- Home

- »

- Plastics, Polymers & Resins

- »

-

Ready-To-Drink Packaging Market Size, Industry Report 2033GVR Report cover

![Ready-To-Drink Packaging Market Size, Share & Trends Report]()

Ready-To-Drink Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Glass, Plastic, Paper & Paperboard, Metal), By Product (Cans, Cartons, Bottles, Pouches), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-687-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ready-To-Drink Packaging Market Summary

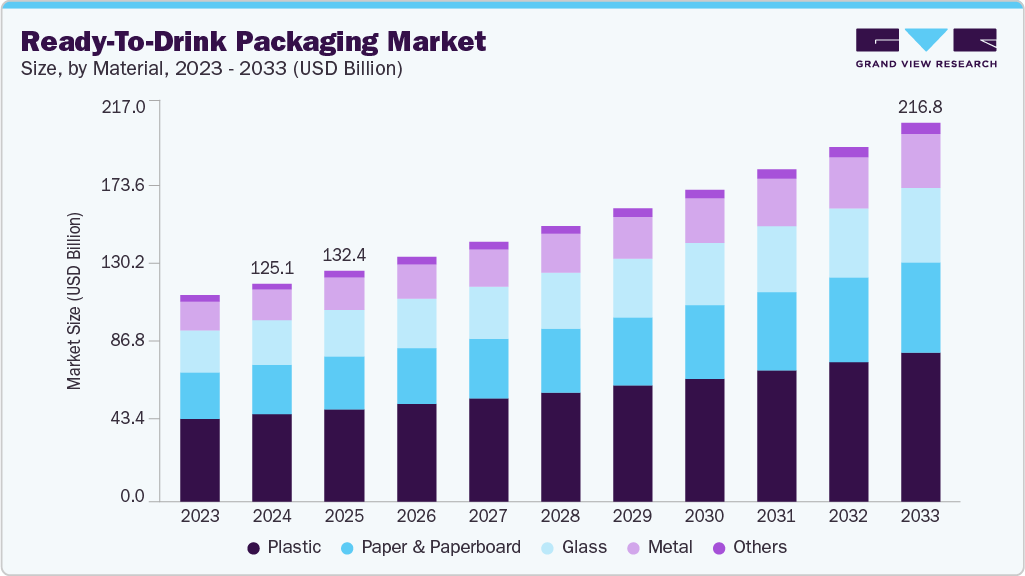

The global ready-to-drink packaging market size was estimated at USD 125.10 billion in 2024 and is expected reach USD 216.79 billion by 2033 at a CAGR of 6.4% from 2025 to 2033. Rising consumer demand for convenience and on-the-go consumption is driving the global ready-to-drink packaging market.

Key Market Trends & Insights

- North America dominated the ready-to-drink packaging market with the largest revenue share of over 38.0% in 2024.

- The ready-to-drink packaging market in China is expected to grow at a substantial CAGR of 7.3% from 2025 to 2033.

- By material, the paper & paperboard segment is expected to grow at a considerable CAGR of 7.0% from 2025 to 2033 in terms of revenue.

- By Product, the pouches segment is expected to grow at a considerable CAGR of 7.0% from 2025 to 2033 in terms of revenue.

- By end use, the plant-based beverages segment is expected to grow at a considerable CAGR of 8.0% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 125.10 Billion

- 2033 Projected Market Size: USD 216.79 Billion

- CAGR (2025-2033): 6.4%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Market over 2025 to 2033

Moreover, increased health awareness and the growing popularity of functional beverages are fueling market growth. Consumers across the globe are increasingly seeking healthier and functional beverage options that align with active lifestyles. This trend has significantly boosted demand for RTD products like protein shakes, cold brew coffees, functional teas, and vitamin-infused waters. Packaging that supports on-the-go consumption, such as PET bottles, cartons, and aluminum cans, is being prioritized by manufacturers to meet this demand. For example, Nestlé’s RTD protein shakes and PepsiCo’s LifeWTR emphasize not only functional benefits but also portability and aesthetic appeal, driving innovation in health-conscious, single-serve packaging formats.With urban populations growing and consumer lifestyles becoming busier, there's a growing preference for ready-to-consume beverages that require no preparation. This shift is particularly evident among millennials and Gen Z consumers in metropolitan areas, who value time-saving, portable beverage options. RTD packaging offers the necessary convenience by enabling easy storage, handling, and disposal, all while maintaining product shelf life. Brands such as Starbucks and The Coca-Cola Company are expanding their RTD coffee and tea offerings in compact formats (e.g., 250ml PET bottles or Tetra Paks) specifically designed for on-the-go consumption.

The growth of online grocery platforms and delivery apps has created new distribution channels for RTD beverages, which require robust, attractive, and protective packaging. RTD products sold online often face longer transit times and handling, demanding packaging that ensures durability without compromising aesthetics. Manufacturers are leveraging shelf-ready packaging (SRP), multi-pack cartons, and lightweight flexible pouches to appeal to digital consumers. For instance, La Colombe uses sleek aluminum RTD coffee cans with minimalistic branding, optimizing their appearance for online marketplaces such as Amazon and Walmart.

Environmental concerns and regulatory pressures have prompted RTD brands to adopt sustainable packaging practices, which in turn enhance brand reputation and consumer loyalty. The use of recyclable PET bottles, paper-based cartons and compostable pouches is growing steadily. Many beverage companies are adopting circular economy models, such as refillable or returnable packaging. For example, Coca-Cola’s 100% recycled PET bottles for some of its RTD drinks signal a broader industry shift. These sustainable packaging efforts resonate with environmentally conscious consumers, acting as both a competitive differentiator and a market driver.

Market Concentration & Characteristics

The RTD packaging market is characterized by high product differentiation. Beverage manufacturers invest heavily in branding and packaging to stand out in a crowded shelf space. Packaging serves not only functional purposes (protection, portability, shelf life) but also acts as a marketing tool. For instance, unique shapes, bold graphics, and limited-edition labels help drive impulse purchases. RTD alcoholic and functional drinks often use premium glass bottles or metallic finishes to signal quality and exclusivity.

Innovation is a core aspect of the industry, with continuous development in materials (bio-based plastics, paper-based bottles), features (resealable caps, tamper-evident seals), and formats (single-serve, multipacks). There’s a strong push toward eco-friendly packaging solutions, driven by consumer demand and environmental regulations. Lightweight, recyclable, and biodegradable materials are becoming the norm. For example, brands are shifting from multi-layer PET to mono-materials to enhance recyclability.

Material Insights

The plastic segment recorded the largest market revenue share of over 40.0% in 2024. Plastic, especially PET (Polyethylene Terephthalate), is widely used in the RTD segment due to its lightweight, durability, design flexibility, and low production costs. It is commonly used for water, carbonated soft drinks, iced teas, and flavored juices. PET bottles also support high-speed production and filling lines, making them a cost-effective choice for manufacturers. Plastic dominance is fueled by its affordability, convenience for on-the-go consumption, and adaptability across various RTD beverage types.

The paper & paperboard segment is expected to grow at the fastest CAGR of 7.0% during the forecast period. Paper & paperboard are primarily used in carton-based RTD packaging, especially for dairy beverages, juices, and plant-based drinks. These materials offer good barrier properties when combined with plastic or aluminum layers and are favored for their renewable source and ease of branding due to printable surfaces. The growing consumer demand for sustainable, biodegradable, and renewable packaging is driving the paper & paperboard segment. In addition, stringent regulations against single-use plastics, especially in Europe, are pushing beverage brands to switch to paper-based RTD packaging options such as Tetra Pak and SIG cartons.

Product Insights

The bottles segment recorded the largest market revenue share of over 42.0% in 2024. Bottles, particularly PET and glass bottles, are dominant in the RTD packaging market due to their versatility, reusability, and ability to protect product integrity. They are used for water, juices, dairy beverages, cold brews, and alcoholic RTDs. PET bottles remain popular due to their affordability, light weight, and suitability for high-speed filling lines. Rising consumption of bottled iced coffee, flavored water, and sports drinks is driving demand. Innovations in lightweighting and rPET usage (recycled PET) are supporting environmental goals and reducing carbon footprints.

The pouches segment is expected to grow at the fastest CAGR of 7.0% during the forecast period. Pouches, including stand-up and spouted types, offer flexible and portable packaging solutions for a variety of RTD beverages, especially those targeting kids and on-the-go consumers. They use significantly less material than rigid formats. Increasing preference for lightweight, resealable, and space-saving packaging is accelerating the demand for pouches. Their adaptability for single-serve formats, especially for smoothies and kids’ drinks, aligns with the rising convenience trend. Cost-effectiveness in production and transport further enhances their market growth.

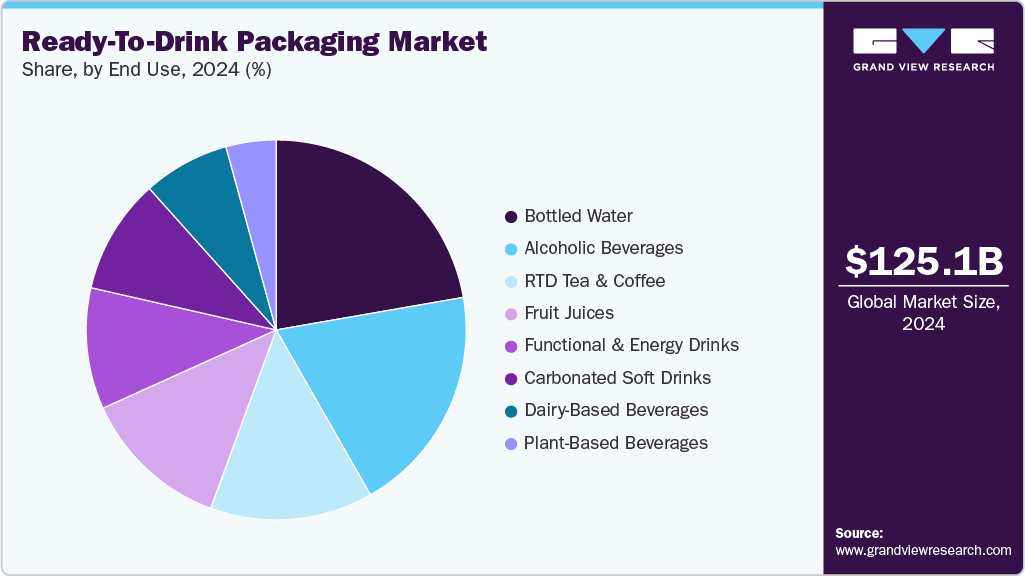

End Use Insights

The bottled water segment recorded the largest market share of over 22.0% in 2024. RTD bottled water is packaged for instant consumption and includes still, sparkling, flavored, and mineral water. It remains one of the most consumed RTD beverages worldwide due to its health and hydration benefits. Rising health awareness, urbanization, and concerns over tap water safety in developing regions are key factors. Moreover, innovative eco-friendly packaging solutions (e.g., rPET bottles, paper-based bottles) and value-added variants such as vitamin-enriched water are gaining traction.

The plant-based beverages segment is projected to grow at the fastest CAGR of 8.0% during the forecast period. This segment includes soy, almond, oat, rice, and coconut milk-based drinks. Often used as dairy alternatives, they come in flavored and unflavored formats, catering to vegans and lactose-intolerant consumers. The growing vegan population, lactose intolerance, and environmental concerns are primary drivers. Product innovations in flavors and added nutritional benefits (e.g., calcium, B12) and eco-conscious packaging are strengthening this segment’s footprint in the RTD packaging market.

Region Insights

North America dominated the market and accounted for the largest revenue share of over 38.0% in 2024. North America leads in RTD packaging innovation, driven by high consumer demand for health-focused and on-the-go beverages. The U.S. and Canada are seeing a rise in cold brew coffee, sparkling water, and CBD-infused drinks, requiring advanced packaging such as aluminum cans (popularized by brands such as LaCroix) and resealable PET bottles. The region’s strict food safety regulations also push manufacturers toward tamper-evident and BPA-free packaging. Furthermore, sustainability trends are boosting the use of biodegradable materials, as seen with Coca-Cola’s paper-based bottle trials and PepsiCo’s shift to 100% recycled plastic for its RTD products.

U.S. Ready-To-Drink Packaging Market Trends

The U.S. growth in the RTD packaging market is driven by trends in health-conscious and premium beverages. The success of brands such as Bang Energy (in cans) and Starbucks’ RTD coffee (in glass bottles) highlights the demand for varied packaging formats. The hard seltzer boom, led by White Claw, has popularized slim aluminum cans, while sustainability initiatives push companies such as Keurig Dr Pepper toward 100% recyclable materials. The convenience store culture also fuels demand for grab-and-go bottle designs with enhanced durability.

Europe Ready-To-Drink Packaging Market Trends

Europe’s RTD packaging market is shaped by stringent environmental regulations and a strong preference for sustainable solutions. The EU’s Single-Use Plastics Directive has accelerated the adoption of glass bottles, aluminum cans, and compostable materials for RTD beverages. Germany and UK are seeing growth in functional and organic drinks, with brands such as Innocent Drinks using recycled PET bottles. In addition, the popularity of carbonated soft drinks and hard seltzers in Scandinavia is driving demand for lightweight, recyclable cans, as seen with Norwegian brand Oskar Blues.

Asia Pacific Ready-To-Drink Packaging Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 7.1% over the forecast period. This positive outlook is due to rapid urbanization, a growing middle class, and increasing demand for convenience beverages. Countries such as China, India, and Japan are witnessing a surge in RTD tea, coffee, and functional drinks, prompting innovations in lightweight, eco-friendly, and portable packaging. For example, Japan’s vending machine culture and China’s booming e-commerce sector have accelerated demand for durable, single-serve packaging solutions. In addition, sustainability concerns are pushing brands to adopt recyclable materials, such as Tetra Pak for plant-based beverages in Southeast Asia.

Key Ready-To-Drink Packaging Company Insights

The competitive environment of the ready-to-drink (RTD) packaging market is characterized by intense rivalry among both global and regional players striving to innovate in packaging formats, materials, and sustainability. Key players such as Amcor plc, Tetra Pak, Ball Corporation, ALPLA, and SIG are competing on the basis of lightweight packaging, extended shelf life, convenience, and recyclability. The market is highly influenced by consumer demand for eco-friendly, portable, and single-serve formats, prompting companies to invest in R&D and advanced manufacturing technologies. In addition, strategic partnerships, mergers & acquisitions, and geographic expansions are common as companies aim to enhance their market share and respond quickly to evolving consumer preferences and beverage trends.

-

In August 2024, ALPLA, a global company in plastic packaging, launched a new line of PET bottles that boast a premium, glass-like appearance, targeting the beverage sector with a sustainable and visually appealing alternative to traditional glass. These innovative bottles, already introduced for mineral water brands in Poland, are designed to closely mimic the look and feel of glass while offering significant advantages such as being lightweight, shatterproof, and fully recyclable.

-

In August 2024, Berry Global Inc. partnered with Norwegian brand Aquafigure to launch a new line of reusable 330ml water bottles designed to encourage water consumption among young people through customizable, interchangeable 3D artwork cards. Made from BPA-free Tritan, a recyclable and food-approved copolyester. Production is handled at Berry’s facilities in the Netherlands and England, with a focus on ensuring a secure yet child-friendly seal. The partnership aims to deliver a “bottle for life” solution, advancing both sustainability and consumer engagement as Aquafigure expands into new markets.

Key Ready-To-Drink Packaging Companies:

The following are the leading companies in the ready-to-drink packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Ball Corporation

- Tetra Pak

- Berry Global Inc.

- ALPLA

- Smurfit Westrock

- Crown

- SIG

- Silgan Plastics

- Ajanta Bottle

- Graham Packaging

- Toyo Seikan Group Holdings, Ltd.

Ready-To-Drink Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 132.43 billion

Revenue forecast in 2033

USD 216.79 billion

Growth rate

CAGR of 6.4% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Mexico; Canada; Germany; France; UK; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Amcor plc; Ball Corporation; Tetra Pak; Berry Global Inc.; ALPLA; Smurfit Westrock; Crown; SIG; Silgan Plastics; Ajanta Bottle; Graham Packaging; Toyo Seikan Group Holdings, Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ready-To-Drink Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ready-to-drink packaging market report based on material, product, end use, and region:

-

Material Outlook (Revenue, USD Million 2021 - 2033)

-

Glass

-

Plastic

-

Paper & Paperboard

-

Metal

-

Others

-

-

Product Outlook (Revenue, USD Million 2021 - 2033)

-

Cans

-

Cartons

-

Bottles

-

Pouches

-

Others

-

-

End Use Outlook (Revenue, USD Million 2021 - 2033)

-

Alcoholic Beverages

-

RTD Tea & Coffee

-

Bottled Water

-

Fruit Juices

-

Dairy-Based Beverages

-

Plant-Based Beverages

-

Carbonated Soft Drinks

-

Functional & Energy Drinks

-

-

Region Outlook (Revenue, USD Million 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ready-to-drink packaging market was estimated at around USD 125.10 billion in the year 2024 and is expected to reach around USD 132.43 billion in 2025.

b. The global ready-to-drink packaging market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2033 to reach around USD 216.79 billion by 2033.

b. The bottled water segment emerged as the dominating end use segment in the ready-to-drink packaging market due to increasing health consciousness and rising demand for safe, on-the-go hydration.

b. The key players in the ready-to-drink packaging market include Amcor plc; Ball Corporation; Tetra Pak; Berry Global Inc.; ALPLA; Smurfit Westrock; Crown; SIG; Silgan Plastics; Ajanta Bottle; Graham Packaging; and Toyo Seikan Group Holdings, Ltd.

b. Rising consumer demand for convenience and on-the-go consumption is driving the global ready-to-drink packaging market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.