- Home

- »

- Next Generation Technologies

- »

-

Software As A Service (SaaS) Market Size Report, 2030GVR Report cover

![Software As A Service (SaaS) Market Size, Share & Trends Report]()

Software As A Service (SaaS) Market Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise-size, By Application (CRM, ERP, Content), By Industry (BFSI, Retail, Healthcare), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-940-5

- Number of Report Pages: 128

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

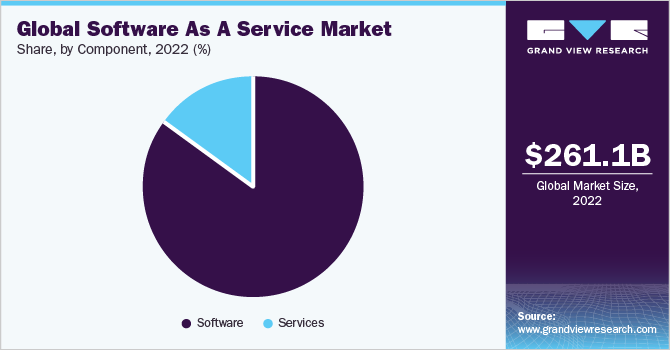

The global software as a service (SaaS) market size was valued at USD 261.15 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.7% from 2023 to 2030. SaaS is a cloud service that provides software applications virtually through Internet. Rising adoption of public cloud services across enterprises is one of the major factors that propel the market growth. The growing shift of enterprises towards SaaS from an on-premises model owing to high cost of on-premises software deployment is further projected to propel the market growth. However, concerns related to data privacy and security related to public cloud is projected to hinder market growth.

Significant increase in the adoption of emails, instant messaging applications, and video calls encourages demand for smart devices among end-users and is projected to contribute to the growth of SaaS market. Furthermore, adoption of CRM SaaS solutions continues to rise as businesses seek to reduce their IT costs and improve scalability. Customization and configuration of CRM SaaS solutions are becoming easier and more accessible, allowing businesses to tailor their CRM systems to their specific needs, such as security. For instance, in December 2022, AppOmni announced a partnership with Veeva Systems to provide enhanced security for Veeva CRM and Veeva Vault. With this new offering, life sciences customers can access AppOmni's comprehensive threat detection and configuration management capabilities. Joint customers can operationalize best practices to protect sensitive data while ensuring regulatory compliance with AppOmni's Veeva integration.

COVID-19 outbreak further positively impacted SaaS market as many of the enterprises opted for cloud software platforms during lockdown. The lockdown imposed by government worldwide has led to substantial growth in adoption of cloud software platform services such as SaaS across various enterprises. Increased use of public cloud services during work from home has reinforced SaaS adoption for virtual management of work in enterprises. Therefore, significant increase in adoption of third-party software services globally during pandemic further augmented market growth.

Market Dynamics

Mobile devices are now capable of running more sophisticated software applications, increasing demand for SaaS solutions that can be accessed from any device with an internet connection. Modern tablets and smartphones are equipped with relatively powerful embedded processors, which allow processing on the device itself. This processing power is used for various applications, from running complex software applications and games to processing high-resolution images and videos and executing artificial intelligence and machine learning algorithms. Since 2020, COVID-19 has sped up the development of distant online labor, creating enormous digital needs across multiple horizontal SaaS sectors, including education, retail e-commerce, online supply chain management, office automation, and electronic contracts. Enterprise users prioritize updating solutions that help them provide better customer service. For instance, ERP providers in e-commerce retail assist businesses in developing member management systems; marketing SaaS providers assist businesses in conducting online marketing and reaching customers remotely through traffic platforms; and catering SaaS vendors assist offline restaurants in developing ordering systems using mini-programs to realize contactless ordering. Among the key attributes of SaaS technology are flexibility, scalability, reliability, and agility. Software as a service (SaaS) helps businesses with their IT infrastructure costs in various ways. It is the main factor driving firms to embrace SaaS apps more frequently. Businesses are investing increasingly in mobile SaaS and app-based solutions as smartphones become an essential part of people's lives, allowing for simple access to information whenever and wherever. Users can synchronize, update, and manage documents using smartphones and app-based SaaS.

Component Insights

Software segment led the market in 2022 and accounted for a total revenue share of more than 84%. The pandemic has accelerated trends in remote work and flexible work arrangements, leading to a shift in employee expectations. As a result, many businesses are adopting SaaS solutions to enable remote collaboration, productivity, and communication. It includes tools for project management, video conferencing, and cloud storage. Additionally, there is a growing demand for SaaS solutions that offer automation and AI-powered insights to optimize workflows and increase efficiency. As digital transformation continues to accelerate across industries, businesses increasingly rely on data to expedite their operations and gain a better understanding of their customers or users. It has led to growing investment in analytics-driven SaaS solutions.

Services systems segment is estimated to grow significantly over the forecast period. SaaS servicing trends include a growing focus on customer experience, security, and compliance. SaaS providers are investing heavily in customer support and self-service options, such as chatbots and online knowledge bases, to provide quick and efficient support to users. Additionally, SaaS providers are increasingly offering more customizable and modular solutions to meet unique needs of different businesses and integrating with other third-party tools and services to provide a seamless experience for users. For instance, in March 2022, Ada released a new generative AI capability that cut the time and labor required to create, train, and maintain customer service chatbots by multifold compared to conventional corporate automation solutions. To significantly strengthen Ada's conversational AI platform, Ada announced it would expand its use of OpenAI's technology.

Deployment Insights

Private cloud segment held the largest revenue share of over 43% in 2022. Combining the deployment of SaaS applications at the network's edge with a private cloud infrastructure can provide organizations with greater control and security over their data while improving performance and reducing latency. Additionally, organizations can maintain greater control over their data by using a private cloud infrastructure, ensuring compliance with regulatory requirements, and mitigating risk of data breaches. Overall, combining edge computing with private cloud can provide a powerful platform for delivering SaaS applications that meet the needs of modern businesses.

Hybrid cloud segment is predicted to foresee significant growth in the forecast period. Increasing demand for industry-specific SaaS applications, such as those tailored to healthcare, finance, and education, is driven by need for specialized features and compliance with specific industry regulations. Organizations in these industries seek SaaS solutions customized to their unique needs and requirements, such as hybrid cloud. For instance, in August 2021, Accenture announced agreements of Information Technology Outsourcing (ITO) with Japanese equipment maker Kubota to speed up the migration of old systems to the Microsoft Azure cloud and with Chubu Electric Power Group to change its operations. Additionally, Infosys agreed to a multi-year contract for cloud modernization via Microsoft Azure with Australia's Ausgrid, an electricity distribution firm.

Enterprise-size Insights

Large enterprises segment led the market in 2022, accounting for over 60% share of the global revenue. SaaS solutions offer large enterprises several benefits, including cost-effectiveness, scalability, and flexibility. A trend seen in large enterprises is adopting multi-cloud and hybrid-cloud strategies, driven by the need to manage complex distributed application environments that span multiple geographies, data centers, and cloud providers. Another trend observed among large enterprises is the adoption of platform-as-a-service (PaaS) solutions. PaaS solutions provide a higher level of abstraction than SaaS solutions, allowing enterprises to focus on application development and deployment rather than managing the underlying infrastructure. It can help large enterprises to accelerate their time-to-market, reduce development costs, and improve agility and innovation.

Small & medium enterprises segment is estimated to grow significantly over the forecast period. On-demand consumption model of SaaS has revolutionized the IT landscape, with small and medium enterprises rapidly adopting SaaS over the past few years. Cost-effectiveness, accessibility, and scalability of SaaS have made it an attractive option for SMEs that have smaller budgets and cannot afford the initial capital outlay and ongoing service and maintenance costs of traditional IT infrastructure. By adopting SaaS, SMEs can access powerful software applications and services that would otherwise have been beyond their reach. It can help them to compete more effectively with larger businesses, increase productivity, and drive growth.

Application Insights

Others segment held the largest revenue share of over 42% in 2022. Others segment include supply chain management, security as a service, AI as a service, IoT as a service, edge computing, unified communications as a service, and operations management. Emergence of new technologies like robotic process automation (RPA), cloud computing, and artificial intelligence (AI) can potentially revolutionize supply chain software market. AI has the potential to transform supply chain management by providing real-time insights into inventory levels, demand forecasting, and delivery schedules. With increasing data availability and advanced analytics tools, AI will become a key enabler for supply chain optimization and agility.

Content, collaboration, and communication segment is predicted to foresee significant growth in the forecast period. Content, collaboration, and communication are critical components of modern business operations, and rise of SaaS has transformed how organizations approach these areas. SaaS collaboration platforms are becoming increasingly popular, offering a central location for employees to share files, communicate with colleagues, and collaborate on projects. Collaboration software is becoming more integrated, with platforms combining multiple tools such as video conferencing, instant messaging, document sharing, and project management. Additionally, Artificial intelligence (AI) is being integrated into collaboration software to help teams work more efficiently. For instance, AI-powered chatbots help employees find information or schedule meetings, while machine learning algorithms can analyze data to provide insights and recommendations.

Industry Insights

Others segment led the market in 2022, accounting for over 38% share of the global revenue. The other segment includes automobile and media & entertainment industries. Further, BFSI segment accounted for over 24% share of the global revenue owing to the significant transformation in the sector, with new technologies and digital platforms disrupting traditional business models. Additionally, cloud-based core banking solutions are becoming increasingly popular as they offer greater flexibility and scalability than traditional on-premises solutions. These tools allow financial institutions to quickly adapt to changing market conditions, scale up or down as needed, and reduce costs. For instance, in June 2022, Aqua Security Software Ltd., a cloud-native security company, announced the general availability of cloud-native security software as a Service (SaaS) from Singapore, supplying the wider Asia Pacific and Japan (APJ) region. With this launch, government, banking, financial services, and other regulated sectors in the region can leverage the service for complete compliance, cloud-native security, and risk management that manages their data authority and management needs.

Education segment is estimated to grow significantly over the forecast period. Learning management systems (LMS) software is becoming increasingly popular in the education sector, enabling teachers to deliver online and hybrid learning experiences. SaaS solution providers like Canva and Blackboard, Inc. provide secure and reliable LMS services, helping to improve educational outcomes and reduce administrative burdens. Student information systems (SIS) software is essential for managing student data, such as grades and attendance records. Education analytics software is becoming increasingly important in the education sector, enabling teachers and administrators to analyze student data and identify trends.

Regional Insights

North America dominated the market in 2022, accounting for over 44% share of the global revenue. The U.S. is positively contributing to the growth of market revenue. Presence of well-established market players is one of the driving factors for market growth. Moreover, developed IT infrastructure increases easy deployment of cloud-based virtual services in the region, further contributing to a significant share in the global software as a service (SaaS) market. Moreover, significant expenditure on cloud infrastructure and availability of many secured internet servers further contributed to the highest market share.

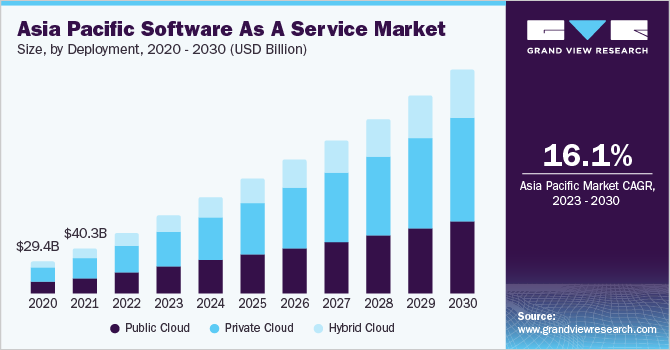

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. China and India are positively contributing to this growth owing to growing demand for outsourcing cloud-based software coupled with rising number of small and medium enterprises outsourcing across the region. SMEs significantly outsource cloud-based software platforms for reducing cost of on-premises software deployment. Moreover, significant growth in the IT industry is further expected to offer ample opportunity to the market.

Key Companies & Market Share Insights

Key market players tend to launch new strategies more frequently in order to stay head-on in the market. Moreover, companies are focusing on increasing investments in the advancement of cloud services to increase customer base in the market. Moreover, major players are targeting new regions and geographies to increase their revenue from the industry, by either entering new market solely or by collaborating with local companies worldwide. Some of the prominent players in the global software as a service (SaaS) market include:

-

Adobe Inc.

-

Microsoft

-

Alibaba Cloud

-

IBM

-

Google LLC

-

Salesforce, Inc.

-

Oracle

-

SAP SE

-

Rackspace Technology, Inc.

-

VMware Inc.

-

IONOS Cloud Inc.

-

Cisco Systems, Inc.

-

Atlassian

-

ServiceNow

Software As A Service (SaaS) Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 333.03 billion

Revenue forecast in 2030

USD 819.23 billion

Growth Rate

CAGR of 13.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment,enterprise-size, application, industry, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; Singapore; South Korea; Malaysia; Australia; Brazil

Key companies profiled

Adobe Inc.; Microsoft; Alibaba Cloud; IBM; Google LLC; Salesforce, Inc.; Oracle; SAP SE; Rackspace Technology, Inc.; VMware Inc.; IONOS Cloud Inc.; Cisco Systems, Inc.; Atlassian; ServiceNow

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Software As A Service (SaaS) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global software as a service (SaaS) market report based on component, deployment, enterprise-size, application, industry, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Enterprise-size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Customer Relationship Management (CRM)

-

Enterprise Resource Planning (ERP)

-

Human Capital Management

-

Content, Collaboration & Communication

-

BI & Analytics

-

Others

-

-

Industry Outlook (Revenue, USD Billion, 2017 - 2030)

-

Banking, Financial Services & Insurance (BFSI)

-

Retail & Consumer Goods

-

Healthcare

-

Education

-

Manufacturing

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

South Korea

-

Malaysia

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global software as a service market size was estimated at USD 261.15 billion in 2022 and is expected to reach USD 333.03 billion in 2023.

b. The global software as a service market is expected to grow at a compound annual growth rate of 13.7% from 2023 to 2030 to reach USD 819.23 billion by 2030.

b. North America dominated the software as a service (SaaS) market with a share of 45.0% in 2022. This is attributable to the developed IT infrastructure which increases the easy deployment of cloud-based virtual services and the significant expenditure on the cloud infrastructure coupled with the availability of high number of secured internet servers.

b. Some key players operating in the SaaS market include Adobe Inc.; Microsoft Corp.; Alibaba Cloud; IBM Corp.; Google LLC; Salesforce; Oracle Corp.; SAP SE; Rackspace Technology, Inc.; and VMware Inc.

b. Key factors that are driving the SaaS market growth include the rising adoption of public cloud services across enterprises and the growing shift of enterprises towards SaaS from an on-premises model owing to the high cost of the on-premises software deployment across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."