- Home

- »

- Plastics, Polymers & Resins

- »

-

Recycled Polyester Market Size, Share, Industry Report 2030GVR Report cover

![Recycled Polyester Market Size, Share & Trends Report]()

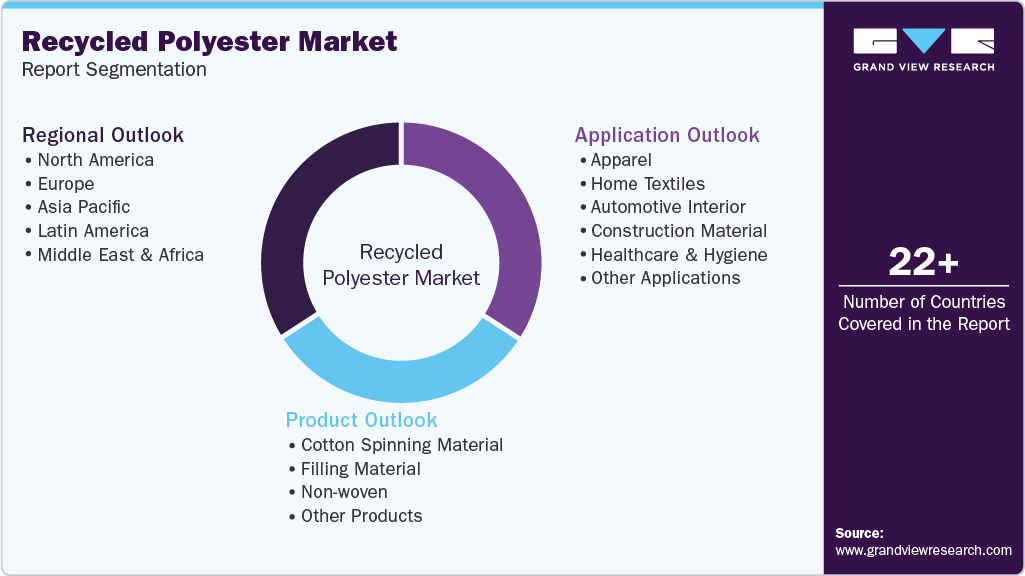

Recycled Polyester Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Cotton Spinning Material, Filling Material, Non-woven), By Application (Apparel, Home Textiles), By Region And Segment Forecasts

- Report ID: GVR-4-68040-603-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recycled Polyester Market Summary

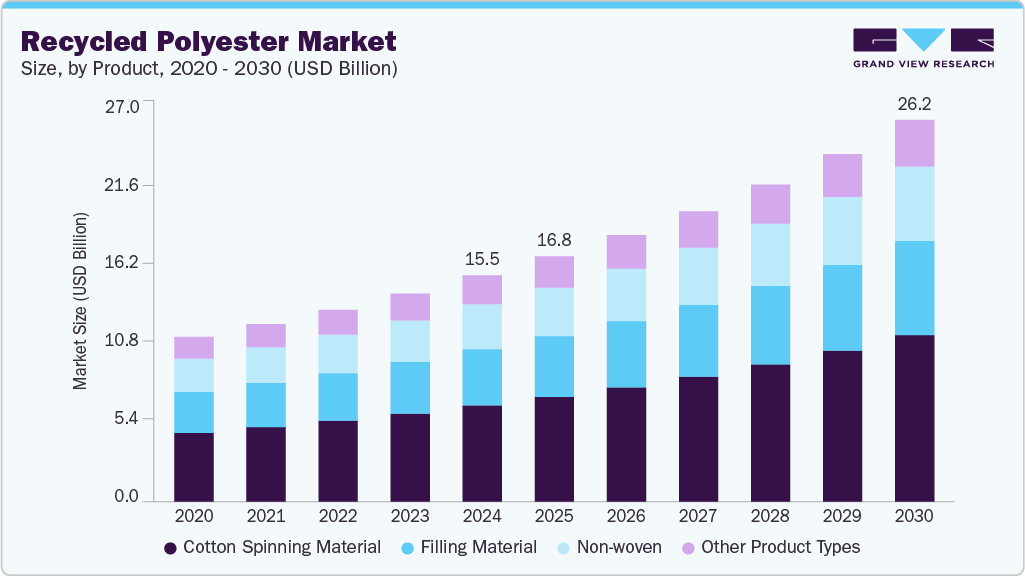

The global recycled polyester market size was estimated at USD 15.52 billion in 2024 and is projected to reach USD 26.18 billion by 2030, growing at a CAGR of 9.25% from 2025 to 2030. The market has been experiencing steady growth as industries increasingly prioritize sustainability and circular economy practices.

Key Market Trends & Insights

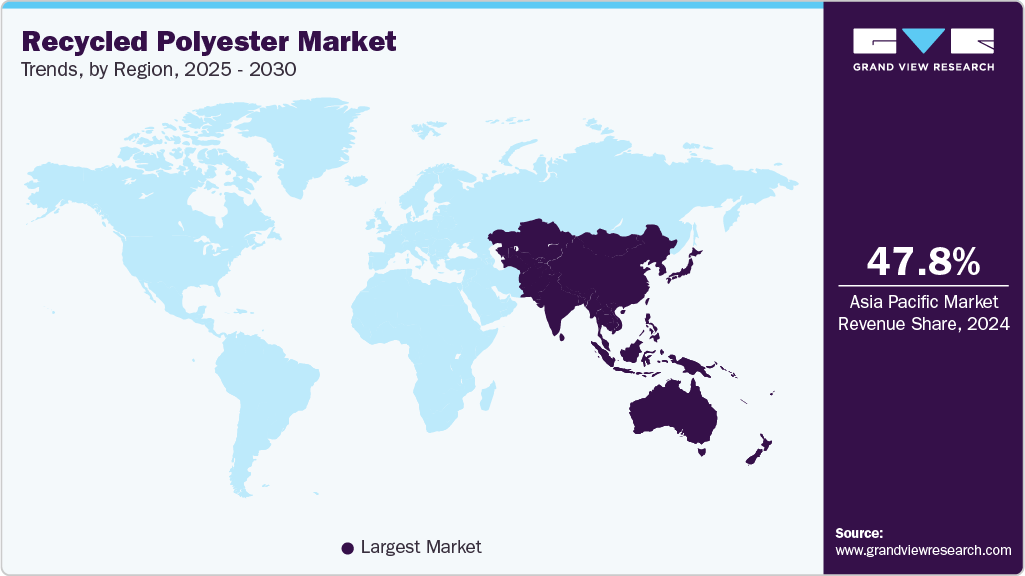

- The Asia Pacific recycled polyester industry is the largest and fastest-growing market, with a revenue share of 47.78% in 2024.

- By product, the cotton spinning material segment dominated the market in terms of revenue, accounting for a market share of 42.33% in 2024.

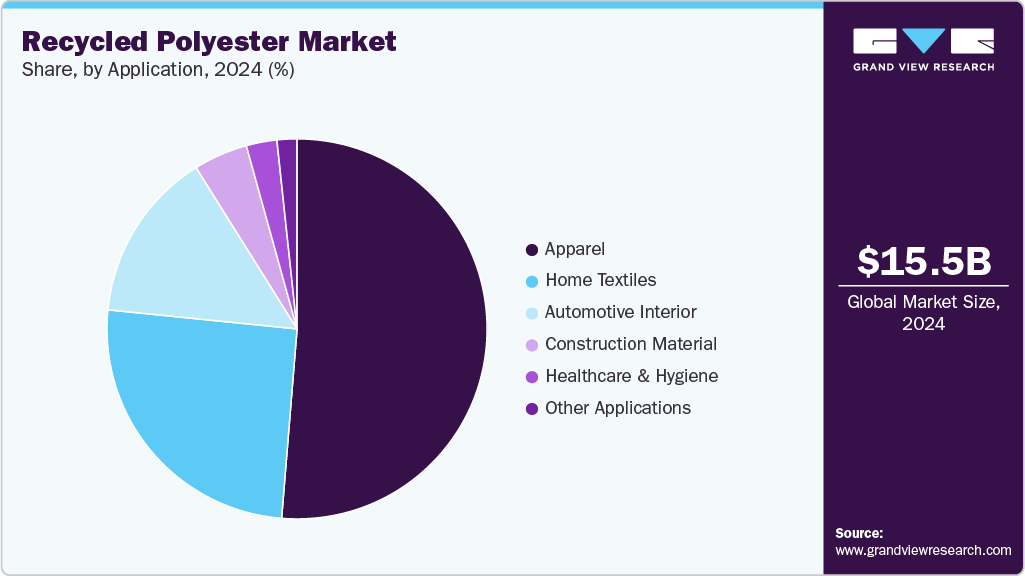

- By application, the apparel segment dominated the market in terms of revenue, accounting for a market share of 51.32% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.52 Billion

- 2030 Projected Market Size: USD 26.18 Billion

- CAGR (2025-2030): 9.25%

- Asia Pacific: Largest market in 2024

Recycled polyester, primarily derived from post-consumer PET plastic bottles and industrial waste, is widely used in sectors such as textiles, packaging, automotive interior, and home textiles. Its ability to reduce reliance on virgin petroleum-based materials, lower carbon emissions, and minimize plastic waste has made it a preferred alternative in environmentally conscious production.

Drivers, Opportunities & Restraints

One of the primary drivers of the market for recycled polyester is the growing demand for sustainable and eco-friendly materials across industries, particularly in textiles and packaging. As environmental concerns around plastic pollution and carbon emissions intensify, both consumers and manufacturers are shifting toward recycled alternatives to reduce their ecological footprint.

Recycled polyester, derived from post-consumer PET bottles and industrial waste, helps reduce landfill accumulation and lowers the energy required for production compared to virgin polyester, making it a favorable option for companies aiming to meet sustainability goals. Government regulations and policy incentives further accelerate the growth of the market. Many countries are implementing stringent regulations on plastic waste and promoting circular economy practices, which encourage the use of recycled materials.

Subsidies, tax incentives, and public-private partnerships aimed at improving recycling infrastructure and encouraging recycled content in consumer products have made it easier and more economically viable for companies to invest in rPET. This regulatory environment fosters innovation and expands the application of recycled polyester across sectors such as Automotive Interior, apparel, and home furnishings.

The advancements in recycling technologies and supply chain integration are boosting market growth. Improved collection systems, chemical recycling techniques, and sorting technologies have enhanced the quality and availability of recycled polyester, enabling it to compete more effectively with virgin polyester in terms of performance and appearance. At the same time, fashion brands and global corporations are increasingly adopting rPET in their product lines as part of corporate social responsibility strategies, further propelling demand.

Despite its growth potential, the recycled polyester industry faces a significant restraint in the form of high processing costs and supply chain inconsistencies. The collection, sorting, and processing of post-consumer PET waste are often complex and resource-intensive, leading to higher costs compared to producing virgin polyester.

Inconsistent availability and quality of raw materials, coupled with underdeveloped recycling infrastructure in many regions, hinder the ability of manufacturers to scale production efficiently. These challenges can discourage small and mid-sized companies from transitioning to recycled polyester, limiting market penetration.

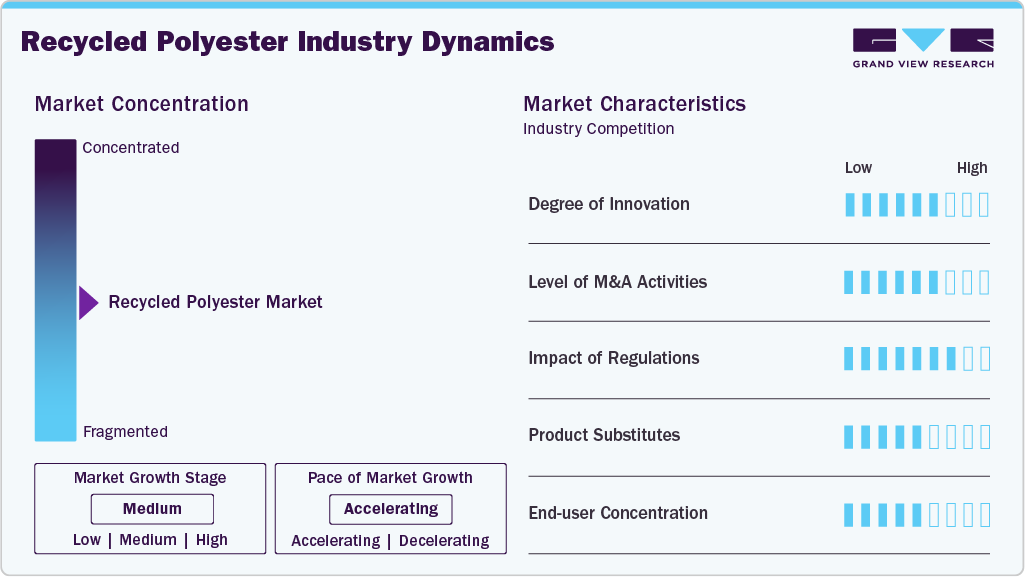

Market Concentration & Characteristics

The market growth stage of the recycled polyester industry is medium and at an accelerating pace. The market exhibits a moderate-to-high degree of innovation, driven by technological advancements in recycling methods and product development. Innovations such as chemical recycling, which allows for higher purity and better quality rPET, are gaining traction alongside traditional mechanical recycling.

Governments across North America, Europe, and parts of Asia are implementing stricter policies to limit plastic waste and promote the use of recycled materials. Regulations such as extended producer responsibility (EPR), recycled content mandates, and bans on single-use plastics are pushing industries to adopt rPET. These measures not only increase demand but also create a more structured market environment, though compliance can be complex and costly for smaller players.

The presence of product substitutes poses a moderate threat to the recycled polyester industry. Alternatives such as organic cotton, recycled nylon, biodegradable plastics, and plant-based fibers offer sustainable solutions that can replace rPET in certain applications. However, recycled polyester maintains a strong position due to its durability, cost-efficiency, and compatibility with existing manufacturing infrastructure.

The recycled polyester industry exhibits a moderate to high degree of end user concentration, particularly dominated by the textile and apparel industry. Major global fashion brands and retailers have become key consumers of rPET as they shift toward more sustainable product lines. In addition, the packaging sector, especially for beverages and consumer goods, is increasingly incorporating rPET due to regulatory pressures and brand image considerations.

Product Insights

Cotton spinning material dominated the market in terms of revenue, accounting for a market share of 42.33% in 2024, as its high strength, durability, and ability to hold dye make it a viable alternative or complement to cotton in spinning applications. As sustainability becomes a core focus in textile manufacturing, mills are increasingly incorporating rPET into cotton-polyester blends to reduce environmental impact while maintaining performance and cost-efficiency.

The filling material segment is anticipated to grow at a significant CAGR of 12.6% through the forecast period, owing to its wide use in home textiles such as pillows, cushions, comforters, and upholstered furniture. Its lightweight, hypoallergenic properties and affordability make it a preferred choice over traditional synthetic and natural fillers. Growing demand for eco-friendly interior furnishings, combined with consumer preference for cruelty-free and sustainable materials, has led to increased use of rPET fiberfill.

Application Insights

Apparel application dominated the market in terms of revenue, accounting for a market share of 51.32% in 2024, driven by global fashion brands’ commitment to reducing their carbon footprint and reliance on virgin synthetic fibers. rPET is being used in a wide range of garments, from activewear and casual clothing to outerwear, due to its moisture-wicking, quick-drying, and durable characteristics. Asia Pacific, particularly China, serves as a major production hub, supplying both domestic and international markets.

The home textile segment is anticipated to grow at a significant CAGR of 9.5% through the forecast period. Recycled polyester is increasingly used in home textile applications such as curtains, bed linens, upholstery, and decorative fabrics. Its resilience, ease of care, and cost-effectiveness make it a strong alternative to virgin polyester and natural fibers. The trend toward sustainable living and eco-conscious home décor is driving demand, especially in regions like Europe and North America, where environmental awareness is high.

Regional Insights

The North America recycled polyester industry is experiencing steady growth globally, driven by heightened environmental awareness, evolving consumer preferences, and regulatory pressure to adopt sustainable materials. While domestic recycling capacity is still expanding, many companies rely on imported rPET, especially from Asia. The region sees strong demand from the fashion and home textiles industries, with many brands committing to recycled content in their supply chains.

U.S. Recycled Polyester Market Trends

The recycled polyester industry in the U.S. is driven by the significantly growing demand for recycled polyester across both the apparel and home textile sectors. American consumers are increasingly prioritizing sustainability, and brands are responding by integrating rPET into product lines. The country faces challenges in PET collection and recycling infrastructure, but is making progress through regulatory incentives and investments in new recycling technologies.

Asia Pacific Recycled Polyester Market Trends

The Asia Pacific recycled polyester industry is the largest and fastest-growing market, with a revenue share of 47.78% in 2024. Countries across the region are benefiting from cost-effective manufacturing, abundant PET waste availability, and increasing focus on environmental sustainability. Regional government support and corporate ESG goals are pushing the adoption of rPET, particularly in textiles used for export.

China recycled polyester industry is rapidly advancing owing to its massive PET waste processing capacity, extensive recycling infrastructure, and leadership in textile manufacturing. As the world’s largest producer and exporter of polyester fibers, China has scaled up rPET production to meet both global sustainability demands and local policy mandates aimed at reducing plastic waste. The government’s push for green manufacturing and the growing involvement of Chinese brands in sustainable practices further solidify China’s critical role in the market.

Europe Recycled Polyester Market Trends

Europe recycled polyester industry represents a highly mature market for recycled polyester, characterized by strong regulatory frameworks and a deeply entrenched culture of sustainability. The European Union’s mandates for recycled content and waste reduction have accelerated the adoption of rPET in both the textile and packaging industries. Brands operating in Europe often face consumer pressure for transparency and environmental responsibility, making rPET a strategic material choice.

Germany recycled polyester industry is a leader within the European region, known for its sophisticated waste management and recycling infrastructure. The country has stringent regulations regarding plastic use and recycling, encouraging widespread adoption of sustainable materials like rPET. German textile companies, particularly in home furnishings and technical textiles, are actively incorporating recycled polyester to align with EU sustainability directives. Germany also plays a central role in research and innovation around circular materials and advanced recycling technologies.

Latin America Recycled Polyester Market Trends

The Latin America recycled polyester marketis emerging with rising awareness of sustainability and increasing investments in local recycling capacity. While adoption is still in its early stages compared to more developed markets, demand is being driven by the region’s growing textile industry and efforts to boost exports to environmentally conscious markets such as the U.S. and Europe.

Saudi Arabia recycled polyester industryis at a nascent stage but shows strong potential due to national sustainability goals outlined in Vision 2030. The country is beginning to invest in recycling infrastructure and green industrial development as part of broader economic diversification efforts. While the market for rPET is currently limited, increasing interest from government and industry stakeholders signals potential for future growth, especially as local manufacturers align with international sustainability standards.

Key Recycled Polyester Company Insights

The recycled polyester industry is moderately consolidated, with key players such as Indorama Ventures, Unifi Inc., Far Eastern New Century, and Sinopec Yizheng Chemical Fibre holding significant shares. These companies benefit from vertically integrated operations, global supply chains, and strategic partnerships with major textile brands. Market competition is intensifying as more players enter, particularly in Asia, aiming to meet growing global demand.

Key Recycled Polyester Companies:

The following are the leading companies in the recycled polyester market. These companies collectively hold the largest market share and dictate industry trends.

- Indorama Ventures

- Far Eastern New Century

- Unifi Inc.

- Reliance Industries Limited

- Sinopec Yizheng Chemical Fibre

- Alpek Polyester

- Zhejiang Jiaren New Materials Co., Ltd.

- Polyfibre Industries Pvt. Ltd.

- Bottloop

- Margasa Group

Recent Developments

-

In April 2025, Swiss cleantech company DePoly announced the upcoming launch of a 500-tonne-per-year demonstration plant in Monthey, Switzerland. This facility will showcase DePoly's proprietary chemical recycling technology, which transforms PET and polyester waste into virgin-quality raw materials without the use of fossil fuels. The process effectively handles various forms of plastic waste, including water bottles and discarded textiles, converting them into high-purity monomers suitable for producing new bottles, textile fibers, and cosmetic packaging.

-

In March 2025, PUMA and RE&UP Recycling Technologies announced a multi-year collaboration aimed at advancing circular textile solutions by transforming textile waste into RE&UP’s next-generation recycled cotton fibers and recycled polyester chips. This partnership supports PUMA's Vision 2030 sustainability goals, particularly its objective to have 30% of polyester fabric in apparel sourced from fiber-to-fiber recycling by 2030.

Recycled Polyester Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.82 billion

Revenue forecast in 2030

USD 26.18 billion

Growth rate

CAGR of 9.25% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

Indorama Ventures; Far Eastern New Century; Unifi Inc.; Reliance Industries Limited; Sinopec Yizheng Chemical Fibre; Alpek Polyester; Zhejiang Jiaren New Materials Co., Ltd.; Polyfibre Industries Pvt. Ltd.; Bottloop; Margasa Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Polyester Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the recycled polyester market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cotton Spinning Material

-

Filling Material

-

Non-woven

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Home Textiles

-

Automotive Interior

-

Construction Material

-

Healthcare & Hygiene

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global recycled polyester market size was estimated at USD 15.52 billion in 2024 and is expected to reach USD 16.82 billion in 2025.

b. The global recycled polyester market is expected to grow at a compound annual growth rate of 9.25% from 2025 to 2030 to reach USD 26.18 billion by 2030.

b. Apparel application dominated the recycled polyester market with a revenue share of 51.32% in 2024, driven by global fashion brands’ commitment to reducing their carbon footprint and reliance on virgin synthetic fibers.

b. Some key players operating in the recycled polyester market include Indorama Ventures , Far Eastern New Century, Unifi Inc., Reliance Industries Limited, Sinopec Yizheng Chemical Fibre and Alpek Polyester.

b. Recycled polyester market is primarily driven by growing demand for sustainable and eco-friendly materials across industries, particularly in textiles and packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.