- Home

- »

- HVAC & Construction

- »

-

Smart Infrastructure Market Size, Share, Growth Report 2030GVR Report cover

![Smart Infrastructure Market Size, Share & Trends Report]()

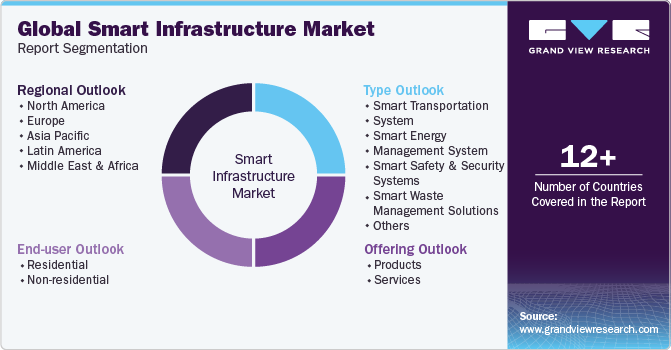

Smart Infrastructure Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering (Products, Services), By Type, By End-user (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-175-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Infrastructure Market Summary

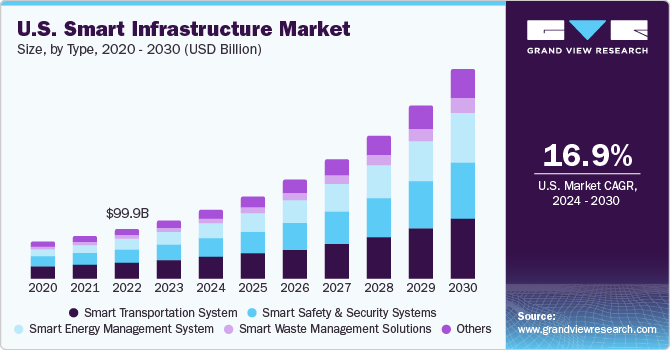

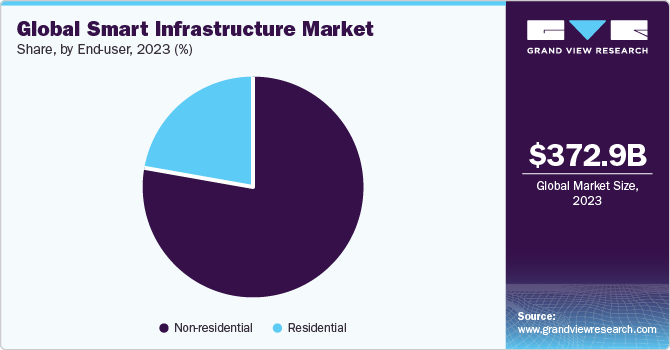

The global smart infrastructure market size was estimated at USD 372.95 billion in 2023 and is projected to reach USD 1,355.44 billion by 2030, growing at a CAGR of 20.5% from 2024 to 2030. The considerable growth of the smart infrastructure market can be attributed to increasing public and private investments in smart city projects, supportive government initiatives for digitalization, and shifting focus of various end-user companies toward improving their consumer experience.

Key Market Trends & Insights

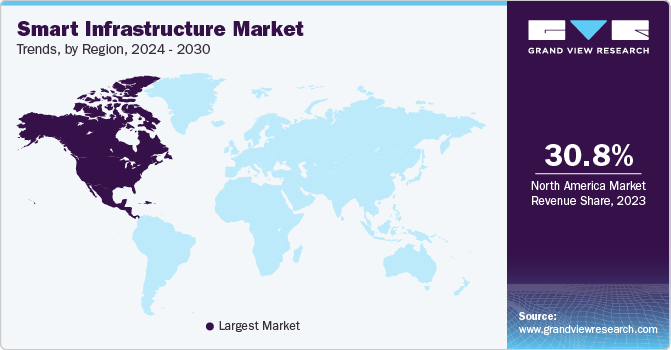

- North America dominated the market with a share of 30.84% in 2023.

- Based on end-user, the non-residential end-users held the largest market revenue share in 2023.

- Based on offering, the products led the market and held over 68.0% of global revenue share in 2023.

- Based on type, the smart transportation system accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 372.95 Billion

- 2030 Projected Market Size: USD 1,355.44 Billion

- CAGR (2024-2030): 20.5%

- North America: Largest Market in 2023

Smart infrastructure collects valuable information using connected devices, cameras, and sensors to assist urban planners, transport department officials, and city leaders, among others, to provide countless benefits to citizens or end-users, thus supporting smart infrastructure market growth. Companies operating in this market, such as Siemens, Honeywell International Inc., and International Business Machines Corporation, are notably investing in developing smart infrastructure solutions, creating robust opportunities for the smart infrastructure industry.

For instance, in November 2023, VMware announced a collaboration with International Business Machines Corporation (IBM) to integrate IBM Watsonx data and Artificial Intelligence (AI) on Red Hat OpenShift and VMware Private AI platform. This will enable their clients to improve operational efficiency of their AI-powered infrastructure and cloud platform.

Shifting focus of governments of various countries such as China, India, Germany, Brazil, and South Africa towards smart cities to elevate living standards of citizens is creating a positive outlook for smart infrastructure market. Governments in these countries are launching various smart city projects, which are anticipated to fuel market growth. For instance, in April 2022, the Government of Mpumalanga province in South Africa announced the transformation of Nkosi city, which is located near the Kruger National Park, into a smart city. The project is valued at around USD 5.24 billion and has received all government approvals.

Furthermore, various governments are organizing smart city exhibitions, which is propelling market growth. For instance, in October 2023, the Government of New York organized Smart City Expo USA 2023 in partnership with National League of Cities (NLC) and the African American Mayors Association (AAMA). The event was held at Pier 36 NYC, New York, and visited by various key market players who presented their latest technology-equipped smart infrastructure solutions, demos, and workshops, among others.

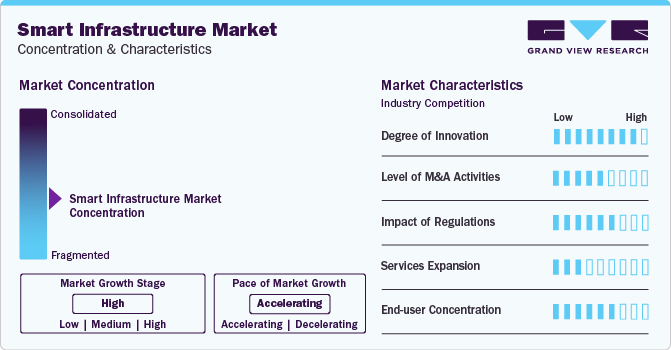

Market Concentration & Characteristics

The growth of market is very high and pace is accelerating. The smart infrastructure market is characterized by a high degree of innovation owing to rapid advancements in various technologies such as Artificial Intelligence (AI), Machine Learning (ML), big data analytics, cybersecurity, and Blockchain, among others. Further, emerging AI and cloud platforms are disrupting the current market and creating new opportunities for market stakeholders.

The market is also witnessing a high level of merger and acquisition (M&A) activity by key players. These players are focusing on acquiring technology providers to optimize their research & development (R&D) costs and expand their business presence into untapped markets.

The market is also subject to rules and regulations set by international, regional, and country-level regulatory bodies. The regulations for the next generation of emerging technologies are becoming stringent owing to rising privacy violations and manipulation in application algorithms. Owing to this, rules & regulations can significantly influence the development of the smart infrastructure market.

There are no direct substitutes for smart infrastructure solutions. The industry is relatively focused on narrow solutions that have few technology-driven substitutes and comparable product offerings. Companies are investing large amounts in research and development for the development of new products and technologies.

End-user concentration is one of the considerable factors that is anticipated to influence market growth. These solutions are witnessing high demand owing to their sustainability and enhanced efficiency. High need for customizable solutions to address specific needs of end-users creates challenges for emerging market players who are trying to establish their brand image.

End-user Insights

Non-residential end-users held the largest market revenue share in 2023. This high share can be attributed to the increasing adoption of smart infrastructure solutions in various commercial and industrial companies to digitize their business operations and improve consumer experience. Smart infrastructure solution consists of automation systems that contribute to streamlining operations and effective resource utilization. Furthermore, businesses integrate smart infrastructure solutions to strengthen the digital security and safety of their sensitive data.

The residential end-user segment is projected to witness highest growth rate over the forecast period. The segment growth can be attributed to the rise in demand for HVAC management, smart home lighting, smart meters, and smart door lock security systems to monitor & manage a building's electrical and mechanical systems. Moreover, the segment is anticipated to benefit from increased awareness about smart grids, growth of the consumer electronics sector, rising personal income in developing economies, and improved power line communication.

Offering Insights

Products led the market and held over 68.0% of global revenue share in 2023. This high segment share can be attributed to increasing adoption of smart infrastructure hardware & software such as smart grid solutions, Building Automation Systems (BAS), and Internet of Things (IoT)-based environmental monitoring system, among others, to improve the operational efficiency and reduce human errors. This segment is expected to dominate the market through 2030 and witness robust functionality due to rapid technological advancements in smart infrastructure solutions development.

Service offering is anticipated to witness the highest CAGR from 2024 to 2030 in the market for smart infrastructure. The considerable growth expected during the forecast period can be attributed to shifting focus of organizations on utilizing smart infrastructure services to optimize their budgets. Market players offer consulting, support & maintenance, and designing services to assist end-users in digitalizing their operations and maximizing their business profitability.

Regional Insights

North America dominated the market with a share of 30.84% in 2023. This high share is attributable to presence of established market players such as Cisco Systems Inc., Honeywell International Inc., Johnson Controls, & International Business Machines Corporation, as well as favorable government policies for digitalization. In the U.S., various non-residential sectors emphasize transforming their existing offices into smart offices. Such initiatives by end-user companies are anticipated to boost smart infrastructure solution adoption in this country during the forecast period.

Asia Pacific is anticipated to witness significant growth in the smart infrastructure industry. This growth is aided by high urbanization, shifting consumer focus toward remote management services through IoT technology, and increasing rate of internet penetration. Supportive government initiatives for smart cities and rising concerns regarding energy consumption among buildings are driving China's smart infrastructure market growth. Moreover, regional industries are focusing on automation to improve their business operations and reduce overhead costs.

Type Insights

Smart transportation system accounted for the largest revenue share in 2023. Current advancements in computing, communications sensors, and network speed have made it possible to overhaul the transportation infrastructure, vehicular operations, and traffic management. Advances in sensing technologies and telecommunications have improved the capabilities of transportation systems to ensure safety and security. Further, favorable policies and regulations, increased awareness of road safety, and a growing number of vehicles pose many potential opportunities in this segment during the forecast period.

Smart waste management is expected to register the fastest CAGR during the forecast period. The significant segment growth can be attributed to the rising usage of smart bin technology, implementation of Blockchain technology for tracking waste from generation to disposal, and development of automated sorting systems. Local governments, technology solutions providers, distributors, and system integrators are the major stakeholders in the implementation of city-level waste management projects. Different types of mobile apps are being developed to monitor the fill levels of bins and enhance user convenience.

Key Companies & Market Share Insights

Some of the key players operating in the market include ABB; Honeywell International Inc., International Business Machines Corporation; Siemens; and Cisco Systems, Inc.

-

ABB offers smart infrastructure solutions for the management of water, energy, healthcare facilities, and communications, among others. ABB’s Asset Manager and Ability Energy Manager are cloud solutions that offer asset and energy management functionalities through a single intuitive dashboard.

-

Honeywell International Inc. utilizes its IoT-enabled command & control platform for city management. It offers various smart city applications for Geographic Information System (GIS)-based incident management, citizen engagement, and workforce dispatch.

Panamax Infotech, Huawei Technologies Co., Ltd., and Dynamic Ratings, Inc. are some of the emerging market participants in the smart infrastructure market.

-

Panamax Infotech provides Smart Infrastructure Solutions (SIS) that includes Integrated Command and Control Centre (ICCC), smart surveillance, smart transport & mobility solution, and smart healthcare solution.

-

Dynamic Ratings specializes in designing and developing smart infrastructure solutions such as EV charging systems, outage detection systems, and Distributed Energy Resources (DERs).

Key Smart Infrastructure Companies:

- ABB

- Aclara Technologies LLC (Hubbell Incorporated)

- Broadcom, Inc. (VMware)

- Cisco Systems, Inc.

- Dynamic Ratings

- Honeywell International Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- L&T Technology Services Limited

- Panamax Infotech

- Schneider Electric

- Siemens

- Wipro

- Xylem (Sensus)

Recent Developments

-

In September 2023, Huawei Technologies Co., Ltd. launched smart infrastructure solutions such as Intelligent DC OptiX, an ultra-broadband solution, and CloudEngine XH, the company’s AI Computing DCN Switch Series to enable enterprises to digitize their business operations

-

n August 2023, Honeywell International Inc. announced that it would be providing its City Suite Software for a smart city project handled by Atlanta BeltLine that includes the redevelopment of 22 miles of railroad in this city. The software will help smart city developers display data from multiple points across the whole area in a single unified view

-

In June 2023, ABB strengthened its smart home product portfolio with the acquisition of the smart home solution provider Eve Systems GmbH for an undisclosed amount. The acquisition will help ABB improve its brand image in North America and Europe

Smart Infrastructure Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 443.81 billion

Revenue forecast in 2030

USD 1,355.44 billion

Growth rate

CAGR of 20.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offering, type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

ABB; Aclara Technologies LLC (Hubbell Incorporated); Broadcom, Inc. (VMware); Cisco Systems, Inc.; Dynamic Ratings; Honeywell International Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; International Business Machines Corporation; L&T Technology Services Limited; Panamax Infotech; Schneider Electric; Siemens; Wipro; Xylem (Sensus)

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Infrastructure Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart infrastructure market report based on offering, type, end-user, and region:

-

Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Products

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Transportation System

-

Smart Energy Management System

-

Smart Safety & Security Systems

-

Smart Waste Management Solutions

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart infrastructure market size was estimated at USD 372.95 billion in 2023 and is expected to reach USD 443.81 billion by 2024.

b. The global smart infrastructure market is expected to grow at a compound annual growth rate of 20.5% from 2024 to 2030 to reach USD 1,355.44 billion by 2030.

b. The products offering segment accounted for the largest revenue share of more than 68.0% in 2023. The high market share of the products segment can be attributed to the increasing adoption of smart infrastructure hardware & software such as smart grid solutions, Building Automation Systems (BAS), and Internet of Things (IoT)-based environmental monitoring systems, among others to improve the operational efficiency and reduce the human error

b. The key players operating in the smart infrastructure market include ABB; Aclara Technologies LLC (Hubbell Incorporated); Broadcom, Inc. (VMware); Cisco Systems, Inc.; Dynamic Ratings; Honeywell International Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; International Business Machines Corporation; L&T Technology Services Limited; Panamax Infotech; Schneider Electric; Siemens; Wipro; and Xylem (Sensus).

b. The considerable growth of the smart infrastructure market can be attributed to the increasing public & private investment in smart city projects, supportive government initiatives for digitalization, and shifting various end-user companies’ focus toward improving their consumer experience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.