- Home

- »

- Next Generation Technologies

- »

-

Small Cell 5G Network Market Size, Industry Report, 2033GVR Report cover

![Small Cell 5G Network Market Size, Share & Trends Report]()

Small Cell 5G Network Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Services), By Network Model, By Network Architecture (Distributed, Virtualized), By Deployment Mode (Indoor, Outdoor), By Frequency Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-887-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Small Cell 5G Network Market Summary

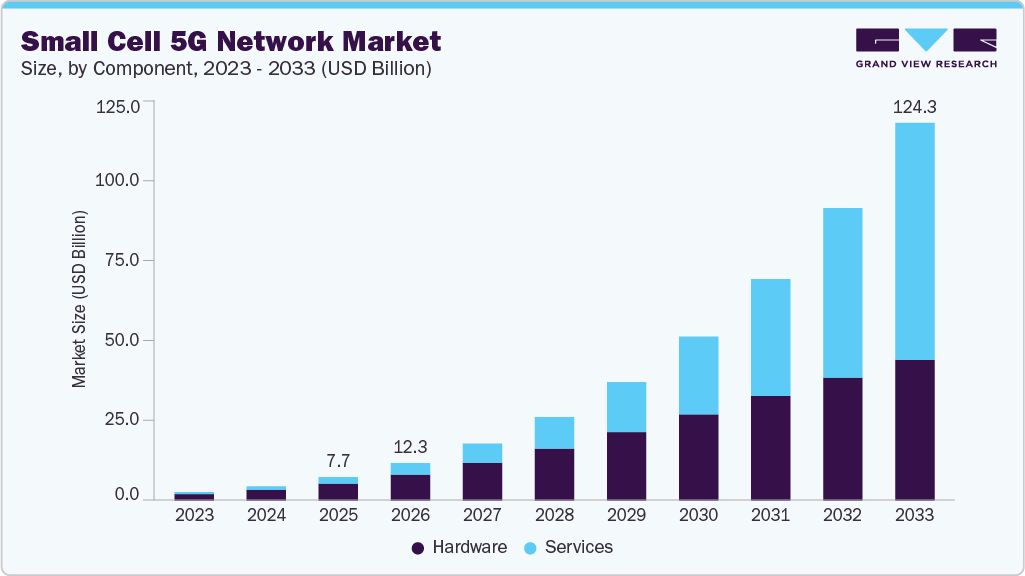

The global small cell 5G network market size was estimated at USD 7.73 billion in 2025 and is projected to reach USD 124.32 billion by 2033, growing at a CAGR of 39.2% from 2026 to 2033. The market is primarily driven by the rising need to enhance network capacity, coverage, and performance in densely populated urban areas.

Key Market Trends & Insights

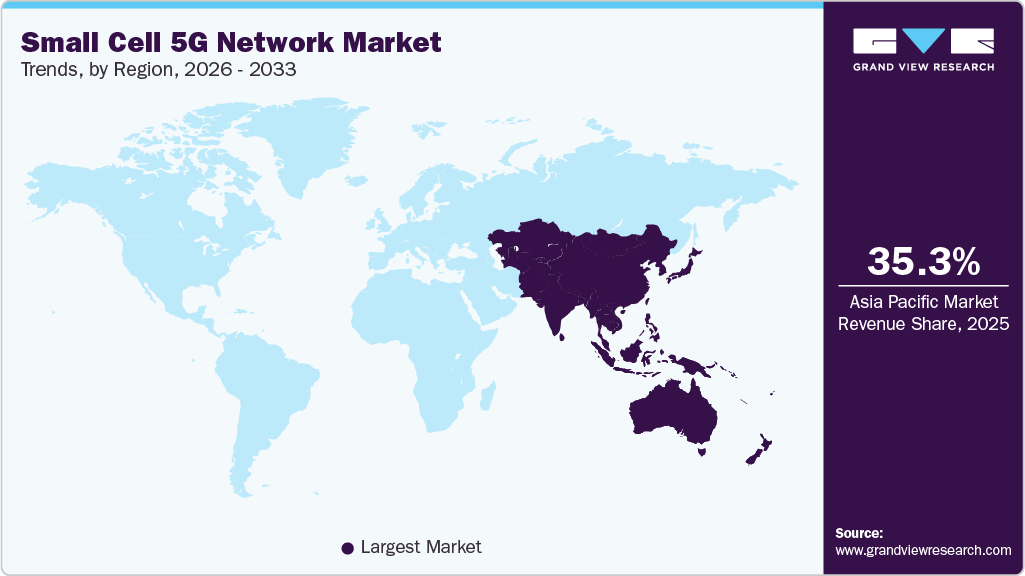

- Asia Pacific dominated the small cell 5G network industry and accounted for a share of 35.3% in 2025

- Small cell 5G network market in China held a substantial market share in 2025.

- By component, the hardware segment dominated the market in 2025 and accounted for the largest share of 72.6%.

- By network model, the non-standalone (NSA) segment dominated the market in 2025.

- By network architecture, the virtualized segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 7.73 Billion

- 2033 Projected Market Size: USD 124.32 Billion

- CAGR (2026-2033): 39.2%

- Asia Pacific: Largest market in 2025

The rapidly increasing demand for fast mobile data connectivity among consumers has increased the deployment of the next-generation 5G Radio Access Network (RAN). The rising installation of small cell 5G networks is growing across industrial, enterprise, and residential applications to provide enhanced coverage capacity at an affordable cost. In addition, the rapidly building smart cities in developed countries such as the U.S., Canada, Singapore, UK, Germany, Italy, and France have surged the deployment of small cell 5G networks for several applications, such as residential, industrial, commercial, government, and others.Mobile data traffic and 5G adoption is increasing rapidly across the globe. With the rising demand for 5G services, telecom service providers are investing heavily in developing and improving 5G infrastructure. As of 2022, several countries have already deployed 5G. 5G services are currently provided using the existing (non-standalone) network infrastructure. However, as the number of 5G users increases rapidly, the existing infrastructure is expected to become insufficient, and telecom operators will deploy standalone 5G infrastructure. Small cell 5G network is a crucial component of the overall 5G standalone (and non-standalone) ecosystem. Hence, increasing 5G demand and increasing 5G standalone network infrastructure deployment is anticipated to create significant market growth opportunities.

The deployment of next-generation small cell networks is estimated to witness a significant CAGR over the forecast period. This is attributable to the increasing demand for the 5G network from a massive chunk of customers at public locations such as offices, malls, and stadiums. Also, the demand for 5G data services for several use cases, including seamless video calling, Ultra-high Definition (UHD)/4K video, and cloud-based VR/AR gaming, is rapidly mounting. 5G small cell network can improve the overall signal performance. The growing demand for data-intensive 5G applications is anticipated to drive the market's growth over the forecast period.

Growing demand for 5G connectivity from various end use industries is anticipated to create demand in the market. Some of the largest economies, such as the U.S. and China, are expected to continue spending insistently on provisioning healthcare facilities. The healthcare industry, especially in developed economies, has begun emphasizing remote diagnosis and patient surgeries. In addition, the COVID-19 pandemic has enabled several key countries to build more robust healthcare capabilities through investing in advanced technologies such as 5G infrastructure. Thus, to deliver constant data connectivity during remote patient surgeries and telemedicine, the demand for a small cell 5G network is expected to drive the market growth over the forecast period.

However, health concerns and disadvantages associated with small 5G cells are major factors that could hamper the market growth. Small cells necessitate additional power sources, distinct network backhaul arrangements, and precise positioning of their dedicated radios to ensure indoor coverage for public mobile networks. They are typically positioned alongside existing private LTE, Wi-Fi-based wireless LANs, or other secure wireless infrastructure within an enterprise. Thus, creating a separate small-cell system to extend public mobile network coverage can involve investments in time, resources, and additional expenditures for deployment and ongoing maintenance.

Component Insights

The hardware segment dominated the market in 2025 and accounted for the largest share of 72.6%. The hardware segment is further bifurcated into Picocell, Femtocell, and Microcell.In terms of volume, the femtocell segment held the market with a share exceeding 65.0% in 2025.This is attributed to its increasing demand for unified bandwidth coverage for several enclosed applications such as malls, homes, offices, and hospitals. Based on their different ranges, small cells are mainly available in three categories, including femtocells, picocells, and microcells. The covering bandwidth ranges of femtocells, picocells, and microcells encompass up to 50 meters, up to 250 meters, and up to 3 Kilometers, respectively. Out of the three, femtocells rely on wired backhaul or fiber networks and tend to be the lowest-cost option for small cells, which is driving the adoption of the femtocell segment.

The services segment is expected to grow at a significant CAGR over the forecast period. The services segment is further divided into consulting, deployment & integration, and training and support & maintenance. The segment is driven by the increasing complexity of small cell 5G deployments and the growing need for specialized expertise in network planning, installation, and optimization. Rising enterprise demand for customized indoor 5G solutions is further accelerating the need for consulting, design, and maintenance services.

Network Model Insights

The non-standalone (NSA) segment dominated the market in 2025.This is attributed to the early rollouts of the non-standalone network across the globe. The non-standalone network is commonly deployed in integration with the existing legacy network infrastructure, due to its time and cost-efficient option. Besides, several key service providers, such as AT&T, Inc. and Verizon Communications, have first deployed a 5G non-standalone (NSA) network model that caters to the primary use cases, including cloud-based AR/VR gaming, mobile streaming, and UHD videos.

The standalone segment is expected to witness the fastest CAGR during the forecast period. The swiftly rising digitalization in industries has paved a new revenue stream for service providers across the globe. To provide endless connectivity between machines to machines, the need for ultra-reliable high frequency with low latency communication is a prerequisite. Besides, the need for unified bandwidth capacity with minimum latency to establish seamless communication between autonomous vehicles is expected to drive market demand in the transportation & logistics segment. Therefore, the growing need for faster data speed across the verticals, as mentioned above, is anticipated to boost the deployment of the standalone network model during the forecast period.

Network Architecture Insights

The virtualized segment dominated the market in 2025. The dominating share of the segment can be attributed to a robust deployment of a small cell 5G network with a centralized baseband unit controllable architecture. This helps service providers to reduce the Total Cost of Ownership (TCO) and increase the overall flexibility of the network by managing virtually all the small cell base stations. Besides, the introduction of Software-defined Networking (SDN) technology and Network Function Virtualization (NFV) to improve the operational efficiency of the RAN network is further expected to augment the segment growth over the forecast period.

The distributed segment is expected to grow at a notable CAGR over the forecast period.The distributed network architecture segment is being driven by the growing need for highly scalable and low-latency 5G connectivity across dense urban environments and enterprise campuses. Increased traffic loads and rising demand for localized data processing are encouraging operators to deploy distributed architectures that bring compute and radio functions closer to end users. This approach is being favored for its ability to support edge computing, private 5G networks, and mission-critical applications that require real-time responsiveness.

Deployment Mode Insights

The indoor segment dominated the market in 2025.This is attributed to the growing demand for 5G indoor coverage. Small cells provide reliable 5G data connectivity across residential and non-residential applications. The non-residential uses mainly involve enterprises, retail malls, airports, hospitals, and among others. Moreover, the data published by China's Ministry of Industry and Information Technology (MIIT) states that high-value customers are devoting over 80% of their working hours to indoor premises. As a result, it is estimated to elevate the adoption of small cells for indoor applications over the forecast period.

The outdoor segment is expected to witness the fastest CAGR over the forecast period.Outdoor small cells are primarily installed for public networks in suburban, urban, or rural areas. The swiftly growing number of IoT devices across many applications, such as autonomous vehicles and vehicles, to infrastructure (V2I) connectivity, have generated the need for high-speed data capacity. In addition, the deployment of lamp post small cells is gaining popularity in rapidly building smart cities across the globe. This, in turn, is expected to fuel the market growth of the outdoor segment.

Frequency Type Insights

The sub-6GHz + mmWave segment dominated the market in 2025, driven by the need to balance wide-area coverage with ultra-high-capacity performance in 5G networks. Sub-6 GHz bands are being adopted for their strong propagation characteristics and ability to support broad, reliable coverage. At the same time, mmWave is being leveraged to deliver multi-gigabit speeds in dense urban, enterprise, and indoor environments. Operators are increasingly deploying small cells that support both frequency ranges to meet diverse performance requirements and manage rising data demand.

The mmWave segment is expected to witness the fastest CAGR over the forecast period.mmWave frequencies are high band frequencies that offer high bandwidth capacity with low latency. The spectrum bands are majorly helpful in applications where ultra-reliable connectivity is required, especially in vehicle-to-vehicle (V2V) connectivity and remote patient surgeries. In addition, the governments of some countries across the developed economies have released the mmWave spectrum bands to provide enhanced data services. For instance, the Federal Communication Commission (FCC) released many types of mmWave frequencies, including 24.25-24.45 GHz, 24.75-25.25 GHz, 47.2-48.2 GHz, 38.6-40 GHz, and others, with a view to delivering ultra-reliable connectivity for applications including autonomous vehicles, and AR/VR applications. Countries such as India, Japan, Russia, South Korea, and Italy have released mmWave frequencies for improved data capacity across the country. This is expected to augment the mmWave segment growth from 2026 to 2033.

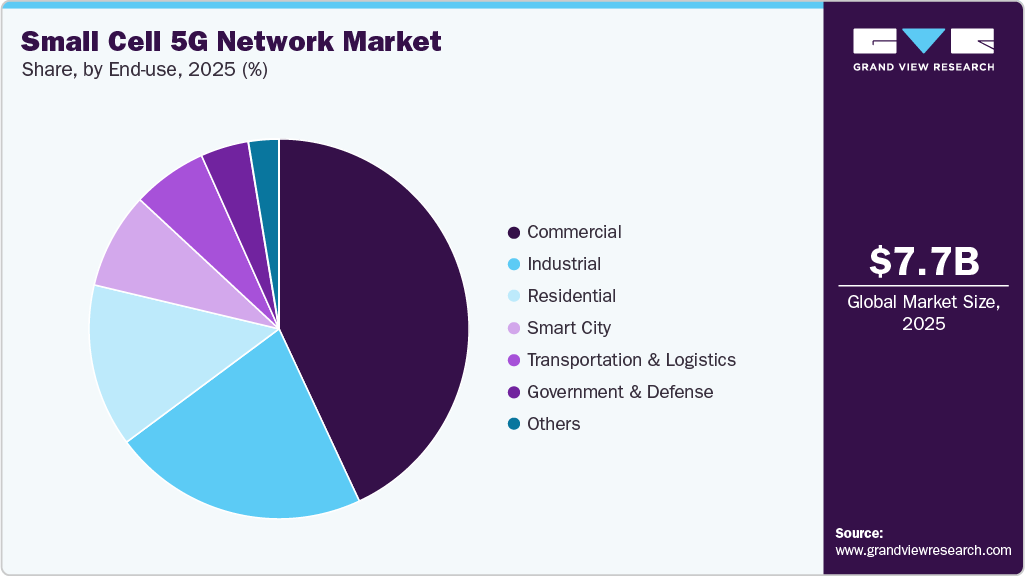

End-use Insights

The commercial segment dominated the market in 2025. This is attributed to the growing deployment of small cell 5G networks across large as well as Small and Medium Enterprises (SMEs) across the globe. This 5G RAN network helps enterprises cater to the demand for massive data capacity and coverage needs at a very affordable cost. Moreover, small cell 5G networks also assist organizations utilize the existing broadband infrastructure to deploy these next-generation networks.

The residential segment is expected to grow at a significant CAGR over the forecast period. The segment’s growth is primarily driven by the rapid growth in in-home data consumption and the need for stronger, more consistent indoor connectivity. As households increasingly rely on bandwidth-heavy applications, such as 4K/8K streaming, cloud gaming, remote work platforms, and emerging AR/VR experiences, traditional macro networks struggle to deliver sufficient coverage and capacity indoors. Small cells offer a cost-effective, high-performance solution that enhances indoor signal strength, reduces latency, and supports high device density, making them ideal for modern smart homes.

Regional Insights

Asia Pacific small cell 5G network marketdominated the and accounted for a share of 35.3% in 2025. This is attributed to the increasing deployment of 5G new radio infrastructure by major communication service providers, including China Mobile Limited, NTT Docomo Inc., KT Corporation, and Rakuten Mobile, Inc. In addition, governments across major countries such as China, South Korea, and Japan are highly focused on launching multiple sub-6GHz and mmWave frequencies to cater to the growing need for high-speed data connectivity among a large subscriber base. Consequently, the market in the region is anticipated to grow at a robust CAGR over the forecast period.

China Small Cell 5G Network Market Trends

Small cell 5G network market in China held a substantial market share in 2025. Small cell 5G network market growth in China is driven by large investments in 5G network infrastructure and favorable government initiatives.

India small cell 5G network market is expected to witness the fastest CAGR from 2026 to 2033. India is witnessing increasing demand for high-speed data connectivity. The deployment of 5G networks in smart cities and emphasis on deploying sub-6 GHz frequencies to cater to diverse user needs are contributing to market’s growth in India.

The small cell 5G network market in Japan is anticipated to grow at a moderate CAGR from 2026 to 2033. Key trends, including the deployment of 5G networks in urban areas for high-speed data capacity and the adoption of 5G networks in autonomous vehicles and remote surgeries, are significantly contributing to the market growth in Japan.

North America Small Cell 5G Network Market Trends

The North America small cell 5G network market is expected to grow at a notable CAGR during the forecast period. North America’s small-cell 5G market is being driven by a mix of strong operator investment to boost indoor coverage and capacity in dense urban and suburban areas, rapid uptake of 5G Fixed Wireless Access as a viable home-broadband alternative, and increasing availability of mid- and high-band spectrum that makes small-cell deployments more attractive for high-capacity hotspots.

Small cell 5G network market in the U.S. held a dominant position in the region in 2025.The U.S. market. is experiencing robust growth, driven by large investments in 5G network infrastructure from telecom companies such as AT&T, Inc. and Verizon. These prominent service providers are engaged in launching new products to gain a competitive advantage and expand their product portfolio.

Europe Small Cell 5G Network Market Trends

Europe small cell 5G network market is expected to register a notable CAGR from 2026 to 2033. The European market's growth is attributed to the favorable regulatory policies in countries such as the UK, Germany, and France and large investments in 5G network infrastructure.

The UK small Cell 5G network market held a substantial market share in 2025. The country's market growth is attributed to the increasing investment in healthcare applications, the adoption of smart cities, and the growth in virtualized network architecture to optimize operational efficiency.

Small cell 5G network market in Germany is expected to grow at a notable CAGR from 2026 to 2033. Germany's market is growing steadily, driven by investments in Industry 4.0 and smart city initiatives. The deployment of 5G networks in industrial IoT applications is further driving the market's growth.

Key Small Cell 5G Network Company Insights

Some of the key companies in the small cell 5G network industry include Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Nokia Corporation, Telefonaktiebolaget LM Ericsson, and ZTE Corporation, among others. These companies focus on product innovation, R&D and strategic initiatives such as new product launches, business expansions, partnerships, collaborations and mergers and acquisitions.

-

Telefonaktiebolaget LM Ericsson provides various Information and Communication Technology (ICT) solution and services, including 5G and IoT-powered networks, managed services, digital services, and others to service providers across the globe

-

ZTE Corporation provides integrated global telecommunications solutions to consumers, enterprise networks, carriers, businesses, and government customers. The company has a global presence in more than 160 countries, including Canada, the U.S., Austria, France, Belgium, Germany, Italy, the UK, China, Oman, UAE, Argentina, Mexico, and Chile, among others

Key Small Cell 5G Network Companies:

The following are the leading companies in the small cell 5G network market. These companies collectively hold the largest Market share and dictate industry trends.

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- Fujitsu Limited

- CommScope Inc.

- Comba Telecom Systems Holdings Ltd.

- Ceragon

- Airspan Networks

Recent Developments

- In September 2025, Tidal Wave, India’s prominent private 5G network provider, announced a strategic partnership with RANsemi, a pioneer in Open RAN innovation, to develop its next-generation private 5G systems. As part of the collaboration, Tidal Wave is expected to use RANsemi’s integrated small-cell platform as the core of its private network deployments, enabling high-performance connectivity solutions that are robust, scalable, and easy to deploy.

Small Cell 5G Network Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 12.30 billion

Revenue forecast in 2033

USD 124.32 billion

Growth rate

CAGR of 39.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, network model, network architecture, deployment mode, frequency type, end-use, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; Russia; China; India; Japan; South Korea; Brazil; Kingdom of Saudi Arabia (KSA); UAE; Saudi Arabia

Key companies profiled

Huawei Technologies Co., Ltd.; Samsung Electronics Co., Ltd.; Nokia Corporation; Telefonaktiebolaget LM Ericsson; ZTE Corporation; Fujitsu Limited; CommScope Inc.; Comba Telecom Systems Holdings Ltd.; Ceragon; Airspan Networks

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small Cell 5G Network Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global small cell 5G network market report based on component, network model, network architecture, deployment mode, frequency type, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Picocell

-

Femtocell

-

Microcell

-

-

Services

-

Consulting

-

Deployment & Integration

-

Training and Support & Maintenance

-

-

-

Network Model Outlook (Revenue, USD Million, 2021 - 2033)

-

Standalone

-

Non-standalone

-

-

Network Architecture Outlook (Revenue, USD Million, 2021 - 2033)

-

Distributed

-

Virtualized

-

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Indoor

-

Outdoor

-

-

Frequency Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Sub-6 GHz

-

mmWave

-

Sub-6GHz + mmWave

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Corporates/ Enterprises

-

Hospitals

-

Hotels & Restaurants

-

Malls/Shops

-

Stadiums

-

Others

-

-

Industrial

-

Smart Manufacturing

-

Energy & Utility

-

Oil & Gas and Mining

-

-

Smart City

-

Transportation & Logistics

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Russia

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global small cell 5G network market size was estimated at USD 7.73 billion in 2025 and is expected to reach USD 12.30 billion in 2026.

b. The global small cell 5G network market is expected to grow at a compound annual growth rate of 39.2% from 2026 to 2033 to reach USD 124.32 billion by 2033.

b. Asia Pacific dominated the small cell 5G network industry and accounted for a share of 35.3% in 2025. This is attributable to the aggressive deployment of 5G new radio infrastructure by major communication service providers such as China Mobile Limited, KT Corporation, Rakuten Mobile, Inc., and NTT Docomo Inc., among others.

b. Some key players operating in the small cell 5G network market include Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Nokia Corporation, Telefonaktiebolaget LM Ericsson, ZTE Corporation, Fujitsu Limited, CommScope Inc., Comba Telecom Systems Holdings Ltd., Ceragon, Airspan Networks

b. Key factors that are driving the small cell 5G network market growth include ever-rising demand for fast mobile data connectivity among consumers and rising mobile data traffic across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.