- Home

- »

- Plastics, Polymers & Resins

- »

-

Recyclable 3D Printing Filament Market Size Report, 2033GVR Report cover

![Recyclable 3D Printing Filament Market Size, Share & Trends Report]()

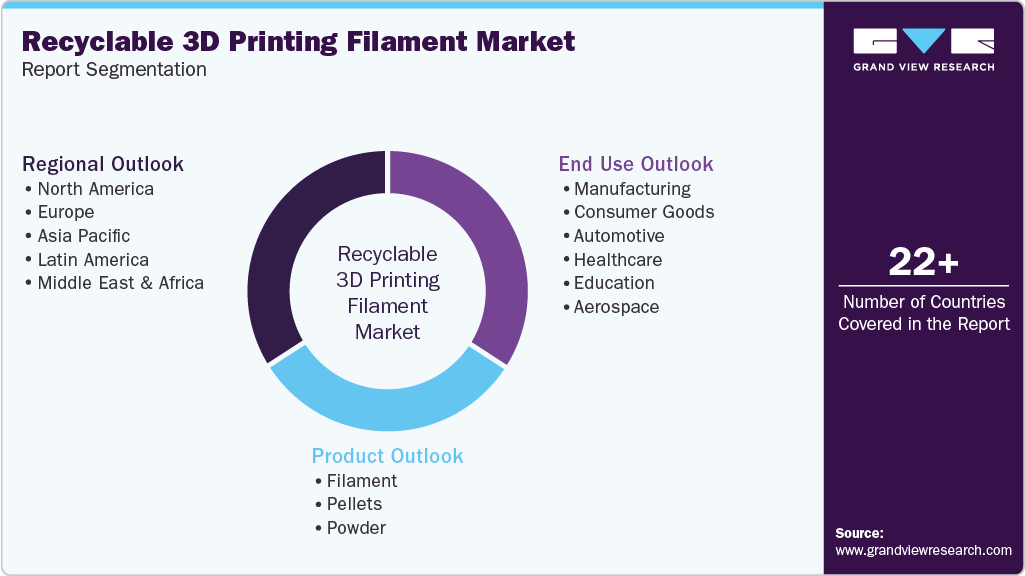

Recyclable 3D Printing Filament Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Filament, Pellets, Powder), By End Use (Manufacturing, Consumer Goods, Education, Automotive, Aerospace, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-796-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recyclable 3D Printing Filament Market Summary

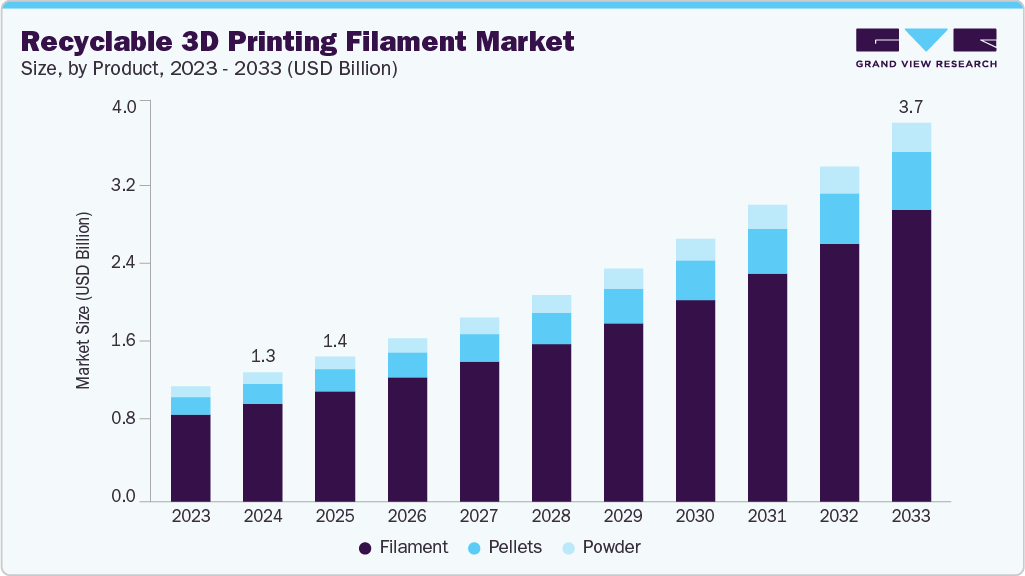

The global recyclable 3D printing filament market size was estimated at USD 1.26 billion in 2024 and is projected to reach USD 3.69 billion by 2033, growing at a CAGR of 12.7% from 2025 to 2033. The growing emphasis on sustainable manufacturing and circular economy practices is driving demand for recyclable 3D printing filaments.

Key Market Trends & Insights

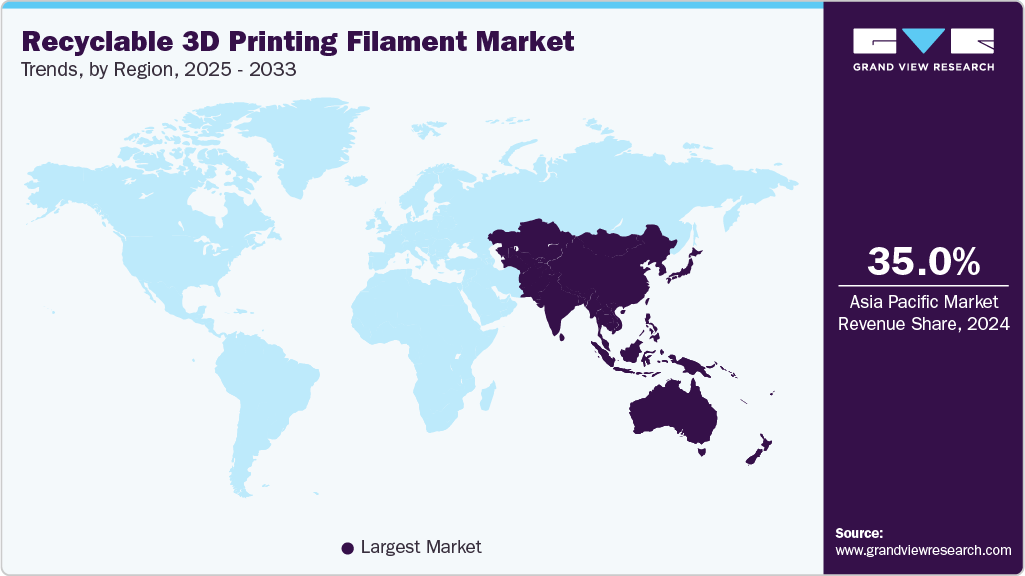

- Asia Pacific dominated the recyclable 3D printing filament market with the largest revenue share of over 35.0% in 2024.

- The recyclable 3D printing filament market in the U.S. is expected to grow at a substantial CAGR of 12.3% from 2025 to 2033.

- By product, the filament segment is expected to grow at a considerable CAGR of 12.9% from 2025 to 2033 in terms of revenue.

- By end use, the automotive segment is expected to grow at a considerable CAGR of 13.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1.26 Billion

- 2033 Projected Market Size: USD 3.69 Billion

- CAGR (2025-2033): 12.7%

- Asia Pacific: Largest market in 2024

Increasing adoption of eco-friendly materials by industries to reduce plastic waste and carbon footprint further supports market growth. Corporations, governments, and end-users are pushing to reduce plastic waste and embodied carbon, and 3D printing is no exception. Customers and procurement policies increasingly prefer materials with recycled content or a clear end-of-life pathway. That shift raises demand for recyclable filaments (and for systems that make used prints and support material feedstock reusable). For example, manufacturers seeking lower Scope 3 emissions will favor r-filaments for prototyping and jigs, and universities and makerspaces adopt them to meet campus sustainability targets.Feedstock availability and circular supply chains make recyclable filament viable at scale. Large streams of recyclable plastic, post-consumer PET bottles, industrial trimmings, and failed prints/support waste can be converted into filament or pellets, creating predictable, lower-cost inputs. Businesses and community labs that collect their own scrap (failed prints, rafts, and support structures) can close the loop locally, while recycling partnerships with municipalities or manufacturers supply rPET and recycled ABS at higher volumes. That steady supply reduces dependence on fluctuations in virgin resin prices and strengthens the economics of recycled filament.

Advances in recycling and material technology are improving performance and trust. New mechanical and chemical recycling processes, improved pellet-to-filament extruders, compatibilizers, and additive recipes reduce defects (such as brittleness and inconsistent diameter) that previously limitedthe adoption of these technologies. Workplace recycling stations and automated filament makers enable labs and small manufacturers to turn scrap into usable filament on-site, increasing confidence that recycled filament can meet the functional requirements of many non-critical and semi-structural applications.

Finally, economics and new business models accelerate uptake. Recycled filament can be cheaper than virgin equivalents when feedstock is sourced locally or in bulk, and product differentiation (eco-labeled filaments, circular-brand positioning) commands premium contractual opportunities with eco-conscious OEMs. Service models, filament subscription with take-back, closed-loop programs for industrial users, and “recycle-as-a-service” for schools and makerspaces, lower barriers to switching. Together with growing design tolerance for recycled materials in various use cases (prototypes, fixtures, consumer products), these commercial forces are making recyclable 3D printing filament an expanding and sustainable market segment.

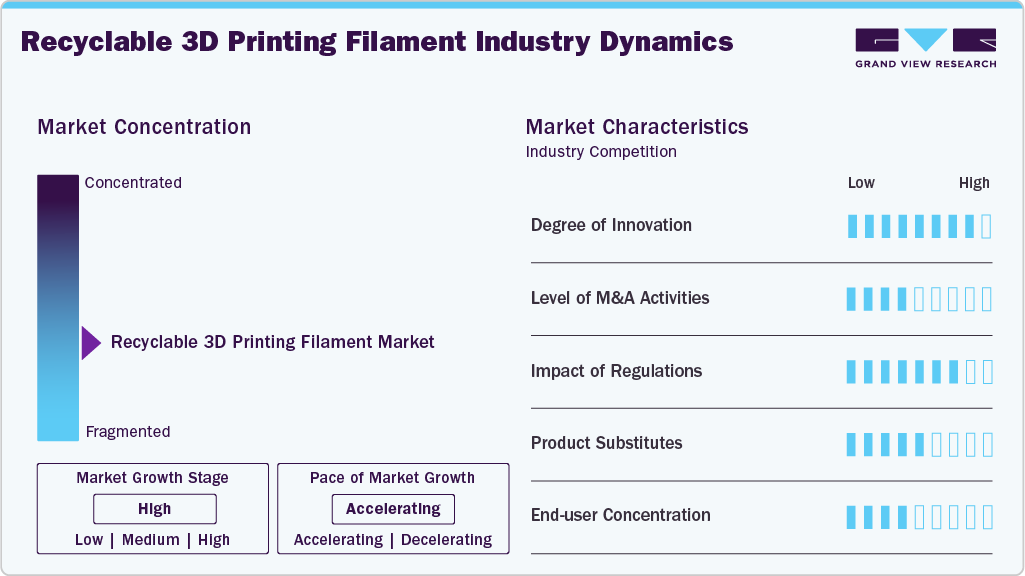

Market Concentration & Characteristics

The industry is characterized by a strong intersection of sustainability, innovation, and circular economy principles. It is part of the broader additive manufacturing ecosystem, which is rapidly evolving toward greener production models. The industry’s core goal is to minimize plastic waste by reusing or recycling materials such as PLA, PET, and ABS into new filament spools that maintain consistent mechanical and thermal properties. This sustainable approach aligns with global decarbonization goals and rising demand from eco-conscious consumers and industries that are adopting additive manufacturing for prototyping, tooling, and even end-use parts.

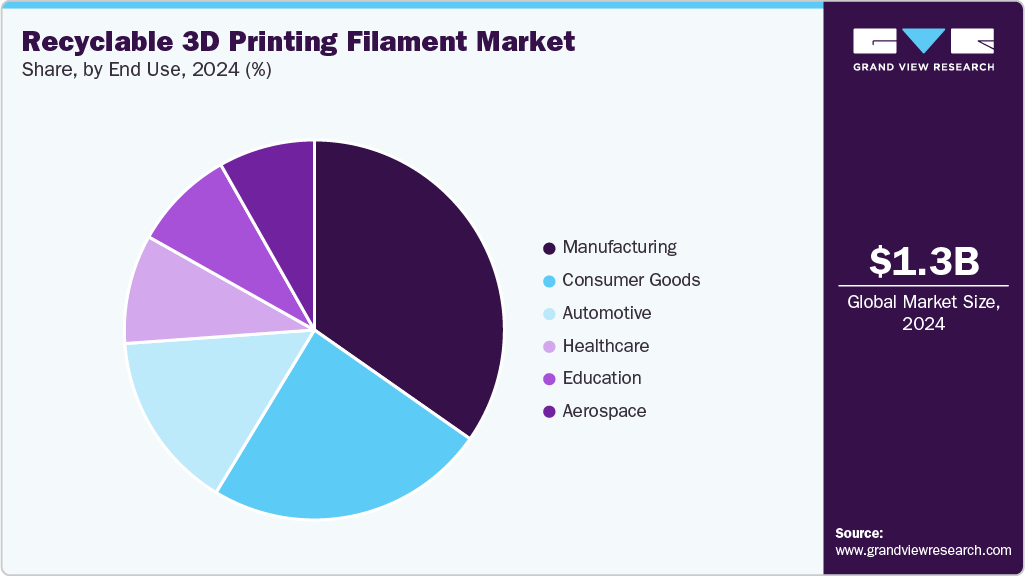

The industry is defined by growing end-user adoption across multiple sectors. Key application areas include consumer goods, education, automotive prototyping, architecture, and medical modeling. Educational institutions and maker communities play a pivotal role by promoting sustainable printing habits and closing the recycling loop on campus. Industrial users, on the other hand, are integrating recyclable filaments into broader ESG strategies, using them to reduce waste and demonstrate environmental leadership. Together, these factors make the recyclable 3D printing filament industry a dynamic and future-oriented segment within the global circular manufacturing landscape.

Product Insights

The filament segment recorded the largest market revenue share of over 75.0% in 2024 and is expected to grow at the fastest CAGR of 12.9% during the forecast period. Filament is the most common and commercially established product form in the market. Recyclable filaments are often made from bio-based or recycled materials such as recycled PLA, PETG, ABS, and rPET (recycled PET). This product segment benefits from high user convenience, wide printer compatibility, and established consumer acceptance across educational, prototyping, and small-scale manufacturing sectors.

Pellets are small granules of thermoplastic material that can be directly used in pellet-fed 3D printers or reprocessed into filament using extrusion systems. Recyclable pellets are often sourced from industrial waste streams, post-consumer plastics, or bio-based polymers such as PLA, PHA, or recycled PET. This form enables bulk handling, lower material costs, and greater flexibility in adjusting material formulations. The need for cost efficiency and scalability in industrial additive manufacturing drives the pellet segment.

End Use Insights

The manufacturing segment held the largest market share, exceeding 34.0% in 2024. This outlook is due to the technology’s ability to streamline prototyping and small-batch production. Manufacturers utilize recyclable filaments to create tooling, molds, and custom jigs, thereby reducing material waste and production costs. The ability to recycle failed prints or excess materials back into usable filament further strengthens closed-loop production processes. Sustainability regulations, pressure to minimize waste, and the need for rapid prototyping are key drivers.

The automotive segment is projected to grow at the fastest CAGR of 13.2% during the forecast period. In the automotive industry, recyclable 3D printing filaments are gaining traction for prototyping, producing spare parts, and tooling. Automakers such as BMW and Volkswagen have adopted recycled thermoplastics and composites to manufacture lightweight, durable components for both interior and exterior applications. The push toward sustainable mobility, coupled with OEM commitments to reduce lifecycle carbon emissions, drives adoption.

Region Insights

The Asia Pacific dominated the market, accounting for the largest revenue share of over 35.0% in 2024, and is expected to witness strong growth, growing at the fastest CAGR of 13.4% during the forecast period. The region drives the market primarily due to its rapidly expanding manufacturing base and government support for circular economy initiatives. Countries such as China, Japan, and South Korea are major adopters of additive manufacturing technologies, especially in electronics, automotive, and consumer goods. Government-led sustainability programs and industrial digitization initiatives such as “Made in China 2025” and Japan’s Green Growth Strategy are also driving demand for recyclable 3D printing materials.

North America Recyclable 3D Printing Filament Market Trends

The recyclable 3D printing filament market in North America is growing due to its mature additive manufacturing ecosystem and strong focus on sustainability. The region is home to key filament manufacturers that emphasize closed-loop production models utilizing post-consumer recycled plastics. The U.S. leads in R&D, with universities and tech companies developing high-performance recycled filaments for aerospace, healthcare, and automotive applications. Furthermore, the circular economy approach embraced by corporations such as Ford Motor Company, which recycles 3D printing waste into new filaments, reflects a growing corporate shift toward low-carbon manufacturing.

Europe Recyclable 3D Printing Filament Market Trends

The recyclable 3D printing filament market in Europe remains at the forefront due to its strict environmental legislation and proactive adoption of circular economy principles. Countries such as Germany, the Netherlands, and the UK are key hubs for sustainable filament manufacturing. The European Union’s Green Deal and Circular Economy Action Plan encourage industries to minimize plastic waste and invest in sustainable material innovation, directly benefiting the recyclable filament market. Stringent EU regulations on plastic recycling, such as the Single-Use Plastics Directive, and carbon neutrality goals are primary drivers of growth.

Key Recycled 3D Printing Filaments Company Insights

The market's competitive environment is moderately fragmented, characterized by the presence of both established material producers and emerging startups that focus on sustainable innovation. Major players compete through advancements in eco-friendly materials, including rPLA (recycled PLA), rPETG (recycled PETG), and bio-based composites.

The market is witnessing a rise in R&D investments aimed at enhancing the mechanical strength, printability, and recyclability of filaments. Strategic collaborations between filament manufacturers, 3D printer OEMs, and recycling technology providers are becoming common to close the material loop. However, competition intensifies due to pricing pressures, regional material availability, and the need for consistent filament quality across recycled batches.

Key Recycled 3D Printing Filaments Companies:

The following are the leading companies in the recycled 3D printing filaments market. These companies collectively hold the largest market share and dictate industry trends.

- Fillamentum

- Polymaker

- FormFutura

- Protoplant

- MS SYNERGY sp. z o.o.

- 3DXTECH

- Printerior

- GreenGate3D

- colorFabb BV

- Filamentive Limited

- Sulapac Oy

- KiwiFil

Recent Developments

-

In July 2025, Polymaker introduced Fiberon PA612-ESD, a next-generation nylon composite filament reinforced with carbon nanotubes and 10% carbon fiber. Designed for industrial applications such as PCB manufacturing, jigs, and electronic housings, it offers high mechanical strength, heat resistance (up to 157°C), and built-in ESD protection without coatings.

-

In September 2025, the BMW Group established a closed-loop recycling system at its Additive Manufacturing Campus in Germany, converting waste 3D printing powder and shredded parts into new filament and granulate for FFF and FGF production. Originating from the 2018 “bottleUP” project, the initiative now recycles up to 12 tonnes annually, creating sustainable, high-quality components for global production.

Recyclable 3D Printing Filament Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.42 billion

Revenue forecast in 2033

USD 3.69 billion

Growth rate

CAGR of 12.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

States scope

North America; Europe; Asia Pacific; Latin America; MEA

Key companies profiled

Fillamentum; Polymaker; FormFutura; Protoplant; MS SYNERGY sp. z o.o.; 3DXTECH; Printerior; GreenGate3D; colorFabb BV; Filamentive Limited; Sulapac Oy; KiwiFil

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled 3D Printing Filaments Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global recyclable 3D printing filament market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Filament

-

Pellets

-

Powder

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

Consumer Goods

-

Automotive

-

Healthcare

-

Education

-

Aerospace

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global recyclable 3D printing filament market size was estimated at USD 1.26 billion in 2024 and is expected to reach USD 1.42 billion in 2025.

b. The global recyclable 3D printing filament market is expected to grow at a compound annual growth rate of 12.7% from 2025 to 2033 to reach USD 3.69 billion by 2033

b. The filament segment recorded the largest market revenue share of over 75.0% in 2024 and is expected to grow at the fastest CAGR of 12.9% during the forecast period.

b. Some key players operating in the recyclable 3D printing filament market include Fillamentum; Polymaker; FormFutura; Protoplant; MS SYNERGY sp. z o.o.; 3DXTECH; Printerior; GreenGate3D; colorFabb BV; Filamentive Limited; Sulapac Oy; and KiwiFil

b. The growing emphasis on sustainable manufacturing and circular economy practices is driving demand for recyclable 3D printing filaments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.