- Home

- »

- Healthcare IT

- »

-

RFID in Healthcare Market Size And Share Report, 2030GVR Report cover

![RFID In Healthcare Market Size, Share & Trends Report]()

RFID In Healthcare Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Systems & Software, Tags), By Application (Blood Tracking, Patient Tracking, Pharmaceutical Tracking, Asset Tracking), By Region, And Segment Forecasts

- Report ID: 978-1-68038-623-3

- Number of Report Pages: 96

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

RFID In Healthcare Market Summary

The global RFID In healthcare market size was estimated at USD 4.64 billion in 2023 and is projected to reach USD 14.65 billion by 2030, growing at a CAGR of 17.85% from 2024 to 2030. Radio-frequency identification (RFID) technology is anticipated to observe robust growth in the healthcare sector in the coming years.

Key Market Trends & Insights

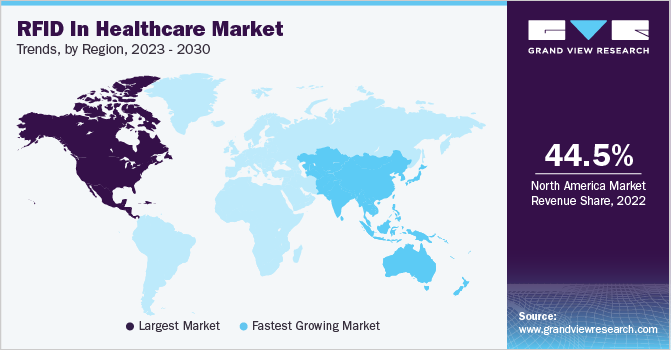

- North America held the largest share of 44.50% in 2022.

- The U.S. is the largest market in this region, contributing to the high adoption of this technology in healthcare services.

- Based on product, the tags segment captured the highest market share of 61.28 % in 2022.

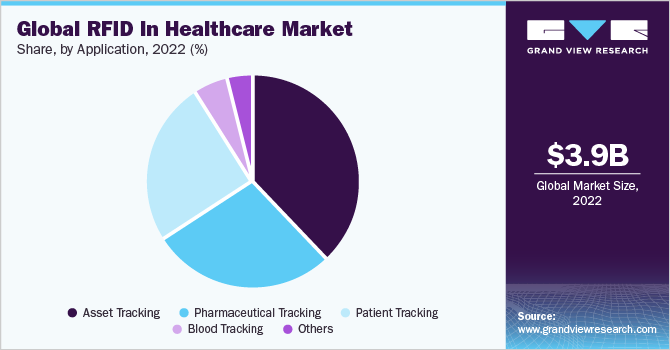

- In terms of application, the asset tracking segment dominated the market in 2022 and accounted for the largest share of 38.28% of the global revenue.

- On the basis of application, the pharmaceutical tracking segment is expected to witness the fastest CAGR over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 4.64 Billion

- 2030 Projected Market Size: USD 14.65 Billion

- CAGR (2024-2030): 17.85%

- North America: Largest market in 2022

Hospitals, biotechnology firms, and pharmacies are increasingly utilizing RFID technology for effective inventory management and enhanced patient security. Additionally, the cost-efficiency and high productivity of RFID systems are driving the market demand, as well as the uptake of automated processes in healthcare facilities. Moreover, increasing patient visits to hospitals and the need for effective supply chain management are some of the major factors driving market growth.

Integrating RFID technology can help streamline inventory management, reduce stock-outs, and prevent overstock. Moreover, it can provide real-time data and help prevent inventory loss and theft. In the medical field, RFID tagging of medical supplies can make it easier for staff to track essential items used in surgeries and boost patient safety. This is expected to drive the market growth.

RFID is widely used by medical institutions, such as pharmaceutical companies, blood banks, hospitals, and others for workflow management. It can be used to minimize medical errors, and inventory management, for efficient utilization of healthcare assets. Growing demand for cost-efficient & novel therapies and the rising adoption of pharmacy automation in hospitals and pharmacies is driving the market growth. Moreover, increasing focus on patient safety and convenience is contributing to the market growth.

According to the Code of Food and Drug Administration of Health and Human Services, in March 2023, all labeling and packaging materials must adhere to written standards for receiving, identification, storage, handling, sampling, examination, and testing in order to gain approval and be released for use. If these standards are not met, the material must be rejected, and records of each shipment received must be kept. This increased emphasis on quality control is creating a demand for RFID technology.

The COVID-19 pandemic has boosted the adoption of RFID technology, mainly in the healthcare industry. Hospitals were increasingly using this technology to manage patients and personnel in response to the pandemic. RFID tools, which use wireless communications to identify and track assets and equipment, have seen a significant uptake in the healthcare sector. This technology helps to improve the efficiency and accountability of care teams in times of public health emergencies. Additionally, during the COVID-19 pandemic, several companies entered into partnerships with RFID technology providers to develop COVID-19 test kits. For instance, in May 2020, SUKU entered into a strategic alliance with Smartrac, a subsidiary of Avery Dennison, to utilize Near Field Communication (NFC) RFID tagging technology to authenticate and verify PPE suits and COVID-19 test kits. This partnership will help to ensure the accuracy and reliability of the products and secure the supply chain.

Product Insights

The tags segment captured the highest market share of 61.28 % in 2022. Increasing awareness about the benefits of these devices is anticipated to boost segment growth. RFID tracking aids medical staff to locate any patients in the hospital to confirm their safety and sustain the care procedure.

Moreover, companies are introducing novel products to reduce risk and create efficiencies in organizations. For instance, in December 2021, AmerisourceBergen launched a service that allows customers across the U.S. to purchase pre-tagged products using RFID technology. The tags are compatible with the global standards established by the RAIN Alliance and can be managed and read by any RAIN RFID technology system capable of reading RFID tags. This service provides customers with the ability to access a broad range of products with increased efficiency.

RFID systems & software segment is expected to hold a significant market share over the coming years. These systems are typically used in hospitals and other healthcare facilities to track staff, equipment, and inventories. The implementation of patient monitoring systems and the prevention of counterfeit drugs and devices are on the rise due to an increased focus on streamlining the workflow and prioritizing patient safety. This has been the primary factor driving growth in this segment. In addition, penetration of these systems is increasing and their ability to integrate with existing hospital Enterprise Resource Planning (ERP) software is also a key contributor to the growth of the segment.

Application Insights

Asset tracking segment dominated the market in 2022 and accounted for the largest share of 38.28% of the global revenue. Increasing demand for efficient medical equipment tracking systems and increasing adoption of RFID systems for the patient as well as staff tracking are among the key factors contributing to the dominant share of the segment.

Pharmaceutical tracking segment is expected to witness the fastest CAGR over the forecast period. In addition to monitoring and tracing pharmaceuticals across the supply chain and minimizing total cost of business (TCOB) in the event of product recalls RFID offers a trustworthy method for obtaining product information. Moreover, several pharmaceutical companies work along with RFID firms to introduce new products using RFID. For instance, three injectable medications with RFID tags were introduced in the United States by Sandoz Inc. and Kit Check Inc. in October 2020. The goal of this launch was to give the hospital a consistent supply of high-quality injectable medications.

On the other hand, the patient tracking segment accounted for a significant market share in 2022. Growing demand for real time patient monitoring, & better tracking of the treatment process, and increasing investments by healthcare IT players are some of the key factors expected to propel the market. In addition, tags are widely used for patient tracking in hospitals.

Regional Insights

North America held the largest share of 44.50% in 2022. The market growth is mainly driven by the increase in regulations for patient safety, mandates for tracking medical devices, and the rising number of hospitals. The presence of developed healthcare infrastructure and the high adoption of advanced technologies in healthcare are some other factors contributing to regional growth. The U.S. is the largest market in this region, contributing to the high adoption of this technology in healthcare services. The increasing recognition of the potential benefits of incorporating RFID technology, combined with increasing concern about the risks of medication errors, is driving growth in the region.

The Asia Pacific region is expected to witness the fastest growth rate in the forecast period from 2023 to 2030. Improving healthcare infrastructure, the presence of a large pharmaceutical industry, and rising healthcare expenditure are some of the key factors that are contributing to regional demand. There is a large number of life sciences and pharmaceutical entities in the region with rising demand for efficient supply chain management.

Moreover, the region has a large patient pool with infectious and chronic disorders. Rising disease burden is anticipated to increase the demand for efficient healthcare services, resulting in contributing to market growth.

Key Companies & Market Share Insights

The key players in the RFID in healthcare market are undertaking various strategic initiatives, such as partnerships, product launches, mergers and acquisitions, to strengthen their presence in the market. For instance, in June 2022, Avery Dennison released a dual-frequency RFID inlay designed for healthcare and industrial applications. This cutting-edge inlay offers a cost-efficient way to track individual items, as it combines RAIN RFID (UHF) and NFC (HF) technology into a single, compact design. Its dual-frequency technology enables inlay to update product information in real time, providing users with a powerful and comprehensive solution. Some of the key players in the global RFID in Healthcare market include:

-

Alien Technology, LLC

-

Zebra Technologies Corp.

-

Avery Dennison Corporation

-

Impinj, Inc.

-

GAO RFID Inc.

-

LogiTag Systems

-

Mobile Aspects

-

CenTrak, Inc.

-

Terso Solutions, Inc.

-

Tagsys RFID

RFID In Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.39 billion

Revenue forecast in 2030

USD 14.65 billion

Growth rate

CAGR of 17.85% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; Spain; France; Italy; Sweden; Norway; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Alien Technology, LLC; Zebra Technologies Corp.; Avery Dennison Corporation; Impinj, Inc.; GAO RFID Inc.; LogiTag Systems; Mobile Aspects; CenTrak, Inc.; Terso Solutions, Inc.; Tagsys RFID.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global RFID In Healthcare Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global RFID in healthcare market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Systems & Software

-

Tags

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Asset Tracking

-

Patient Tracking

-

Pharmaceutical Tracking

-

Blood Tracking

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global RFID in healthcare market size was estimated at USD 3.95 billion in 2022 and is expected to reach USD 4.64 billion in 2023.

b. The global RFID in healthcare market is expected to grow at a compound annual growth rate of 17.85% from 2023 to 2030 to reach USD 14.65 billion by 2030.

b. The tags segment dominated the RFID in healthcare market with a share of 61.28% in 2022. This is attributable to rising awareness regarding the benefits of these devices.

b. Some key players operating in the RFID in healthcare market include Alien Technology, Zebra Technologies, Avery Dennison Corporation, Impinj, GAO RFID, LogiTag, Mobile Aspects, CenTrak, Terso Solutions, and Tagsys RFID.

b. Key factors that are driving the market growth include rising requirement for reducing operating costs, adoption of Radio-frequency Identification (RFID) in healthcare, and mandates for increasing patient safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.