- Home

- »

- Medical Devices

- »

-

Retinal Imaging Devices Market Size & Share Report, 2030GVR Report cover

![Retinal Imaging Devices Market Size, Share & Trends Report]()

Retinal Imaging Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Device (Optical Coherence Tomography (OCT) Devices, Fundus Cameras), By Application, By Indication, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-107-8

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Retinal Imaging Devices Market Summary

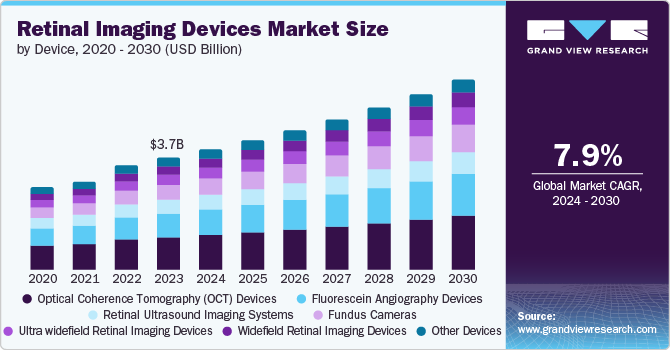

The global retinal imaging devices market size was estimated at USD 3.74 billion in 2023 and is projected to reach USD 6.35 billion by 2030, growing at a CAGR of 7.9% from 2024 to 2030. The increasing prevalence of retinal disorders, such as diabetic retinopathy and age-related macular degeneration, fuels the demand for advanced diagnostic tools.

Key Market Trends & Insights

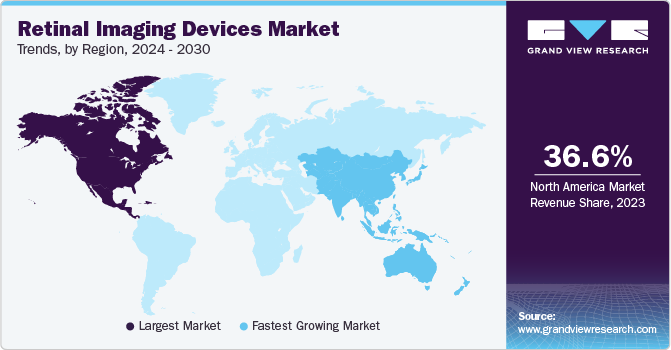

- North America dominated the global retinal imaging devices market with the largest revenue share of 36.63% in 2023.

- Contry-wise, the retinal imaging devices market in the U.S. accounted for the largest market revenue share in North America in 2023.

- By device, the optical coherence tomography (OCT) devices segment accounted for the largest revenue share in 2023.

- By application, the disease diagnosis segment accounted for the largest revenue share in 2023.

- By end-use, the ophthalmology clinics segment is expected to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 3.74 Billion

- 2030 Projected Market Size: USD 6.35 Billion

- CAGR (2024-2030): 7.9%

- North America: Largest market in 2023

According to the CDC, in 2021, around 9.6 million people of all ages were living with DR in the U.S. Among them, around 1.84 million had vision-threatening DR. In addition, the expanding geriatric population, which is more susceptible to eye diseases, supports market growth. Regulatory approvals and government initiatives focused on eye health also contribute to the positive outlook of the market.

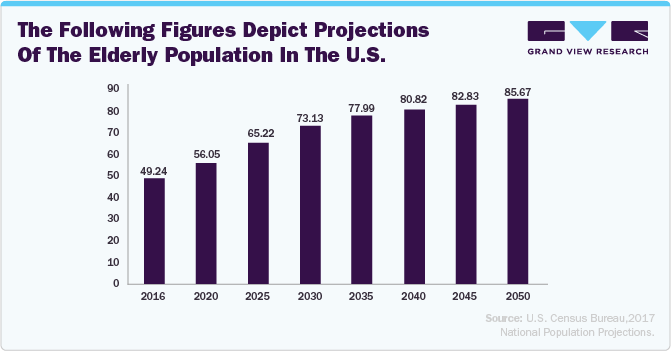

The growing prevalence of retinal diseases, including DR, Age-related Macular Degeneration (AMD), and glaucoma, is significantly increasing the demand for advanced retinal imaging devices. If not diagnosed early, these diseases can lead to severe vision impairment or blindness. In addition, the increasing number of elderly individuals further creates a higher demand for regular eye examinations and advanced diagnostic tools to monitor & treat these conditions effectively. For instance, according to WHO, in 2017, the proportion of people aged 60 or above was 9.8% and is expected to increase to 13.7% and 20.3% by 2030 and 2050, respectively. Older adults (aged ≥65) are currently the fastest-growing group of the general population in the U.S. The National Population Projections by the U.S. Census Bureau 2017 states that nearly one in four U.S. citizens is likely to be an older adult by 2060.

The retinal imaging devices market growth is also anticipated to be driven by innovations such as optical coherence tomography (OCT) and artificial intelligence (AI) integration. These technologies facilitate high-resolution imaging, enabling earlier and more accurate detection of retinal diseases like diabetic retinopathy and age-related macular degeneration. Additionally, the rise of tele-ophthalmology and portable retinal imaging devices is expanding access to care, particularly in underserved regions, thereby increasing the demand for advanced imaging solutions. These technological innovations improve the quality of retinal care and drive the adoption of advanced imaging devices in clinical settings.

Consequently, key players are increasingly engaged in producing these devices, which is expected to fuel market growth and enhance the overall standard of ophthalmic practice. For instance, in June 2024, NIDEK CO., LTD. unveiled the RS-1 Glauvas OCT system. This cutting-edge OCT system features scan speeds of up to 250 kHz, high-resolution wide & deep area imaging, excellent operability, and advanced deep learning-based analytics. Furthermore, advancements in portable and handheld imaging devices are increasing accessibility, allowing for more widespread screening & diagnosis, even in remote or underserved areas (Example- Optomed Aurora IQ).

“We have confidence that the RS-1 Glauvas is an ideal solution for retinal assessment in high-volume clinical practice.”

“The engineering and technical advances incorporated into the RS-1 Glauvas help address physician and staff workload by achieving high-speed imaging and excellent operability. In addition, our innovative analytics functions will enhance clinical efficiency and diagnostic confidence. ”

-Motoki Ozawa, President and CEO of NIDEK CO., LTD

Several initiatives undertaken by the government for the awareness and treatment of the retinal disorders are expected to contribute to market growth. Increased funding from private companies and government agencies is crucial for advancing research & development in retinal imaging technologies. These financial investments enable researchers to explore and develop cutting-edge technologies, such as advanced imaging techniques and innovative diagnostic tools. For instance, in April 2023, Mediwhale, a Seoul-based company, successfully closed a USD 9 million Series A funding round, attracting investors from both the US and South Korea. The company aimed to utilize the funds to facilitate its entry into the US market. The investment round was led by SBI Investment, with participation from Woori Venture Partners and HeartX Fund. Mediwhale's Reti-Intelligence technology employed non-invasive retinal scans combined with deep-learning algorithms to identify disease risks, particularly focusing on cardiovascular health, kidney function, and aging.

Furthermore, the surge in the geriatric population is expected to contribute to the market growth significantly. As people age, they become more susceptible to various eye conditions, including AMD, DR, and glaucoma, all of which can lead to severe vision impairment or blindness if not diagnosed and managed promptly. The increasing number of elderly individuals creates a higher demand for regular eye examinations and advanced diagnostic tools to monitor & treat these conditions effectively.

Retinal imaging technologies, such as OCT & fundus photography, are essential for the early detection and ongoing management of these age-related eye diseases. The rise in the elderly population thus drives the need for these advanced imaging solutions, encouraging healthcare providers to adopt & invest in the latest technologies to cater to this growing demographic.

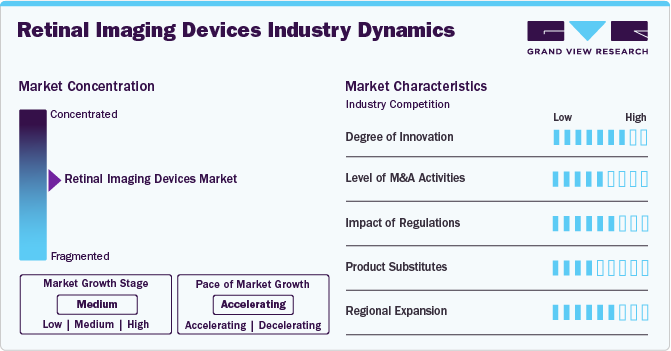

Industry Dynamics

The industry is accelerating at a high pace and has seen significant innovation driven by technological advancements that have significantly enhanced the accuracy and efficiency of imaging outcomes. Moreover, the rising incidence of retinal disorders is further expected to fuel the demand and development in this industry. This surge in geriatric population has emphasized the necessity for more advanced eye imaging devices.

Major players in the industry are continuously working to improve their product offerings in order to expand their customer base and gain a larger industry share, This involves upgrading their products, exploring acquisitions, obtaining government approvals. For instance, in June 2024, the company unveiled the RS-1 Glauvas OCT system. The RS-1 Glauvas is a cutting-edge OCT system featuring scan speeds of up to 250 kHz, high-resolution wide and deep area imaging, excellent operability, and advanced deep learning-based analytics.

The retinal imaging devices industry is characterized by a high degree of innovation, driven by rapid advancements in imaging technologies and artificial intelligence. Companies and government are increasingly investing in research and development to enhance image resolution, speed, and diagnostic accuracy. For instance, in April 2024, according to MJH Life Sciences the I-SCREEN project was backed by the European Innovation Council with USD 5.1 million funding, aims to enhance early detection of age-related macular degeneration (AMD) using AI-integrated OCT scanners. I-SCREEN will improve AMD monitoring and diagnosis by combining advanced imaging with AI.

" AMD poses a significant healthcare challenge, often slipping under the radar until severe vision loss occurs. The I-SCREEN project is dedicated to addressing this silent threat, leveraging AI and cloud technology together with imaging devices and expertise within Optometry to make early AMD detection and treatment accessible to citizens from their local high street.”

- Dr Ruth Hogg from the Centre for Public Health at Queen’s University Belfast"

The industry exhibits a strong level of partnership and collaboration (P&C) activities, as companies seek to leverage each other's strengths to drive innovation and market penetration. Collaborations between technology firms and healthcare providers are common, aiming to integrate advanced imaging solutions into existing healthcare infrastructures. For instance, in February 2023, the company announced a global partnership with HOYA Vision Care. This agreement between NIDEK and HOYA Vision Care offers eye care professionals access to a comprehensive portfolio of advanced optical instruments and products.

“Our collaboration with HOYA Vision Care is a great opportunity for us to provide more ECPs with seamless eyecare solutions and to support them in achieving greater patient satisfaction and enhancing patients’ quality of life

“The strategic partnership with trusted optical leader NIDEK aligns with HOYA Vision Care’s core mission to provide innovative solutions and high-quality products to our valued ECPs enhancing their business and offerings to patients.”

-Alexandre Montague, Chief Executive Officer, HOYA Vision Care.

Regulatory agencies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are key players in guiding the development and use of retinal imaging devices. Their regulations are designed to ensure the safety and effectiveness of these medical devices for patients.

Product substitutes in the industry include traditional methods such as direct ophthalmoscopy and slit-lamp biomicroscopy, though these are increasingly being overshadowed by more advanced imaging techniques due to the superior accuracy and non-invasiveness of retinal imaging devices.

The retinal imaging devices industry’s geographical reach has been expanding at a moderate to high level owing to population growth, growing healthcare expenditure, and regulatory environments. For instance, in September 2023, BVI (Bausch + Lomb) announced its acquisition of Medical Mix, a prominent supplier of surgical ophthalmic products in Spain and Portugal. company's commitment to developing and producing products within India, targeting both domestic and international markets.

Device Insights

The optical coherence tomography (OCT) segment dominated the market in 2023 and expected to lead during the forecast period. OCT operates on the principle of low-coherence interferometry, where near-infrared light is projected onto the tissue. The light reflected from the different tissue layers is collected and measured to construct detailed images. This imaging indication is akin to ultrasound but uses light waves instead of sound waves, allowing for much higher resolution. For instance, in June 2022, researchers developed an advanced OCT technique called 3D Optical Coherence Refraction Tomography (3D OCRT). This new method provides higher contrast and resolution over a wider 3D field of view, improving biomedical imaging capabilities.

The fundus cameras segment is expected to grow at the fastest growth rate during the forecast period, 2024 to 2030. According to the National Center for Biotechnology and Information (NCBI) in August 2023, smartphone-based fundus imaging has emerged as an affordable alternative to traditional fundus photography. It is capable of capturing images with both dilated & undilated pupils and plays a significant role in screening diseases such as DR, AMD, ROP, and glaucoma. This technology is proving valuable for teleophthalmology and has led to the development of low-cost fundus cameras for use in remote areas. Many companies have launched nonmydriatic fundus cameras, expanding the market. In January 2023, Topcon released the NW500 nonmydriatic retinal camera in the U.S. to provide efficient, high-quality imaging without pupil dilation.

"The NW500 reflects Topcon’s commitment to continuous innovation in pursuit of technology that helps to improve the quality-of-care patients receive and make care more efficient and accessible. Combined, the innovative slit scan technology and 12-megapixel camera offer clinicians fast, sharp quality imaging with less failure and retakes, making the process of acquiring fundus images faster and more reliable than before. Enhancing the patient experience through the absence of needing dilation will lead to greater workflow efficiencies and give clinicians a competitive advantage.”

- Senior Director of Product Management, Tobias Kurzke"

Application Insights

The disease diagnosis segment dominated the market by capturing a share of 53.9% in 2023. The increasing prevalence of retinal diseases, such as DR and AMD, is a significant driver for the disease diagnosis segment of the market. As diabetes rates soar worldwide, the incidence of DR is rising, necessitating regular screening and early detection to prevent vision loss, thereby boosting the demand for advanced retinal imaging technologies. According to a report published by the U.S. CDC in 2023, in the U.S., approximately 9.6 million individuals across all age groups were affected by DR. Similarly, the aging global population contributes to a higher prevalence of AMD, making early diagnosis crucial for effective management and progression control.

The treatment monitoring segment is expected to grow at a fastest CAGR during the forecast period. Growing awareness about the significance of monitoring retinal health has led to heightened patient engagement and more proactive involvement in managing eye conditions. Educated patients are more likely to understand the critical role of regular retinal imaging in tracking the progression of their disease and assessing the effectiveness of their treatments. This increased awareness prompts more frequent follow-ups and adherence to recommended imaging schedules, which are crucial for timely adjustments to treatment plans and early detection of any complications.

Indications Insights

Diabetic retinopathy segment held the largest market share of 32.1% in 2023. Diabetic Retinopathy (DR) is a major concern in the market, driving the demand for advanced diagnostic and monitoring technologies. DR is a complication of diabetes that affects the blood vessels of the retina, leading to vision loss if untreated.

Innovations in imaging, such as AI-enhanced systems, have further improved the management of DR by automating the detection of diabetic changes in the retina and providing accurate assessments quickly. For example, AI algorithms can analyze retinal images to identify DR stages and predict disease progression, facilitating early intervention and personalized treatment plans. For instance, in May 2024, AEYE Health received FDA clearance for the first fully autonomous AI system that diagnoses referable DR from images captured by a handheld camera.

“This is the 'holy grail' of eye screening - fully autonomous AI, using either portable or tabletop retinal cameras and a procedure that takes a minute to perform, alongside the best-in-class diagnostic efficacy. In the coming years our fully autonomous screening technology will become standard across points of care in the US. We believe this innovation will prevent the blindness of millions of people in the US and around the world."

- Zack Dvey-Aharon, PhD, cofounder and CEO of AEYE Health

The glaucoma segment is expected to grow at the fastest growth rate of 9.0% over the forecast period 2024 to 2030. According to the Indian Journal of Ophthalmology in October 2023, glaucoma is the second-leading cause of irreversible but preventable blindness globally, accounting for nearly 8% of worldwide blindness. In 2020, over 76 million people were affected by glaucoma, with estimates reaching 111 million by 2040. According to Optometry Times, iHealthScreen's iPredict glaucoma detection model received a full patent from the USPTO in March 2024, which made it the first company to earn two U.S. patents for early diagnosis of AMD and glaucoma. The iPredict model uses AI to analyze high-resolution retinal images, providing automated glaucoma detection results in under 60 seconds, with the entire test completed in 5 minutes. Thus, early screening and detection of glaucoma can potentially prevent its progression to severe stages & save millions from blindness.

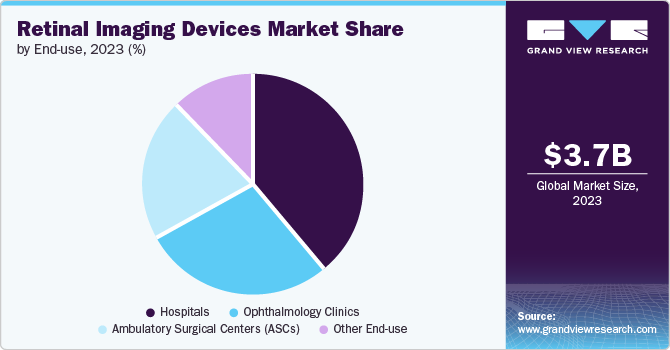

End-use Insights

The hospitals segment dominated the market with a share of over 39.5% in 2023. Advanced imaging technologies in hospitals enable the early detection of retinal disorders, allowing for prompt intervention and treatment. In addition, partnerships & collaborations between hospitals and other companies to meet clinical needs contribute to market growth. For instance, in October 2022, Samsung announced it has partnered with local hospitals to achieve its goal of screening 150,000 people in India for eye diseases using the EYELIKE fundus camera. This initiative aims to enhance eye care accessibility, leveraging Samsung's advanced imaging technology to detect conditions like diabetic retinopathy. Such initiatives are expected to drive the segment growth over the forecast period.

Ophthalmology clinics are expected to grow at the fastest growth rate over the forecast period. Ophthalmology clinics are key players in the market, driving both demand and innovation. These specialized clinics focus on diagnosing and managing various retinal conditions, including diabetic retinopathy, Age-related Macular Degeneration (AMD), and retinal vein occlusion. They rely on advanced retinal imaging technologies such as OCT, fundus photography, and widefield imaging to provide accurate diagnoses & monitor disease progression.

Regional Insights

North America market held the largest share of 36.63% in 2023. Factors such as the region's advanced infrastructure and strong emphasis on research and development have facilitated the rapid adoption of innovative technologies. The high prevalence of retinal disorders also contributes to this dominance. Government initiatives and awareness programs aimed at the early detection and management of eye diseases are expected to further drive demand for retinal imaging devices. Additionally, the growing aging population, which is more susceptible to conditions like diabetic retinopathy and age-related macular degeneration (AMD), is likely to increase the need for advanced diagnostic tools in this region.

U.S. Retinal Imaging Devices Market Trends

The market in U.S. held the largest market share in 2023 in the North America region. The growth can be attributed to the factors such as aging population, higher diabetes prevalence, and greater exposure to environmental risks contribute to this trend, emphasizing the need for improved eye care & diagnostic technologies. According to a January 2024 publication by the American Heart Association, 9.7 million adults in the U.S. have undiagnosed diabetes, 29.3 million have been diagnosed, and 115.9 million have prediabetes. In addition, major companies are introducing or expanding their product lines in the U.S. to drive market growth. For instance, in May 2023, Optos, Plc announced expanding its optomap features. It added Ultra-Widefield (UWF) retinal imaging capabilities with the California FA device to aid eyecare professionals in disease management & treatment planning.

Europe Retinal Imaging Devices Market Trends

The market in Europe held a significant market share in 2023. Europe is one of the most developed regions in the world. Increasing public & private investment in R&D are some of the significant factors contributing to the growth of this region. Rising demand for healthcare devices and the increasing prevalence of eye disorders are major drivers anticipated to augment regional market growth.

The retinal imaging devices market in the UK is expected to grow owing to high per capita income, an established healthcare system, a significant number of healthcare professionals, proper access to healthcare services, availability of advanced devices, and favorable reimbursement policies are among the major factors expected to drive the market in the UK. In February 2024, Optos announced 25,000 devices and 2,500 clinical papers highlighting its significant impact on retinal imaging. This milestone underscores the widespread adoption and clinical validation of Optos’s technology, enhancing its reputation in the UK market. The extensive use and research validate the effectiveness of their devices, driving further interest and investment. Such factors are expected to drive the market growth in country in the forecast period.

France retinal imaging devices market is expected to grow over the forecast period. A report published by Eurostat indicated that in the fiscal year 2022, individuals aged 65 years to 79 years in France made up 14.9% of the overall population, nearly matching the EU average of 15.1%. This demographic trend underscores the substantial proportion of elderly residents in France, reflecting similar patterns observed across the EU. The growing number of elderly individuals and rising awareness about eye health drive the need for advanced retinal imaging technologies.

The retinal imaging devices market in Germany is expected to grow over the forecast period this can be attributed to the increasing prevalence of retinal disorders such as diabetic retinopathy and age-related macular degeneration, which necessitates advanced diagnostic solutions. Germany’s robust healthcare system, with its emphasis on high-quality care and cutting-edge technology, supports the adoption of these advanced imaging devices. Additionally, there is a growing demand for non-invasive diagnostic methods among both patients and healthcare providers. The competitive landscape in Germany is marked by the presence of both established international companies and innovative domestic firms. Furthermore, the market comprises of high R&D activities, with numerous companies focusing on advancing imaging capabilities and incorporating AI to enhance diagnostic precision. The installation of the RTX1 in February 2024, a retinal imaging device in Halle, highlights a significant advancement in Germany’s retinal imaging market. This high-resolution, wide-field imaging system enhances the detection and monitoring of retinal conditions with exceptional clarity.

Asia Pacific Retinal Imaging Devices Market Trends

The market in Asia Pacific is estimated to witness the fastest CAGR of 8.6% during the forecast period. The market is driven by an increasing prevalence of retinal diseases, a growing elderly population, and rising awareness of eye health. Conditions such as diabetic retinopathy, AMD, and glaucoma are common, necessitating advanced diagnostic tools. OCT, fundus photography, and scanning laser ophthalmoscopes are crucial technologies providing high-resolution images for accurate diagnosis. Recently, the 2023 Asia-Pacific Academy of Ophthalmology (APAO) meeting highlighted the importance of reconnection and collaboration among professionals in the region, fostering advancements in retinal imaging technologies.

Retinal imaging devices market in China is expected to grow at notable growth rate over the forecast period, this growth can be attributed to the increasing product approval is expected to boost market growth by expanding cutting-edge retinal imaging technology availability in China. In August 2023, TowardPi introduced the Swept-Source OCTA technology at Retina China, marking a significant advancement in ophthalmology. This imaging technology offers enhanced clarity and depth, revolutionizing the diagnosis and treatment of retinal conditions. The technology’s ability to provide detailed, high-resolution images supports early detection and better management of diseases like diabetic retinopathy and AMD.

Japan retinal imaging devices market is expected to grow, over the forecast period. The increasing demand for precise diagnostic tools, fueled by Japan’s aging demographic, is complemented by government support for enhanced healthcare infrastructure and early detection. The success of this innovation promotes further research and investment, leading to broader adoption and availability of advanced retinal imaging devices across Japan.

Latin America Retinal Imaging Devices Market Trends

The Latin America market is anticipated to undergo considerable growth over the forecast period. The market is poised for growth, driven by an increasing prevalence of retinal disorders and a growing awareness of eye health. One of the key market drivers is the rising incidence of diabetes and age-related eye conditions, which fuels the demand for advanced diagnostic tools. Additionally, improvements in healthcare infrastructure and increasing healthcare expenditure across the region are facilitating the adoption of retinal imaging technologies. There are significant growth opportunities as governments and healthcare organizations invest in screening programs for early detection and management of eye diseases. The market is also seeing a rise in the adoption of portable and user-friendly imaging devices, which are particularly valuable in rural and underserved areas.

MEA Retinal Imaging Devices Market Trends

The market in MEA is anticipated to grow substantially over the forecast period, due to several key factors. There is a rising expansion of the private healthcare sector in many countries across the Middle East & Africa (MEA). Private and government entities are investing heavily in advanced medical technologies, such as retinal imaging devices, essential for complex surgeries & critical care interventions. For instance, in October 2023, the Saudi Arabia Ministry of Investment signed 8 MoUs worth USD 1.07 billion to help localize advanced medical devices. These investments aim to meet the rising demand for specialized medical treatments and attract the production of medical devices in the region.

Key Retinal Imaging Devices Company Insights

The major players in the market are actively strengthening their product portfolios through various strategies to remain competitive and expand their market share. These strategies include continuous product upgrades to integrate the latest technological advancements, forming strategic collaborations, and exploring opportunities for acquisitions. Furthermore, obtaining government approvals for their products is essential to ensure compliance with regulatory standards.

Carl Zeiss Meditec AG, Topcon Corporation, NIDEK Co., Ltd., Heidelberg Engineering GmbH, Optos Plc (a Nikon Company), Canon Inc. are among the major market players driving innovation and growth in the retinal imaging devices sector. These companies are committed to developing advanced solutions that cater to the evolving needs of healthcare providers and patients.

Key Retinal Imaging Devices Companies:

The following are the leading companies in the retinal imaging devices market. These companies collectively hold the largest market share and dictate industry trends.

- Carl Zeiss Meditec AG

- Topcon Corporation

- NIDEK CO., LTD.

- Optos

- Canon Medical Systems

- Essilor Instruments

- Optomed

- Lumibird Medical

- Heidelberg Engineering Inc.

- Visionix

- OPTOPOL Technology Sp

Recent Developments

-

In May 2024, Carl Zeiss Meditec AG announced that the CIRRUS 6000 now offers a highly efficient and data-driven workflow for ophthalmologists, backed by the largest OCT reference database in the U.S. market and newly enhanced cybersecurity features.

-

In April 2024, the Carl Zeiss Meditec AG company acquired 100% of the Dutch Ophthalmic Research Center (D.O.R.C.) from the investment firm Paris, Eurazeo SE, France. This acquisition enhances and expands ZEISS Medical Technology’s extensive ophthalmic portfolio & its range of digitally connected workflow solutions for addressing various eye conditions, including cataracts, retina and cornea disorders, glaucoma, and refractive errors.

-

In April 2024, Optomed announced that the ‘Optomed Aurora’ handheld fundus camera, equipped with AEYE’s AI, received FDA clearance.

-

In February 2023, NIDEK CO., LTD. announced a global partnership with HOYA Vision Care. This agreement between NIDEK and HOYA Vision Care offers eye care professionals access to a comprehensive portfolio of advanced optical instruments and products.

Retinal Imaging Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.02 billion

Revenue forecast in 2030

USD 6.35 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Actual period

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, application, indications, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Carl Zeiss Meditec AG; Topcon Corporation; NIDEK Co., Ltd.; Heidelberg Engineering GmbH; Optos Plc (a Nikon Company); Canon Inc.; Alcon Inc.; Bausch + Lomb (a division of Bausch Health Companies Inc.); Optovue, Inc.; Essilor International; Olympus Vision

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retinal Imaging Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global retinal imaging devices market report on the basis of device, application, indications, end use, and region:

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical Coherence Tomography (OCT) Devices

-

Spectral-Domain OCT (SD-OCT)

-

Swept-Source OCT (SS-OCT)

-

Handheld OCT

-

-

Fluorescein Angiography Devices

-

Fundus Cameras

-

Mydriatic Fundus Cameras

-

Non-Mydriatic Fundus Cameras

-

Hybrid Fundus Cameras

-

ROP fundus cameras

-

-

Retinal Ultrasound Imaging Systems

-

Ophthalmic A-Scan Ultrasound

-

Ophthalmic B-Scan Ultrasound

-

Ophthalmic Ultrasound Biomicroscopes

-

Ophthalmic Pachymeters

-

-

Ultra Widefield Retinal Imaging Devices

-

Widefield Retinal Imaging Devices

-

Other Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Disease Diagnosis

-

Treatment Monitoring

-

Research & Development

-

-

Indications Outlook (Revenue, USD Million, 2018 - 2030)

-

Diabetic Retinopathy

-

Age-Related Macular Degeneration (AMD)

-

Glaucoma

-

Retinal Vein Occlusion

-

Other Indications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmology Clinics

-

Ambulatory Surgical Centers (ASCs)

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global retinal imaging devices market size was estimated at USD 3.74 billion in 2023 and is expected to reach USD 4.02 billion in 2024.

b. The global retinal imaging devices market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 6.35 billion by 2030.

b. The Optical Coherence Tomography (OCT) devices segment dominated the retinal imaging devices market with a share of 28.9% in 2023.

b. Some key players operating in the retinal imaging devices market include Carl Zeiss Meditec AG, Topcon Corporation, NIDEK CO., LTD., Optos, Canon Medical Systems, Essilor Instruments, Optomed, Lumibird Medical, Heidelberg Engineering Inc..

b. Key factors that are driving the retinal imaging devices market growth include technological advancements, increase in R&D activities, increasing prevalence of retinal disorders, such as diabetic retinopathy and age-related macular degeneration, fuels the demand for advanced diagnostic tools.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.