- Home

- »

- Biotechnology

- »

-

Scaffold Technology Market Size And Share Report, 2030GVR Report cover

![Scaffold Technology Market Size, Share & Trends Report]()

Scaffold Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Hydrogels, Polymeric Scaffolds), By Disease Type (Cancer, Neurology), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-913-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2026 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Scaffold Technology Market Summary

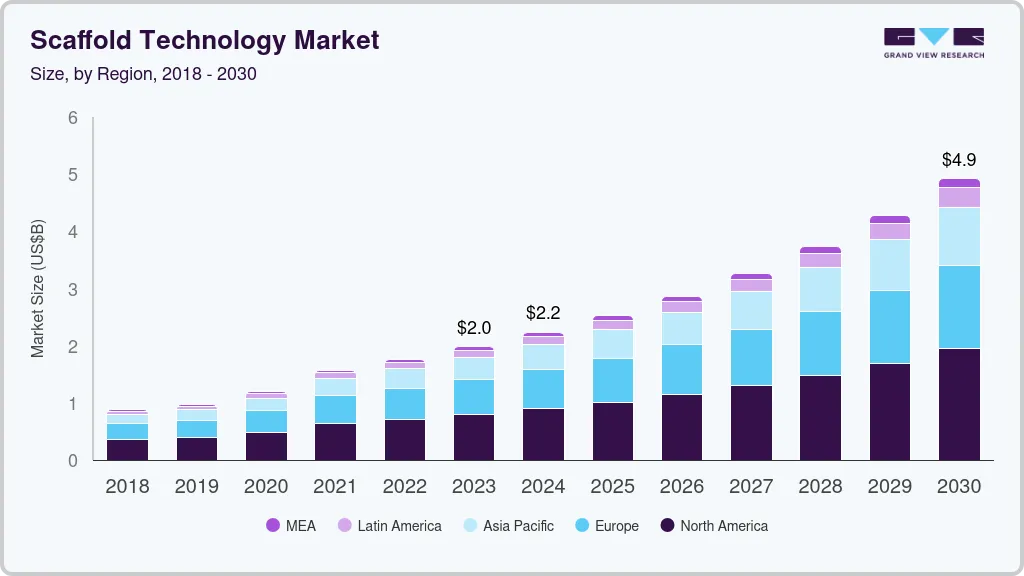

The global scaffold technology market size was valued at USD 1.98 billion in 2023 and is expected to reach USD 4.91 billion by 2030, growing at a CAGR of 13.9% from 2024 to 2030. The market growth is driven by the rising demand for 3D cellular models for applications in biological studies and translational research.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 40.44% in 2022.

- By type, hydrogels segment emerged as the most dominant segment and accounted for the largest revenue share of 41.69% in 2022.

- By disease type, the orthopedics, musculoskeletal, and spine segment held the largest share of 52.98% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 1.98 Billion

- 2030 Projected Market Size: USD 4.91 Billion

- CAGR (2024-2030): 13.9%

- North America: Largest market in 2022

The rapid shift in the cell culture paradigm to overcome the challenges associated with the drug development process is expected to propel the growth of the market for scaffold technology. Moreover, the COVID-19 pandemic became a positive catalyst for scaffold technology. Tissue engineering is extensively used for understanding virology and epidemiology, developing in vitro model systems, and finding efficient therapeutic solutions for dealing with infections.

For instance, a study published in the Advanced Healthcare Materials Journal in October 2021 demonstrated the development of a COVID-19 vaccine candidate that employs biomaterial scaffolds as recruitment sites for immune cells to develop adaptive immunity.

Furthermore, applications of scaffold technologies in 3D cell cultures are growing as they are efficient in mimicking the in vivo physiological state for efficient representation of disease-causing microenvironmental factors. Thus, 3D cell culture techniques have emerged as novel tools for early drug discovery as well as potential therapeutic solutions for the treatment of various diseases. Several companies are focusing on enhancing their product portfolios and on the development of new products to offer a broad range of solutions within the scaffold technologies space.

For instance, in August 2022, Conmed announced the acquisition of Biorez, a company offering bio-inductive scaffolds, to expand its sports medicine soft tissue-healing portfolio. Furthermore, in June 2023, RevBio, Inc. secured a USD 2 million grant from the National Institutes of Health (NIH) for the development of its new dental adhesive bone scaffold product.

In addition, the significant advancements in regenerative medicine and tissue engineering in recent years have increased the adoption of 3D bioprinting for organ and tissue reconstruction procedures. The 3D bioprinting technique is known as one of the most profitable advancements in the field of regenerative medicine as the technique allows for direct printing of biological materials onto scaffolds that could require cell seeding.

Companies are developing novel 3D bio-printed personalized scaffolds for applications in tissue regeneration. for instance, in June 2022, 3D Systems collaborated with United Therapeutics Corporation. Together, they showcased a human lung scaffold and two other significant advancements in 3D-printed organs. Following the establishment of its Regenerative Medicine business last year, 3D Systems has concentrated heavily on its 3D bioprinting and regenerative medicine initiatives.

Type Insights

The hydrogels segment emerged as the most dominant segment and accounted for the largest revenue share of 41.69% in 2022. Technological advancements in microfabrication procedures for hydrogels are anticipated to fuel the segment growth during the forecast period. In addition, companies are launching new hydrogels for cell transplantation, drug depots, and a barrier against restenosis.

For instance, in March 2021, Bio-Techne Corporation introduced the Cultrex UltiMatrix reduced growth factor Basement Membrane Extract (BME) for culturing pluripotent stem cells and other cell types. It is an advanced matrix hydrogel that consists of optimum extracellular matrix protein composition, and improved tensile strength for personalized medicine, drug discovery research, and regenerative medicine.

The nanofiber-based scaffolds segment is anticipated to witness the fastest CAGR of 14.56% from 2023 to 2030. The increasing usage of nanofiber-based scaffolds in tissue engineering and regeneration applications is fueling segment growth. In addition, researchers are modifying these scaffolds for expanding their tissue engineering applications. For instance, researchers are exploring the use of nanofiber scaffolds for supporting nerve tissue engineering. Approaches such as electrospinning are used to create nano-sized structures that can act as an extracellular matrix for cellular transformation. In addition, electrospinning has several advantages such as ease of use, low cost, and high adaptability, which can boost the segment growth.

Disease Type Insights

The orthopedics, musculoskeletal, and spine segment held the largest share of 52.98% in 2022. It is estimated that around 34.0 million surgeries are performed on the musculoskeletal systems in the U.S. annually. Hence, regenerative medicines are gaining traction due to the various low-risk alternatives to allograft surgery offered by such therapies. A variety of biomaterials is used in scaffold engineering, and materials such as silk fibroin are ideal for this purpose due to their impressive cytocompatibility and slow biodegradability, which can boost their demand and positively affect segment growth.

The neurology segment is expected to witness the fastest CAGR of 16.57% from 2023 to 2030 due to the high adoption of stem cell therapy and regenerative medicine for the treatment of neurodegenerative disorders. In addition, researchers are developing new scaffolds for nerve regeneration, which is further contributing to segment growth. For instance, in January 2021, researchers developed a bioactive scaffold containing polycaprolactone/chitosan (PCL/CS) nanofibers for supporting nerve regeneration. This scaffold facilitated increased cell attachment and nerve cell growth.

Application Insights

The stem cell therapy, regenerative medicine, and tissue engineering segment accounted for the largest market share of 66.45% in 2022. This can be attributed to the growing adoption of scaffold technology for aesthetic and reconstruction surgeries, soft tissue, tumor repair, periodontology, and colorectal procedures. In addition, the extensive application of scaffold technology across the field of regenerative medicine is gaining significant traction among researchers in recent years.

For instance, in January 2023, ReLive Biotechnologies, Ltd. announced that it has completed the acquisition of Germany-listed biotech company Co.Don AG. This acquisition will empower ReLive to conduct independent research and develop cost-effective tissue-engineered products based on stem cell technology and 3D printing.

The drug discovery segment is expected to witness substantial growth at a CAGR of 13.75% from 2023 to 2030. The need to develop versatile and portable tools in the biomedical space, including drug discovery and development, has driven the demand for scaffold technology in this segment. Compared to conventional procedures, this technology enables a more efficient elucidation of the underlying factors responsible for the activity of drug candidates during toxicity screening procedures. Such applications can boost the market prospects for scaffold technologies.

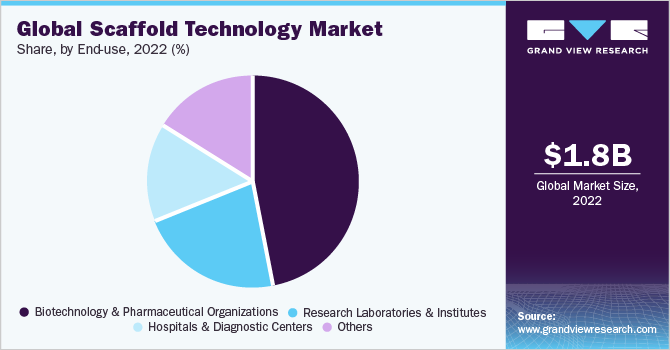

End-Use Insights

The biotechnology and pharmaceutical organizations segment dominated the market and accounted for the largest share of 46.51% in 2022. The growth of the segment can be attributed to the widespread applications of scaffold technology in tissue engineering fields including cartilage development, periodontal regeneration, repair of nasal and auricular malformations, bone formation, tendon repair, and heart valves.

In addition, biotechnology companies are also undertaking new product initiatives for the development of new scaffolding structures. For instance, in April 2023, Systemic Bio opened its new lab in Texas, U.S. for hydrogel scaffold manufacturing and research and development activities for organ-on-a-chip technology to enhance drug discovery and development.

The hospitals & diagnostic centers segment is expected to witness the fastest CAGR of 14.32% from 2023 to 2030. The high growth of the segment is due to an increase in the number of grafting procedures and rising incidences of road accidents and related injuries. All of these remain important factors for a greater demand for biological scaffolds. Furthermore, with the increasing availability of advanced scaffold materials that are mechanically stable and highly biocompatible, the segment is projected to grow at a rapid pace over the forecast period.

Regional Insights

North America dominated the market with a revenue share of 40.44% in 2022. The growth in this region is driven by the presence of prominent players such as Thermo Fisher Scientific Inc.; Akron Biotech; 3D Biotek LLC; Molecular Matrix Inc.; Xanofi; and Corning Incorporated. In addition, companies in this region are launching new and innovative products to support the development of scaffold technologies, which can be further attributed to the region’s growth. For instance, in November 2022, Gelomics and Rousselot announced a cobranding collaboration that involves the use of Rousselot Biomedical’s X-Pure GelMA (gelatin methacryloyl) extracellular matrix in combination with Gelomics' LunaGel 3D Tissue Culture System.

The Asia Pacific market for scaffold technology is expected to witness the fastest CAGR of 14.98% from 2023 to 2030. The growth in the region can be attributed to the presence of government organizations that conduct regenerative medicine and stem cell research. For instance, in India, the Ministry of Science and Technology and the Indian Council of Medical Research focus on stem cell research and regenerative medicine. Furthermore, research undertaken by the National Centre for Cell Science in stem cell biology and other advanced therapy areas is expected to increase the penetration of scaffold technology in the country.

Key Companies & Market Share Insights

The rising initiatives for promoting products based on scaffold technology are contributing to the growth of the market for scaffold technology. For instance, in April 2023, BellaSeno and Evonik collaborated to commercialize 3D-printed scaffolds for bone regeneration. Some prominent players in the global scaffold technology market include:

-

Thermo Fisher Scientific, Inc.

-

Merck KGaA

-

Tecan Trading AG

-

REPROCELL Inc.

-

3D Biotek LLC

-

Becton, Dickinson, and Company

-

Medtronic

-

Xanofi

-

Molecular Matrix, Inc.

-

Matricel GmbH

-

Pelobiotech

-

4titude

-

Corning Incorporated

-

Akron Biotech

-

Avacta Life Sciences Limited.

-

Vericel Corporation

-

NuVasive, Inc.

-

Allergan

Scaffold Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.23 billion

Revenue forecast in 2030

USD 4.91 billion

Growth rate

CAGR of 13.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, disease type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Tecan Trading AG; REPROCELL Inc.; 3D Biotek LLC; Becton, Dickinson and Company; Medtronic; Xanofi; Molecular Matrix, Inc.; Matricel GmbH; Pelobiotech; 4titude, Corning Incorporated; Akron Biotech; Avacta Life Sciences Limited.; Vericel Corporation; NuVasive, Inc.; Allergan

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Scaffold Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global scaffold technology market report based on type, disease type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hydrogels

-

Wound Healing

-

3D Bioprinting

-

Immunomodulation

-

-

Polymeric Scaffolds

-

Micropatterned Surface Microplates

-

Nanofiber Based Scaffolds

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics, Musculoskeletal, & Spine

-

Cancer

-

Skin & Integumentary

-

Dental

-

Cardiology & Vascular

-

Neurology

-

Urology

-

GI, Gynecology

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Stem Cell Therapy, Regenerative Medicine, & Tissue Engineering

-

Drug Discovery

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology & Pharmaceutical Organizations

-

Research Laboratories & Institutes

-

Hospitals & Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global scaffold technology market size was estimated at USD 1.76 billion in 2022 and is expected to reach USD 1.98 billion in 2023.

b. The global scaffold technology market is expected to grow at a compound annual growth rate of 13.87% from 2023 to 2030 to reach USD 4.92 billion by 2030.

b. The hydrogel segment dominated the scaffold technology market with a share of 41.69% in 2022. This is attributable to the properties associated with the use of hydrogels such as the ease of loading cells and drugs for controlled drug delivery.

b. Some key players operating in the scaffold technology market include Thermo Fisher Scientific, Inc.; Merck KGaA; Tecan Trading AG; REPROCELL Inc.; 3D Biotek LLC; Becton, Dickinson and Company; Medtronic; Xanofi; Molecular Matrix, Inc.; Matricel GmbH; Pelobiotech; 4titude, Corning Incorporated; Akron Biotech; Avacta Life Sciences Limited.; Vericel Corporation; NuVasive, Inc.; Allergan

b. Key factors that are driving the scaffold technology market growth include rising demand for 3D cellular models in translational research, increasing demand for body reconstruction procedures and tissue engineering, and technological advancement of scaffold technology.

b. The stem cell therapy, regenerative medicine, and tissue engineering segment dominated the market for scaffold technology and accounted for the largest revenue share of 66.45% in 2022.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.