- Home

- »

- IT Services & Applications

- »

-

Saudi Arabia Workplace Safety Market, Industry Report, 2030GVR Report cover

![Saudi Arabia Workplace Safety Market Size, Share & Trends Report]()

Saudi Arabia Workplace Safety Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (PPE, Workplace Safety Services, Safety Equipment & Systems), By Technology, By Deployment Mode, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-562-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

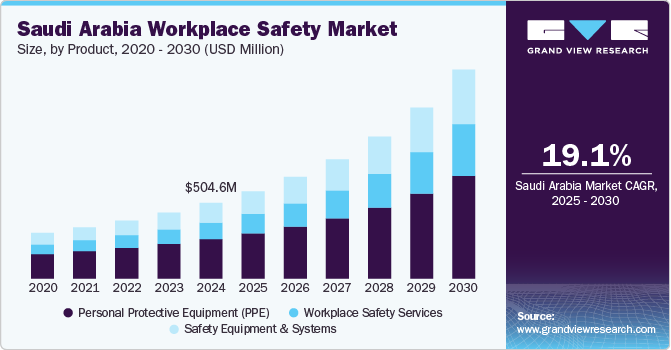

The Saudi Arabia workplace safety market size was estimated at USD 504.6 million in 2024 and is anticipated to grow at a CAGR of 19.1% from 2025 to 2030. As businesses become more aware of the importance of ensuring a safe working environment, the demand for safety solutions, including personal protective equipment (PPE), safety management systems, and employee training, has increased. The rise in workplace injuries and fatalities across industries has intensified the focus on workplace safety, prompting companies to implement more comprehensive safety measures and protocols.

The market growth is strongly driven by the country's economic transformation under Vision 2030, which emphasizes industrial diversification, infrastructure development, and an improved quality of life. This long-term initiative has led to significant investments in sectors such as construction, oil and gas, manufacturing, and logistics, requiring comprehensive safety systems to mitigate occupational hazards. The expansion of mega-projects like NEOM, the Red Sea Project, and Qiddiya has amplified the need for advanced safety equipment, training programs, and digital safety platforms to protect workers in high-risk environments.

The rising awareness among employers of the economic and reputational risks associated with workplace accidents is a key factor driving market growth. Companies increasingly recognize that safety incidents can lead to costly disruptions, legal liabilities, and damage to their brand image. This shift in perception has fueled demand for proactive safety management strategies rather than reactive responses. A significant enabler of this trend is the growing adoption of digital technologies. IoT-based sensors, for instance, allow real-time monitoring of hazardous conditions, while AI-powered analytics can predict potential risks by analyzing historical and environmental data.

Real-time incident reporting systems further enhance responsiveness and transparency, enabling quicker corrective actions and compliance tracking. These digital tools help reduce injuries and fatalities and improve operational efficiency and productivity by minimizing downtime, streamlining audits, and ensuring continuous improvement in workplace safety practices across high-risk sectors like construction, oil & gas, and manufacturing.

Stricter regulations from government entities like the Ministry of Human Resources and Social Development and Saudi Aramco’s stringent contractor safety requirements are compelling organizations to enhance their focus on occupational health and safety (OHS) compliance. These rules mandate rigorous safety practices, regular inspections, and adherence to international standards. As a result, companies across sectors invest in safety training, protective equipment, and digital monitoring tools to reduce risks, avoid penalties, and meet the high benchmarks of regulatory authorities and industry leaders. In February 2025, Red Sea Global (RSG), a company owned by Saudi Arabia's Public Investment Fund (PIF), inaugurated its first Health & Safety Training Academy at the AMAALA luxury wellness destination. This initiative follows a successful pilot phase that trained over 1,000 workers. The academy offers free training to RSG's workforce, partners, and contractors, focusing on essential construction skills and safety practices.

Product Insights

The personal protective equipment (PPE) segment dominated the market and accounted for a revenue share of over 51.0% in 2024. The construction boom in Saudi Arabia, driven by Vision 2030 giga-projects like NEOM, Red Sea Project, and Qiddiya, is fueling demand for helmets, gloves, harnesses, and high-visibility clothing to protect workers from falls, debris, and accidents. Meanwhile, the oil & gas sector, a cornerstone of the economy, enforces strict PPE rules, requiring flame-resistant (FR) suits, respirators, and protective eyewear to shield workers from fires, toxic gases, and chemical exposures. Both industries prioritize safety compliance, with Aramco and government regulations mandating high-quality PPE. As these sectors expand, the need for advanced, durable, and compliant protective gear grows, making PPE a critical component of workplace safety in Saudi Arabia.

The workplace safety services segment is anticipated to grow at a significant CAGR during the forecast period. Saudi corporations increasingly prioritize occupational safety, investing in comprehensive training programs, behavior-based safety initiatives, and thorough incident investigations to foster a proactive safety culture. Simultaneously, rising insurance costs and legal liabilities push companies to outsource safety services, ensuring compliance and minimizing workplace risks. This dual trend accelerates demand for professional safety consulting, risk assessments, and compliance solutions, making workplace safety services a critical growth segment in Saudi Arabia's evolving industrial landscape.

Technology Insights

The IoT-enabled segment accounted for the largest market share in 2024. Saudi Arabia’s government mandates accelerate IoT adoption in workplace safety, requiring smart safety solutions in construction and industrial zones under Vision 2030 and Saudi OSH regulations. This includes wearable IoT devices like smart helmets and vests that monitor worker vitals, fatigue, and environmental hazards, ensuring real-time alerts for accidents or health risks. In high-risk sectors like oil & gas and mining, IoT-enabled gas/chemical sensors detect instant leaks, preventing explosions and toxic exposures. These technologies enhance compliance, reduce accidents, and improve emergency response times. With 5G and AI integration, IoT safety systems are becoming indispensable for predictive risk management, driving rapid market growth as industries prioritize data-driven, proactive safety measures.

The virtual reality (VR) segment is expected to grow significantly during the forecast period. VR in safety training effectively simulates real-world scenarios, enabling employees to practice handling workplace hazards in a safe, controlled setting. This immersive experience increases engagement, making learning more interactive and memorable. As employees actively participate in simulations, they retain safety protocols better, leading to improved understanding and quicker response times in actual situations. Ultimately, VR helps reduce workplace accidents and enhances overall safety performance.

Deployment Mode Insights

The cloud segment accounted for the largest market share of over 54% in 2024. The demand for real-time data & analytics is accelerating cloud adoption in the market. Cloud platforms enable remote monitoring of critical safety metrics- incident reports, PPE compliance, and hazard alerts—across multiple sites, ensuring proactive risk management. In addition, cloud solutions offer scalability and cost efficiency, eliminating the need for expensive on-premise IT infrastructure. With pay-as-you-go models, businesses of all sizes can access advanced safety analytics, reducing operational costs while maintaining compliance. This shift toward data-driven, cloud-based safety systems aligns with Saudi Arabia’s Vision 2030 goals, driving efficiency and transparency in workplace safety management.

The on-premises segment is expected to grow at a significant CAGR during the forecast period. High-risk industries like oil refineries, petrochemical plants, and mining sites in Saudi Arabia rely on on-premises safety systems for uninterrupted offline functionality in remote areas with unreliable internet. Critical infrastructure projects like NEOM or Aramco facilities prioritize on-site servers to ensure real-time emergency response without cloud latency risks. This local control guarantees instant safety alerts, equipment shutdowns, and hazard mitigation, making on-prem solutions indispensable for mission-critical operations where delays could lead to catastrophic failures.

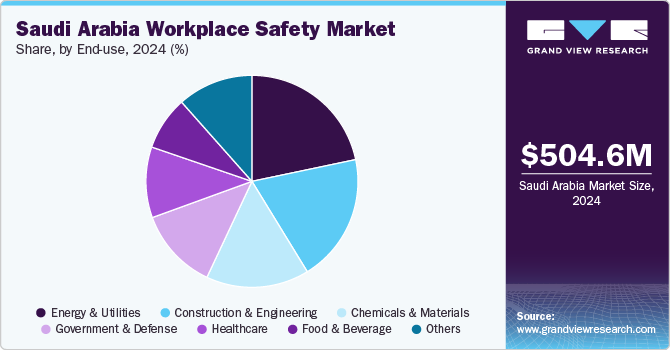

End Use Insights

The energy and utilities segment accounted for the largest market share in 2024. Saudi Arabia's energy sector faces stringent workplace safety regulations, with Saudi Aramco's Safety Management System (SMS) enforcing rigorous standards for contractors, mandating PPE compliance, gas detection systems, and emergency protocols. Saudi OSH laws and ECRA (Energy Compliance Regulations) also require real-time safety monitoring in utilities like power plants and desalination facilities. These regulations drive the adoption of IoT sensors, automated alerts, and digital compliance tracking to prevent accidents and ensure worker safety. As Aramco and the government prioritize zero-incident operations, compliance with these mandates becomes critical, fueling growth in advanced safety solutions across the energy sector.

The healthcare segment is expected to grow at a significant CAGR during the forecast period. Saudi Arabia's healthcare sector is witnessing a surge in demand for PPE (masks, gloves, gowns) and disinfection systems due to stricter infection control mandates post-pandemic. Moreover, Vision 2030's healthcare expansion, including new medical cities like King Salman Medical City and privatized hospitals, drives heightened safety compliance needs. These factors are accelerating investments in advanced sterilization tech, smart monitoring systems, and staff safety training, ensuring adherence to MOH and CBAHI standards while preparing for future health crises.

Key Saudi Arabia Workplace Safety Company Insights

The key market players in the Saudi Arabia market include 3M, ABB, ANSELL LTD, Drägerwerk AG & Co. KGaA, Ecolab, Hexagon AB, Honeywell International Inc., MSA, VIKING, Wolters Kluwer N.V., SGS Société Générale de Surveillance SA., RAKME SAFETY, REDA Hazard Control Ltd, International Safety Consultants, and UL Solutions. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Saudi Arabia Workplace Safety Companies:

- 3M

- ABB

- ANSELL LTD

- Drägerwerk AG & Co. KGaA

- Ecolab

- Hexagon AB

- Honeywell International Inc.

- MSA

- VIKING

- Wolters Kluwer N.V.

- SGS Société Générale de Surveillance SA.

- RAKME SAFETY

- REDA Hazard Control Ltd

- International Safety Consultants

- UL Solutions

Recent Developments

-

In January 2025, Saudi Arabia became the first Arab nation to introduce a National Policy on Forced Labour and Worker Rights. This initiative, led by the Ministry of Human Resources and Social Development, aims to enhance workplace safety and ensure fairer working conditions, aligning with international human rights standards. The policy addresses the country's significant modern slavery issue, with an estimated 740,000 individuals affected, according to the Global Slavery Index.

-

In March 2025, UL Solutions and Aramco signed a memorandum of understanding (MoU) to collaborate on enhancing safety in Saudi Arabia. The partnership focuses on advancing fire and life safety, conducting field engineering evaluations, and providing training on UL Standards. This initiative supports Aramco's In-Kingdom Total Value Add (IKTVA) program. It aligns with Saudi Arabia's Vision 2030 goals, aiming to develop the local energy sector, create jobs, and improve public safety.

-

In April 2024, Hexagon AB announced the acquisition of Xwatch Safety Solutions, a UK-based company specializing in construction machinery equipment. This strategic move aims to bolster Hexagon AB's construction safety portfolio by integrating Xwatch's advanced machine control hardware and software technologies. These solutions are designed to improve safety protocols on construction sites, reinforcing Hexagon's commitment to enhancing workplace safety through innovative technology.

Saudi Arabia Workplace Safety Market Report Scope

Report Attribute

Details

Market size in 2025

USD 581.9 million

Market Size forecast in 2030

USD 1.40 billion

Growth rate

CAGR of 19.1% from 2025 to 2030

Actual data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Market size in USD million/billion and CAGR from 2025 to 2030

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, technology, deployment mode, end use

Country scope

Saudi Arabia

Key companies profiled

3M; ABB; ANSELL LTD; Drägerwerk AG & Co. KGaA; Ecolab; Hexagon AB; Honeywell International Inc.; MSA; VIKING; Wolters Kluwer N.V.; SGS Société Générale de Surveillance SA.; RAKME SAFETY; REDA Hazard Control Ltd; International Safety Consultants; UL Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Saudi Arabia Workplace Safety Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the workplace safety market report based on product, technology, deployment mode, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Protective Equipment (PPE)

-

Head Protection

-

Eye & Face Protection

-

Hearing Protection

-

Respiratory Protection

-

Protective Clothing

-

Fall Protection

-

-

Workplace Safety Services

-

Safety Audits & Inspections

-

Safety Training & Consultation

-

Emergency Response Services

-

-

Safety Equipment & Systems

-

Fire Safety Systems

-

Safety Signs & Labels

-

Surveillance & Monitoring Systems

-

Environmental Health & Safety (EHS) Software

-

Industrial Safety Equipment

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

IoT-enabled

-

Wearable

-

Automation & Robotics

-

Artificial Intelligence (AI)

-

Big Data & Predictive Analytics

-

Virtual Reality (VR)

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premises

-

Cloud

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy and Utilities

-

Construction and Engineering

-

Chemicals and Materials

-

Government and Defense

-

Healthcare

-

Food and Beverage

-

Others

-

Frequently Asked Questions About This Report

b. Saudi Arabia workplace safety market size was valued at USD 504.6 million in 2024 and is expected to reach USD 581.9 million in 2025

b. Saudi Arabia workplace safety market is expected to witness a compound annual growth rate of 19.1% from 2025 to 2030 to reach USD 1.40 billion by 2030.

b. The cloud segment accounted for the largest market share of over 54% in 2024. The demand for real-time data & analytics is accelerating cloud adoption in Saudi Arabia's workplace safety market. Cloud platforms enable remote monitoring of critical safety metrics like incident reports, PPE compliance, and hazard alerts—across multiple sites, ensuring proactive risk management.

b. Some of the key companies operating in the Saudi Arabia workplace safety market include 3M, ABB, ANSELL LTD, Drägerwerk AG & Co. KGaA, Ecolab, Hexagon AB, Honeywell International Inc., MSA, VIKING, Wolters Kluwer N.V., SGS Société Générale de Surveillance SA., RAKME SAFETY, REDA Hazard Control Ltd, International Safety Consultants, and UL Solutions.

b. The growth of the workplace safety market in Saudi Arabia is driven by the country's economic transformation under Vision 2030, which emphasizes industrial diversification, infrastructure development, and an improved quality of life. This long-term initiative has led to significant investments in sectors such as construction, oil and gas, manufacturing, and logistics, all of which require comprehensive safety systems to mitigate occupational hazards.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.