- Home

- »

- Automotive & Transportation

- »

-

Refrigerated Warehousing Market Size & Share Report, 2030GVR Report cover

![Refrigerated Warehousing Market Size, Share & Trends Report]()

Refrigerated Warehousing Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Private & Semi-Private, Public), By Temperature Range, By Application (Food & Beverages, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-109-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global refrigerated warehousing market size was valued at USD 85.04 billion in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 17.8% from 2023 to 2030. The market is driven by factors such as growing consumption of frozen foods and changing consumer preferences. Moreover, the growing adoption of automation in refrigerated warehouses is boosting market growth. A refrigerated warehouse is a space or building built for handling or storing temperature-sensitive products such as pharmaceutical and food products. Mechanical refrigeration keeps the space temperature low, within the required temperature ranges. Refrigerated storage helps preserve the quality of temperature-sensitive products and extend their shelf life.

Automation in refrigerated warehouses is seeing a rise in adoption as it helps improve the processes at a refrigerated warehouse with transparent and continuous monitoring of stored goods and processes. Automated Storage and Retrieval Systems (AS/RS), Automated Guided Vehicles (AGVs), and other automation technologies are used in these facilities to improve efficiency. Innovations of such products will likely improve the overall operations at the warehouses. For instance, in June 2023, Germany-based KION GROUP AG’s Dematic announced the launch of its third generation of freezer-rated AGVs. The AGVs are designed to operate in cold storage environments 24/7, minimizing occupational health and safety risks.

Numerous industrial cold storage warehouses are being built in urban areas to meet quick delivery needs. Hence, the need to address high operating costs due to expensive land in urban areas is driving companies to build taller warehouses. This has created the need for fall protection equipment to minimize worker risk. Sustainability and energy-efficiency initiatives are being undertaken by businesses to maximize energy efficiency. Refrigerated warehouses need huge amounts of energy for continuously running cooling equipment, which can be costly. Hence, maximizing energy efficiency using technologies such as Thermal Energy Storage (TES) can help reduce operating costs.

North America has huge refrigerated warehouse space and a presence of numerous market players. Moreover, the growing adoption of automation in warehouses and initiatives by regional governments are driving market growth in North America. The market is fragmented, with many international and regional companies. The new entrants and market players are adopting strategies such as acquisitions and expansion to gain a competitive edge.

COVID-19 Impact Analysis

The COVID-19 pandemic led to lockdowns and social distancing to restrict the spread of the virus, posing significant challenges for the warehousing industry. The COVID-19 pandemic disrupted supply chains, leading to shutdowns, shipping bottlenecks, and labor shortages, posing significant challenges for the refrigerated warehousing industry. Online shopping accelerated post the onset of the COVID-19 pandemic, highlighting the need for increased cold storage warehouse capacity. Growing e-commerce sales have increased the need for refrigerated warehouses to be closer to the customers, aiding in reducing transportation costs and meeting customer expectations of quick delivery.

The COVID-19 pandemic highlighted the need for automation in cold storage facilities to address labor shortage challenges and improve warehouse operations, meeting increased demand and adapting to changing customer preferences. Safe storage and distribution of the COVID-19 vaccines increased the need for temperature-controlled warehouses. According to World Health Organization (WHO)’s 2022 global vaccine market report, in 2021, COVID-19 vaccines accounted for twice the value and volume of all other distributed vaccines, leading to an increase in the global vaccine market from 2019 to 2021. Hence, the demand for refrigerated warehouses for essential food products and pharmaceuticals increased post the COVID-19 pandemic.

Type Insights

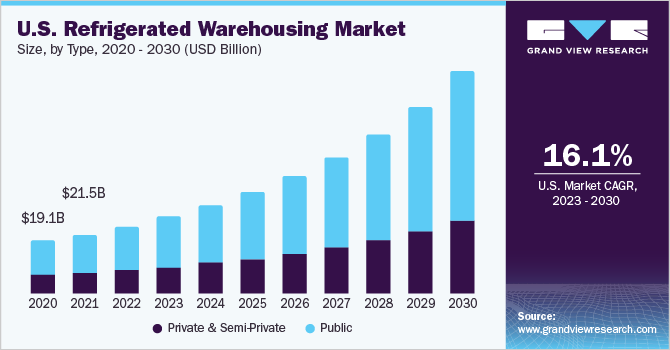

Based on type, the market is bifurcated into public and private & semi-private. The public segment dominated the overall market, gaining a market share of 64.4% in 2022. It is expected to grow at the fastest CAGR of 18.2% throughout the forecast period. Public refrigerated warehouses are owned and operated by the government or Third-Party Logistics (3PL) companies. Public warehouses handle goods on behalf of their client companies. In comparison to private & semi-private warehouses, public warehouses are more adaptable, cost-effective, and convenient. Public warehouses are witnessing significant growth as they are more cost-effective, and many of them provide value-added services such as assembling and quality control which helps businesses focus on their core expertise.

The private & semi-private segment is anticipated to grow at a significant CAGR of 16.8% throughout the forecast period. Private & semi-private warehouses are owned and operated by manufacturers, distributors, and wholesalers. These warehouses require significant investment in the construction and maintenance of the facility. Hence, they are more suitable for large corporations than Small and Medium-sized Enterprises (SMEs). However, private & semi-private temperature-controlled warehouses offer benefits such as greater control over warehouse operations and inventory for businesses, driving segment growth.

Temperature Range Insights

Based on temperature range, the market has been segmented into chilled (0°C to 15°C), frozen (-18°C to -25°C), and deep-frozen (below -25°C). The frozen (-18°C to -25°C) segment dominated the overall market, gaining a market share of more than 61.7% in 2022. It is expected to grow at the highest CAGR of 19.0% throughout the forecast period. Temperature-sensitive goods such as poultry, beef, pork, and bakery & confectionary products need to be kept at frozen temperatures to preserve their quality. According to American Frozen Food Institute (AFFI), in 2022, frozen food sales in the U.S. reached USD 72.2 billion, growing by 8.6% from 2021. Consumers are shifting to frozen foods due to their larger shelf life than fresh foods, reducing food wastage. The rising consumption of frozen food is driving the growth of the frozen (-18°C to -25°C) segment.

The chilled (0°C to 15°C) segment is anticipated to grow at a considerable CAGR of 15.9% throughout the forecast period. Refrigerated warehouses operating within this temperature range store and handle temperature-sensitive products such as fresh meat, fruits, vegetables, and dairy products. Chilled temperature range warehouses are essential to maintain the quality of these products to prevent contamination. The need to minimize food wastage is driving the growth of this segment.

Application Insights

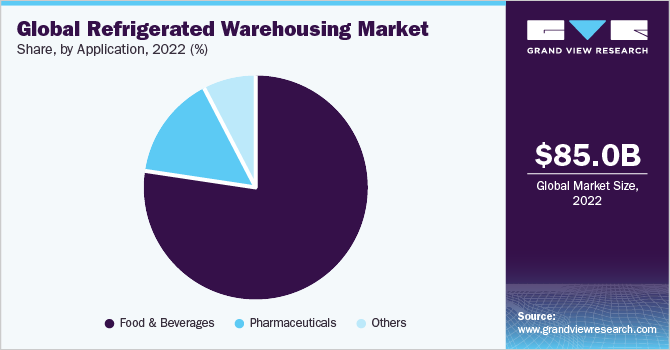

Based on application, the refrigerated warehousing market is segmented into pharmaceuticals, food & beverages, and others. The food & beverages segment held the highest revenue share of more than 77.1% in 2022. It is expected to grow at a CAGR of 17.6% throughout the forecast period. Food & beverage goods need controlled temperature environments to remain fresh and avoid contamination. Moreover, the growth in online food delivery, boosted by the COVID-19 pandemic, is driving the need for more refrigerated space for food & beverage products. According to the Food and Agricultural Organization (FAO), 30 to 40 percent of food produced is lost before it reaches the market due to a lack of proper processing, storage, and transport. Hence, growth in online food delivery and the need to reduce food wastage drive the segment’s growth.

The pharmaceuticals segment is expected to grow at the fastest CAGR of 19.7% over the forecast period. Pharmaceutical cold storage is complicated due to strict regulations and tight temperature tolerances. Hence, companies in the pharmaceutical business need to ensure compliance by maintaining the quality and shelf life of pharmaceutical products. Companies such as India-based Jam Jams Group and U.K.-based Alloga offer temperature-controlled warehouses for the pharmaceutical industry. Moreover, the pharmaceutical industry incurs huge losses due to temperature-control failures across the supply chain. The need to comply with strict regulations is driving the segment’s growth.

Regional Insights

The North America segment led the market and accounted for a 36.0% share of the global revenue in 2022. The market's growth in the region can be attributed to the presence of some of the largest refrigerated warehouse market players, such as U.S.-based LINEAGE LOGISTICS HOLDING, LLC, and Canada-based CONESTOGA COLD STORAGE. Moreover, developed technological infrastructure and the adoption of automation among the region's companies drive the region's growth. For instance, U.S.-based Americold Logistics, Inc. uses robotics and automation at its warehouses. Moreover, government initiatives to develop temperature-controlled facilities significantly boost the market. For instance, in March 2023, the government of Canada announced an investment of USD 3.4 million for constructing a specialized storage facility for seafood at the Gander International Airport in Canada. The project will allow the Gander International Airport Authority Inc. to build a storage facility equipped with chilled/cold storage and blast freezers, among others.

Asia Pacific is expected to grow at the fastest CAGR of 20.4% over the forecast period. Asia Pacific has a huge population, and the COVID-19 pandemic accelerated e-commerce sales in the region. The growing economy of Asia Pacific and changing consumer preferences are likely to drive the demand for frozen foods in the region. Hence, the demand for temperature-controlled warehouses will likely grow with the need for storing these products. Moreover, market players are expanding their refrigerated warehouse facilities in the region. For instance, in June 2021, Netherlands-based NewCold announced an investment of USD 120.5 million to expand its cold storage facility in Victoria, Australia, to 225,000 pallet positions from 115,000 pallet positions.

Key Companies & Market Share Insights

The market is fragmented and highly competitive, and companies are adopting mergers & acquisitions, expansion, and product development strategies to gain a competitive edge. For instance, in June 2023, Compass Cold Storage announced the opening of the first phase of its new cold storage facility inArkansas, U.S. The facility’s size is 142,160-square-foot and built to maintain temperatures between -20° F and 40° F.Some of the prominent key companies in the global refrigerated warehousing market include:

-

LINEAGE LOGISTICS HOLDING, LLC

-

CONESTOGA COLD STORAGE

-

Americold Logistics, Inc.

-

NewCold

-

Burris Logistics

-

Tippmann Group

-

NICHIREI CORPORATION

-

United States Cold Storage

-

FreezPak Logistics

-

Confederation Freezers.

Refrigerated Warehousing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 98.16 billion

Revenue forecast in 2030

USD 308.31 billion

Growth rate

CAGR of 17.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, temperature Range, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Spain; Italy; Norway; Netherlands; Switzerland; Russia; China; Japan; India; Singapore; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

LINEAGE LOGISTICS HOLDING, LLC, CONESTOGA COLD STORAGE, Americold Logistics, Inc., NewCold, Burris Logistics, Tippmann Group, NICHIREI CORPORATION, United States Cold Storage, FreezPak Logistics, and Confederation Freezers.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

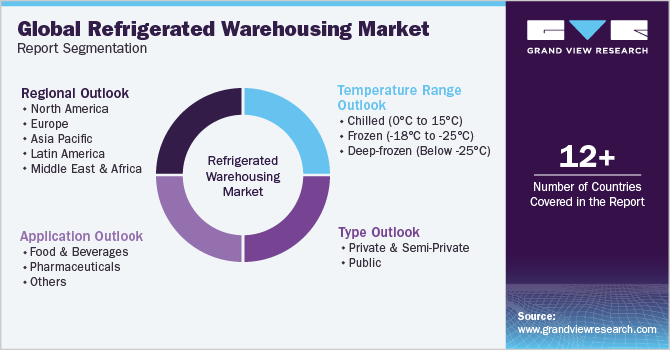

Global Refrigerated Warehousing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global refrigerated warehousing market report based on type, temperature range, application, and region:

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Private & Semi-Private

-

Public

-

-

Temperature Range Outlook (Revenue, USD Million; 2017 - 2030)

-

Chilled (0°C to 15°C)

-

Frozen (-18°C to -25°C)

-

Deep-frozen (Below -25°C)

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice cream

-

Others

-

-

Fish, Meat, And Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Norway

-

Netherlands

-

Switzerland

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global refrigerated warehousing market size was estimated at USD 85.04 billion in 2022 and is expected to reach USD 98.16 billion in 2023.

b. The global refrigerated warehousing market is expected to grow at a compound annual growth rate of 17.8% from 2023 to 2030 to reach USD 308.31 billion by 2030.

b. North America dominated the refrigerated warehousing market with a share of 36.0% in 2022. This is attributable to the developed cold storage and technology infrastructure and the presence of prominent refrigerated warehousing companies.

b. Some key players operating in the refrigerated warehousing market include LINEAGE LOGISTICS HOLDING, LLC, CONESTOGA COLD STORAGE, Americold Logistics, Inc., NewCold, Burris Logistics, Tippmann Group, NICHIREI CORPORATION, United States Cold Storage, FreezPak Logistics, and Confederation Freezers.

b. Key factors driving the market growth include the growing adoption of automation in refrigerated warehouses and the growing consumption of frozen food.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.