- Home

- »

- Clinical Diagnostics

- »

-

Saliva Collection And Diagnostics Market Size Report, 2030GVR Report cover

![Saliva Collection And Diagnostics Market Size, Share & Trends Report]()

Saliva Collection And Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Site Of Collection (Parotid Gland Collection, Submandibular/Sublingual Gland Collection), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-990-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Saliva Collection And Diagnostics Market Summary

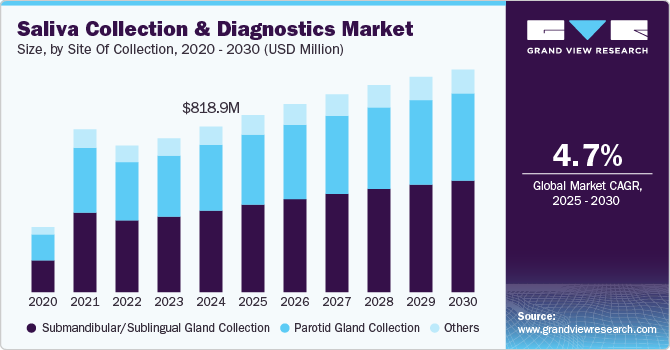

The global saliva collection and diagnostics market size was estimated at USD 819.0 million in 2024 and is projected to reach USD 1,100.2 million by 2030, growing at a CAGR of 4.7% from 2025 to 2030. Primary growth is driven by factors such as the rising demand for quick diagnoses of chronic diseases, advances in infant sample collection technology, and rising public awareness regarding safe and convenient diagnostic options for various conditions.

Key Market Trends & Insights

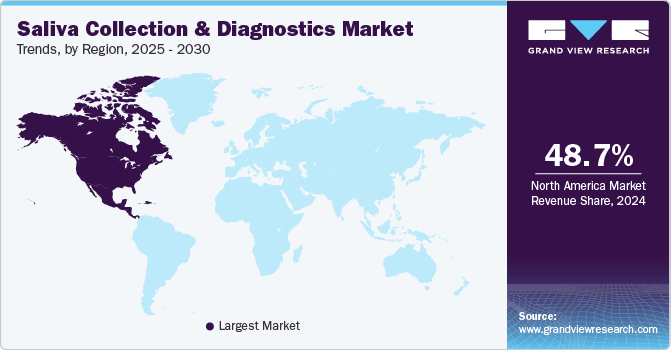

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, submandibular/sublingual gland collection accounted for a revenue of USD 432.3 million in 2024.

- Submandibular/Sublingual Gland Collection is the most lucrative site of collection segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 819.0 Million

- 2030 Projected Market Size: USD 1,100.2 Million

- CAGR (2025-2030): 4.7%

- North America: Largest market in 2024

For instance, in September 2021, Thermo Fisher Scientific, Inc. introduced the SpeciMAX Stabilized Saliva Collection Kit, designed for secure sample collection in research applications. This kit includes a spill-resistant funnel, a standardized tube, and a secure cap to facilitate proper sample handling.

The COVID-19 pandemic has positively influenced the demand for collection, driven by the rise in infectious disease cases, new product developments, and an increasing preference for non-invasive, self-administered tests. Saliva has emerged as a viable alternative sample for COVID-19 diagnosis, largely due to its ease of collection. Patients widely accept saliva testing since it does not require personal protective equipment (PPE) or healthcare personnel, allowing individuals to self-collect samples. The heightened need for COVID-19 diagnostics has opened substantial growth opportunities in this sector. For instance, in February 2022, researchers from the IrsiCaixa AIDS Research Institute and ICFO-The Institute of Photonic Sciences introduced a cost-effective, portable device that uses fluid and light manipulation to detect SARS-CoV-2 in oral samples.

Saliva-based tests offer a precise and painless alternative for assessing female hormone levels, standing out as a reliable diagnostic method. Previously, blood tests were the standard for measuring these levels, but they are costly, invasive, and often challenging to administer. Consequently, there has been a noticeable shift toward more affordable and convenient sample types like salivary collection. Saliva-based diagnostics are now applied to monitor various physiological conditions, including stress, depression, and sleep disorders, and are widely used in fields like occupational health and sports medicine, fueling market growth.

Innovations in non-invasive testing technologies are transforming the landscape, offering more comfortable and user-friendly alternatives to traditional diagnostic methods. New devices and kits are being introduced that enhance the accuracy and reliability of tests, making them more appealing to both healthcare providers and patients. These developments include improved collection techniques that ensure sample integrity and stability, which is essential for accurate results. Furthermore, the emergence of multiplex testing capabilities allows for the simultaneous detection of multiple conditions from a single sample, streamlining the diagnostic process and increasing efficiency.

With the development of more assays, oral collection is positioned to become a leading alternative for detecting and diagnosing a range of conditions, from cancers to monitoring disease recurrence, treatment effectiveness, and patient risk. For example, in November 2021, Salignostics introduced SaliStick, a pregnancy test that provides results using only an oral sample.

Site of Collection Insights

Based on site of collection, the submandibular/sublingual gland collection segment led the market with the largest revenue share of 49.2% in 2024. Around 70% of unstimulated saliva is generated by the submandibular gland, which is also the most affected by sialoliths, or salivary stonesa prevalent condition in middle-aged adults. Approximately 80% of these stones form in the submandibular gland, with 6-15% occurring in the parotid gland and 2% in the minor or sublingual glands. As cases of sialolithiasis continue to rise, this trend is likely to drive growth in this segment over the coming years.

The parotid gland collection segment is expected to grow at a significant CAGR during the forecast period. Salivary gland cancer, a rare malignancy originating in salivary gland tissues, often presents with symptoms like difficulty swallowing or a noticeable lump. Most salivary gland tumors are benign, typically affecting the parotid glands. Diagnosis of this condition relies on imaging tests and biopsies, including CT scans, MRIs, and positron emission tomography (PET) scans. The rising incidence of parotid gland cancer has bolstered the growth of oral sample collection and diagnostics in this segment.

Application Insights

Based on application, the disease diagnostics segment led the market with the largest revenue share of 90.6% in 2024. Saliva-based testing has proven to be a non-invasive, cost-effective, and highly reliable alternative to traditional blood sampling. This method of testing is particularly advantageous for diagnosing a range of diseases, including infectious diseases, hormonal imbalances, and cancers, as it eliminates the need for needles, reducing patient discomfort and increasing compliance. The COVID-19 pandemic accelerated the adoption of oral sampling, as it offered a safe, efficient sample collection option that minimized healthcare personnel exposure and reduced the demand for personal protective equipment. In addition, the ease of self-collection and transportability of oral samples made it ideal for widespread testing and home-based diagnostics, significantly expanding its application in disease monitoring and early detection.

Innovations in saliva diagnostic technology have further advanced the disease diagnostics segment growth. New saliva-based assays can now detect biomarkers associated with specific diseases, including cardiovascular disease and certain cancers, supporting early diagnosis and personalized treatment. As demand for rapid, accessible, and reliable diagnostics grows globally, the disease diagnostics segment is well-positioned to maintain its dominance in the market, driven by its broad diagnostic scope and patient-friendly approach.

The forensic segment is likely to grow at the fastest CAGR of 3.8% over the forecast period. Demand for saliva collection in forensic applications is rising due to advancements in DNA analysis and the non-invasive nature of saliva sampling. Saliva contains DNA, proteins, and other biomarkers that can provide critical information in forensic investigations, including individual identification, toxicology testing, and criminal profiling. Unlike blood or tissue samples, saliva can be easily collected from various surfaces, making it a practical choice for crime scenes. The increased demand for rapid, accurate, and less intrusive methods in forensic science has bolstered the use of saliva-based diagnostics, helping to streamline evidence collection and analysis in legal and investigative settings.

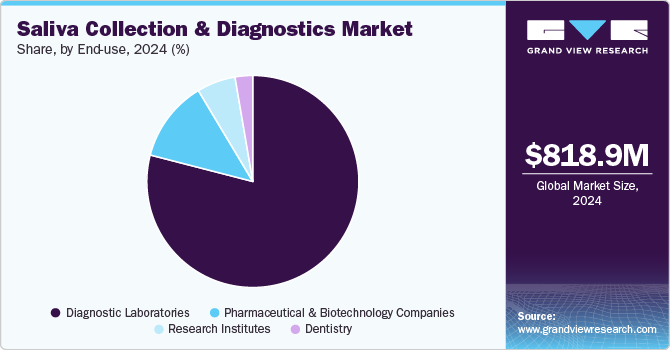

End-use Insights

Based on end use, the diagnostic laboratories segment led the market with the largest revenue share of 79.1% in 2024. The expansion of diagnostic laboratories and networks worldwide to address the increasing demand from customers has significantly boosted segment growth. For instance, in October 2024, Saudi German Hospital announced launch of new on-site diagnostic laboratory in partnership with Pharmatrade LLC and Roche Diagnostics. The opening of new facility is likely to increase the testing landscape within UAE fueling the regional growth.

The pharmaceutical and biotechnology companies segment is expected to experience at a steady CAGR during the forecast period, due to numerous product launches and strategic partnerships by major industry players. Collaboration between research institutions and commercial enterprises is also fostering innovation, leading to the rapid introduction of novel testing solutions tailored to specific health conditions. Regulatory support for the rapid approval of new diagnostic products is encouraging companies to invest in research and development, resulting in a more diverse range of available tests. As these innovative products enter the market, they not only meet the growing demand for accessible diagnostic options but also enhance public health outcomes by facilitating early detection and effective disease management. Overall, ongoing product development is vital for the expansion and evolution of this dynamic market. For instance, in September 2021, EQL Pharma launched a saliva-based COVID-19 antigen self-test, notable for being the first CE-marked test available directly to consumers instead of healthcare providers. In addition, in July 2021, Nusantics Group and Bio Farma launched the Bio Saliva test, which utilizes a gargling method to detect the coronavirus in both symptomatic and asymptomatic individuals. Such product launches are expected to drive the segment growth in coming years.

Regional Insights

North America saliva collection and diagnostics market held the largest revenue share of 48.71% in 2024, driven by a growing preference for salivary fluid-based tests, an increase in infectious disease cases, and the introduction of innovative products by regional companies. According to the International Agency for Research on Cancer, in 2022, there were more than 30,000 new cases of oral cancer which are likely to grow up to 35,000 by 2030. Such lucrative growth, in a number of cases, demands regular saliva testing.

U.S. Saliva Collection And Diagnostics Market Trends

The saliva collection and diagnostics market in U.S. is projected to grow on account of the increasing demand for non-invasive testing methods, which saliva sampling provides. This preference is driven by patient comfort and convenience, making it an attractive alternative to traditional blood tests. In addition, the presence of a robust healthcare infrastructure, including numerous diagnostic labs and research institutions, is supporting innovation and product development in the market. Strategic partnerships and collaborations among key market players are also enhancing the availability of novel salivary fluid testing products.

Europe Saliva Collection And Diagnostics Market Trends

The saliva collection and diagnostics market in Europe is expected to show at a lucrative CAGR during the forecast period, owing to the regional expansion of local players. For instanc , in June 2024, Aware announced the opening of a new diagnostic laboratory in Amsterdam. With such emerging players in the region, the Europe market is likely to flourish in the coming years.

The UK saliva collection and diagnostics market is projected to grow at a significant CAGR during the forecast period, driven by rising demand for non-invasive testing methods that offer patient comfort and convenience. As healthcare providers increasingly adopt saliva-based tests for various applications, including infectious disease detection and hormonal assessments, the market is likely to benefit from advancements in technology. In addition, the UK’s strong emphasis on public health and early disease detection has accelerated the development and approval of innovative saliva testing solutions. The COVID-19 pandemic further fueled the effectiveness of saliva tests for rapid screening, boosting their acceptance among healthcare professionals and patients alike.

The saliva collection and diagnostics market in France is expected to experience at a noticeable CAGR over the forecast period, driven by stringent regulatory landscape ensuring high quality products and services available within the country.

The Germany saliva collection and diagnostics market is projected to expand at the fastest CAGR during the forecast period, owing to the increasing prevalence of chronic and infectious diseases. As rates of chronic conditions, infectious diseases, and cancers continue to rise, there is a heightened demand for effective and accessible diagnostic tools. Saliva-based tests offer a non-invasive and patient-friendly alternative to traditional blood tests, making them appealing for both healthcare providers and patients.

Asia Pacific Saliva Collection And Diagnostics Market Trends

The saliva collection and diagnostics market in Asia Pacific is expected to grow at a significant CAGR over the forecast period. The regional demand is driven by the increasing prevalence of infectious diseases where saliva testing is effectively utilized. According to the World Health Organization, respiratory infections, including COVID-19, are among the leading causes of morbidity and mortality in the region, with millions of new cases reported annually. For instance, in 2022, India alone reported over 18 million confirmed cases of COVID-19, highlighting the urgent need for efficient testing methods. Saliva testing has gained prominence due to its non-invasive nature and ease of collection, making it particularly beneficial in densely populated areas.

The China saliva collection and diagnostics market is projected to expand at the fastest CAGR throughout the forecast period, driven by well established regulations. The National Medical Products Administration (NMPA) has established clear guidelines for the development and approval of diagnostic tests, including saliva-based assays. This regulatory oversight has helped build confidence among healthcare providers and patients regarding the reliability of these tests.

The saliva collection and diagnostics market in Japan is anticipated to grow at a significant CAGR during the forecast period, primarily due continuous R&D programs running within the country. Japan's strong emphasis on research and development, supported by collaborations between academic institutions and biotech firms, is driving advancements in saliva diagnostics technology.

Latin America Saliva Collection And Diagnostics Market Trends

The saliva collection and diagnostics market in Latin America is expected to experience at a significant CAGR throughout the forecast period. The region has been dealing with high rates of dengue fever, Zika virus, and others, highlighting the need for efficient and accessible diagnostic solutions. Saliva testing offers a practical alternative to traditional blood tests, especially in rural and underserved areas where healthcare access may be limited. In addition, advancements in technology are improving the accuracy and reliability of saliva-based diagnostics, further enhancing their appeal.

The Brazil saliva collection and diagnostics market is projected to expand at the fastest CAGR during the forecast period. Improving healthcare infrastructure is playing a vital role in the growth of the saliva collection procedures by enhancing access to diagnostic services and the overall efficiency of healthcare delivery. As the government invests in upgrading healthcare facilities, expanding laboratory networks, and increasing the availability of diagnostic technologies, more patients, especially in rural and underserved areas, can access non-invasive testing methods like saliva diagnostics

Middle East & Africa Saliva Collection And Diagnostics Market Trends

The saliva collection and diagnostics market in Middle East & Africa is expected to show at a promising CAGR over the forecast period. The region faces a high burden of diseases such as HIV, tuberculosis, and hepatitis, necessitating efficient diagnostic solutions that can be easily accessed by patients. Saliva-based tests offer easy testing solutions in this case, as are an alternative to traditional blood sampling, which can be challenging in areas with limited healthcare infrastructure.

The Saudi Arabia saliva collection and diagnostics market is anticipated to show at a significant CAGR during the forecast period, driven by increasing awareness of non-invasive testing methods and a rising prevalence of infectious diseases. As Saudi Arabia enhances its healthcare infrastructure through substantial investments and reforms, there is a greater emphasis on innovative diagnostic solutions, including saliva-based tests.

Key Saliva Collection And Diagnostics Company Insights

The competitive scenario in the market is high, with key players offering diverse testing solutions for testing purposes. Major companies include Thermo Fisher Scientific, Inc., Neogen Corporation, Abbott, Sarstedt AG & Co.KG, Autogen, Inc., Oasis Diagnostics, Porex, Salimetrics, LLC, Takara Bio, Inc., Arcis Bio, Orasure Technologies, and more. Key market participants are actively engaged in research and development to enhance the accuracy, reliability, and convenience of saliva-based testing solutions. Collaborations and partnerships are common as companies seek to leverage each other’s expertise and technologies to accelerate product development and market entry. In addition, the growing focus on non-invasive testing methods has led to increased competition, with firms expanding their portfolios to include a wider range of diagnostic applications, such as infectious disease detection, hormonal assessments, and genetic testing.

Key Saliva Collection And Diagnostics Companies:

The following are the leading companies in the saliva collection & diagnostics market. These companies collectively hold the largest market share and dictate industry trends..

- Thermo Fisher Scientific, Inc.

- Neogen Corporation

- Abbott

- Sarstedt AG & Co.KG

- Autogen, Inc.

- Oasis Diagnostics

- Porex

- Salimetrics, LLC

- Takara Bio, Inc.

- Arcis Bio

- Orasure Technologies

Recent Developments

-

In January 2024, Isohelix announced the launch of the SaliFix Saliva Swab DNA Collection Kit, which can be used at home, in the clinic, or at any remote location.

-

In August 2024, Mark Microbiotech announced the launch of a saliva-based organ age test. This epigenetics-based test marks the expansion of the company’s business into a saliva-based genetic tests business.

-

In October 2023, Salignostics, a startup based in Israel, developed a saliva based pregnancy test for which it was selected for best innovation nomination by the TIME magazine in 2023.

Saliva Collection And Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 875.5 million

Revenue forecast in 2030

USD 1,100.2 million

Growth rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data 2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Site of collection, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa.

Key companies profiled

Thermo Fisher Scientific Inc.; Neogen Corporation; Abbott; Sarstedt AG & Co.KG; Autogen, Inc.; Oasis Diagnostics; Porex; Salimetrics, LLC; Takara Bio Inc.; Arcis Bio; Orasure Technologies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Saliva Collection And Diagnostics Market Report Segmentation

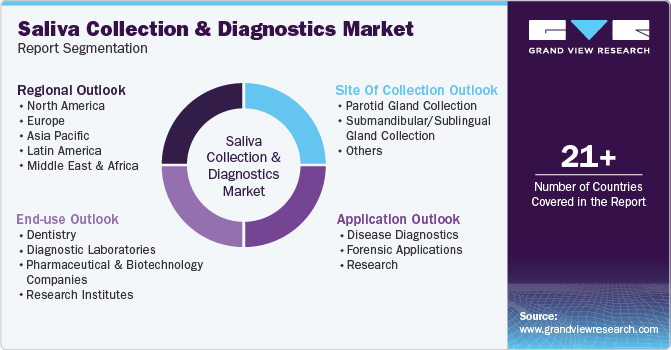

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global saliva collection and diagnostics market report based on the site of collection, application, end-use, and region:

-

Site of Collection Outlook (Revenue, USD Million, 2018 - 2030)

-

Parotid Gland Collection

-

Submandibular/Sublingual Gland Collection

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Disease Diagnostics

-

Forensic Applications

-

Research

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dentistry

-

Diagnostic Laboratories

-

Pharmaceutical & Biotechnology Companies

-

Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global saliva collection and diagnostics market size was estimated at USD 818.9 million in 2024 and is expected to reach USD 875.5 million in 2025.

b. The global saliva collection and diagnostics market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2030 to reach USD 1,100.2 million by 2030.

b. North America dominated the saliva collection and diagnostics market with a share of 48.71% in 2024. This is attributable to the increasing preference for saliva tests, the rising cases of infectious diseases, and the launch of novel products by the market players operating in the region.

b. Some key players operating in the saliva collection and diagnostics market include Thermo Fisher Scientific Inc., Neogen Corporation, Abbott, Sarstedt AG & Co.KG, Autogen, Inc., Oasis Diagnostics, Porex, Salimetrics, LLC, Takara Bio, Inc., Arcis Bio, Orasure Technologies.

b. Key factors that are driving the saliva collection and diagnostics market growth include the increasing need for rapid diagnosis of chronic diseases, technological advancements in infant saliva collection, and rising awareness among the population regarding the easy and safe diagnosis of several diseases, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.