- Home

- »

- Plastics, Polymers & Resins

- »

-

Recycled Plastics Market Size, Share & Growth Report, 2030GVR Report cover

![Recycled Plastics Market Size, Share & Trends Report]()

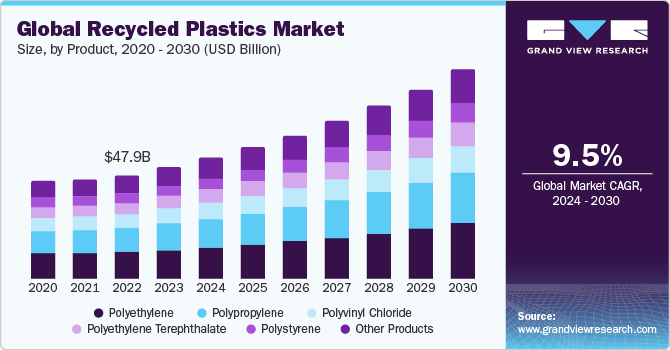

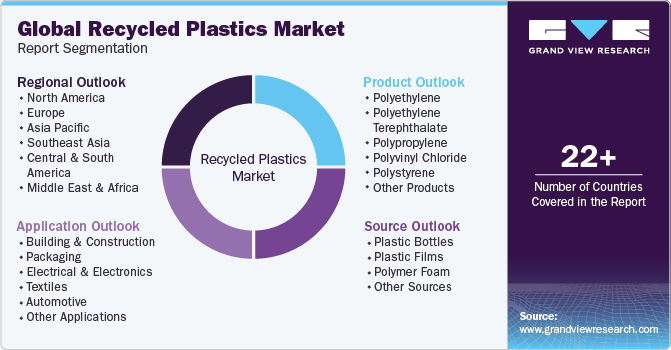

Recycled Plastics Market Size, Share & Trends Analysis Report By Product (Polyethylene, Polyethylene Terephthalate, Polypropylene, Polyvinyl Chloride, Polystyrene), By Source, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-043-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Recycled Plastics Market Size & Trends

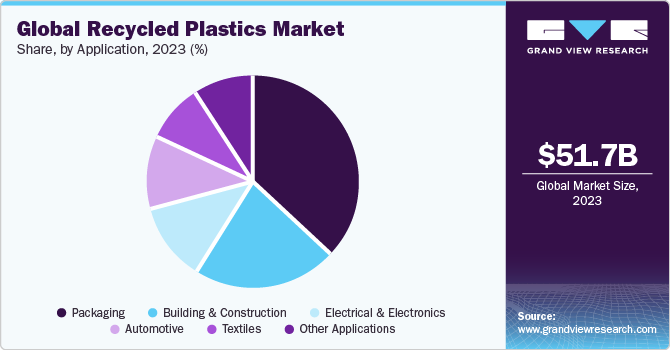

The global recycled plastics market size was estimated at USD 51.70 billion in 2023 and is projected to grow at a CAGR of 9.5% from 2024 to 2030. Increasing plastic consumption in the production of lightweight components which are used in various industries including building & construction, automotive, electrical & electronics, and various other industries are expected to propel the market growth over the forecast period.

The rise in online purchases of electrical & electronics, personal care products and personal protective equipment products such as gloves, face masks, and various products is driving the demand for recycled plastics used in different types of packaging sources.

According to the Verge, the demand for affordable consumer electronic products such as laptops, mobile, modems and various others have increased majorly through e-commerce websites. These rise in demand for consumer electronic have propelled the demand of recycled plastics in electrical & electronics and packaging source which is expected to boost the demand over the forecast period.

The growth of the construction industry in emerging economies such as Brazil, China, India, and Mexico is expected to drive the demand for recycled plastics in the manufacturing of components such as insulation, fixtures, structural lumber, windows, fences, and various others over the forecast period. The growth of recycled plastic in building & construction market can be attributed to increased foreign investment in these countries construction industry, as a result of easing FDI norms and requirements for redevelopment of public and industrial infrastructure.

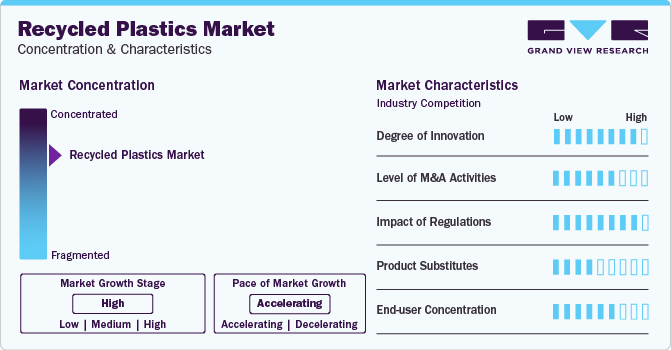

Market Concentration & Characteristics

The market is moderately consolidated, with key participants involved in R&D and technological innovations. Notable companies include REMONDIS SE & Co. KG, Biffa, Stericycle, Republic Services, Inc., and WM Intellectual Property Holdings, L.L.C, among others. Several players are engaged in framework development to improve their market share.

Regulatory measures and policies aimed at reducing plastic pollution and promoting a circular economy contribute to the boost the recycled plastics adoption. Governments and environmental agencies worldwide are implementing measures to limit single-use plastics, encourage recycling, and incentivize the use of alternative materials including recycled plastics.

Growing demand for sustainable materials, such as recycled and bio-based plastics, is driving the market growth. These materials offer the potential for reduced environmental impact and are often marketed as eco-friendly alternatives. This can create potential market growth.

Companies are pursuing global expansion strategies through market entry into new geographic areas, forming partnerships with local distributors, and customizing products to align with rising needs for recycled plastics materials in several industries including packaging, construction, and automotive.

Product Insights

The polyethylene segment led the market with the largest revenue share of 26.0% in 2023. This high share is attributable to the rising demand for packaging material in consumer goods, food & beverage, industrial and various other industries. In addition, it is commonly used in laundry detergents packaging, milk cartons, cutting boards, and garbage bins, among various other sources.

Polypropylene is extensively used in manufacturing automotive components, packaging & labelling, medical devices, and diverse laboratory equipment among various others owing to its excellent chemical and mechanical properties. It is resistant to several chemical solvents, acids, and bases and have excellent mechanically strength. It is also among the most highly formulated plastics across the globe.

In addition, components produced using polypropylene are fatigue resistant, which is beneficial in building & construction industry for producing plastic hinges, piping systems, consumer-grade daily-use products, manufacturing mats, and carpets & rugs among various other sources. The growth of automotive, packaging, building & construction is expected to drive the demand of recycled polypropylene over the forecast period.

Application Insights

In terms of application, the packaging segment led the market with the largest revenue share of over 37.4% in 2023. The market growth in the region is driven by the high demand for building & construction products, consumer goods, and electrical & electronics, especially from China, India, and Southeast Asia. In addition, a flexible regulatory environment is expected to offset constraints that are usually evident in the Western markets.

In addition, recycled plastic products, such as composite lumber, roofing tiles, insulation, rocks, and fences, among others, are widely used in the building & construction industry owing to rising environmental concerns. Furthermore, properties of recycled plastics such as lower carbon footprint and low cost in comparison to virgin plastics are aiding the demand for recycled plastics. Building & construction application are anticipated to be one of the significant contributors to the market growth.

Source Insights

Based on source, the plastic bottles segment led the market with the largest revenue share of 74.14% in 2023. Plastic bottles are the major sources of recycled products. Plastic bottles are used in various applications across various industries in the packaging of water, oils, pharmaceuticals, and carbonated drinks. SKS Bottle & Packaging, Inc., CABKA Group, Maynard & Harris Plastics, and Placon are some of the key recycled plastic bottle manufacturers.

Polymer foam source include packaging foam & sheets which is widely used in impact resistant packaging. Expanded polystyrene is the most common type of polymer foam in the packaging industry. Automobile and electrical & electronics manufacturers, such as Panasonic Corporation; SONY Electronics Inc., Ltd.; Hitachi, Ltd.; and Honda Motor Company Ltd. are moving toward adoption of recycled plastic foam over virgin polymer foam.

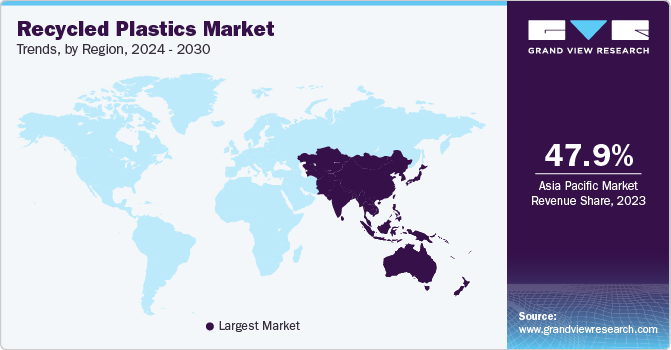

Regional Insights

The recycled plastics market in North America is expected to grow at a significant CAGR over the forecast period. The North America market accounted with a revenue share of 18.27% in 2023. The market is driven by the growth of the major end-use industries such as electrical & electronics, construction, and packaging. Rising demand for packed & processed food and rising construction industry in the U.S., Mexico and Canada are anticipated to augment market growth over the forecast period.

U.S. Recycled Plastics Market Trends

The recycled plastics market in U.S. is expected to grow at the fastest CAGR over the forecast period. Polyethylene terephthalate, low-density polyethylene, high-density polyethylene, polypropylene, polyvinyl chloride, and polystyrene are the most common types of plastic waste in the country. These plastics are used to produce food & beverage bottles, films & wraps, bottles caps, containers, and blister packs among other products.

Asia Pacific Recycled Plastics Market Trends

Asia Pacific dominated the recycled plastics market with a revenue share of over 47.97% in 2023. Asia Pacific is characterized by the growing packaging industry and technological advancements in the industry. Moreover, Asia Pacific will witness immense market growth, owing to the rising electronics expenditure in the countries such as China, India, and Japan. In addition, presence of various electronic product manufacturers which are involved in research & development activities in the region including ASE Electronics Malaysia; Foxconn Technology Group; Honeywell International Inc.; SAMSUNG; Lenovo, Bajaj Electronics; Huawei Technologies Co., Ltd.; Havells Group; Haier Inc. and various others will propel industry expansion over the forecast period.

The recycled plastics market in China held a significant share in the Asia Pacific region. The market is anticipated to register at a fastest CAGR of 10.3% over the forecast period. China market is a well-established one. However, the ban on import of 24 types of plastic waste is expected to hamper the market growth in the country.

The India recycled plastics market is expected to grow at the fastest CAGR over the forecast period. Rising environmental concerns among consumers coupled with the government policies such as “Swachh Bharat Mission” are anticipated to fuel the demand for recycled plastics in the country. Growing packaging, automotive, and construction industries in the country are further propelling the demand for recycled plastics.

Southeast Asia Recycled Plastics Market Trends

The recycled plastics market in Southeast Asia is expected to grow at a significant CAGR of 8.2% during the forecast period. Southeast Asia market is characterized by the growth in recycling activities across the region. The Association of Southeast Asian Nations (ASEAN) member countries have decided to tackle the plastic waste ending up in oceans by 2025.

Europe Recycled Plastics Market Trends

The recycled plastics market in Europe ranks second in terms of revenue after Asia Pacific over the forecast period. The market is driven by the adaption of circular economy to reduce the carbon foot print associated with conventional method of plastic production by increasing the plastic recycling in the region.

The Germany recycled plastics market held a significant share in Europe. The market is anticipated to register at the fastest CAGR of 10.0% over the forecast period. The advanced recycling technologies of Germany significantly influences the demand for recycled plastics in the country. According to the report of Federal Ministry for Environment, Nature Conservation, Nuclear Safety and Consumer Protection, in 2023, Germany generated 340 million tons of plastic waste per year and had a recycling of wastes is approximately 50 million tons.

The recycled plastics market in Italy is expected to grow at a significant CAGR over the forecast period. The Italy market is quite active and involves more than 350 companies. These companies include waste collectors, sorters, and industrial waste handlers. The cultural emphasis of Italy towards sustainable products is expected to boost the demand for recycled plastics in several industries including automotive and textiles.

Central & South America Recycled Plastics Market Trends

The recycled plastics market in Central & South America is expected to witness at the significant CAGR over the forecast period. The rise of e-commerce and changing consumer preferences towards sustainability including plastic recycling in Central & South America are contributing to the demand for recycled plastics in packaging.

The Brazil recycled plastics market held the significant share in Central & South America. The market is anticipated to register at the fastest CAGR of 8.2% over the forecast period. The country has huge potential for recycled plastics as these would solve both the plastic waste problem as well as floods occurring due to plastic waste in water bodies.

Middle East & Africa Recycled Plastics Market Trends

The recycled plastics market in Middle East & Africa is expected to witness at a significant CAGR over the forecast period. The region was dependent on exporting its plastic waste to other countries for recycling, but as the Asia Pacific and Southeast Asia countries are banning the plastic waste imports, the region is developing recycling facilities.

The Saudi Arabia recycled plastics market held a significant share in Middle East & Africa. The market is anticipated to register at the fastest CAGR of 7.4% over the forecast period. The flourishing building & construction industry in the country is expected to drive the demand for recycled plastics in the country.

Key Recycled Plastics Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key Recycled Plastics Companies:

The following are the leading companies in the recycled plastics market. These companies collectively hold the largest market share and dictate industry trends.

- REMONDIS SE & Co. KG

- Biffa

- Stericycle

- Republic Services, Inc.

- WM Intellectual Property Holdings, L.L.C.

- Veolia

- Shell International B.V.

- Waste Connections

- CLEAN HARBORS, INC.

- Covestro AG

Recent Developments

-

In January 2024, Republic Services, Inc. announced the opening of a new Salt River recycling center. The new facility will play a vital role in improving recycling rates in the Valley as it has more modern technology and higher capacity than its predecessor. It is a 51,000-square-foot recycling center in the Salt River Pima-Maricopa Indian Community, designed to manage recyclables from approximately 1.4 million residents and over 2,000 businesses. The facility can process up to 40 tons of recyclables or eight truckloads per hour. This includes cardboard, paper, jugs, plastic bottles, metal food and beverage cans, and glass bottles and jars

-

In September 2023, WM has recently announced the opening of a new recycling facility in Cleveland, spanning over a vast area of 100,000 square feet. The facility is anticipated to process nearly 420 tons of recyclable materials daily. This project is part of WM's previously declared enterprise-wide initiative to invest over USD 1 billion in recycling infrastructure, which includes around 40 automated or planned new recycling facilities. The new facilities are expected to add 2.8 million incremental tons managed by 2026

-

In April 2023, Biffa announced the acquisition of North Yorkshire based Esterpet Ltd, a recycler of Polyethylene Terephthalate (PET) plastic. Esterpet converts 25,000 tons of plastic flakes each year, generated from recycled bottles, into high-purity plastic pellets. This latest acquisition builds on Biffa’s existing strong capabilities in closed-loop food grade plastic recycling, including its plants in Seaham, Redcar and Washington where it already converts over 165,000 tons of plastic each year into high quality recycled polymers

Recycled Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 55.98 billion

Revenue forecast in 2030

USD 96.48 billion

Growth rate

CAGR of 9.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, source, application, region

Regional scope

North America; Europe; Asia Pacific; Southeast Asia; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Malaysia; Indonesia; Thailand; Brazil; Saudi Arabia

Key companies profiled

REMONDIS SE & Co. KG; Biffa; Stericycle; Republic Services, Inc.; WM Intellectual Property Holdings; L.L.C.; Veolia; Shell International B.V.; Waste Connections; CLEAN HARBORS, INC.; Covestro AG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Plastics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global recycled plastics market report based on product, source, application, and region:

-

Product Outlook (Volume, Kilotons, Revenue; USD Million, 2018 - 2030)

-

Polyethylene

-

Polyethylene Terephthalate

-

Polypropylene

-

Polyvinyl Chloride

-

Polystyrene

-

Other Products

-

-

Source Outlook (Volume, Kilotons, Revenue; USD Million, 2018 - 2030)

-

Plastic Bottles

-

Plastic Films

-

Polymer Foam

-

Other Sources

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Packaging

-

Electrical & Electronics

-

Textiles

-

Automotive

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Southeast Asia

-

Malaysia

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global recycled plastics market size was estimated at USD 51.70 billion in 2023 and is expected to reach USD 55.98 billion in 2024.

b. The global recycled plastics market is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2030 to reach USD 96.48 billion by 2030.

b. Polyethylene dominated the recycled plastics market with a share of over 26% in 2023. This is attributable to the rising demand for sustainable packing and components used in various end-use industries to reduce the carbon footprint.

b. Some of the key players operating in the recycled plastics market include REMONDIS SE & Co. KG, Biffa, Stericycle, Republic Services, Inc., WM Intellectual Property Holdings, L.L.C., Veolia, Shell International B.V., Waste Connections, CLEAN HARBORS, INC., and Covetsro AG.

b. Key factors driving the recycled plastics market growth include laws & regulations enforced by governments, increasing awareness regarding sustainable plastic waste management, and reduction in environmental impact from plastic production.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."