- Home

- »

- Next Generation Technologies

- »

-

Robot Operating System Market Size, Industry Report, 2033GVR Report cover

![Robot Operating System Market Size, Share & Trends Report]()

Robot Operating System Market (2025 - 2033) Size, Share & Trends Analysis Report By Robot Type (Articulated Robots, Cartesian Robotics, Collaborative Robots, SCARA Robots, Others), By Application, By End-use, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-336-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Robot Operating System Market Summary

The global robot operating system market size was estimated at USD 442.1 million in 2024 and is projected to reach USD 1,214.9 million by 2033, growing at a CAGR of 11.8% from 2025 to 2033. This growth is attributed to robotic systems enhancing various human roles across industries such as manufacturing, healthcare, logistics, and services, driven by the need for automation, precision, and operational efficiency.

Key Market Trends & Insights

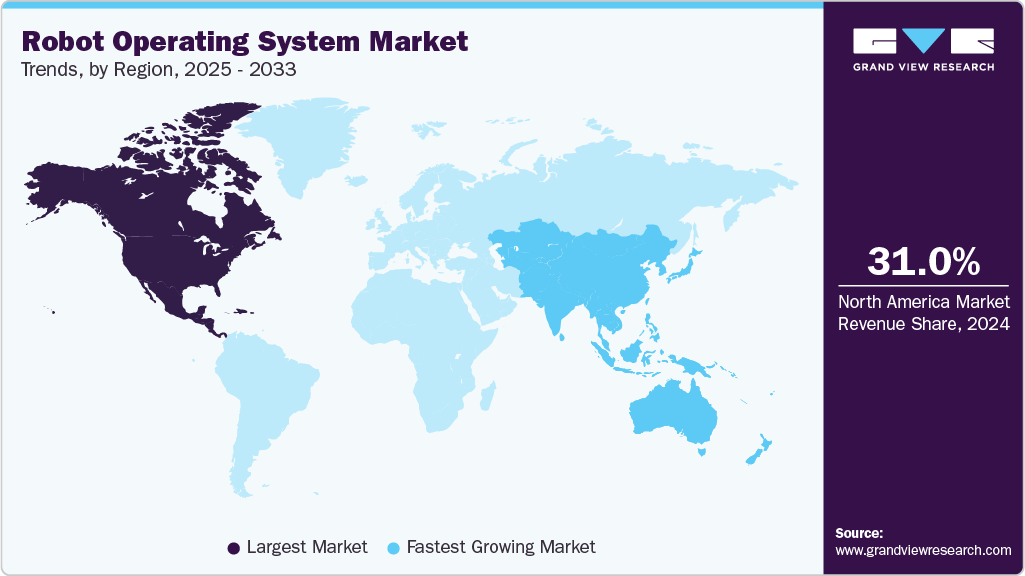

- North America dominated the global robot operating system market with the largest revenue share of 32.9% in 2024.

- The robot operating system market in the U.S. led the North America market and held the largest revenue share in 2024.

- By robot type, SCARA robots segment led the market, holding the largest revenue share of 26.2% in 2024.

- By application, the mapping and navigation segment led the market, holding the largest revenue share in 2024.

- By end use, the mapping and navigation segment anticipated to register the fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 442.1 Million

- 2033 Projected Market Size: USD 1,214.9 Million

- CAGR (2025-2033): 11.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest Growing Market

The current state of the global Robot Operating System (ROS) market reflects increasing adoption driven by the growing integration of robotics in manufacturing, healthcare, and logistics. Organizations leverage ROS to enable flexible, modular, and scalable robot control, which simplifies programming and accelerates deployment. The open-source nature of ROS encourages collaboration and innovation among developers, system integrators, and end-users, facilitating rapid advancements and widespread acceptance. Additionally, improvements in sensor technologies, artificial intelligence, and machine learning enhance ROS capabilities, supporting more autonomous and intelligent robotic applications. In addition, the market growth is supported by expanding use cases across industries such as automotive, electronics, and agriculture, where automation demands continue to rise. Developing user-friendly ROS platforms and standardized software packages lowers barriers to entry for small and medium enterprises, enabling broader adoption. Integrating emerging technologies like 5G and edge computing improves real-time data processing and robot responsiveness, enhancing operational efficiency. Moreover, key players' increasing investments in research and development contribute to continuous innovation in ROS functionalities and ecosystem expansion.

Furthermore, growth is also driven by the growing demand for collaborative robots (cobots) that work safely alongside humans in shared environments. ROS facilitates the development of such robots by providing flexible frameworks for sensor fusion, motion planning, and control algorithms. The rise of smart factories and Industry 4.0 initiatives encourages the deployment of ROS-enabled robots for tasks requiring adaptability and precision. Regulatory support for automation and workforce augmentation further drives the adoption of ROS solutions, positioning the market for sustained growth through diversified applications and technological advancements.

Robot Type Insights

The SCARA robots segment led the market and accounted for 25% of the global revenue in 2024. Several factors, including increasing adoption across various automotive, electronics, pharmaceuticals, and consumer goods industries, drive this growth. SCARA robots are highly valued for their flexibility, speed, precision, and compact design, making them ideal for manufacturing and assembly processes. The rising demand for automation in developing countries and increasing labor costs are further fueling market expansion. Technological advancements are crucial in market expansion, integrating AI and IoT technologies, creating new opportunities for SCARA robot applications. These innovations and improvements in vision systems and end-of-arm tooling enhance the robots' capabilities and ease of use. The rising labor costs in developing countries also contribute to increased adoption of SCARA robots as a cost-effective solution for repetitive tasks.

The articulated robots segment is estimated to grow significantly over the forecast period. The integration of advanced technologies such as artificial intelligence and machine learning is enhancing the capabilities of articulated robots, allowing for more adaptive and efficient operations. Additionally, the emergence of collaborative robots is expanding the use of articulated systems in industries requiring human-robot interaction. Moreover, the increasing demand for automation, rising labor costs, and the need for improved efficiency in manufacturing processes are key factors fueling this growth. However, the market faces some challenges, including competition from alternative robotic systems like SCARA and Cartesian robots. Despite these challenges, the articulated robot market is poised for continued expansion across various industries, driven by technological advancements and the ongoing trend towards industrial automation.

End-use Insights

The metal and machinery segment accounted for the largest revenue share in 2024, which is attributed to the significant growth in the adoption of Robot Operating System (ROS) applications that are driven by the increasing demand for industrial automation and the need for more flexible, efficient manufacturing processes. ROS provides a robust and adaptable platform for developing sophisticated robotic solutions in this sector, offering seamless integration of advanced sensors, vision systems, and specialized tools crucial for complex manufacturing operations. The modular architecture of ROS allows for scalable and customizable automation solutions, enabling manufacturers to adapt their systems as production needs evolve easily. The open-source nature of ROS fosters a collaborative environment, accelerating innovation and knowledge sharing among developers and researchers in the field.

The automotive segment is predicted to foresee significant growth in the forecast period. This growth is driven by the increasing demand for automation and the need for more precise, efficient manufacturing processes. This growth is fueled by the integration of Industry 4.0 technologies. ROS provides a flexible platform for developing intelligent and adaptive robotic systems that enhance quality control, enable predictive maintenance, and improve overall manufacturing efficiency. The adoption of ROS-based systems helps automotive manufacturers reduce labor costs and address workforce shortages while offering modular and scalable solutions that can be easily customized to meet changing production needs. The rise of collaborative robots (cobots) based on ROS is expanding the use of robotics in areas requiring human-robot interaction.

Application Insights

The mapping and navigation segment dominated the market in 2024. The mapping and navigation capabilities within Robot Operating Systems (ROS) are experiencing significant growth, driven by a confluence of technological advancements and increasing demand across various industries. As autonomous robots become more prevalent in sectors such as manufacturing, logistics, and services, the need for sophisticated mapping and navigation solutions within ROS has intensified. This growth is fueled by continuous improvements in Simultaneous Localization and Mapping (SLAM) algorithms, which enable robots to create more accurate maps and navigate complex environments with greater efficiency. The integration of advanced sensor technologies, such as LiDAR and high-resolution cameras, is further enhancing the perception and mapping abilities of ROS-based robots. The open-source nature of ROS fosters a collaborative ecosystem, accelerating innovations in mapping and navigation packages.

The home automation and security segment is projected to grow significantly over the forecast period. A convergence of technological advancements and increasing consumer demand for smart home solutions drives the growth. As homeowners seek more sophisticated ways to manage their living spaces, ROS-based systems are gaining traction due to their ability to offer advanced control over various household functions, from lighting and climate control to appliance management. The integration of artificial intelligence and machine learning capabilities within ROS is enabling the development of more intelligent and adaptive home automation systems that can learn and anticipate user preferences. In the realm of security, ROS's flexibility allows for the seamless integration of diverse sensors and devices, creating comprehensive and customizable home security solutions.

Regional Insights

North America dominated the robot operating system industry with a revenue share of over 31% in 2024, driven by factors highlighting its increasing importance in the region. The rising demand for automation across various industries in this region, including manufacturing, logistics, and healthcare, is a key driver, as ROS provides a flexible and robust platform for developing and implementing automated systems. The integration of advanced technologies such as artificial intelligence and machine learning with ROS is further enhancing the capabilities of robots, leading to increased adoption. ROS is utilized in various sectors, from agriculture and construction to retail, showcasing its versatility and adaptability.

U.S. Robot Operating System Market Trends

The U.S. robot operating system industry is expected to grow significantly in 2024, driven by factors highlighting its increasing importance in the region. The rising demand for automation across various industries, including manufacturing, logistics, and healthcare, is a key driver, as ROS provides a flexible and robust platform for developing and implementing automated systems. The integration of advanced technologies such as artificial intelligence and machine learning with ROS is further enhancing robots' capabilities, leading to increased adoption.

Europe Robot Operating System Market Trends

The robot operating system market in Europe is expected to grow significantly over the forecast period. Europe's strong focus on research and development, coupled with government initiatives and funding for robotics and AI research, provides a supportive environment for the growth of ROS. Collaboration and partnerships between academia, research institutions, and industry players are also contributing to the advancement of ROS in the region. The growing demand for service robots and autonomous systems in Europe is another factor driving the adoption of ROS, as it enables developing and controlling these sophisticated systems.

Asia Pacific Robot Operating System Market Trends

The robot operating system industry in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region has a thriving startup ecosystem focused on robotics and automation. Many startups are developing ROS-based solutions for various applications, contributing to the growth of the ROS community in the region. Moreover, Companies and research institutions in the Asia Pacific region are collaborating with global players in the robotics industry to develop and deploy ROS-based solutions. This collaboration helps to share knowledge and best practices, further driving the growth of ROS in the region.

Key Companies & Market Share Insights

Some key companies in the robot operating system industry are Universal Robotics, ABB, FANUC, and KUKA AG.

-

Universal Robotics specializes in collaborative robotic automation, offering user-friendly robot operating systems that enable businesses of all sizes to integrate robotic solutions into their production environments. Their platform supports easy programming, flexible deployment, and seamless integration with various end-effectors and accessories through the UR+ ecosystem. By focusing on intuitive software and extensive training resources, Universal Robotics facilitates rapid adoption of robot operating systems, making automation accessible and scalable for industries seeking to enhance productivity and operational flexibility.

-

ABB is a prominent player in robotics and automation, providing advanced robot operating systems that power its extensive portfolio of industrial and collaborative robots. ABB’s ROS solutions enable precise control, navigation, and coordination of robotic systems across automotive, electronics, and manufacturing sectors. The company emphasizes integrating AI and sensor technologies to enhance robot intelligence and adaptability. Its software platforms support complex automation workflows, helping enterprises improve their robotic operations' efficiency, safety, and scalability.

Key Robot Operating System Companies:

The following are the leading companies in the robot operating system market. These companies collectively hold the largest market share and dictate industry trends.

- Universal Robotics

- ABB

- FANUC

- KUKA AG

- Yaskawa Electric Corporation

- Denso

- Microsoft

- Omron Corporation

- iRobot Corporation

- Clearpath Robots

Recent Developments

-

In May 2025, China advanced its pursuit of technological self-reliance by launching Intewell, a developed operating system for robots created by Beijing-based Kyland Technology. Intewell serves as a foundational platform for embodied intelligent robots-autonomous machines capable of physical interaction with their environment. This development marks a significant milestone in China’s robotics software industry, enhancing the country’s capabilities in intelligent automation and supporting broader goals in artificial intelligence and advanced manufacturing.

-

In November 2025, Wandelbots GmbH introduced the world’s first agnostic operating system designed specifically for industrial robotic automation. This innovation establishes a new benchmark in the automation industry by enhancing efficiency, accessibility, and fostering greater innovation. The platform’s agnostic nature enables seamless integration across diverse robotic hardware and software ecosystems, simplifying deployment and accelerating adoption in manufacturing and industrial environments.

-

In October 2024, Flexiv, a robotic and AI solutions provider, launched Flexiv Elements, a new operating system designed for adaptive robots. This platform introduces advanced features that simplify the programming and integration of complex robotic tasks, enabling system integrators to develop customized applications more efficiently. Flexiv Elements aims to enhance operational productivity and flexibility by supporting adaptive robot capabilities, thereby addressing the growing demand for intelligent automation in manufacturing and other dynamic industrial environments.

Robot Operating System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 498.9 million

Revenue forecast in 2033

USD 1,214.9 million

Growth rate

CAGR of 11.8% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, robot type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Universal Robotics, ABB., FANUC, KUKA AG, Yaskawa, Electric Corporation, Denso, Microsoft, Omron Corporation, iRobot Corporation, Clearpath Robots

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Robot Operating System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global robot operating system market report based on robot type, application, end-use, and region.

-

Robot Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Articulated Robots

-

Cartesian Robotics

-

Collaborative Robots

-

SCARA Robots

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Pick and Place

-

Plastic Injection and Blow Molding

-

Testing and Quality Inspection

-

Metal Sampling and Press Trending

-

End of Line Packaging

-

Mapping and Navigation

-

Inventory Management

-

Home Automation and Security

-

Personal Assistance

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Electrical and Electronics

-

Metal and Machinery

-

Plastics

-

Rubber and Chemicals

-

Food and Beverages

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global robot operating system market size was estimated at USD 442.1 million in 2024 and is expected to reach USD 622.0 million in 2025.

b. The global robot operating system market is expected to grow at a compound annual growth rate of 11.8% from 2025 to 2033 to reach USD 1,214.9 million by 2033.

b. North America dominated the robot operating system market with a share of 32.9% in 2024. The rising demand for automation across various industries in this region, including manufacturing, logistics, and healthcare, is a key driver, as ROS provides a flexible and robust platform for developing and implementing automated systems.

b. Some key players operating in the robot operating system market include: Universal Robotics, ABB Ltd., FANUC, KUKA AG, Yaskawa Electric Corporation, Denso, Microsoft, Omron Corporation, iRobot Corporation, Clearpath Robots

b. Key factors that are driving the market growth is attributed to the Robotic systems that are increasingly taking over or enhancing various human roles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.