- Home

- »

- Biotechnology

- »

-

Single-use Bioprocessing Market Size, Industry Report, 2030GVR Report cover

![Single-use Bioprocessing Market Size, Share & Trends Report]()

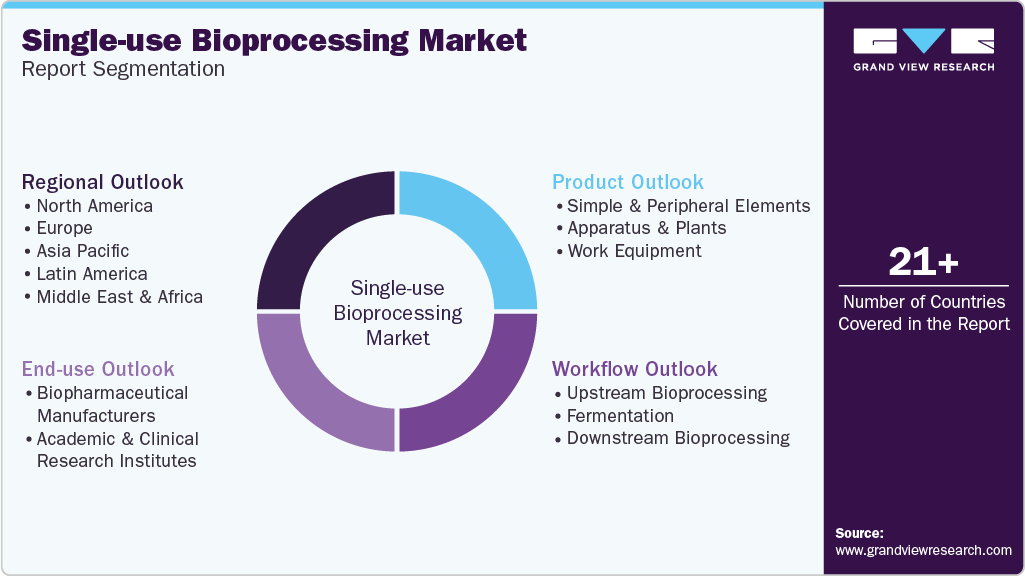

Single-use Bioprocessing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Simple & Peripheral Elements, Apparatus & Plants), By Workflow (Upstream, Downstream), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-370-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Single-use Bioprocessing Market Summary

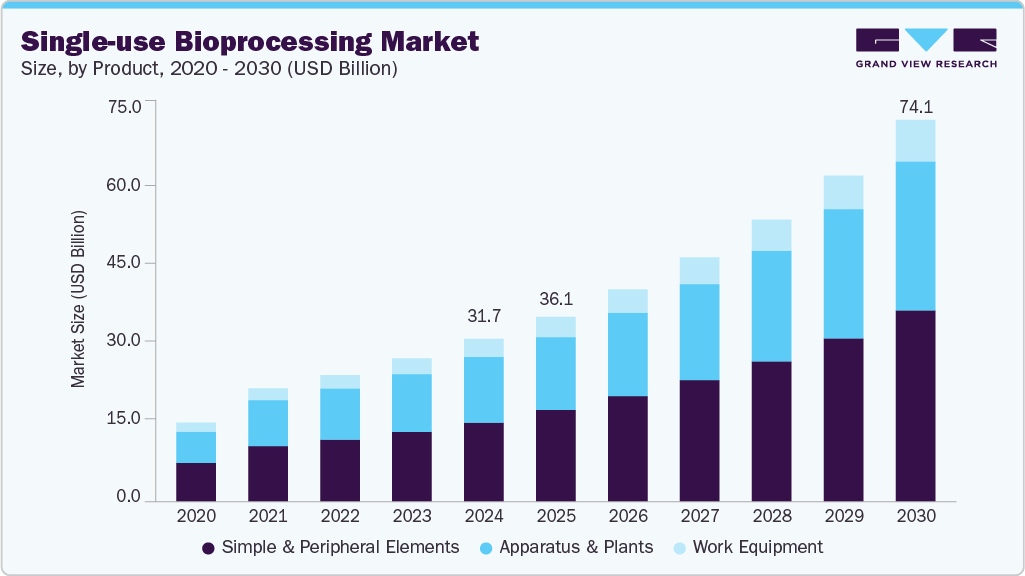

The global single-use bioprocessing market size was estimated at USD 31.71 billion in 2024 and is projected to reach USD 74.09 billion by 2030, growing at a CAGR of 15.44% from 2025 to 2030. Adoption of single-use bioprocessing technology is driven by the growing demand for biopharmaceuticals over the past few years, along with increase in investments for development of biologics, such as monoclonal antibodies, vaccines, recombinant proteins, and others.

Key Market Trends & Insights

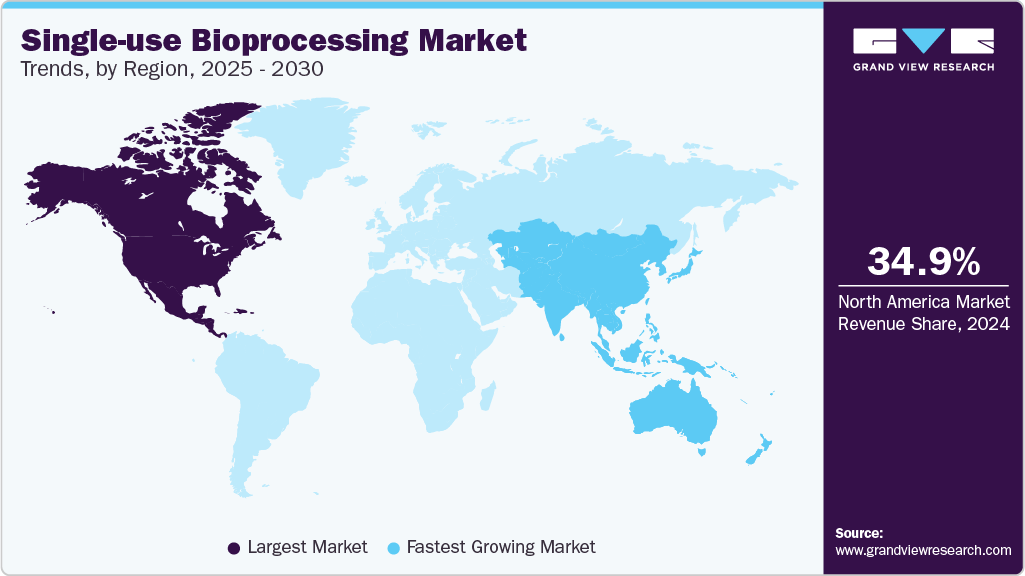

- North America held the largest revenue share of more than 34.96% in 2024.

- The U.S. market is driven by the strong presence of biopharmaceutical manufacturers.

- By product, the simple & peripheral elements segment recorded the largest market share of 48.82% in 2024.

- By workflow, upstream bioprocessing segment held the largest market share of 58.23% in 2024.

- By end use, the biopharmaceutical manufacturers dominated the market and accounted for the largest share 2024.

Market Size & Forecast

- 2024 Market Size: USD 31.71 Billion

- 2030 Projected Market Size: USD 74.09 Billion

- CAGR (2025-2030): 15.44%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, benefits pertaining to the use of single-use technology, such as significant reduction in costs and time required for operations & facility construction have supported the implementation of single-use systems in the bioprocessing sector. The COVID-19 pandemic has generated new growth opportunities for key stakeholders in the single-use bioprocessing industry. Key biopharmaceutical players can leverage the opportunity by expanding their COVID-19 related product offerings via scaling up their production facilities with the implementation of single-use bioprocessing equipment. A significant number of biopharmaceutical companies are actively involved in development and production of COVID-19 vaccines. These programs are majorly based on single-use technologies as these systems are flexible, cost-effective, and reduce risk of cross-contamination.

Such an ongoing and continuous increase in the adoption of these bioprocessing systems due to the COVID-19 pandemic is anticipated to drive single-use bioprocessing industry growth. The commercial success of biopharmaceuticals has led single-use manufacturers to expand their production facilities globally. Capacity expansion projects have been a part of many manufacturers’ multi-year plans, to leverage a global reach and a broader customer base. For instance, in December 2020, Merck KGaA invested over USD 42 million to broaden its existing manufacturing facilities in Danvers, Massachusetts, and Jaffrey, New Hampshire, U.S.

This expansion was aimed at enhancing the company’s single-use assembly operations along with other product portfolios. Furthermore, with the rising focus on the development of regenerative medicine, such as cell and gene therapies, increased success of clinical trials, and enhanced rate of regulatory approvals, demand for commercialization of these products is expected to grow in the near future. In addition, owing to the increasing outsourcing activities in biopharmaceutical manufacturing, CMOs are adopting single-use systems for maintaining highly dynamic and frequently changing product portfolios.

Consequently, the extensive implementation of single-use systems in CMOs across the globe is likely to boost industry growth. For instance, in July 2021, Pall Corp. signed a contract with Exothera S.A., a CDMO, to establish a manufacturing space using Allegro STR single-use bioreactors and other technologies. Although innovations in single-use technology are the current trend for the bioprocessing industry, the technology has still not completely displaced stainless steel reusable systems. High-volume biopharmaceutical product manufacturers continue to fixate on the multi-use system due to their feasibility at large scales. This represents a significant challenge for the single-use bioprocessing industry growth.

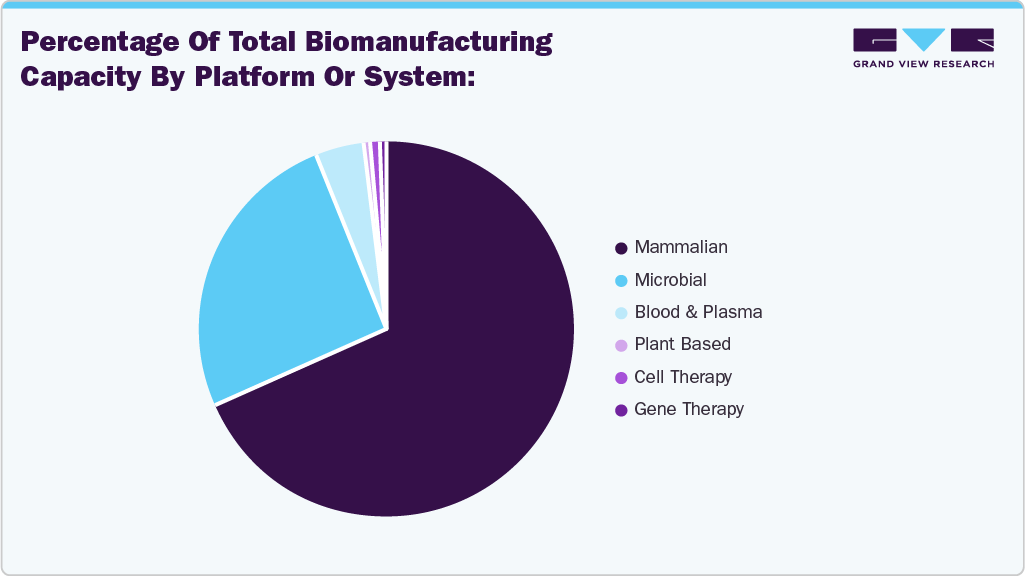

The above-mentioned figure of BioProcess International article illustrates the percentage distribution of global biomanufacturing capacity by platform or system. Between 2018 and 2021, the total global bioprocessing capacity increased from 16.5 million liters to 17.4 million liters. However, this growth rate has decelerated compared to previous years, indicating a shift in the industry’s focus from merely expanding capacity to enhancing productivity and efficiency. This transition is attributed to several factors, including advancements in cell culture technologies leading to higher titers, the widespread adoption of single-use systems reducing the reliance on large stainless-steel bioreactors, and a decrease in the approval of large-volume biologics, diminishing the need for massive production facilities. Consequently, the industry is now emphasizing strategies that optimize existing capacities, such as flexible facility designs and peak-demand planning, to meet evolving production requirements more effectively.

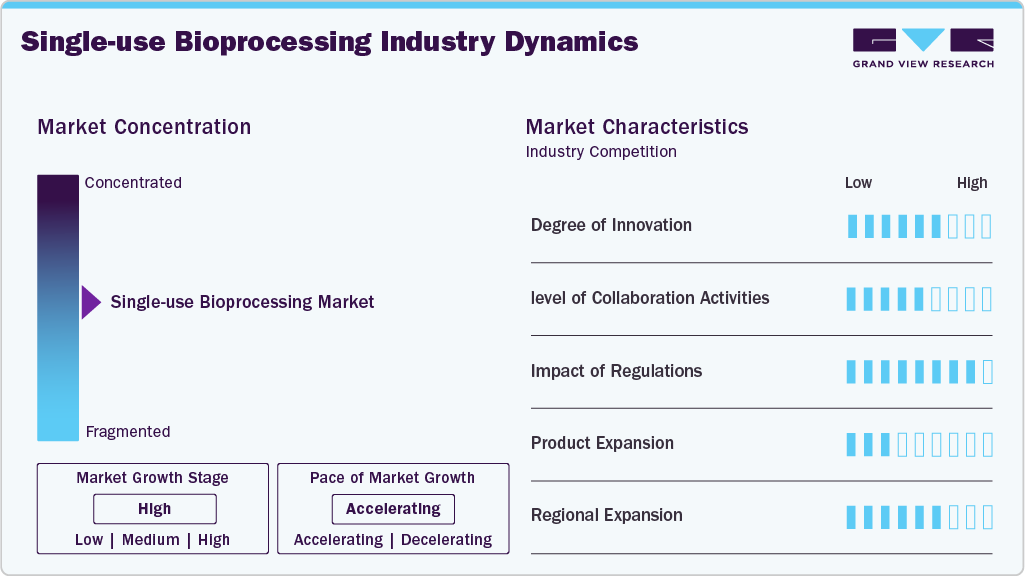

Market Concentration & Characteristics

The single-use bioprocessing industry demonstrates a moderately high degree of innovation, driven by increasing demand for flexible, scalable, and contamination-free solutions in biologics manufacturing. Continuous advancements are observed in material science (e.g., gamma-stable polymers), sensor integration for real-time monitoring, and automation technologies. Innovation is largely concentrated among established players and a few high-growth disruptors, contributing to improved efficiency, ease of use, and cost-effectiveness in bioprocess workflows.

The industry is characterized by a high level of collaboration, with partnerships between biopharmaceutical companies, CDMOs, technology providers, and academic institutions playing a critical role in accelerating development. Strategic alliances are frequently seen in areas such as technology licensing, co-development of modular platforms, and integration of single-use components into end-to-end bioprocessing solutions. These collaborations help address compatibility challenges, shorten time-to-market, and foster innovation.

Regulatory influence is significant but supportive, focusing on product safety, sterility assurance, and standardization. Agencies like the FDA and EMA have developed clear frameworks and guidelines to validate the use of single-use technologies (SUTs) in GMP environments. While these regulations ensure patient safety and product integrity, they can also slow adoption if suppliers are unable to meet stringent documentation, extractables/leachable testing, and quality control requirements. Compliance remains a barrier for new entrants but creates opportunities for quality-driven incumbents.

The single-use bioprocessing industry has witnessed extensive product expansion, with vendors broadening their portfolios beyond traditional bags and filters to include single-use bioreactors, mixers, connectors, sensors, and even integrated upstream and downstream systems. This expansion is fuelled by rising demand for flexible manufacturing platforms, particularly for cell and gene therapies and personalized biologics. Major players are also customizing products to cater to emerging markets and small-scale manufacturing needs, enhancing their global footprint and increasing competitive intensity.

The regional expansion of the single-use bioprocessing industry is being driven by increasing biologics manufacturing activity across emerging and established markets. North America and Europe remain the dominant regions due to mature biopharma infrastructures, strong regulatory frameworks, and early adoption of single-use technologies. However, rapid growth is being observed in Asia Pacific, particularly in countries such as China, India, and South Korea, where governments are investing heavily in biomanufacturing capabilities and local companies are scaling up production. Similarly, Latin America and the Middle East & Africa are seeing growing interest, largely fueled by international partnerships and the localization of pharmaceutical production. This global shift is prompting manufacturers to establish regional production hubs, expand distribution networks, and tailor products to meet local regulatory and operational requirements.

Product Insights

The simple & peripheral elements segment recorded the largest market share of 48.82% in 2024 due to continuous innovations in these products and increasing prominence of bioprocessing operations in overall manufacturing process. Tubing, filters, connectors, and transfer systems held a majority share within simple & peripheral elements as tubing and connectors are provided by most single-use suppliers in a compatible format with single-use bags, bioreactors, or other single-use bioprocessing apparatus. For instance, Thermo Fisher Scientific, Inc. offers customization options to add tubing and connectors to its bioprocessing container bags and other bioprocessing equipment. These factors are expected to drive the segment.

The apparatus & plants segment is projected to grow at a significant CAGR over the forecast period due to its significant penetration in the bioprocessing space majorly driven by a variety of single-use bioreactors. For instance, single-use bioreactors are available from a working volume range of 15 mL and 250 mL, such as the Ambr 15 and 250 sold by Sartorius AG, to a working volume of 6000 L, such as the CSR 7500 SUB sold by ABEC. This allows the End Users to easily scale products right from the stage of clone selection and benchtop production to harvesting high-volume yields of biologics. As a result, the availability of a broad range of options for apparatus & plants for bioprocessing is anticipated to drive the segment.

Workflow Insights

Upstream bioprocessing segment held the largest market share of 58.23% in 2024 and expected to register fastest CAGR over the forecast period. This can be attributed to the continuous developments and advancements in technologies for upstream bioprocessing. For instance, advanced products, such as Ambr 15 micro-bioreactor system by Sartorius AG, are offering high-throughput upstream process development as well as efficient cell culture processing and media & feed optimization with automated experimental setup and sampling. These solutions can reduce the time taken for upstream bioprocessing operations and are anticipated to boost segment growth.

The fermentation segment is expected to register significant CAGR over the forecast period. The growth can be attributed to the launch of several innovative fermentation offerings that provide optimum conditions for bioprocessing reactions. For instance, the HyPerforma Enhanced S.U.F by Thermo Fisher Scientific, Inc. delivers optimal oxygen mass transfers and temperature control to the culture by increasing the turbine impellers and cooling jacket surface areas, respectively. Furthermore, companies such as Cytiva are also involved in bringing single-use fermentation solutions for their End Users, such as the Xcellerex XDR MO, a stirred tank system with powerful mixing, efficient temperature control, and high oxygen transfer capacities for microbial cell culture. Significant innovations like these are likely to aid in revenue generation in this segment.

End Use Insights

The biopharmaceutical manufacturers dominated the market and accounted for the largest share 2024. An increase in the commercial success of biologics in recent years and a rise in contract manufacturing/research services have led to the high growth of the segment. CROs and CMOs can offer several benefits in bioprocessing operations, such as scalability, flexibility, decreased internal infrastructure requirements, and dedicated supply channels. These advantages are fueling the adoption of contract services and are anticipated to positively affect the industry growth in the near future.

Academic & clinical research institutes are expected to grow at the fastest CAGR during forecast period. The availability of benchtop scale bioprocessing equipment and technological progress in single-use systems has accelerated the adoption of such technologies in academic and research institutes. For instance, institutes like the NIBRT (National Institute for Bioprocessing Research), in Ireland offer contract research services for biologics, while also conducting workshops and training for single-use technologies. Furthermore, the involvement of academic institutes and scientific communities in developing new biologics, such as cell & gene therapies and vector production, is likely to increase the implementation of single-use systems due to its cost reduction and flexibility benefits.

Regional Insights

North America held the largest revenue share of more than 34.96% in 2024, which can be attributed to the presence of an established pharmaceutical and biomanufacturing industry in the region as well as a high extent of R&D activities. Similarly, the demand for single-use bioprocessing equipment is also driven by an increasing focus on vaccine production to aid in disease prevention measures in the region. Moreover, the presence of the Bio-process System Alliance (BPSA) in North America, which aims at advancing the adoption of single-use technologies, is expected to further drive the sales of disposable systems in the region.

U.S. Single-use Bioprocessing Market Trends

The U.S. market is driven by the strong presence of biopharmaceutical manufacturers, well-established CDMOs, and significant R&D investments in biologics and cell therapies. The demand for flexible, scalable manufacturing technologies has surged with the growth of monoclonal antibodies, vaccines, and advanced therapy medicinal products (ATMPs). In addition, supportive FDA guidelines, increased venture capital funding, and the ongoing trend of facility modernization are encouraging the adoption of single-use systems across clinical and commercial production.

Europe Single-use Bioprocessing Market Trends

Europe’s single-use bioprocessing market benefits from strict regulatory standards, a high concentration of biotech startups, and increased government funding for life sciences innovation. The focus on biosimilars and personalized medicine, particularly in Western Europe, is accelerating the need for flexible manufacturing. Sustainability initiatives and the move toward decentralized manufacturing post-COVID-19 are also pushing demand for disposable technologies that reduce contamination risks and offer faster changeover times.

The UK single-use bioprocessing market growth is fueled by a thriving biotech ecosystem, government-backed initiatives such as the Life Sciences Vision strategy, and investments in cell and gene therapy infrastructure (e.g., through the Cell and Gene Therapy Catapult). Brexit has also encouraged more domestic manufacturing capacity, with single-use technologies being favored for their modular and scalable deployment. In addition, strong academic-industry collaborations are driving innovation in bioprocessing technologies.

The single-use bioprocessing market in Germany remains key in Europe due to its robust pharmaceutical industry, advanced manufacturing expertise, and a focus on automation and digitalization in bioprocessing. The country's emphasis on high-quality production, compliance with EU GMP standards, and government incentives for biotech innovation support the adoption of single-use systems. Furthermore, Germany hosts several leading CDMOs and equipment manufacturers that are actively innovating in the single-use space.

Asia Pacific Single-use Bioprocessing Market Trends

The Asia Pacific region is expected to grow at the fastest rate over the forecast period. The region’s growing bioprocessing market has resulted in multiple investments from several global companies. These investments assist to serve the key companies to create a regional presence and take advantage of the untapped avenues. Furthermore, the increasing interest of contract service providers to develop their base in Asia Pacific, coupled with the trend of implementation of disposables in CMOs, acts as a catalyst for continued investments by local as well as global companies. For instance, in September 2021, Singapore witnessed the expansion of Lonza’s drug development facility. The CDMO enhanced its capacity to support the growing manufacturing needs in the region.

China single-use bioprocessing market is rapidly growing, driven by aggressive expansion of domestic biologics production, government support for biotech development (e.g., Made in China 2025), and increasing investment from global pharmaceutical firms. The rising incidence of chronic diseases, an expanding biologics pipeline, and efforts to meet international GMP standards are encouraging Chinese companies to adopt modern, single-use-based facilities to improve flexibility, reduce costs, and accelerate time-to-market.

The single-use bioprocessing market in Japan is propelled by an aging population demanding innovative biologics, government-led initiatives to support regenerative medicine and personalized therapies, and a strong commitment to quality and safety standards. The adoption of single-use technologies is also supported by collaborations between multinational vendors and local biopharma firms. However, adoption is somewhat conservative, requiring high validation standards and localized technical support, which global players are increasingly addressing.

MEA Single-use Bioprocessing Market Trends

In the Middle East, the single-use bioprocessing market is growing due to government diversification strategies (e.g., Saudi Vision 2030), the rise of domestic pharmaceutical manufacturing, and increased interest from international biopharma companies to establish local presence. Countries such as the UAE and Qatar are investing in healthcare infrastructure and biotechnology R&D, with single-use systems offering an attractive solution due to their lower capital investment and ease of deployment.

The Saudi Arabia single-use bioprocessing market is driven by strategic government initiatives aimed at localizing pharmaceutical production and fostering biotech innovation under Vision 2030. Investment in research centers, partnerships with international biotech firms, and a push to reduce reliance on imported drugs are increasing the adoption of single-use bioprocessing systems. These technologies align well with the country’s goals of achieving fast-track deployment of manufacturing facilities and ensuring quality control.

The single-use bioprocessing market in Saudi Arabia is primarily driven by efforts to strengthen domestic pharmaceutical production, modernize healthcare infrastructure, and improve drug security. While still at an early stage compared to regional leaders, the government is initiating public-private partnerships and expanding regulatory frameworks that support biomanufacturing. Single-use technologies are being considered a practical solution due to their modular nature, lower upfront investment, and reduced risk of cross-contamination.

Key Single-use Bioprocessing Company Insights

The market is witnessing several strategic initiatives such as product launches, expansions adopted by key players to increase their reach in the market and to maintain their industry presence. These developments also enhance the availability of their products in diverse geographical areas.

Key Single-Use Bioprocessing Companies:

The following are the leading companies in the single-use bioprocessing market. These companies collectively hold the largest market share and dictate industry trends.

- Sartorius AG

- Danaher Corporation

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Avantor, Inc.

- Eppendorf SE

- Corning Incorporated

- Boehringer Ingelheim International GmbH

- Lonza

- Infors AG

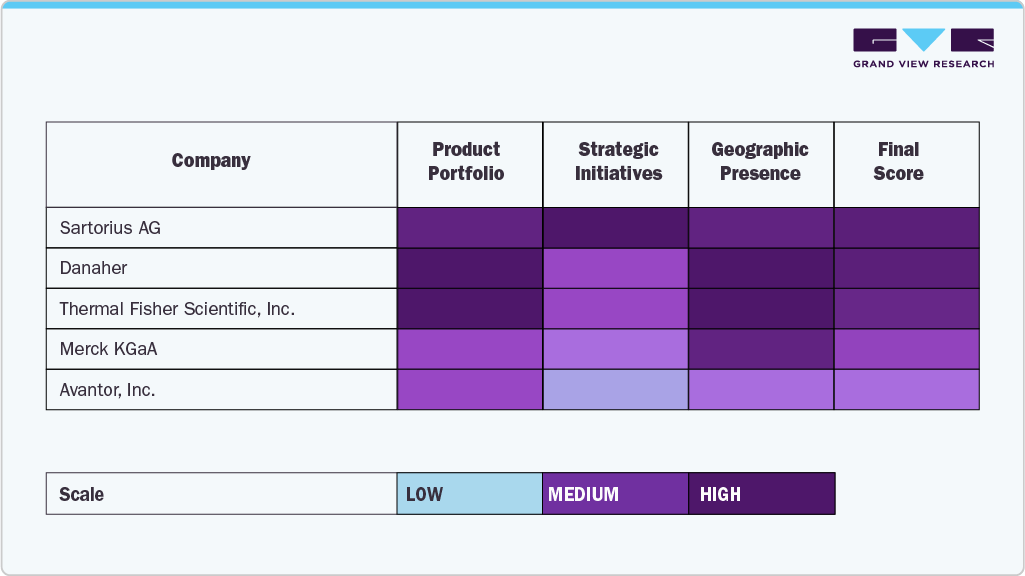

Heat Map Analysis:

The heat map analysis of key players in the single-use bioprocessing market reveals a competitive and innovation-driven landscape. Sartorius AG shows strong market penetration and technological innovation, especially in upstream bioprocessing and integrated single-use solutions, supported by its robust global supply chain. Danaher, through its subsidiaries like Cytiva and Pall, demonstrates a broad and deep product portfolio with significant investments in capacity expansion and acquisitions, positioning it as a market leader.

Thermo Fisher Scientific, Inc. excels in scalability and workflow integration, offering comprehensive single-use technologies and bioprocessing services, particularly strong in CDMO support. Merck KGaA is notable for its process innovation and regulatory support capabilities, with a strong emphasis on process safety and material science. Avantor, Inc. focuses on customization and logistics excellence, catering effectively to regional biopharma needs, and has made notable strides in offering integrated solutions for flexible manufacturing. Overall, each company holds strategic strengths across innovation, product depth, global presence, and customer alignment.

Recent Developments

-

In January 2024, CDMO AGC Biologics announced a growth strategy to develop pharmaceutical manufacturing capabilities in the Asia region through the expansion of their mammalian cell culture, mRNA and cell therapy facility in Japan. This development is aimed to support the global demand for biologics and advanced therapy medicinal products.

-

In September 2023, Getinge launched a single-use bioreactor named the AppliFlex ST GMP. The new product is available in different sizes and provides a comprehensive cGMP manufacturing solution for mRNA production and cell and gene therapies.

-

In April 2023, Merck KGaA launched Ultimus, a single-use process container film, to provide superior strength & leak resistance for single-use assemblies.

-

In April 2023, Cytiva introduced the X-platform bioreactors that simplifies the upstream bioprocessing operations for the production of monoclonal antibodies (mAbs), protein-based drugs and cell and gene therapies.

Single-use Bioprocessing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 36.13 billion

Revenue forecast in 2030

USD 74.09 billion

Growth rate

CAGR of 15.44% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, workflow, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Sartorius AG; Danaher Corporation; Thermo Fisher Scientific, Inc.; Merck KGaA; Avantor, Inc; Eppendorf SE; Corning Incorporated; Boehringer Ingelheim International GmbH; Lonza; Infors AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Single-use Bioprocessing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the single-use bioprocessing market on the basis of product, workflow, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Simple & Peripheral Elements

-

Tubing, Filters, Connectors, & Transfer Systems

-

Bags

-

Sampling Systems

-

Probes & Sensors

-

pH Sensor

-

Oxygen Sensor

-

Pressure Sensors

-

Temperature Sensors

-

Conductivity Sensors

-

Flow Sensors

-

Others

-

-

Others

-

-

Apparatus & Plants

-

Bioreactors

-

Upto 1000L

-

Above 1000L to 2000L

-

Above 2000L

-

-

Mixing, Storage, & Filling Systems

-

Filtration System

-

Chromatography Systems

-

Pumps

-

Others

-

-

Work Equipment

-

Cell Culture System

-

Syringes

-

Others

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream Bioprocessing

-

Fermentation

-

Downstream Bioprocessing

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Manufacturers

-

CMOs & CROs

-

In-house Manufacturers

-

-

Academic & Clinical Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global single-use bioprocessing market size was estimated at USD 31.71 billion in 2024 and is expected to reach USD 36.13 billion in 2025.

b. The global single-use bioprocessing market is expected to witness a compound annual growth rate of 15.44% from 2025 to 2030 to reach USD 74.09 billion by 2030.

b. The simple and peripheral elements segment, which includes filters, tubing, transfer systems, and connectors, dominated the market for single-use bioprocessing and accounted for the largest revenue share of 48.82% in 2024.

b. Some key participants in the market for single-use bioprocessing include Sartorius AG, Danaher, Thermo Fisher Scientific, Inc., Merck KGaA, Avantor, Inc., Eppendorf SE, Corning Incorporated, Boehringer Ingelheim International GmbH, Lonza, PBS Biotech, Inc.

b. Commercial advantages of single-use technology within the bioprocessing industry with respect to operating & production costs, and new product development timelines, have driven the revenue of the single-use bioprocessing market.

b. The upstream workflow segment dominated the single-use bioprocessing market and accounted for the largest revenue share of 58.06% in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.