- Home

- »

- Pharmaceuticals

- »

-

Rat Model Market Size, Share And Growth Report, 2030GVR Report cover

![Rat Model Market Size, Share & Trends Report]()

Rat Model Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Outbred, Knockout), By Technology (Embryonic Stem Cell, Microinjection), By Service, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-708-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global rat model market size was valued at USD 1.49 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2030. The growth of the market is attributed to a rise in the demand for medicines, which has facilitated the increase in research activities for better health. Moreover, the advent of gene engineering tools has allowed the use of genetic engineering in rat models. These genetically engineered mouse models (GEMM) are exhaustively used to identify as well as validate the pharmacokinetics and pharmacodynamics of therapeutics during pre-clinical and clinical trials. The increasing consumption of medicines and the consequent increase in the testing of drugs can drive the market in the forecast period.

The COVID-19 pandemic had a positive impact on the market growth. There was a heavy influx of investment and grants from both the government and key players towards the development of detection and treatment plans for COVID-19 infection. This increased spending was directly proportional to the increase in the research activities for the development of novel vaccines and diagnostics. For instance, in 2020, Mirimus Inc., a U.S.-based innovative animal model-generating company, announced its collaboration with an academic group of researchers. These researchers created a rat model with human ACE2 receptors to study the entry mechanism of the SARS-CoV-2 virus. Such initiatives demonstrate the growing use of the rat model for understanding disease pathogenicity and further developing therapeutics for treatment.

The use of rat models for disease experimentation and research has become more appropriate in the past few years. These models provide insights into human disease that others might not allow. Additionally, in the case of rats, their specific DNA and physiology have permitted researchers to discover a variety of pathophysiological and physiological mechanisms. Rats have since been used to answer an extensive range of scientific questions associated with human diseases in the fields of pharmacology, nutrition, physiology, toxicology, immunology, learning, and behavior. Moreover, the physiological similarity between the rat and human genomes has furthered the adoption of rat models in research.

Also, after developments in gene editing and gene targeting due to the advent of synthetic biology, it has been possible to modify the rat genome to produce knockin and knockout models. This is further improving the perception of human disease through the advancement of customized powerful CRISPR rat models. Moreover, these GEM rat models are likely to decline drug failure in clinical trials. As per a study published in The Conversation in February 2022, about 90% of drugs fail in the clinical trial stage, which often increases the development time and costs to market.

Additionally, substantial developments across most aspects of the production process of the rat model comprising technologies such as improved fertilized egg injection and ovulation promotion techniques will further support the industry's growth. Such improvements in genome editing tools have enabled the generation of more compound genetically modified models, which will bolster market growth. For instance, Cyagen’s CRISPR/Cas9-based services provide rapid knockout rats in as little time as 3-4 months.

The continuous use of rats in scientific procedures has drawn additional attention to the ethical use of these valued creatures. Strict legislation and rules for the use of animals for human benefits hamper the growth of the global market. One of these standards is illustrated by the National Advisory Committee for Laboratory Animal Research, Singapore, which has short yet thorough facts about the care and use of animals for research and scientific purposes.

Type Insights

The outbred segment held the largest revenue share of 28.48% in 2022. The outbred rats represent the genetic variations of humans more accurately, resulting in their vast use during preclinical research. This contributes to the larger share of outbred models. These outbred rats are phenotypically stable to a certain extent and also are less susceptible to differences in the environment, making them a right fit to mimic the genetic variations that eventually result in diseases. Key players such as Charles River Laboratories International Inc. have implemented genetic management programs for their rodent models in line with the International Genetic Standardization (IGS) program. This program ensures that rat models produced across the globe are of the same genetic profile.

The inbred segment accounted for a considerable share in 2022. The predominant use of the inbred rat model in toxicology studies and stable genome structure facilitates the growth of the segment. A toxicology study using a small number of inbred models of different strains can provide extensive data.

The knockout segment is expected to grow at the fastest CAGR of 8.95% over the forecast period owing to their higher genetic resemblance with humans. Knockout rats are largely used for experimentation for cardiovascular studies such as hypertension, stroke, and heart-related disease because of their large size and physiology. Moreover, they are also relevant for the study of nervous system diseases. With the rising prevalence of these cardiovascular and nervous system diseases, demand for knockout rats is also expected to grow. The advent of genome editing tools has facilitated the generation of knockout rat models. Moreover, owing to the presence of multiple players with a reduced turnaround time for the knockout model, it is expected to observe lucrative growth during the forecast period.

Technology Insights

The other technologies segment held the largest revenue share of 33.04% in 2022 and it is expected to grow at the fastest CAGR of 10.64% during the forecast period. The other technologies include CRISPR/CAS, ZFN, TALEN, and RNAi, among many others. The developments in synthetic biology and increased application of gene editing tools of aforementioned technologies among many other technologies during model creation are contributing to the segment growth. The ease of genetic manipulation via these molecular tools facilitates the rat model creation procedure efficiently with a shorter timeline for research breakthroughs.

Additionally, during the projected period, advanced genome editing tools are likely to observe the fastest growth. With the recognition of CRISPR-Cas9 in the 2020 Nobel Prize in Chemistry, biomedical research has been revolutionized. This editing tool has been employed to establish multiple rat models, which are used for drug-related studies. For instance, as per a review article published in October 2021, a series of knockout rat models has been generated for DMPK (drug metabolism and pharmacokinetics) studies by using the CRISPR-Cas9 method.

Furthermore, the use of microinjection to introduce these nucleases directly into the fertilized embryos eliminates the need for stem cell altercations and saves time. Companies are capitalizing on this market trend and offering custom rat model generation services. The model generation services are mediated by these aforementioned technologies, which ultimately boosts revenue generation in the market.

Service Insights

In 2022, breeding services segment held the largest revenue share of 31.73%. This is due to the increased demand for the rat model for experiments and research studies. The similarity in genome structure, behaviors, and easy handling are a few of the factors that contribute to the growth of the breeding segment. Moreover, the presence of inbred and outbred models to generate different genetic profiles contributes to revenue generation within this segment. Their wide application in various advanced research often requires mating schemes and genome management programs in rodent handling facilities, which further drives the market.

The cryopreservation service segment is estimated to grow at the fastest CAGR of 10.60% over the forecast period. This service includes the ultra-freezing of embryos, sperms, and even research strains of the rat, and creates a cost-effective plan to store and back up the required models with anticipated future use. These cryoservices also offer protection to the intended model in case of contamination, natural calamity, unintentional accident, and gene alteration or drift in later generations. Furthermore, the ease of recovering these cryopreserved stocks in 10-12 weeks drives the segment. For example, in a January 2020 published scientific article, researchers from Japan developed a satisfactory protocol for both cryopreservation of rat sperm and in-vitro fertilization. It was even demonstrated in the study that these frozen sperms yielded high fertilization rates.

Application Insights

The toxicology segment held the largest revenue share of 33.13% in 2022. Continuous demand for medicines and therapies led to growing investments by both the government and key healthcare players. This never-ending demand for innovative medications and therapeutics drives research activities to advance the health infrastructure. During the preclinical stage of any drug development, the rat model is employed in toxicology studies to assess the dosing regimen, optimal dose, route of administration, and many other parameters. Moreover, during these studies, the rat model helps in analyzing the functioning of organs and protein expression approaches during human treatments. Due to these factors, the application of the rat model in toxicology is massive.

The immunology segment is expected to grow at the fastest CAGR of 10.69% from 2023 to 2030 owing to the increase in chronic and infectious diseases. The COVID-19 pandemic also increased research activities and drug development required a huge number of rat models. As directed by the US FDA, it is required to verify the efficacy and safety of new candidates in animals before directing them to human clinical trials. Additionally, the development of multiple vaccines all across the globe for the COVID-19 virus demonstrated the usage rate of rats. Such importance of animal models in research and development programs bolsters the future growth of the market.

End-use Insights

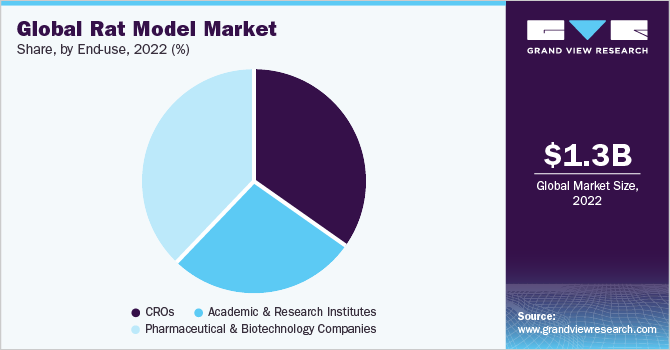

The pharmaceutical and biotechnology companies segment held the largest revenue share of 37.81% in 2022. The increased application of the rat model during the R&D pipeline and the production of drugs and vaccines for autoimmune disorders and infectious diseases have boosted revenue generation. Furthermore, key players are entering into exclusive partnerships and collaborations to increase the commercialization of innovative models for extensive use in research. For instance, in March 2022, Hera BioLabs announced an agreement with Charles River International Inc. for breeding and delivering its innovative SRG rat. This global license helps Hera BioLabs to commercialize its highly immunodeficient rats to a broader customer base.

The Contract Research Organizations (CROs) segment is expected to grow at the fastest CAGR of 9.41% during the forecast period. This growth can be attributed to the increase in outsourcing of preclinical and clinical testing by healthcare companies and the consequent rise in the number of CROs. With the presence of multiple product development programs and an aim to increase the market entry speed, pharma and biotech companies usually outsource their trials and testing on rat models to CROs. Moreover, the well-equipped facilities, trained professionals, and legal compliances in places make CROs an attractive option, thus contributing to the lucrative growth of the segment.

Regional Insights

North America held the largest revenue share of 48.79% in 2022. The growing prevalence of chronic conditions, the advent of novel infectious strains, and the rising healthcare economic burden in North America are likely to assist the research activities within the region. Growth in the number of research activities conducted by research and academic institutes is expected to fuel regional growth. For example, Simons Foundation Autism Research Initiative is collaborating with the Medical College of Wisconsin to generate and deliver engineered rat models of autism. This collaboration will cascade research activities for understanding autism in the future.

Asia Pacific is expected to grow at the fastest CAGR of 11.68 % over the forecast period. It is likely to be driven due to low research and labor costs. This probability of research at a lower cost in countries such as Japan and India is anticipated to stimulate industry growth in this region. The Chinese market held a considerable share in 2022 and is anticipated to retain its dominance over the forecast period due to growing government spending on the overall research and development of pharmaceuticals and a significant rise in the number of clinical trials using animal models.

Key Companies & Market Share Insights

The rat model market has been characterized by the presence of established and emerging players that provide different types and services of rat models. Launch of new gene editing technologies, mergers & acquisitions and collaborations & partnerships for global expansions further strengthen the market foothold of players. For example, in January 2022, an EA (Early Access) humanized immune system (HIS) mouse, huNOG-EXL, was launched by Taconic Biosciences. It is expected to expand the study window for immune-oncology research. In November 2021, Inotiv, a leading CRO in non-clinical and analytical drug discovery and development product and services, acquired Envigo, a global leading provider of research models and services In October 2021, The Jackson Laboratory announced their acquisition of Japan’s Charles River Laboratories, an outbred rat model supplier for biomedical research. This acquisition is expected to improve drug discoveries and research.

In March 2020, Cyagen Biosciences announced that it has launched a new knockout catalog model to be used in research, which offers economic and efficient options. This newly launched catalog is available in the U.S. and Europe and allows the company to broaden its customer base and expand its services in these regions. Such initiatives by new players increase global competition and create the opportunity for novel developments by other players, thereby driving the market. Some prominent players in the global rat model market include:

-

Charles River Laboratories

-

Envigo

-

genOway

-

Laboratory Corporation of America Holdings (LabCorp)

-

Janvier Labs

-

Taconic Biosciences, Inc.

-

TransViragen, Inc.

-

Biomere

-

Cyagen Biosciences

Rat Model Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.65 billion

The revenue forecast in 2030

USD 2.41 billion

Growth rate

CAGR of 7.1 % from 2024 to 2030

The base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Type, technology, service, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Charles River Laboratories; genOway; TransViragen, Inc.; Laboratory Corporation of America Holdings (LabCorp); Janvier Labs; Taconic Biosciences, Inc.; Biomere; Cyagen Biosciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.

Global Rat Model Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global rat model market report based on type, technology, service, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Knockout

-

Outbred

-

Inbred

-

Hybrid

-

Immunodeficient

-

Conditioned

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Nuclear Transferase

-

Microinjection

-

Embryonic Stem Cell

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Cryopreservation

-

Breeding

-

Re-derivation

-

Genetic Testing

-

Quarantine Depending

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Neurology

-

Immunology

-

Toxicology

-

Other

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

CROs

-

Academic and Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global rat model market size was estimated at USD 1.32 billion in 2022 and is expected to reach USD 1.5 billion in 2023.

b. The global rat model market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 2.41 billion by 2030.

b. North America dominated the rat model market with a share of 48.8% in 2022. This is attributed to rising incidence of chronic conditions, introduction of new infectious strains, and growing healthcare economic burden.

b. Some key players operating in the rat model market include genOway, Charles River Laboratories International, Inc., Envigo, Covance Inc., Horizon Discovery Group plc, Janvier Labs, Taconic Biosciences, Inc., and Biomedical Research Models (Biomere).

b. Key factors that are driving the market growth include growing development of new medical devices and biotechnological products coupled with rising number of new players coming up with innovative healthcare solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.