- Home

- »

- Plastics, Polymers & Resins

- »

-

Recycled Thermoplastics Market Size & Share Report, 2030GVR Report cover

![Recycled Thermoplastics Market Size, Share & Trends Report]()

Recycled Thermoplastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Form (Flakes, Pellets), By Technology (Extrusion, Blow Molding), By Product, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-441-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recycled Thermoplastics Market Trends

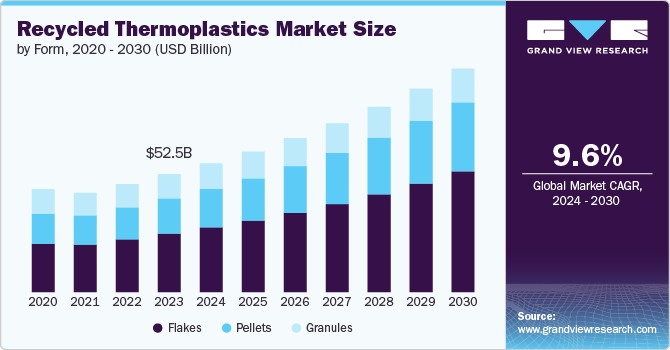

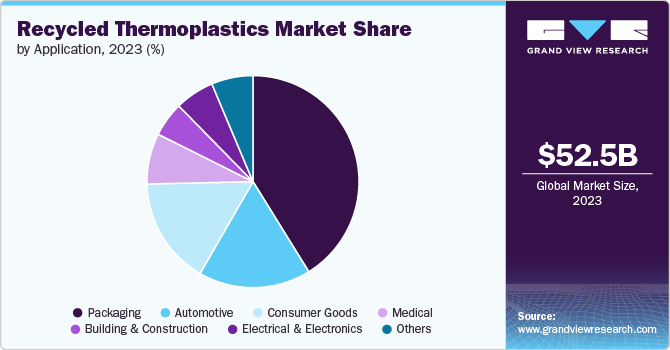

The global recycled thermoplastics market size was estimated at USD 52.51 billion in 2023 and is projected to grow at a CAGR of 9.6% from 2024 to 2030. Growing concerns regarding the increasing plastic waste globally are driving the need to reduce plastic waste using various methods, including recycling, thus driving the market.

The recycled thermoplastic market is seeing increased demand as industries shift towards sustainability. Governments worldwide are enacting stricter environmental regulations, pushing manufacturers to adopt eco-friendly practices. Companies increasingly use recycled plastics in packaging, automotive, and consumer goods. The growth in plastic recycling technologies, such as chemical recycling, enhances the quality of recycled materials, making them more comparable to virgin plastics. This trend is also driven by consumers demanding more environmentally responsible products, leading to widespread adoption across multiple industries.

Drivers, Opportunities & Restraints

Rising global focus on reducing plastic waste is augmenting the recycled thermoplastic market. With landfills overflowing and oceans polluted with plastic debris, governments and environmental agencies are promoting recycling initiatives. Many industries, especially packaging, automotive, and electronics, must meet specific recycling quotas, pushing them to incorporate recycled thermoplastics in their products. Additionally, the energy savings and reduced carbon emissions associated with using recycled materials instead of producing new plastics further encourage their use, especially in industries with sustainability goals.

A significant opportunity for the recycled thermoplastic market lies in the advancement of recycling technologies. With the rise of chemical recycling, which breaks down plastics into their original monomers, the quality of recycled thermoplastics is improving, making them more suitable for high-performance applications. This opens up new markets, such as aerospace and medical devices, where material performance is critical. Additionally, emerging economies in regions like Southeast Asia and Latin America are developing waste management systems, creating fresh opportunities for companies that provide recycled thermoplastics to these expanding markets.

Despite its potential, the recycled thermoplastics market faces challenges that could hinder its growth. A key restraint in the recycled thermoplastic market is the high cost of recycling processes and the inconsistent supply of recyclable plastics. Although advancements in recycling technology have improved, many processes remain expensive, particularly chemical recycling. The market also faces challenges in collecting and sorting recyclable materials, leading to supply chain disruptions. In many regions, recycling infrastructure is underdeveloped, leading to lower collection rates and a lack of quality materials. These factors often result in higher prices for recycled plastics compared to virgin materials, limiting their broader adoption.

Form Insights & Trends

Based on form, the flakes segment led the market with the largest revenue share of 49.65% in 2023. The increasing demand for cost-effective recycling solutions is a key driver for the segment. As more companies seek to reduce production costs while meeting sustainability goals, recycled plastic flakes offer a lower-cost alternative to virgin plastics. Plastic waste is typically washed, shredded, and processed into flakes, which can then be used to produce new products. Flakes are highly versatile and are often used in applications like plastic bottles, containers, and textile fibers. Due to their relatively simple production process, flake-form recycled thermoplastics are cost-effective and efficient for large-scale recycling operations. However, the quality of the flakes depends heavily on the cleanliness and sorting of the raw materials, which can sometimes be a challenge, especially in regions with less developed recycling infrastructure.

The granule segment is expected to grow significantly over the forecast period. The growing demand for high-performance recycled materials drives the adoption of granule form recycled thermoplastics. Granules offer greater uniformity and consistency, making them ideal for industries requiring precision, such as automotive, electronics, and packaging. These recycled granules are easier to handle and store, allowing manufacturers to blend them more seamlessly with virgin materials. Despite their higher quality, granule production is more energy-intensive, leading to higher costs than flake forms, which can be a limiting factor for some budget-conscious industries.

Technology Insights & Trends

Based on technology, the extrusion segment led the market with the largest revenue share of 36.51% in 2023, which can be attributed to the increasing demand for sustainable building materials. As construction and infrastructure projects worldwide move towards greener practices, using recycled thermoplastics in products like pipes, siding, and insulation materials is growing. Extrusion allows for the continuous production of long, durable plastic components widely used in construction, packaging, and agricultural sectors. Additionally, the push for reducing carbon footprints in the construction industry encourages builders to adopt recycled materials, boosting demand for extruded recycled thermoplastics that are both cost-effective and environmentally friendly.

The blow molding segment is driven by the growing demand for lightweight and sustainable packaging in industries like food and beverages, personal care, and household goods. Blow molding is ideal for producing hollow, thin-walled containers such as bottles and jars, increasingly made from recycled thermoplastics. Manufacturers are incorporating recycled thermoplastics into blow-molded products as consumer preferences shift toward eco-friendly packaging and regulatory bodies enforce stricter recycling mandates. This shift reduces the environmental impact of packaging and helps companies meet sustainability targets, fueling the adoption of recycled materials in the blow molding process.

Product Insights & Trends

Based on product, the polyethylene (PE) segment led the market with the largest revenue share of 32.49% in 2023, which can be attributed to the increased use of recycled plastics in flexible packaging solutions. Polyethylene is widely used in products like plastic bags, films, and shrink wraps, and it is essential in the food, retail, and e-commerce sectors. As companies strive to reduce their environmental footprint, there’s growing pressure to replace virgin polyethylene with recycled versions. Governments impose stricter regulations on single-use plastics, pushing manufacturers to adopt recycled PE in everyday packaging. The recyclability and versatility of PE make it a prime candidate for industries focused on meeting sustainability goals without compromising performance.

The polyethylene terephthalate (PET) segment is driven by the surging demand for recycled PET in the beverage and bottled water industry. PET is the material of choice for producing plastic bottles, which makes it highly sought after by companies aiming to reduce plastic waste and promote circular economies. With consumer demand for sustainable packaging rising, beverage companies increasingly use recycled PET in their bottles to meet both environmental regulations and consumer expectations. Moreover, advanced recycling technologies are improving the quality of recycled PET, allowing it to be reused in food-grade packaging, further boosting its adoption in high-volume industries.

Application Insights & Trends

Based on application, the packaging segment dominated the market with the largest revenue share of 29.88% in 2023, owing to the growing shift towards circular economies and sustainable packaging solutions. Consumers are becoming more environmentally conscious, leading companies to prioritize eco-friendly packaging materials. Recycled thermoplastics, particularly recycled polyethylene and polypropylene, are increasingly used in food packaging, shipping materials, and retail bags. This transition is further supported by government regulations mandating reductions in plastic waste and the use of recycled content in packaging. Large brands are committing to using more recycled plastics to appeal to eco-conscious customers and comply with stricter recycling standards, driving the demand for recycled thermoplastics in the packaging industry.

The automotive segment is driven by the rising demand for lightweight materials to improve fuel efficiency and reduce emissions. Recycled thermoplastics are increasingly used to produce automotive parts such as dashboards, bumpers, and interior components. These materials offer the dual benefits of being lightweight and durable, helping manufacturers meet stringent environmental regulations and improving vehicle performance. The need for recycled thermoplastics has grown as the automotive industry shifts towards electric vehicles (EVs) and sustainable manufacturing practices. They allow automakers to reduce the overall carbon footprint of production while meeting customer demands for greener, more efficient vehicles.

Regional Insights & Trends

In North America, a major driver for the recycled thermoplastics market is the growing adoption of corporate sustainability initiatives across industries. Many companies are setting ambitious sustainability goals to reduce plastic waste and carbon footprints, especially in packaging, consumer goods, and automotive sectors. This shift is heavily influenced by consumer demand for environmentally responsible products, alongside stricter government regulations promoting recycling. Additionally, state-level mandates and federal policies are pushing industries to incorporate a higher percentage of recycled materials into their products, accelerating the adoption of recycled thermoplastics in the region.

U.S. Recycled Thermoplastics Market Trends

The U.S. recycled thermoplastics market is fueled by the increasing investment in recycling infrastructure and technology. The U.S. government and private organizations are investing heavily in upgrading recycling systems to handle a broader range of plastics, including advanced sorting and chemical recycling technologies. This improved infrastructure is helping to increase the availability and quality of recycled thermoplastics. Furthermore, public awareness campaigns around plastic waste reduction, driven by environmental organizations, encourage consumers to recycle more, leading to a more robust supply of post-consumer plastic materials for recycling companies.

Asia Pacific America Recycled Thermoplastics Market Trends

Asia Pacific dominated the global Recycled Thermoplastics market and accounted for the largest revenue share of 58.51% in 2023, owing to the rapid industrialization and urbanization in emerging economies like China and India. As these countries expand their manufacturing capacities, there is increasing pressure to manage waste effectively, leading to a higher demand for recycled thermoplastics. Governments are implementing waste management and recycling policies to address growing environmental concerns, driving the demand for recycled materials in various sectors such as packaging, construction, and consumer goods. Moreover, local industries are leveraging recycled thermoplastics as a cost-effective alternative to virgin materials, especially as raw material prices fluctuate.

Europe Recycled Thermoplastics Market Trends

The recycled thermoplastics market in Europe is driven by stringent environmental regulations and the EU’s focus on achieving a circular economy. The European Union has implemented several policies to reduce plastic waste, including bans on single-use plastics and requirements for higher recycled content in products and packaging. These regulations are compelling manufacturers to use more recycled thermoplastics in their operations. Additionally, Europe’s well-established recycling infrastructure supports collecting and processing high-quality recyclable materials, further driving the demand for recycled thermoplastics in industries such as automotive, construction, and packaging.

Key Recycled Thermoplastics Company Insights

The Recycled Thermoplastics market is highly competitive, with several key players dominating the landscape. Major companies include APC recycling B. Schoenberg & Co., Clear Path Recycling, Custom Polymers, Envision Plastics, Fresh Pak Corporation, KW Plastics, Maine Plastics Incorporation, PARC Corporation, Plastipak Holdings, RJM International Inc., Suez, United plastic recycling, Veolia, and B&B Plastics. The recycled thermoplastics market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance their products' performance, cost-effectiveness, and sustainability.

Key Recycled Thermoplastics Companies:

The following are the leading companies in the recycled thermoplastics market. These companies collectively hold the largest market share and dictate industry trends.

- APC recycling

- B. Schoenberg & Co.

- Clear Path Recycling

- Custom Polymers

- Envision Plastics

- Fresh Pak Corporation

- KW Plastics.

- Maine plastics incorporation

- PARC corporation

- Plastipak Holdings

- RJM International Inc.

- Suez

- United plastic recycling

- Veolia

- B&B Plastics

Recent Developments

-

In October 2023, Coca-Cola India launched new bottles of 100% recycled plastic (rPET) in smaller sizes, specifically 250 ml and 750 ml. These bottles are produced with bottling partners Moon Beverages Ltd. and SLMG Beverages Ltd. The initiative is part of Coca-Cola's broader sustainability efforts, which include using 50% recycled content in its packaging by 2030 and ensuring all packaging is recyclable by 2025.

-

In July 2022, Dow and Mura Technology announced a significant partnership to address the global plastic waste crisis. They plan to build multiple advanced recycling facilities in the U.S. and Europe, each with a capacity of 120 kilotons per year, totaling up to 600 kilotons of annual recycling capacity. This initiative represents their largest commitment to date in scaling advanced recycling capabilities.

Recycled Thermoplastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 62.53 billion

Revenue forecast in 2030

USD 108.52 billion

Growth rate

CAGR of 9.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Form, technology, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

APC recycling B. Schoenberg & Co.; Clear Path Recycling; Custom Polymers; Envision Plastics; Fresh Pak Corporation; KW Plastics; Maine Plastics Incorporation; PARC Corporation; Plastipak Holdings; RJM International Inc.; Suez; United plastic recycling; Veolia; B&B Plastics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Thermoplastics Market Report Segmentation

This report forecasts volume & revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global recycled thermoplastics market report based on form, technology, product, application, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flakes

-

Pellets

-

Granules

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Extrusion

-

Injection Molding

-

Blow Molding

-

Others (Thermoforming, 3D Printing)

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene

-

Polyethylene Terephthalate

-

Polypropylene

-

Polystyrene

-

Polyvinyl Chloride

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive

-

Consumer Goods

-

Medical

-

Building & Construction

-

Electrical and Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global recycled thermoplastics market size was estimated at USD 52.51 billion in 2023 and is expected to reach USD 62.52 billion in 2024 owing to the increasing exponential demand from the automotive industry.

b. The global recycled thermoplastics market is expected to grow at a compound annual growth rate of 9.6% from 2024 to 2030 to reach USD 108.52 billion by 2030.

b. Based on technology, the extrusion segment led the market with the largest revenue share of 36.51% in 2023, which can be attributed to the increasing demand for sustainable building materials. As construction and infrastructure projects worldwide move towards greener practices, the use of recycled thermoplastics in products like pipes, siding, and insulation materials is growing.

b. Some key players operating in the recycled thermoplastics market include APC recycling B. Schoenberg & Co.; Clear Path Recycling; Custom Polymers; Envision Plastics; Fresh Pak Corporation; KW Plastics; Maine Plastics Incorporation; PARC Corporation; Plastipak Holdings; RJM International Inc.; Suez; United plastic recycling; Veolia; B&B Plastics.

b. The growing concerns regarding the increasing plastic waste globally is driving the need to reduce plastic waste using various methods including recycling, thus driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.