- Home

- »

- Communication Services

- »

-

Revenue Assurance Market Size & Analysis Report, 2030GVR Report cover

![Revenue Assurance Market Size, Share & Trends Report]()

Revenue Assurance Market Size, Share & Trends Analysis Report By Solution, By Deployment (On-premise, Cloud), By End Use (BFSI, Telecom, Healthcare, Retail, Energy & Utilities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-690-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Report Overview

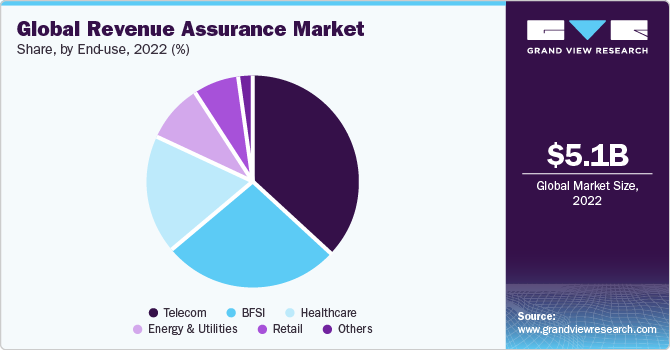

The global revenue assurance market size was valued at USD 5.68 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.5% from 2024 to 2030. Revenue assurance is an operator's process to ensure that revenues for the services provided to customers and third parties are precisely billed, accounted for, and fully collected. It is an umbrella term that describes a company's activities to ensure that its procedures and processes reduce revenue leakage. Leakages occur when the company has earned revenue and services rendered to the customers are lost on their way to the billing systems. Therefore, the increasing incidence of revenue leakages is one of the prominent factors expected to drive the market over the forecast period.

Changes occurring in the internal customer priorities, a mismatch between component expectations and deliverables due to implementation issues or poor communication, and unknown or unforeseen invoicing and billing errors are some of the reasons that lead to revenue leakage. Revenue assurance promises to help telecom providers secure revenue for services they offer, which they cannot charge for due to ineffective back-office practices like record maintenance, regulatory compliance, and accounting. Relatively modest costs and quick payback make revenue assurance a more compelling option for carriers to improve profits than acquiring new customers or expanding into new markets. With cost and revenue leakages arising across the operator’s business, it is essential to recognize the cause of revenue leakages, measure their enormity, and holistically address them.

With the adoption of new access and service delivery technologies and incessantly changing offerings, service providers are continually confronted with revenue leakage difficulties, irrespective of the increased awareness of the necessity of revenue assurance. Lack of transparency is one of the potential causes of revenue loss that impedes an organization’s ability to deploy effective strategies to reduce risks. Organizations can develop and implement effective policies, processes, and controls that help mitigate revenue loss and significantly improve financial performance by identifying and prioritizing risk factors using revenue assurance components. As a result, awareness of the severe impacts of revenue leakages is likely to elevate the demand for revenue assurance components and services over the forecast period.

The rising introduction of advanced technologies and products lag in reconciliations, and poor coordination between teams are leading to a massive rise in demand for network elements. Introducing new technologies and the arrival of over-the-top (OTT) services intensifies competition from players with extremely disruptive business models, even in national markets. The market is highly competitive, resulting in multiple options for customers. It has encouraged operators to capitalize on state-of-the-art products and technologies. These new services, tiered and bundled product plans, and flat rates have fueled the demand for billing and OSS and BSS systems. Billing and collection, which were relatively straightforward exercises, have become complicated. It has further resulted in demand for revenue assurance to ensure that everything that should be paid and billed for is done at the right time for all services across all cost and revenue streams in a simplified manner. It, in turn, is expected to boost the growth of the overall market in the near future.

Technological advancements in revenue assurance are anticipated to provide opportunities for the market over the forecast period. New technologies, including cloud, 4G/5G, IoT, and SDN/NFV, are creating opportunities for operators to launch new business models and services but are also allowing for new instances of fraud to arise. Conventional systems must keep up with the complexities of a modern mobile environment, which has paved the way for revenue leakage and erosion of potential profits. The introduction of advanced technologies and mechanisms, such as real-time revenue assurance, is anticipated to boost market growth in the approaching years.

Solution Insights

The software segment dominated the global industry and accounted for a revenue share of 62.3% in 2023. The growth of this segment is attributed to the availability of highly flexible and innovative revenue assurance software. The distinctive process-driven methodology of this software aids service providers and significantly enhances their business and financial performance by efficiently identifying revenue leakages within the desired network. It allows traffic to be monitored, highlighting all irregularities that could direct an inappropriate use of services, delivering a flexible, easy-to-use environment to control apprehensive events, and allowing an automatic pause of specific services to be instigated if particular conditions arise.

The services segment is anticipated to witness the fastest CAGR during the forecast period. This segment is further segregated into planning and consulting, operations and maintenance, system integration, and managed services. Several end-use verticals across the globe are progressively adopting revenue assurance software and services to reduce the effects of revenue leakages. The growing need for an organization to understand the potential impact of revenue leakage in business is driving the segment. The planning and consulting services in revenue assurance help the service providers identify the affected areas more accurately, helping them streamline the process to avoid further losses.

Deployment Insights

The cloud segment accounted for the largest revenue share in 2023 and is expected to expand at the fastest CAGR over the forecast period. A paradigm shift from on-premise to cloud is set to create varied opportunities in the market in the years to come. Cloud enables operators to access high speed, agility, and effective management of revenue and fraud. For instance, WeDo Technologies provides revenue assurance and fraud management components and continues to invest in its cloud-based components, reinforcing its commitment to enable telecom operators to protect their revenues and minimize fraud. In another instance, in July 2023, SUBEX announced the general availability of its HyperSense Fraud Management solution on Google Cloud. This collaboration provides enhanced fraud detection and prevention capabilities by leveraging Google Cloud's scalability to handle increasing volumes of data and transactions.

The on-premise segment is expected to witness significant growth over the forecast period. The development of this segment is mainly attributed to the exceptional security it provides. Critical data can be stored in an on-premise deployment with no third-party access. Although the cloud model has grown in popularity, on-premise components may continue to serve the business needs of several organizations effectively. On-premise or cloud deployment both demand data security. Therefore, security is the primary concern for many organizations. As a result, an on-premise environment is preferred over a cloud, regardless of its drawbacks and high costs.

End Use Insights

The telecom segment dominated the market and held the largest share in 2023. The segment’s dominance is driven by the increasing incidences of telecom fraud, one of the key reasons for revenue leakages in the telecom industry. For instance, according to the Fraud Loss Survey conducted by the Communications Fraud Control Association (CFCA), telecom operators lost USD 38.95 billion in 2023, a reported 12% increase in fraud losses in 2023 compared to 2021. Apart from fraud, which is a huge cause, revenue leakage also occurs from communication gaps in planning, inferior systems coordination, poor processes, new products, and incorrect call detail records & tariffs, which are not properly endorsed.

Telecom giants have encountered large number of incidents related to revenue leakages. With the growing competition from merging media like the Internet, telecom products must incorporate faster and better technology to match the necessary standards set by regulatory bodies. Globally, telecom service providers are dealing with problems of revenue leakage, compliance complexities, customer dissatisfaction, and billing errors. As a result, there has been a massive demand for revenue assurance in the telecom industry.

The BFSI sector is anticipated to witness healthy growth over the forecast period. Revenue leakage occurs in almost all areas of a bank. Both commercial and retail customers could be contributing to the loss of income. The implementation of revenue assurance projects is achieving great results in the banking industry, thereby providing several market growth opportunities.

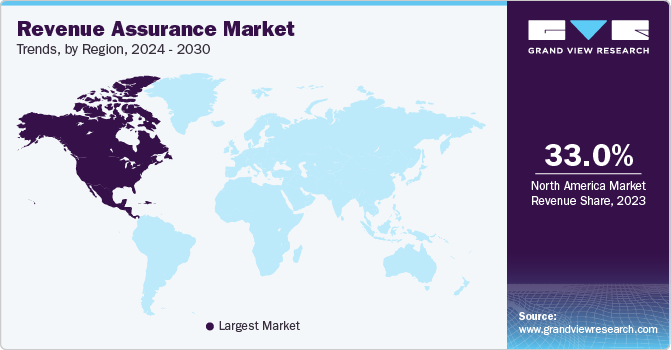

Regional Insights

North America dominated the global revenue assurance market and accounted for a revenue share of 33.0% in 2023. The growth of this industry is attributed to multiple factors, such as a favorable business environment in the region, rising new incidents of revenue leakages, and strong consumer support that continues to boost innovative projects and growth in technology expenditure. The revenue assurance market in North America has witnessed substantial growth due to the expanding telecom sector and rising awareness regarding the influences of revenue leakages on an organization's overall profitability. Loss of banking income or fees from inconsistent practices, poor pricing controls, and lack of attention to detail often lead to revenue leakages in the banking industry. When banks and financial establishments lack consistent observance of a pricing structure with clear pricing communication, revenue leakage occurs, and price confusion reigns. In addition, the increasing digital transaction further drives the region's growth. For instance, in February 2024, Bank of America (BofA) reported that its clients achieved a record 23.4 billion digital interactions in 2023, an 11% increase from the previous year.

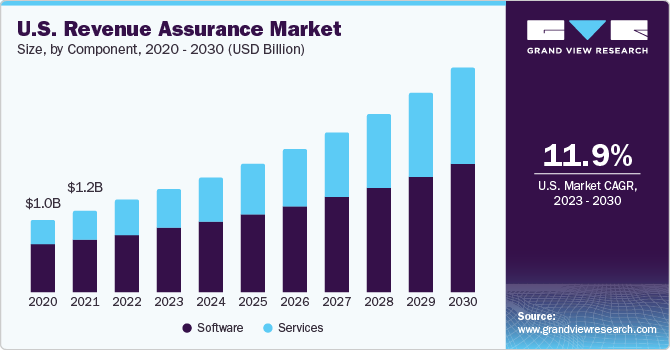

U.S. Revenue Assurance Market Trends

The U.S. dominated the North America revenue assurance market in 2023. The widespread adoption and implementation of revenue assurance solutions across various industries, particularly in the BFSI and telecom sectors, has driven the growth of this market. For example, in June 2023, The White House allocated USD 42 billion to the nation's 50 states and U.S. territories to ensure universal access to high-speed broadband by 2030. Moreover, the region has multiple revenue assurance vendors in the U.S., such as Amdocs, Ericsson, and IBM. The region has a well-established regulatory environment, with clear guidelines and standards for revenue assurance, which has encouraged the adoption of revenue assurance solutions.

Europe Revenue Assurance Market Trends

Europe held a significant revenue share of the global revenue assurance industry in 2023. The increasing adoption of advanced technologies such as AI, IoT, and big data analytics is enhancing the capabilities of revenue assurance solutions, allowing businesses to detect better and prevent revenue leakage. The growing number of mobile and internet users also contributes to the demand for effective revenue management strategies. Furthermore, the expansion of non-telecom sectors, including banking, e-commerce, and healthcare, highlights the need for tailored revenue assurance practices to address unique transaction reconciliation and compliance challenges.

Germany revenue assurance market held is expected to experience a noteworthy growth during forecast period. The region's growth is attributed to its robust technological infrastructure and substantial government investments. The rising telecom activity in Germany, with more users subscribing to diverse services such as 5G, IoT, cloud computing, and advanced data packages, significantly contributes to the region's growth. Furthermore, the increasing complexity of business models and service offerings, coupled with evolving technologies, creates more opportunities for revenue leakage in the area.

Asia Pacific Revenue Assurance Market Trends

Asia Pacific revenue assurance market is expected to witness the fastest CAGR of 15.2% during the forecast period. The market growth in the region is mainly driven by increased demand for cloud-based services from small and mid-sized companies. Digital transformation is catching up in the region at an accelerated pace, and this will continue to drive significant investments in new and advanced technologies. In addition, the booming telecom sector in the region is supporting the market growth.

China held a significant revenue share of the regional industry in 2023. The rapid increase in internet penetration and mobile connectivity has led to a surge in transaction data generation, necessitating advanced revenue assurance solutions to manage and mitigate revenue leakage effectively. Rapid economic growth and growing telecommunications and banking sectors have created a significant demand for revenue assurance solutions to prevent revenue leakage and ensure accurate billing and charging. Furthermore, the Chinese government's supportive policies toward digital transformation and technology investments further bolster the market growth.

Key Companies & Market Share Insights

Some key companies involved in the revenue assurance market include SUBEX, Araxxe, Tech Mahindra Limited, Amdocs, Mobileum, and others. To address growing competition in the industry, the companies are adopting strategies such as innovation, enhanced geographical presence, expansion of solutions portfolio and collaborations with other organizations.

-

SUBEX, a global telecom analytics solutions company, offers a range of solutions for fraud management, signaling risk intelligence, business assurance, enterprise billing, enterprise cybersecurity, partner ecosystem management, and enterprise asset management. The company has a strong presence across multiple regional markets and also offers a wide range of services, such as subcontracting services, managed services, support services, and implementation and customization support services.

-

Araxxe, a major market participant in revenue assurance, end-to-end billing verification, and interconnect fraud detection solutions industry, offers its expertise to telecommunication companies worldwide. The company operates its monitoring services in a 'service bureau' mode. Araxxe's services portfolio includes rating & billing verification, inbound & outbound roaming billing, data services billing verification, interconnect bypass detection, OTT bypass detection, and SMS termination verification.

Key Revenue Assurance Companies:

The following are the leading companies in the revenue assurance market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Amdocs

- Araxxe

- Hewlett Packard Enterprise Development LP

- IBM

- SUBEX

- TATA Consultancy Services Limited

- Tech Mahindra Limited

- Telefonaktiebolaget LM Ericsson

- TEOCO

- Mobileum

Recent Developments

-

In August 2024, Grameenphone, one of the largest telecommunication service providers catering to a large number of subscribers, collaborated with Mobileum, a major market participant in the analytics solutions industry, to implement its risk management transformation strategy via Mobileum's next-generation revenue assurance and fraud management (RAFM) solution.

-

In April 2024, SUBEX announced a deal with one of Asia Pacific's prominent telecommunication service providers for AI-driven business assurance. Subex Pte Ltd, a subsidiary of SUBEX, signed the agreement, leveraging the company's advanced business assurance solution on HyperSense. The partnership aims to enhance customer experience through quality service by providing superior, unparalleled 5G connectivity and integrated solutions.

Revenue Assurance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.31 billion

Revenue Forecast in 2030

USD 12.14 billion

Growth Rate

CAGR of 11.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Solution, deployment, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Accenture; Amdocs; Araxxe; Hewlett Packard Enterprise Development LP; IBM; SUBEX; TATA Consultancy Services Limited; Tech Mahindra Limited; Telefonaktiebolaget LM Ericsson; TEOCO; Mobileum

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

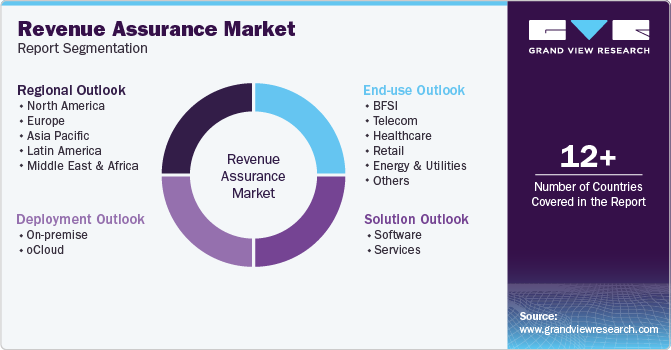

Global Revenue Assurance Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the revenue assurance market report based on solution, deployment, end use, and region.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Telecom

-

Healthcare

-

Retail

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."