- Home

- »

- Medical Devices

- »

-

Sleep Tracking Devices Market Size & Share Report, 2030GVR Report cover

![Sleep Tracking Devices Market Size, Share & Trends Report]()

Sleep Tracking Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software & Solutions), By Operating System (Android, IOS), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-316-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sleep Tracking Device Market Summary

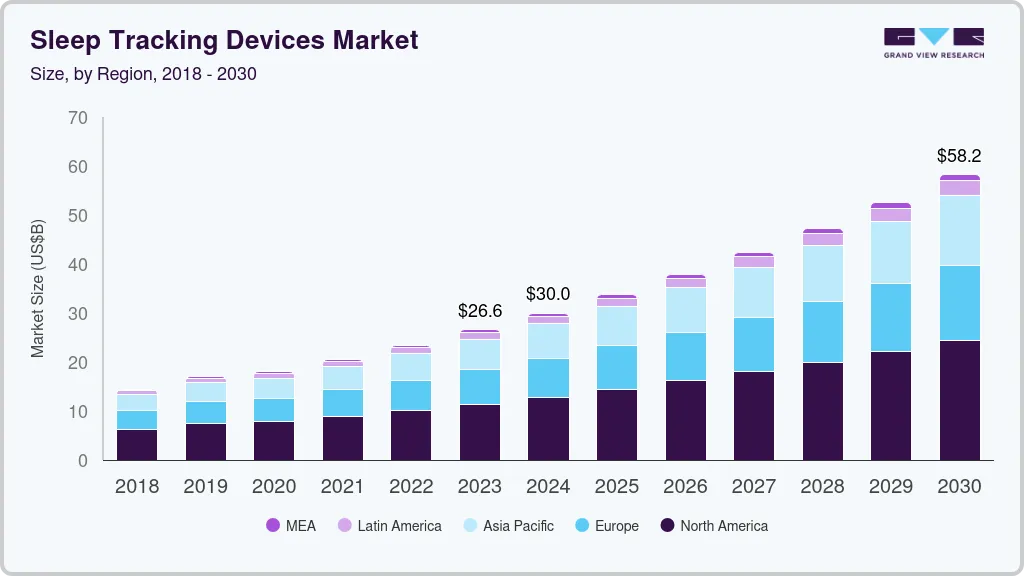

The global sleep tracking devices market size was estimated at USD 26.6 billion in 2023 and is projected to reach USD 58.21 billion by 2030, growing at a CAGR of 11.7% from 2024 to 2030. The rising prevalence of sleep disorders is expected to increase the use of sleep-tracking devices. For instance, according to the United Health Foundation, in 2022, 35.5% of American adults stated that they slept less than seven hours in a 24-hour period.

Key Market Trends & Insights

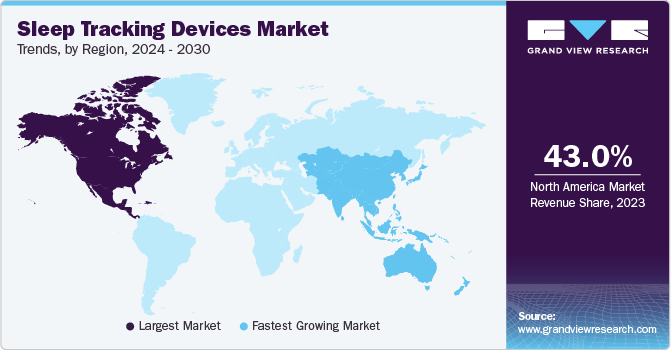

- The sleep tracking devices market in North America dominated 2023 and accounted for the largest revenue share of 43.0%.

- The U.S. is projected to reach 93.5 million by 2024, which accounts for 27.4% of the total population.

- The sleep tracking devices market in Asia Pacific is anticipated to register the fastest growth rate during the forecast period.

- Based on component, the hardware segment dominated the market and accounted for the largest revenue share of 70.5% in 2023.

- In terms of operating system, the android segment is anticipated to register the fastest growth rate with a CAGR of 12.2% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 26.6 billion

- 2030 Projected Market Size: USD 58.21 billion

- CAGR (2024-2030): 11.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Additionally, a report published in 2024 by the National Council on Aging, Inc. revealed that around 30% of adults experience symptoms of insomnia, with 10% having insomnia that affects their daily activities. The population affected by sleep apnea ranges from 9% to 38%, as per the same report. Increasing cases of sleep apnea and insomnia across the globe are driving market growth. Additionally, the growing number of government and non-government efforts to raise awareness about the significance of sleep is driving market expansion. In May 2024, Norfolk County Council introduced a new Sleep Awareness Campaign aimed at emphasizing the importance of good sleep for the health and well-being of young people.

Specifically targeting individuals aged 14 to 25, the campaign centers around three key themes: mobile phone usage, exercise, and exposure to natural light. It provides advice for achieving a good night's sleep and offers a variety of resources to support better quality sleep. These initiatives are expected to boost the demand for sleep-tracking devices, which are used to monitor sleep for improved health.

Moreover, the increasing usage of wearable devices among the population is driving market growth. According to the Tech Report Inc. report, the number of connected wearable devices rose from 325 million in 2016 to 722 million in 2019. Furthermore, in 2020, 22% of the world's population owned a wearable device, and 3 out of every 5 people used it daily. Additionally, the International Data Corporation (IDC) predicts that global shipments of wearable devices will increase by 10.5% year over year, reaching 559.7 million units in 2024. Wearable devices include various features including sleep tracking, thereby fostering market growth.

The increasing understanding of the significance of sleep for overall health and wellness is driving the need for sleep-tracking devices. Additionally, research studies demonstrating the positive impact of using sleep-tracking devices are driving market growth. For instance, a study published in 2024 by Springer Nature revealed that various studies involving participants of all ages indicate that consumer sleep-tracking devices are as effective as, or even more effective than, actigraphy. These promising findings from the studies are expected to further boost market growth.

Moreover, the growing preference for personalized treatment across the globe is boosting the demand for sleep monitoring. Furthermore, growing funding in sleep devices is contributing to market growth. In January 2024, Sleeptech Onera Health, a leading Dutch company in remote sleep monitoring and diagnostic solutions, successfully raised more than USD 32.6 million in Series C funding for remote sleep diagnostics. The funding will enable the company to expedite its manufacturing and deployment plans to meet the increasing customer need for its self-administered, wire-free end-to-end solution. Additionally, in May 2021, Oura's sleep-tracking ring raised USD 100 million to further help users control their health.

Market Concentration & Characteristics

The market is constantly evolving due to advancements in sensor technology, artificial intelligence (AI), and integration with the Internet of Things (IoT). Modern sleep trackers are equipped with sophisticated sensors that monitor heart rate variability, respiratory rate, and blood oxygen levels, providing comprehensive sleep analysis. AI and machine learning algorithms enhance these devices by delivering precise, personalized sleep recommendations and detecting subtle sleep pattern irregularities. Furthermore, integration with IoT allows seamless connectivity with smart home devices.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for sleep-tracking devices. In July 2023, Beacon Biosignals, a company that focuses on computational electroencephalogram (EEG) and neurodiagnostics analytics, acquired Dreem's research and development division. Dreem is an innovative company based in Paris that specializes in at-home sleep monitoring. This strategic acquisition paves the way for comprehensive clinical trial evaluations by integrating Dreem's hardware with Beacon's EEG analytics platform.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) provide guidelines and standards for sleep-tracking devices. Additionally, regulations such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. mandate stringent data protection measures.

In the sleep tracking devices market, various traditional and modern methods serve as substitutes for monitoring and enhancing sleep quality. One well-established substitute is polysomnography (PSG), which is a comprehensive sleep study conducted in specialized sleep clinics. PSG is considered the gold standard for diagnosing sleep disorders such as sleep apnea and narcolepsy, as it provides detailed insights into various physiological parameters, including brain activity, eye movements, heart rate, and breathing patterns. Another widely used substitute is the sleep diary, in which individuals manually record their sleep patterns, including bedtimes, wake times, and perceived sleep quality.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product approvals create more opportunities for market players to enter new regions. In March 2024, Beacon Biosignals received FDA clearance for SleepStageML, an advanced machine-learning software that automatically stages sleep using electroencephalogram (EEG) signals from clinical polysomnography (PSG) recordings. This software is designed to assist in the diagnosis and evaluation of sleep and sleep-related disorders.

Component Insights

The hardware segment dominated the market and accounted for the largest revenue share of 70.5% in 2023. The increasing use of artificial intelligence and machine learning in sleep devices is improving their features and driving market growth. In September 2023, Beacon Biosignal received U.S. Food and Drug Administration (FDA) 510(k) clearance for its artificial intelligence-aided sleep monitoring device, Dreem 3S. This innovative wearable headband, equipped with integrated machine-learning algorithms, is designed to collect electroencephalogram (EEG) data from the brain to monitor sleep patterns and aid in diagnosing sleep disturbances.

The software & solutions segment in the market is anticipated to witness significant growth over the forecast period. The growing adoption of organic and inorganic strategies by key market players is driving segmental growth. In April 2024, ŌURA, the creator of the Oura Ring, a highly precise and reliable smart ring, introduced a new in-app platform called Oura Labs.

This new feature, which is part of the Oura Membership experience, aims to accelerate innovation by involving members in the research and development process. Members can have the option to participate in testing new features, share their feedback, and engage in discussions about Oura and the future of wearable technology. This increasing participation of the population in testing wearable devices will increase the quality of products, leading to growing demand.

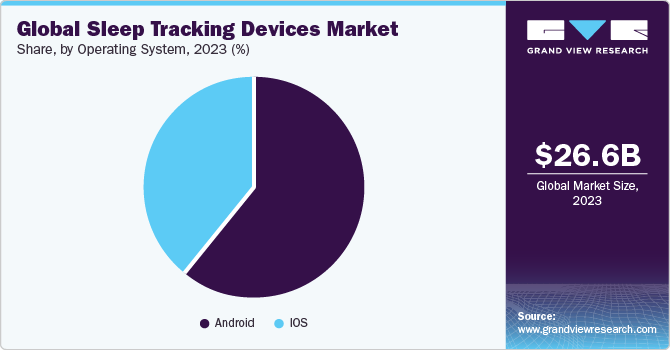

Operating System Insights

The android segment dominated the market and accounted for the largest revenue share in 2023, and is anticipated to register the fastest growth rate with a CAGR of 12.2% over the forecast period. The widespread adoption of android smartphones globally is driving the segmental growth. According to the Backlinko report, as of Q4 2023, android smartphones represented 56% of global quarterly smartphone sales.

Furthermore, the android operating system has undergone continuous improvements. These include enhanced health and fitness tracking features, API integrations, and machine learning capabilities. These enhancements strengthen the functionality and accuracy of sleep-tracking devices. Additionally, the affordability of android sleep-tracking devices is contributing to increased market growth. Moreover, the growing adoption of health and fitness apps on android platforms is also fueling the market growth.

The IOS segment in the market is anticipated to witness significant growth over the forecast period owing to robust brand loyalty. For instance, according to a 2021 survey, 65% of U.S. Apple customers have been with the brand for more than 3 years. Furthermore, regular updates and new features in iOS, such as advanced sleep tracking algorithms and improved sensor technology in devices such as the Apple Watch are fostering market growth. Moreover, continuous innovation in hardware and software by Apple is supplementing market growth.

Regional Insights

The sleep tracking devices market in North America dominated 2023 and accounted for the largest revenue share of 43.0% owing to the increasing prevalence of sleep disorders such as insomnia, sleep apnea, and restless leg syndrome. For instance, according to the NIH report published in 2023, in North America, obstructive sleep apnea (OSA) affects between 15 and 30 percent of males and 10 to 15 percent of females. Additionally, the region's high levels of disposable income and strong healthcare infrastructure make advanced sleep-tracking devices more accessible to a wider population.

U.S. Sleep Tracking Devices Market Trends

The U.S. sleep tracking devices market held the largest share of the North American market in 2023. The integration of advanced features such as artificial intelligence, machine learning, and Internet of Things (IoT) connectivity in sleep-tracking devices are driving market growth. Furthermore, increasing wearable users in the country is driving market growth. For instance, according to the report from Coolest Gadgets, the number of wearable users in the U.S. is projected to reach 93.5 million by 2024, which accounts for 27.4% of the total population.

The sleep tracking devices market in Canada is anticipated to register the fastest growth during the forecast period owing to the increasing health consciousness. Moreover, government initiatives aimed at promoting health and wellness, including campaigns addressing sleep health, are contributing to market growth. Additionally, the increasing penetration of smartphones in Canada is supplementing the market growth. For instance, as per the Business of Apps report, in 2023, over 80.9% of the Canadian population were active smartphone users.

Europe Sleep Tracking Devices Market Trends

Europe sleep tracking devices market is anticipated to register lucrative growth during the forecast period. The increasing prevalence of lifestyle-related health issues, such as stress and anxiety, has highlighted the significance of sleep for overall well-being. A Eurobarometer survey in June 2023 found that almost half of the EU population (46%) had experienced emotional or psychosocial issues, such as depression or anxiety, in the previous 12 months.

The sleep tracking devices market in Germany is anticipated to register a considerable growth rate during the forecast period. The presence of a well-established healthcare system that integrates digital health solutions enhances the adoption of sleep-tracking devices. Furthermore, increasing collaboration and partnership among market players are supplementing market growth. In March 2022, German electronics company Infineon collaborated with Sleepiz, a Swiss digital health firm, to offer a user-friendly at-home sleep monitoring device.

UK sleep tracking devices market is anticipated to register a considerable growth rate during the forecast period. Increasing research and development activities for expanding the application of sleep devices are expected to boost market growth. For instance, in May 2023, researchers at Imperial College London, the UK Dementia Research Institute, University College London, and Newcastle University worked together on developing technology to identify people who are at risk of dementia. This new project, funded by the National Institute for Health and Care Research, involves using a sleep sensor mat and a "digital biomarker" to monitor 250 individuals participating in the Insight 46 study. The aim is to observe which individuals show signs of poor brain health.

Asia Pacific Sleep Tracking Devices Market Trends

The sleep tracking devices market in Asia Pacific is anticipated to register the fastest growth rate during the forecast period. Rapid urbanization, rising disposable incomes, and an increasing awareness of health and wellness are escalating regional growth. The increasing adoption of smartphones and wearable technology, coupled with advancements in artificial intelligence and machine learning are supplementing market growth.

China sleep tracking devices market held the largest share in 2023. The presence of leading technology companies in China, such as Huawei and Xiaomi, is accelerating market growth. Moreover, increasing sleeping problems in the country is fostering market growth. For instance, the ‘2021 Exercise and Sleep White Paper’ released by the China Sleep Research Association has shown that over 300 million people in China experience sleep issues. This accounts for 38% of the country's population, which is significantly higher than the global figure of 27% reported by the World Health Organization.

The sleep tracking devices market in India is anticipated to register considerable growth during the forecast period. Increasing sleep awareness campaigns in the country are driving the demand for sleep-tracking devices. In March 2024, The Sleep Company launched the #OneMoreHour campaign advocating for India to sleep better.

Latin America Sleep Tracking Devices Market Trends

Latin America sleep tracking devices market is anticipated to register the fastest growth during the forecast period owing to the increasing awareness of the importance of sleep health. Moreover, the adoption of a sedentary lifestyle among the population is fostering market growth.

The sleep tracking devices market in Brazil is anticipated to register considerable growth during the forecast period. The growing adoption of smartphones is expected to supplement market growth. For instance, as per the Business of Apps article, over two-thirds of Brazilians will use a smartphone in 2023, and this is projected to increase to 75% by 2025.

MEA Sleep Tracking Devices Market Trends

MEA sleep tracking devices market is anticipated to register significant growth during the forecast period. The growing adoption of advanced technologies and the increasing availability of innovative health devices are boosting regional growth. Furthermore, the rising adoption of wearable technologies is anticipated to spur market growth.

Key Sleep Tracking Devices Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions. Some of the key players operating in the market include Fitbit, Apple Inc., Withings, and ResMed.

Key Sleep Tracking Devices Companies:

The following are the leading companies in the sleep tracking devices market. These companies collectively hold the largest market share and dictate industry trends.

- Fitbit

- Apple Inc.

- Withings

- ResMed

- Sleepace

- Garmin Ltd.

- Huawei Device Co., Ltd.

- Fossil Inc

- Ōura Health Oy.

- Amazon

Recent Developments

-

In May 2024, Somnee introduced an improved app interface and additional functionalities for its intelligent sleep headband, aimed at improving the assessment of sleep quality and readiness. The enhancements encompass brain mapping, a sleep diary, sleep readiness ratings, and measurements.

-

In January 2024, PranaQ launched its TipTraQ, an AI-powered system designed to track and enhance sleep. This innovative product surpasses conventional sleep monitoring by providing a complete solution for identifying and overseeing respiratory sleep issues such as sleep apnea, as well as enhancing sleep quality.

-

In June 2023, Oura introduced additional functionalities related to sharing on social media and monitoring sleep in its smart ring. The company's latest feature, called Circles, enables users of the ring to form exclusive groups for sharing readiness, sleep, and activity scores.

Sleep Tracking Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.0 billion

Revenue forecast in 2030

USD 58.21 billion

Growth rate

CAGR of 11.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, operating system, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Fitbit; Apple Inc.; Withings; ResMed; Sleepace; Garmin Ltd.; Huawei Device Co.; Ltd.; Fossil Inc; Ōura Health Oy.; Amazon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sleep Tracking Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the sleep tracking devices market report based on component, operating system, and region:

-

Component Outlook (Revenue USD Million, 2018 - 2030)

-

Hardware

-

Wearable

-

Watches

-

Bands

-

Earbuds

-

Others

-

-

Non-wearables

-

Bedside Tracking Devices

-

Bed Sensors

-

-

Hardware, by Distribution Channel

-

Online

-

Offline

-

-

-

Software & Solutions

-

-

Operating System Outlook (Revenue USD Million, 2018 - 2030)

-

Android

-

IOS

-

-

Regional Outlook (Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sleep tracking devices market size was estimated at USD 26.6 billion in 2023 and is expected to reach USD 30.0 billion in 2024.

b. The global sleep tracking devices market is expected to grow at a compound annual growth rate of 11.7% from 2024 to 2030 to reach USD 58.21 billion by 2030.

b. In 2023, the android segment dominated the sleep tracking devices market and accounted for the largest revenue share and is anticipated to register the fastest growth rate with a CAGR of 12.2% over the forecast period. The widespread adoption of android smartphones globally is driving the segmental growth.

b. Some key players operating in the market include Fitbit, Apple Inc., Withings, ResMed, Sleepace, Garmin Ltd., Huawei Device Co., Ltd., Fossil Inc, Ōura Health Oy., Amazon

b. The increasing understanding of the significance of sleep for overall health and wellness is driving the need for sleep tracking devices. Moreover, the growing preference for personalized treatment across the globe is boosting the demand for sleep monitoring.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.