- Home

- »

- Next Generation Technologies

- »

-

Refrigerated Trailer Market Size, Share, Industry Report 2030GVR Report cover

![Refrigerated Trailer Market Size, Share & Trends Report]()

Refrigerated Trailer Market (2025 - 2030) Size, Share & Trends Analysis Report By Trailer (Single-Temperature, Multi-Temperature), By Axle (Single Axle, Tandem Axle, Triple Axle), By Power Source, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-583-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Refrigerated Trailer Market Summary

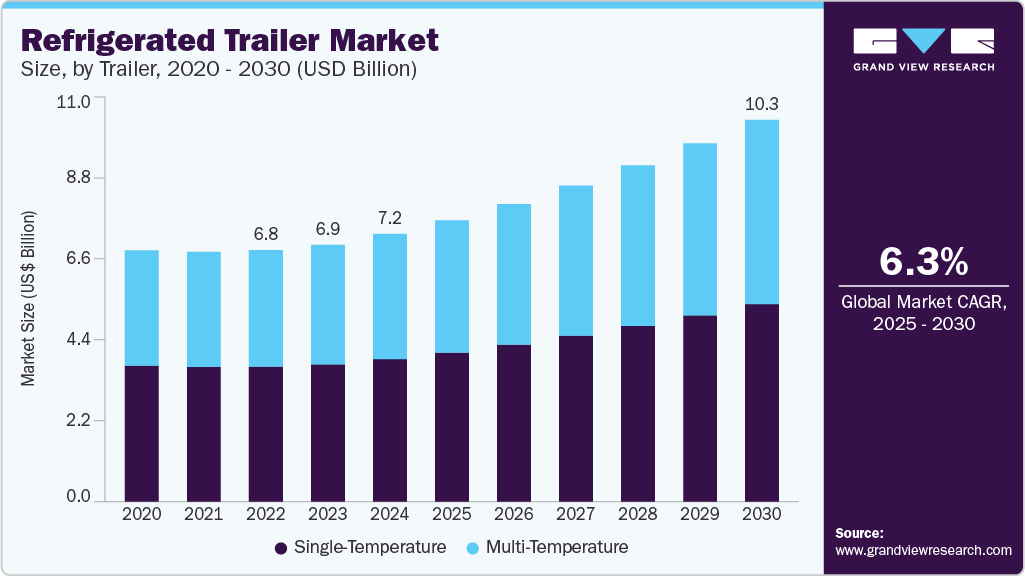

The global refrigerated trailer market size was estimated at USD 7.24 billion in 2024 and is projected to reach USD 10.32 billion by 2030, growing at a CAGR of 6.3% from 2025 to 2030. The market is gaining momentum, driven by increasing demand for perishable goods and the growing expansion of e-commerce and online grocery.

Key Market Trends & Insights

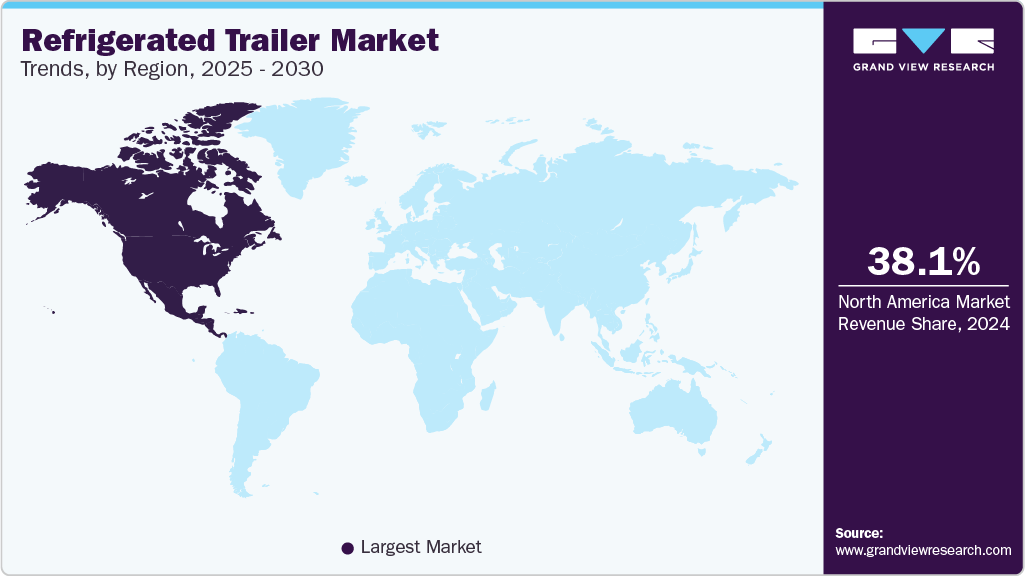

- The North America refrigerated trailer industry accounted for 38.1% of the global share in 2024.

- The U.S. refrigerated trailer industry held a dominant position in 2024.

- By trailer, the single-temperature segment held the largest share of 53.2% in 2024.

- By axle, the tandem axle segment held the largest revenue share in 2024.

- By power source, the diesel-powered segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.24 Billion

- 2030 Projected Market Size: USD 10.32 Billion

- CAGR (2025-2030): 6.3%

- North America: Largest market in 2024

However, the high upfront costs of refrigerated trailers remain a key challenge. The growing technological advancements in refrigeration and the rising stringency of environmental regulations present a major growth opportunity for the market. In addition, the ongoing shift towards electric and energy-efficient refrigeration systems is expected to accelerate the adoption of refrigerated trailers further, enhancing sustainability and reducing operational costs for fleet operators.The increasing demand for perishable goods is a major driver of growth in the refrigerated trailer industry. With the rise in e-commerce, particularly online grocery shopping, consumers now expect fresh, organic, and frozen food to be delivered quickly and in optimal condition. For example, supermarkets like Walmart and Tesco have expanded their online grocery services, leading to an uptick in demand for refrigerated trailers to transport products such as fruits, vegetables, dairy, meat, and frozen goods. In addition, the food service industry, including restaurants and catering companies, also depends on refrigerated transport to ensure freshness. This heightened demand for cold chain logistics drives the need for more advanced refrigerated trailers.

As consumer preferences shift toward the convenience of shopping online, demand for fast, fresh, and reliable delivery services has surged. For instance, in India, the e-commerce industry, valued at USD 125 billion in 2024, is projected to grow to USD 345 billion by 2030, with a CAGR of 15%, according to the India Brand Equity Foundation (IBEF). Similarly, in the U.S., e-commerce sales are expected to grow by 8.1% in 2024, making up 16.1% of total retail sales, as per the Census Bureau of the Department of Commerce. This growth has led to an increased need for refrigerated trailers to ensure the safe transport of perishable goods, including fresh produce, dairy, and frozen items, for these online grocery services.

Governments across key markets are enforcing stricter emission norms, prompting a shift toward zero-emission transport solutions. In the U.S., the California Air Resources Board (CARB) mandates that all new trailer Transport Refrigeration Units (TRUs) meet Ultra-Low Emission TRU (ULETRU) standards from 2023 onward and is advancing rules to transition TRUs to zero-emission technologies. In the EU, Regulation (EU) 2024/573 limits fluorinated greenhouse gases used in refrigeration. These policies are accelerating the demand for cleaner technologies. For instance, in September 2024, Trailer Dynamics and THE REEFER Group partnered to launch the eCool Trailer, a fully electric refrigerated trailer that powers both propulsion and refrigeration systems, helping fleets meet regulatory compliance while reducing long-term emissions and operating costs.

The high upfront costs of refrigerated trailers present a significant challenge, particularly for smaller fleet operators. Advanced models, such as electric or hybrid trailers with battery systems or energy recovery technology, can cost significantly more than traditional diesel units. For instance, Carrier's all-electric Vector eCool trailer can cost approximately USD 30,000 more than a standard diesel refrigeration unit due to its advanced features. In addition, solar-powered refrigerated trailers, like those from TIP Group and Valoe in Finland, involve substantial investments, with projects valued at around USD 20 million for retrofitting hundreds of trailers. While these technologies promise long-term savings, the initial high costs remain a barrier for many businesses looking to adopt them.

Trailer Insights

The single-temperature segment held the largest share of 53.2% in 2024. Factors such as the increasing demand for perishable goods, strict temperature-controlled supply chain requirements, and the growth of e-commerce are contributing to segment growth. The need for efficient transportation of products such as pharmaceuticals, dairy, and meat products, which require constant, uniform temperatures, is also supporting this trend.

The multi-temperature segment is expected to grow at the fastest CAGR from 2025 to 2030. Factors such as the increasing demand for transporting mixed perishable goods, the need for flexible temperature zones for different products, and the growth in food service and pharmaceutical industries are supporting the segment's growth. Companies are focusing on flexible temperature management solutions, integrating advancements in refrigeration, energy efficiency, and autonomous control. For instance, in May 2024, Thermo King announced the launch of two new trailer refrigeration units: the E1000M and the Precedent S-750M, at the Advanced Clean Transportation (ACT) Expo. These units are designed to support fleet sustainability goals and include advanced features that enable multi-temperature operations, providing flexibility for transporting mixed perishable goods across different temperature zones.

Axle Insights

The tandem axle segment held the largest revenue share in 2024, driven by key factors such as the increasing demand for high-capacity trailers, the need for improved stability during transportation, and growing consumer preference for advanced handling systems. The use of tandem axles offers better weight distribution, which enhances safety and performance. Companies in the market are focusing on enhancing load capacity, improving stability, and integrating advanced suspension systems, driving growth in the tandem axle segment. For instance, in April 2024, Air-tow Trailers launched the groundbreaking ZERO refrigerated trailer, featuring a unique ground-level loading system for safer, faster, and more efficient handling of goods. The trailer, equipped with a Thermo King V-320 MAX refrigeration system, ensures temperatures as low as 0°F and is designed with tandem axles, offering a capacity of 7,000 lbs and a hydraulic lift mechanism.

The triple axle segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment is mainly attributed to increasing demand for higher load capacity, improved stability, and the ability to transport heavier and bulkier goods. In addition, the rising need for efficiency in long-haul transportation, along with advancements in suspension systems, is driving the adoption of triple axle trailers.

Power Source Insights

The diesel-powered segment held the largest revenue share in 2024, primarily due to its proven reliability, extensive refueling infrastructure, and cost-effectiveness for long-distance hauling. Diesel-powered refrigerated trailers are known for their robust performance, especially in harsh conditions, and their ability to operate continuously for extended periods without the need for recharging, unlike electric systems. The availability of widespread diesel fueling stations globally ensures ease of operation, particularly in regions with limited access to electric charging infrastructure.

The electric-powered segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment is mainly attributed to the increasing demand for sustainable and eco-friendly solutions, as well as stricter emissions regulations in regions including the European Union and California. In addition, the expansion of electric vehicle charging infrastructure and advancements in battery technology are making electric-powered trailers more viable and attractive to fleet operators. Companies are increasingly adopting electric-powered refrigeration solutions to reduce emissions and improve sustainability in the logistics sector. For instance, in June 2024, Thermo King, in partnership with Woolworths and DP World, introduced Africa’s first refrigerated trailer featuring the Thermo King AxlePower system. This system enables 100% electric refrigeration, saving up to 27 tonnes of CO2 annually.

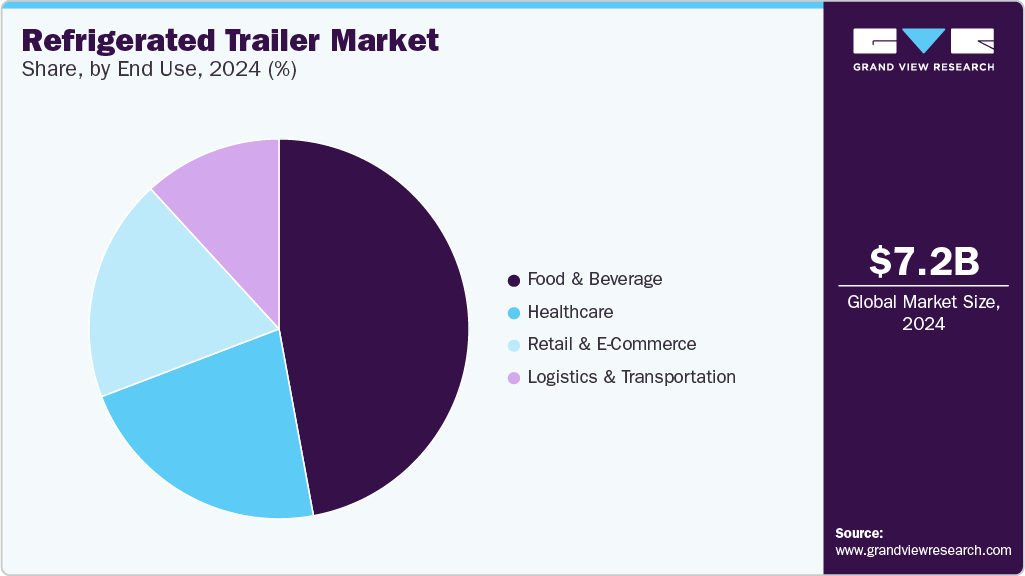

End Use Insights

The food & beverage segment held the largest share in 2024. Factors such as the increasing demand for perishable goods, the expansion of global supply chains, and the growing trend of online food delivery are fueling the segment’s growth. For instance, the rise in e-commerce platforms for grocery and food delivery services, such as Walmart and Amazon Fresh, has boosted the need for reliable refrigerated transport solutions to maintain product freshness throughout the supply chain.

The retail & e-commerce segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment is mainly attributed to the increasing demand for perishable goods, the rapid expansion of online grocery services, advancements in last-mile delivery infrastructure, and rising consumer expectations for fast and reliable delivery of fresh products. Companies operating in the segment are focusing on adopting innovative solutions such as temperature-controlled packaging and electric-powered refrigerated trailers to ensure the safe and efficient delivery of perishable goods.

Regional Insights

The North America refrigerated trailer industry accounted for 38.1% of the global share in 2024. The market in North America is being driven by the rapid growth of e-commerce, and online grocery shopping has surged the demand for refrigerated trailers to transport perishable goods, as consumers expect faster and fresher deliveries. In addition, stricter environmental regulations, such as California's Low-Emission Vehicle (LEV) program and upcoming zero-emission mandates, are pushing companies to adopt more sustainable refrigerated transportation options, including electric-powered trailers.

Advancements in last-mile delivery infrastructure, particularly in urban areas, are further fueling the need for efficient refrigerated solutions to ensure timely deliveries. For instance, in October 2023, United Natural Foods Inc. (UNFI) introduced a zero-emission refrigerated delivery system at its West Sacramento distribution center, featuring two battery-electric semi-trucks and five regenerative electric refrigerated trailers. The initiative supports UNFI’s 2030 emissions reduction goals while enhancing logistics efficiency and lowering delivery cost-per-mile in the Sacramento and Gilroy, California markets.

U.S. Refrigerated Trailer Market Trends

The U.S. refrigerated trailer industry held a dominant position in 2024. The market in the U.S. is witnessing significant transformation, driven by rising consumer demand for fresh and perishable goods, especially in the food & beverage and e-commerce sectors. The growth of cold chain logistics, coupled with technological advancements in refrigeration systems, is further enhancing operational efficiency. Stringent environmental regulations, such as the California Air Resources Board's (CARB) push for low-emission trailers, are also prompting a shift towards more sustainable, electric-powered refrigerated trailers.

The refrigerated trailer industry in Mexico is experiencing robust growth, driven by the rising demand for fresh and frozen products in sectors like food & beverage and pharmaceuticals. In addition, improvements in infrastructure and logistics hubs across Mexico are enhancing the transportation of temperature-sensitive goods, further fueling market growth.

Asia Pacific Refrigerated Trailer Market Trends

The Asia Pacific refrigerated trailer industry was identified as a lucrative region in 2024, driven by the region's rapidly expanding food export industry, particularly in countries such as India, China, and Southeast Asia. The region is experiencing a shift toward modernizing cold chain logistics, supported by government policies such as India’s National Cold Chain Policy, aimed at reducing food wastage and improving storage and transportation infrastructure. In addition, the demand for temperature-sensitive products, such as pharmaceuticals and chemicals, is increasing, further boosting the market. The rapid expansion of e-commerce platforms in Southeast Asia is driving a rise in demand for reliable last-mile cold delivery solutions.

The China refrigerated trailer industry held a substantial market share in 2024, driven by the country’s ongoing investment in developing its cold chain infrastructure. The Made in China 2025 initiative focuses on enhancing supply chain efficiency, particularly in refrigerated transportation. China’s growing demand for premium food products, such as dairy, meat, and seafood, is propelling the need for refrigerated transport solutions. Furthermore, the Belt and Road Initiative (BRI) is strengthening trade routes and increasing the demand for cross-border refrigerated transport. In addition, the government’s commitment to reducing carbon emissions is encouraging the adoption of energy-efficient refrigerated trailers.

The refrigerated trailer industry in Japan held a significant share in 2024, driven by the country’s strong export of seafood and other perishable food products, requiring advanced cold storage and transportation solutions. Japan’s aging population has led to an increased demand for pharmaceutical logistics, pushing the need for refrigerated trailers to transport temperature-sensitive medical products. The country’s strict environmental regulations, such as the Act on the Rational Use of Energy, are driving demand for energy-efficient and electric refrigerated trailers. Additionally, Japan’s advanced logistics infrastructure is facilitating the adoption of refrigerated trailers for efficient last-mile delivery, particularly in the booming e-commerce sector.

Europe Refrigerated Trailer Market Trends

The Europe refrigerated trailer industry was identified as a lucrative region in 2024. The European market is witnessing significant transformation, driven by factors such as the region's stringent food safety and cold chain regulations, growing demand for sustainable logistics solutions, and increasing trade in perishable goods. The European Union's Cold Chain Logistics and Food Safety Regulations, such as Regulation (EC) No 852/2004 on the hygiene of foodstuffs, are pushing the adoption of advanced refrigerated trailers to ensure the safe and efficient transportation of temperature-sensitive goods.

The European refrigerated trailer industry is increasingly focusing on sustainability and energy efficiency to meet stringent environmental regulations, such as the European Union’s Green Deal and the European Climate Law, which target a ~55% reduction in greenhouse gas emissions by 2030. As a result, many companies are exploring innovative solutions to minimize the carbon footprint of refrigerated transportation. For instance, in June 2023, TIP Group, in collaboration with Valoe and Frigoscandia, introduced Finland's first solar-powered refrigerated trailer. Equipped with Valoe’s solar system, the trailer ensures uninterrupted cold chain transport using solar power.

The German refrigerated trailer industry is being shaped by several key factors, including the country’s strong manufacturing base and demand for high-quality logistics solutions. Germany's central role in European trade, especially with neighboring countries, drives the need for advanced refrigerated transport systems. The country’s commitment to reducing carbon emissions through initiatives like the German Climate Action Plan is encouraging the adoption of energy-efficient refrigerated trailers. Additionally, Germany’s robust e-commerce and food delivery market, combined with stringent food safety regulations, is further fueling demand for refrigerated trailers.

The refrigerated trailer industry in the UK was identified as a lucrative market in 2024. UK’s e-commerce sector has seen significant growth, driving an increased demand for efficient cold chain logistics, particularly for temperature-sensitive products like fresh food, pharmaceuticals, and beverages. The rise in online grocery shopping and home delivery services has significantly boosted the need for refrigerated trailers to ensure that perishable goods reach consumers in optimal condition. In addition, the UK’s commitment to reducing carbon emissions, supported by initiatives like the “Clean Growth Strategy,” is further fueling the demand for energy-efficient refrigerated trailers equipped with advanced refrigeration technologies.

The UK market is also benefiting from technological advancements aimed at improving cold chain efficiency and regulatory compliance. For instance, in June 2023, ORBCOMM expanded its UK distribution network by partnering with Refrigerated Trailer Services (RTS) to market its advanced temperature dataloggers. This collaboration targets refrigerated fleet operators and trailer bodybuilders, offering real-time cold chain monitoring and compliance tools to enhance operational efficiency and reduce the carbon footprint in the food, pharmaceutical, and transport sectors. This move reflects the increasing importance of digital solutions in maintaining the integrity of temperature-sensitive products and improving the sustainability of refrigerated transport in the country.

Key Refrigerated Trailer Company Insights

Some of the key players operating in the market include Wabash National Corporation, Schmitz Cargobull AG, Great Dane LLC, and Utility Trailer Manufacturing Company.

-

Founded in 1985 and headquartered in Indiana, U.S., Wabash National Corporation specializes in the design and manufacturing of refrigerated trailers, dry vans, and other transportation equipment. The company offers a wide range of products, focusing on lightweight, durable solutions for the transportation of temperature-sensitive goods. Wabash is recognized for its innovation in using advanced composite materials and fuel-efficient technologies to reduce operational costs and improve overall performance. It serves various industries, including food and beverage, pharmaceuticals, and retail, and operates a comprehensive network of facilities to support its global customer base.

-

Founded in 1892 and headquartered in Altenberge, Germany, Schmitz Cargobull AG is a leading manufacturer of refrigerated trailers and other commercial transportation solutions. The company designs and manufactures high-quality, energy-efficient refrigerated trailers, specializing in temperature-sensitive cargo for industries such as food, pharmaceuticals, and chemicals. Schmitz Cargobull is known for its advanced trailer designs, incorporating insulation technology and innovative refrigeration systems to optimize energy consumption.

Key Refrigerated Trailer Companies:

The following are the leading companies in the refrigerated trailer market. These companies collectively hold the largest market share and dictate industry trends.

- Wabash National Corporation

- Schmitz Cargobull AG

- Great Dane LLC

- Utility Trailer Manufacturing Company

- CIMC Vehicles Group Co., Ltd.

- Kögel Trailer GmbH & Co. KG

- Lamberet SAS

- Fahrzeugwerk Bernard Krone GmbH & Co. KG

- Hyundai Translead, Inc.

- Gray & Adams Ltd.

Recent Developments

-

In April 2025, Birds Eye, in partnership with DFDS and Sunswap, introduced solar-powered refrigerated trailers in the UK to enhance the sustainable transport of frozen goods. The initiative supports Birds Eye’s carbon reduction targets and will deploy advanced battery-electric refrigeration systems powered by rooftop solar panels.

-

In March 2025, Utility Trailer and Cargobull North America introduced innovative upgrades to their hybrid refrigerated trailer units, including a compact microchannel condenser and a Load-Dividing Bulkhead option. The new condenser boosts thermal efficiency and cooling performance for the 625 and 655MT models.

-

In December 2024, Wabash unveiled its Acutherm refrigerated freight body built with EcoNex composite technology, marking a major structural innovation in the refrigerated trailer industry. The new body design offers a 25% improvement in thermal efficiency and significantly reduced weight, aiming to boost energy performance and sustainability in temperature-controlled transport.

-

In October 2024, Wabash announced a USD 1.6 million U.S. Department of Energy grant to partner with the University of Delaware in developing solar-integrated refrigerated trailers. The three-year project aims to reduce emissions and grid reliance by embedding high-efficiency solar tech into trailer and truck body structures.

Refrigerated Trailer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.61 billion

Revenue Forecast in 2030

USD 10.32 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Trailer, axle, power source, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Wabash National Corporation; Schmitz Cargobull AG; Great Dane LLC; Utility Trailer Manufacturing Company; CIMC Vehicles Group Co., Ltd.; Kögel Trailer GmbH & Co. KG; Lamberet SAS; Fahrzeugwerk Bernard Krone GmbH & Co. KG; Hyundai Translead, Inc.; Gray & Adams Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Refrigerated Trailer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global refrigerated trailer market report based on trailer, axle, power source, end use, and region.

-

Trailer Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Temperature

-

Multi-Temperature

-

-

Axle Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Axle

-

Tandem Axle

-

Triple Axle

-

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Diesel-Powered

-

Electric-Powered

-

Solar-Assisted

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Healthcare

-

Retail & E-Commerce

-

Logistics & Transportation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global refrigerated trailer market size was estimated at USD 7.24 billion in 2024 and is expected to reach USD 7.61 billion in 2030.

b. The global refrigerated trailer market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 10.32 billion by 2030.

b. North America dominated the global refrigerated trailer market with a share of 38.1% in 2024. This is attributable to the rapid growth of e-commerce, and online grocery shopping has surged the demand for refrigerated trailers to transport perishable goods, as consumers expect faster and fresher deliveries.

b. Some key players operating in the refrigerated trailer market include Wabash National Corporation, Schmitz Cargobull AG, Great Dane LLC, Utility Trailer Manufacturing Company, CIMC Vehicles Group Co., Ltd., Kögel Trailer GmbH & Co. KG, Lamberet SAS, Fahrzeugwerk Bernard Krone GmbH & Co. KG, Hyundai Translead, Inc., and Gray & Adams Ltd.

b. Key factors that are driving the market growth include increasing demand for perishable goods and the growing expansion of e-commerce and online grocery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.