- Home

- »

- Biotechnology

- »

-

RNAi Technology Market Size & Share, Industry Report 2033GVR Report cover

![RNAi Technology Market Size, Share & Trends Report]()

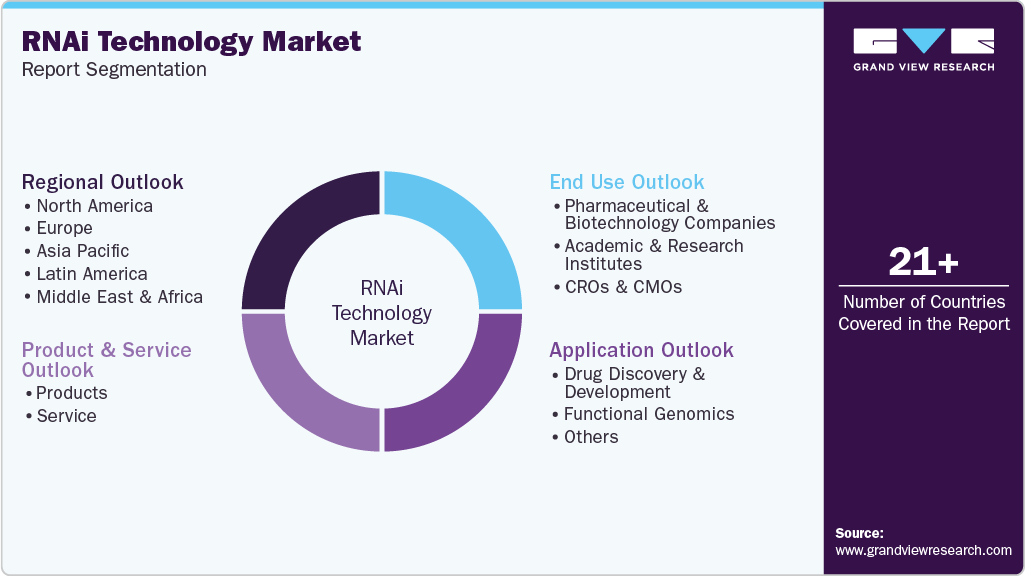

RNAi Technology Market (2025 - 2033) Size, Share & Trends Analysis Report By Product & Services (Products, Services), By Application (Drug Discovery & Development, Functional Genomics), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-295-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

RNAi Technology Market Summary

The global RNAi technology market size was estimated at USD 2.94 billion in 2024 and is projected to reach USD 9.52 billion by 2033, growing at a CAGR of 14.25% from 2025 to 2033. This market growth is attributed to the increasing prevalence of autoimmune diseases, rare disorders, and cancer across the globe.

Key Market Trends & Insights

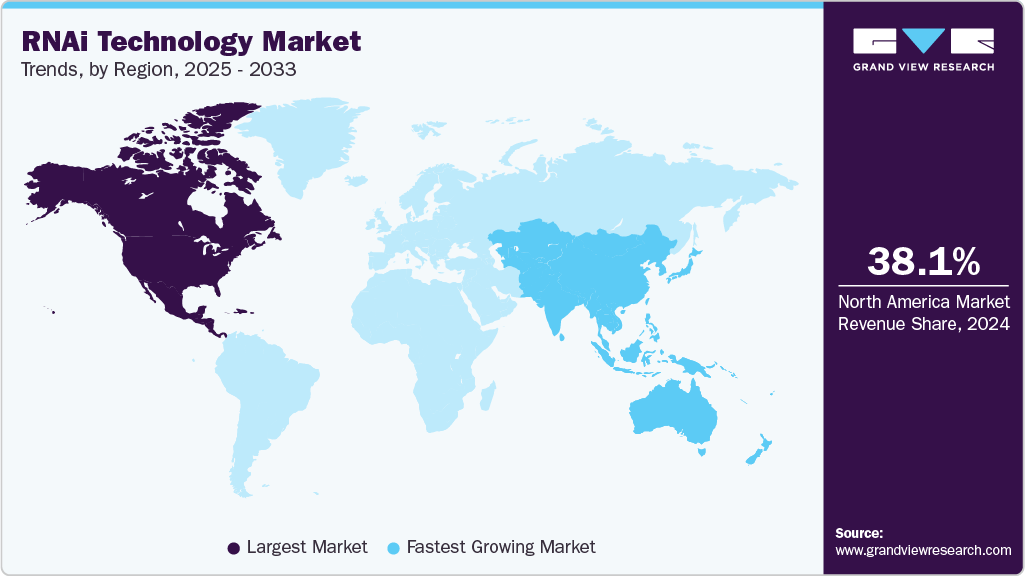

- The North America RNAi technology market held the largest share of 38.10% of the global market in 2024.

- The RNAi technology industry in the U.S. is expected to grow significantly over the forecast period.

- By product & service, the product segment held the largest market share of 67.98% in 2024.

- Based on application, the drug discovery & development segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.94 Billion

- 2033 Projected Market Size: USD 9.52 Billion

- CAGR (2025-2033): 14.25%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Expansion of RNAi-Based Therapeutics

The RNAi technology market is growing rapidly due to strong clinical validation and multiple FDA/EMA approvals, including ONPATTRO, GIVLAARI, OXLUMO, and AMVUTTRA. These approvals have proven that RNAi can be developed into safe and effective therapeutics, boosting confidence among biopharma companies and accelerating investment in RNAi platforms. Its ability to precisely silence disease-causing genes makes RNAi a transformative option for rare genetic and liver-targeted disorders. As approved RNAi therapies show strong clinical and commercial performance, demand for RNAi tools, reagents, and delivery technologies continues to rise.

FDA-approved siRNA medications

Medication

Target

Disease

FDA Approval

Patisiran (Onpattro)

TTR

hATTR

2018

Givosiran (Givlaari)

ALAS1

AHP

2019

Lumasiran (Oxlumo)

HAO1

PH1

2020

Inclisiran (Leqvio)

PCSK9

HeFH, ASCVD

2021

Source: Journal of Pharmacology and Experimental Therapeutics, Secondary Research, Grand View Research

The growth of the market is being further accelerated by significant pharmaceutical interest. Through partnerships, acquisitions, and internal research and development, businesses such as Alnylam, Arrowhead, Dicerna (Novo Nordisk), AstraZeneca, and Takeda are growing their RNAi pipelines. Through these initiatives, RNAi applications are expanding into the fields of oncology, infectious diseases, and cardiometabolic disorders. Significant investments, enduring collaborations, and specialized RNAi research facilities are propelling clinical activity, product launches, and ongoing innovation. The need for RNAi platforms in drug discovery and clinical development keeps growing as the therapeutic pipeline broadens and industry investment increases.

Advancements in Delivery Technologies

Advances in RNAi delivery systems have become a key growth driver for the RNAi technology industry. Earlier issues, such as poor uptake, rapid degradation, and off-target effects, have been largely addressed through innovations in LNPs, GalNAc-siRNA conjugates, polymer carriers, and viral vectors. These next-generation platforms enhance stability, biodistribution, and tissue-specific targeting, particularly in the liver, a major site for genetic and metabolic disorders. As delivery becomes more efficient and clinically viable, demand for RNAi reagents, delivery kits, and development solutions continues to increase.

In addition, RNAi is expanding beyond liver targets owing to advanced delivery technologies. New strategies, such as targeted nanoparticles, peptide-based carriers, and engineered exosomes, are creating opportunities for applications in infectious diseases, cancer, and the central nervous system. To improve their pipelines and lower development risk, biopharma companies are making significant investments in these delivery innovations.

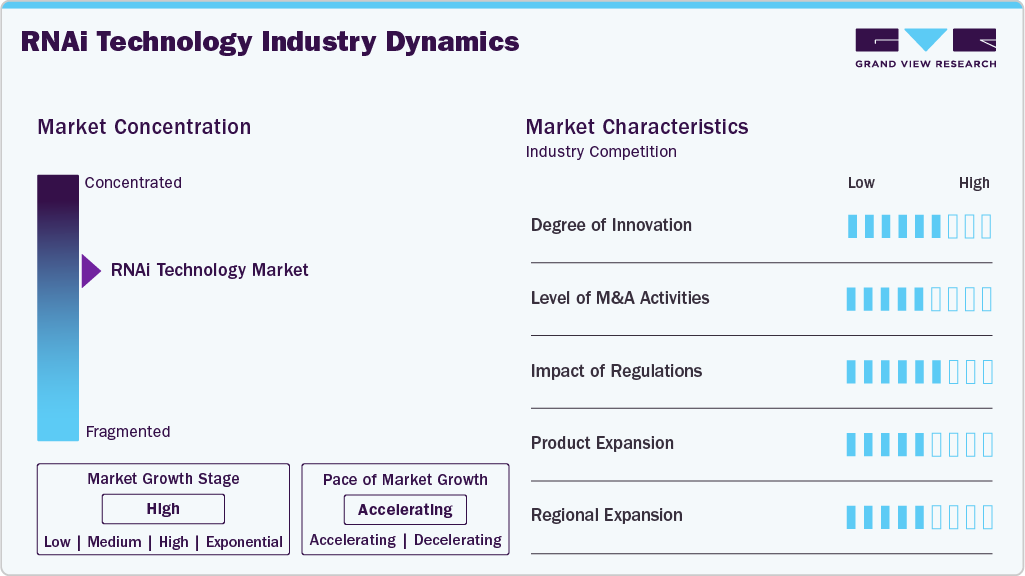

Market Concentration & Characteristics

Recent developments in molecular biology, biotechnology, and therapeutic development have propelled substantial innovation in the RNAi technology industry. Through the silencing of genes linked to diseases, RNA interference (RNAi) has become increasingly utilized to develop treatments for genetic disorders. Moreover, a large number of RNAi-based therapies targeting various illnesses, including neurological disorders, metabolic diseases, and viral infections, are currently undergoing clinical trials at different stages.

Mergers and acquisitions activities are moderately prevalent in the industry, reflecting a medium level of engagement within the industry. The collaboration is crucial for advancing technology and overcoming the challenges associated with RNAi therapeutics. For instance, in December 2023, Innovent and SanegeneBio entered a strategic partnership to develop a siRNA drug for the treatment of hypertension.

The regulatory impact on the RNAi technology industry is significant. Regulatory agencies, such as the FDA and the European Medicines Agency, are developing and refining guidelines for advanced therapeutic applications. These guidelines aim to establish a framework for the assessment of clinical trials, addressing issues such as off-target effects, unintended consequences, and long-term safety.

The market has experienced moderate growth in recent years, driven by the rising demand for RNAi technology and the increasing R&D activities in the drug discovery and development process. For instance, in November 2020, Alnylam Pharmaceuticals, Inc. launched new Value-based Agreements (VBAs) to improve patient access to givosiran. This was expected to enhance the company’s business and boost its offerings in RNAi therapeutics.

The industry is experiencing a high level of regional expansion, indicating rapid growth and increasing market presence across different geographic regions. This expansion is driven by several factors, including the growing research activities in genomic research and the increasing demand for epigenetic services worldwide.

Product & Service Insights

The products segment dominated the market in 2024 due to the high specificity of RNAi-based tools in targeting and degrading mRNA, enabling precise molecular interventions. Rising investments are also strengthening product pipelines. For instance, in August 2023, ADARx Pharmaceuticals raised USD 200 million in Series C funding to advance its siRNA programs, including ADX-324 and ADX-038, and further develop its RNA-targeting and delivery platforms. Such investments are expected to accelerate product innovation and fuel segment growth over the forecast period.

The services segment is expected to register the fastest CAGR over the forecast period. The difficulty and technical demands of RNAi technology increase the demand for specialized companies with the right skills and equipment. Contract Research Organizations (CROs) and similar firms offer comprehensive RNAi services, encompassing target identification, study design, and execution before and during clinical trials, which helps accelerate the development of new drugs.

Application Insights

The drug discovery & development segment dominated the market in 2024 with the share of 68.87% and is expected to grow the fastest over the forecast period. RNAi’s ability to precisely silence specific genes makes it an essential tool for studying gene function and validating therapeutic targets, accelerating early-stage research. Rising investments, strategic collaborations for RNAi-based therapeutics, and continued advances in delivery technologies are further driving growth in this segment.

The functional genomics segment is expected to register a significant CAGR over the forecast period. This growth can be attributed to research efforts focused on interpreting the phenotypical expression associated with specific disease conditions. A considerable number of cancer gene therapies are developed using functional genomic technology as their foundation.

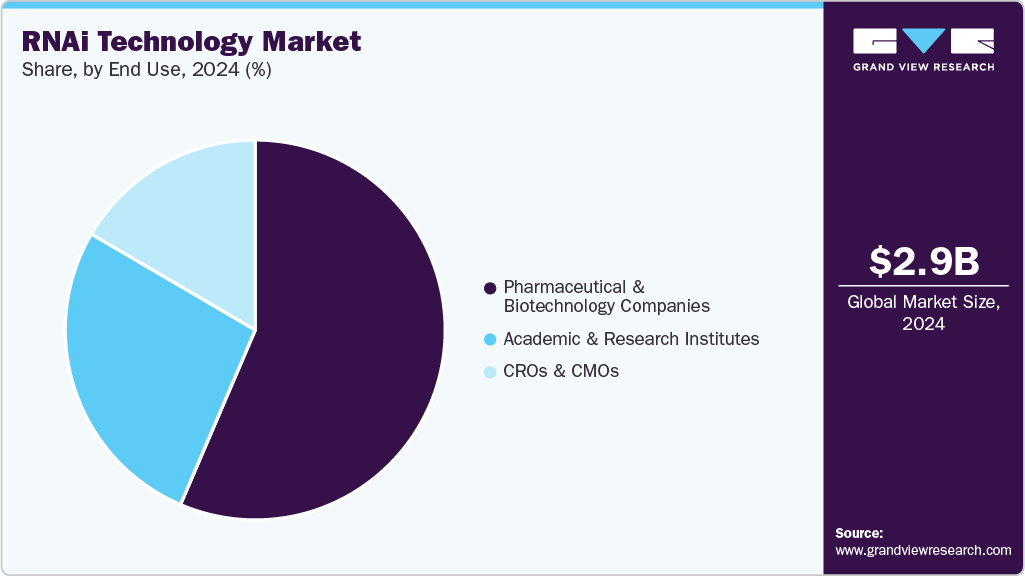

End Use Insights

The pharmaceutical & biotechnology companies segment dominated the market, accounting for a 56.44% share in 2024. This is attributed to several factors, including ongoing research and development efforts, innovative therapies, and the introduction of advanced pharmaceutical products. In addition, the increasing demand for healthcare solutions and advancements in biotechnology contributed to the segment's stronghold in the market.

The CROs & CMOs segment is projected to witness the fastest CAGR over the forecast period, largely due to an increasing number of pharmaceutical and biotech companies outsourcing to cut costs and boost efficiency. Businesses can access cutting-edge knowledge and technologies while concentrating on their core competencies by outsourcing research and manufacturing to specialized service providers.

Regional Insights

The RNAi technology industry in North America held the largest market share of 38.10% in 2024. This is attributed to numerous academic institutions and research centers conducting state-of-the-art work in molecular biology, biotechnology, and genomics. These institutions' investigation of RNAi therapeutics technologies is driving the need for RNAi therapeutics in research applications. For instance, in May 2024, Codexis, Inc. successfully synthesized an oligonucleotide using an enzymatic manufacturing route, supporting the growing need for RNA-based therapeutics. Presented at the TIDES USA meeting, this milestone highlights a viable alternative to traditional manufacturing methods amid rising demand for RNAi therapeutics.

U.S.RNAi Technology Market Trends

The RNAi technology industry in the U.S. is expected to grow over the forecast period due to advancements in RNA-based technologies & their applications across various industries and the presence of key market players.

Europe RNAi Technology Market Trends

The RNAi technology industry in Europe was identified as a lucrative region in this industry. With organizations such as the Center for Genomic Regulation (CRG) and the National Center for Biotechnology (CNB) actively investigating RNA interference applications in healthcare, this further supports the regional market's growth.

The UK RNAi technology industry held a significant share, attributed to the increasing prevalence of genetic disorders & diseases, the need for more efficient and effective treatments, and the growing interest in gene-editing technologies among researchers & scientists.

The RNAi technology industry in Germany is anticipated to grow significantly over the forecast period. Germany’s strong R&D landscape in these areas is expected to improve the adoption of innovative therapies. Germany is one of the global leaders in scientific research, with renowned institutions & multiple biotechnology companies actively developing RNA-based research tools and novel therapeutics. For instance, in April 2024, Merck invested in a new Life Science Research Center in Germany, expanding capabilities in mRNA and bioproduction technologies to meet rising global demand in the industry.

Asia Pacific RNAi Technology Market Trends

The RNAi technology industry in the Asia Pacific is poised to exhibit the fastest CAGR of 16.08% over the forecast period, due to the high birth rate, high prevalence of genetic disorders, and various factors, such as consanguineous marriages and founder mutations.

The China RNAi technology industry is expected to grow over the forecast period. The increasing prevalence of genetic diseases and the rising need for personalized medicine are some of the major factors fueling the demand for RNA-based therapies.

The RNAi technology industry in Japan is witnessing rapid growth due to the growing adoption of precision medicine and personalized healthcare in Japan, which is boosting the demand for RNAi applications. In addition, Japan is a major player in scientific research, particularly in biotechnology & biopharmaceuticals.

Middle East and Africa RNAi Technology Market Trends

The RNAi technology industry in the Middle East and Africa (MEA) is expected to grow notably over the forecast period. Cancer is a major public health concern in MEA. The high mortality rate associated with the unavailability of resources, such as diagnostics, an underdeveloped healthcare infrastructure, and a lack of affordable treatment options, makes MEA a preferred region for investments by large manufacturers. However, a limited number of institutes with advanced research facilities is hampering market growth in the region.

The Kuwait RNAi technology industry is steadily growing, driven by investments in precision medicine, more RNAi tools being used in genetic research, and more advanced RNA-delivery systems being adopted in important therapeutic areas. The nation's RNAi ecosystem is steadily strengthening, despite its infancy, thanks to government support for genomics and healthcare innovation.

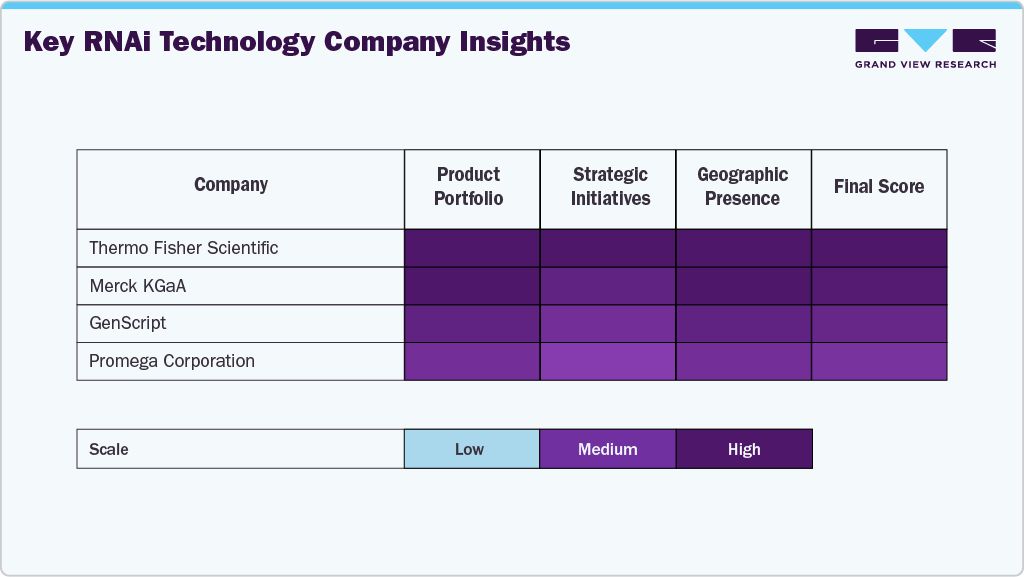

Key RNAi Technology Company Insights

Several well-known companies dominate the RNAi technology industry due to their extensive product lines, cutting-edge gene-silencing technologies, and consistent research and development expenditures. Due to their superior RNAi reagents, delivery systems, genome-wide siRNA/shRNA libraries, and robust worldwide distribution networks, industry leaders such as Thermo Fisher Scientific, Inc., Merck KGaA, Danaher, and Revvity command a sizable portion of the market. By providing integrated RNAi workflows that aid in drug discovery, functional genomics, and therapeutic development, these companies continue to solidify their position in the market.

By offering cutting-edge RNAi tools, specifically designed siRNA/shRNA constructs, delivery kits, and cell-based RNAi screening services, companies such as GenScript, Promega Corporation, Creative Biolabs, OriGene Technologies, Inc., Altogen Biosystems, and Bioneer Corporation are expanding their footprint. Their expanding contributions support the growing demand for gene-silencing applications from academic institutions, biopharmaceutical companies, CROs, and translational research centers.

Key RNAi Technology Companies:

The following are the leading companies in the RNAi technology market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Creative Biolabs

- GenScript

- Revvity

- Promega Corporation

- OriGene Technologies, Inc.

- Altogen Biosystems

- Danaher

- Bioneer Corporation

Recent Developments

-

In November 2025, SanegeneBio in China and the US signed a global licensing deal with Eli Lilly to develop LEAD-enabled RNAi therapies for metabolic diseases, reflecting rising worldwide demand for advanced RNAi technologies.

-

In October 2025, Creative Biolabs in the US launched a fully integrated RNA therapeutics platform, strengthening global RNAi research capacity and supporting rising demand for advanced RNAi-based drug discovery solutions.

-

In May 2025, Biogen and City Therapeutics in the US formed a collaboration to develop RNAi therapies, reflecting rising global demand for next-generation RNAi technologies and advanced CNS-targeted delivery platforms.

-

In August 2024, Skyhawk Therapeutics in the US entered a multibillion-dollar collaboration with Merck KGaA to discover small RNA-targeting molecules, reflecting surging global demand for RNA-modulation technologies in neurological drug development.

RNAi Technology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.28 billion

Revenue forecast in 2033

USD 9.52 billion

Growth rate

CAGR of 14.25% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Creative Biolabs; GenScript; Revvity; Promega Corporation; OriGene Technologies, Inc.; Altogen Biosystems; Danaher; Bioneer Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global RNAi Technology Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global RNAi technology market report on the basis of product & service, application, end use, and region:

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Products

-

miRNA

-

siRNA

-

Others

-

-

Service

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Discovery & Development

-

Neurology

-

Oncology

-

Infectious Diseases

-

Metabolic Diseases

-

Others

-

-

Functional Genomics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

CROs & CMOs

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.