- Home

- »

- Agrochemicals

- »

-

Seed Coating Market Size & Share, Industry Report, 2033GVR Report cover

![Seed Coating Market Size, Share & Trends Report]()

Seed Coating Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Powder, Liquid), By Additive (Polymers, Colorants, Binders, Minerals), By Crop Type (Cereals & Grains, Oilseeds & Pulses), By Process (Encrusting, Pelleting), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-363-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Seed Coating Market Summary

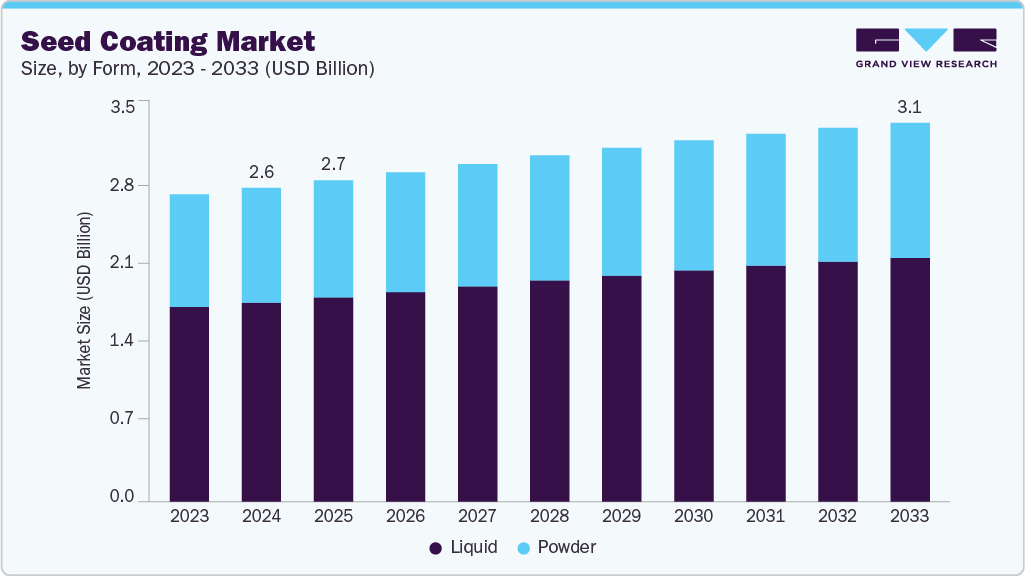

The global seed coating market size was estimated at USD 2,613.3 million in 2024 and is projected to reach USD 3,156.4 million by 2033, growing at a CAGR of 2.1% from 2025 to 2033. The market is primarily driven by the growing need to enhance seed performance and improve crop yield amidst shrinking arable land and increasing global food demand.

Key Market Trends & Insights

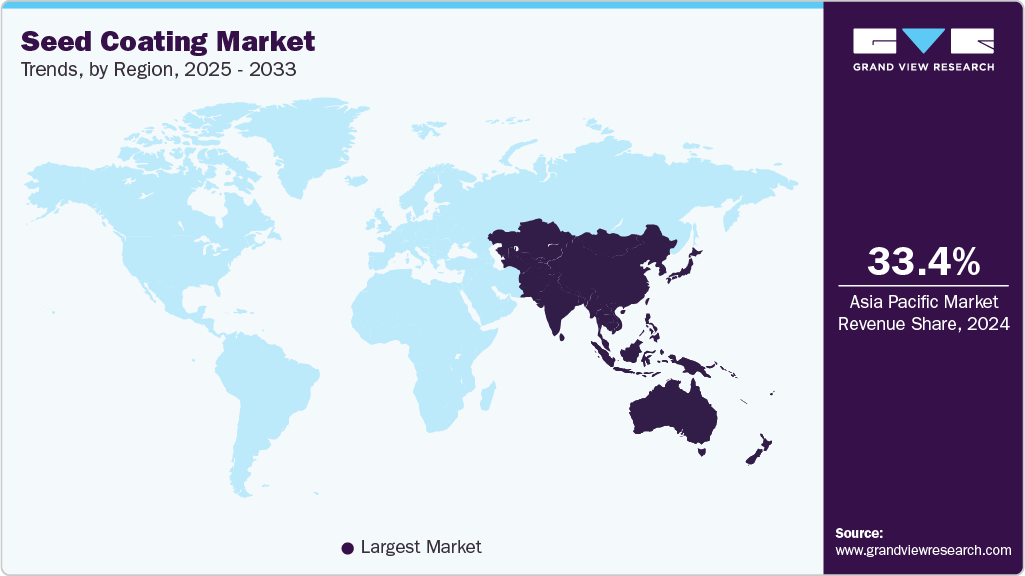

- Asia Pacific dominated the seed coating market with the largest revenue share of 33.4% in 2024.

- The market in China is expected to grow at a significant CAGR of 2.6% from 2025 to 2033.

- By form, the liquid seed coating segment dominated the market in 2024, accounting for a substantial 63.5% revenue share.

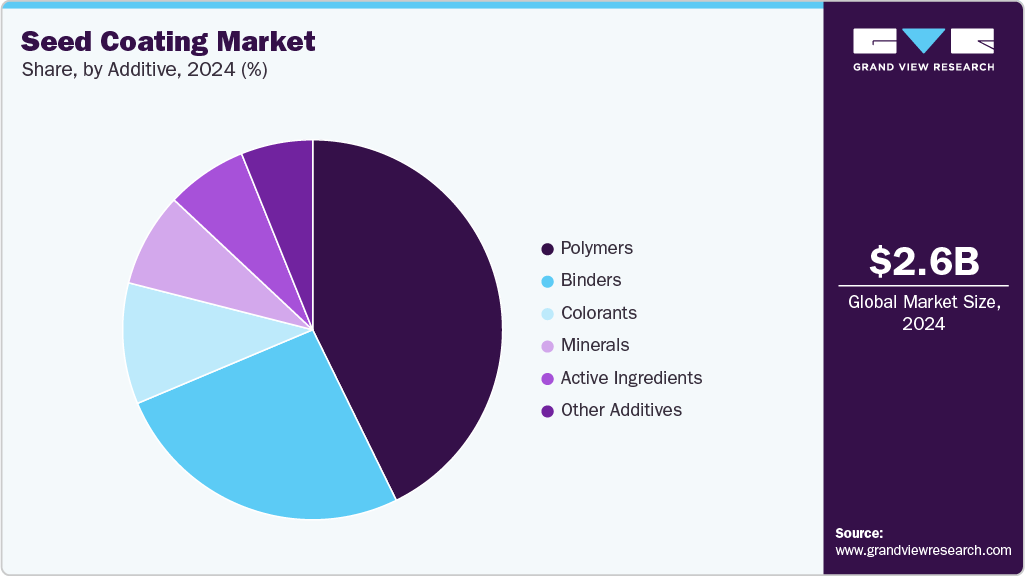

- By additive, the polymers emerged as the leading seed coating additive in 2024, accounting for a dominant 42.7% share of total market revenue.

- By crop type, the cereals & grains segment accounted for the largest revenue share of 43.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,613.3 Million

- 2033 Projected Market Size: USD 3,156.4 Million

- CAGR (2025-2033): 2.1%

- Asia Pacific: Largest market in 2024

The rising adoption of precision agriculture and advanced farming technologies has accelerated the use of coated seeds, especially in high-value and large-scale farming operations. In addition, the increasing focus on improving seed germination rates, uniform emergence, and early-stage pest protection is encouraging the integration of active ingredients, polymers, and micronutrients into seed coatings.The market offers significant opportunities with the rising demand for sustainable and organic seed coatings, driven by global shifts toward environmentally friendly farming practices. Advancements in biological additives, such as microbial inoculants and biostimulants, are opening new avenues for innovation and differentiation. In addition, expanding agricultural activities in emerging economies across Asia Pacific, Latin America, and Africa, supported by government initiatives and increased awareness about seed quality, are expected to create lucrative growth prospects for market participants.

Despite its advantages, the market faces challenges such as the high costs of seed coating technologies and raw materials, which can restrict adoption among small and medium-scale farmers. Moreover, variability in seed performance under different climatic and soil conditions may hinder consistent outcomes, reducing farmer confidence in certain regions. Regulatory restrictions on chemical-based additives and growing scrutiny over environmental impact also pose barriers to market expansion, particularly in Europe and North America.

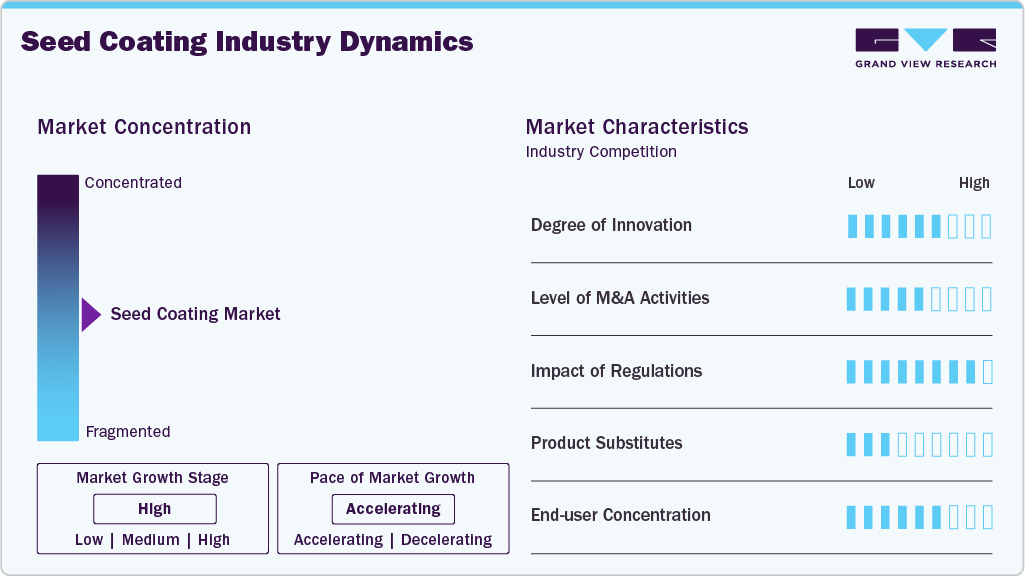

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Solvay, BASF SE, Croda International Plc, Clariant, and DSM, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the seed coating market are adopting a mix of strategic initiatives to strengthen their market position and address evolving agricultural demands. Key strategies include product innovation focused on sustainable and biodegradable coatings, integration of biological additives such as biopesticides and microbial inoculants, and developing customized formulations for specific crops and regional climates. Companies are also engaging in strategic partnerships and collaborations with seed producers, agrochemical firms, and research institutions to expand their technological capabilities and global footprint.

Form Insights

The liquid seed coating segment dominated the market in 2024, accounting for a substantial 63.5% revenue share, owing to its superior performance characteristics and widespread adoption in commercial agriculture. Liquid coatings offer enhanced adhesion, uniform seed coverage, and better compatibility with a broad range of additives such as polymers, colorants, and active ingredients. These coatings facilitate precise and efficient application, improving seed handling, flowability, and germination consistency. The growing emphasis on precision farming and the need for high-quality, pre-treated seeds, especially in crops like cereals, oilseeds, and vegetables, have further contributed to the segment’s market leadership.

In contrast, while powder-based coatings remain cost-effective and are used in traditional or small-scale farming setups, they lack the consistency and binding strength of liquid formulations. The increasing demand for high-performance seed treatments and the integration of biologically active compounds, requiring liquid dispersal systems, continue to shift market preference toward liquid forms. Additionally, advancements in seed coating equipment and automation technologies are better aligned with liquid formulations, making them the preferred choice for large seed processors and agribusinesses seeking scalability and operational efficiency.

Additive Insights

The polymers emerged as the leading seed coating additive in 2024, accounting for a dominant 42.7% share of total market revenue, driven by their critical role in enhancing seed protection, durability, and controlled-release functionality. Polymers act as binding agents that ensure uniform coating, improve adhesion of other additives, and form a protective barrier around the seed, preventing moisture loss and mechanical damage. Their versatility in both liquid and film coating processes, along with compatibility with a wide range of chemical and biological inputs, makes them indispensable in modern seed treatment solutions. Additionally, the growing adoption of polymer-based biodegradable and water-soluble formulations aligns with sustainability trends, further fueling demand.

Other additive categories such as colorants, binders, minerals, and active ingredients serve specialized roles, colorants aid in seed differentiation and safety compliance, binders enhance coating adhesion, minerals provide micronutrient support, and active ingredients deliver protection against pests and diseases. While these additives are essential, their effectiveness is often dependent on the structural base provided by polymers. As seed companies increasingly pursue integrated formulations for high-value crops, the demand for advanced polymer systems, capable of encapsulating active ingredients while maintaining seed vigor, continues to position this segment at the forefront of additive innovation and revenue generation.

Crop Type Insights

The cereals & grains segment accounted for the largest revenue share of 43.0% in 2024, driven by the vast global acreage dedicated to staple crops such as wheat, corn, rice, and barley. These crops form the cornerstone of food security across developed and developing nations, driving consistent demand for high-quality, treated seeds. Seed coating is widely adopted in cereals and grains to enhance uniform germination, improve seed flow during mechanical sowing, and provide early-stage protection against pathogens and pests. Additionally, large-scale commercial farming operations in key agricultural economies, such as the United States, China, Brazil, and India, have accelerated the uptake of coated cereal seeds to ensure higher yields and operational efficiency.

While other crop types such as oilseeds & pulses, fruits & vegetables, and flowers & ornamentals are gaining traction, particularly with the expansion of high-value and export-oriented farming, their total cultivated area remains significantly lower than that of cereals and grains. Moreover, seed coating in cereals is cost-effective and scalable, making it particularly attractive for both seed manufacturers and farmers operating in high-volume markets. As global food demand continues to rise, coupled with the need for sustainable agricultural inputs, the cereals & grains segment is expected to maintain its dominant position in the crop-type outlook of the seed coating market.

Process Insights

The pelleting segment captured the largest revenue share of 54.4% in 2024, driven by its advanced functionality and high precision in sowing applications. Pelleting involves transforming irregular-shaped seeds, such as lettuce, carrots, or flower seeds, into uniformly round units by adding inert materials, significantly enhancing planting accuracy and flowability in automated equipment. This method is particularly favored in high-value crops and horticultural sectors where uniform plant spacing and efficient seedling emergence are critical for maximizing yield and resource efficiency. Moreover, pelleting enables the incorporation of multiple active ingredients, including micronutrients, biostimulants, and protective agents, making it a preferred solution for value-added, multi-functional seed treatment.

Although film coating and encrusting remain widely used, especially for field crops and cost-sensitive applications, they typically involve thinner layers and less structural modification compared to pelleting. Film coating is popular for cereals and oilseeds due to its simplicity and minimal impact on seed size, while encrusting serves as a middle ground, offering slight increases in weight and improved handling. However, the versatility, mechanical precision, and compatibility with sophisticated sowing machinery have positioned pelleting as the most commercially viable and revenue-generating process, particularly in regions with advanced agricultural practices and intensive farming systems.

Regional Insights

Asia Pacific seed coating market held the largest share of the global market in 2024, accounting for 33.4% of total revenue, driven by rapid agricultural expansion, rising demand for high-yield crops, and government initiatives promoting seed quality enhancement. Countries such as India, China, Australia, and Southeast Asian nations are increasingly adopting coated seeds in cereals, rice, pulses, and vegetables to meet growing food security demands and export opportunities. Additionally, the region benefits from a large agricultural workforce, expanding mechanization, and rising awareness of precision farming techniques, further accelerating the adoption of advanced seed coating technologies.

China seed coating market represents a major contributor within the Asia Pacific seed coating market, supported by its vast agricultural base and strong government emphasis on improving seed performance and food self-sufficiency. With a focus on increasing crop productivity and reducing agrochemical inputs, Chinese seed producers are integrating coatings with biological and micronutrient additives. Rapid industrialization of agriculture, large-scale commercial farming in northern provinces, and the growth of protected cultivation for vegetables and ornamentals have positioned China as a key market for both film coating and pelleting technologies.

Latin America Seed Coating Market Trends

Latin America held a substantial 26.4% market share in 2024, fueled by large-scale cultivation of soybean, corn, and other cash crops, particularly in Brazil and Argentina. The region benefits from a strong export-oriented agricultural model and increasing mechanization, driving demand for coated seeds that support uniform sowing and yield consistency. Favorable climate conditions, growing awareness of seed technology benefits, and partnerships between global agribusinesses and regional players are contributing to the rapid expansion of both polymer-based coatings and pelleted seed formats.

Brazil seed coating marketstands as a key growth engine in the global seed coating market, driven by its dominant position in global soybean, corn, and cotton production. The country’s highly developed agribusiness sector and expansive commercial farming operations have accelerated the adoption of advanced seed coating technologies, particularly in the pelleting and film coating segments. Brazilian farmers are increasingly utilizing coated seeds to enhance plantability, protect against soil-borne pests, and optimize yield performance across large-scale plantations.

Europe Seed Coating Market Trends

European market captured 19.5% of the global seed coating market revenue in 2024, underpinned by strict seed quality standards, growing demand for organic and low-input farming, and government support for sustainable agriculture. The region exhibits strong adoption of eco-friendly seed coating formulations, with emphasis on biodegradable polymers and biological additives that comply with EU regulatory frameworks. High-value crops such as vegetables, fruits, and ornamentals, often cultivated under controlled conditions, drive the demand for pelleting and encrusting technologies, especially in countries such as Germany, France, and the Netherlands.

Seed coating market in Germany plays a pivotal role in the European seed coating market, driven by its highly mechanized agricultural sector and advanced seed treatment infrastructure. German seed companies prioritize quality, traceability, and regulatory compliance, leading to the widespread use of environmentally sustainable coatings. The country shows high demand for pelleted seeds in vegetable farming and controlled-environment agriculture, with a focus on reducing chemical usage through precision seed treatments. Germany also serves as a hub for R&D in novel coating materials and seed enhancement technologies.

North America Seed Coating Market Trends

North America accounted for 16.3% of the market in 2024, supported by the widespread adoption of precision agriculture, advanced seed technologies, and strong R&D investments by leading agri-input companies. The region is characterized by high usage of coated seeds in genetically modified (GM) and hybrid crops, particularly corn, soybean, and canola. Technological innovations in biologically active seed coatings and sustainability-driven formulations are gaining momentum, especially as environmental regulations and climate-resilient farming practices influence product development and adoption.

U.S. Seed Coating Market Trends

The United States remains the core market within North America, with robust adoption of coated seeds in large-scale monoculture farming and contract seed production. U.S. agribusinesses are leveraging pelleting and film coating techniques to improve seed flowability, optimize planting rates, and ensure early-stage crop protection. Regulatory support for advanced agri-tech and partnerships between seed companies and research institutions continue to drive innovation in polymer coatings and bio-based additives. Demand is particularly strong in crops such as maize, soybean, and vegetables cultivated in the Midwest and California regions.

Middle East & Africa Seed Coating Market Trends

The Middle East & Africa region is an emerging market in the seed coating industry, with growth supported by efforts to enhance agricultural productivity, food security, and water-use efficiency. While adoption is still in early stages, countries such as South Africa, Kenya, Saudi Arabia, and the UAE are increasingly exploring coated seeds to improve crop resilience under arid and semi-arid conditions. International development programs, government subsidies, and private sector investments in agricultural modernization are gradually driving uptake, particularly in staple crops and horticultural segments.

Key Seed Coating Company Insights

Key players, such as Solvay, BASF SE, Croda International Plc, Clariant, DSM, Precision Laboratories LLC, are dominating the market.

-

Solvay is a leading global chemical company that plays a significant role in the seed coating market through its portfolio of high-performance polymers, binders, and specialty additives. Leveraging its deep expertise in advanced materials and sustainable chemistry, Solvay provides innovative solutions that enhance seed protection, improve adhesion, and support the controlled release of active ingredients. The company is actively focused on developing bio-based and eco-friendly coating materials aligned with evolving regulatory standards and sustainable agriculture trends. Through strategic R&D investments, partnerships with agricultural technology firms, and a commitment to green innovation, Solvay continues to strengthen its position as a trusted supplier to seed treatment and crop protection companies worldwide.

Key Seed Coating Companies:

The following are the leading companies in the seed coating market. These companies collectively hold the largest market share and dictate industry trends.

- Solvay

- BASF SE

- Croda International Plc

- Clariant

- DSM

- Precision Laboratories LLC

- Chromatech Incorporated

- Germains Seed Technology

- Universal Coating Systems

- Michelman Inc.

Global Seed Coating Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,677.1 million

Revenue forecast in 2033

USD 3,156.4 million

Growth rate

CAGR of 2.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, additive, crop type, process, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

Solvay; BASF SE; Croda International Plc; Clariant; DSM; Precision Laboratories LLC; Chromatech Incorporated; Germains Seed Technology; Universal Coating Systems; Michelman Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Seed Coating Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global seed coating market report based on form, additive, crop type, process, and region.

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Powder

-

Liquid

-

-

Additive Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polymers

-

Colorants

-

Binders

-

Minerals

-

Active Ingredients

-

Other Additives

-

-

Crop Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Flowers & Ornamentals

-

Other Crop Types

-

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Film Coating

-

Encrusting

-

Pelleting

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global seed coating market size was estimated at USD 2,613.3 million in 2024 and is expected to reach USD 2,677.1 million in 2025.

b. The global seed coating market is expected to grow at a compound annual growth rate of 2.1% from 2025 to 2033 to reach USD 3,156.4 million by 2033.

b. The liquid segment held the largest revenue share in 2024 due to its superior adhesion, uniform seed coverage, and compatibility with a wide range of additives, enhancing overall seed performance. Its ease of application and suitability for large-scale, precision farming further accelerated its adoption across key crop segments.

b. Some of the key players operating in the seed coating market include Solvay, BASF SE, Croda International Plc, Clariant, DSM, Precision Laboratories LLC, Chromatech Incorporated, Germains Seed Technology, Universal Coating Systems, Michelman Inc.

b. The seed coating market is driven by the growing demand for high-yield, high-quality seeds amid shrinking arable land and increasing global food needs. Advancements in precision agriculture and rising adoption of biologically active seed treatments are fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.