- Home

- »

- Advanced Interior Materials

- »

-

Resinous Flooring Market Size, Share, Industry Report, 2033GVR Report cover

![Resinous Flooring Market Size, Share & Trends Report]()

Resinous Flooring Market (2025 - 2033) Size, Share & Trends Analysis Report By Resin Type (Epoxy, Polymethyl Methacrylate, Polyurethane), By End Use (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-310-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Resinous Flooring Market Summary

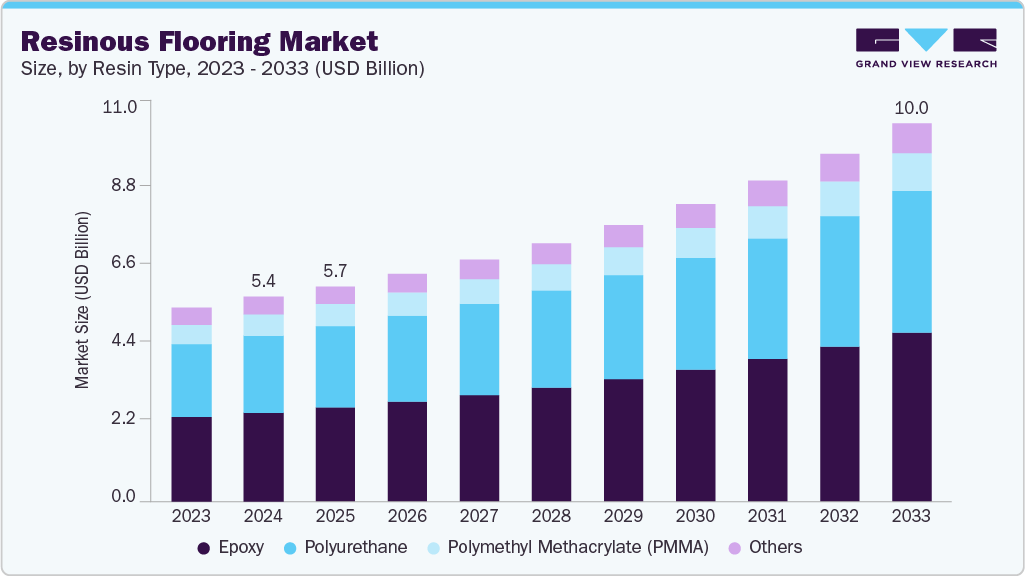

The global resinous flooring market size was estimated at USD 5.39 billion in 2024 and is projected to reach USD 10.02 billion by 2033, growing at a CAGR of 9.9% from 2025 to 2033. The market's growth can be attributed to the surging demand for highly durable and aesthetically appealing flooring developed from resins such as epoxy, polyurethane, and polymethyl methacrylate.

Key Market Trends & Insights

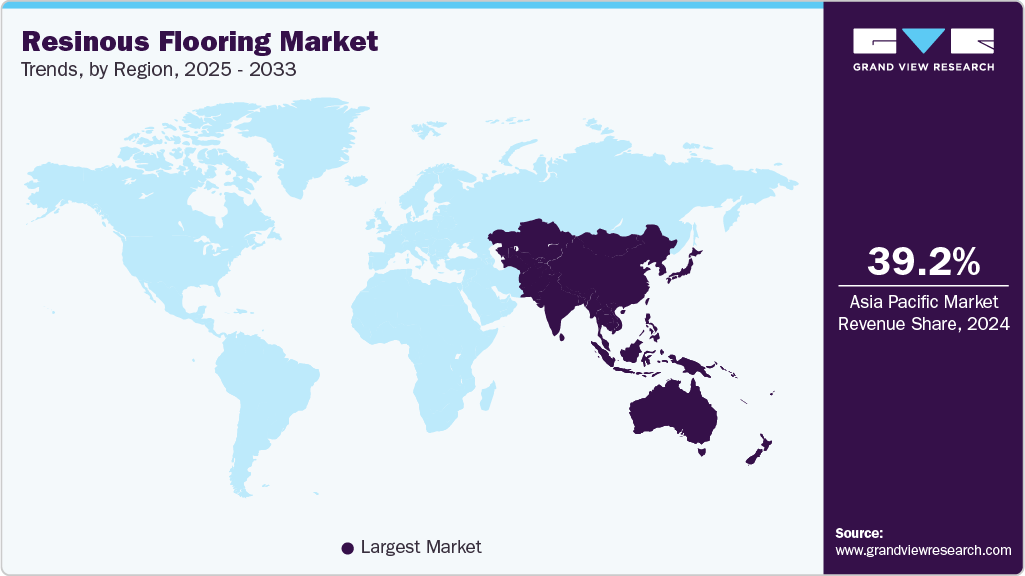

- Asia Pacific dominated the polyester staple fiber market with the largest revenue share of 39.92% in 2024.

- By resin type, the epoxy segment is expected to grow at the fastest CAGR of 10.3% over the forecast period.

- By end use, the non-residential segment is expected to grow at the fastest CAGR of 9.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3.89 Billion

- 2033 Projected Market Size: USD 10.02 Billion

- CAGR (2025-2033): 9.9%

- Asia Pacific: Largest market in 2024

Additionally, the rising per capita income of the masses and the increasing population fuel construction activities worldwide, leading to a surge in global product demand. Additionally, growing population, increasing per capita income, and rising urbanization in emerging countries, such as Mexico, South Africa, India, China, South Korea, and Brazil, are expected to boost the number of residential and non-residential construction projects in the coming years.Resinous flooring types like epoxy and polymethyl methacrylate offer high insulation properties. They are used to provide thermal insulation to buildings to maintain the inner temperature of a structure. Additionally, these types have superior sound insulation properties, preventing sound from spreading and reducing noise level impacts. This makes it an ideal flooring solution for areas that require a silent environment.

The manufacturing and installation of resinous floorings have a negative environmental impact, which is expected to hamper the market's growth. Epoxy resin is derived from petroleum products and emits fumes when applied as a flooring material. The fumes emitted by epoxy resin can be hazardous to construction workers and the environment. Epoxy resin may also leach chemicals, such as Bisphenol A, into groundwater, thereby polluting the waterbodies. The higher pollution rates caused by epoxy resins are expected to restrict market growth.

The presence of a large number of suppliers, leading to low switching costs, is expected to increase buyers' bargaining power. Major players cater to customers’ needs through e-commerce platforms. A variety of resinous flooring solutions are available in different colors, dimensions, materials, textures, and costs, which increases customers' options. Thus, buyers' bargaining power is expected to be high over the forecast period.

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The growth in printing technologies, such as digital printing, aids in providing a variety of patterns along with realistic visuals. Furthermore, the new material and coating technologies provide several benefits, such as a wide range of patterns and colors, stain and chemical resistance, high wear resistance, and low maintenance. These factors led to a moderately high degree of innovation.

The resinous flooring market is governed by several regulations and standards regarding its use and production. Several agencies, such as the National Bureau of Standards, U.S. Food & Drug Administration, FeRFA-Resin Flooring Association, EFNARC, and Indian Standard, have levied regulations on resins used in the manufacturing process. The regulations have also been implemented regarding the requirements and test methods for resinous flooring production.

The market witnesses a wide range of substitutes for resinous flooring, such as wood, LVT, vinyl, resilient, carpet, and ceramic tiles. The development of eco-friendly solutions, including cork, natural linoleum, bamboo, and rubber, further threatens market growth.

Cost, design, and aesthetics play important roles in end users' selection of resinous flooring options. In addition, increasing government spending on infrastructure development for residential and non-residential structures in developing countries, such as India, Taiwan, Brazil, and Mexico, is expected to augment the end use concentration.

Resin Type Insights

Epoxy resin accounted for 43.6% of the market share in 2024 and is expected to grow at the fastest CAGR of 10.3% over the forecast period. Epoxy resinous flooring consists of a combination of epoxy resin and a hardening agent. Its features, such as durability, chemical resistance, and easy-to-clean properties, make it suitable for various industrial, commercial, and residential applications.

Polyurethane resin is expected to grow significantly at a CAGR of 9.7% over the forecast period due to its exceptional durability, chemical resistance, and mechanical strength. These characteristics make it ideal for high-traffic environments such as industrial plants, commercial facilities, hospitals, and warehouses. Epoxy-based flooring systems are highly resistant to wear and abrasion, offering long-term performance even under extreme operating conditions. Furthermore, its resistance to harsh chemicals, including solvents, acids, and alkalis, makes it a preferred choice for laboratories and manufacturing sectors. These properties significantly reduce maintenance costs and downtime, enhancing end users' operational efficiency.

End Use Insights

The non-residential segment accounted for a major share of around 88.1% of the global revenue in 2024. Non-residential spaces include commercial buildings, such as offices, convenience stores, shopping malls, and retail stores. These spaces are subject to high foot traffic and, thus, require resinous flooring made from epoxy, polymethyl methacrylate, and polyurethane, owing to its durability and low maintenance.

Commercial and industrial buildings often require flooring that is low-maintenance and resistant to stains. Resinous floors offer protection against scratches, abrasions, and stains and require routine sweeping to maintain their integrity. These factors are driving the product demand.

The residential end-use segment is expected to grow at a CAGR of 9.5% over the forecast period. Epoxy and polyurethane flooring are being used more and more in living rooms, kitchens, garages, and basements, owing to their easy maintenance, durability, seamless finish, and versatility.

Moreover, the growing employment rate, the rising income level of the masses, and the easy availability of finances for the public are surging the demand for residential buildings in developing economies, such as India, Mexico, China, and Brazil.

Regional Insights

Asia Pacific held the highest market share of 39.2% in 2024, driven by rapid industrialization and urban infrastructure expansion, particularly in countries like India, China, and Southeast Asia. Increased investments in manufacturing facilities, commercial complexes, and healthcare infrastructure create robust demand for durable, hygienic, and chemical-resistant flooring solutions. Moreover, growing awareness about workplace safety and hygiene standards encourages industries to adopt epoxy and polyurethane resin flooring, especially in pharmaceutical, electronics, and food processing units.

China Resinous Flooring Market Trends

The resinous flooring market in China is propelled by strong government initiatives supporting industrial modernization and smart manufacturing. The "Made in China 2025" strategy and sustained investment in high-tech manufacturing zones are accelerating the adoption of high-performance flooring systems. Additionally, stringent safety and cleanliness standards in cleanroom environments, automotive factories, and logistics hubs further boost demand for resin-based flooring solutions that offer easy maintenance, anti-slip surfaces, and chemical resistance.

North America Resinous Flooring Market Trends

North America’s resinous flooring market benefits from a mature industrial base and a strong emphasis on occupational safety regulations enforced by agencies such as OSHA and ANSI. The increasing renovation of aging commercial and industrial infrastructure across the United States and Canada also supports market growth. Additionally, the region’s demand for quick-turnaround flooring installations, particularly in retail and food service environments, fuels the use of methyl methacrylate (MMA) resins for their rapid curing capabilities.

U.S. Resinous Flooring Market Trends

In the U.S., growth is largely attributed to the widespread adoption of resinous flooring in healthcare, educational institutions, and commercial real estate sectors. Hospitals and pharmaceutical facilities prefer seamless, antimicrobial flooring solutions that reduce contamination risks. Simultaneously, the demand for decorative resin floors in offices and public buildings pushes manufacturers to offer more customizable and aesthetically appealing products with long-lasting surface finishes.

Europe Resinous Flooring Market Trends

Strict environmental and safety regulations and a strong focus on sustainability in building materials drive Europe’s resinous flooring market. The region has witnessed a steady shift towards eco-friendly, low-VOC resin flooring systems, especially in Germany, France, and the Nordic countries. Moreover, expanding manufacturing and cold storage facilities-coupled with stringent EU norms for hygiene in food and beverage sectors-support the uptake of polyurethane and epoxy flooring systems across Europe.

Germany Resinous Flooring Market Trends

As a leading European manufacturing hub, Germany fuels the demand for resinous flooring in automotive, aerospace, and precision engineering sectors. The need for abrasion-resistant, static-dissipative flooring in these high-tech facilities has driven innovation in specialty resin systems. In addition, Germany's emphasis on energy-efficient and green construction has encouraged using flooring materials that support LEED and BREEAM certification requirements.

Central & South America Resinous Flooring Market Trends

Ongoing improvements in industrial infrastructure and rising investment in logistics, food processing, and chemical sectors drive the resinous flooring market in Central & South America. Countries like Mexico and Chile are witnessing greater adoption of epoxy and polyurethane flooring systems for their performance in harsh environments and resistance to frequent cleaning. Government-led economic development plans promote local manufacturing and commercial construction, further fueling demand.

Brazil Resinous Flooring Market Trends

Brazil’s resinous flooring market is growing due to increased construction activity in the healthcare and retail sectors and the modernization of its manufacturing base. The country's expanding middle class also influences trends toward enhanced aesthetics and comfort in public and commercial spaces, leading to higher adoption of customizable and decorative resin floors. Additionally, public infrastructure upgrades ahead of international events and growing food export industries are pushing demand for hygienic and chemical-resistant flooring options.

Middle East & Africa Resinous Flooring Market Trends

The resinous flooring market in the Middle East and Africa is influenced by large-scale investments in oil and gas, healthcare, and mega-infrastructure projects, especially in the Gulf countries. Harsh climatic conditions necessitate the use of temperature-resistant and UV-stable flooring systems. Moreover, growing urbanization and government-backed construction initiatives such as Saudi Arabia's Vision 2030 and the UAE’s smart city projects have increased the implementation of durable and low-maintenance resin flooring in airports, malls, and healthcare facilities.

Key Resinous Flooring Company Insights

Some of the key players operating in the market include Sika AG, Stonhard, Flowcrete Group Ltd., and CEMENTOS CAPA, S.L:

-

Flowcrete Group Ltd. develops flooring solutions for commercial and industrial applications. It manufactures smoothing epoxies, polyurethane (PU) screeds, methyl methacrylate (MMA) finishes, and vinyl ester resins.

-

Sika AG provides solutions for construction and industrial applications. Its construction solutions include building materials, protection solutions, finishing solutions, and repair materials for airports, bridges, highways, dams and hydropower plants, data centers, factories and warehouses, tunnels, and mines.

Tripolarcon Pvt. Ltd. and Zeraus Products, Inc. are some of the emerging market participants in the resinous flooring market.

-

Tripolarcon Pvt. Ltd. manufactures chemical products such as waterproofing chemicals, epoxy floorings, coating solutions, PU coatings, and sealants used in the construction industry.

-

Zeraus Products, Inc. develops, manufactures, and supplies a range of epoxy floorings, advanced waterborne coatings, adhesives, and polyaspartics to enhance and protect concrete structures.

Key Resinous Flooring Companies:

The following are the leading companies in the resinous flooring market. These companies collectively hold the largest market share and dictate industry trends.

- Stonhard

- Tripolarcon Pvt Ltd

- Zeraus Products Inc.

- Flowcrete Group Ltd.

- ArmorPoxy

- Sika AG

- RESDEV

- RCR Industrial Flooring.

- CEMENTOS CAPA, S.L.

- Jemkon Private Limited

Recent Developments

-

In April 2023, Dur-A-Flex, Inc. launched its new product, a breathable epoxy flooring system named Vent-E. It is specifically designed to protect concrete floors.

-

In November 2022, Stonhard announced the launch of its FE series for decorative flooring products, i.e., Stonblend FE, Stontec FE, and Stonshield FE. These flooring products can be easily installed and cleaned, and offer custom design options. They are produced from flex epoxy mixed with quartz aggregates.

Resinous Flooring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.70 billion

Revenue forecast in 2033

USD 10.02 billion

Growth rate

CAGR of 9.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in Million Square Meters, Revenue in USD Million/Billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin Type, end use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Stonhard; Tripolarcon Pvt Ltd; Zeraus Products Inc.; Flowcrete Group Ltd.; ArmorPoxy; Sika AG; RESDEV; RCR Industrial Flooring; CEMENTOS CAPA, S.L.; Jemkon Private Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Resinous Flooring Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each sub-segments from 2018 to 2030. Grand View Research has segmented the global resinous flooring market report for this study based on resin type, end use, and region.

-

Resin Type Outlook (Volume, Million Square Feet; Revenue, USD Million; 2021 - 2033)

-

Epoxy

-

Polymethyl Methacrylate

-

Polyurethane

-

Other Resin Types

-

-

End Use Outlook (Volume, Million Square Feet; Revenue, USD Million; 2021 - 2033)

-

Residential

-

Non-residential

-

Industrial Buildings

-

Healthcare

-

Educational

-

Offices

-

Retail Stores

-

Other Non-residential End Uses

-

-

-

Regional Outlook (Volume, Million Square Feet; Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global resinous flooring market size was estimated at USD 5.39 billion in 2024 and is expected to reach USD 5.70 billion in 2025.

b. The global resinous flooring market is expected to grow at a compound annual growth rate of 9.9% from 2025 to 2030 to reach USD 10.02 billion by 2030.

b. Based on resin type, the epoxy segment dominated the market and held 43.6% revenue share in 2024 on account of its rising use in warehouses, factories, and garages owing to its durability, chemical resistance, and ease of cleaning.

b. Key players operating in the market are Sika AG, RESDEV, RCR Industrial Flooring, CEMENTOS CAPA, S.L., and Jemkon Private Limited.

b. The key factors that are driving the resinous flooring include surging demand for highly durable and aesthetically appealing flooring developed from resins such as epoxy, polyurethane, and polymethyl methacrylate.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.