- Home

- »

- Consumer F&B

- »

-

Ready To Drink Coffee Market Size, Industry Report, 2030GVR Report cover

![Ready To Drink Coffee Market Size, Share & Trends Report]()

Ready To Drink Coffee Market (2025 - 2030) Size, Share & Trends Analysis Report By Packaging (Bottles, Cans, Cartons), By Nature (Conventional, Organic), By Distribution Channel (B2B, B2C), By Region (North America, APAC, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-551-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ready To Drink Coffee Market Summary

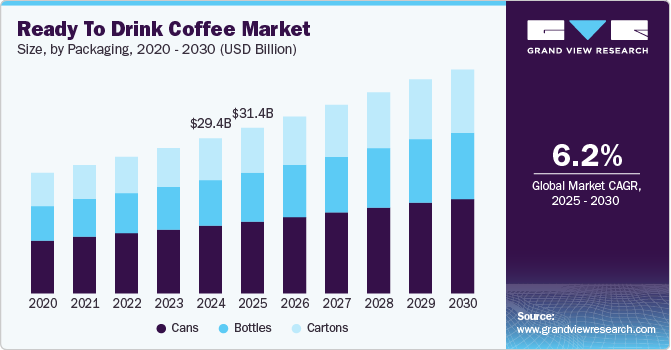

The global ready to drink coffee market size was estimated at USD 29.44 billion in 2024 and is projected to reach USD 42.46 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. The market is expected to grow owing to factors such as increased adoption of coffee culture, lifestyle changes, busy schedules, which are increasing demand for ready-to-drink beverages, and a rise in health-conscious consumers.

Key Market Trends & Insights

- The Ready To Drink coffee industry in North America held over 27.29% of the global revenue in 2024.

- The RTD coffee industry in the U.S. is expected to grow at a CAGR of 5.6% from 2025 to 2030.

- Based on packaging, the canned RTD coffee held a revenue share of 43.63% in 2024.

- Based on nature, the conventional RTD coffee segment held a revenue share of 95.64% of the global revenue in 2024.

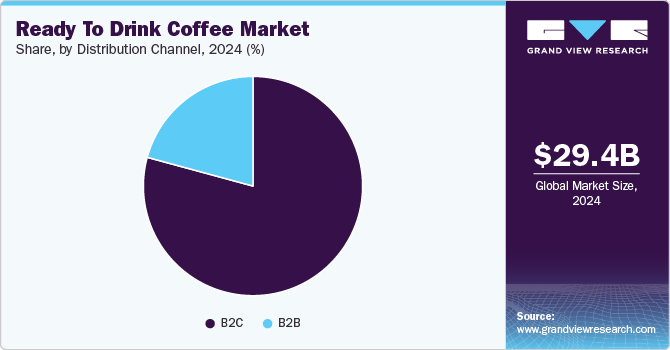

- Based on distribution channel, the sales of RTD coffee through B2C channels held a global revenue share of 79.22% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 29.44 Billion

- 2030 Projected Market Size: USD 42.46 Billion

- CAGR (2025-2030): 6.2%

- North America: Largest market in 2024

In addition, companies are constantly innovating the product by introducing new flavors to enhance its appeal to consumers across boundaries, which, in turn, are contributing to the market growth of RTD coffee.

Lifestyle changes, busy routines, and increased Western influence contribute to the growth of the market. These factors have augmented coffee culture adoption, contributing to market growth. This augmented adoption of the culture and high demand for coffee encourages companies and brands to serve cold beverages that appeal to most consumers. This growth in demand is further fueled by the evolution of e-commerce and social media platforms, which are attracting young consumers to ready-to-drink coffee. Moreover, due to the health benefits of coffee, such as its rich source of antioxidants and low-calorie alternatives, the category has attracted a rising number of health-conscious consumers, which helps in the market growth of RTD coffee.

The increasing population of millennials and Gen Z is a significant factor in the market growth of RTD coffee. According to the Qureos data published in August 2024, the Gen Z population represents nearly 32% of the global population. To meet the evolving needs and demands of young consumers, the brands are introducing ready-to-drink beverages in the market. For instance, according to the BeverageDaily article published in January 2023, Gen Z consumers are inclined towards ready-to-drink coffee compared to traditional hot brew coffee. Such rising evolution, coupled with high coffee consumption, is expected to boost market growth.

The evolving lifestyles and busy routine lifestyles have given rise to health-conscious consumers. This rise in health awareness has created an opportunity for companies to formulate healthy alternatives to the beverage, resulting in higher coffee consumption daily. For instance, according to Levista data published in February 2024, over 2.25 billion people consume coffee as it improves productivity and focus. In addition, the antioxidant in coffee enhances its consumption; for instance, according to the MedicineNet, Inc. data published in March 2023, coffee aids colon digestion, reducing the hazardous impact of carcinogenic compounds on colon tissue. Thus, the lifestyle changes and health benefits of coffee make it a suitable alternative for health-conscious consumers.

The market growth is expected to rise owing to factors such as increased health-conscious consumers, lifestyle changes, and a growing population of young consumers, thereby augmenting the demand for RTD coffee. The rising demand for coffee is encouraging companies to innovate coffee into attractive choices. The RTD coffee is available in the market with a wide array of options, including classic coffee, French vanilla variant, hazelnut coffee, and salted caramel, to name a few. The key players in the category are innovating and launching attractive new products to enhance their appeal to consumers. For instance, in July 2024, Starbucks Corporation launched a new ready-to-drink protein drink imbibed with coffee, attracting health-conscious consumers. The drink is available in scrumptious flavors, including caffe latte, chocolate mocha, and caramel hazelnut. Such product innovations are expected to strengthen the market growth in the RTD coffee category.

Packaging Insights

The canned RTD coffee held a revenue share of 43.63% in 2024. The segment growth is associated with factors such as the convenience of storage, enhancing the portability of the product, appealing to consumers with busy schedules requiring coffee on the go, and maintaining the freshness of the coffee in air-tight container packaging, in turn enhancing the shelf-life. In addition, it offers a sustainable alternative as aluminum cans can be recycled back to their original form, unlike plastics. Companies are encouraged to use aluminum cans to store RTD beverages. For instance, in March 2023, a new campaign called Canifesto was launched by RTD brands to promote the use of cans to store beverages, emphasizing the sustainable angle. Such growing instances are expected to boost market growth.

The carton RTD coffee is expected to grow at a CAGR of 7.0% from 2025 to 2030. The growth of the segment can be attributed to the benefits offered by the packaging style, as it offers portability, convenience, and cost-effectiveness. According to the data published by MTPak Coffee, the cartons are of a suitable packaging style for cold brew coffee as it reduces shipping costs and requires less packaging material. In addition, paper can be recycled which also proves a sustainable alternative to plastic packaging. Moreover, it proves advantageous for the companies to brand their product in attractive packaging, enhancing their appeal to the targeted consumers. The advantages the carton packaging provides also contribute to the growth of the market.

Nature Insights

The conventional RTD coffee segment held a revenue share of 95.64% of the global revenue in 2024, driven by factors like convenience, affordability, and a wider range of flavors and formulations. Consumers, particularly in developing markets, are drawn to its lower price point and accessibility in mainstream retail outlets. Furthermore, innovative flavor combinations, energy-boosting additives, and collaborations with popular brands are constantly being introduced to cater to a broad spectrum of consumer preferences, solidifying its position as a readily available and satisfying caffeine source for immediate consumption. For instance, Monster Energy Company launched a new RTD cold brew coffee in June 2022, which is available in latte and sweet black flavors. In addition, price-conscious consumers prefer conventional coffee due to its easy availability, effective taste, and reasonable pricing.

Organic RTD coffee is expected to grow at a CAGR of 9.1% from 2025 to 2030. Organic cold brew coffee is made without synthetic raw materials and is free from chemicals such as pesticides and fertilizers. Health-conscious consumers are willing to pay a higher price for chemical-free products over conventional coffee products. Furthermore, organic RTD coffee is available with various organic certifications, which attract the attention of high-end consumers, and companies offer such products in the market to meet the rising demand. For instance, Blue Bottle Coffee, Inc. has made its RTD coffee available in an organic form with USDA certification to enhance its authenticity. Such rising demand from consumers coupled with health-conscious lifestyles are leading consumers to the market, which is expected to grow over the years.

Distribution Insights

The sales of RTD coffee through B2C channels held a global revenue share of 79.22% in 2024. Supermarkets and hypermarkets offer a wide range of products in this category, allowing consumers to choose according to their preferences. These distribution channels perform well in terms of sales due to their wide range of products available in various brands, various flavored RTD coffee options, and different packaging styles. These advantages give consumers the edge in making quick decisions with attractive discounted pricing. The companies, looking at the rising demand in the category, are making their products available in supermarkets and hypermarkets. For instance, Bones Coffee Company announced the launch of RTD coffee cold brews in July 2024. These newly launched products will be available in five attractive variations and will also be available to consumers at Walmart. Such new product launches made available in supermarkets and hypermarkets are expected to boost market growth.

The sales of RTD coffee through the B2B channel are expected to grow at a CAGR of 5.5% from 2025 to 2030. The offices and hotels & restaurants contribute to sales growth through B2B distribution channels. The commercial offices are equipped with vending machines through which employees can enjoy RTD coffee, which improves productivity and increases attention span. Furthermore, factors such as increased disposable income, rise in tourism, and lifestyle alterations, hotels & restaurants offer various RTD coffee options appealing to the consumers. The hotels & restaurants offer fancy options in the RTD coffee beverage range of products and are involved in making their presence in QSRs and hotels. For instance, Kings Coffee, in August 2022, made its mark in the RTD coffee space by planning for B2B collaborations with QSRs and hotels. Such rising instances are expected to boost market growth.

Regional Insights

The Ready To Drink (RTD) coffee industry in North America held over 27.29% of the global revenue in 2024. The high coffee culture's existence augments factors such as convenience and portability, high product innovations, and a wide range of RTD coffee beverages available, and the rising young consumer population, such as millennials and Gen Z, adds to the ripe market. The strong presence of key companies offering RTD coffee further offers market growth in the region. For instance, in June 2024, Westrock Coffee Company launched the largest RTD manufacturing unit in North America. The product launches and huge investments by the giant companies enhance the growth of the market.

U.S. RTD Coffee Market Trends

The RTD coffee industry in the U.S. is expected to grow at a CAGR of 5.6% from 2025 to 2030. The market growth in the country can be attributed to the core coffee culture and high coffee consumption by Americans. In addition, the country hosts several cafes and restaurants offering the instant gush of energy to corporate employees, ready-to-drink beverage enthusiasts, and young consumers. For instance, according to the National Coffee Association of U.S.A., Inc. data published in April 2024, daily coffee consumption has risen by 37% since 2004. For instance, according to a report published by the National Coffee Association in September 2024, 21% of coffee consumers believed cold brew is a healthier kind compared to other coffee types. Furthermore, ready-to-drink coffee is now the third most popular coffee method among specialty coffee enthusiasts, rising by 83% since 2023, according to the SCA (Specialty Coffee Association) report published in June 2023.

Europe RTD Coffee Market Trends

The Europe RTD coffee industry is expected to grow at a CAGR of 6.7% from 2025 to 2030. The rising population of millennials and Gen Z consumers, increased tourism in the region coupled with several cafes with high adoption of coffee contribute to the growth of the market. The rising demand for RTD coffee is encouraging companies in the region to collaborate and acquire RTD's growing brand in the product category. For instance, Britvic plc, in July 2023, acquired the fastest-growing RTD coffee brand, Jimmy's Iced Coffee, to expand its portfolio. This acquisition will enable Britvic plc to enhance the growth of Jimmy’s Iced Coffee, utilizing its customer relationships and increasing efficiency through the supply chain. The higher activities of key players in the region are expected to accelerate the growth of the market.

Asia Pacific RTD Coffee Market Trends

The Asia Pacific RTD coffee industry is expected to grow at a CAGR of 6.3% from 2025 to 2030. The increased influence of Western trends, the evolution of internet connectivity that paved the way for the rise of social media, and the high adoption of coffee culture in the region contribute to the market growth. In addition, the warm and humid climate further accelerates the demand for cold brew and RTD cold coffee alternatives. The urbanization and smart city developments coupled with busy routine lifestyles add to the rising demand for RTD coffee in the region. Key companies are strategizing to make their presence in the RTD coffee category and serve the target consumers. For instance, Rage Coffee launched RTD coffee variants in March 2023 in delicious flavors, including mocha frappe, salted caramel, and hazelnut latte. Companies innovating and launching new products in the category enhance market growth.

Key Ready To Drink Coffee Company Insights

The global ready-to-drink coffee industry is characterized by numerous well-established and emerging players. Manufacturers are continually introducing new products to capture consumer interest. This includes a variety of ready-to-drink coffee beverages such as classic, vanilla, hazelnut, and caramel coffee options. For instance, brands such as Ueshima Coffee Company, based in Japan, have launched two new RTD coffees in the UK market in iced latte and iced matcha latte variants. Moreover, the companies are embracing sustainability in product packaging and adopting aluminum cans as they are recyclable. In addition, various companies are strategizing to enter the lucrative space by launching new products, acquiring RTD coffee brands, and launching manufacturing facilities to accelerate market growth.

Key Ready To Drink Coffee Companies:

The following are the leading companies in the ready to drink coffee market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- Starbucks Coffee Company

- Sleepy Owl Coffee

- Tata Consumer Products Limited

- Kings Coffee

- Rage Coffee

- Costa

- Tim Hortons

- Blue Bottle Coffee, Inc.

- Inspire Brands, Inc. (Dunkin’)

Recent Developments

-

In April 2023, Chamberlain Coffee launched new products in the RTD coffee space by introducing plant-based RTD cold brew lattes and collaborating with Walmart.

-

In June 2023, Tata Consumer Products Limited introduced RTD cold coffee in three variants, including classic, mocha, and hazelnut. The new product launch will enable the company to offer the coffee experience to the target consumers.

-

In March 2023, The Coca‑Cola Company partnered with Inspire Brands, Inc. (Dunkin’) to expand the latter company's relationship into the RTD coffee line of products into cans packaging style. The RTD coffee product line includes various flavors parallel to their donuts, including brownie batter donuts, cake batter donuts, and coffee cake muffins.

Ready To Drink Coffee Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 31.43 billion

Revenue forecast in 2030

USD 42.46 billion

Growth Rate (Revenue)

CAGR of 6.2% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Packaging, nature, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Nestlé; Starbucks Coffee Company; Sleepy Owl Coffee; Tata Consumer Products Limited; Kings Coffee; Rage Coffee; Costa; Tim Hortons; Blue Bottle Coffee, Inc.; Inspire Brands, Inc. (Dunkin’)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ready To Drink Coffee Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ready to drink coffee market report based on packaging, nature, distribution channel, and region.

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Cartons

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2C

-

Grocery Stores/Supermarkets

-

Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Online Direct-to-Consumer (DTC)

-

Others

-

-

B2B

-

Cafes

-

Hotels & Restaurants

-

Offices

-

Bakeries and Coffee Shops

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ready to drink coffee market size was valued at USD 29.44 billion in 2024 and is expected to reach USD 31.43 billion in 2025.

b. The global ready to drink coffee market is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2030 to reach USD 42.46 billion by 2030.

b. The canned RTD coffee accounted for a revenue share of 43.63% in 2024. The segment growth is associated with factors such as the convenience of storage, enhancing the portability of the product, appealing to consumers with busy schedules requiring coffee on the go, and maintaining the freshness of the coffee in air-tight container packaging, in turn enhancing the shelf-life. In addition, it offers a sustainable alternative as aluminum cans can be recycled back to their original form, unlike plastics. Companies are encouraged to use aluminum cans to store RTD beverages. For instance, in March 2023, a new campaign called Canifesto was launched by RTD brands to promote the use of cans to store beverages, emphasizing the sustainable angle. Such growing instances are expected to boost market growth.

b. Some of the key players operating in the global RTD coffee market include Nestlé; Starbucks Coffee Company; Sleepy Owl Coffee; Tata Consumer Products Limited; Kings Coffee; Rage Coffee; Costa; Tim Hortons; Blue Bottle Coffee, Inc.; Inspire Brands, Inc. (Dunkin’)

b. The RTD coffee market is expected to grow owing to factors such as increased adoption of coffee culture, lifestyle changes, busy schedules, which are rising demand for ready-to-drink beverages, and a rise in health-conscious consumers. In addition, companies are constantly innovating the product by introducing new flavors to enhance its appeal to consumers across boundaries, which in turn are contributing to the market growth of RTD coffee.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.