- Home

- »

- Organic Chemicals

- »

-

Rutile Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Rutile Market Size, Share & Trends Report]()

Rutile Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By Application (Paints & Coatings, Plastics, Paper & Pulp, Inks, Welding Electrodes, Titanium Metals & Alloys), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-829-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rutile Market Summary

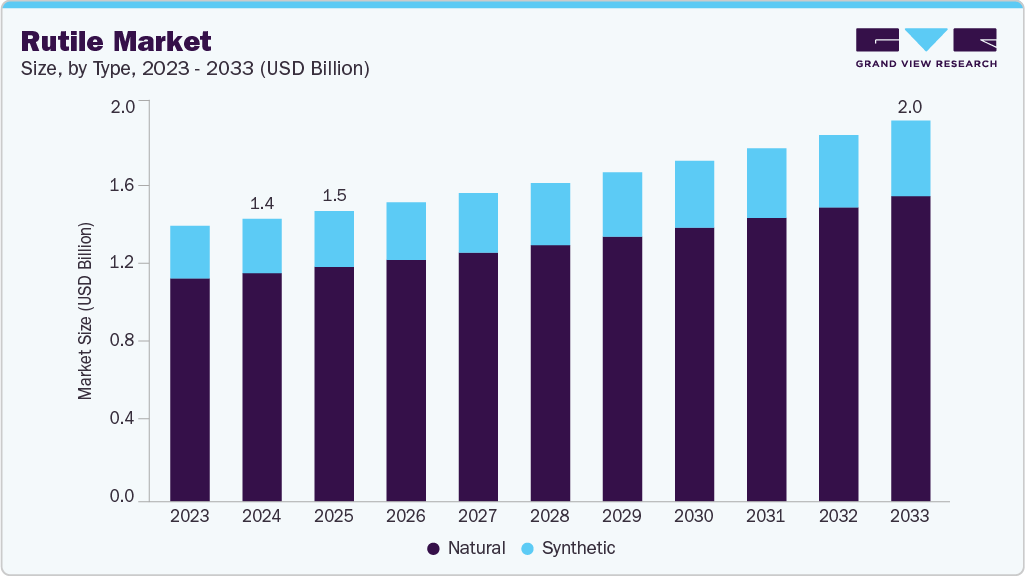

The global rutile market size was estimated at USD 1.49 billion in 2024 and is projected to reach USD 2.01 billion by 2033, growing at a CAGR of 3.4% from 2025 to 2033. The rutile industry is gaining momentum due to the rising production of titanium dioxide pigments, which remain indispensable in coatings, plastics, and paper industries.

Key Market Trends & Insights

- Asia Pacific dominated the rutile market with the largest market revenue share of 53.3% in 2024.

- By type, the natural segment led the market with the largest revenue share of 80.9% in 2024.

- By application, the titanium metals & alloys segment is anticipated to register at the fastest CAGR of 6.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1.49 Billion

- 2033 Projected Market Size: USD 2.01 Billion

- CAGR (2025-2033): 3.4%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Increasing infrastructure development across emerging economies is creating steady demand for high-performance coatings that rely heavily on rutile-based TiO₂ for durability, opacity, and brightness. This trend aligns with rapid urban expansion, which continues to elevate pigment consumption across architectural and industrial applications.Titanium metal, extracted from rutile through advanced processing routes, offers exceptional strength-to-weight advantages and corrosion resistance. As manufacturers seek to enhance fuel efficiency and achieve stringent environmental targets, the adoption of titanium alloys is rising, accelerating the need for high-grade rutile feedstock.

Advances in additive manufacturing and precision engineering are giving the rutile industry further traction. Titanium powders used in 3D printing require consistent, high-purity input materials that many rutile-based processes can deliver. The expansion of metal additive manufacturing for medical implants, automotive components, and aerospace parts is pushing producers to scale up rutile supply chains to meet evolving quality standards.

The shift toward renewable energy technologies present another significant growth avenue. Rutile is increasingly used in photocatalysts, dye-sensitized solar cells, and other energy-conversion materials where its crystalline structure enhances performance. As nations accelerate clean energy deployment to meet climate goals, the requirement for advanced materials with strong optical and electronic characteristics is widening, strengthening rutile consumption in these emerging applications.

Rising mining investments across Australia, South Africa, and African coastal regions are also supporting market growth. Expanded exploration activities, improved beneficiation technologies, and the development of new mineral sands projects are boosting rutile output. This supply-side expansion is helping stabilize availability while enabling downstream industries to plan long-term production strategies, creating a favorable environment for sustained market growth.

Drivers, Opportunities & Restraints

The rutile industry is driven by the expanding consumption of titanium dioxide pigments across coatings, plastics, and paper industries. Strong construction activity across Asia Pacific, the Middle East, and Africa is strengthening the need for high-opacity and weather-resistant coatings, which rely heavily on rutile for superior brightness and performance. Rising demand for titanium metal in aerospace, automotive, and medical applications is adding to this momentum as manufacturers focus on lightweight materials that improve efficiency and durability.

Opportunities are emerging through the growing use of rutile in advanced technologies such as additive manufacturing, photocatalysts, and next-generation solar cells. High-purity grades are gaining prominence as industries seek materials with excellent optical, thermal, and electronic properties. The development of new mineral sands projects in Australia and Africa, along with improvements in beneficiation techniques, is creating room for capacity expansion and supply diversification. Increasing research in nanostructured TiO₂ is also opening potential avenues for high-value applications.

The rutile industry faces restraints due to fluctuations in mineral sands production, resource depletion in mature mines, and inconsistent supply from certain regions. Growing environmental regulations related to mining activities are adding operational challenges for producers, especially in regions with stricter land restoration and water-use rules.

Type Insights

The natural segment led the market with the largest revenue share of 80.9% in 2024, due to rising demand from titanium dioxide producers seeking high-grade feedstock with stable mineralogical properties. Natural rutile offers superior TiO₂ content, which enhances pigment brightness and opacity, making it a preferred raw material for premium coatings and plastics. As construction, automotive, and packaging industries scale up production, manufacturers are increasingly relying on natural rutile to achieve consistent product quality while reducing processing costs associated with upgrading lower-grade alternatives.

The synthetic segment is anticipated to register at the fastest CAGR over the forecast period. Synthetic rutile provides controlled TiO₂ content and reduced impurities, which helps pigment producers optimize production efficiency and achieve consistent optical performance in coatings, plastics, and paper. As downstream manufacturers focus on uniformity in pigment batches for architectural and industrial applications, the reliability of synthetic grades is becoming a key advantage that fuels market adoption.

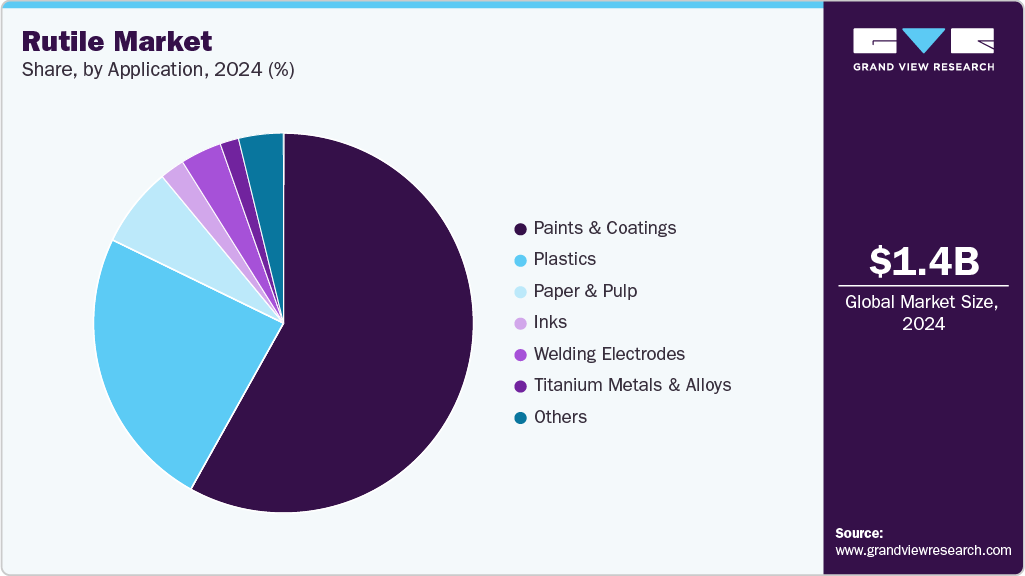

Application Insights

The paints and coatings segment led the market with the largest revenue share of 58.1% in 2024, as manufacturers increasingly prioritize high-performance formulations that deliver strong opacity, UV resistance, and long-term durability. Rutile-based titanium dioxide remains central to achieving these attributes because its crystal structure and high refractive index enhance brightness and coverage. As residential, commercial, and industrial construction accelerates across Asia Pacific, the Middle East, and Africa, demand for architectural coatings with consistent color retention and weather protection continues to rise, supporting steady uptake of rutile in this application.

The titanium metals and alloys segment is anticipated to grow at the fastest CAGR during the forecast period, as industries adopt lightweight and high-strength materials to improve efficiency and withstand demanding operating environments. Rutile serves as a key feedstock for producing high-purity titanium sponge, which is then converted into alloys used in aerospace, automotive, chemical processing, and marine engineering. The shift toward fuel-efficient aircraft and electric vehicles is strengthening the need for titanium components that offer corrosion resistance, heat stability, and long service life, which in turn drives consistent demand for rutile-based inputs.

Regional Insights

The North America rutile market is experiencing growth largely due to strong demand from the titanium dioxide sector, particularly for applications in paints and coatings. For instance, major American companies such as The Sherwin-Williams Company and PPG Industries require a consistent, high-quality supply of TiO₂ to meet demand from the housing and commercial construction markets. Similarly, the automotive industry, with its manufacturing hubs in the U.S. Midwest and South, consumes vast quantities of rutile-derived pigments for both vehicle coatings and plastic components, directly tying rutile consumption to North American industrial production cycles.

U.S. Rutile Market Trends

The rutile market in the U.S. is served by several primary TiO₂ pigment production plants, operated by companies such as The Chemours Company and Tronox Holdings, which rely on rutile as a key feedstock. The country is a global leader in aerospace and defense, with giants such as Boeing, Lockheed Martin, and GE Aerospace, as well as a dynamic private space industry led by SpaceX, all of which are heavily dependent on high-strength, corrosion-resistant titanium metal.

Asia Pacific Rutile Market Trends

Asia Pacific dominated the global rutile market with the largest revenue share of 53.3% in 2024, as rising construction activity in countries such as China and India boosts the consumption of titanium dioxide pigments. Large-scale urban development projects like India’s Smart Cities Mission and China’s ongoing industrial expansion require high-performance coatings for buildings, bridges, and industrial equipment. These coatings rely on rutile-based TiO₂ to achieve brightness, opacity, and long-term weather resistance. The growing plastics and packaging industries in Southeast Asian economies such as Vietnam and Indonesia further support the need for rutile, since manufacturers depend on pigment consistency for producing films, containers, and molded products at scale.

Europe Rutile Market Trends

The rutile market in Europe is anticipated to grow at the fastest CAGR during the forecast period, due to strong demand from the titanium dioxide pigment industry, which is widely used in paints, coatings, plastics, and construction materials. Countries like Germany, France, the UK, and Italy lead this demand, driven by their advanced automotive, aerospace, and industrial manufacturing sectors. High environmental and safety regulations in the European Union, such as REACH, promote the use of high-purity, low-toxicity rutile-based pigments, accelerating the shift toward sustainable and high-performance materials.

Latin America Rutile Market Trends

The rutile market in Latin America is experiencing rapid growth. The massive mining industries in Chile, Peru, and Brazil, focused on copper, iron ore, and lithium, are major consumers of heavy-duty equipment. The maintenance and protection of this machinery in highly corrosive environments requires robust, rutile-rich welding electrodes and anti-corrosion coatings. Furthermore, the agricultural powerhouse of Brazil and Argentina depends on plastics for silage bags, irrigation systems, and packaging, all of which incorporate TiO₂ for durability and UV protection. This creates a unique, resource-based demand stream that is deeply embedded in the core economic activities of Latin America.

Key Rutile Company Insight

Some of the key players operating in the rutile industry include Rio Tinto Group, Sierra Rutile Limited, and others

-

Rio Tinto Group is a diversified mining and metals company with a global footprint and a long history in mineral resource development. It operates large-scale assets across iron ore, aluminum, copper, minerals, and energy transition materials, supported by integrated logistics and advanced processing technologies. The company focuses on improving productivity, lowering emissions across its operations, and expanding the supply of critical minerals required for industrial and manufacturing sectors. Its mineral sands portfolio benefits from established production hubs, strong customer relationships, and long-term supply contracts.

-

Sierra Rutile Limited is a mineral sands producer known for its high-quality natural rutile deposits in Sierra Leone. The company operates one of the oldest and most significant rutile mining regions in the world, supported by a combination of dredge, dry mining, and processing facilities. Ongoing mine life expansion projects, community engagement programs, and continuous improvement in mineral recovery support its operations. The company maintains strong export relationships across Europe, North America, and Asia, positioning it as a key supplier in the titanium value chain.

Key Rutile Companies:

The following are the leading companies in the rutile market. These companies collectively hold the largest market share and dictate industry trends.

- Base Resources Limited

- Cochin Minerals and Rutile Limited

- Iluka Resources Limited

- Kenmare Resources plc

- Kerala Minerals and Metals Ltd

- Rio Tinto Group

- Sierra Rutile Limited

- TiZir Limited

- Tronox Holdings plc

- V V Mineral

Recent Development

-

In October 2025, Lion Rock Minerals Ltd announced a commitment to raise approximately USD 5.6 million through a share placement to enhance exploration efforts at its Minta rutile and monazite project in Cameroon. This deal will give Tronox about 5% ownership in Lion Rock and establish a strategic partnership aimed at accelerating drilling and resource definition at the Minta project, which is one of the most advanced rutile exploration initiatives in Cameroon.

Rutile Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the annual sales value of rutile sold for end-use purposes.

Market size value in 2025

USD 1.53 billion

Revenue forecast in 2033

USD 2.01 billion

Growth rate

CAGR of 3.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, volume in tons, and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Saudi Arabia; UAE

Key companies profiled

Iluka Resources Limited; Tronox Holdings plc; Rio Tinto Group; Kenmare Resources plc; TiZir Limited; Sierra Rutile Limited; Base Resources Limited; Cochin Minerals and Rutile Limited; Kerala Minerals and Metals Ltd; V V Mineral

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rutile Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global rutile market report based on type, application, and region.

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Natural

-

Synthetic

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Paints & Coatings

-

Plastics

-

Paper & Pulp

-

Inks

-

Welding Electrodes

-

Titanium Metals & Alloys

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global rutile market size was estimated at USD 1.49 billion in 2024 and is expected to reach USD 1.53 billion in 2025.

b. The global rutile market is expected to grow at a compound annual growth rate of 3.4% from 2025 to 2033 to reach USD 2.01 billion by 2033.

b. The natural segment dominated the market with a revenue share of 80.9% in 2024.

b. Some of the key players of the global rutile market are Iluka Resources Limited, Tronox Holdings plc, Rio Tinto Group, Kenmare Resources plc, TiZir Limited, Sierra Rutile Limited, Base Resources Limited, Cochin Minerals and Rutile Limited, Kerala Minerals and Metals Ltd, V V Mineral, and others.

b. The key factor driving the growth of the global rutile market is the rising demand for high grade titanium dioxide used across coatings, plastics, and paper applications, which continues to elevate the need for stable, high purity rutile supply worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.