- Home

- »

- Plastics, Polymers & Resins

- »

-

Rigid Food Packaging Market Size, Industry Report, 2033GVR Report cover

![Rigid Food Packaging Market Size, Share & Trends Report]()

Rigid Food Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Plastic, Metal, Paperboard), By End Use (Dairy Products, Bakery & Confectionery, Ready-to-Eat Meals, Meat, Poultry & Seafood), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-824-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rigid Food Packaging Market Summary

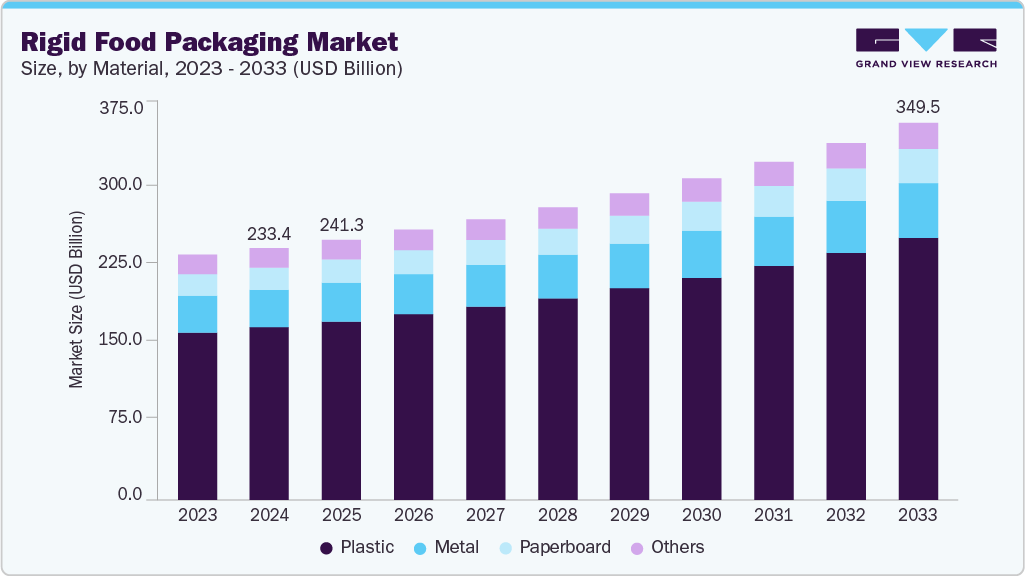

The global rigid food packaging market size was valued at USD 233.4 billion in 2024 and is expected to reach USD 349.5 billion by 2033, expanding at a CAGR of 4.7% from 2025 to 2033. Rising demand for longer shelf-life and contamination-free food is driving the global rigid food packaging market, as brands prioritize durable materials that ensure product safety and freshness.

Key Market Trends & Insights

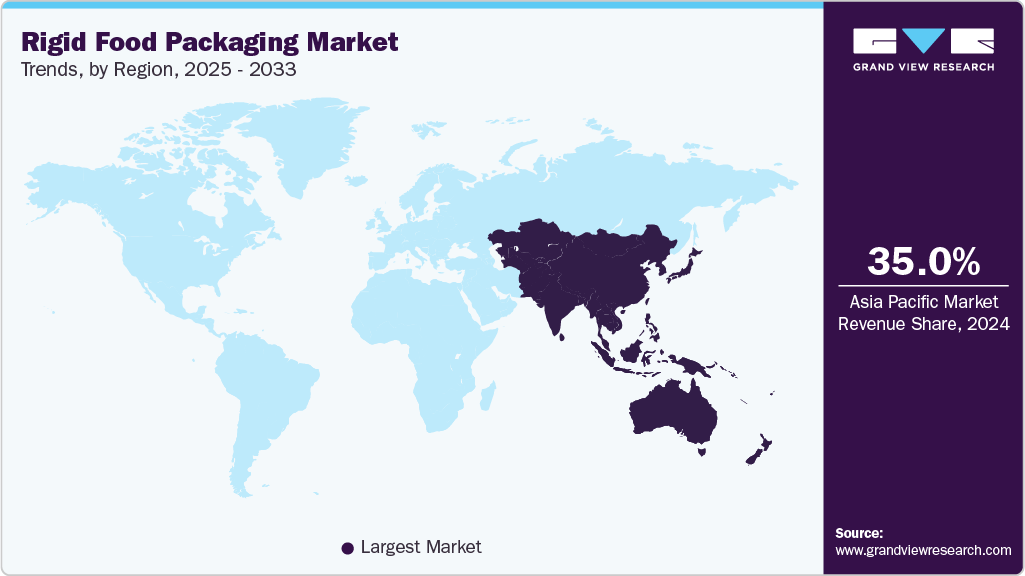

- Asia Pacific dominated the rigid food packaging market with the largest revenue share of over 35.0% in 2024.

- The rigid food packaging market in China is expected to grow at a substantial CAGR of 5.7% from 2025 to 2033.

- By material, the paperboard segment is expected to grow at a considerable CAGR of 5.3% from 2025 to 2033 in terms of revenue.

- By end use, the ready-to-eat meals segment is expected to grow at a considerable CAGR of 5.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 233.4 Billion

- 2033 Projected Market Size: USD 349.5 Billion

- CAGR (2025-2033): 4.7%

- Asia Pacific: Largest market in 2024

Additionally, growth in online grocery and food delivery services is accelerating the adoption of robust, impact-resistant rigid packaging that protects products during handling and transportation.Urbanization, rising disposable incomes, and fast-paced lifestyles have made quick-serve foods, frozen meals, microwaveable dishes, and single-serve beverages essential for daily consumption. Rigid packaging formats such as PET bottles, PP containers, trays, tubs, and laminated plastic jars offer durability, portability, and product protection, making them ideal for these applications. For example, the rapid expansion of frozen foods in the U.S., India, China, and Southeast Asia has increased demand for rigid trays and thermoformed containers that withstand cold-chain distribution.

Rigid food packaging also supports portion control and time-saving meal preparation, which is increasingly valued by urban millennials, working professionals, and dual-income households. Single-serve yogurt cups, instant noodles in rigid bowls, dip containers, and ready-meal clamshells are examples where rigid formats deliver convenience without compromising product integrity. Moreover, global growth of cloud kitchens and food delivery services such as DoorDash, Swiggy, and Deliveroo intensifies the demand for sturdy, leak-proof packaging that maintains food quality during transit, an area where rigid packaging outperforms flexible packaging.

Increasing food safety and contamination protection requirements tied to convenience foods are also fueling the market growth. Rigid packaging provides superior barrier properties, mechanical strength, and resistance to deformation, safeguarding products such as dairy, meats, sauces, baked goods, and beverages from spoilage or external contamination. Many multinational food brands, including Nestlé, General Mills, and Danone, rely on rigid packaging to comply with safety regulations while ensuring extended freshness. For example, PET bottles and PP tubs maintain product stability for extended periods on supermarket shelves.

Rigid packaging also supports the convenience trend by enabling consumer-friendly features such as tamper-evident closures, resealable lids, easy-open tear bands, microwave-safe materials, and ergonomic designs. These functional enhancements significantly improve user experience and contribute to repeat purchases. As a result, companies continue investing in advanced rigid packaging technologies, including lightweighting, smart labeling, and recyclable mono-material systems, to meet rising consumer expectations for convenience combined with sustainability.

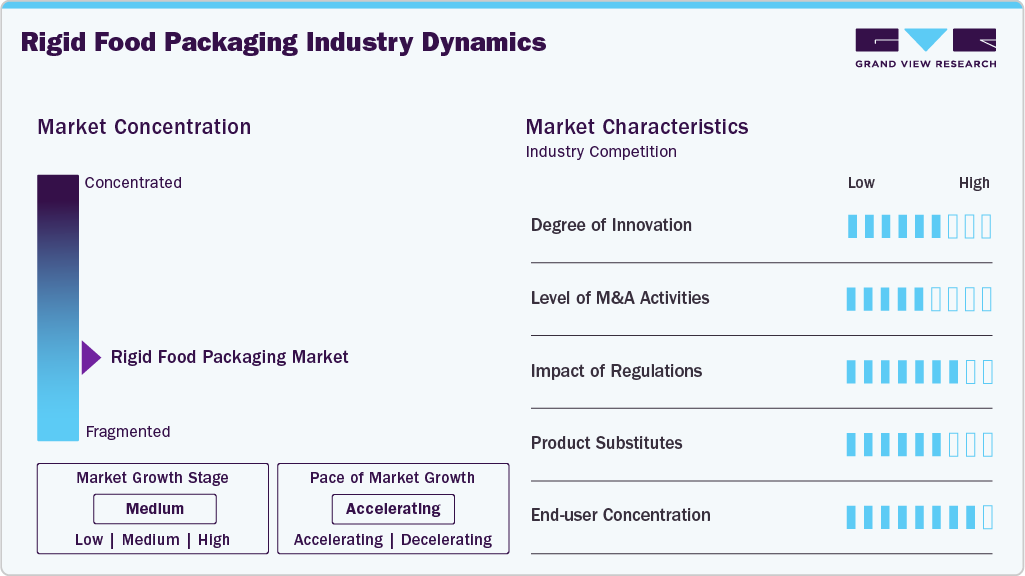

Market Concentration & Characteristics

The industry is strongly characterized by its focus on maintaining food safety, preventing contamination, and extending shelf life. Rigid packaging materials such as PET, PP, HDPE, glass, and metal provide strong barrier properties, ensuring protection against moisture, oxygen, and physical damage. This characteristic is crucial for packaging dairy, meats, sauces, beverages, and ready-to-eat products where hygiene standards are extremely strict.

The industry's growth is heavily tied to the expansion of organized retail, food delivery platforms, cloud kitchens, and quick-service restaurants. These channels rely on leak-proof, sturdy, and tamper-evident rigid packaging to maintain food quality during storage and transit. The rise of online grocery and meal delivery has amplified demand for durable, rigid formats that protect food integrity.

Material Insights

The plastic segment recorded the largest market revenue share of over 68.0% in 2024, driven by its versatility, cost-effectiveness, and superior functional properties that make it ideal for a wide range of rigid food packaging applications. Plastics such as PET, PP, HDPE, and PS offer excellent durability, lightweight performance, impact resistance, and strong barrier protection against moisture and oxygen, which are critical for preserving freshness and extending shelf life.

The availability of recyclable and food-grade plastic options, along with growing adoption of rPET and mono-material designs, has also supported continued demand even amid sustainability pressures, ensuring plastics remain the preferred material choice for rigid food packaging globally.

The paperboard segment is expected to grow at the fastest CAGR of 5.3% during the forecast period, driven by the global shift toward sustainable and eco-friendly packaging solutions, along with increasing regulatory pressure to reduce single-use plastics. Paperboard offers biodegradability, recyclability, and a strong environmental profile, making it an attractive alternative for brands seeking to improve their sustainability credentials.

Its versatility in forming rigid cartons, trays, sleeves, and containers supports expanding applications in bakery, dairy, frozen foods, and ready-to-eat meals. Advancements in coated and laminated paperboard technologies have also enhanced moisture and grease resistance, enabling it to compete more directly with plastic-based rigid formats.

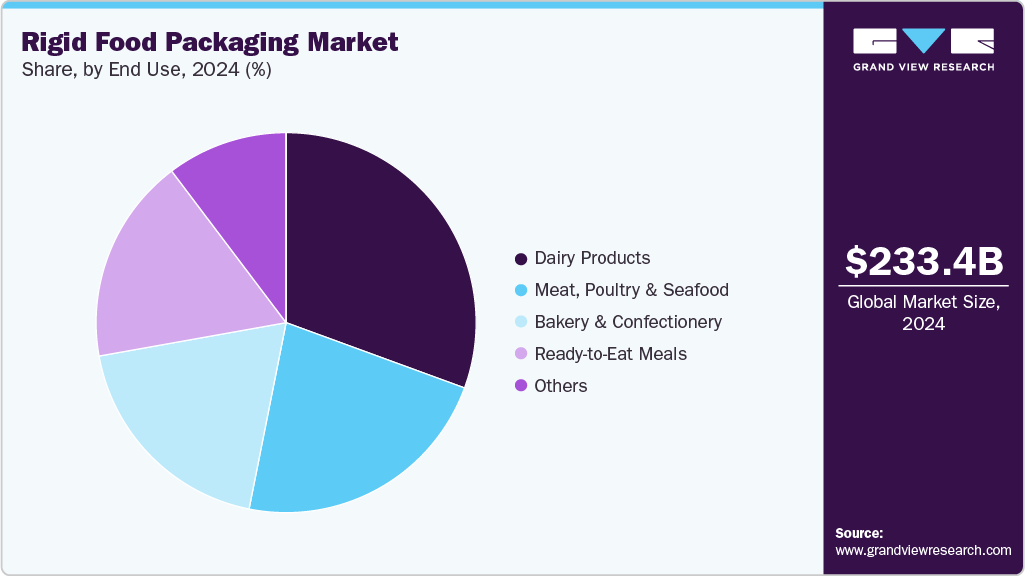

End Use Insights

The dairy products segment captured the largest market share of over 30.0% in 2024 because dairy items such as milk, yogurt, cheese, butter, cream, and flavored beverages require high-barrier, contamination-resistant, and structurally durable packaging, making rigid formats the preferred choice for safety and shelf-life protection.

The global rise in consumption of value-added dairy products, including probiotic yogurts, flavored milks, single-serve dairy drinks, and specialty cheeses, further boosts demand for rigid packaging that offers tamper resistance, temperature stability, and strong product visibility. The expansion of cold-chain retail, increasing demand for hygienic packaging in developing markets, and dairy brands’ preference for rigid formats that support branding, labeling, and convenience features also contribute to the segment’s dominant market share.

The ready-to-eat meals segment is projected to grow at the fastest CAGR of 5.6% during the forecast period, driven by rising urbanization, busy lifestyles, and the increasing preference for convenient, time-saving meal options among working professionals, students, and dual-income households. The rapid expansion of online food delivery platforms, cloud kitchens, and retail-ready meal kits has further accelerated demand for sturdy, leak-proof rigid packaging that ensures safe transport and hassle-free consumption.

Region Insights

Asia Pacific dominated the global market and accounted for the largest revenue share of over 35.0% in 2024 and is expected to grow at the fastest CAGR of 5.3% during the forecast period. This positive outlook is due to the rapidly expanding food and beverage industry, rising urbanization, and a large working-class population seeking convenient, packaged, and ready-to-eat food products.

Countries such as China, India, Indonesia, and Vietnam are experiencing strong growth in organized retail, online grocery, and food delivery ecosystems, increasing the demand for rigid packaging formats like bottles, tubs, trays, containers, and jars. The region’s booming dairy, bakery, snacks, and processed food sectors rely heavily on rigid plastics, paperboard cartons, and metal packaging to ensure product safety, shelf-life extension, and brand differentiation. The expansion of modern trade channels like 7-Eleven, Walmart China, Big Bazaar, and FamilyMart also supports higher consumption of packaged foods requiring rigid formats.

Europe Rigid Food Packaging Market Trends

Europe’s growth in the market is due to its strict regulations on food safety, sustainability, and waste management, which encourage the adoption of high-quality, recyclable rigid packaging formats. European consumers prefer environmentally friendly packaging, promoting demand for paperboard cartons, glass containers, metal cans, and high-grade PET and PP rigid plastics. Countries such as Germany, France, and the UK have strong packaged food industries that rely heavily on rigid formats for hygiene and preservation.

North America Rigid Food Packaging Market Trends

The region’s growth in the rigid food packaging market is owing to its mature food processing industry, high consumption of packaged foods, and strong adherence to food safety standards. The U.S. and Canada have a well-established demand for rigid packaging formats such as HDPE milk jugs, PET beverage bottles, PP tubs, and thermoformed trays used for dairy, frozen meals, snacks, sauces, and meat products. The region’s consumers prioritize convenience, portion-controlled packaging, and ready-to-eat meals, which significantly increases the use of rigid containers and microwaveable packaging. Major food brands including Kraft Heinz, General Mills, Tyson Foods, and Danone heavily invest in high-quality rigid packaging to maintain freshness and regulatory compliance.

Key Rigid Food Packaging Company Insights

Key players operating in the rigid food packaging market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

The competitive environment of the rigid food packaging market is characterized by intense rivalry among global packaging giants and regional converters, driven by high production volumes, stringent quality requirements, and continuous pressure for cost optimization. Major players such as Amcor plc, Sonoco Products Company, Tetra Pak, Huhtamaki, ALPLA, Silgan Holdings, and Graphic Packaging International, LLC compete on material innovation, sustainability, lightweighting technologies, and advanced molding capabilities to secure long-term contracts with large food and beverage manufacturers.

The market is moderately consolidated in certain material categories like PET bottles and rigid paperboard cartons, while segments such as thermoformed trays and tubs remain more fragmented with strong regional participation. Increasing regulatory pressure for recyclable and sustainable packaging is accelerating R&D investments and collaborations across the supply chain, raising the competitive stakes further. Additionally, customer expectations for tamper-evident, resealable, and convenience-enhancing features drive continuous innovation, making product differentiation essential in securing competitive advantage.

-

In May 2025, Hotpack, a Dubai-based food packaging company, announced a USD 100.0 million investment to establish its first manufacturing and distribution facility in North America, located in Edison, New Jersey. The facility is expected to specialize in the customization of cups, containers, and clamshells made from both plastic and paper, aiming to enhance Hotpack’s ability to serve its growing U.S. customer base with greater efficiency and flexibility. This move aligns with Hotpack’s 2030 Vision for international growth and reflects a strong commitment to innovation and sustainability in the global packaging industry.

-

In April 2025, Amcor plc completed its all-stock acquisition of Berry Global Inc, creating a global packaging leader with around 400 facilities, 75,000 employees, and operations in 140 countries. The merger, valued at approximately USD 13.0 billion, enhances Amcor's portfolio with expanded material science and innovation capabilities, positioning it to deliver more consistent growth and improved margins.

-

In September 2024, Colpac introduced a new range of paperboard food packaging aimed at enhancing sustainability in the food service industry. This line includes various products designed for takeaway and delivery, emphasizing eco-friendly materials and recyclable options. The company aims to meet the growing demand for sustainable packaging solutions while maintaining functionality and design appeal.

-

In June 2024, Sonoco Products Company announced its plan to acquire Eviosys, a Switzerland-based metal packaging company, from KPS Capital Partners for USD 3.9 billion. This acquisition aims to position Sonoco as the leading manufacturer of metal food cans and aerosol packaging globally. The deal is expected to close by the end of the year, pending regulatory approvals, and will allow Sonoco to expand its market in metal packaging to approximately USD 25 billion.

Key Rigid Food Packaging Companies:

The following are the leading companies in the rigid food packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Sonoco Products Company

- Tetra Pak

- Huhtamaki

- ALPLA

- Silgan Holdings

- Graphic Packaging International, LLC

- Novolex

- Smurfit Westrock

- ProAmpac

- SIG

- Greiner Packaging

- Pactiv Evergreen Inc.

- Anchor Packaging LLC

Rigid Food Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 241.3 billion

Revenue forecast in 2033

USD 349.5 billion

Growth rate

CAGR of 4.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Amcor plc; Sonoco Products Company; Tetra Pak; Huhtamaki; ALPLA; Silgan Holdings; Graphic Packaging International, LLC; Novolex; Smurfit Westrock; ProAmpac; SIG; Greiner Packaging; Pactiv Evergreen Inc.; Anchor Packaging LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rigid Food Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global rigid food packaging market report based on material, end use, and region:

-

Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

Plastic

-

Metal

-

Paperboard

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Dairy Products

-

Meat, Poultry & Seafood

-

Bakery & Confectionery

-

Ready-to-Eat Meals

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The rigid food packaging market is driven by rising demand for convenience foods, increasing focus on food safety and shelf life, growth of organized retail, and expanding use of recyclable and sustainable rigid materials.

b. The global rigid food packaging market was estimated at around USD 233.4 billion in the year 2024 and is expected to reach around USD 241.3 billion in 2025.

b. The global rigid food packaging market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2033 to reach around USD 349.5 billion by 2033.

b. The dairy products segment dominated the rigid food packaging market due to its stringent requirements for contamination protection, extended shelf life, and durable packaging formats needed for high-volume, frequently purchased items like milk, yogurt, and cheese.

b. The key players in the rigid food packaging market include Amcor plc; Sonoco Products Company; Tetra Pak; Huhtamaki; ALPLA; Silgan Holdings; Graphic Packaging International, LLC; Novolex; Smurfit Westrock; ProAmpac; SIG; Greiner Packaging; Pactiv Evergreen Inc.; and Anchor Packaging LLC

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.