Market Size & Trends

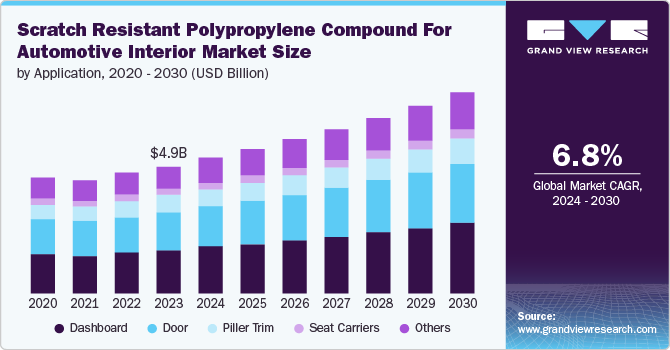

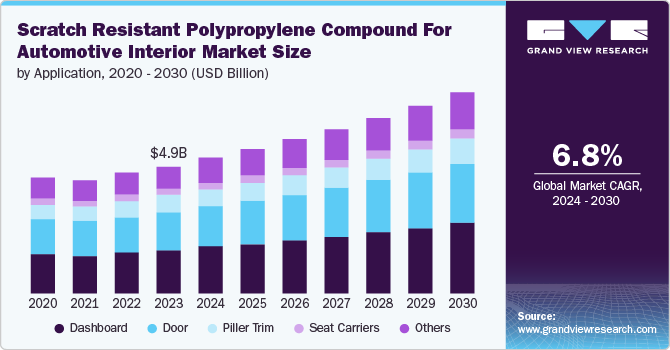

The global scratch resistant polypropylene compound for automotive interior market size was valued at USD 4.97 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. The increasing demand for long-lasting and aesthetically pleasing indoor spaces drives the scratch-resistant polypropylene compound for the automotive interior market. The expansion of automotive industry is leading to the development of advanced scratch resistant formulations, which is fueling the market growth.

Increasing usage of engineering plastics to comply with stringent legislation is likely to foster the market demand. Stringent regulatory norms, such as directives from the European Union and EPA to cut down carbon emission have triggered the need to reduce gross vehicular weight. Such enforcements have been instrumental in driving engineering plastics demand for automotive production. Ample supply coupled with superior properties is expected to trigger the polypropylene (PP) compound market growth. Polypropylene compound has its use in a variety of applications ranging from automobiles, packaging, construction, and infrastructure.

The growing concerns of customers to secure their vehicles such as cars from being damaged is driving the demand for scratch-resistant polypropylene compound. Scratch resistance refers to how well a material can resist scratches on its surface, determining the durability and longevity of a product is an essential factor. Focusing on customization and offering tailored solutions to meet specific customer requirements enhances the market growth.

Desirable mechanical characteristics, moldability, and low cost make PP compounds in the automotive industry extremely sought after products. In different automotive interior applications, the development of these plastics strengthens the enhanced efficiency of PP resins. After compounding with additives such as glass fiber, mica, talc, or other materials, these assist in imparting characteristics such as scratch resistance, high impact resistance that are crucial for indoor automotive applications. The view of the customer linked to the aesthetics of indoor and outdoor cars has altered dramatically. Today, customers expect cars to retain a more significant portion of the vehicle's lifecycle's aesthetic appeal. These factors are anticipated to drive PP compound demand in dashboard manufacturing, door trimming, and others.

Application Insights

The dashboard segment dominated the market and accounted for the largest revenue share of 34.3% in 2023. The rising concerns of driver’s safety is one of the major factors attributing to the market growth. The dashboard helps in displaying visual information in one location. It is designed to present various interconnected pieces of information in a user-friendly format.

The door segment is expected to experience significant growth over the forecast period. The door panels have the most controls and decorations among interior components. Thus, it becomes important to maintain a balance between individual components while also ensuring a cohesive connection among all parts. Scratch-resistant polypropylene compounds are utilized in indoor trim applications to simplify assembly and decrease the weight of the door panel while enhancing user experience. It provides protection and aesthetic appeal as well.

Regional Insights

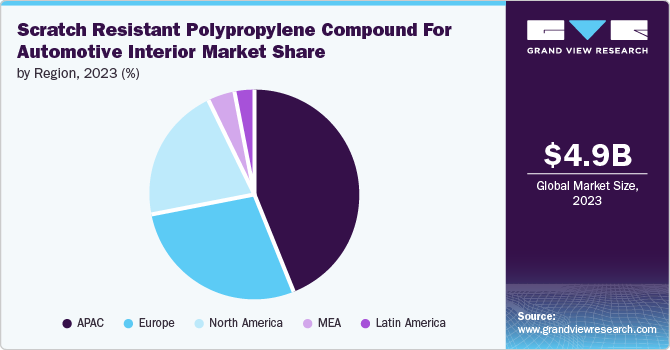

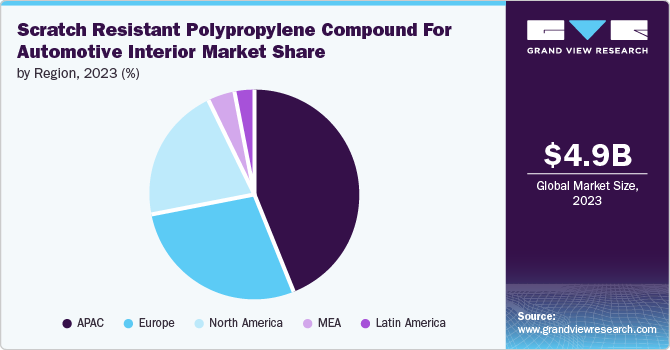

The North America scratch-resistant polypropylene compound for automotive interior market had a market share of 21.4% in 2023. The region has a strong automotive manufacturing foundation with major original equipment manufacturers and Tier-1 suppliers. The increasing popularity of customizing vehicles is driving the need for aftermarket parts such as wheels, exhaust systems, and others constructed from scratch-resistant polypropylene.

U.S. Scratch Resistant Polypropylene Compound For Automotive Interior Market Trends

The scratch resistant polypropylene compound for automotive interior market in the U.S. held significant share in 2023. The rising demand for high-end vehicles with premium interiors is leading to the growth of luxury vehicle segment. The development of innovative polypropylene compounds that have improved scratch resistance and other desirable characteristics is propelling to the market growth.

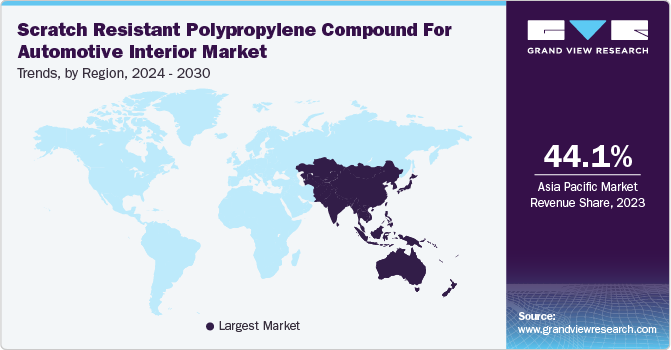

Asia Pasific Scratch Resistant Polypropylene Compound For Automotive Interior Market Trends

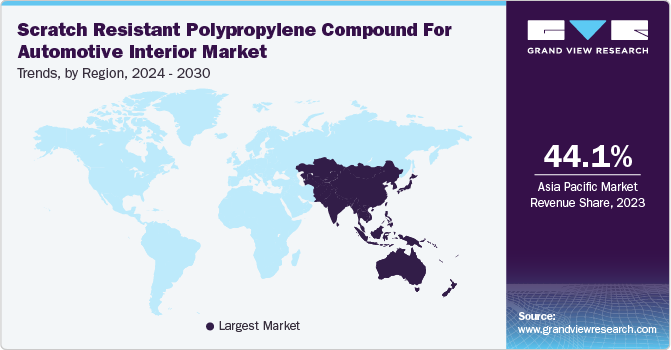

The Asia Pacific scratch resistant polypropylene compound for automotive interior market dominated with a market share of 44.1% in 2023. The increasing urbanization in countries such as India and China has led to a surge in demand for automotive production and its components. According to Society of Indian Automobile Manufacturers, a total of 2,59,31,867 vehicles were manufactured by the industry from April 2022 to March 2023, which includes passenger vehicles, commercial vehicles, three wheelers, two wheelers, and quadricycles, surpassing the 2,30,40,066 units produced from April 2021 to March 2022.

The scratch resistant polypropylene compound for automotive interior market in China is expected to grow significantly in the coming years due to the increasing global sales of automobiles leading to higher demand for interior components. The emerging EV vehicle market in the country is driving the demand for scratch resistant polypropylene compound for automotive interior.

Europe Scratch Resistant Polypropylene Compound For Automotive Interior Market Trends

Europe scratch-resistant polypropylene compound for automotive interior market is expected to grow at a CAGR of 6.5% over the forecast period. The region has strict goals for recycling automotive parts. Polypropylene's ability to be recycled is well in line with these regulations.

Key Scratch Resistant Polypropylene Compound For Automotive Interior Company Insights

Some of the key participants in the global scratch resistant polypropylene compound for automotive interior market are LyondellBasell Industries Holdings B.V., Borealis AG., SABIC, Mitsui Chemicals, Inc., RTP Company, and others.

-

Borealis is a prominent provider of advanced and sustainable polyolefin solutions, polyolefin recycling, and a major producer of base chemicals. Its business in the mobility industry develops innovative and eco-friendly polypropylene (PP) and thermoplastic polyolefin (TPO) products for various specific interior uses such as dashboards, door panels, center consoles, trims, and structural parts.

Key Scratch Resistant Polypropylene Compound For Automotive Interior Companies:

The following are the leading companies in the scratch resistant polypropylene compound for automotive interior market. These companies collectively hold the largest market share and dictate industry trends.

- LyondellBasell Industries Holdings B.V.

- Borealis AG.

- Exxon Mobil Corporation.

- SABIC

- Mitsui Chemicals, Inc.

- Sumitomo Chemical Co., Ltd.

- RTP Company

- Present Advanced Composites Inc.

- Washington Penn

- Kingfa Sci. &Tech. Co.,Ltd.

Recent Developments

-

In July 2024, LyondellBasell Industries Holdings B.V. launched new Schulamid ET100 product line, which is a revolutionary polyamide-based compound product. This new technology highlights LYB's innovative capabilities in engineered polymers, specifically for automotive interior structural solutions like door window frames.

Scratch Resistant Polypropylene Compound For Automotive Interior Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 5.28 billion

|

|

Revenue forecast in 2030

|

USD 7.83 billion

|

|

Growth rate

|

CAGR of 6.8% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in Kilotons, Revenue in Million, and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Denmark; Sweden; Norway; China; India; Japan; South Korea; Indonesia; Australia; Vietnam; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

|

|

Key companies profiled

|

LyondellBasell Industries Holdings B.V.; Borealis AG.; Exxon Mobil Corporation.; SABIC; Mitsui Chemicals, Inc.; Sumitomo Chemical Co., Ltd.; RTP Company; Present Advanced Composites Inc.; Washington Penn; Kingfa Sci. &Tech. Co.,Ltd.

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

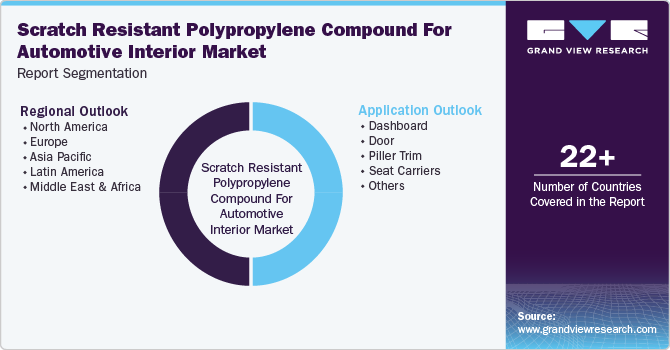

Global Scratch Resistant Polypropylene Compound For Automotive Interior Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global scratch resistant polypropylene compound for automotive interior market report based on application and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dashboard

-

Door

-

Piller Trim

-

Seat Carriers

-

Others

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)