- Home

- »

- Next Generation Technologies

- »

-

Shared Mobility Market Size, Share & Growth Report, 2030GVR Report cover

![Shared Mobility Market Size, Share & Trends Report]()

Shared Mobility Market (2023 - 2030) Size, Share & Trends Analysis Report By Service Model (Ride Hailing, Bike Sharing, Ride Sharing, Car Sharing), By Channel, By Vehicle (Cars, Two-wheelers), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-746-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Shared Mobility Market Summary

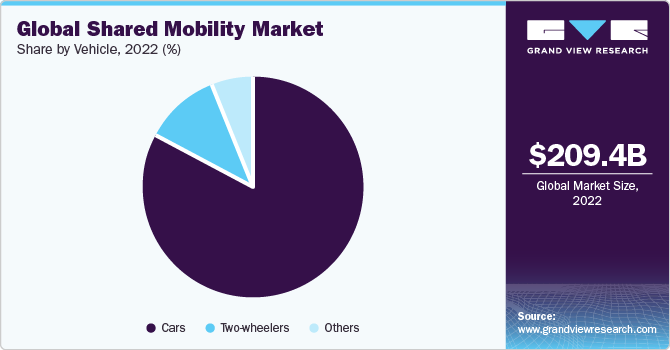

The global shared mobility market size was estimated at USD USD 209.42 billion in 2022 and is projected to reach USD 675.36 billion by 2030, growing at a CAGR of 14.8% from 2023 to 2030. Market's growth can be attributed to the rise of ride-hailing services such as Uber and Lyft, which have disrupted traditional taxi services.

Key Market Trends & Insights

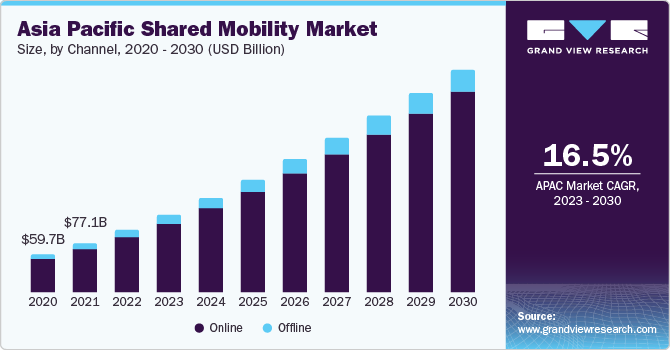

- In terms of region, Asia Pacific was the largest revenue generating market in 2022.

- Country-wise, India is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, ride hailing accounted for a revenue share of 55.0% in 2022.

- Bike sharing is the most lucrative service model segment registering CAGR of 19.0% during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 209.42 billion

- 2030 Projected Market Size: USD 675.36 billion

- CAGR (2023-2030): 14.8%

- Asia Pacific: Largest market in 2022

In addition, growing popularity of car-sharing services such as Zipcar and Car2Go and the emergence of bike-sharing and scooter-sharing services such as Lime and Bird have also contributed to the market growth.

Widespread adoption of mobile apps enables users to access and book car-pool services quickly and easily. Such apps provide real-time information on vehicle availability, pricing, and location, making it easier for users to plan their trips and navigate cities. Electric vehicles also benefit from advancements in battery technology which have increased their range and made them more practical for car-pool services. Electric and hybrid cars are increasingly used in shared mobility services as they offer more sustainable and environmentally friendly transportation options.

Electric vehicles have zero emissions and can be charged from renewable energy sources, making them a key solution in transitioning to a low-carbon economy. Hybrid vehicles combine an electric motor with a gasoline engine reducing emissions and increasing fuel efficiency. Companies like Uber and Lyft are increasingly offering electric and hybrid vehicles as a part of their fleets providing riders with a more sustainable option.

Car-sharing companies like Zipcar and Car2Go also introduced electric and hybrid vehicles to their fleet, giving users access to better short-term rental options. Use of electric and hybrid vehicles in the market is expected to grow in upcoming years as cities and governments increasingly prioritize sustainable transportation solutions to reduce carbon emissions and improve air quality.

Consumer preferences are rapidly changing, driven by various factors such as need for convenience, sustainability, and cost-effectiveness. The younger generation is showing less interest in owning a car due to the shift from car ownership towards shared mobility services. In addition to a preference for carpooling, consumers increasingly prioritize sustainability in their transportation choices. This has led to a rise in the use of electric and hybrid vehicles in the market and the growth of bike-sharing and scooter-sharing services. Consumers also demand more convenience and flexibility in the services, which has led to the development of new business models and services. For example, Uber and Lyft have introduced ride-hailing services that offer on-demand transportation. In contrast, car-sharing services like Zipcar and Car2Go provide flexible pick-up and drop-off options for hourly rentals.

Bike-sharing programs typically involve a fleet of bicycles stationed at various locations throughout a city. Users can rent a bike for a short period, typically by scanning a QR code with their smartphone or swiping a membership card, and then return it to another station when finished. Bike sharing is often used for shirt trips such as community to work or running errands. Scooter-sharing programs operate similarly, with users renting electric scooters instead of bicycles. These scooters are often equipped with GPS trackers, allowing users to locate them through a mobile app and unlock them with a code. Like bike sharing, scooter sharing is often used for short trips, although it is generally considered faster than biking.

Machine learning and artificial intelligence are already being used to improve efficiency, safety, and user experience. AI can be used to analyze data from vehicle and predict when maintenance will be needed. This can help companies to schedule maintenance more efficiently, reduce downtime, and extend lifespan of their vehicles. Machine learning algorithms can analyze data on past usage patterns and weather conditions to forecast demand for the service in future. This can help companies allocate resources more effectively and avoid a supply shortage.

Market Dynamics

RISE IN ADOPTION OF AI AND CLOUD TECHNOLOGY IN LEGAL SERVICES

Urbanization is a phenomenon based on the economic, demographic, technological, psychological, and socio-cultural conditions. The main trigger of urbanization is the prospect of more jobs in cities. Such cities function as the center for business activities with many employment options in different sectors. However, as more people are concentrated in small areas, there is a higher need for efficient transport services. Sustainable mobility can be facilitated in congested urban areas using shared mobility systems that are affordable, convenient and time saving. In addition, there is a greater awareness of environmental concerns than before due to increased population concentration in urban centers. Electric shared mobility service has become a better alternative to the traditional vehicles that cause carbon emission which pollute the atmosphere and the air that we breathe, as well as contribute to traffic jams within a given city or area.

Traffic congestion is becoming an increasingly severe problem in most of the largest cities around the globe. The problem impacts economic costs and lowers quality of life in cities. However, the emergence of shared mobility has made it easier to solve this problem and optimize the transport resources utilization.

RISING COST OF VEHICLE OWNERSHIP GLOBALLY

According to American Automobile Association (AAA), in August 2023, the average annual cost in the first five years of new-car ownership rose to $12,182 this year, from $10,728 last year, reflecting increased purchase prices, maintenance costs and finance charges. That’s 16 percent of the median household income before taxes. The shared mobility market is experiencing a surge in popularity worldwide, driven in part by the rising cost of vehicle ownership. In many countries, owning a car has become increasingly expensive due to factors such as fuel costs, insurance premiums, and maintenance expenses. As a result, more and more people are turning to shared mobility solutions as a cost-effective alternative. Shared mobility encompasses a range of transportation options, including car-sharing services, ride-hailing apps, bike-sharing programs, and more. These services allow users to access vehicles on an as-needed basis, without the high upfront costs and ongoing expenses associated with owning a car.

Service Model Insights

Ride-hailing service model segment is gaining market traction with revenue share of around 55.0% in 2022. This model involves connecting drivers with passengers through a mobile application platform, making it easier and more convenient for people to find transportation on demand. Growth of ride-hailing has been driven by factors such as the increasing use of smartphones, the growth of the sharing economy, and a desire for more flexible and affordable transportation options. Convenience of ride-hailing services and the ability to easily compare prices and select preferred drivers have made them popular among customers. In addition to providing a convenient and affordable transportation option for individuals, ride-hailing services have also contributed to reducing traffic congestion and improving air quality in some cities. On the other hand, geographical expansion strategies of global ride hailing companies are further projected to create opportunities for segment’s growth. For instance, in October 2023, Yango, the ride-hailing app owned by Yandex N.V., expanded its presence by opening a new office in Dubai Internet City as a part of Dubai business park operator TECOM Group.

Bike-sharing service model segment is growing at the fastest growth rate, with a CAGR of around 19.0% during the forecast period of 2023-2030. This model involves renting bicycles to individuals for short-term use, typically through a mobile app platform. Bike-sharing services have become increasingly popular due to their affordability, convenience, and sustainability. They offer an environmentally friendly transportation option that is often faster and more flexible than other public transportation. In addition, bike-sharing services have contributed to reducing traffic congestion in some cities and promoting healthy and active lifestyles. They have also become important to customers' first and last-time connectivity. Many European city councils have awarded tenders to implement a few Bicycle Sharing Schemes (BSS) in the coming years. Government measures like these are also expected to increase the need for two-wheeled driving.

Vehicle Insights

Cars segment is gaining market traction by acquiring a market revenue share of around 83.0% in 2022. Growth of cars segment is driven by increasing demand for convenient, flexible, and affordable transportation options as more people look for alternatives to traditional car ownership as these services become more popular. In addition, rise of the gig economy and flexible work arrangements has also contributed to the growth of shared mobility as more people need to get around for work purposes. Increasing availability of electric and hybrid vehicles also supports the segment's growth. Many operators in the market are transitioning to electric and hybrid vehicles to reduce emissions and improve sustainability. These vehicles can also provide cost savings in the long term, as they require less maintenance and have lower fuel costs.

Two-wheeler segment is the highest-growing segment, with a CAGR of over 18.0% from 2023-2030. Ongoing trend of shared transportation has grown significantly in recent years, with various factors, such as rapid urban development, increased natural resources, limited energy resources, and economic concerns, expected to boost the global tourism market during the forecast period. Two-wheeler sharing is an inexpensive and fast option that commuters can use compared to other models. Many industrial players make a lot of money to expand their service line, while car sharing is estimated to prove a significant increase in demand during forecasting. It has a substantial impact on the decline in car ownership rates. The emergence of free-floating free models in developed countries, due to benefits such as flexibility and automation, is expected to increase the car share in the forecast period.

Regional Insights

Asia Pacific is gaining market traction by acquiring a market revenue share of around 54.0% in 2022. This region is home to some of the world’s largest and fastest-growing cities, and as a result, there is a growing demand for convenient and sustainable transportation options. Rapid growth of ride-hailing services in the region due to the presence of companies like Uber and Grab has seen tremendous success, as they offer a convenient and affordable alternative to traditional taxis. In addition, many of these companies have expanded their services to include other forms of transportation, such as bike sharing and car sharing.

Middle East and Africa is the highest growing market acquiring a CAGR of 17.0% during 2023-2030.This region is experiencing rapid urbanization and a growing population, contributing to the demand for more sustainable and efficient modes of transportation. Companies like Dyky and Lime are offering bike-sharing services in some of the larger cities, providing users with a convenient and environmentally friendly mode of transportation.

Key Companies & Market Share Insights

Shared mobility market is fragmented in nature. Market players are pursuing various strategies such as Key players in the global market are focusing on mergers, acquisitions, partnerships, and research & development to be able to separate their portfolio from competitors to stand out with their market presence and attract new users. Implementing emerging technologies like contactless payment and autonomous driving readiness drives the market towards technological process advancements.

In September 2023, Uber Technologies Inc., announced the launch of Uber One in Brazil, a new subscription program that will benefits to travel and who place grocery orders through the Uber application. The new subscription program includes journeys with cashback in Uber credits, free delivery, and exclusive deals, all for R$19.90 per month or R$198 per year. Some of the key players in the global shared mobility market include:

-

Car2Go

-

Deutsche Bahn Connect GmbH

-

DiDi Chuxing

-

Drive Now (BMW)

-

EVCARD

-

Flinkster

-

Grab

-

GreenGo

-

Lyft

-

Uber

-

Zipcar

Recent Development

-

In October 2023, Meitetsu Kyosho Co., Ltd. opened two new Kariteco Bike ports in Nagoya. The ports would provide vehicle-related services, such as car sharing, car leasing, and insurance and management.

-

In July 2023, Grab announced the acquisition of Trans-cab, a taxi operator in Singapore. The acquisition incorporates Trans-cab’s maintenance workshop, fuel pump operations, and car rental business. Additionally, the company will launch Grab Driver application, that would be integrated in mobile display units in Trans-cab taxis.

-

In March 2023, Zipcar, Inc. launched the next phase of carshare program across the city of New York. The company’ carsharing services would be on the streets of Kew Gardens Hills in Queens, West Village in Manhattan, and Bedford Park in the Bronx.

Shared Mobility Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 257.76 billion

Revenue forecast in 2030

USD 675.36 billion

Growth rate

CAGR of 14.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, consumer behavior analysis, leading regional games, competitive landscape, growth factors, and trends

Segments Covered

Service Model, channel, vehicle, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; Singapore; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Car2Go (ShareNow GmbH); Deutsche Bahn Connect GmbH; DiDi Chuxing; DriveNow; EvCard; Flinkster; Grab Holdings Limited; GreenGro; Lyft Inc.; Toyota Motor Corporation; Docomo Bike Share Inc.; Meitetsu Kyosho Co. Ltd.; Nissan Rental Solution Co. Ltd.; Earthcar Co. Ltd.; Times Mobility Co. Ltd.; Orix Corporation; Tembici; BlaBlaCar; Uber Technologies Inc.; Picap; Cabify Espana S.L.U.; 99Taxi; Zipcar Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Shared Mobility Market Report Segmentation

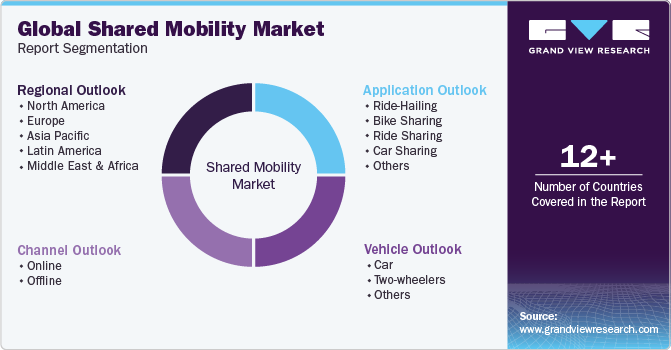

This report forecasts revenue growth and provides an analysis of the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global shared mobility market report based on service model, channel, vehicles, and region:

-

Service Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ride-Hailing

-

Bike Sharing

-

Ride Sharing

-

Car Sharing

-

Others

-

-

Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Car

-

Two-wheelers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

Latin America

-

Brazil

-

Mexico

-

Middle East and Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Frequently Asked Questions About This Report

b. The global shared mobility market is anticipated to expand at a CAGR of over 14.8% from 2023 to 2030 to reach USD 675.36 billion by 2030.

b. The ride-hailing segment dominated the market with over 60.0% of the revenue share in 2022. It is poised to maintain its dominance from 2023 to 2030 as well.

b. The major companies operating in the market are Uber, Car2Go, DiDi Chuxing, Drive Now (BMW), Deutsche Bahn Connect GmbH, and many others.

b. The global shared mobility market size was valued at USD 209.42 billion in 2022 and is expected to reach USD 257.76 billion in 2023.

b. The development of user-friendly mobile applications coupled with the increased use of smartphones has contributed significantly to the demand for shared mobility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.