- Home

- »

- Biotechnology

- »

-

Sequencing Consumables Market Size & Share Report, 2033GVR Report cover

![Sequencing Consumables Market Size, Share & Trends Report]()

Sequencing Consumables Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Kits, Reagents, Accessories), By Platform (1st Generation, 2nd Generation, 3rd Generation), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-149-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sequencing Consumables Market Summary

The global sequencing consumables market size was estimated at USD 8.42 billion in 2024 and is projected to reach USD 55.62 billion by 2033, growing at a CAGR of 23.49% from 2025 to 2033. Continuous advancements in sequencing technologies and a growing emphasis on genomics research are the primary factors driving the global sequencing consumables industry's overall growth.

Key Market Trends & Insights

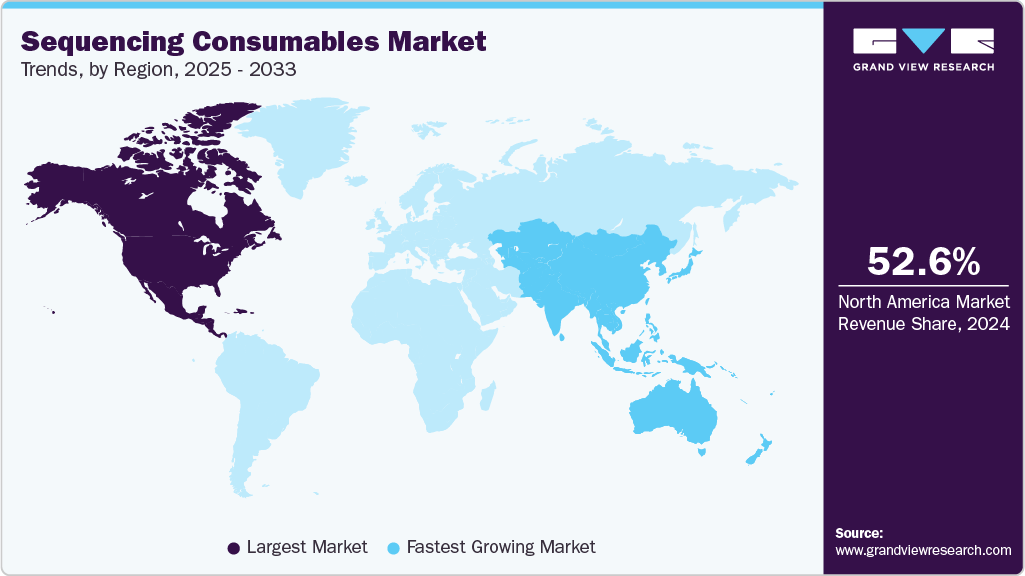

- The North America sequencing consumables market held the largest share of 52.61% of the global market in 2024..

- The sequencing consumables industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the kits segment held the highest market share of 81.10% in 2024.

- Based on platform, the second-generation sequencing consumables segment held the highest market share in 2024.

- By application, the cancer diagnostics segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.42 Billion

- 2033 Projected Market Size: USD 55.62 Billion

- CAGR (2025-2033): 23.49%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As sequencing technologies evolve, they become more efficient, accurate, and capable of handling larger volumes of data, which drives the increased adoption of sequencing in various fields, including genomics and personalized medicine.

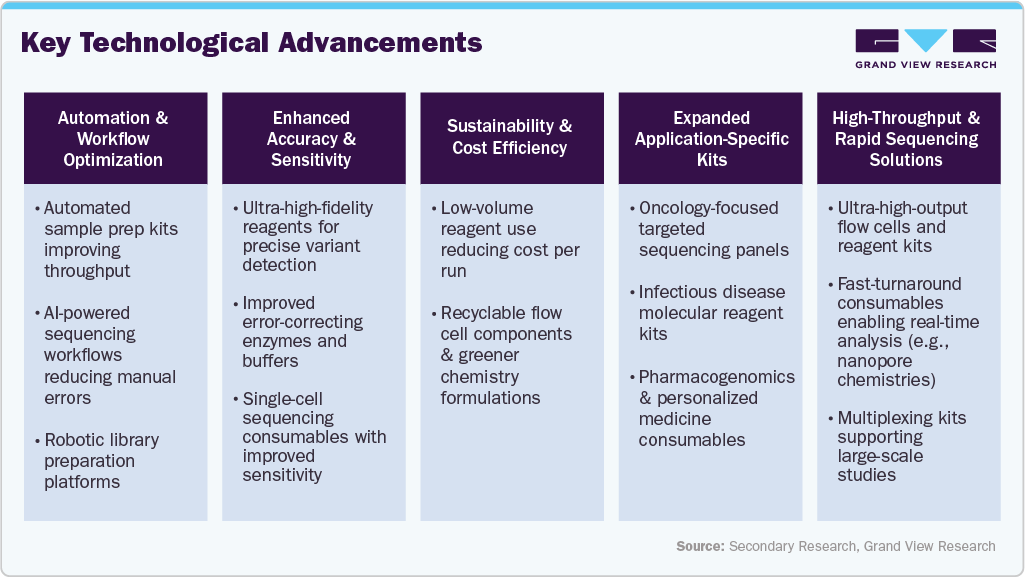

Rapid Technological Advancements

The rapid advancement of sequencing technologies significantly drives the sequencing consumables market. The shift from legacy sequencing technologies to next-generation sequencing systems, which include accessible high-throughput short-read, real-time long-read sequence, and new emerging ultra-high-accuracy single-cell sequencing technologies, is fueling ongoing increases in demand for defined consumables. New sequencing technologies unlock enhanced sensitivity and speed through chemistry, workflows, and throughput, which necessitate new classes of reagents, buffers, library preparation kits, adapters, and sequencing chips.

At the same time, the producers have also been working on consumables specific to more advanced platforms such as nanopore flow cells, long-read sequencing cartridges, and microfluidic single-cell kits. The accelerated implementation of automated platforms, which involve integrated sample-to-result workflows and cloud-connected sequencing components, continues to increase capacities and offer reliable sales of consumables for compatible technologies.

Surge in Genomic Research

Growing global investments in genomic research and large-scale population sequencing programs are significantly accelerating demand in the sequencing consumables market. Governments, academic consortia, and private organizations are increasing funding to decode genetic diversity, understand disease mechanisms, and build national genomic databases.

The growing culture of collaborative genomics research, supported by strong public-private funding, is further expanding the installed base of sequencing instruments worldwide, thereby amplifying consumables usage as sequencing shifts from periodic experiments to routine, scaled genomic workflows.

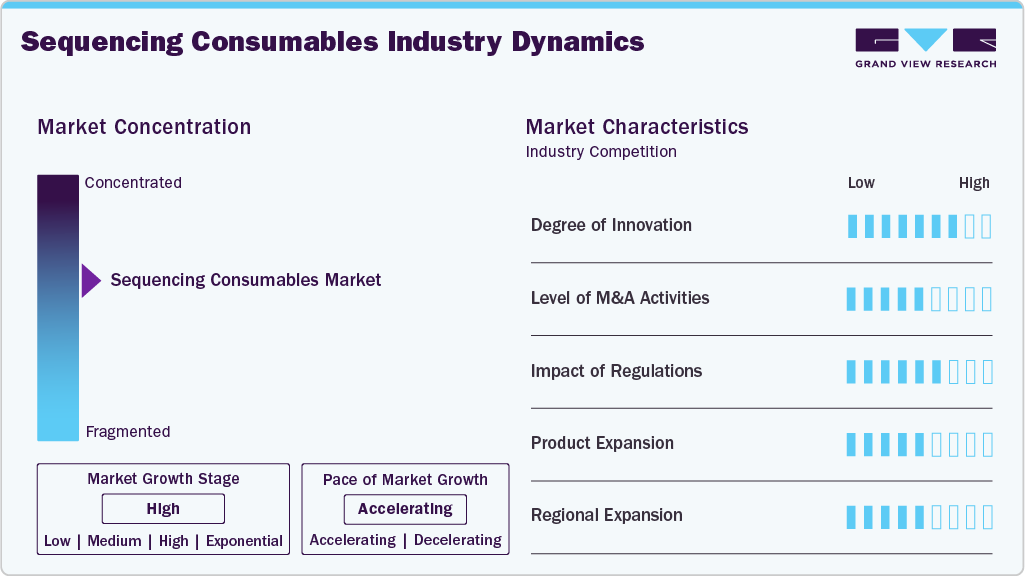

Market Concentration & Characteristics

The sequencing consumables industry exhibits a high degree of innovation, driven by continued advancements in sequencing chemistries, automated library prep kits, and high-density flow cells that enhance speed, accuracy, and throughput. Companies are developing specialized reagents, cartridge-based consumables, and multi-omic sample prep solutions designed for next-generation and single-cell sequencing platforms. For instance, in October 2025, PacBio announced innovations for its Revio and Vega platforms, including new SPRQ-Nx reagents and consumables, that aim to decrease sequencing costs by up to 40% and optimize long-read capabilities.

M&A activity in the sequencing consumables industry is moderate but increasing as competition intensifies and demand for high-performance consumables increases. Continued consolidation between mid-sized companies and more specialized technology companies is likely to occur. For instance, in April 2025, Eurofins Genomics acquired LGC's Sanger sequencing operations, thereby expanding Eurofins' Sanger capacity and closing gaps in its broad genomic services offering, particularly in sequencing and gene production.

Regulations have a significant impact on the sequencing consumables industry, particularly as genomic testing expands into clinical and diagnostic applications. In addition, supportive policies related to the advancement of precision medicine and companion diagnostics are contributing to our market expansion.

Product growth in the sequencing consumables industry is expanding rapidly, as companies introduce new products to support various sequencing applications and next-generation sequencing platforms. Companies are increasing the availability of new, specialized reagents, high-throughput library preparation kits, and cartridges designed for use in long-read, single-cell, or multi-omic processes and projects, thereby expanding their overall portfolio of offerings. This range of product offerings supports improved workflows and more utilization within research, clinical research, and biopharma applications.

Regional expansion in the sequencing consumables market is accelerating as companies target high-growth regions, including the Asia-Pacific, the Middle East, and Latin America. The suppliers are improving access, streamlining supply chain efficiencies & capabilities, and enabling the advancement of genomics and precision medicine efforts across these emerging markets via strengthened local partnerships, distribution networks, and manufacturing footprints.

Product Insights

The kits segment dominated the market in 2024 with a revenue share of over 81.11%, driven by their convenience, reliability, and standardized workflows. Pre-optimized and quality-controlled parts reduce errors and hands-on time, making kits ideal for high-throughput sequencing environments. For instance, in September 2025, Quantum-Si launched its V4 Sequencing Kit, which expands coverage of the proteome with enhanced amino-acid recognition, extended barcoding, and bioinformatics for advanced single-molecule protein sequencing applications.

The reagents segment is anticipated to grow at fastest CAGR from 2025 to 2033. Sequencing consumable reagents produce various layers of genomic data vital for drug development, ranging from studying genomic alterations to profiling the transcriptome. This versatility is anticipated to drive substantial growth in this market segment.

Platform Insights

Based on the platform, the second-generation sequencing consumables segment dominated the segment with a revenue share of over 66.87% in 2024. Second-generation sequencing consumables are known for their high-throughput ability, accuracy, and low cost, which enables a variety of project types. Moreover, the ability to reduce the risk of artifacts introduced by cloning or PCR amplification by analyzing individual molecules at a time further contributes to the segment's dominance.

The third-generation sequencing consumables segment is expected to grow at the fastest CAGR in the forecast period. Third-generation sequencing technology, as developed, is one of the most advanced technologies, offering longer read times that mitigate many computational hurdles surrounding genome assembly and transcript reconstruction. It also contributes to the segments' rising demand as it has a faster turnaround time than second-generation sequencing, making it a preferred option compared to other technologies.

Application Insights

The cancer diagnostics segment dominated the market in 2024 with a revenue share of 26.85%, supported by the increasing need for accurate and personalized cancer care. A key factor driving demand for consumables used in mutation detection, biomarker discovery, and disease monitoring is the rising incidence of cancer and the broader adoption of sequencing in oncology. Key players are continuing to offer cancer-oriented products; for example, Illumina's TruSight Oncology 500 consumables allow more expansive genomic profiling of tumor samples.

The pharmacogenomics segment is anticipated to show a significant CAGR of 24.38% through the forecast period because of its immense potential for understanding how human genes influence the way people respond to medical treatment. Therefore, increased clinical adoption of pharmacogenomics will drive the demand for sequencing consumables, including reagents, library preparation kits, and target enrichment solutions. This demand will be a factor driving growth during the forecast period.

End Use Insights

The hospitals and laboratories segment captured the highest revenue share in 2024 at 36.03%. Hospitals leverage sequencing consumables for cancer detection, infectious disease testing, and personalized medicine. At the same time, clinical labs and research institutions rely on them for genomics research, disease studies, and drug development, further supporting the segment growth.

The pharmaceutical and biotechnology companies segment is anticipated to register the fastest CAGR over the forecast period, driven by their increasing adoption of genomics technologies for drug discovery, development, and precision medicine initiatives. Sequencing consumables are crucial for enabling pharmaceutical and biotechnology companies to identify drug targets, conduct biomarker research, and assess the safety and efficacy of pharmaceutical compounds. This is expected to propel the pharmaceutical and biotechnology companies segment over the forecast period.

Regional Insights

North America dominated the market, accounting for a revenue share of 52.61% in 2024. The regional market is driven by the presence of multiple clinical laboratories that employ NGS to provide genetic testing services. In addition, substantial government investments in genomics research also contribute to the market growth in the region.

U.S Sequencing Consumables Market Trends

The U.S. sequencing consumables industry is expanding rapidly, driven by the strong adoption of NGS in precision medicine, oncology, and infectious disease surveillance. Significant research funding, clinical lab capacity, and growth in high-throughput sequencing at academic and biopharma centers continue to boost demand for sample-prep kits, reagents, and sequencing cartridges, reinforcing the U.S. as a leading global market.

Europe Sequencing Consumables Market Trends

The market for sequencing consumables in Europe is continuing to grow. More specifically, sustained demand for reagent kits and library preparation solutions is arising from the expansion of clinical sequencing in oncology, infectious disease tracking, and reproductive genomics. For instance, in August 2025, Eurofins Genomics relocated and expanded its NGS activities across parts of Europe, increasing sequencing capacity and access to regional services to support the growing demand for sequencing consumables and integrated workflows in genomics.

The UK market for sequencing consumables is expanding due to a robust genomic research infrastructure, national precision medicine initiatives, and the increasing applications of next-generation sequencing (NGS) in cancer diagnostics, rare disease testing, and population-level sequencing, which supports market growth.

The market for sequencing consumables in Germany is expanding due to the strength of its ecosystem in clinical research, the growth of the biopharma sector, and the increased adoption of genomic tools in hospitals and academic institutions.

Asia Pacific Sequencing Consumables Market Trends

The Asia-Pacific sequencing consumables market is expected to record the fastest CAGR of 27.25% throughout the forecast period, driven by increasing investments in genomic research, the rising burden of genetic and chronic diseases, and the expansion of precision medicine programs. Moreover, Rapid advances in biotechnology capability and government-supported genomics initiatives position the Asia Pacific as a major future growth engine.

China is rapidly becoming a leading market for sequencing consumables, driven by significant government investment in genomics, the expansion of commercial sequencing labs, and large-scale cancer and population-genomics programs. Growing biotech activity and national innovation initiatives further boost demand and domestic production of sequencing consumables.

Japan's sequencing consumables market is growing, driven by strong research in genomics and molecular medicine, studies on aging-related diseases, and the increasing adoption of cancer sequencing. Precision-medicine investment and academic-industry collaboration continue to drive demand for reagents, NGS kits, and advanced sequencing chemistries. For instance, in January 2024, Quantum-Si established a partnership with Digital TOMY Biology to offer the Platinum protein sequencer and consumables.

MEA Sequencing Consumables Market Trends

The Middle East & Africa sequencing consumables market is growing, driven by rising genomic research programs, precision-medicine initiatives, and healthcare modernization. Increased cases of genetic disorders and cancer, as well as global partnerships, are increasing the need for sequencing reagents and clinical genomic workflows, mainly in GCC countries.

The sequencing consumables industry in Kuwait is experiencing steady growth. Economic diversification and research infrastructure upgrades are promoting the use of more sophisticated sequencing devices, while international academic and industry partnerships are building knowledge transfer and access to high-quality sequencing reagents and consumables.

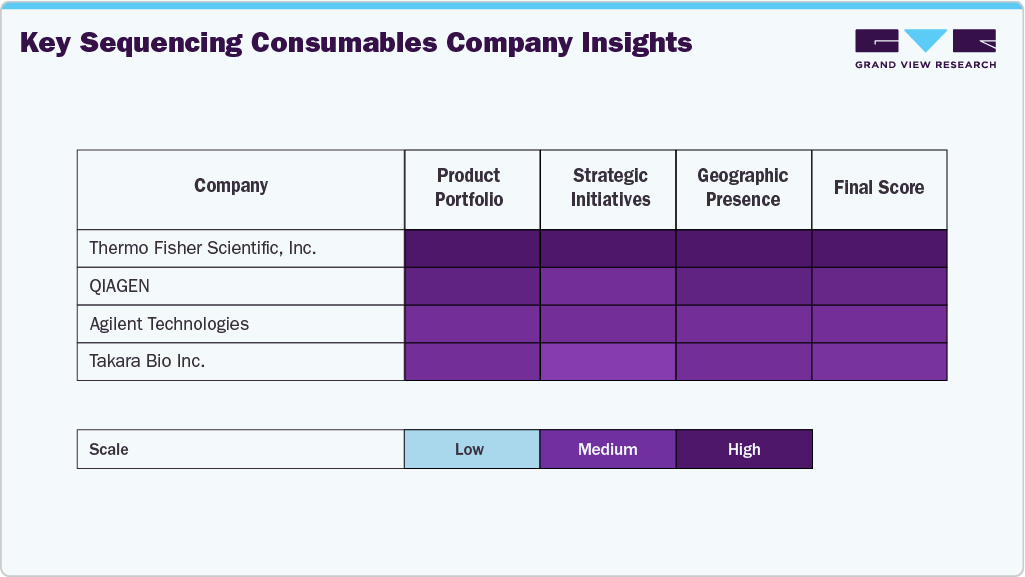

Key Sequencing Consumables Company Insights

The sequencing consumables industry is characterized by well-established players with strong product portfolios, extensive R&D capabilities, and global distribution networks. Leading companies such as Thermo Fisher Scientific, Hoffmann-La Roche Ltd, QIAGEN, Agilent Technologies, Millipore Sigma, Takara Bio Inc., and Oxford Nanopore Technologies maintain significant market share due to their advanced sequencing chemistries, proprietary consumable kits, and integrated workflow solutions that support clinical diagnostics, research, and applied genomics.

Companies such as Beckman Coulter, Eurofins Genomics, and BGI Genomics are expanding their market presence through their focus on automation-ready consumables, high-throughput processing, and cost-efficient sequencing reagents support growing adoption in emerging regions and decentralized genomic workflows.

With the increasing use of sequencing in clinical and applied settings, market leadership will increasingly hinge on reliability, scalability, cost-efficiency, and regulatory-ready consumable solutions.

Key Sequencing Consumables Companies:

The following are the leading companies in the sequencing consumables market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- QIAGEN.

- Agilent Technologies

- Millipore Sigma

- Takara Bio Inc

- Beckman Coulter, Inc

- Eurofins Genomics

- Oxford Nanopore Technologies Ltd

- Thermo Fisher Scientific, Inc

- BGI Genomics

Recent Developments

-

In July 2025, QIAGEN launched its QIAseq xHYB Long Read Panels in the Netherlands, expanding long-read NGS capabilities and addressing rising demand for advanced sequencing consumables to analyze complex genomic regions.

-

In April 2025, QIAGEN advanced plans in the Netherlands to launch three automated sample-prep instruments, enhancing genomics workflows and supporting rising sequencing consumables demand through improved lab automation and throughput.

Sequencing Consumables Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.28 billion

Revenue forecast in 2033

USD 55.62 billion

Growth rate

CAGR of 23.49% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, platform, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd.; QIAGEN; Agilent Technologies; Millipore Sigma; Takara Bio Inc.; Beckman Coulter, Inc.; Eurofins Genomics; Oxford Nanopore Technologies Ltd.; Thermo Fisher Scientific, Inc.; BGI Genomics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Sequencing Consumables Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global sequencing consumables market on the basis of product, platform, application, end use, and region.

-

Product Scope Outlook (Revenue, USD Million, 2021 - 2033)

-

Kits

-

DNA Library Preparation

-

RNA Library Preparation

-

Target enrichment

-

Library quantification

-

Purification & quality control

-

Others

-

-

Reagents

-

Sample Prep

-

Library preparation and amplification

-

Sequencing

-

-

Accessories

-

Collection tubes

-

Plates

-

Others

-

-

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

1st Generation sequencing Consumables

-

2nd Generation sequencing Consumables

-

3rd Generation sequencing Consumables

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cancer Diagnostics

-

Infectious Disease Diagnostics

-

Reproductive Health Diagnostics

-

Pharmacogenomics

-

Agrigenomics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical and biotechnology companies

-

Hospitals and laboratories

-

Academic research institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sequencing consumables market size was estimated at USD 8.42 billion in 2024 and is expected to reach USD 10.28 billion in 2025.

b. The global sequencing consumables market is expected to grow at a compound annual growth rate of 23.49% from 2025 to 2033 to reach USD 55.62 billion by 2033.

b. North America dominated the sequencing consumables market with a share of 52.61% in 2024. This is attributable to the large number of research institutes and biotechnology companies using sequencing consumables within the region

b. Some key players operating in the sequencing consumables market include Hoffmann-La Roche Ltd., QIAGEN, Agilent Technologies, Millipore Sigma, Takara Bio Inc., Beckman Coulter, Inc, Eurofins Genomics, Oxford Nanopore Technologies Ltd, Thermo Fisher Scientific, Inc, BGI Genomics

b. Key factors that are driving the market growth include continuous advancement in sequencing technologies and growing emphasis on genomics research across the globe

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.