- Home

- »

- Plastics, Polymers & Resins

- »

-

Rice Paper Packaging Market Size, Industry Report, 2030GVR Report cover

![Rice Paper Packaging Market Size, Share & Trends Report]()

Rice Paper Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sheets & Rolls, Pouches & Wraps, Labels & Stickers), By Application (Food & Beverage, Cosmetics & Personal Care, Retail & Gift Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-586-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rice Paper Packaging Market Size & Trends

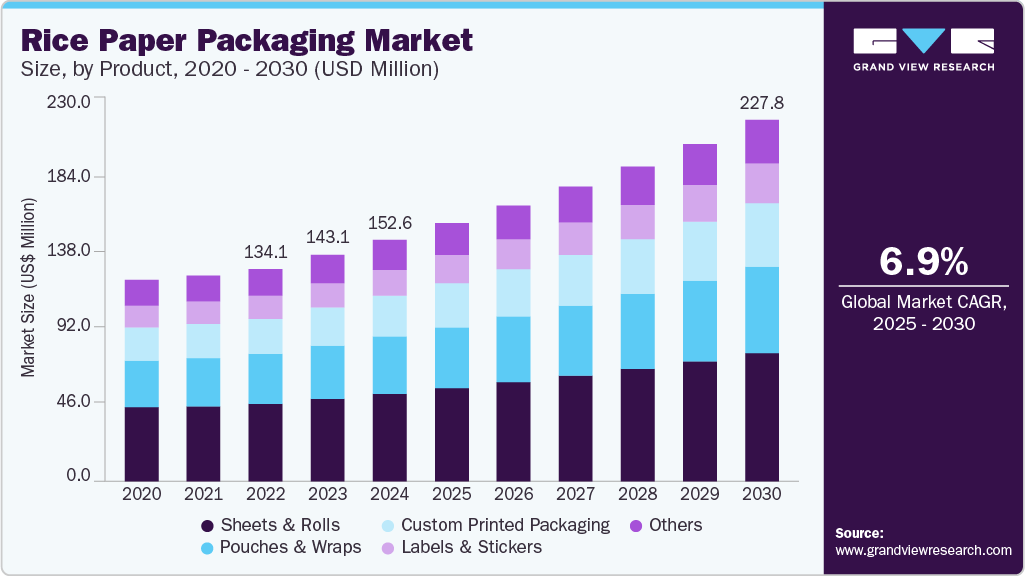

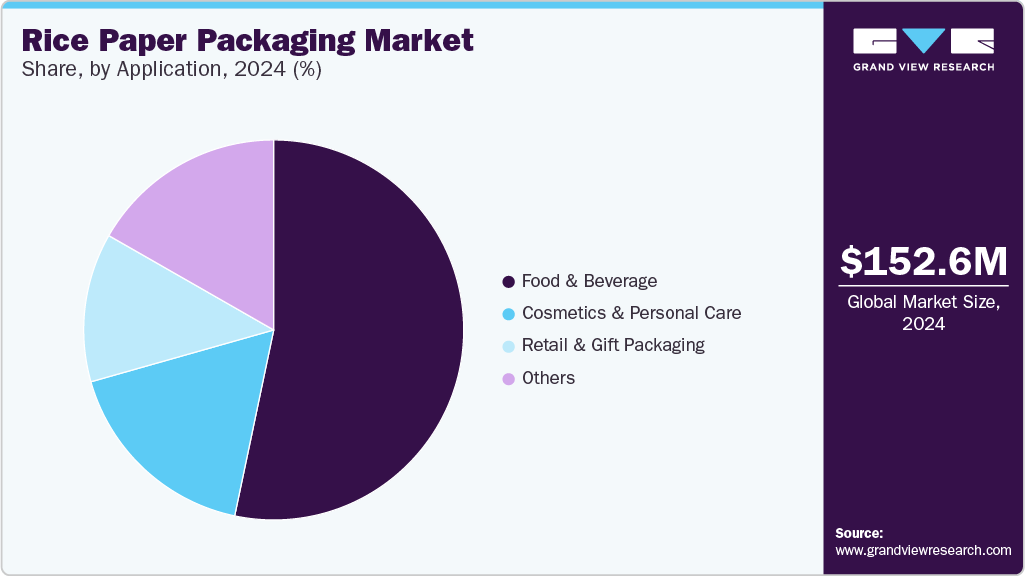

The global rice paper packaging market size was estimated at USD 152.6 million in 2024 and is expected to grow at a CAGR of 6.9% from 2025 to 2030. The industry is driven by rising consumer demand for eco-friendly, biodegradable alternatives to plastic and increasing regulatory pressure to reduce single-use plastics.

Key Highlights:

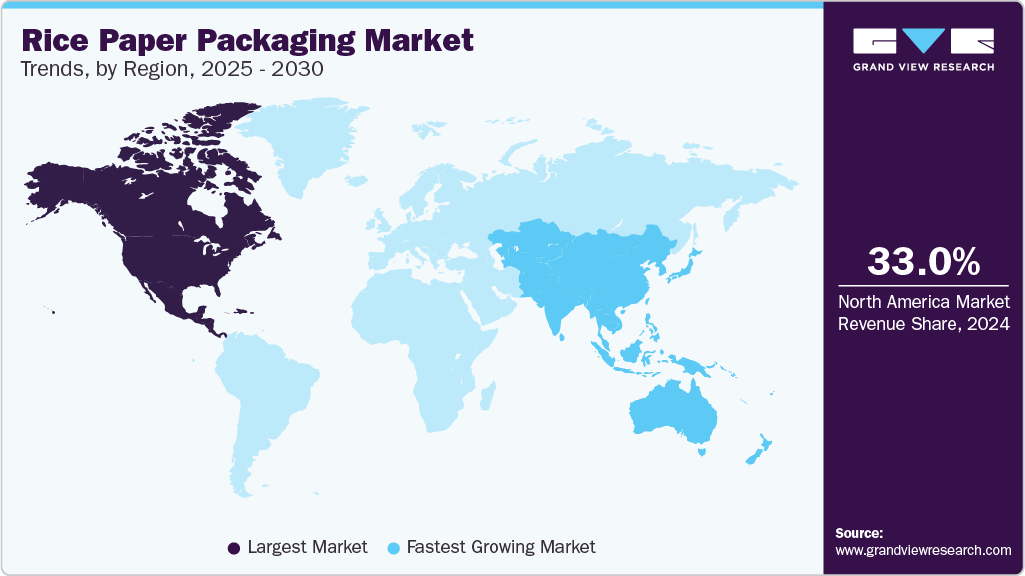

- North America rice paper packaging market dominated the global industry and accounted for the largest revenue share of over 33.0% in 2024.

- The rice paper packaging market in the U.S. is primarily driven by sustainability trends, corporate ESG commitments, and federal/state-level plastic restrictions.

- By product, the sheets & rolls segment recorded the largest revenue share of over 36.0% in 2024.

- By application, the food & beverages segment recorded the largest share of over 53.0% in 2024.

Additionally, its aesthetic appeal and suitability for food-safe applications boost its adoption in the food and retail sectors.

As environmental concerns rise and awareness about plastic pollution spreads, rice paper, made from natural ingredients such as rice, tapioca, and water, offers a compostable and eco-friendly alternative to conventional plastic packaging. Governments and regulatory bodies across regions such as the EU, North America, and parts of Asia Pacific are implementing stringent regulations that push manufacturers to adopt biodegradable materials. For example, the EU's 2024 Packaging and Packaging Waste Regulation (PPWR) mandates ambitious recycled content targets for plastic packaging, which has triggered unprecedented research and development (R&D) investment across industries. PPWR requires all packaging to be recyclable or reusable by 2030, with specific minimum recycled content targets for plastic packaging increasing progressively through 2030 to 2040.

Another key factor driving the industry is the surging demand for sustainable food packaging, especially in organic and health-conscious segments. Rice paper is already widely accepted in Asian cuisines and is now increasingly used to wrap snacks, candies, and even fresh produce in Western markets. Brands seeking a natural and artisanal aesthetic prefer rice paper for its transparent, minimalistic look that aligns well with clean-label products. For instance, organic food brands in the U.S. have started using rice paper wraps for chocolate and dry snacks to appeal to eco-conscious millennials and Gen Z consumers.

The growth of e-commerce and eco-friendly gifting trends is also propelling the industry. E-commerce brands, particularly those offering handmade, vegan, or artisanal products, are leveraging rice paper for inner wrapping to enhance brand identity and reduce their carbon footprint. Rice paper is lightweight, reducing shipping costs and carbon emissions, making it suitable for sustainable logistics. In Japan and South Korea, rice paper is even being used in premium gift packaging and origami-style designs, enhancing product presentation while minimizing plastic use.

Moreover, supportive market dynamics in Asia-Pacific and emerging economies are creating significant growth opportunities. Countries such as Vietnam, Thailand, and Indonesia have abundant raw materials and traditional know-how related to rice paper production, enabling scalable and cost-effective manufacturing. With increasing global demand and supportive export policies, these nations are well-positioned as key supply hubs. Additionally, the rise in local consumption of eco-friendly products in these regions is fostering domestic adoption. As both local and international brands look to align with sustainable development goals (SDGs), rice paper packaging is expected to emerge as a viable and attractive option in the coming years.

Market Concentration & Characteristics

The industry is still in the early stages of industrial adoption, categorized as a niche within the overall biodegradable and sustainable packaging sector. While demand is growing, especially among eco-conscious consumers and small to mid-sized organic brands, large-scale industrial adoption remains limited. The market is characterized by a relatively small number of specialized producers, mainly concentrated in regions with traditional expertise, such as China, Vietnam, Thailand, and Indonesia.

The industry heavily depends on agricultural raw materials such as rice starch, tapioca, and water, making it sensitive to crop yields and seasonal variations. Additionally, production is regionally concentrated, especially in Asia-Pacific, which has abundant raw materials and low-cost skilled labor for artisanal production. This geographic concentration offers cost advantages but also makes the industry susceptible to supply chain disruptions and trade policy changes.

Moreover, the industry has low technological barriers to entry, especially for small-scale producers, which encourages the participation of craft-based or regional firms. However, scaling operations to meet industrial packaging standards, especially in terms of moisture resistance, tensile strength, and automated packaging line compatibility, poses a challenge. This limits the ability of the market to quickly transition into mass production for mainstream FMCG applications.

Product Insights

The sheets & rolls segment recorded the largest revenue share of over 36.0% in 2024. Sheets and rolls are widely used forms of rice paper packaging. They are typically supplied in flat or rolled formats and used for direct food wrapping, interleaving food items, or as liners in food containers. Their biodegradable and compostable properties make them highly favorable for sustainable packaging solutions in both foodservice and retail applications.

Custom printed packaging is projected to grow at the fastest CAGR of 7.7% during the forecast period. This segment includes rice paper materials that are customized with logos, patterns, or product information using eco-friendly printing techniques. Custom printed packaging is widely used for boutique brands, gift items, and premium organic products. It enhances brand identity while maintaining environmental credibility.

Application Insights

The food & beverages segment recorded the largest share of over 53.0% in 2024. Rice paper packaging is widely used in the food and beverage industry due to its edible nature, biodegradability, and aesthetic appeal. It is especially common for wrapping snacks, candies, specialty food items, and artisanal goods, particularly in eco-conscious or premium product lines. The material also offers moisture resistance and is perceived as a natural alternative to plastic.

Cosmetics & personal care is projected to grow at the fastest CAGR of 7.5% during the forecast period. Rice paper packaging is used for wrapping soap bars, bath bombs, and eco-friendly product lines. Its smooth, translucent texture offers a natural and premium feel, appealing to brands emphasizing sustainability and aesthetics. Rising consumer awareness around sustainable beauty and wellness products is fueling the demand for biodegradable and zero-waste packaging.

Rice paper is also preferred in retail and gift packaging for its visual elegance, natural texture, and customizable surface. It is often used for wrapping specialty gifts, handmade crafts, luxury stationery, and eco-friendly product collections, lending a premium, artisanal look. Growing demand for customized, eco-conscious gift and retail packaging solutions is a major contributor to segment growth.

Regional Insights

North America rice paper packaging market dominated the global industry and accounted for the largest revenue share of over 33.0% in 2024. This dominance can be attributed to its stringent environmental regulations and consumer preference for sustainable products. The U.S. and Canada are witnessing a surge in demand for compostable and biodegradable packaging, particularly in the food and beverage sector. The rise of e-commerce has also fueled demand for eco-friendly shipping materials, with rice paper being used as an alternative to bubble wrap and plastic fillers. Corporate sustainability commitments, such as those by McDonald’s and Starbucks, further drive adoption, pushing manufacturers to invest in rice-based materials.

U.S. Rice Paper Packaging Market Trends

The rice paper packaging market in the U.S. is primarily driven by sustainability trends, corporate ESG commitments, and federal/state-level plastic restrictions. Major food brands and retailers are adopting rice paper for products such as snack wrappers, tea bags, and bakery packaging.

Europe Rice Paper Packaging Market Trends

The rice paper packaging market in Europe is primarily driven by strict EU regulations on single-use plastics and a strong circular economy framework. Countries such as Germany, France, and the UK are leading the shift toward biodegradable packaging, with rice paper being used for food wraps, tea bags, and disposable cutlery. For example, German companies such as Bio4Pack offer rice-based packaging for organic food brands, aligning with the EU’s Green Deal objectives. The region’s well-established food delivery sector is also adopting rice paper containers as a sustainable alternative to plastic. Additionally, European consumers’ high willingness to pay for eco-friendly products supports market expansion, with startups innovating in edible rice packaging for confectionery and gourmet foods.

Asia Pacific Rice Paper Packaging Market Trends

The rice paper packaging market in Asia Pacific is anticipated to grow at the fastest CAGR of 7.5% over the forecast period. This outlook is due to its strong agricultural base, increasing sustainability awareness, and government initiatives promoting eco-friendly alternatives. Countries such as China, India, and Japan are leading the adoption of rice-based packaging as a biodegradable solution to combat plastic pollution. For example, China’s ban on single-use plastics has accelerated demand for rice paper packaging in food service and retail industries. Startups in Southeast Asia are innovating with rice-based edible packaging for coffee and snacks, further boosting market growth.

Key Rice Paper Packaging Companies Insights

Key players operating in the rice paper packaging market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Rice Paper Packaging Companies:

The following are the leading companies in the rice paper packaging market. These companies collectively hold the largest market share and dictate industry trends.

- TIPA LTD

- Green Compostables

- Guangdong BN Packaging Co., Ltd

- IMPAK Corporation

- TedPack Company Limited

- VINPACK JOINT STOCK COMPANY

- MST Packaging Co., Ltd.

- Huizhou Yito Packaging Co., Ltd.

- MTPak Coffee

- Biopacktech Co., Ltd.

- ClearBags

- BioPack

- GreenBiobag Co., Ltd.

Recent Developments

-

In February 2025, Bio4Pack and Argos Packaging formed a strategic partnership to introduce innovative, sustainable trays made from paddy straw, a by-product of rice plantations, exclusively in the Netherlands. This rice-based packaging solution offers significant environmental benefits by utilizing rice straw waste that would otherwise be burned, thereby reducing harmful emissions, lowering CO2 output, improving air quality, and protecting groundwater.

-

In November 2023, TIPA, a compostable packaging solutions provider, launched an innovative fully compostable and recyclable packaging tray made from rice waste, specifically paddy straw, an agricultural byproduct typically burned and causing air pollution. These trays offer a sustainable alternative to plastic and polystyrene takeaway containers, aligning with recent bans on such plastics in the UK and other regions.

Rice Paper Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 162.9 million

Revenue forecast in 2030

USD 227.8 million

Growth rate

CAGR of 6.9% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

TIPA LTD; Green Compostables; Guangdong BN Packaging Co.,Ltd; IMPAK Corporation; TedPack Company Limited; VINPACK JOINT STOCK COMPANY; MST Packaging Co., Ltd.; Huizhou Yito Packaging Co., Ltd.; MTPak Coffee; Biopacktech Co.,Ltd.; ClearBags; BioPack; GreenBiobag Co.,Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rice Paper Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rice paper packaging market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sheets & Rolls

-

Pouches & Wraps

-

Labels & Stickers

-

Custom Printed Packaging

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Cosmetics & Personal Care

-

Retail & Gift Packaging

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The rice paper packaging market was estimated at around USD 152.6 million in the year 2024 and is expected to reach around USD 162.9 million in 2025.

b. The rice paper packaging market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach around USD 227.8 million by 2030.

b. The food & beverage application segment dominated the rice paper packaging market in 2024 with over 53.0% value share due to increasing demand for eco-friendly, biodegradable packaging and growing use of rice paper in wrapping snacks, confectionery, and fresh produce.

b. The key players in the rice paper packaging market include TIPA LTD; Green Compostables; Guangdong BN Packaging Co.,Ltd; IMPAK Corporation; TedPack Company Limited; VINPACK JOINT STOCK COMPANY; MST Packaging Co., Ltd.; Huizhou Yito Packaging Co., Ltd.; MTPak Coffee; Biopacktech Co.,Ltd.; ClearBags; BioPack; and GreenBiobag Co.,Ltd.

b. The rice paper packaging market is driven by increasing demand for eco-friendly, biodegradable alternatives to plastic and growing consumer preference for sustainable and visually appealing packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.