- Home

- »

- Network Security

- »

-

Security Service Edge Market Size, Industry Report, 2033GVR Report cover

![Security Service Edge Market Size, Share, & Trend Report]()

Security Service Edge Market (2025 - 2033) Size, Share, & Trend Analysis By Component (Solution, Services), By Deployment (On-premises, Cloud-based, Hybrid), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-688-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Security Service Edge Market Summary

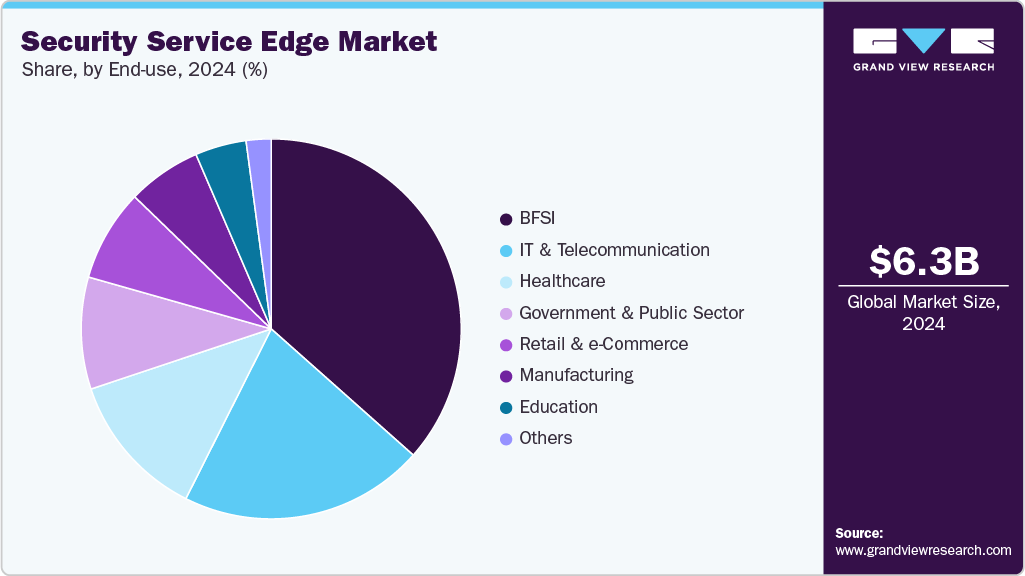

The global security service edge market size was estimated at USD 6.26 billion in 2024 and is projected to reach USD 36.87 billion by 2033, growing at a CAGR of 21.9% from 2025 to 2033. The market growth is attributed to the increasing adoption of security service edge (SSE) by enterprises to unify access control, threat protection, and data security across hybrid and multi-cloud environments.

Key Market Trends & Insights

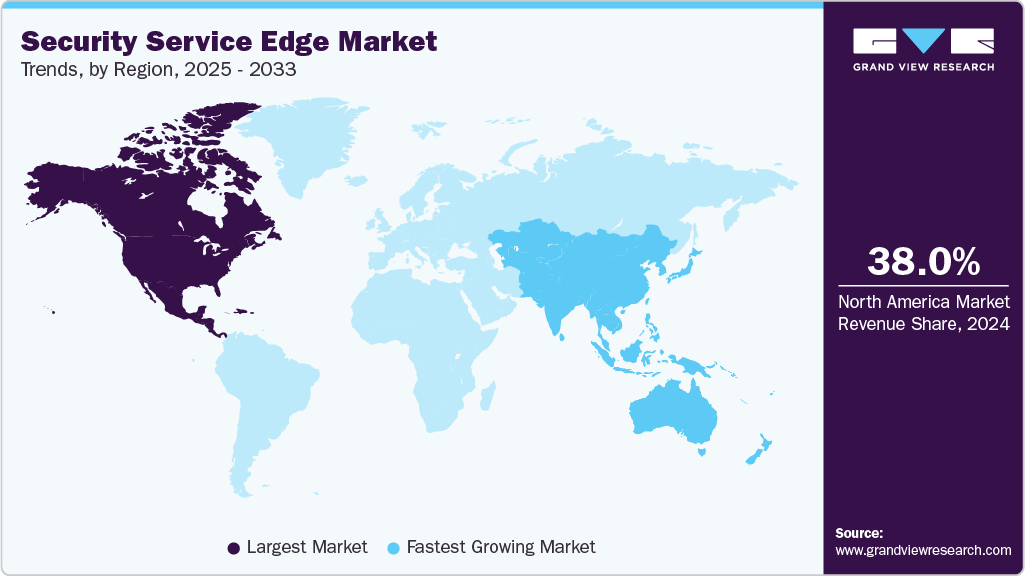

- North America held a 38.01% revenue share of the global security service edge market in 2024.

- In the U.S., the market is driven by accelerated enterprise cloud adoption, heightened cybersecurity risks, and evolving regulatory mandates.

- By component, the solution segment held the largest revenue share of 67.25% in 2024.

- By deployment, cloud-based segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.26 Billion

- 2033 Projected Market Size: USD 36.87 Billion

- CAGR (2025-2033): 21.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The SSE market is further accelerated by the convergence of AI-powered analytics, automation, and edge computing, enabling real-time threat detection, policy enforcement, and performance optimization at the network edge. In addition, Advanced Secure Web Gateways (SWG) and Firewall-as-a-Service (FWaaS) are being integrated with machine learning to proactively block malicious traffic, reduce false positives, and adapt to evolving attack vectors. Moreover, sectors like healthcare and retail are adopting SSE to protect patient and customer data while ensuring fast, secure access to cloud-based tools and digital services. Vendors are embedding Data Loss Prevention (DLP), Remote Browser Isolation (RBI), and behavior analytics into SSE frameworks to enhance visibility, mitigate insider threats, and support business continuity without compromising user experience.

Moreover,Security Service Edge (SSE) is evolving from a reactive security measure into a foundational pillar of enterprise architecture, supporting secure, resilient, and scalable digital operations. As enterprises struggle with the growing complexity of hybrid work models, cloud sprawl, and an expanding device ecosystem, SSE platforms are serving as strategic control points that unify access management, data protection, and device intelligence. For instance, in November 2024, Absolute Security launched its Enterprise SSE platform, integrating endpoint-to-network Zero Trust capabilities with adaptive policy enforcement and persistent application resilience. By offering self-healing ZTNA, advanced data loss prevention, and continuous risk visibility, Absolute enables organizations to maintain robust security postures across distributed environments. Consequently, the growing adoption of SSE as an embedded, enterprise-wide security fabric capable of securing users, applications, and data in real time across dynamic digital ecosystems is driving the growth of the global market.

Component Insights

The solution segment accounted for the largest revenue share of 67.25% in the global Security Service Edge (SSE) market in 2024, driven by increasing enterprise demand for unified, cloud-native security platforms that support secure connectivity, data protection, and policy-based access control across distributed users and applications. These solutions, which include Secure Web Gateway (SWG), Cloud Access Security Broker (CASB), Zero Trust Network Access (ZTNA), and Firewall-as-a-Service (FWaaS), are critical for enabling modern security architectures that emphasize real-time visibility, identity-driven enforcement, and seamless integration with multi-cloud and hybrid environments. Furthermore, solution offerings deliver scalable functionality, automation capabilities, and enterprise-wide security intelligence, allowing organizations to reduce risk while enhancing operational efficiency. For instance, in November 2024, Cisco expanded its partnership with LTIMindtree to deliver AI-enabled SSE capabilities and integrated observability, helping global enterprises modernize their secure access frameworks. In conclusion, the growing preference for comprehensive and scalable SSE platforms that combine advanced threat prevention, centralized control, and seamless user experience are contributing significantly in driving the growth of solution segment in the global market.

The services segment is expected to register the fastest CAGR of 22.5% during the forecast period in the global Security Service Edge (SSE) market, fueled by the increasing complexity of securing hybrid work environments and the growing demand for implementation, integration, and lifecycle management. As enterprises expand their cloud footprints and adopt Zero Trust architecture, they lack the internal resources to deploy and manage SSE solutions on a scale. This has led to a surge in demand for professional and managed services that provide strategic guidance, customized configurations, threat monitoring, and policy optimization across dynamic IT ecosystems. For instance, in February 2025, Kyndryl partnered with Palo Alto Networks to introduce a suite of co-developed services aimed at helping enterprises transition to secure access service edge (SASE) and SSE architectures. These services focus on simplifying deployment, enhancing security posture, and improving operational resilience across complex digital infrastructures. In conclusion, the growing reliance on external service providers to operationalize and maintain SSE deployments is accelerating the growth of the services segment, positioning it as the fastest-growing component of the market.

Deployment Insights

The cloud-based segment accounted for the largest market share of 56.49% in the global Security Service Edge (SSE) market in 2024, driven by the enterprise shift toward cloud-first strategies, the growing adoption of hybrid work models, and the need for scalable security frameworks that align with dynamic application environments. Cloud-based SSE deployments offer reduced infrastructure overhead, faster implementation timelines, and real-time updates, ideal for organizations with distributed users and multi-cloud workloads. In addition, these deployments also support seamless integration with SaaS platforms and enable centralized policy enforcement, threat detection, and compliance management across diverse geographies. For instance, in May 2024, Lacework expanded its data-centric cloud security platform by introducing Lacework Edge, a cloud-delivered SSE solution designed to extend behavioral analytics and anomaly detection to the edge, enhancing visibility and control without reliance on traditional perimeter defenses. Subsequently, the increasing reliance on cloud-delivered security to ensure agility, resilience, and cost-efficiency across decentralized IT infrastructures is driving the cloud-based segment growth in the global SSE market.

The hybrid segment is expected to grow at the fastest CAGR of 20.5% over the forecast period in the global Security Service Edge (SSE) market, supported by rising enterprise demand for flexible deployment models that balance regulatory compliance, performance optimization, and cloud transition readiness. In addition, organizations in highly regulated industries such as finance, healthcare, and government require on-premises security controls for sensitive workloads while leveraging cloud-based SSE components for scalability and operational efficiency. This has led to increased adoption of hybrid SSE architectures that integrate cloud-native capabilities with localized enforcement points, ensuring consistent security policies across both cloud and on-premises environments. Enterprises are particularly drawn to hybrid models that support phased cloud migration strategies without compromising threat protection or user experience. In conclusion, the hybrid segment’s ability to deliver operational agility while addressing jurisdictional data residency, latency-sensitive workloads, and transitional IT needs is driving its accelerated growth within the Security Service Edge (SSE) market.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of 68.98% in the global Security Service Edge (SSE) market in 2024, driven by the increasing demand for advanced, scalable security solutions capable of protecting IT environments, extensive user bases, and globally distributed operations. In addition, large enterprises are prioritizing SSE adoption to support Zero Trust policies, streamline secure access to cloud and on-premises applications, and ensure real-time visibility and policy enforcement across hybrid infrastructures. Moreover, these organizations face elevated regulatory scrutiny and cyber risk exposure, prompting investment in integrated platforms that consolidate threat protection, data security, and access management under a unified architecture. For instance, in March 2022, Zscaler unveiled a series of SSE innovations targeting enterprise-scale needs, including AI-driven data protection, real-time threat correlation, and inline inspection of GenAI prompts, all delivered through its Zero Trust Exchange to support high-volume, performance-sensitive environments. In conclusion, the growing need for comprehensive and enterprise-wide security is driving the growth of large organizations in the global Security Service Edge (SSE) landscape.

The Small and Medium‑Sized Enterprise (SME) segment is expected to grow at the highest CAGR of 22.6% during the forecast period in the global Security Service Edge (SSE) market, fueled by the increasing cyber-security awareness among growing enterprises and their demand for cloud-native security solutions. SMEs are undergoing digital transformation, embracing remote work models, and expanding their use of SaaS applications, but lack the in-house resources to manage traditional on-premises security infrastructure. As a result, they are turning to SSE platforms that offer centralized policy enforcement and advanced threat protection without requiring significant capital investment. For instance, in February 2025, VikingCloud and Mastercard partnered together aimed at empowering SMEs with enhanced cybersecurity tools, combining VikingCloud’s managed security services with Mastercard’s cyber threat intelligence and protection strategies. This provides small- and mid-sized organizations with access to security frameworks, enabling them to safeguard their digital assets with minimal complexity. In conclusion, the convergence of rising cybersecurity risks, digital expansion, and increased access to managed SSE services positions SMEs as the fastest-growing segment in the market.

End Use Insights

The BFSI segment accounted for the largest market share of 36.57% in 2024, fueled by the sector’s stringent data protection requirements, high transaction volumes, and regulatory compliance demands. Financial institutions rely on SSE to protect sensitive customer information and transactional data by enforcing Zero Trust Network Access (ZTNA), Secure Web Gateway (SWG), and Cloud Access Security Broker (CASB) policies across multiple environments. This elevated threat landscape, characterized by cyberattacks and continuous digital transformation, compels BFSI organizations to invest in intelligent security frameworks that provide real-time threat detection. For instance, in December 2022, Axis Security introduced its Atmos Winter release, designed to support C-level decision-makers by offering a unified SSE platform that integrates Secure Web Gateway (SWG), Cloud Access Security Broker (CASB), data loss prevention (DLP), digital experience monitoring, and IPSec support within a single policy and user interface. This enterprise-grade solution enabled financial institutions to achieve enhanced visibility, improved threat detection accuracy, and consistent security performance for accessing critical applications across data centers, cloud platforms, and remote endpoints. In conclusion, the BFSI leading investment in SSE solutions driven by its need for secure, compliant, and seamless connectivity has reinforced its position as the dominant adopters of SSE technologies.

The IT and telecommunication segment is expected to register the fastest growth at a CAGR of 23.0% during the forecast period in the global Security Service Edge (SSE) market, driven by increasing demand for high-performance, low-latency security solutions that can scale with global connectivity infrastructure and support real-time digital services. As telecom operators and IT service providers expand their cloud-native ecosystems and edge networks, the need for integrated and policy-driven security frameworks becomes more critical. For instance, in June 2024, Tata Communications launched its Hosted Secure Access Service Edge (SASE) solution, developed in collaboration with Versa Networks, to provide enterprises with unified SD-WAN and SSE functionality through a single-pass architecture. The platform delivers zero trust access, carrier-grade performance, and advanced threat protection while reducing total cost of ownership by nearly 40%, suitable for telecom and IT organizations managing distributed users and infrastructure. In conclusion, the alignment of SSE capabilities with next-generation networking requirements is accelerating adoption in the IT and telecommunication sector, positioning it as the fastest-growing industry in the market.

Regional Insights

North America accounted for the largest market share of 38.01% in 2024 in the global security service edge market, driven by enterprise adoption of zero trust frameworks, accelerated cloud migration strategies, and increasing regulatory emphasis on data protection and cyber resilience. In addition, there is an increase in the deployment of AI-powered threat detection and behavioral analytics within SSE platforms, reflecting the region’s demand for proactive risk mitigation. Moreover, with the proliferation of hybrid workforces across North America, demand is surging for identity-centric SSE architectures that ensure secure, uninterrupted access to cloud and SaaS applications across geographically dispersed teams. These dynamics highlights North America's position as an innovation hub within the global security service edge landscape.

U.S. Security Service Edge Market Trends

The U.S. Security Service Edge (SSE) market is experiencing robust growth, driven by accelerated enterprise cloud adoption, heightened cybersecurity risks, and evolving regulatory mandates. Organizations across the U.S. are rapidly transitioning from legacy perimeter-based models to cloud-native SSE frameworks that provide granular, identity-driven access control and unified threat prevention. Moreover, the widespread adoption of hybrid and remote work has further intensified the need for secure access to SaaS and IaaS environments across diverse endpoints and geographies. In addition, compliance with U.S.-specific regulatory frameworks such as HIPAA, GLBA, and emerging state privacy laws is pushing enterprises to adopt SSE platforms that offer centralized visibility, real-time policy enforcement, and integrated data protection. Furthermore, the presence of leading SSE vendors, a mature cybersecurity ecosystem, and strong federal support for secure digital infrastructure is expected to position the U.S. as the most advanced SSE market globally.

Europe Security Service Edge Market Trends

The security service edge market in Europe is anticipated to register significant growth from 2025 to 2033, driven by stringent regional and national cybersecurity mandates such as the EU’s GDPR, NIS2 Directive, and Digital Operational Resilience Act (DORA), which demand unified security across critical infrastructure and digital services.European enterprises are increasingly seeking SSE platforms that ensure data sovereignty and compliance, prompting preference for EU‑based providers such as Deutsche Telekom Security and Atos to address concerns over third-party access.Moreover, the rising deployment of zero-trust architectures and AI-driven threat analytics within SSE solutions addresses Europe’s need for smart, compliance-ready security technologies compatible with hybrid and edge computing environments.

The security service edge market in the UK is poised for accelerated growth from 2025 to 2033, as businesses are preparing for the impending Cyber Security and Resilience Bill, which will mandate stringent cyber risk management and incident reporting for critical infrastructure and regulated entities. In addition, UK organizations are increasingly aligning SSE deployments with national security frameworks, ensuring data sovereignty and adherence to Cyber Essentials standards endorsed by the National Cyber Security Centre (NCSC).Moreover, telecom and managed service providers in the UK are embedding SSE into their offerings to support broadened cloud-migration and hybrid work demands, particularly for SMEs and public-sector entities adapting to remote operations.

Germany’s Security Service Edge (SSE) market is advancing, driven by the nation’s strict data protection standards under GDPR and the Federal Office for Information Security (BSI), which mandate secure handling of industrial and supply-chain data across its robust manufacturing and automotive sectors. Enterprises are transitioning to cloud-based SSE, yet regulatory imperatives around data sovereignty and concerns regarding non-EU cloud providers prompt a preference for EU-based vendors such as Deutsche Telekom Security and Atos. This shift is prevalent in manufacturing environments, where the Industry 4.0 paradigm has led to extensive IoT deployments and interconnected OT systems vulnerable to targeted cyber threats, elevating demand for SSE platforms capable of deep integration with industrial cybersecurity frameworks.

Asia Pacific Security Service Edge Market Trends

Asia Pacific is expected to register the fastest CAGR of 23.1% from 2025 to 2033 in the Security Service Edge (SSE) market, driven by growing cloud adoption and expanding cyber risk exposure across emerging economies. Countries such as India, China, Japan, and Australia are experiencing demand for SSE solutions as enterprises shift toward hybrid work models and multi-cloud environments. In addition, governments across the region are also introducing stricter data protection regulations, such as India’s Digital Personal Data Protection Act and China's Cybersecurity Law, which are compelling organizations to adopt integrated SSE frameworks. Moreover, telecom operators and managed security service providers (MSSPs) are embedding SSE capabilities within their offerings to cater to a growing base of SMEs. Furthermore, with rising investments in AI-powered security analytics, zero trust architectures, and localized cloud infrastructure, Asia Pacific is emerging as a strategic growth hub to expand their SSE presence in high-growth, regulation-sensitive markets.

Japan’s Security Service Edge (SSE) market is emerging as a dynamic and rapidly evolving space, driven by increasing cloud adoption, heightened cyber threats, and a strategic pivot toward managed service partnerships. Enterprises across industries from finance to manufacturing are accelerating cloud-first initiatives and remote access strategies, which call for identity-based SSE frameworks. For instance, in August 2024, Netskope partnered with SoftBank Corp. to deliver intelligent cloud-native SSE services through SoftBank’s managed service infrastructure. This collaboration enables Japanese organizations to leverage advanced SSE functions like Zero Trust Network Access (ZTNA), Secure Web Gateway (SWG), Cloud Access Security Broker (CASB), Data Loss Prevention (DLP), and real-time threat analytics.The alliance is significant as it addresses Japan’s strict data protection standards under the updated Act on the Protection of Personal Information (APPI). In conclusion, the aforementioned factors are contributing notably in positioning Japan as a leading security service edge adopter in the Asia Pacific region.

China’s Security Service Edge (SSE) market is advancing under the influence of stringent national cybersecurity regulations such as the Cybersecurity Law and MLPS 2.0, which mandate robust controls on cloud and internet-based services. These policies are catalyzing demand for SSE solutions that integrate Secure Web Gateway (SWG), Cloud Access Security Broker (CASB), and Zero Trust Network Access (ZTNA), particularly among enterprises in finance, government, and critical infrastructure that are subject to strict data localization and protection requirements.Furthermore, China’s growing push toward AI-driven threat detection and machine learning-based anomaly analytics is propelling adoption of advanced SSE platforms tailored to large-scale, regulated environments. As a result, China is solidifying its position as a growth driver in the Asia Pacific region’s SSE market, with its demand for compliance-first, intelligent SSE solutions expected to continue expanding in the coming years.

The security service edge (SSE) market in India is witnessing strong growth, driven by rapid cloud adoption, the expansion of hybrid workforces, and increased cybersecurity awareness across both large enterprises and small to mid-sized businesses. In addition, the implementation of the Digital Personal Data Protection (DPDP) Act has heightened the focus on data privacy, compelling organizations to adopt SSE frameworks that offer centralized policy enforcement, secure access to cloud applications, and real-time data protection. Moreover, sectors such as BFSI, IT services, healthcare, and e-commerce are leading the adoption curve, seeking scalable solutions that align with Zero Trust principles while meeting compliance and performance requirements. Furthermore, the growing reliance on managed security service providers due to resource constraints and skills shortages is fueling demand for SSE as-a-service offerings.

Key Security Service Edge Company Insights

Key players operating in the security service edge industry Zscaler, Palo Alto Networks, Cisco, Fortinet, and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2025, Vectra AI partnered with Zscaler, extending its network detection and response (NDR) capabilities to cover both Zscaler Internet Access (ZIA) and Private Access (ZPA) traffic. This collaboration delivers comprehensive visibility into SASE data flows, significantly enhancing threat detection, investigation, and response, while enabling stronger enforcement of Zero Trust policies across the enterprise network.

-

In March 2025, Globalgig announced partnership with Palo Alto Networks to enhance its managed Secure Service Edge (SSE) offeringsintegrating Palo Alto’s Prisma SASE, Prisma Access, and SD‑WAN solutions with Globalgig’s Orchestra Insight platform. This collaboration delivers AI-driven security analytics, unified management of networking and threat defense, and improved performance for globally distributed enterprise environments.

-

In December 2024, Bell Canada formed a strategic partnership with Palo Alto Networks, positioning Bell as a managed and professional services provider for Palo Alto’s AI-driven platforms. The collaboration enables Bell to deliver 24/7 support, unified threat prevention, and secure connectivity by integrating solutions such as Prisma Access, NGFW, Prisma Cloud, and Cortex XSIAM across Canadian enterprises.

Key Security Service Edge Companies:

The following are the leading companies in the security service edge (SSE) market. These companies collectively hold the largest market share and dictate industry trends.

- Zscaler

- Palo Alto Networks

- Cisco

- Fortinet

- Netskope

- Cato Networks

- Proofpoint

- Barracuda Networks

- Menlo Security

- Cloudflare

- Forcepoint

- Skyhigh Security

- Axis Security

- VMware

- Akamai

Security Service Edge Market Report Scope

Report Attribute

Details

Market size in 2025

USD 7.56 billion

Revenue forecast in 2033

USD 36.87 billion

Growth rate

CAGR of 21.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Zscaler; Palo Alto Networks; Cisco; Fortinet; Netskope; Cato Networks; Proofpoint; Barracuda Networks; Menlo Security; Cloudflare; Forcepoint; Skyhigh Security; Axis Security; VMware; Akamai

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Enterprise Size and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Security Service Edge Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the security service edge market report based on component, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Secure Web Gateway (SWG)

-

Cloud Access Security Broker (CASB)

-

Zero Trust Network Access (ZTNA)

-

Firewall-as-a-Service (FWaaS)

-

Data Loss Prevention (DLP)

-

Remote Browser Isolation (RBI)

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud-based

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Size Enterprise

-

Small and Medium Sized Enterprise (SMEs)

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT and Telecommunication

-

BFSI

-

Government & Public Sector

-

Healthcare

-

Retail and e-Commerce

-

Manufacturing

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global security service edge market size was estimated at USD 6.26 billion in 2024 and is expected to reach USD 7.56 billion in 2025.

b. The global security service edge market is expected to grow at a compound annual growth rate of 21.9% from 2025 to 2033 to reach USD 36.97 billion by 2033.

b. The solution segment accounted for the largest revenue share of 67.25% in the global Security Service Edge (SSE) market in 2024, driven by increasing enterprise demand for unified, cloud-native security platforms that support secure connectivity, data protection, and policy-based access control across distributed users and applications.

b. Some key players operating in the market include Zscaler, Palo Alto Networks, Cisco, Fortinet, Netskope, Cato Networks, Proofpoint, Barracuda Networks, Menlo Security, Cloudflare, Forcepoint, Skyhigh Security, Axis Security, VMware, Akamai and Others.

b. Factors such as the increasing adoption of SSE by enterprises to unify access control, threat protection, and data security across hybrid and multi-cloud environments plays a key role in accelerating the security service edge market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.