerce segment is expected to grow rapidly during the forecast period. The rapid growth of online shopping, along with shifting consumer expectations for faster and more sustainable delivery, is reshaping logistics networks worldwide. Rail offers an attractive alternative to long-haul trucking, delivering cost advantages and environmental benefits over extended distances. Major retailers and third-party logistics providers are increasingly integrating rail into their supply chains, supported by investments in inland ports, distribution centers, and rail-linked fulfillment hubs. With global and regional e-commerce volumes climbing and companies seeking to reduce carbon footprints, reliance on rail for middle-mile transportation is expected to expand, thereby driving the segment’s growth.

Regional Insights

The North America rail logistics market is expected to grow at a moderate CAGR during the forecast period. The market growth is driven by the expansion of intermodal freight networks and rising demand for cross-border trade between the U.S., Mexico, and Canada. Investments in upgrading rail infrastructure and improving service reliability are supporting greater adoption, particularly for containerized and automotive freight, thereby driving regional growth.

U.S. Rail Logistics Market Trends

The U.S. rail logistics market held a dominant position in the region in 2024, supported by government-backed infrastructure programs and private investments aimed at modernizing rail networks. The growth of domestic e-commerce, energy exports, and agricultural shipments is fueling rail freight demand.

Europe Rail Logistics Market Trends

Europe rail logistics industry is expected to register a moderate CAGR from 2025 to 2030. Europe’s market is undergoing a transformation, propelled by the EU’s Green Deal policies and ambitious targets to shift freight from road to rail. Intermodal freight corridors connecting major ports and inland hubs are expanding, supported by cross-border harmonization and infrastructure upgrades. In addition, the focus on reducing carbon emissions and alleviating road congestion is boosting rail’s attractiveness for shippers.

The UK rail logistics market is expected to register a notable CAGR from 2025 to 2030, driven by rising demand for intermodal services linked to retail, e-commerce, and port traffic. Post-Brexit trade shifts are encouraging greater use of rail for inland distribution, particularly as logistics networks adapt to new customs procedures. Investments in electrification, digital signaling, and rail-linked warehousing are enhancing efficiency, which in turn is driving the country’s market growth.

The rail logistics market in Germany held a substantial market share in 2024. Germany remains the largest and most advanced rail logistics market in Europe, benefiting from its central position in the continent’s freight network. Strong government support for rail freight, combined with industrial demand from the automotive, chemicals, and manufacturing sectors, is sustaining growth.

Asia Pacific Rail Logistics Market Trends

The Asia Pacific rail logistics industry is anticipated to grow at a CAGR of 7.9% during the forecast period. The regional growth is fueled by expanding trade flows, infrastructure megaprojects, and supply chain diversification. China’s Belt and Road Initiative, along with investments in rail networks across Southeast Asia and India, is transforming the regional freight landscape.

India’s rail logistics market is expected to grow at the fastest CAGR during the forecast period. India’s rail logistics sector is entering a high-growth phase, supported by the government’s focus on modernizing infrastructure through projects such as the Dedicated Freight Corridors (DFC). Rising industrial output, agricultural exports, and the growth of e-commerce are boosting demand for efficient rail freight solutions.

The rail logistics market in China held a substantial market share in 2024. The government’s sustained investment in rail infrastructure, coupled with its Belt and Road Initiative, is expanding rail freight capacity and reducing transit times. High demand for automotive parts, electronics, and industrial goods is supporting strong intermodal freight growth. In addition, China’s carbon neutrality targets are accelerating the modal shift from road to rail, strengthening rail logistics as a pillar of the country's international trade strategy.

Key Rail Logistics Company Insights

Some of the key companies in the rail logistics industry include Union Pacific, Canadian National Railway, and BNSF Railway. These players are taking several strategic initiatives, such as new product launches, business expansions, partnerships, collaborations, and agreements, among others.

-

Union Pacific is a prominent company rail logistics market. The company provides a critical link in the global supply chain, offering diverse logistics solutions and serving a wide range of industries. Its network extends to major ports, gateways, and connects with other rail systems.

-

BNSF Railway offers a wide range of services and solutions for businesses seeking to ship freight by rail. The company has a vast network, strategic investments in infrastructure, and a focus on providing cost-effective and efficient transportation options.

Key Rail Logistics Companies:

The following are the leading companies in the rail logistics market. These companies collectively hold the largest market share and dictate industry trends.

- US Rail & Logistics

- CSX Transportation

- Union Pacific

- CEVA Logistics

- BNSF Railway

- DHL

- PLS Logistic Services

- Rhenus Group

- Canadian National Railway

- Rail Logistics, Inc.

Recent Developments

- In September 2024, Noatum Logistics, part of AD Ports Group and a prominent provider of logistics solutions, announced the launch of its rail logistics service in the Middle East. This offering provides weekly departures, each capable of transporting up to 78 Forty-Foot Equivalent Units or 156 Twenty-Foot Equivalent Units per trip in either direction using a single train. To ensure seamless end-to-end connectivity, the service can be enhanced with first- and last-mile trucking options based on client demand.

Rail Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 385.82 billion

Revenue forecast in 2030

USD 531.37 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, cargo type, end-use industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

US Rail & Logistics; CSX Transportation; Union Pacific; CEVA Logistics; BNSF Railway; DHL; PLS Logistic Services; Rhenus Group; Canadian National Railway; Rail Logistics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rail Logistics Market Report Segmentation

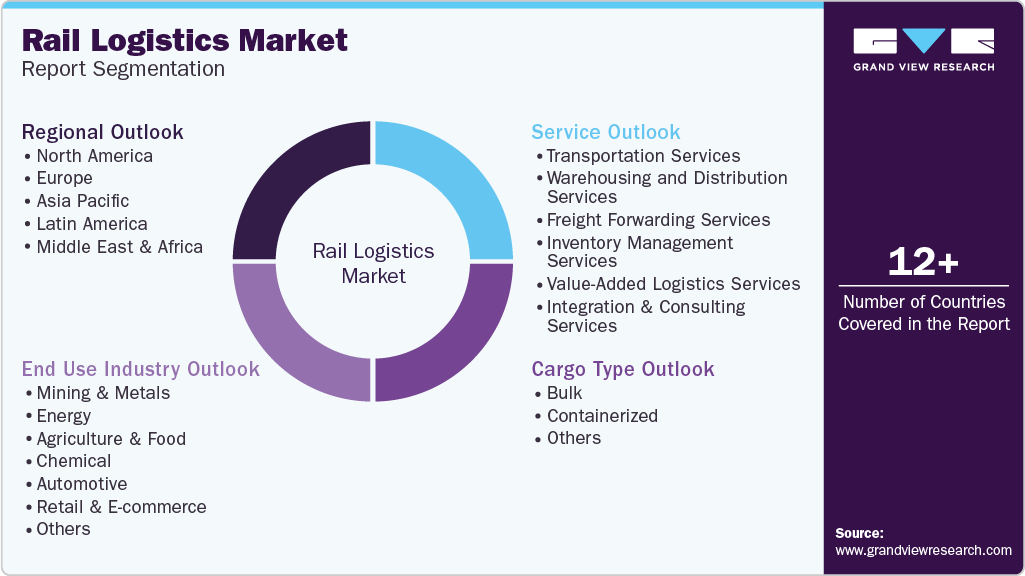

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rail logistics market report based on service, cargo type, end-use industry, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation Services

-

Warehousing and Distribution Services

-

Freight Forwarding Services

-

Inventory Management Services

-

Value-Added Logistics Services

-

Integration & Consulting Services

-

-

Cargo Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bulk

-

Containerized

-

Others

-

-

End Use Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Mining and Metals

-

Energy

-

Agriculture & Food

-

Chemical

-

Automotive

-

Retail & E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rail logistics market size was estimated at USD 372.77 billion in 2024 and is expected to reach USD 385.82 billion in 2025.

b. The global rail logistics market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 531.37 billion by 2030.

b. The transportation services segment accounted for the largest share of 29.6% in 2024. The segment growth is supported by expanding rail networks and increasing demand for cost-efficient, long-haul freight solutions.

b. Some key players operating in the rail logistics market include US Rail & Logistics, CSX Transportation, Union Pacific, CEVA Logistics, BNSF Railway, DHL, PLS Logistic Services, Rhenus Group, Canadian National Railway, and Rail Logistics, Inc.

b. The rail logistics market has been driven by several underlying drivers, most notably the growing demand for cost-efficient, bulk transportation solutions amid rising global trade volumes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.